Bel Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Bel Bundle

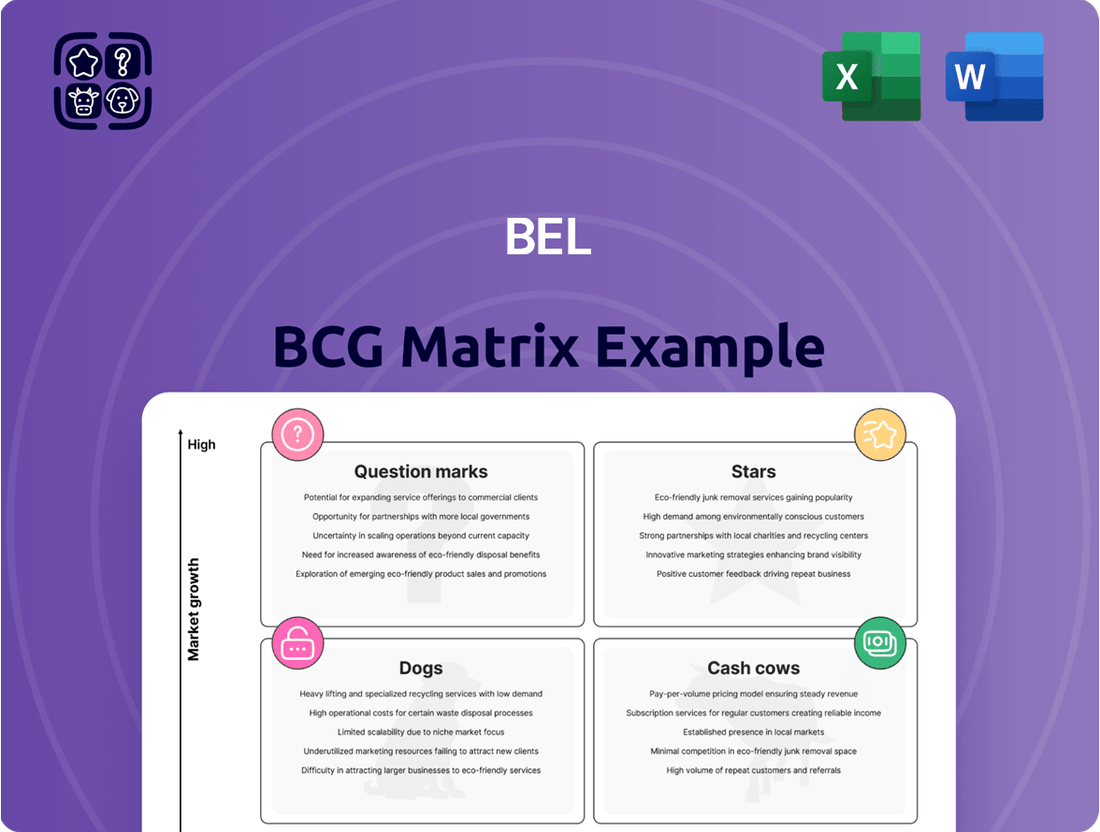

The BCG Matrix is a powerful tool for understanding your product portfolio's performance, categorizing them as Stars, Cash Cows, Dogs, or Question Marks based on market share and growth. This initial glimpse shows you the framework, but imagine the strategic advantage of knowing precisely where each of your products fits.

Unlock the full potential of your business strategy by purchasing the complete BCG Matrix. Gain actionable insights into optimizing resource allocation, identifying growth opportunities, and divesting underperforming assets for maximum profitability.

Stars

Mini Babybel is a shining star for Bel Group, demonstrating robust growth. In 2024, its performance, particularly in North America and Europe, fueled significant organic sales increases for the parent company. This brand holds a substantial market share within the expanding snacking cheese sector, underscoring its star status.

Bel Group's strategic investments in its industrial infrastructure are designed to boost Mini Babybel's production capacity. This commitment further cements its position as a key growth driver and a vital component of the company's portfolio.

Boursin is a shining star in Bel's portfolio, especially in North America, where it's a key driver for the group's mature cheese categories. Its impressive performance points to a significant market share in the expanding specialty cheese sector.

Bel's commitment to Boursin is evident in its investments to bolster production efficiency and capacity, ensuring the brand can meet growing consumer demand. This strategic focus on a high-performing product like Boursin underscores its importance to Bel's overall growth strategy.

Kiri, within Bel's portfolio, exemplifies a Star. Its remarkable growth, particularly in the dynamic Chinese market, has cemented a high market share in a rapidly expanding sector. This success, mirrored in the United States, underscores Kiri's position as a key driver of Bel Group's overall sales momentum.

GoGo squeeZ / Pom'Potes

GoGo squeeZ and its French counterpart, Pom'Potes, represent a strong position within the fruit snack sector. This segment has experienced robust sales increases, especially in European markets like France, reflecting their substantial market share in the growing healthy snacking trend. Consumers are increasingly seeking convenient, fruit-forward choices, driving this demand.

Bel's strategic investment in its Nampa, Idaho facility, aimed at doubling GoGo squeeZ production capacity, underscores the brand's importance and the company's commitment to meeting domestic demand in the United States. This expansion ensures a more reliable local supply chain for this popular product.

- Market Dominance: GoGo squeeZ and Pom'Potes hold significant market share in the fruit snack category, fueled by a growing consumer preference for healthy, on-the-go options.

- Sales Growth: The fruit snack segment, including these brands, has demonstrated notable sales growth, particularly in key European markets.

- Production Expansion: Bel's investment to double GoGo squeeZ production at its Nampa, Idaho facility highlights the brand's strong performance and the company's focus on the US market.

- Consumer Demand: The success of these brands is directly linked to increasing consumer demand for convenient, fruit-based snacks as part of a healthier lifestyle.

Plant-based innovations (new launches)

Bel Group is strategically investing in plant-based cheese innovations, exemplified by new launches like plant-based Mini Babybel and Boursin. This focus aligns with their ambitious target of deriving 50% of revenues from plant-based and fruit products by 2030.

These product introductions tap into a rapidly expanding market for plant-based alternatives, positioning them as strong contenders for future growth, or 'Stars', within Bel's portfolio.

- Market Growth: The global plant-based food market is projected to reach $162 billion by 2030, indicating significant demand for products like Bel's new cheese alternatives.

- Strategic Partnerships: Bel is collaborating with AI and biotech firms to expedite the development and market penetration of these innovative plant-based offerings.

- Product Diversification: The expansion into plant-based versions of iconic brands like Babybel and Boursin diversifies Bel's product range and appeals to a growing segment of health-conscious and environmentally aware consumers.

Mini Babybel and Boursin, particularly in North America and Europe, are key growth drivers for Bel Group, showcasing strong organic sales increases in 2024. Kiri's success in China and the US, alongside GoGo squeeZ and Pom'Potes in the fruit snack sector, further solidifies their star status. Bel's strategic investments in production capacity for these brands, including doubling GoGo squeeZ output in Idaho, underscore their vital role in the company's portfolio and its expansion into plant-based alternatives.

| Brand | Key Markets | Growth Drivers | Strategic Focus |

| Mini Babybel | North America, Europe | Snacking cheese sector growth | Production capacity expansion |

| Boursin | North America | Specialty cheese sector growth | Production efficiency and capacity |

| Kiri | China, United States | Rapidly expanding sector | Sales momentum |

| GoGo squeeZ / Pom'Potes | Europe (France), United States | Healthy snacking trend | Doubling US production capacity |

| Plant-based innovations | Global | Plant-based food market expansion | Achieving 50% revenue from plant-based by 2030 |

What is included in the product

The BCG Matrix categorizes products based on market share and growth to guide investment decisions.

A clear visual representation of your portfolio, simplifying complex strategic decisions.

Cash Cows

The Laughing Cow is a significant cash cow for the Bel Group, showcasing consistent growth, especially in key European markets like the United Kingdom. Its enduring presence in the mature cheese sector points to a substantial market share and strong, reliable cash flow generation.

Bel's commitment to The Laughing Cow is evident through strategic investments, including a return to its classic recipe and impactful marketing collaborations in France. This focus reinforces its position as a dependable source of funds for the company.

Bel Group's mature dairy portfolio, excluding its star brands, likely functions as cash cows within the BCG framework. These established cheese products hold substantial market share in mature markets, reliably generating consistent cash flow. While their growth potential is limited, they demand minimal marketing expenditure, contributing significantly to the company's financial stability.

In 2024, Bel's dairy segment, including these mature offerings, underpinned the company's overall financial strength. This segment's performance highlights the enduring value and consistent revenue generation of these less dynamic but highly profitable products.

Bel's traditional portion-sized cheese formats, like Mini Babybel and The Laughing Cow, are firmly established as cash cows. These products benefit from decades of brand recognition and consistent consumer demand, especially in the snacking and lunchbox categories. In 2023, Bel reported that its cheese segment, which heavily features these portioned items, continued to be a significant contributor to overall revenue, demonstrating their enduring market appeal and stable cash-generating capabilities.

Established International Brands (local market leaders)

Bel's portfolio includes established international brands that are often leaders in their respective local markets, characterized by low growth environments. These brands, despite not seeing explosive expansion, reliably generate consistent revenue and profits for the company, serving as its core cash cows.

Their enduring market presence and strong brand recognition are key factors in their ability to consistently generate cash. For instance, in 2024, Bel's cheese division, a significant contributor to its international brand portfolio, reported stable sales, underscoring the mature yet profitable nature of these established products.

- Brand Strength: Long-standing international brands with high local market penetration.

- Revenue Generation: Consistent and reliable cash flow contribution to Bel's overall financials.

- Market Position: Dominant players in mature, low-growth markets.

- Profitability: High profitability due to established market share and brand loyalty.

Manufacturing and Distribution Infrastructure

Bel Group's manufacturing and distribution infrastructure acts as a significant cash cow. The company made substantial investments in its industrial facilities and global supply chains throughout 2024, reinforcing their ability to produce and deliver products efficiently worldwide. This robust infrastructure allows Bel to leverage economies of scale, resulting in high profit margins and consistent cash flow generation.

The strategic investments made in 2024 are designed to maintain and enhance operational efficiencies within Bel's manufacturing and distribution arms. These upgrades are crucial for sustaining the high levels of profitability associated with these mature, well-established business segments. The ongoing focus on this infrastructure ensures its continued role as a reliable source of cash for the company.

- 2024 Investment: Bel Group allocated significant capital to upgrade its manufacturing plants and expand its distribution networks globally.

- Economies of Scale: The vast operational scale of its infrastructure allows for cost efficiencies, driving healthy profit margins.

- Global Reach: Established distribution channels ensure widespread product accessibility, a key factor in its cash cow status.

- Efficiency Focus: Continued investment aims to optimize production processes and logistics, safeguarding future cash flow.

Cash cows in Bel's portfolio, like The Laughing Cow and Mini Babybel, represent established brands with strong market share in mature, low-growth segments. These products consistently generate significant, reliable cash flow for the company due to decades of brand recognition and stable consumer demand, particularly in snacking and lunchbox occasions.

Bel's manufacturing and distribution infrastructure also functions as a cash cow. Substantial investments in 2024 to upgrade these facilities and expand global supply chains enhance operational efficiencies and economies of scale, leading to high profit margins and sustained cash generation.

| Brand/Segment | Market Position | Cash Flow Contribution | Growth Potential |

|---|---|---|---|

| The Laughing Cow | Dominant in mature cheese markets | High, consistent | Low |

| Mini Babybel | Leader in portioned cheese | High, consistent | Low |

| Manufacturing & Distribution | Global, efficient operations | Significant, stable | Moderate (efficiency gains) |

Full Transparency, Always

Bel BCG Matrix

The BCG Matrix preview you are currently viewing is precisely the document you will receive upon purchase, offering a complete and unwatermarked strategic planning tool. This comprehensive report, meticulously crafted for clarity and actionable insights, is ready for immediate integration into your business strategy discussions. You will gain access to the full, professionally formatted BCG Matrix, designed to help you effectively analyze your product portfolio and make informed decisions. Rest assured, the file you see is the final, ready-to-use version, empowering you to leverage its strategic framework without any further modifications or limitations.

Dogs

Within the Bel Group's diverse portfolio, certain local cheese brands likely fall into the 'Dogs' category of the BCG Matrix. These brands operate in markets experiencing low growth and possess a low relative market share. For instance, if a local cheese brand in a mature, non-expanding market only holds a 5% market share against a dominant competitor with 50%, it fits this profile.

Such 'Dog' brands typically generate very little cash, or may even be a drain on resources, requiring significant investment for minimal return. In 2024, for a brand to be considered a 'Dog,' its market growth might be below 3% annually, while its market share is less than 10% of its largest competitor. These brands are often candidates for divestment or a strategic overhaul to improve their position or exit the market.

Niche dairy products with limited appeal, such as specialized lactose-free cheeses or artisanal yogurts targeting very specific dietary needs, could be categorized as Dogs within Bel's portfolio. These products often face a shrinking or highly segmented consumer base, leading to low market share and minimal growth prospects.

For instance, if a particular niche product saw sales decline by 5% in 2023 and held less than a 1% market share in its category, it would strongly indicate Dog status. Bel's strategic emphasis on powerhouse brands like The Laughing Cow and Babybel, alongside investments in emerging markets and healthy snacking, suggests a likely divestment or reduced focus on such underperforming niche items.

Legacy products with declining demand, often categorized as Dogs in the BCG matrix, represent a challenge for businesses. Think of certain older or traditional cheese products that have seen a significant drop in consumer interest or are battling tough competition from newer, more innovative options. These items typically have low growth and low market share.

For instance, a dairy company might find that its classic cheddar cheese, once a staple, now only accounts for 2% of the market, with the overall cheese market growing at a meager 1% annually. This scenario illustrates a Dog, where investment might drain resources without generating substantial returns, potentially becoming a cash trap.

Nurishh (being discontinued)

Bel Group is discontinuing its plant-based cheese brand, Nurishh, by the end of 2025. This strategic move places Nurishh firmly in the 'Dog' category of the BCG Matrix. Despite operating in the growing plant-based market, the brand has evidently failed to capture significant market share or demonstrate robust growth.

The decision to discontinue Nurishh suggests that the investment required to revive its performance outweighed the potential future returns. Bel Group is likely reallocating resources from this underperforming asset to more promising ventures within their plant-based portfolio. In 2023, the global plant-based cheese market was valued at approximately $3.2 billion and is projected to grow, highlighting that Nurishh's struggles were brand-specific rather than a reflection of the overall market's health.

- Discontinuation: Bel Group phasing out Nurishh by end of 2025.

- BCG Classification: Nurishh is categorized as a 'Dog' due to low market share and growth.

- Market Context: The plant-based cheese market is expanding, with a global valuation around $3.2 billion in 2023.

- Strategic Rationale: Divestment allows Bel Group to focus resources on more successful plant-based initiatives.

Any specific product lines struggling in competitive markets

In the intensely competitive global cheese landscape, Bel's product lines that struggle to carve out a distinct identity or capture substantial market interest against formidable local and international rivals would be classified as Dogs. These offerings are typically marked by a meager market share and exhibit either flat or diminishing growth trajectories.

For instance, if a particular Bel cheese variant, perhaps a niche regional flavor, fails to resonate with consumers or faces aggressive pricing from competitors, it could languish in this category. Such products would contribute minimally to overall revenue and profitability, potentially draining resources without a clear path to improvement.

- Low Market Share: Products failing to gain significant penetration in their respective cheese segments.

- Stagnant or Declining Growth: Sales volumes are not increasing, or are actively decreasing year-over-year.

- Intense Competition: Facing pressure from established global brands and agile local players.

- Lack of Differentiation: Product attributes do not stand out to consumers in crowded markets.

Brands categorized as 'Dogs' within Bel's portfolio are those with low market share in low-growth markets. These products typically generate minimal cash flow and may even require significant investment to maintain, offering little prospect of substantial returns. For example, a niche cheese product with a market share of less than 5% in a category experiencing annual growth of under 2% would likely be classified as a Dog.

Bel's strategic decision to discontinue its Nurishh plant-based cheese brand by the end of 2025 exemplifies this classification. Despite the overall growth in the plant-based sector, which was valued at approximately $3.2 billion globally in 2023, Nurishh failed to gain traction. This move allows Bel to reallocate resources from underperforming assets to more promising areas, a common strategy for managing Dog products.

Products that have seen declining sales, such as a legacy cheese line with a 3% market share in a mature market growing at 1% annually, are also prime candidates for the Dog category. These often require careful consideration for divestment or a significant strategic pivot to avoid becoming cash drains.

| BCG Category | Market Growth | Relative Market Share | Example Characteristic | Bel Group Action Example |

|---|---|---|---|---|

| Dogs | Low | Low | Niche product with declining sales | Discontinuation of Nurishh |

| Under 3% annually | Less than 10% of largest competitor | Legacy cheese with stagnant demand | Potential divestment | |

| 1% annually | 2% of market | Regional flavor struggling against competition | Reduced marketing focus |

Question Marks

Bel Group is leaning into precision fermentation dairy, a burgeoning sector, through strategic alliances with innovators like Standing Ovation and Perfect Day. This move signals a strong commitment to a high-growth market where Bel's current footprint is likely minimal, positioning these ventures as potential future stars in their portfolio.

New product introductions are slated for Q4 2024, underscoring the group's aggressive timeline for capturing market share. This segment demands substantial investment to establish a strong foothold and validate its long-term potential, a crucial step for transforming these early-stage initiatives into market leaders.

Bel's AI-driven product development, particularly its collaboration with Dassault Systèmes and Climax Foods for plant-based cheese, falls into the Question Mark category of the BCG Matrix. This initiative targets a high-growth, innovative segment within the food industry, representing a significant opportunity for future expansion.

While the potential for AI in food innovation is substantial, Bel's current market presence in AI-developed food products is nascent. This necessitates considerable investment to nurture these emerging technologies and translate them into commercially viable products that can capture significant market share in this evolving landscape.

Bel's 'Cocagne project' is developing innovative fermented and ripened plant-based cheese alternatives, moving beyond their initial Babybel and Boursin launches. This strategic move targets a burgeoning market segment with significant growth potential.

The plant-based cheese market is experiencing rapid expansion, with global sales projected to reach over $7 billion by 2027, according to recent market analyses. Despite this growth, Bel's new formulations currently occupy a low market share, necessitating considerable investment in research, development, and consumer marketing to establish a strong foothold.

Expansion into new geographic markets for plant-based products

Expansion into new geographic markets for plant-based products positions these offerings as Question Marks within Bel's BCG Matrix. While Bel has introduced plant-based options in select regions, entering new territories with potentially lower consumer familiarity or more established competition requires careful consideration. These emerging markets often present significant growth opportunities for plant-based alternatives. For instance, the global plant-based food market was valued at approximately USD 30 billion in 2023 and is projected to grow substantially, with regions like Southeast Asia showing increasing interest.

Bel's market share in these new geographies would likely start low, necessitating strategic investments in marketing, distribution, and potentially product localization to gain traction. The success hinges on understanding local consumer preferences and adapting the plant-based product portfolio accordingly. For example, in markets where dairy consumption is deeply ingrained, the challenge lies in effectively communicating the benefits and taste profiles of plant-based substitutes.

- Market Potential: Emerging markets offer substantial untapped demand for plant-based foods, driven by health and environmental consciousness.

- Initial Market Share: Bel's presence in these new territories will likely begin with a low market share, requiring investment to build brand awareness and distribution networks.

- Competitive Landscape: Entering markets with nascent or rapidly evolving competitive landscapes necessitates agility and differentiated product offerings.

- Investment Needs: Significant investment in market research, product development, marketing campaigns, and supply chain establishment will be crucial for success.

Sustainability-focused innovations (e.g., methane reduction feeds)

Bel's exploration of sustainability-focused innovations, such as incorporating methane-reducing feed additives like Bovaer in its dairy operations, positions these initiatives as Question Marks within the BCG framework. These ventures tap into a burgeoning market driven by environmental consciousness and consumer demand for sustainable products.

While the growth potential in reducing greenhouse gas emissions from agriculture is significant, the current market share and immediate profitability of these specific feed additives for Bel remain uncertain. For instance, the global market for feed additives is projected to reach approximately $30 billion by 2027, indicating substantial growth, but the precise contribution of methane reduction technologies to this figure is still developing.

Bel's investment in these areas signifies a strategic bet on future market trends and a commitment to environmental stewardship. However, realizing the full potential of these innovations will likely require sustained investment in research and development, alongside robust market education to foster wider adoption and demonstrate tangible benefits.

Key aspects of Bel's sustainability-focused innovations as Question Marks:

- High Growth Potential: Addressing methane emissions is a critical area for agricultural sustainability, aligning with global climate goals and increasing consumer demand for environmentally responsible products.

- Uncertain Market Share: The adoption rate and market penetration of specific methane-reducing feed additives are still in their early stages, making their direct contribution to Bel's current market share unclear.

- Investment Requirement: Continued investment is necessary to refine these technologies, scale production, and educate stakeholders on their efficacy and benefits, which is characteristic of Question Mark strategies.

- Consumer & Regulatory Drivers: Growing consumer awareness and potential regulatory pressures regarding agricultural emissions provide a strong impetus for developing and implementing such innovations.

Bel's AI-driven plant-based cheese development, alongside its 'Cocagne project' for fermented plant-based alternatives, are prime examples of Question Marks. These initiatives target the rapidly expanding plant-based market, which saw global sales exceeding $7 billion by 2027, but Bel's current market share in these specific innovative segments is minimal.

Significant investment is required to scale these AI and fermentation technologies, build consumer awareness, and establish a strong market presence against established players. This strategic focus on high-growth potential, coupled with low initial market share and substantial investment needs, firmly places them in the Question Mark category.

The success of these ventures hinges on Bel's ability to navigate the evolving consumer preferences and competitive landscape in the plant-based sector, a market projected for continued robust growth through the next decade.

Bel's expansion into new geographic markets with its plant-based products also fits the Question Mark profile. While the global plant-based food market was valued at approximately USD 30 billion in 2023 and is growing, Bel's initial market share in these new territories is likely low, demanding considerable investment in marketing and distribution.

| Initiative | Market Potential | Current Market Share | Investment Needs | BCG Category |

| AI-Driven Plant-Based Cheese | High (Global market over $7B by 2027) | Low | High (R&D, Marketing) | Question Mark |

| 'Cocagne Project' (Fermented Plant-Based) | High (Burgeoning segment) | Low | High (R&D, Consumer Education) | Question Mark |

| Plant-Based Expansion (New Geographies) | High (Global market ~$30B in 2023) | Low | High (Market Entry, Distribution) | Question Mark |

| Methane-Reducing Feed Additives | High (Sustainability focus) | Uncertain/Low | High (Scaling, Market Education) | Question Mark |

BCG Matrix Data Sources

Our BCG Matrix leverages robust data from company financial statements, industry growth reports, and competitive market analysis to provide strategic direction.