Greencore SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Greencore Bundle

Greencore's ability to leverage its extensive food manufacturing capabilities is a significant strength, while its reliance on a few key customers presents a notable risk. Understanding these dynamics is crucial for anyone looking to invest or strategize within the food sector.

Want the full story behind Greencore’s strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

Greencore boasts a leading position in the UK and Irish convenience food sector, a testament to its robust operational capabilities. These strengths are significantly amplified by its well-established and deep relationships with major grocery retailers, which are crucial for securing and maintaining substantial private-label and own-brand supply contracts. For example, in fiscal year 2023, Greencore reported revenue of £1.6 billion, with a significant portion derived from these key retail partnerships.

Greencore's extensive and diverse product portfolio is a significant strength, encompassing a wide range of items like sandwiches, salads, sushi, and ready meals. This breadth caters to varied consumer tastes and different eating occasions, making them a go-to for many shoppers.

This diversified offering is crucial as it mitigates the risk associated with relying too heavily on any one product category. For instance, if demand for salads dips, their strong presence in ready meals can help offset the impact, providing a more stable revenue stream.

The company's specialization in chilled, fresh, and frozen foods positions them advantageously within the convenience food market. This focus allows for deep expertise and efficient operations across a substantial segment of consumer food needs.

Greencore's business model is built around high-volume, quick-turnaround food solutions, showcasing its strong and efficient production capabilities. This operational strength enables them to effectively manage large orders from major retailers, leverage economies of scale for cost optimization, and maintain competitive pricing in a demanding market.

Focus on Convenience and Freshness

Greencore's dedication to chilled and fresh food products perfectly matches the increasing consumer desire for convenient, ready-to-eat meals that are also seen as healthy. This specialization caters to busy lifestyles, offering quick meal solutions that minimize preparation time for customers. The company's commitment to freshness serves as a significant advantage in the crowded food sector.

This focus on convenience and freshness is a strong point for Greencore, especially as consumer trends continue to favor quick and easy meal solutions. For instance, the UK ready meal market alone was valued at approximately £5.7 billion in 2023 and is projected to grow. Greencore's ability to consistently deliver high-quality, fresh products positions them well within this expanding market.

- Convenience Driven Demand: Consumers increasingly seek ready-to-eat meals due to time constraints.

- Health Perception: Fresh ingredients often translate to a perception of healthier eating options.

- Market Alignment: Greencore's offerings directly address the fast-paced modern lifestyle.

- Differentiation: Emphasis on freshness sets Greencore apart from competitors focusing on longer shelf-life products.

Resilient Business Model with Private Label Focus

Greencore's strength lies in its resilient business model, heavily focused on private label and own-brand products. This B2B approach leverages the market power of its retail partners, significantly reducing the need for costly direct consumer marketing and brand-building initiatives. For instance, in fiscal year 2023, private label sales constituted a substantial portion of revenue, demonstrating the effectiveness of this strategy.

This focus on private label offers a stable demand base, often secured through long-term contracts with major retailers. This contractual stability translates into predictable revenue streams and enhances overall business resilience. The company's ability to adapt to specific retailer requirements, such as unique product formulations or packaging, further solidifies these partnerships.

Key advantages include:

- Reduced Marketing Costs: By supplying private labels, Greencore avoids direct consumer advertising expenses.

- Stable Revenue: Long-term contracts with retailers provide predictable income.

- Retailer Power Leverage: Greencore benefits from the established customer base of its retail partners.

- Adaptability: The model allows for flexibility in meeting diverse retailer specifications.

Greencore's dominant position in the UK and Ireland's convenience food market is underpinned by its strong relationships with major grocery retailers, securing significant private-label contracts. This is evident in their fiscal year 2023 revenue of £1.6 billion, largely driven by these partnerships.

Their extensive product range, including sandwiches, salads, and ready meals, caters to diverse consumer preferences and eating occasions, mitigating risks associated with single-product reliance.

The company's focus on chilled, fresh, and frozen foods aligns perfectly with growing consumer demand for convenient, healthy, ready-to-eat options, a trend supported by the UK ready meal market's estimated £5.7 billion valuation in 2023.

Greencore's business model thrives on high-volume, quick-turnaround production, enabling cost efficiencies and competitive pricing in a dynamic market.

| Strength Area | Key Aspect | Supporting Data/Insight |

|---|---|---|

| Market Leadership | Leading UK & Ireland convenience food supplier | FY2023 Revenue: £1.6 billion |

| Retailer Partnerships | Deep relationships with major grocers | Secures substantial private-label contracts |

| Product Diversification | Wide range of chilled convenience foods | Mitigates reliance on single product categories |

| Operational Efficiency | High-volume, quick-turnaround production | Enables economies of scale and competitive pricing |

What is included in the product

Delivers a strategic overview of Greencore’s internal and external business factors, highlighting its strengths in food-to-go, weaknesses in operational efficiency, opportunities in market expansion, and threats from competition and changing consumer preferences.

Greencore's SWOT analysis offers a clear roadmap to navigate market complexities, transforming potential challenges into actionable strategies for sustainable growth.

Weaknesses

Greencore's significant reliance on a few major supermarket chains for a substantial portion of its revenue, estimated to be over 50% from its top three customers in recent years, creates a notable concentration risk. This dependency means that any shifts in these retailers' strategies, such as product delistings or intensified competition, could have a disproportionately negative effect on Greencore's financial results. This can also limit their negotiation leverage.

Greencore's position as a major food producer means it's heavily impacted by swings in the cost of ingredients, energy, and packaging. For instance, a significant portion of their cost of goods sold is tied to commodities like wheat, dairy, and oils, which can see sharp price increases due to weather events or geopolitical instability.

These cost surges can directly squeeze profit margins if Greencore can't fully pass the higher expenses onto their retail partners. In 2023, for example, food manufacturers across the UK faced considerable pressure from rising energy bills and raw material costs, with some reporting that they could only pass on an average of 50-70% of these increases to consumers and retailers, impacting profitability.

Greencore's reliance on a large workforce for its high-volume, quick-turnaround convenience food production exposes it to significant labor intensity challenges. This can lead to vulnerability during labor shortages and intense competition for talent. For instance, the UK food manufacturing sector, where Greencore operates, has faced persistent labor pressures, with reports indicating a shortage of skilled and unskilled workers throughout 2024 and into early 2025.

Wage inflation presents another substantial weakness. As the cost of living rises and labor markets tighten, Greencore must contend with increasing wage demands to attract and retain staff. This upward pressure on wages, a trend observed across the broader hospitality and food production industries, directly impacts operational costs and can erode profit margins if not effectively managed through productivity gains or price adjustments.

The potential for industrial relations issues is also a concern. A large, often unionized, workforce in a demanding sector can be susceptible to disputes over pay, working conditions, or staffing levels. Such issues can disrupt production, damage reputation, and incur additional costs, impacting the company's overall operational efficiency and financial performance.

Perishability of Products and Waste Management

The perishable nature of Greencore's chilled and fresh food products presents a significant weakness, directly impacting waste management and requiring meticulous inventory control. Shelf life limitations mean that unsold products can quickly become unsaleable, leading to potential financial losses.

Effective inventory management is therefore paramount to mitigate spoilage and maintain profitability. This involves sophisticated forecasting and demand planning to align production with actual sales, a constant challenge in the dynamic food retail sector.

Furthermore, maintaining the integrity of the cold chain from production to delivery is critical. Any breaches in this chain can compromise product quality and safety, necessitating robust logistical systems and potentially increasing operational costs. For instance, in 2023, the UK food industry experienced significant waste, with estimates suggesting millions of pounds worth of edible food is discarded annually, underscoring the scale of this challenge for companies like Greencore.

- Short Shelf Life: Chilled and fresh food items have a limited window of saleability, increasing the risk of product obsolescence.

- Inventory Control Complexity: Balancing stock levels to meet demand without overstocking and incurring waste is a continuous operational hurdle.

- Cold Chain Dependency: Maintaining a consistent, unbroken cold chain is essential but adds significant logistical complexity and potential failure points.

- Waste Management Costs: Disposing of expired or unsaleable products incurs direct costs and represents lost revenue opportunities.

Competitive Market and Margin Pressure

Greencore operates in intensely competitive UK and Irish convenience food markets, facing pressure from a wide array of manufacturers, from large-scale producers to specialized niche companies. This crowded landscape, coupled with the significant leverage held by major retail partners, often translates into persistent demands for lower prices, directly impacting profit margins.

For example, in the fiscal year ending September 2023, the UK's grocery market saw intense promotional activity, with discounters like Aldi and Lidl continuing to gain market share, putting downward pressure on prices across the sector. This environment necessitates Greencore’s continuous focus on innovation and operational efficiency to safeguard its competitive standing and profitability.

- Intense Competition: The convenience food sector in the UK and Ireland is saturated with both large and small players.

- Retailer Bargaining Power: Major supermarkets exert considerable influence on pricing due to their volume purchasing.

- Margin Squeeze: Constant price negotiations can erode profit margins, requiring cost management.

- Innovation Imperative: Greencore must consistently develop new products and improve processes to stay ahead.

Greencore's significant reliance on a few major supermarket chains for a substantial portion of its revenue, estimated to be over 50% from its top three customers in recent years, creates a notable concentration risk. This dependency means that any shifts in these retailers' strategies, such as product delistings or intensified competition, could have a disproportionately negative effect on Greencore's financial results and limit their negotiation leverage.

The perishable nature of Greencore's chilled and fresh food products presents a significant weakness, directly impacting waste management and requiring meticulous inventory control. Shelf life limitations mean that unsold products can quickly become unsaleable, leading to potential financial losses, with the UK food industry estimating millions of pounds worth of edible food is discarded annually.

Greencore operates in intensely competitive UK and Irish convenience food markets, facing pressure from a wide array of manufacturers, from large-scale producers to specialized niche companies. This crowded landscape, coupled with the significant leverage held by major retail partners, often translates into persistent demands for lower prices, directly impacting profit margins, as evidenced by intense promotional activity in the UK grocery market during 2023.

Preview Before You Purchase

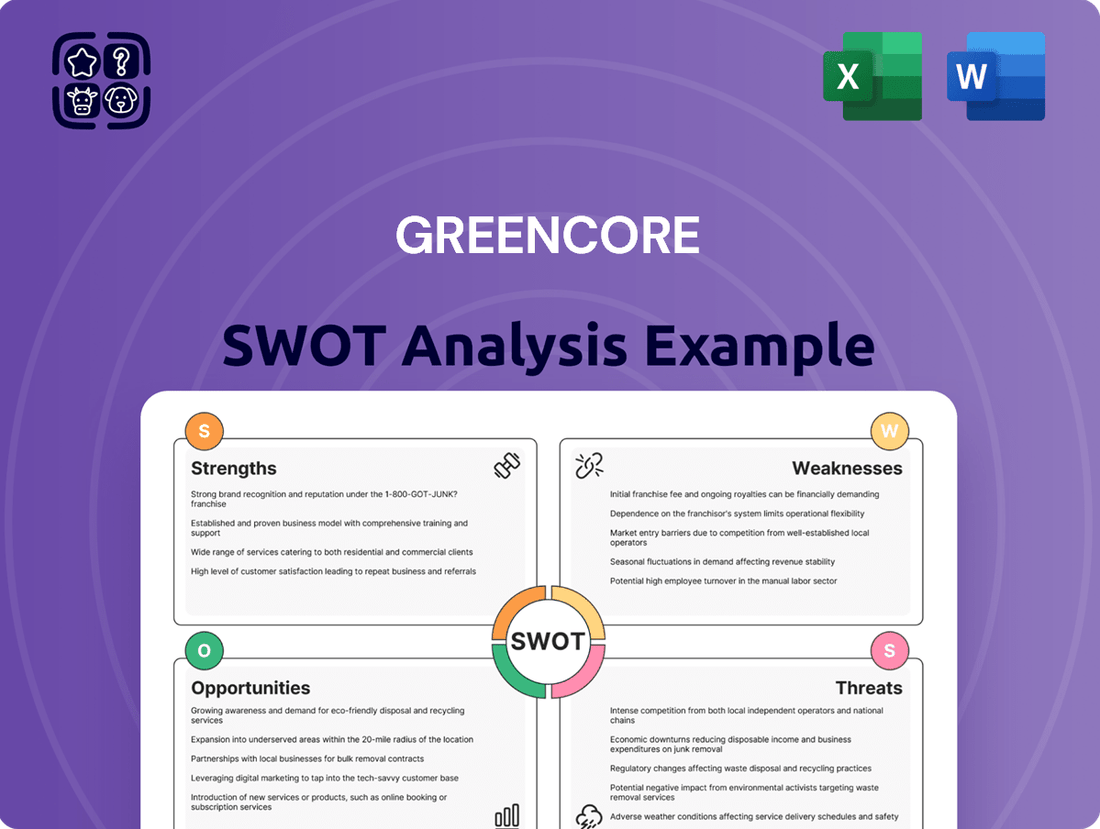

Greencore SWOT Analysis

The preview you see is the actual SWOT analysis document you’ll receive upon purchase—no surprises, just professional quality. This detailed analysis offers a comprehensive look at Greencore's strategic position.

You’re viewing a live preview of the actual SWOT analysis file. The complete version, including all detailed insights into Greencore's Strengths, Weaknesses, Opportunities, and Threats, becomes available after checkout.

This is the same SWOT analysis document included in your download. The full content, providing a thorough examination of Greencore's internal and external factors, is unlocked after payment.

Opportunities

The persistent societal shift towards busier lifestyles is a significant driver for convenient, ready-to-eat food, a market segment Greencore is well-positioned to serve. This trend is further amplified by a growing consumer consciousness around health and sustainability. For instance, the UK's ready-to-eat meal market was valued at approximately £4.7 billion in 2023, with a projected compound annual growth rate (CAGR) of 4.5% through 2028, indicating substantial opportunity.

Greencore can leverage this by expanding its portfolio with more nutritious, plant-based, and ethically sourced meal options, aligning with consumer preferences for healthier and more sustainable choices. The company's existing infrastructure and supply chain capabilities provide a strong foundation to meet this evolving demand, potentially capturing a larger share of this expanding market. By focusing on innovation in these areas, Greencore can enhance its brand appeal and drive revenue growth.

Greencore can capitalize on the booming plant-based and free-from food markets, which saw significant growth in 2024. For instance, the global plant-based food market was projected to reach over $74 billion by 2030, indicating substantial untapped potential. Expanding into these categories aligns with consumer demand for healthier and more sustainable options, offering a clear avenue for revenue diversification and market share expansion.

Greencore’s primary focus on the UK and Ireland presents a clear opportunity for geographic expansion. Exploring markets with similar consumer preferences and retail landscapes, such as parts of mainland Europe or North America, could significantly broaden its revenue streams. This strategic move would not only diversify its income but also mitigate risks associated with over-reliance on its existing core markets, which have shown consistent growth, with Greencore reporting revenue of £1.5 billion for the year ended October 1, 2023.

Leveraging Technology and Automation for Efficiency

Greencore can significantly boost its operational efficiency by integrating advanced manufacturing technologies, automation, and data analytics across its production and supply chain. This strategic adoption is projected to reduce labor costs and ensure greater product consistency, a crucial factor in the competitive food sector. For instance, in 2024, companies in the food manufacturing industry saw an average reduction of 15% in operational expenses after implementing automation in key areas.

Investing in automation also serves as a proactive measure against labor-related risks, such as shortages or rising wages, which have been a persistent challenge. By automating tasks, Greencore can improve its speed-to-market for new product launches, a critical differentiator in the fast-paced convenience food market. This agility allows for quicker responses to consumer trends and demand shifts.

- Enhanced Efficiency: Automation can streamline production lines, reducing waste and increasing output.

- Cost Reduction: Lowering labor dependency directly impacts the bottom line, especially with rising wage pressures.

- Improved Quality Control: Automated systems ensure greater precision and consistency in product manufacturing.

- Agility and Responsiveness: Faster production cycles enable quicker adaptation to market demands and new product introductions.

Sustainability and ESG Initiatives

Greencore is well-positioned to capitalize on the increasing consumer and retailer demand for sustainable practices. This trend is driving significant market shifts, with consumers actively seeking out products that demonstrate responsible sourcing, reduced food waste, and eco-friendly packaging. For instance, a 2024 report indicated that over 60% of consumers are willing to pay more for products with strong sustainability credentials.

By bolstering its Environmental, Social, and Governance (ESG) initiatives, Greencore can significantly enhance its brand reputation and market appeal. This strategic focus allows the company to align with evolving customer expectations and gain a competitive edge. Optimizing its supply chain for sustainability, a key ESG component, can lead to cost efficiencies and improved resource management.

Greencore has opportunities to innovate in areas such as reducing its carbon footprint and developing advanced sustainable packaging solutions. These efforts not only address environmental concerns but also create new product development avenues. The company's commitment to these areas can resonate with a growing segment of the market actively looking for environmentally conscious food providers.

- Growing Consumer Preference: Over 60% of consumers in 2024 expressed willingness to pay a premium for sustainable products.

- Retailer Demand: Major retailers are increasingly prioritizing suppliers with robust ESG commitments and transparent supply chains.

- Brand Enhancement: Strengthening ESG initiatives can elevate Greencore's brand image, attracting environmentally conscious consumers and business partners.

- Innovation Potential: Opportunities exist in developing circular economy models for packaging and reducing Scope 1, 2, and 3 emissions across operations.

Greencore can capitalize on the growing demand for healthier and more convenient food options. The UK ready-to-eat meal market, valued at approximately £4.7 billion in 2023, is projected to grow at a 4.5% CAGR through 2028, presenting a significant opportunity for Greencore to expand its offerings in nutritious and plant-based meals.

The company can also leverage the increasing consumer focus on sustainability by enhancing its ESG initiatives and developing eco-friendly packaging solutions. With over 60% of consumers in 2024 willing to pay more for sustainable products, this focus can bolster brand appeal and market share.

Geographic expansion into markets like mainland Europe or North America, which share similar consumer preferences, offers a pathway to diversify revenue streams beyond its core UK and Ireland markets. Greencore's reported revenue of £1.5 billion for the year ended October 1, 2023, underscores its existing market presence and potential for broader reach.

Further opportunities lie in adopting advanced manufacturing technologies and automation, which can reduce operational expenses by an estimated 15% on average, as seen in the food manufacturing industry in 2024. This also mitigates labor-related risks and improves speed-to-market.

| Opportunity Area | Market Trend/Data | Greencore's Advantage/Action |

|---|---|---|

| Convenience & Health Foods | UK ready-to-eat market: £4.7bn (2023), 4.5% CAGR (2023-2028) | Expand nutritious, plant-based, and ethically sourced meal options. |

| Sustainability & ESG | 60%+ consumers willing to pay more for sustainable products (2024) | Enhance ESG initiatives, develop sustainable packaging, optimize supply chain. |

| Geographic Expansion | Similar consumer preferences in Europe/North America | Explore new markets to diversify revenue and mitigate regional risks. |

| Operational Efficiency | Automation can reduce operational expenses by ~15% (2024) | Integrate automation and data analytics to cut costs and improve product consistency. |

Threats

Greencore operates in a highly competitive convenience food market, facing pressure from both established players like Bakkavor and new entrants. Retailers also pose a threat by increasingly developing their own in-house food manufacturing capabilities, directly competing with suppliers like Greencore. This intensified competition can lead to price wars, potentially impacting Greencore's profitability and market share.

For instance, the UK ready meal market, a key segment for Greencore, is highly saturated. Reports from 2024 indicate that major supermarkets are investing heavily in their own food production facilities to gain greater control over quality and cost, directly challenging their existing supply partners. This trend puts significant pressure on Greencore to maintain competitive pricing and product innovation.

The threat of new entrants, particularly those with agile business models and lower overheads, is also a concern. These companies can quickly adapt to changing consumer preferences, potentially eroding market share from incumbents. Greencore's strategy to counter this involves strengthening its long-standing relationships with major retailers and focusing on product differentiation through quality and innovation.

Greencore faces the threat of rapid shifts in consumer preferences and dietary trends. For example, a growing demand for plant-based or low-carbohydrate options, as seen in the expanding vegan market which reached an estimated £7.4 billion in the UK in 2023, could reduce demand for Greencore's traditional sandwich and ready-meal offerings.

A significant move away from these core product lines would necessitate costly and rapid product diversification efforts to remain competitive. Staying agile and responsive to evolving consumer tastes, such as the increasing popularity of convenience foods with perceived health benefits, is crucial for Greencore to mitigate this risk.

Economic instability, with persistent inflation and a cost-of-living crisis, directly impacts consumer behavior. In 2024, for instance, many households faced increased prices for essential goods, leading to a significant reduction in discretionary spending. This trend is expected to continue into 2025, as economic forecasts suggest a slow recovery.

For Greencore, this translates to a potential drop in sales, particularly for convenience foods that consumers might view as less essential. As shoppers prioritize value, they are likely to switch to cheaper alternatives or increase home cooking, directly affecting Greencore's sales volumes and overall profitability.

Supply Chain Disruptions and Geopolitical Instability

Greencore faces significant threats from supply chain disruptions, exacerbated by ongoing geopolitical instability. Events like the Russia-Ukraine conflict and trade tensions can lead to shortages of key agricultural inputs and packaging materials, driving up costs. For instance, the global fertilizer price surge in 2022, partly due to geopolitical factors, directly impacted agricultural raw material costs for food producers.

The company’s extensive network, while efficient, also presents a vulnerability. A disruption at any point in its complex supply chain, from ingredient sourcing to product distribution, can cause significant delays and increase operational expenses. This could hinder Greencore's capacity to fulfill orders from major retailers, potentially impacting revenue and market share.

- Increased Raw Material Costs: Geopolitical events can cause volatility in commodity prices, affecting the cost of ingredients like grains and vegetables.

- Logistics Challenges: Trade disputes and conflicts can disrupt shipping routes and increase freight costs, impacting delivery times and overall expenses.

- Production Delays: Shortages of necessary components or labor due to global instability can lead to manufacturing slowdowns or stoppages.

Stricter Regulations and Food Safety Standards

The food manufacturing sector faces increasingly rigorous regulations covering food safety, accurate labeling, allergen management, and environmental impact. For instance, in the UK, the Food Standards Agency (FSA) continuously updates its guidance, with significant focus in 2024 and 2025 on issues like sugar and salt reduction targets, and enhanced traceability requirements following past incidents. Failure to adhere to these evolving standards can lead to substantial financial penalties, costly product recalls, and severe damage to brand reputation and consumer confidence.

Greencore must dedicate significant resources to monitoring and implementing these new regulatory demands. This ongoing commitment to compliance represents a considerable and continuous operational expense. For example, adapting packaging to meet new allergen labeling laws or investing in advanced traceability systems to comply with enhanced food safety protocols can require substantial capital outlay and ongoing operational adjustments.

The potential consequences of non-compliance are significant:

- Financial Penalties: Fines for breaches of food safety or labeling regulations can run into millions of pounds, impacting profitability.

- Product Recalls: A single recall event can cost millions in logistics, disposal, and lost sales, alongside the reputational damage.

- Reputational Damage: Loss of consumer trust due to safety concerns or regulatory non-compliance can be extremely difficult and expensive to rebuild.

- Operational Disruption: Adapting to new standards often requires changes to manufacturing processes, supply chain management, and quality control systems, which can temporarily disrupt operations.

Greencore faces intense competition from both established rivals and retailers developing in-house food production, potentially leading to price wars and reduced market share. Rapidly changing consumer preferences, particularly towards healthier or niche diets, pose a threat to its core product lines, necessitating costly adaptation. Economic downturns and cost-of-living pressures in 2024 and projected into 2025 can curb consumer spending on convenience foods, impacting sales volumes. Furthermore, ongoing geopolitical instability continues to create supply chain vulnerabilities, driving up raw material and logistics costs, while stringent and evolving food safety and labeling regulations demand significant ongoing investment and pose risks of penalties and reputational damage if not met.

SWOT Analysis Data Sources

This Greencore SWOT analysis is built upon a foundation of robust data, drawing from the company's official financial statements, comprehensive market research reports, and expert industry commentary. These sources provide a well-rounded perspective on the competitive landscape and internal capabilities.