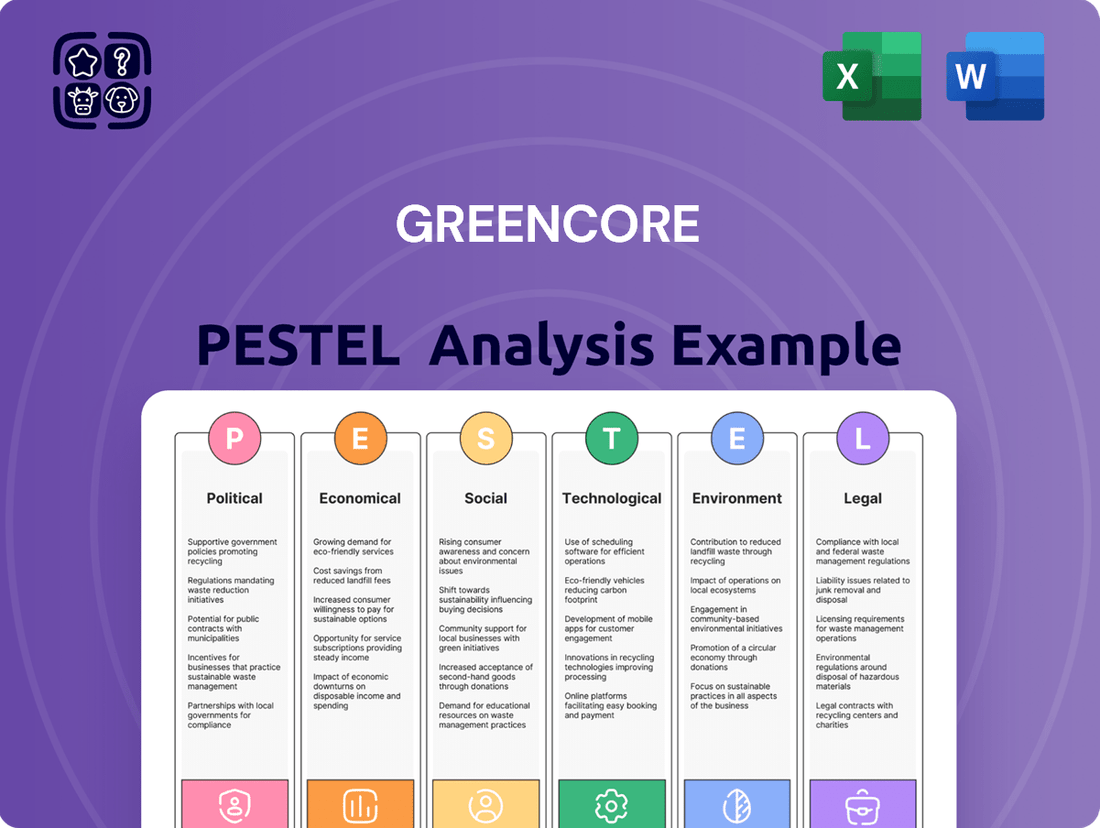

Greencore PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Greencore Bundle

Uncover the critical political, economic, social, technological, legal, and environmental factors shaping Greencore's trajectory. Our expertly crafted PESTLE analysis provides the essential external intelligence you need to anticipate challenges and seize opportunities. Don't navigate the market blindfolded; download the full version for actionable insights that will empower your strategic decisions.

Political factors

Government food policies and regulations, particularly concerning food production, safety, and public health, directly shape Greencore's operational landscape. For instance, the UK's ongoing implementation of High Fat, Sugar, and Salt (HFSS) regulations, which began in October 2022 and continues to evolve, mandates changes in product placement and promotional strategies for many convenience food items, impacting Greencore's product development and sales approach.

The United Kingdom's ongoing integration into new trade agreements post-Brexit continues to shape Greencore's operational landscape. For instance, the Trade and Cooperation Agreement between the UK and EU impacts customs declarations and regulatory alignment, directly affecting the movement of food products between Ireland and the UK. In 2024, businesses like Greencore are still navigating the nuances of these arrangements, which can introduce delays and increased administrative burdens, potentially impacting the cost of sourcing ingredients and distributing finished goods.

Legislation around minimum wages, working hours, and employment rights in the UK and Ireland directly affects Greencore's labor expenses and how it manages its staff. For instance, the UK's National Living Wage increased to £11.44 per hour for those aged 21 and over from April 2024, impacting companies with a significant hourly workforce like Greencore.

Any shifts in these legal frameworks, such as potential adjustments to the working week or enhanced employee benefits, could require Greencore to rethink its staffing arrangements and how it compensates its employees to remain competitive and compliant.

Staying current with and adhering to these developing labor laws is crucial for Greencore's smooth operations and for fostering positive relationships with its employees, preventing potential disputes or penalties.

Food Labeling and Allergen Laws

Stricter food labeling and allergen information laws, like Natasha's Law in the UK, mandate detailed and accurate ingredient declarations for all pre-packed for direct sale (PPDS) foods. This directly impacts Greencore's operations as a significant producer of sandwiches and ready meals.

Greencore must implement rigorous allergen management systems and ensure labeling accuracy to protect consumers and avoid legal repercussions. For instance, the Food Standards Agency (FSA) in the UK actively enforces these regulations, with non-compliance potentially leading to significant fines and reputational damage.

These legislative demands necessitate substantial investment in:

- Enhanced traceability systems for raw ingredients.

- Advanced packaging technologies for clear allergen warnings.

- Ongoing staff training on allergen control protocols.

- Regular audits to guarantee compliance with evolving standards.

Public Health Initiatives

Government-backed public health campaigns, such as those focusing on reducing childhood obesity or encouraging balanced diets, directly influence consumer preferences and Greencore's product innovation. For instance, the UK's Sugar Tax, introduced in 2018 and expanded in 2022, has already prompted significant reformulation across the food and beverage industry, with many companies, including those in the convenience food sector, reducing sugar content to avoid levies. This trend is expected to continue and intensify as public health targets evolve.

These initiatives often translate into regulatory pressures and consumer expectations for healthier convenience food options. Greencore may find itself needing to adapt its recipes to lower levels of sugar, salt, and saturated fats to align with national health strategies and maintain market appeal. For example, in 2024, the UK government continued its focus on tackling obesity, with ongoing discussions around further restrictions on promotions of unhealthy foods, which could impact Greencore's product placement and marketing strategies.

- Government Health Targets: National strategies aiming to improve public health, such as those set by Public Health England or its successor bodies, often set specific targets for nutrient reduction in processed foods.

- Consumer Demand Shift: Increased consumer awareness of health issues, driven by public health messaging, leads to a greater demand for products perceived as healthier, impacting sales volumes for less healthy options.

- Reformulation Costs: Adapting product formulations to meet new health standards can involve significant research and development costs, as well as potential changes to sourcing and manufacturing processes for Greencore.

- Regulatory Compliance: Staying abreast of evolving public health regulations and ensuring compliance is crucial for avoiding penalties and maintaining brand reputation.

Government food policies, such as the UK's High Fat, Sugar, and Salt (HFSS) regulations, continue to influence Greencore's product development and sales strategies, impacting convenience food items. The ongoing evolution of post-Brexit trade agreements, like the UK-EU Trade and Cooperation Agreement, affects the movement of food products, potentially causing delays and increased administrative burdens for Greencore in 2024.

Labor laws, including the UK's National Living Wage which rose to £11.44 per hour in April 2024, directly impact Greencore's operational costs and workforce management. Strict food labeling laws, like Natasha's Law in the UK, necessitate robust allergen management systems and accurate ingredient declarations for Greencore's pre-packed foods, with the Food Standards Agency enforcing compliance.

Public health campaigns, such as the UK's Sugar Tax, continue to drive consumer demand for healthier options and prompt reformulation efforts from companies like Greencore, impacting product innovation and marketing.

What is included in the product

This Greencore PESTLE analysis provides a comprehensive examination of the external macro-environmental factors impacting the company across Political, Economic, Social, Technological, Environmental, and Legal dimensions.

It offers actionable insights for strategic decision-making by identifying key trends and their potential implications for Greencore's operations and future growth.

A concise, actionable Greencore PESTLE analysis that highlights key external factors, simplifying complex market dynamics for strategic decision-making.

Economic factors

Greencore faces significant headwinds from persistent high inflation, which directly inflates the cost of essential inputs like wheat, dairy, and packaging materials. For instance, UK food price inflation remained elevated in early 2024, with some categories seeing double-digit percentage increases year-on-year, impacting Greencore's procurement expenses.

The broader cost of living crisis further complicates matters by squeezing household budgets. Consumers are likely to trade down to cheaper alternatives, potentially impacting demand for Greencore's premium convenience food offerings. This economic environment necessitates careful cost management and a strategic approach to pricing to maintain market share.

Fluctuations in global commodity prices, energy costs, and transportation expenses directly impact Greencore's operational profitability. For instance, the cost of key ingredients like fresh produce and meat, along with packaging materials, can significantly affect margins, especially for a high-volume producer. In 2024, continued volatility in energy markets, with Brent crude oil averaging around $80-$85 per barrel for much of the year, directly influences transportation and production costs.

Given Greencore's extensive operations, even minor percentage shifts in ingredient costs can have a substantial effect on overall profitability. For example, a 1% increase in the cost of fresh vegetables, a staple in their ready-meal production, could translate to millions in additional expenses annually. This underscores the critical need for robust procurement and effective hedging strategies to navigate these inherent supply chain cost risks.

Consumer spending habits are a crucial economic factor for Greencore, particularly in the UK and Ireland. During 2024, persistent inflation and the cost of living crisis continued to shape how consumers allocate their budgets. For instance, data from the Office for National Statistics (ONS) in late 2024 indicated a noticeable shift towards value-oriented purchases, with consumers scrutinizing spending on non-essential or premium convenience food items. This trend directly impacts Greencore's sales forecasts and the need to adapt its product offerings to meet evolving price sensitivities.

Exchange Rate Volatility

Greencore's operations across the UK and Ireland mean it's directly affected by the fluctuating exchange rates between the British Pound (GBP) and the Euro (EUR). This volatility can significantly alter the cost of goods purchased from overseas and the revenue generated from sales in different currencies, impacting the company's bottom line.

For instance, during periods of Pound weakness against the Euro, Greencore's costs for raw materials sourced from the Eurozone would increase. Conversely, if the Pound strengthens, its products exported to Ireland might become more expensive for Irish consumers, potentially reducing sales volume. This dynamic is crucial for managing profitability.

To navigate these currency risks, Greencore likely employs financial instruments such as forward contracts or options. These hedging strategies aim to lock in exchange rates for future transactions, providing greater certainty and stability in its financial planning. For example, in early 2024, the GBP/EUR exchange rate saw fluctuations, with the Pound trading around 1.17 EUR in February, a level that would have influenced import costs for businesses relying on Eurozone suppliers.

- Impact on Costs: A weaker Pound in 2024 could have increased Greencore's cost of sourcing ingredients from the Eurozone.

- Impact on Revenue: A stronger Pound might have made Greencore's products less competitive in the Irish market.

- Hedging Necessity: Financial strategies are essential to mitigate the unpredictable nature of currency markets.

- Market Sensitivity: The food manufacturing sector, with its reliance on global supply chains, is particularly sensitive to exchange rate shifts.

Interest Rates and Investment Environment

Changes in central bank interest rates directly impact Greencore's cost of capital. For instance, if the Bank of England raises its base rate, Greencore's borrowing costs for new investments, like expanding its convenience food production capacity, will likely increase. This makes large-scale projects less attractive and could temper expansion plans.

The prevailing interest rate environment also shapes the broader investment landscape. Higher rates can lead investors to favor lower-risk fixed-income assets over equities, potentially reducing the availability of capital for companies like Greencore seeking funding for strategic development, such as acquisitions or significant technological upgrades.

- Interest Rate Impact: A 1% increase in interest rates could add millions to Greencore's annual financing costs on its existing debt, impacting profitability.

- Investment Climate: In a high-interest-rate environment, the cost of equity might also rise as investors demand higher returns to compensate for increased risk-free rates.

- Growth Constraints: Elevated borrowing costs can disproportionately affect capital-intensive sectors like food manufacturing, potentially slowing Greencore's ability to invest in new markets or sustainable packaging solutions.

Persistent inflation continued to pressure consumer spending in 2024, with UK food price inflation remaining a significant concern. This economic climate forces consumers to prioritize value, potentially impacting Greencore's sales volumes for convenience foods as they seek more budget-friendly options.

The cost of living crisis directly influences consumer purchasing power, making them more sensitive to price increases. Greencore must balance input cost pressures with the need to remain competitive, a challenge highlighted by reports in late 2024 indicating consumers actively seeking promotions and own-brand alternatives.

Fluctuations in global commodity prices, energy, and transportation costs remain critical economic factors for Greencore. For instance, the average Brent crude oil price hovering around $80-$85 per barrel in 2024 directly impacts logistics and production expenses, affecting the company's overall profitability and necessitating robust cost management strategies.

| Economic Factor | 2024 Impact | Implication for Greencore |

|---|---|---|

| Inflation | UK food price inflation remained elevated, with some categories seeing double-digit increases year-on-year. | Increased procurement costs for raw materials and packaging; potential pressure on consumer demand for premium convenience foods. |

| Consumer Spending | Cost of living crisis led to a shift towards value-oriented purchases. | Need to adapt product offerings and pricing to meet price-sensitive consumer demand. |

| Energy & Commodity Prices | Brent crude oil averaged $80-$85/barrel; volatility in agricultural commodity markets. | Higher transportation and production costs, impacting operational profitability and margins. |

| Exchange Rates (GBP/EUR) | GBP fluctuated, trading around 1.17 EUR in early 2024. | Impacts cost of imported goods from Eurozone and competitiveness of exports to Ireland. |

| Interest Rates | Central bank base rates remained a key consideration for borrowing costs. | Higher borrowing costs can affect investment in expansion and capital projects. |

Same Document Delivered

Greencore PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive PESTLE analysis of Greencore delves into Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company's operations and strategy.

This is a real screenshot of the product you’re buying—delivered exactly as shown, no surprises. You'll gain immediate access to a detailed breakdown of the external forces shaping Greencore's business landscape.

The content and structure shown in the preview is the same document you’ll download after payment. This PESTLE analysis provides actionable insights into the opportunities and threats facing Greencore.

Sociological factors

Consumers are increasingly prioritizing health and wellness, leading to a significant surge in demand for plant-based and free-from options. In 2024, the global plant-based food market was valued at over $40 billion, with projections indicating continued robust growth. Greencore's ability to adapt its product portfolio to include more nutritious and specialized dietary choices, such as gluten-free or low-sugar alternatives, is crucial for capturing this expanding market segment and staying competitive.

Modern life, with its packed schedules and smaller family units, fuels a significant appetite for convenient food options. This is evident in the UK's food-to-go market, which saw substantial growth, with sales reaching an estimated £17.1 billion in 2023, indicating a clear consumer preference for ready-made meals and snacks.

Greencore's business, focused on items like sandwiches and ready meals, directly taps into this demand. Their ability to deliver these products quickly aligns perfectly with consumer needs for on-the-go consumption and time-saving solutions.

To maintain its edge, Greencore must continually evolve its product offerings and distribution channels. For instance, expanding into new formats like chilled salads or plant-based meal kits could further capture evolving convenience preferences, building on the 10% year-on-year growth seen in the UK's chilled convenience foods sector in early 2024.

Growing consumer awareness around health and wellness significantly shapes purchasing habits, driving a demand for products that clearly display nutritional content, minimize artificial ingredients, and offer tangible health advantages. This trend is evident globally, with reports indicating that over 60% of consumers in developed markets actively seek healthier food options.

Greencore must adapt by reformulating its product lines to reduce sugar, salt, and unhealthy fats, while also emphasizing the positive nutritional aspects of its offerings. Transparent and informative labeling is crucial; for instance, clear "free-from" claims or certifications for organic or natural ingredients can build substantial consumer trust and meet evolving expectations in a competitive market.

Ethical and Sustainable Consumption

Consumers are increasingly prioritizing ethical and sustainable choices, with a significant portion of shoppers willing to pay more for products aligned with their values. For instance, a 2024 survey indicated that over 60% of consumers actively seek out brands with strong environmental and social responsibility credentials. This trend directly impacts Greencore, as it faces mounting pressure to ensure its supply chain upholds ethical sourcing, animal welfare standards, and minimizes the environmental impact of its food production processes.

Greencore must actively showcase its commitment to responsible practices to resonate with these ethically conscious consumers. This includes transparently detailing sustainable sourcing initiatives, promoting fair labor conditions across its operations, and demonstrating tangible efforts to reduce its overall environmental footprint. Failing to do so risks alienating a growing segment of the market and diminishing brand reputation, especially as competitors increasingly highlight their sustainability efforts.

- Growing Consumer Demand: In 2024, studies showed that 65% of consumers consider sustainability when making food purchases.

- Ethical Sourcing Focus: Consumers are scrutinizing ingredient origins, with a particular emphasis on fair trade and animal welfare.

- Brand Reputation Impact: Greencore's ability to demonstrate ethical and sustainable practices directly influences consumer trust and loyalty.

- Competitive Landscape: Companies with robust sustainability programs are gaining market share, putting pressure on all players to adapt.

Demographic Shifts and Urbanization

Demographic shifts, including an aging population and a trend towards smaller households, are reshaping consumer behavior across the UK and Ireland. This means people are looking for different types of food. For instance, as the UK population ages, there’s a growing demand for convenient, ready-to-eat meals that are easy to prepare and consume. The Office for National Statistics reported that in 2023, the proportion of people aged 65 and over in the UK reached 19.7% of the total population, a figure expected to rise.

Urbanization continues to be a significant trend, concentrating more people in cities. This concentration drives demand for easily accessible food options, such as single-portion meals and grab-and-go items, particularly for busy urban dwellers. By 2023, the UK's urban population stood at approximately 84% of its total population, highlighting the importance of catering to city-based consumers. Greencore needs to align its product offerings and distribution networks to meet the needs of these increasingly urbanized and time-poor consumers.

To effectively engage these evolving consumer segments, Greencore must adapt its strategies. This includes adjusting product sizes to suit smaller households and single individuals, optimizing distribution channels to reach urban centers efficiently, and tailoring marketing messages to resonate with the specific needs and preferences of an aging demographic and urban populations. For example, focusing on the convenience and nutritional value of their products would likely appeal to both segments.

- Aging Population: The UK's population aged 65 and over is projected to increase, driving demand for convenient, nutritious meals.

- Urbanization: With over 84% of the UK population living in urban areas, there's a growing need for readily available, single-portion food options.

- Smaller Households: The trend towards smaller household sizes necessitates smaller product portions and flexible meal solutions.

- Consumption Patterns: These demographic changes directly influence consumer preferences, pushing Greencore to innovate in product development and accessibility.

Sociological factors significantly influence consumer choices, with health consciousness and convenience being paramount. In 2024, the global market for healthy and convenience foods continued its upward trajectory, with consumers actively seeking nutritional transparency and ease of preparation. This trend is further amplified by evolving demographic patterns, such as an aging population and increasing urbanization, which collectively drive demand for accessible, single-serving, and nutritionally balanced meal solutions.

| Sociological Factor | Impact on Greencore | Supporting Data (2023-2025) |

|---|---|---|

| Health & Wellness Focus | Increased demand for nutritious, "free-from" options. | Global plant-based food market valued over $40 billion in 2024; 60%+ consumers seek healthier options. |

| Demand for Convenience | Growth in ready-to-eat meals and grab-and-go items. | UK food-to-go market reached £17.1 billion in 2023; 10% YoY growth in UK chilled convenience foods (early 2024). |

| Demographic Shifts (Aging Population) | Need for easy-to-prepare, nutritious meals. | UK population aged 65+ reached 19.7% in 2023, a rising trend. |

| Urbanization | Demand for accessible, single-portion food options. | Approx. 84% of UK population lives in urban areas (2023). |

Technological factors

Advancements in automation and robotics present significant opportunities for Greencore to boost efficiency and lower labor expenses. For instance, the global food automation market was valued at approximately $15.5 billion in 2023 and is projected to reach over $28 billion by 2028, indicating strong growth and adoption trends that Greencore can leverage.

Implementing automated systems for tasks like ingredient preparation, product assembly, and packaging can streamline Greencore's high-volume manufacturing. This technological integration is vital for maintaining competitiveness, as seen with competitors increasingly adopting automated solutions to increase production capacity and ensure product consistency.

Innovations in food preservation are transforming the industry, moving beyond basic chilling and freezing. Technologies such as high-pressure processing (HPP) and modified atmosphere packaging (MAP) are gaining traction, offering ways to significantly extend shelf life and bolster food safety. These advancements are crucial for reducing waste and improving the overall quality of food products.

For a company like Greencore, adopting these advanced techniques presents a clear opportunity to boost product quality and streamline logistics. For example, HPP can maintain the fresh-like qualities of products without heat, while MAP controls the atmosphere inside packaging to prevent spoilage. These methods can lead to greater efficiency and a stronger market position.

The market for these advanced preservation technologies is growing. The global HPP market, for instance, was valued at approximately USD 400 million in 2023 and is projected to reach over USD 700 million by 2030, demonstrating a strong compound annual growth rate. This indicates a clear trend towards adopting these methods for competitive advantage.

Greencore's supply chain is significantly benefiting from the integration of digital technologies like AI and IoT. For instance, AI-powered demand forecasting tools are becoming crucial. In the food sector, accurate forecasting can reduce spoilage by up to 20%, a direct cost saving for companies like Greencore.

The use of IoT sensors allows for real-time monitoring of temperature and humidity throughout the supply chain, ensuring product quality and safety. This is particularly important for fresh produce, where maintaining optimal conditions can extend shelf life and reduce waste. Advanced software platforms are also streamlining inventory management, leading to fewer stockouts and less excess inventory, potentially improving working capital by 5-10%.

These advancements in digitalization enhance Greencore's ability to respond quickly to market changes and customer demand. Improved traceability, from farm to fork, is also a key benefit, building consumer trust and meeting regulatory requirements. The overall operational control and efficiency gains are substantial, directly impacting profitability and sustainability.

E-commerce and Direct-to-Consumer Platforms

The burgeoning e-commerce sector, particularly in grocery, presents a significant technological factor for Greencore. The rapid growth of online grocery shopping and expedited delivery services offers opportunities to broaden market access. For instance, in the UK, online grocery sales are projected to reach £20.1 billion by the end of 2024, a substantial increase from previous years.

Adapting to this digital shift necessitates strategic adjustments in packaging to ensure product integrity during transit and optimizing logistics for efficient last-mile delivery. Greencore may need to explore direct-to-consumer (DTC) models or strengthen collaborations with established online grocery retailers to effectively tap into these evolving consumer purchasing behaviors.

- Market Reach Expansion: E-commerce platforms allow Greencore to reach a wider customer base beyond traditional retail channels.

- Logistical Adaptation: The company must invest in supply chain technologies that support efficient, rapid delivery of fresh food products.

- Packaging Innovation: New packaging solutions are required to maintain product quality and shelf life during online distribution.

- Partnership Opportunities: Collaborating with major online grocers can provide immediate access to a significant digital customer segment.

Food Science and Ingredient Innovation

Ongoing advancements in food science are continuously yielding new ingredient discoveries, including the burgeoning field of alternative proteins and sophisticated flavour technologies. Greencore can harness these innovations to create healthier, more sustainable, and novel convenience food options that align with evolving consumer preferences and dietary needs.

For example, the global plant-based food market, a direct beneficiary of ingredient innovation, was valued at approximately $29.7 billion in 2023 and is projected to reach $169.9 billion by 2031, showcasing significant growth potential for companies like Greencore to tap into. Staying informed about these scientific breakthroughs is crucial for Greencore’s product diversification and maintaining a competitive edge in the market.

- Ingredient Innovation: Development of novel ingredients from sources like algae or fungi for enhanced nutritional profiles.

- Alternative Proteins: Growth in plant-based and cultivated meat technologies offering sustainable protein sources.

- Flavour Technologies: Innovations in natural flavourings and encapsulation for improved taste and shelf-life.

- Health and Nutrition Focus: Scientific efforts to reduce sugar, salt, and fat while increasing fibre and essential nutrients in convenience foods.

Technological advancements are reshaping Greencore's operational landscape, particularly in automation and digital integration. The global food automation market's projected growth to over $28 billion by 2028 underscores the efficiency gains available through robotics in manufacturing, from preparation to packaging. This adoption is crucial for maintaining competitiveness and ensuring consistent product quality in a high-volume environment.

Innovations in food preservation, such as high-pressure processing (HPP) and modified atmosphere packaging (MAP), are extending shelf life and improving food safety, with the HPP market alone expected to surpass $700 million by 2030. Digitalization, including AI for demand forecasting and IoT sensors for supply chain monitoring, is also vital. AI can reduce spoilage by up to 20%, while IoT ensures product integrity, directly impacting profitability and sustainability.

The rise of e-commerce, with UK online grocery sales predicted to hit £20.1 billion by the end of 2024, necessitates technological adaptations in packaging and logistics for efficient last-mile delivery. Furthermore, advancements in food science, such as alternative proteins and new flavour technologies, offer Greencore opportunities to develop healthier, sustainable convenience foods, tapping into a plant-based food market projected to reach $169.9 billion by 2031.

Legal factors

Greencore is subject to rigorous food safety and hygiene regulations, overseen by bodies such as the Food Standards Agency (FSA) in the UK. These rules govern all aspects of food production, from sourcing ingredients to final delivery, ensuring consumer protection and preventing costly breaches.

Failure to comply can lead to significant penalties, including fines and operational shutdowns, as well as severe damage to brand reputation. For instance, the FSA conducts regular inspections, and Greencore's commitment to Hazard Analysis and Critical Control Points (HACCP) is fundamental to maintaining compliance and product integrity.

Laws governing product labeling, nutritional claims, and advertising are paramount for Greencore, especially given its significant private-label business. These regulations ensure ingredient lists, allergen declarations, and marketing statements are accurate, preventing consumer deception. For instance, in the UK, the Food Information Regulations 2014 mandate clear allergen labeling, a critical area for a food producer like Greencore.

Failure to comply with these consumer protection laws can result in substantial penalties, including significant fines and costly product recalls. In 2023, the UK's Food Standards Agency (FSA) reported numerous enforcement actions against food businesses for labeling inaccuracies, highlighting the risks. Greencore must maintain stringent internal compliance processes and legal oversight to safeguard its reputation and avoid financial repercussions.

Greencore, as a significant employer, must navigate a complex web of employment and labour laws. These regulations encompass minimum wage requirements, stipulated working hours, stringent health and safety standards, anti-discrimination provisions, and rules governing collective bargaining. For instance, in the UK, the National Living Wage for those aged 21 and over was £11.44 per hour as of April 2024, a figure Greencore must adhere to across its workforce.

Strict compliance with these laws is non-negotiable for maintaining a lawful and equitable workplace. Failure to do so can lead to costly disputes, damage employee morale, and severely harm Greencore's public image, potentially disrupting its operations and impacting its ability to attract and retain talent.

Competition and Anti-Trust Legislation

Competition and anti-trust legislation are crucial for maintaining a level playing field in the food manufacturing sector. These laws are designed to prevent practices like monopolies, price-fixing, and the abuse of dominant market positions. Greencore must meticulously ensure its business dealings, from commercial agreements to market strategies and potential acquisitions, align with these regulations to promote fair competition.

Failure to comply can lead to severe consequences. For instance, in 2023, the UK's Competition and Markets Authority (CMA) imposed fines totaling millions of pounds on companies for anti-competitive behavior in various sectors. For Greencore, such violations could result in significant financial penalties, costly legal battles, and damage to its reputation and market standing.

- Regulatory Scrutiny: Greencore operates in a market where regulators like the CMA actively monitor for anti-competitive practices.

- Compliance Costs: Ensuring adherence to competition laws requires ongoing investment in legal counsel and internal compliance programs.

- Merger Control: Any significant acquisitions by Greencore would be subject to review to prevent undue market concentration.

- Market Integrity: Upholding competition laws is vital for maintaining consumer trust and the overall health of the food industry.

Packaging Waste and Recycling Legislation

Evolving legislation around packaging waste, particularly in the UK and EU, directly impacts Greencore's operational costs and strategic decisions. For instance, the UK's Plastic Packaging Tax, introduced in April 2022, levies a charge on plastic packaging manufactured or imported into the UK that contains less than 30% recycled plastic. This legislation incentivizes the use of recycled content, pushing companies like Greencore to adapt their supply chains and material sourcing.

Extended Producer Responsibility (EPR) schemes are also a significant legal factor. These schemes place the financial and operational burden of managing packaging waste at the end of its life onto the producers. In 2024, the UK government continued to refine its EPR for packaging system, with full implementation expected to significantly increase compliance costs for businesses handling packaging. Greencore, as a major food producer, will face substantial fees based on the volume and type of packaging it places on the market, necessitating investment in more easily recyclable or reusable materials.

Recycling targets set by governments worldwide directly influence Greencore's packaging choices. For example, the EU's Circular Economy Action Plan aims for all packaging to be reusable or recyclable in an economically viable way by 2030. This legislative push requires Greencore to:

- Invest in innovative, sustainable packaging solutions that meet or exceed recycling targets.

- Reduce reliance on single-use plastics and explore alternatives like compostable or reusable packaging.

- Ensure robust data reporting on packaging materials used and contributions to recycling infrastructure, as mandated by EPR regulations.

Greencore's operations are heavily influenced by food safety and labeling laws, with bodies like the UK's Food Standards Agency (FSA) setting stringent standards. Non-compliance can lead to fines, operational halts, and reputational damage, underscoring the importance of HACCP principles. For instance, the UK's Food Information Regulations 2014 mandates clear allergen labeling, a critical aspect for Greencore's private-label business.

Employment law, including minimum wage and health and safety regulations, is another key legal factor. As of April 2024, the UK's National Living Wage was £11.44 per hour, a standard Greencore must meet. Adherence is crucial to avoid costly disputes and maintain employee morale.

Competition and anti-trust legislation, enforced by bodies like the UK's Competition and Markets Authority (CMA), prevent anti-competitive practices. In 2023, the CMA imposed significant fines on companies for such behavior, highlighting the risks for Greencore if it fails to ensure fair market dealings.

Environmental legislation, particularly concerning packaging waste, impacts Greencore's costs and strategy. The UK's Plastic Packaging Tax, effective since April 2022, charges for packaging with less than 30% recycled content. Furthermore, Extended Producer Responsibility (EPR) schemes, being refined in the UK for 2024, will increase compliance costs for packaging management, pushing Greencore towards more sustainable material choices.

| Legal Area | Key Regulations/Bodies | Impact on Greencore | Example/Data Point (2023-2025) |

|---|---|---|---|

| Food Safety & Hygiene | FSA (UK), HACCP | Mandatory compliance, risk of fines/shutdowns | FSA reported numerous enforcement actions for labeling inaccuracies in 2023. |

| Product Labeling & Advertising | Food Information Regulations 2014 (UK) | Accurate ingredient/allergen info, prevents consumer deception | Mandates clear allergen labeling, critical for private-label products. |

| Employment Law | National Living Wage, Health & Safety Executive (UK) | Fair wages, safe working conditions, employee morale | UK National Living Wage £11.44/hour (April 2024). |

| Competition Law | CMA (UK) | Prevents monopolies, price-fixing, ensures fair competition | CMA imposed millions in fines for anti-competitive behavior in 2023. |

| Environmental Law | Plastic Packaging Tax (UK), EPR Schemes | Incentivizes recycled content, increases packaging management costs | UK EPR for packaging system refinement ongoing in 2024, impacting compliance costs. |

Environmental factors

Greencore faces mounting pressure from governments, consumers, and investors to significantly lower its carbon footprint. This necessitates setting ambitious reduction targets across its manufacturing, logistics, and supply chain operations. For instance, in 2024, the UK government's Environment Act aims to improve air quality and reduce greenhouse gas emissions, creating a regulatory push for companies like Greencore to align their strategies.

Optimizing energy use in manufacturing plants, improving the efficiency of transportation routes, and collaborating with suppliers to cut emissions from raw materials are key strategies. Greencore's commitment to sustainability is measured by its progress in these areas, directly impacting its reputation and investor appeal. By 2025, many companies are expected to report on Scope 1, 2, and 3 emissions, highlighting the urgency for demonstrable reductions.

Greencore is navigating the complex landscape of food and packaging waste, presenting both hurdles and avenues for growth. A significant environmental focus for the company involves developing and implementing effective waste reduction strategies, aiming to divert waste away from landfills.

Adopting circular economy principles for packaging is a critical environmental priority. This means Greencore is actively exploring the use of recyclable, compostable, or reusable packaging materials to minimize its environmental footprint.

Furthermore, the company is investigating innovative ways to utilize food by-products, transforming what was once considered waste into valuable resources. For example, in 2023, the UK food industry generated approximately 10.2 million tonnes of food waste, highlighting the scale of the challenge and the potential impact of initiatives like Greencore's.

Consumers and regulators are increasingly focused on the environmental and social footprint of food production, putting pressure on companies like Greencore to adopt sustainable sourcing practices. Concerns about deforestation, water scarcity, and biodiversity loss are driving demand for ethically produced ingredients. For example, the Roundtable on Sustainable Palm Oil (RSPO) certified 17% of global palm oil production in 2023, highlighting the growing importance of such certifications.

Greencore's reliance on key ingredients like fresh produce, soy, and potentially palm oil necessitates a robust strategy to ensure its supply chain is both sustainable and ethically managed. This involves more than just compliance; it means actively engaging with suppliers to promote responsible agricultural methods. By 2024, over 60% of major food companies reported having policies in place for sustainable sourcing of at least one key commodity.

Meeting these evolving stakeholder expectations requires Greencore to implement rigorous supplier assessment processes and seek credible certifications. This not only mitigates reputational risk but also can lead to more resilient supply chains. The company's commitment to transparency in its sourcing, potentially through annual sustainability reports detailing progress on key environmental metrics, will be crucial in building trust and maintaining its market position through 2025.

Water Usage and Wastewater Management

Water is a vital input for Greencore's food manufacturing operations, demanding careful management of consumption and responsible wastewater handling. The company's commitment to sustainability means prioritizing efficient water use and investing in advanced wastewater treatment to meet stringent environmental standards.

Regulatory pressures and growing public concern over water scarcity are driving investments in water-saving technologies. For instance, in 2024, the UK Environment Agency reported that water companies are facing increased scrutiny over abstraction licenses, impacting industrial users. Greencore's proactive approach in reducing water intensity not only mitigates environmental impact but also offers significant operational cost savings by lowering water bills and treatment expenses.

Greencore's focus on water management is evident in initiatives aimed at reducing water intensity across its sites. By implementing best practices and exploring innovative solutions, the company aims to minimize its water footprint. For example, many food manufacturers are adopting closed-loop water systems and advanced filtration technologies, which can reduce freshwater intake by up to 50%.

- Water Intensity Reduction: Greencore aims to lower its water usage per unit of production, a key metric for environmental performance.

- Wastewater Treatment Investment: Ongoing investment in state-of-the-art wastewater treatment facilities ensures compliance with discharge regulations and protects local water bodies.

- Resource Efficiency Gains: Implementing water-saving technologies contributes to operational cost reductions, aligning environmental responsibility with financial prudence.

- Regulatory Compliance: Adherence to evolving water usage and discharge regulations is paramount, requiring continuous monitoring and adaptation of processes.

Climate Change Impacts on Supply Chain

Climate change presents significant challenges for Greencore's supply chain. Extreme weather events, like the severe droughts experienced in parts of Europe in 2023, directly affect agricultural yields, impacting the availability and cost of key raw materials such as potatoes and vegetables. This volatility poses a direct risk to Greencore's operational stability and can lead to increased procurement expenses.

To mitigate these risks, Greencore must enhance the resilience of its sourcing strategies. This involves diversifying its supplier base across different geographical regions to reduce reliance on areas prone to climate-related disruptions. Furthermore, investing in and promoting climate-resilient agricultural practices among its growers, such as water-efficient irrigation and drought-resistant crop varieties, is crucial for ensuring a consistent and predictable supply of high-quality ingredients.

- Extreme weather events can disrupt agricultural production, impacting raw material availability and price.

- Supply chain volatility increases operational risks and procurement costs for companies like Greencore.

- Diversifying suppliers geographically is a key strategy to build resilience against localized climate impacts.

- Investing in climate-resilient agriculture ensures long-term supply stability and supports sustainable sourcing.

Greencore's environmental strategy is increasingly shaped by the urgency to reduce its carbon footprint, aligning with global sustainability goals and regulatory pressures. For instance, the UK's target to reach net-zero emissions by 2050, reinforced by policies like the 2024 Environment Act, compels significant operational shifts. By 2025, many companies are expected to provide detailed reporting on Scope 1, 2, and 3 emissions, making demonstrable reductions a critical factor for investor confidence and market positioning.

The company is actively addressing food and packaging waste, a significant environmental challenge in the UK food industry, which generated approximately 10.2 million tonnes of food waste in 2023. Greencore's focus on circular economy principles for packaging and innovative utilization of food by-products aims to divert waste from landfills and create value from resources. This commitment is crucial as consumer and regulatory scrutiny on the environmental impact of food production intensifies, driving demand for ethically sourced ingredients and transparent supply chains.

Water management is another key environmental focus, with Greencore prioritizing efficient water use and investing in advanced wastewater treatment to meet stringent standards. Growing concerns over water scarcity, highlighted by increased scrutiny on abstraction licenses for industrial users in 2024, underscore the need for proactive water-saving technologies. By reducing water intensity, Greencore not only mitigates environmental impact but also achieves significant operational cost savings.

Climate change poses substantial risks to Greencore's supply chain, particularly through extreme weather events that affect agricultural yields and raw material costs. In response, the company is enhancing supply chain resilience by diversifying its supplier base geographically and promoting climate-resilient agricultural practices among growers. This strategic approach ensures a more stable supply of ingredients and supports the company's long-term sustainability objectives.

| Environmental Focus Area | Key Initiatives/Challenges | Data Point/Target | Impact/Implication |

|---|---|---|---|

| Carbon Footprint Reduction | Setting emission reduction targets, optimizing logistics, supplier engagement | UK net-zero target by 2050; Expected Scope 1, 2, 3 reporting by 2025 | Regulatory compliance, enhanced investor appeal, reputational risk mitigation |

| Waste Management | Circular economy packaging, food by-product utilization | UK food waste ~10.2 million tonnes (2023) | Resource efficiency, potential new revenue streams, reduced landfill costs |

| Water Management | Water-efficient technologies, advanced wastewater treatment | Increased scrutiny on water abstraction licenses (2024) | Operational cost savings, regulatory compliance, reduced environmental footprint |

| Climate Change Resilience | Supply chain diversification, climate-resilient agriculture promotion | Extreme weather events impacting crop yields (e.g., 2023 droughts) | Supply chain stability, raw material cost management, enhanced operational predictability |

PESTLE Analysis Data Sources

Our Greencore PESTLE Analysis is meticulously crafted using data from reputable sources including government environmental agencies, international food and agriculture organizations, and leading market research firms. We incorporate insights from regulatory bodies, economic trend reports, and technological advancements impacting the food industry.