Greencore Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Greencore Bundle

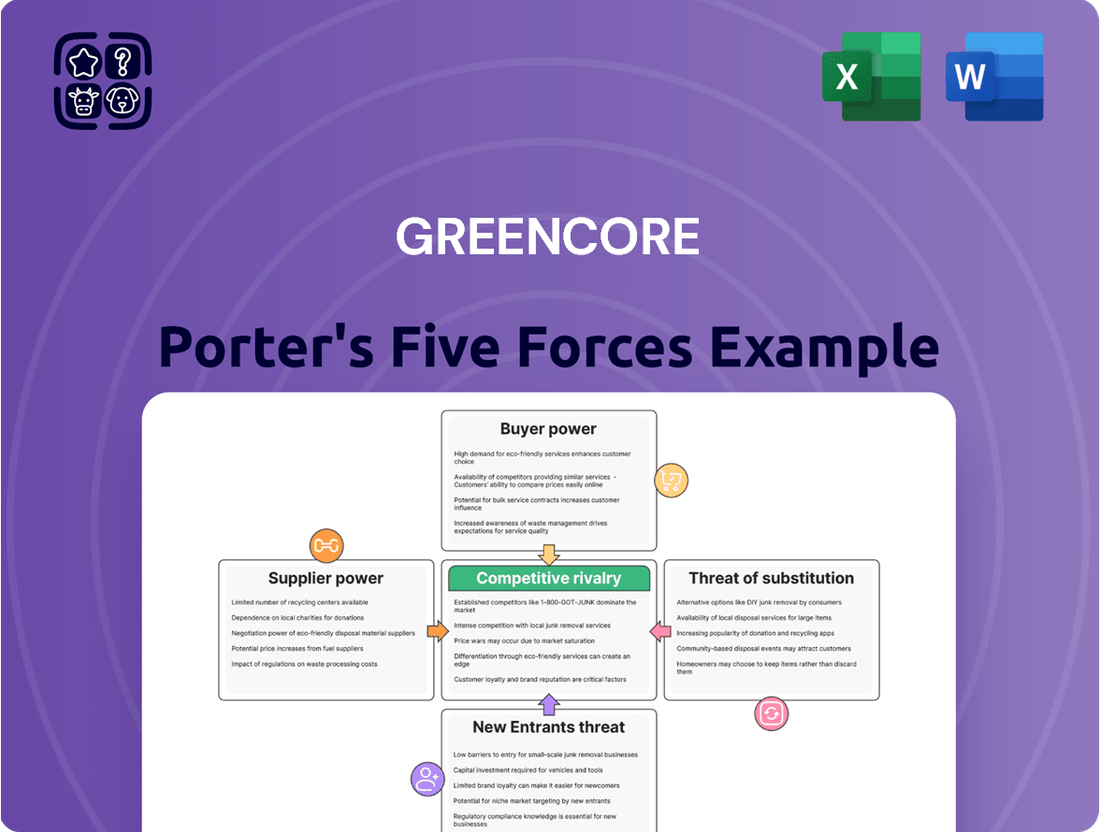

Greencore faces significant competitive pressures, with buyer power and the threat of substitutes playing crucial roles in its market landscape. Understanding these dynamics is key to navigating its industry effectively.

The complete report reveals the real forces shaping Greencore’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

Greencore's reliance on essential inputs like fresh produce, proteins, and packaging makes the bargaining power of its suppliers a critical factor. A concentrated supplier market, where a few dominant players control the supply of key raw materials, can significantly impact Greencore's operational costs and flexibility.

For instance, if the market for a specific type of packaging material is dominated by only two or three major manufacturers, these suppliers can leverage their market position to command higher prices or impose less favorable payment terms. This can directly squeeze Greencore's profit margins, especially in a competitive food-to-go market where price sensitivity is high.

In 2023, the UK food manufacturing sector experienced significant inflationary pressures, with input costs for many raw materials rising by over 10%. This highlights the potential for suppliers in concentrated markets to pass on their own increased costs, or simply exploit their market power, directly affecting companies like Greencore.

Input cost volatility significantly impacts the bargaining power of suppliers for companies like Greencore. The UK food industry, for instance, has witnessed substantial hikes in raw material and energy prices. These increases, often stemming from global events and weather patterns, enable suppliers to demand higher prices from manufacturers, directly affecting Greencore's operational costs and profit margins.

Switching suppliers for Greencore, especially when dealing with specialized ingredients or components crucial for their quick-turnaround food solutions, can incur significant costs. These expenses aren't trivial; they can involve rigorous re-approval processes for new ingredients, substantial adjustments to existing production lines and recipes, and the time and effort required to renegotiate terms with new vendors. These factors collectively increase the difficulty and expense of changing suppliers.

The potential disruption to Greencore's high-volume, rapid-delivery model is a critical consideration. A change in supplier, even if ultimately beneficial, could lead to temporary halts or slowdowns in production, impacting their ability to meet customer demand. This operational risk inherently strengthens the bargaining power of their current, reliable suppliers, as the cost of switching extends beyond mere financial outlay to encompass potential operational instability.

Supplier Importance to Greencore's Product Quality

For Greencore, a leader in fresh and chilled food manufacturing, the quality and consistency of raw materials are absolutely critical. Suppliers who can provide unique or superior ingredients directly impact Greencore's product quality and its brand reputation, thereby strengthening their own bargaining power. Greencore's commitment to meeting customer expectations hinges directly on the dependability of its entire supply chain, making supplier relationships a key consideration.

The bargaining power of suppliers for Greencore is influenced by several factors:

- Supplier Concentration: If only a few suppliers can provide the specific high-quality ingredients Greencore requires, their leverage is amplified.

- Switching Costs: The expense and effort involved for Greencore to change suppliers for key ingredients can be significant, giving existing suppliers more power.

- Input Differentiation: When suppliers offer ingredients that are not easily substituted and are vital to Greencore's unique product offerings, their bargaining position strengthens.

- Threat of Forward Integration: If suppliers have the potential to move into food manufacturing themselves, they gain considerable bargaining power over Greencore.

Backward Integration Potential of Suppliers

The potential for suppliers to integrate backward into food manufacturing significantly amplifies their bargaining power over Greencore. If suppliers can effectively move into producing finished food products themselves, they gain leverage by controlling a larger portion of the value chain.

While basic raw material suppliers typically lack this capability, specialized ingredient providers might explore forward integration. For example, a supplier of a unique sauce or seasoning could potentially develop their own ready-to-eat meal lines, directly competing with Greencore. This threat forces Greencore to maintain favorable terms with such suppliers.

Consider the dairy sector: a major milk supplier, if it developed capabilities in producing yogurts or ready-made desserts, could shift its strategic focus. In 2023, the global dairy market was valued at over $800 billion, indicating substantial capital availability for such strategic moves among large players.

- Supplier Forward Integration Threat: Suppliers moving into food manufacturing increases their leverage.

- Specialized Ingredient Providers: These are more likely to consider forward integration.

- Impact on Greencore: Greencore must offer competitive terms to mitigate this risk.

- Market Dynamics: Large market values in sectors like dairy provide capital for supplier integration.

Greencore's suppliers hold significant power when they are concentrated, offer differentiated inputs, or face low switching costs for Greencore. This power allows them to potentially raise prices or dictate terms, impacting Greencore's profitability and operational efficiency. For example, in 2024, the UK's food and drink sector continued to grapple with input cost volatility, with many raw material prices remaining elevated compared to pre-pandemic levels.

The bargaining power of suppliers is a key consideration for Greencore, particularly concerning raw materials like fresh produce and packaging. When suppliers are concentrated, like in specialized packaging markets, they can exert considerable influence. For instance, in 2024, the cost of certain food-grade plastics saw increases due to global supply chain adjustments, directly affecting manufacturers like Greencore.

Switching costs for Greencore can be substantial, especially for unique ingredients vital to their product lines. The effort and expense of re-qualifying suppliers and adjusting production processes empower existing suppliers. In 2024, the food industry faced ongoing challenges in sourcing specific, high-quality ingredients, reinforcing the leverage of suppliers providing these essentials.

The potential for suppliers to integrate forward into food manufacturing presents a significant threat, increasing their bargaining power over Greencore. This move allows them to capture more value in the supply chain. For example, a supplier of a key sauce or seasoning could develop its own ready-to-eat meals, directly competing with Greencore's offerings.

| Factor | Impact on Greencore | 2024 Relevance |

| Supplier Concentration | Higher prices, less flexibility | Persistent in specialized ingredient markets |

| Switching Costs | Increased dependence on existing suppliers | Significant for unique or regulated ingredients |

| Input Differentiation | Stronger supplier leverage for critical components | Crucial for maintaining product quality and brand reputation |

| Forward Integration Threat | Potential for increased competition and price pressure | More likely for suppliers of proprietary ingredients |

What is included in the product

This analysis delves into the competitive landscape for Greencore, examining the intensity of rivalry, the bargaining power of buyers and suppliers, the threat of new entrants, and the impact of substitute products.

Uncover hidden competitive advantages and threats with a visual breakdown of each force, enabling targeted strategic adjustments.

Customers Bargaining Power

Greencore's customer base is heavily concentrated among major UK and Irish retailers, encompassing all significant supermarket chains. This concentration means a substantial portion of Greencore's revenue is tied to a relatively small number of large buyers.

These dominant retailers wield considerable bargaining power. Their ability to purchase in massive volumes, coupled with their critical role in Greencore's sales, allows them to negotiate aggressively on price, payment terms, and service expectations. For instance, the top five UK supermarkets accounted for over 80% of grocery sales in 2023, illustrating the immense leverage these entities possess.

Greencore's significant reliance on private-label products, where its goods are branded by retailers, directly impacts the bargaining power of its customers. This strategy means consumers often perceive the product as belonging to the supermarket, not Greencore, potentially diminishing brand loyalty to the manufacturer and strengthening the retailer's position.

For instance, in the UK food-to-go sector, private-label sales have seen robust growth. In 2023, private-label products accounted for over half of all grocery sales in the UK, a trend that continued into early 2024. This dominance gives retailers substantial leverage when negotiating terms with suppliers like Greencore, as they can easily switch manufacturers if pricing or terms are not met.

The concentration of Greencore's customer base among a few major retailers further amplifies this customer power. If a large supermarket chain decides to demand lower prices or more favorable terms, Greencore has limited alternatives for those specific private-label contracts, as the volume is tied to that retailer's shelf space and consumer demand.

For major retailers, the cost of switching from one convenience food manufacturer to another is generally quite low. This is especially true if alternative suppliers can readily match the required volume and quality standards. This ease of switching empowers these customers, giving them significant leverage to negotiate more favorable pricing or to seek out other providers if Greencore's terms are not competitive.

Customer Price Sensitivity

Customer price sensitivity is a significant factor for Greencore, particularly in the convenience food sector where high-volume items are common. Consumers often compare prices across brands and retailers, pushing retailers to demand competitive pricing from their suppliers.

This pressure directly impacts manufacturers like Greencore, requiring them to maintain efficient operations and cost control to protect their profit margins. For instance, in the UK convenience food market, which is valued in the billions, even small price fluctuations can significantly affect sales volumes and profitability.

- Price Sensitivity in Convenience Foods: Consumers frequently evaluate price points for everyday food items, influencing purchasing decisions and creating a competitive pricing environment.

- Retailer Pressure on Manufacturers: Retailers, acting on behalf of price-conscious consumers, often pass down pricing demands to food manufacturers, impacting their ability to set prices.

- Margin Impact: The need to remain competitive can squeeze manufacturer margins, necessitating robust cost management strategies to ensure sustained profitability.

- Market Data Context: The UK's convenience food market, a key area for Greencore, demonstrates this sensitivity, with ongoing promotions and price comparisons being a common feature.

Customer's Threat of Backward Integration

Large retailers hold substantial bargaining power over suppliers like Greencore, partly due to their potential to integrate backward. This means they could, in theory, start producing their own private-label convenience foods, thereby cutting out the middleman.

While a massive undertaking, this capability grants them significant leverage during price and supply negotiations. For instance, in 2024, the private-label market share in the UK convenience food sector continued to grow, with major supermarkets actively expanding their own-brand offerings, putting pressure on manufacturers to maintain competitive pricing.

- Retailer Integration Capability: Major supermarket chains possess the financial resources and operational expertise to develop their own food manufacturing facilities.

- Private-Label Growth: The increasing consumer demand for private-label products in 2024 incentivizes retailers to invest in in-house production for greater control and margin.

- Negotiating Leverage: The credible threat of backward integration allows retailers to demand lower prices and more favorable terms from external suppliers like Greencore.

Greencore's customers, primarily large UK and Irish retailers, possess significant bargaining power due to their concentrated market share and the high volume of business they represent. This concentration means retailers can negotiate aggressively on price and terms, as evidenced by the fact that the top five UK supermarkets accounted for over 80% of grocery sales in 2023. The prevalence of private-label products, where retailers brand Greencore's output, further strengthens their position, as consumers often identify the product with the retailer, not the manufacturer. This dynamic is amplified by the low switching costs for retailers, who can readily source from alternative manufacturers if Greencore's terms are not competitive.

| Customer Segment | Market Share (UK Grocery Sales, 2023) | Impact on Greencore |

|---|---|---|

| Major Supermarket Chains | > 80% (Top 5) | High Bargaining Power, Price Pressure |

| Private-Label Consumers | > 50% (UK Grocery Sales, 2023) | Retailer Leverage, Reduced Brand Loyalty to Manufacturer |

Full Version Awaits

Greencore Porter's Five Forces Analysis

This preview shows the exact Greencore Porter's Five Forces Analysis you'll receive immediately after purchase, offering a comprehensive examination of competitive forces within the food industry. You'll gain insights into the bargaining power of buyers and suppliers, the threat of new entrants and substitute products, and the intensity of rivalry among existing competitors. This professionally formatted document is ready for your immediate use, providing valuable strategic intelligence for Greencore.

Rivalry Among Competitors

The UK convenience food market is incredibly fragmented, meaning there are many companies competing for customers. This intense competition is a significant factor for Greencore.

Greencore's core business, including sandwiches, salads, sushi, and ready meals, is characterized by a large number of manufacturers. This crowded landscape naturally drives up rivalry as companies constantly try to outdo each other on price, innovation, and distribution.

For instance, in 2024, the UK ready meal market alone was valued at billions of pounds, with a vast array of suppliers, from large supermarkets' own brands to smaller, specialist producers, all vying for shelf space and consumer attention.

Greencore's position in the food manufacturing sector is significantly shaped by high fixed costs and the inherent perishability of its products. For instance, the capital investment in state-of-the-art food processing plants and advanced logistics networks represents a substantial upfront expenditure.

These considerable fixed costs, coupled with the short shelf-life of chilled and fresh food items, create a powerful incentive for companies like Greencore to maintain high production volumes. This pressure to keep operations running efficiently and to move inventory before it spoils can intensify competitive rivalry, often manifesting as aggressive pricing strategies to capture market share and avoid costly write-offs.

While Greencore actively pursues product innovation, many convenience food items, particularly within the ready-meal and sandwich categories, can appear quite similar to consumers. This perceived homogeneity often shifts competition towards price, intensifying rivalry as companies vie for market share by offering lower costs.

This price-based competition is evident in the UK's ready-to-eat food market, which is highly competitive. For instance, in 2024, the market is projected to continue its growth, but intense competition means that margins can be squeezed if differentiation efforts are not successful. Companies like Greencore must constantly innovate to create unique selling propositions beyond just price.

Growth Rate of the Convenience Food Market

The UK food to go market is experiencing robust growth, projected to reach £20.2 billion by 2024, according to Statista. This expansion naturally draws in new entrants and intensifies competition among existing players, all vying for a greater slice of this expanding market. The prospect of increased market share in a growing sector fuels aggressive strategies and price competition.

Even with a growing market, intense rivalry can significantly pressure profit margins. Companies may resort to heavy discounting, increased marketing spend, and product innovation to differentiate themselves, all of which can erode profitability. This dynamic means that simply being in a growing market doesn't guarantee high returns if competitive pressures are severe.

- Market Growth Attracts Competitors: The UK food to go market's forecast growth to £20.2 billion by 2024 is a significant draw for new and existing businesses.

- Increased Rivalry: A growing market often leads to more companies competing for customers, resulting in heightened rivalry.

- Profitability Pressure: Despite market expansion, intense competition can limit profitability through price wars and increased operational costs.

Customer Loyalty and Brand Recognition

In the competitive landscape of private-label food manufacturing, customer loyalty is a nuanced factor. For Greencore, this loyalty typically resides with the retailer, not the manufacturer itself. This dynamic means Greencore faces an uphill battle in differentiating its products based on its own brand recognition, shifting the competitive focus heavily towards price and operational efficiency.

This reliance on retailer loyalty intensifies rivalry because manufacturers like Greencore must constantly prove their value through cost-effectiveness and reliable supply chains. For instance, in 2024, the private-label market continued its robust growth, with major UK supermarkets reporting significant increases in their own-brand sales, often at the expense of national brands. Greencore's success, therefore, hinges on its ability to be the preferred supplier for these retailers, often through competitive pricing and superior service levels rather than direct consumer brand appeal.

- Retailer-Centric Loyalty: Consumers often associate private-label quality and value with the supermarket brand, not the underlying manufacturer.

- Price and Efficiency as Key Differentiators: Greencore must compete primarily on cost and operational excellence to secure and maintain retailer contracts.

- Intensified Competition: The lack of strong manufacturer brand loyalty among private-label consumers fuels intense competition based on price, quality, and supply chain reliability.

The competitive rivalry within the UK convenience food sector is exceptionally high, driven by a fragmented market with numerous manufacturers vying for consumer attention and supermarket shelf space. This intense competition forces companies like Greencore to focus heavily on price, innovation, and operational efficiency to maintain market share.

The perishability of Greencore's products and significant fixed costs incentivize high production volumes, further escalating rivalry as companies aim to avoid costly inventory write-offs through aggressive pricing. This dynamic is particularly evident in the ready-meal and sandwich categories, where product similarity often leads to price-based competition.

The UK food to go market, projected to reach £20.2 billion by 2024, attracts substantial new entrants and intensifies competition among established players, leading to potential margin pressures despite market growth. In the private-label segment, where loyalty lies with retailers, manufacturers like Greencore must compete primarily on cost-effectiveness and reliable supply chains.

| Factor | Impact on Greencore | 2024 Data/Trend |

|---|---|---|

| Market Fragmentation | Intensified competition for customers and shelf space. | UK convenience food market highly fragmented. |

| Product Homogeneity (Convenience Foods) | Shift in competition towards price. | Ready meals and sandwiches often perceived as similar. |

| High Fixed Costs & Perishability | Pressure for high volumes and efficient operations. | Incentive for aggressive pricing to avoid spoilage. |

| Private-Label Focus | Competition based on cost and service, not manufacturer brand. | Retailer own-brand sales growing, impacting manufacturer differentiation. |

SSubstitutes Threaten

Home cooking and meal preparation represent a significant threat of substitutes for convenience food providers like Greencore. Consumers increasingly opt for preparing meals at home, driven by a desire for healthier ingredients, greater control over nutrition, and potential cost savings. For instance, a 2024 survey indicated that 65% of households reported increased home cooking post-pandemic, a trend that continues to influence purchasing decisions for ready-to-eat meals.

The threat of substitutes for Greencore's prepared meals is significant, as consumers can easily opt to purchase raw ingredients from the very supermarkets Greencore supplies. For instance, in 2024, UK households spent an average of £1,360 annually on groceries, a portion of which could be diverted to assembling homemade meals instead of buying convenience foods. This direct substitution means consumers can bypass Greencore's offerings by choosing to cook from scratch, leveraging the readily available ingredients within the same retail channels.

The threat of substitutes for Greencore's convenience food offerings is significant, stemming from the vast and diverse broader food service market. Consumers have a wide array of choices beyond pre-packaged meals, including traditional restaurants, cafes, and various takeaway services. These alternatives cater to different consumer needs and preferences, such as a desire for a sit-down dining experience or specific culinary cuisines not readily available in convenience formats.

In 2024, the UK food service sector continued its robust recovery and expansion. For instance, the restaurant sector alone saw significant growth, with industry reports indicating a substantial increase in consumer spending. This broad availability of dining and takeaway options means consumers can easily switch from convenience foods to meals prepared outside the home, especially for occasions where they seek variety or a different social experience.

Alternative Convenience Formats

The threat of substitutes for Greencore's chilled and fresh convenience foods is significant, particularly from alternative convenience formats. These include frozen meals and ambient, shelf-stable products, which offer different value propositions to consumers.

Advancements in freezing technology have made frozen meals more appealing, often retaining better texture and flavor than in the past. This can directly compete with Greencore's ready-to-eat chilled options. Similarly, the convenience of ambient products, requiring no refrigeration and having a long shelf life, appeals to consumers seeking ultimate ease and pantry stocking.

- Frozen Meal Market Growth: The global frozen food market is projected to reach over $400 billion by 2027, indicating strong consumer adoption of this substitute format.

- Ambient Product Innovation: Innovations in packaging and preservation for ambient goods continue to expand their variety and appeal, offering competitive convenience.

- Consumer Preference Shifts: As consumers prioritize convenience and value, the accessibility and often lower price points of frozen and ambient options pose a direct challenge to Greencore's market share.

Dietary Trends and Health Consciousness

The rise of plant-based and free-from diets presents a significant threat of substitutes for Greencore. As consumers increasingly seek healthier, less processed options, traditional convenience meals may lose appeal if they don't align with these evolving preferences. For instance, the global plant-based food market was valued at approximately $29.7 billion in 2023 and is projected to reach $162.5 billion by 2030, indicating a substantial shift in consumer spending and a direct challenge to conventional convenience food providers.

Greencore's ability to adapt its product portfolio to cater to these burgeoning dietary trends is crucial. Failure to innovate and offer appealing vegan, gluten-free, or other specialized options could see consumers opting for substitutes from companies that are more attuned to these market demands. In 2024, the demand for convenient, healthy, and sustainably sourced food continues to grow, making it imperative for Greencore to demonstrate its commitment to these areas.

- Growing Demand for Plant-Based Options: The increasing consumer adoption of vegan and vegetarian lifestyles directly substitutes traditional meat-based convenience meals.

- Prevalence of Free-From Diets: The rise in gluten intolerance and celiac disease drives demand for gluten-free alternatives, impacting conventional bakery and meal offerings.

- Health and Wellness Focus: Consumers are actively seeking minimally processed foods with clear nutritional labeling, posing a threat to convenience foods perceived as less healthy.

- Availability of Alternative Meal Solutions: Meal kit services and ready-to-eat meals from specialized health food providers offer direct substitutes, often with a focus on fresh ingredients and specific dietary needs.

The threat of substitutes for Greencore's convenience foods is substantial, encompassing everything from home cooking to diverse food service options. Consumers can easily shift to preparing meals from scratch, leveraging the same grocery channels Greencore supplies. For instance, in 2024, UK households continued to prioritize home cooking, with a significant portion of their grocery budgets allocated to fresh ingredients. This trend directly challenges the demand for pre-prepared meals.

Furthermore, the broader food service market, including restaurants and takeaways, offers compelling alternatives. These outlets cater to varied consumer desires for dining experiences and specific cuisines, often presenting a more appealing substitute than chilled convenience meals. The UK food service sector's robust growth in 2024, with increased consumer spending on dining out, underscores this competitive pressure.

Frozen and ambient food products also represent significant substitutes. Enhanced freezing technologies improve the quality of frozen meals, while ambient goods offer long shelf life and ultimate convenience. These alternatives directly compete with Greencore's chilled offerings by providing different value propositions in terms of storage, preparation, and cost-effectiveness.

The growing demand for plant-based and free-from diets further amplifies the threat of substitutes. As consumers increasingly seek healthier, specialized options, convenience foods that do not align with these evolving preferences face reduced appeal. The global plant-based food market's projected substantial growth highlights a clear consumer shift towards alternatives that Greencore must address.

| Substitute Category | Key Driver | 2024 Impact/Trend |

|---|---|---|

| Home Cooking | Health, Cost Control | Continued rise in home preparation, impacting convenience food sales. |

| Food Service (Restaurants, Takeaways) | Experience, Variety | Robust sector growth and increased consumer spending on dining out. |

| Frozen & Ambient Foods | Convenience, Shelf-Life | Technological advancements and evolving consumer needs for ease. |

| Dietary Specialization (Plant-Based, Free-From) | Health & Wellness Trends | Significant market growth and consumer migration to specialized options. |

Entrants Threaten

The threat of new entrants for Greencore is significantly mitigated by the high capital investment required to establish a comparable food manufacturing operation. Building modern, large-scale production facilities, acquiring advanced machinery, and setting up efficient distribution networks demand substantial upfront funding. For instance, setting up a new, fully automated food production line can easily cost tens of millions of pounds, a figure that presents a formidable barrier for many aspiring competitors.

Greencore benefits from an established supply chain and a direct-to-store distribution network that spans the entire UK. This existing infrastructure represents a substantial barrier for any new company looking to enter the market.

For instance, in 2024, the food-to-go sector, where Greencore operates, saw continued growth, with convenience stores playing a vital role in distribution. New entrants would face immense logistical hurdles and significant capital investment to replicate Greencore's reach and efficiency in delivering fresh products daily to numerous retail locations across the country.

Greencore's established, long-standing relationships with major UK retailers present a significant barrier to new entrants. These dominant customers, like Tesco and Sainsbury's, often prioritize suppliers with proven track records and consistent quality, making it difficult for newcomers to secure initial contracts. In 2023, Greencore reported that over 90% of its revenue was generated from its top ten customers, highlighting the critical importance of these partnerships.

Regulatory Compliance and Food Safety Standards

The food manufacturing sector faces substantial barriers to entry due to rigorous regulatory compliance and food safety standards. New companies must invest significantly in establishing robust quality control systems and navigating a complex web of regulations, which can be a considerable deterrent.

For instance, in 2024, the U.S. Food and Drug Administration (FDA) continued to enforce stringent Food Safety Modernization Act (FSMA) regulations, requiring extensive documentation and preventative controls for food manufacturers. Compliance costs can easily run into hundreds of thousands of dollars for new facilities, impacting initial capital outlay.

- High Capital Investment: New entrants require substantial upfront investment in facilities, equipment, and processes to meet safety and quality certifications.

- Navigating Complex Regulations: Understanding and adhering to diverse national and international food safety laws, such as HACCP principles and specific allergen labeling requirements, is critical.

- Supply Chain Scrutiny: Regulators and consumers demand transparency and safety throughout the supply chain, from raw material sourcing to final product distribution.

- Certification Costs: Obtaining necessary certifications, like ISO 22000 or GFSI-benchmarked standards, involves audits and ongoing compliance, adding to operational expenses.

Brand Recognition and Economies of Scale

Greencore's strong brand recognition, even for private-label products, acts as a significant barrier. Customers trust Greencore's consistent quality and supply chain reliability, making them hesitant to switch to unknown new entrants. For instance, in 2023, Greencore reported revenue of £1.3 billion, demonstrating the scale of its operations.

The company benefits from substantial economies of scale in its high-volume food manufacturing. This allows Greencore to achieve lower production costs per unit, a competitive advantage that smaller, emerging players would find extremely difficult to match. This cost efficiency is crucial in the price-sensitive convenience food market.

- Brand Loyalty: Greencore's established reputation fosters customer loyalty, making it harder for new entrants to gain market share.

- Cost Advantage: Economies of scale in production translate to lower costs, creating a pricing advantage over smaller competitors.

- Operational Efficiency: Years of experience have honed Greencore's operational processes, leading to greater efficiency that new companies would need time and investment to replicate.

The threat of new entrants for Greencore is relatively low due to significant barriers. High capital investment is a major hurdle, with new automated food production lines costing tens of millions of pounds. Established relationships with major retailers, like Tesco and Sainsbury's, where Greencore generated over 90% of its revenue from its top ten customers in 2023, are difficult for newcomers to penetrate.

| Barrier | Description | Impact on New Entrants | Example Data (2023/2024) |

|---|---|---|---|

| Capital Investment | Building modern food manufacturing facilities and distribution networks. | Requires substantial upfront funding, deterring many. | Setting up a new automated line can cost tens of millions of pounds. |

| Established Relationships | Long-standing partnerships with major UK retailers. | Difficult for new entrants to secure initial contracts due to retailer preference for proven suppliers. | Greencore's top ten customers accounted for over 90% of revenue in 2023. |

| Regulatory Compliance | Adhering to stringent food safety and quality standards. | Demands significant investment in quality control systems and navigating complex regulations. | FSMA compliance costs can run into hundreds of thousands of dollars for new facilities. |

| Economies of Scale | High-volume production leading to lower per-unit costs. | New entrants struggle to match Greencore's cost efficiency in the price-sensitive market. | Greencore reported revenue of £1.3 billion in 2023, indicative of its scale. |

Porter's Five Forces Analysis Data Sources

Our Greencore Porter's Five Forces analysis is built upon a robust foundation of data, integrating information from company annual reports, industry-specific market research, and regulatory filings to provide a comprehensive view of the competitive landscape.