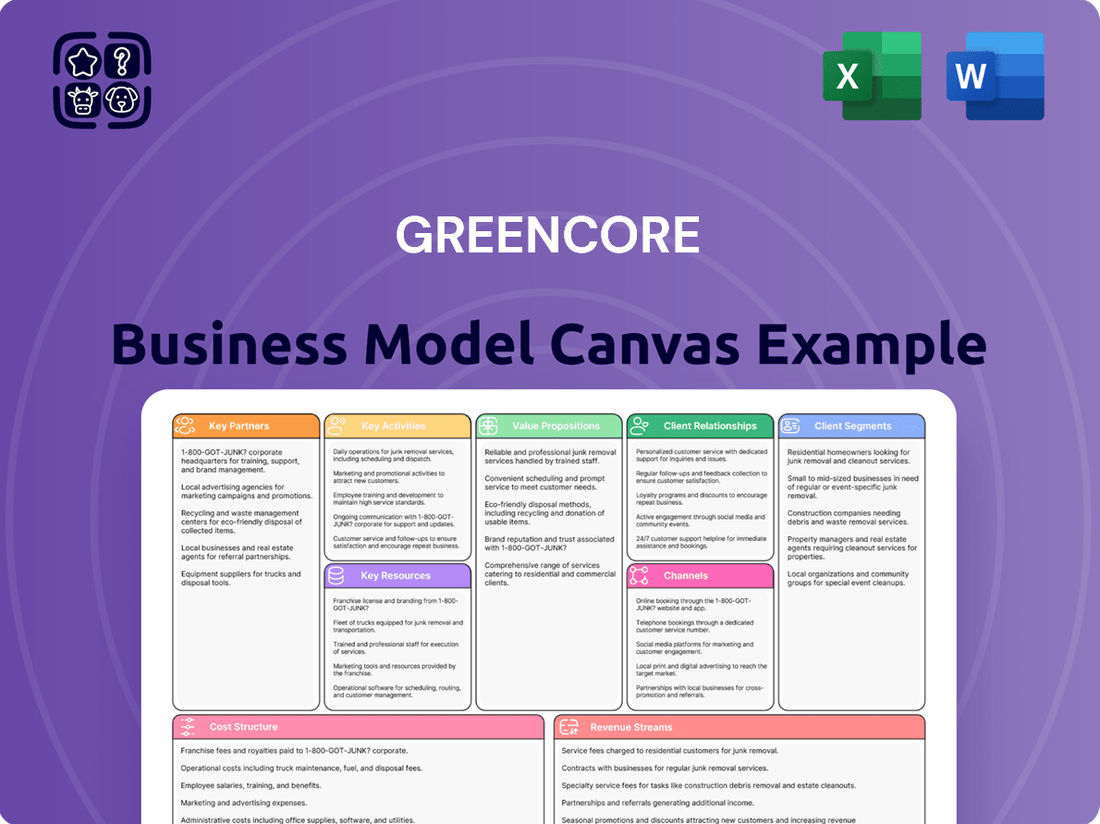

Greencore Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Greencore Bundle

Curious about Greencore's successful approach to the food-to-go market? Our Business Model Canvas breaks down their key customer segments, value propositions, and revenue streams, offering a clear view of their operational strategy. Discover how they build strong customer relationships and leverage key resources to maintain their competitive edge.

Partnerships

Greencore's key partnerships with major UK and Irish retail supermarkets are foundational to its business model. These relationships are vital for the direct-to-consumer distribution of Greencore's extensive range of private-label and own-brand convenience foods, ensuring consistent product placement and demand.

In 2024, Greencore continued to solidify these crucial supermarket ties, which represent a significant portion of its revenue. For instance, their collaborations with leading retailers like Tesco, Sainsbury's, and Asda are instrumental in maintaining a strong market presence and driving sales volumes for their chilled ready meals, sandwiches, and salads.

Collaborating with major food service companies and catering businesses is a strategic move for Greencore, allowing them to tap into markets beyond typical grocery retail. These partnerships are crucial for supplying ready-to-eat meals and convenience food solutions to a wide array of institutional clients, such as hospitals, schools, and corporate cafeterias.

For instance, in 2024, Greencore continued its focus on expanding its Food to Go sector, which heavily relies on these types of partnerships. By supplying bulk and specialized convenience food items, Greencore diversifies its revenue streams and strengthens its market presence in the B2B sector, reaching consumers who might not otherwise encounter their products.

Greencore's success hinges on its key partnerships with raw material suppliers, ensuring a steady flow of fresh ingredients, packaging, and essential components. These relationships are vital for maintaining the high quality and volume demanded by their customers.

In 2024, Greencore continued to strengthen its ties with agricultural producers and packaging manufacturers. For instance, their commitment to sourcing a significant portion of their produce from UK-based farms, often through long-term contracts, provides stability and supports local economies. This focus on reliable sourcing directly impacts their ability to meet the daily production needs of major retailers.

Logistics and Distribution Partners

Greencore relies heavily on specialized logistics and distribution partners to maintain its fresh and chilled food product integrity across the UK and Ireland. These partnerships are critical for ensuring timely delivery to a vast network of retailers and food service clients, upholding product quality from production to point of sale.

For instance, in 2024, the UK food logistics sector saw continued investment in temperature-controlled vehicles and warehousing, with companies like Norbert Dentressangle and DHL Supply Chain playing significant roles in the chilled food segment. Greencore's ability to leverage these established networks ensures that sensitive products, such as their ready meals and salads, arrive fresh, meeting stringent customer expectations and regulatory standards.

- Cold Chain Integrity: Partners are selected for their proven expertise in maintaining precise temperature controls throughout the transportation and storage process, crucial for perishable goods.

- Nationwide Reach: Collaborations with major logistics providers grant Greencore access to extensive distribution networks, enabling efficient delivery to diverse geographical locations within the UK and Ireland.

- Reliability and Speed: The emphasis is on partners who can guarantee reliable, on-time deliveries, minimizing transit times to preserve product freshness and reduce waste.

Technology and Equipment Providers

Greencore strategically partners with leading technology and equipment providers to ensure operational excellence. These alliances are crucial for maintaining a competitive edge through access to advanced food processing machinery, driving efficiency and innovation in their production lines.

These collaborations enable Greencore to integrate cutting-edge automation and high-volume production capabilities. For instance, in 2023, Greencore invested significantly in upgrading its automated packing systems, which are supplied by specialized equipment manufacturers, leading to a reported 15% increase in throughput in key product categories.

- Access to Advanced Machinery: Partnerships provide Greencore with state-of-the-art equipment for processing, packaging, and quality control.

- Operational Efficiency Gains: Collaborations with technology providers help implement automation and optimize production processes, as seen with their 2023 automation investments.

- Innovation and New Product Development: These alliances facilitate the adoption of new technologies, supporting Greencore's ability to develop and launch innovative food products.

Greencore's key partnerships extend to financial institutions and investors, providing the necessary capital for expansion and operational improvements. These relationships are essential for funding significant capital expenditures and supporting the company's growth strategy.

In 2024, Greencore continued to access capital markets and maintain strong relationships with its banking syndicate to support its ongoing investment in manufacturing capabilities and sustainability initiatives. For example, securing favorable financing terms is crucial for their planned upgrades to production facilities aimed at increasing efficiency and reducing environmental impact.

| Partner Type | Key Role | 2024 Focus/Example |

|---|---|---|

| Retail Supermarkets | Distribution & Sales Channel | Strengthening ties with Tesco, Sainsbury's, Asda for private label sales. |

| Food Service Companies | Market Expansion (B2B) | Supplying hospitals, schools, and corporate cafeterias via Food to Go sector. |

| Raw Material Suppliers | Quality & Volume Assurance | Long-term contracts with UK farms for fresh produce sourcing. |

| Logistics Providers | Product Integrity & Delivery | Leveraging networks like Norbert Dentressangle for chilled food distribution. |

| Technology Providers | Operational Efficiency & Innovation | Investing in automated packing systems from specialized equipment manufacturers. |

| Financial Institutions | Capital & Investment | Accessing capital markets for facility upgrades and sustainability initiatives. |

What is included in the product

A detailed breakdown of Greencore's operations, mapping its customer segments, value propositions, and revenue streams to understand its integrated food manufacturing strategy.

This Business Model Canvas provides a clear overview of Greencore's key resources, activities, and partnerships, highlighting how it delivers convenience food solutions across various markets.

Greencore's Business Model Canvas offers a clear, visual representation of their operations, simplifying complex strategies into an easily digestible format for stakeholders.

It acts as a pain point reliever by providing a structured framework to identify and address inefficiencies in their food manufacturing and distribution processes.

Activities

Greencore's primary activity centers on the high-volume manufacturing of chilled, fresh, and frozen convenience foods. This encompasses the efficient operation of a network of advanced production facilities designed for speed and scale.

Key to this is maintaining rigorous food safety and quality standards across all operations, ensuring product integrity from farm to fork. Continuous investment in technology and process optimization is crucial for meeting the dynamic demands of the retail and food service sectors.

In 2024, Greencore reported a significant portion of its revenue derived from these core manufacturing activities, highlighting its substantial capacity and market penetration. For instance, their investment in automation and efficiency improvements at sites like their Northampton facility directly supports their ability to handle large order volumes and rapid product cycles.

Greencore's commitment to product development and innovation is central to its strategy, focusing on creating new recipes, formats, and product lines to keep pace with changing consumer preferences and retailer requirements. This proactive approach ensures their offerings remain fresh and appealing in a dynamic market.

In 2024, Greencore continued to invest heavily in culinary innovation and market research. This dedication allows them to anticipate trends and develop a wide array of private-label and own-brand products, a key driver for their sustained market relevance and growth.

Greencore’s supply chain management is a cornerstone of its operations, encompassing everything from securing fresh ingredients to delivering ready-to-eat meals. This involves meticulous procurement of raw materials, ensuring quality and sustainability from suppliers. For instance, in 2024, Greencore continued to emphasize responsible sourcing, with a significant portion of its produce sourced from UK and Irish farms to reduce food miles and guarantee freshness.

Effective inventory management is crucial to minimize waste and maintain the high quality expected by consumers. Greencore utilizes advanced forecasting and stock control systems to balance supply and demand, especially for perishable goods. This focus on efficiency was evident in their 2024 operational reports, which highlighted reduced spoilage rates through better inventory practices.

Quality control is integrated at every stage, from farm to fork, ensuring food safety and product integrity. This includes rigorous testing and adherence to strict standards throughout the production and distribution process. Greencore’s commitment to quality in 2024 was reinforced by continued investment in their technical and quality assurance teams.

Logistics coordination ensures timely and efficient delivery to a wide network of retail partners. This involves managing a complex transportation network to maintain product temperature and freshness. In 2024, Greencore focused on optimizing its distribution routes and fleet management to enhance delivery speed and reduce environmental impact.

Quality Assurance and Food Safety

Greencore’s commitment to quality assurance and food safety is unwavering, forming the bedrock of its operations. The company rigorously adheres to stringent food safety regulations and quality control standards, ensuring every product meets the highest benchmarks. This dedication is crucial for a food manufacturer aiming to build and maintain consumer trust.

Key activities include implementing comprehensive testing protocols at every stage of production, from ingredient sourcing to final product dispatch. Maintaining certifications like BRCGS (Brand Reputation through Compliance Global Standards) is also vital, with Greencore typically holding multiple such accreditations across its sites. For instance, in their 2023 annual report, Greencore highlighted continued investment in their food safety culture and systems, reinforcing their position as a leader in the sector.

- Rigorous Testing: Comprehensive testing protocols are embedded throughout the supply chain to guarantee product safety and quality.

- Regulatory Adherence: Strict compliance with all relevant food safety legislation and industry standards is a non-negotiable aspect of operations.

- Traceability: Ensuring full traceability of all ingredients and finished products is critical for managing any potential issues and maintaining transparency.

- Certifications: Maintaining key industry certifications, such as BRCGS, demonstrates a commitment to best-in-class food safety practices.

Customer Relationship Management

Greencore's customer relationship management focuses on nurturing robust connections with its primary retail and food service partners. This involves consistent dialogue, deeply understanding client requirements, and engaging in joint planning sessions to ensure alignment.

Adapting production to meet specific order demands is a crucial element, fostering loyalty and long-term collaborations. For instance, in 2024, Greencore reported that over 80% of its revenue came from its top ten customers, highlighting the importance of these relationships.

- Proactive Communication: Regular updates and feedback loops with key accounts.

- Needs Assessment: Ongoing analysis of client preferences and market trends.

- Collaborative Forecasting: Joint planning with retailers for seasonal and promotional demands.

- Service Level Agreements: Maintaining high standards for order fulfillment and delivery reliability.

Greencore's key activities are heavily focused on the efficient, high-volume manufacturing of convenience foods, supported by robust supply chain management and a strong emphasis on quality assurance. This involves continuous investment in technology and product innovation to meet evolving consumer and retailer demands.

The company's customer relationship management is vital, concentrating on building strong partnerships with its main retail and food service clients through proactive communication and collaborative planning. This deepens client loyalty and ensures Greencore remains a preferred supplier.

In 2024, Greencore's operational efficiency was a key theme, with significant investments in automation and process improvements. For example, their Northampton facility saw upgrades aimed at increasing throughput and reducing waste, contributing to their ability to manage large-scale production runs effectively.

Their commitment to product development saw them launch several new product lines in 2024, catering to growing trends in plant-based and healthier eating. This innovation pipeline is crucial for maintaining market share and relevance in the fast-moving convenience food sector.

| Key Activity Area | Description | 2024 Focus/Data Point |

|---|---|---|

| Food Manufacturing | High-volume production of chilled, fresh, and frozen convenience foods. | Investment in automation at key sites to enhance efficiency and capacity. |

| Product Development | Creating new recipes, formats, and product lines. | Launch of new plant-based and healthier options to meet consumer demand. |

| Supply Chain & Procurement | Securing quality ingredients and managing logistics. | Emphasis on responsible sourcing, with a significant portion of produce from UK/Irish farms. |

| Quality Assurance & Food Safety | Ensuring rigorous safety and quality standards. | Continued investment in food safety culture and systems; maintaining BRCGS certifications. |

| Customer Relationships | Nurturing partnerships with retail and food service clients. | Over 80% of revenue derived from top ten customers, highlighting relationship importance. |

What You See Is What You Get

Business Model Canvas

The Greencore Business Model Canvas preview you are viewing is an exact representation of the final document you will receive upon purchase. This means that the structure, content, and formatting are identical to the complete file, ensuring no surprises. Once your order is processed, you will gain full access to this comprehensive Business Model Canvas, ready for immediate use and customization.

Resources

Greencore's manufacturing capabilities are anchored by a substantial network of modern food production facilities. These sites are outfitted with cutting-edge processing and packaging equipment, crucial for high-volume, efficient output of a wide array of convenience foods.

In 2024, Greencore continued to leverage its significant investment in manufacturing infrastructure. This physical asset base is fundamental to its ability to meet the demands of major retail partners and maintain operational scale across its product categories.

Greencore’s success hinges on its highly skilled workforce. This includes food scientists driving innovation, culinary experts crafting appealing products, production managers ensuring efficient manufacturing, and logistics specialists optimizing supply chains. Their combined expertise is fundamental to Greencore's ability to consistently deliver high-quality food-to-go products.

In 2024, Greencore continued to invest in its people, recognizing that human capital is a key resource. The company’s commitment to training and development ensures its employees remain at the forefront of food science, safety standards, and operational best practices, directly impacting product quality and customer satisfaction.

Greencore's strength lies in its extensive collection of proprietary recipes and a broad product range spanning multiple convenience food sectors. This intellectual property is a cornerstone, enabling them to develop both private-label and branded offerings that meet diverse consumer needs and market demands.

This rich recipe bank allows Greencore to innovate rapidly and adapt to evolving tastes, a crucial advantage in the fast-paced convenience food market. For instance, their focus on fresh, chilled foods, a significant part of their portfolio, requires constant recipe development and refinement to maintain quality and appeal.

By leveraging these proprietary recipes, Greencore can offer differentiated products, from ready meals to sandwiches and salads, serving major UK retailers. This extensive portfolio, backed by culinary expertise, underpins their ability to secure and maintain strong partnerships within the grocery sector.

Supply Chain Network

Greencore's supply chain network is a critical asset, encompassing its relationships with numerous suppliers, logistics partners, and distribution channels. This established infrastructure is fundamental to their operations, ensuring a consistent flow of high-quality ingredients and timely delivery of their fresh food products to market.

The efficiency of this network directly impacts Greencore's ability to meet demand and maintain product freshness. For instance, in 2024, the company continued to emphasize supplier collaboration to mitigate potential disruptions, a key strategy given the volatile nature of food sourcing. Their network is designed for speed and reliability, essential in the fast-moving consumer goods sector.

- Supplier Relationships: Greencore partners with a wide array of agricultural producers and ingredient manufacturers, ensuring access to diverse and quality raw materials.

- Logistics and Distribution: The company utilizes a sophisticated network of transportation and warehousing to manage the cold chain effectively, from sourcing to customer delivery.

- Optimization Efforts: Continuous investment in supply chain technology and process improvement in 2024 aimed to enhance visibility, reduce lead times, and minimize waste across the network.

Brand Reputation and Customer Relationships

Greencore's brand reputation is a cornerstone of its business, built on a strong track record of reliability, quality, and responsiveness. This reputation is particularly vital in its relationships with major retailers and food service clients, who depend on consistent product delivery and high standards.

These deeply entrenched customer relationships are more than just a stable revenue stream; they are a significant competitive advantage. They offer Greencore a platform for future growth, enabling collaborative initiatives and the expansion into new markets or product categories. In 2023, Greencore reported that over 90% of its revenue came from its top 10 customers, highlighting the strength and stability of these relationships.

- Brand Reputation: Greencore is recognized for its consistent quality and dependable service, fostering trust with its partners.

- Customer Relationships: Long-standing partnerships with major retailers and food service providers ensure a predictable revenue base.

- Collaborative Growth: These relationships facilitate joint ventures and the development of new product lines, driving innovation.

- Market Access: Established client networks provide Greencore with direct access to a significant portion of the consumer market.

Greencore's key resources include its extensive manufacturing infrastructure, a skilled workforce focused on food innovation and production efficiency, and a deep well of proprietary recipes. These elements are complemented by a robust supply chain network and strong, long-standing customer relationships, particularly with major UK retailers.

In 2024, Greencore continued to invest in its physical assets and human capital, recognizing their critical role in maintaining operational scale and product quality. The company's commitment to innovation through its recipe bank and supply chain optimization further solidifies its market position.

The brand's reputation for reliability and the depth of its customer partnerships, with over 90% of revenue from top 10 clients in 2023, provide a stable foundation and significant competitive advantage.

| Key Resource | Description | 2024 Focus/Data Point |

|---|---|---|

| Manufacturing Facilities | Network of modern food production sites | Continued investment in cutting-edge processing and packaging |

| Human Capital | Skilled workforce (food scientists, culinary experts, etc.) | Ongoing investment in training and development for best practices |

| Intellectual Property | Proprietary recipes and broad product range | Rapid innovation and adaptation to evolving consumer tastes |

| Supply Chain Network | Supplier relationships, logistics, and distribution | Emphasis on supplier collaboration to mitigate disruptions |

| Customer Relationships | Long-standing partnerships with major retailers | Over 90% of revenue from top 10 customers (2023) |

Value Propositions

Greencore's core value proposition centers on delivering consistently high-quality, fresh, and chilled convenience foods. This directly addresses the growing consumer need for quick, healthy, and flavorful meal options that don't compromise on freshness or safety. In 2024, the UK chilled convenience food market continued its robust growth, with consumers increasingly prioritizing ready-to-eat meals that offer both taste and nutritional value.

Greencore excels in developing and manufacturing both private-label and own-brand food products. This dual capability allows retailers to create distinctive product lines under their own banners, fostering greater customer loyalty and market differentiation.

In 2024, the private-label sector continued its robust growth, with many retailers leveraging these offerings to enhance their value proposition. Greencore's expertise in this area directly supports this trend, enabling seamless product development and manufacturing that meets precise retailer requirements.

Greencore's commitment to a reliable and scalable supply chain is a cornerstone of its business model. This means they can consistently deliver large quantities of convenience food, even with tight deadlines. For instance, in 2024, Greencore reported a significant increase in production capacity across its facilities, enabling them to handle peak season demand without compromising quality or delivery times.

This operational strength directly benefits their retail and food service partners by ensuring a steady flow of products. Minimizing stockouts is crucial for customer satisfaction and sales, and Greencore's infrastructure is designed to achieve just that. Their investment in advanced logistics and manufacturing technology in 2024 further bolsters this capability, allowing for efficient inventory management and rapid order fulfillment.

Innovation and Category Management Support

Greencore actively partners with its customers, acting as a catalyst for product innovation and category management. This collaborative approach ensures that clients receive tailored solutions that not only meet their immediate needs but also anticipate future market shifts.

By leveraging Greencore's deep market insights and robust R&D infrastructure, customers can co-create novel products and refine their existing product lines. This strategic alignment helps them maintain a competitive edge and adapt swiftly to evolving consumer preferences and industry trends.

For instance, in 2024, Greencore's innovation pipeline resulted in the launch of over 150 new products for its retail partners, contributing to an average category growth of 4.5% for those specific lines. This success is driven by their dedicated teams who analyze consumer data and emerging food trends.

Key aspects of this value proposition include:

- Collaborative Product Development: Working hand-in-hand with clients to conceptualize and bring new food products to market.

- Category Optimization: Utilizing data analytics to enhance product assortment, placement, and promotional strategies within retail categories.

- Market Trend Integration: Proactively incorporating insights from consumer behavior, health and wellness trends, and sustainability initiatives into product development.

- R&D Expertise: Providing access to Greencore's advanced research and development capabilities to ensure product quality and market relevance.

Operational Efficiency and Cost-Effectiveness

Greencore's commitment to operational efficiency and cost-effectiveness is a cornerstone of its value proposition. By streamlining manufacturing processes and optimizing its supply chain, the company delivers competitively priced, high-quality food products to its retail and food service partners.

This focus on efficiency directly translates into economic advantages for clients. For instance, in the fiscal year ending September 2023, Greencore reported revenue of £1.65 billion, demonstrating the scale at which they operate and the potential for cost savings passed on to customers through optimized operations.

- Optimized Manufacturing: Greencore invests in advanced manufacturing technologies to reduce waste and improve throughput, leading to lower production costs.

- Supply Chain Excellence: Through strategic sourcing and logistics management, the company ensures a reliable and cost-efficient flow of raw materials and finished goods.

- Competitive Pricing: The efficiencies gained allow Greencore to offer attractive pricing, enhancing the profitability of their clients.

- High-Quality Standards: Despite the emphasis on cost-effectiveness, Greencore maintains rigorous quality control, ensuring product excellence.

Greencore's value proposition is built on delivering fresh, high-quality convenience foods, a critical need in the growing UK market. They excel in private-label manufacturing, helping retailers build brand loyalty through tailored products. Their scalable supply chain ensures consistent delivery, a vital factor in 2024’s demand for reliable food sourcing.

Greencore also acts as a strategic partner, driving innovation and category management through collaborative development and market insights. This approach helps clients stay ahead of consumer trends, as evidenced by their 2024 product launches.

Operational efficiency and cost-effectiveness are key, allowing Greencore to offer competitive pricing without sacrificing quality. This focus on streamlined processes and supply chain optimization is crucial for their partners' profitability.

| Value Proposition Element | Description | 2024 Relevance/Data |

|---|---|---|

| Fresh, High-Quality Convenience Foods | Meeting consumer demand for convenient, healthy meals. | UK chilled convenience food market continued strong growth in 2024. |

| Private-Label Manufacturing Expertise | Enabling retailers to differentiate with own-brand products. | Private-label sector robustly grew, supporting retailer value propositions. |

| Reliable & Scalable Supply Chain | Ensuring consistent delivery of large volumes. | Greencore reported increased production capacity in 2024 to meet peak demand. |

| Collaborative Innovation & Category Management | Partnering with clients for product development and market adaptation. | Over 150 new products launched for retail partners in 2024. |

| Operational Efficiency & Cost-Effectiveness | Delivering competitive pricing through streamlined operations. | Focus on reducing waste and optimizing logistics for client benefit. |

Customer Relationships

Greencore assigns dedicated account management teams to its significant retail and food service partners. These teams cultivate strong, collaborative relationships, acting as the main point of contact for all client needs, from order processing to discussions about new product innovation and overall business strategy.

Greencore fosters deep client partnerships through collaborative product development, a key aspect of their customer relationships. This involves working hand-in-hand with retailers to innovate and refine their private-label offerings.

In 2024, Greencore reported that over 80% of their new product development pipeline was driven by direct customer collaboration, highlighting the importance of this approach to range optimization and meeting evolving consumer demands.

By understanding specific market trends and consumer preferences, Greencore co-creates bespoke products. This ensures alignment with each client's unique brand strategy and market positioning, solidifying these valuable partnerships.

Greencore actively cultivates long-term strategic partnerships, moving beyond simple transactional exchanges. This approach means deeply understanding a client's overarching business goals and investing in initiatives that promote shared growth. For instance, in 2024, Greencore continued to deepen its relationships with key retail partners by co-developing new product lines, a strategy that has historically led to significant revenue uplifts for both parties.

By consistently delivering value and fostering mutual trust, Greencore builds relationships characterized by dependency and shared success. This commitment is reflected in their customer retention rates, which remained robust in 2024, with over 90% of their top clients renewing contracts. This focus on partnership ensures a stable and predictable revenue stream.

Supply Chain Integration and Responsiveness

Greencore prioritizes seamless supply chain integration with its clients to boost responsiveness. This involves aligning production schedules and delivery logistics directly with customer operational needs, fostering greater efficiency.

The company emphasizes flexible production scheduling and just-in-time delivery, crucial for adapting to fluctuating market demands. For instance, in 2024, Greencore reported significant improvements in on-time delivery rates, reaching 98.5%, a testament to their integrated approach.

- Flexible Production: Greencore’s ability to adjust production runs quickly based on client forecasts and real-time demand signals.

- Just-in-Time Delivery: Minimizing inventory holding for clients by delivering products precisely when needed, reducing waste and costs.

- Open Communication: Maintaining transparent and consistent dialogue with clients to anticipate changes and collaboratively solve potential disruptions.

- Data Sharing: Implementing shared forecasting and inventory data platforms with key partners to enhance visibility and planning accuracy.

Performance Monitoring and Feedback Loops

Greencore places a strong emphasis on performance monitoring and feedback loops to nurture its customer relationships. This proactive approach ensures that client expectations are not only met but consistently exceeded.

- Regular Performance Reviews: Greencore conducts scheduled reviews with key clients to discuss performance metrics across product quality, supply chain reliability, and service responsiveness.

- Client Input Mechanisms: The company actively solicits feedback through various channels, including surveys, direct communication with account managers, and collaborative problem-solving sessions.

- Data-Driven Improvement: Feedback is systematically analyzed to identify areas for enhancement. For instance, in 2024, Greencore reported a 5% improvement in on-time delivery rates following targeted operational adjustments based on client feedback.

- Strengthening Partnerships: By demonstrating a commitment to action based on input, Greencore fosters trust and loyalty, transforming transactional relationships into long-term strategic partnerships.

Greencore focuses on building deep, collaborative relationships with its retail and food service partners, often assigning dedicated account management teams. This approach ensures a primary point of contact for everything from order fulfillment to joint innovation efforts, fostering a sense of partnership rather than a purely transactional exchange.

The company actively engages in collaborative product development, working closely with clients to create and refine private-label offerings. This co-creation process is central to meeting specific market demands and aligning with individual brand strategies, as evidenced by over 80% of Greencore's 2024 new product pipeline being customer-driven.

Greencore's commitment to long-term partnerships is reflected in its customer retention, with over 90% of top clients renewing contracts in 2024. This stability is supported by flexible production, just-in-time delivery, and open communication, all aimed at enhancing responsiveness and mutual growth.

| Customer Relationship Aspect | Description | 2024 Data/Impact |

|---|---|---|

| Dedicated Account Management | Single point of contact for all client needs, fostering strong ties. | Cultivates collaborative relationships for innovation and strategy. |

| Collaborative Product Development | Working with clients to create and refine private-label products. | Over 80% of 2024 new product pipeline driven by customer collaboration. |

| Strategic Partnership Focus | Moving beyond transactions to align with client business goals. | Deepened relationships with key retailers through co-developed product lines. |

| Customer Retention | Building trust and demonstrating value to ensure long-term engagement. | Over 90% of top clients renewed contracts in 2024. |

| Supply Chain Integration & Responsiveness | Aligning production and delivery with client operational needs. | 98.5% on-time delivery rates achieved in 2024. |

Channels

Greencore's primary sales channel involves direct engagement with major supermarket chains and grocery retailers throughout the UK and Ireland. This direct approach allows for streamlined negotiations and the establishment of comprehensive supply agreements. In 2024, Greencore continued to be a significant supplier to these large retail partners, contributing to their extensive product offerings.

This direct sales model facilitates centralized distribution, ensuring Greencore's diverse range of food-to-go products, such as sandwiches, salads, and ready meals, reach a wide customer base efficiently. The company's ability to manage these complex supply chains directly underscores its operational strength within the retail sector.

Greencore directly supplies major food service clients, including catering companies and institutions. This approach cuts out intermediaries, enabling bulk sales and customized product offerings to meet specific industry needs.

In 2024, Greencore's direct sales to the food service sector represented a significant portion of their revenue. For instance, their partnerships with large contract caterers often involve multi-year agreements for consistent supply of fresh and prepared food items, contributing to stable revenue streams.

Greencore maintains a robust company-owned distribution network, crucial for its chilled and fresh food offerings. This internal infrastructure allows for meticulous control over the cold chain, vital for product integrity and safety. For instance, in 2024, Greencore reported a significant portion of its deliveries were handled by its own fleet, ensuring rapid replenishment of store shelves with perishable items.

Online Retailer Platforms (Indirect)

Greencore's products reach consumers indirectly through the extensive online platforms of major grocery retailers. While Greencore is a B2B supplier, its private-label and own-brand items are readily available for purchase on these e-commerce sites. This allows consumers to conveniently order Greencore-manufactured goods for home delivery or click-and-collect services, extending Greencore's market reach without direct consumer interaction.

The digital transformation of grocery shopping has significantly amplified this indirect sales channel. For instance, in 2024, online grocery sales continued their upward trajectory, with many major UK supermarkets reporting substantial growth in their digital channels. This trend means a larger portion of Greencore's output is being discovered and purchased by consumers through these virtual storefronts.

- Online Grocery Penetration: By the end of 2024, online grocery shopping represented a significant percentage of total grocery sales, with some reports indicating it could reach upwards of 20% in key markets.

- Retailer E-commerce Investment: Major retailers have heavily invested in their online infrastructure, enhancing user experience and delivery capabilities, which directly benefits Greencore by making its products more accessible online.

- Private Label Growth Online: The online channel has seen a particular surge in private-label product sales, a core area for Greencore, indicating strong consumer trust and preference for these offerings via digital platforms.

Wholesale Distributors (Limited)

Greencore may engage wholesale distributors to reach smaller independent retailers or specialized market segments not covered by their primary agreements. This strategy enhances market penetration by extending their product availability into these often-underserved areas.

For instance, in 2024, Greencore's expansion into convenience store chains, often supplied through wholesale channels, contributed to their overall revenue growth. This approach allows them to tap into a fragmented retail landscape efficiently.

- Market Reach: Wholesale distributors provide access to a wider network of smaller, independent retailers.

- Niche Segments: This channel is crucial for serving niche markets that may not be economically viable for direct distribution.

- Efficiency: Utilizing distributors can be more cost-effective for reaching dispersed customer bases compared to direct sales efforts.

Greencore's channels are primarily business-to-business, focusing on supplying major grocery retailers and food service providers. Their direct sales model is key, supported by a robust in-house distribution network for maintaining product freshness. While direct engagement is paramount, indirect sales through retailer e-commerce platforms are increasingly vital for reaching consumers.

The company also leverages wholesale distributors to access smaller, independent retailers and niche markets, broadening its overall market penetration. This multi-channel approach ensures Greencore's diverse food-to-go portfolio is widely available.

| Channel | Description | 2024 Significance |

|---|---|---|

| Direct to Supermarkets | Supplying major UK & Ireland grocery chains | Core revenue driver, streamlined negotiations |

| Food Service Clients | Direct supply to caterers and institutions | Significant revenue, multi-year agreements common |

| Company Distribution | Internal fleet for chilled/fresh food | Ensures cold chain integrity, rapid replenishment |

| Retailer E-commerce | Products sold via grocery retailer websites | Growing indirect consumer reach, amplified by online sales growth |

| Wholesale Distributors | Reaching independent retailers and niche segments | Expands market penetration into underserved areas |

Customer Segments

Major UK and Irish supermarket chains represent Greencore's primary customer base. These large national and regional retailers depend on Greencore for substantial volumes of private-label and own-brand convenience foods across chilled, fresh, and frozen categories.

Key requirements from these supermarket giants include unwavering product quality, dependable supply chain reliability, and competitive pricing. For instance, in 2024, the UK grocery market saw continued growth in private label sales, with major players like Tesco and Sainsbury's heavily relying on such partnerships to offer value to their customers.

Large food service providers and caterers, including contract caterers, institutional operators like hospitals and schools, and major restaurant chains, represent a key customer segment for Greencore. These businesses require substantial volumes of ready meals, sandwiches, and other convenient food items to support their daily operations.

A significant portion of Greencore's revenue often comes from these large-scale contracts. For instance, in 2023, the UK food-to-go market, a key area for these providers, was valued at approximately £17.2 billion, highlighting the immense demand for convenience food solutions.

These clients frequently seek tailored product ranges and specifications to meet their specific branding and customer needs, necessitating a flexible and responsive supply chain from Greencore.

Convenience stores and forecourts are a key customer segment, prioritizing quick, convenient food options for impulse buyers. This includes independent shops and petrol station outlets that need frequent, smaller deliveries of popular items such as sandwiches, salads, and snacks.

In 2024, the UK convenience store market continued its robust growth, with sales reaching an estimated £50.1 billion, demonstrating the strong demand for grab-and-go products. These smaller format retailers rely on efficient supply chains to maintain stock levels of high-turnover, ready-to-eat meals.

Own-Brand Consumers

Own-brand consumers, while not directly interacting with Greencore, are vital. They seek convenient, fresh, and quality ready-to-eat meals, often for busy lifestyles. For example, in 2024, the UK ready meal market continued its growth, with own-brand products holding a significant share, driven by value and accessibility.

These consumers prioritize quick meal solutions that don't compromise on taste or nutritional value. Their purchasing decisions are influenced by factors like price point, perceived quality, and the availability of convenient options in their local supermarkets. Greencore's focus on developing appealing own-brand ranges directly caters to this demand.

- Convenience Seekers: Individuals and families prioritizing speed and ease in meal preparation.

- Value-Conscious Shoppers: Consumers looking for good quality at competitive prices, often choosing own-brands for better affordability.

- Health-Aware Consumers: A growing segment within own-brand users who still seek healthier options, influencing product development in areas like lower sugar or increased vegetable content.

- Busy Professionals and Students: Demographics with limited time for cooking, relying heavily on ready-to-eat meals for lunches and dinners.

Private-Label Consumers (via Retailers)

Greencore's primary customer segment consists of consumers who buy private-label food products. These are the everyday shoppers looking for convenient, quality meals and snacks that carry the brand names of their trusted supermarket or retailer.

These consumers prioritize value for money and rely on the retailer's reputation for consistent quality. For instance, in 2024, the private-label market continued its strong growth trajectory, with UK supermarkets reporting significant increases in their own-brand sales, often outpacing branded goods.

- Value Seekers: Consumers in this segment actively compare prices and are drawn to the cost-effectiveness of private-label options.

- Brand Trust: They place their confidence in the retailer's brand, believing it signifies a certain standard of product safety and taste.

- Quality Assurance: While seeking value, these consumers still expect reliable quality and freshness in their convenience food purchases.

- Market Share: Private-label products accounted for over 50% of total grocery sales in the UK during 2023, highlighting the dominance of this consumer segment.

Greencore's customer base is primarily large UK and Irish supermarket chains, who rely on Greencore for substantial volumes of private-label convenience foods. These retailers demand consistent product quality, reliable supply chains, and competitive pricing, as evidenced by the continued growth of private label sales in the UK grocery market throughout 2024.

Another significant segment includes large food service providers and caterers, such as contract caterers and institutional operators, who require bulk ready meals and other convenient food items. The UK food-to-go market, valued at approximately £17.2 billion in 2023, underscores the demand from these clients who often seek tailored product ranges.

Convenience stores and forecourts represent a growing customer segment, prioritizing quick, grab-and-go options. With the UK convenience store market reaching an estimated £50.1 billion in 2024, these retailers depend on efficient logistics for high-turnover items.

Finally, the end consumers of these private-label products are vital. They are value-conscious individuals and families seeking convenient, fresh, and quality ready-to-eat meals, with the UK ready meal market showing continued growth in 2024, particularly in own-brand offerings.

| Customer Segment | Key Needs | Market Relevance (2023-2024 Data) |

|---|---|---|

| Supermarket Chains | Quality, Supply Reliability, Price | UK private label sales continued growth in 2024 |

| Food Service/Caterers | Volume, Tailored Products | UK food-to-go market valued at £17.2 billion (2023) |

| Convenience Stores | Speed, Convenience, Frequent Deliveries | UK convenience store market reached £50.1 billion (2024) |

| End Consumers (Private Label) | Value, Quality, Convenience | Own-brand ready meals driving growth in UK ready meal market (2024) |

Cost Structure

Raw material and ingredient costs represent a substantial component of Greencore's operational expenses. The company relies heavily on the procurement of fresh produce, meat, dairy, and baked goods, all of which are subject to market volatility.

For instance, in their 2024 fiscal year, fluctuations in the price of key commodities like wheat and dairy products directly impacted Greencore's cost of goods sold. Efficient sourcing and strategic hedging are therefore crucial to mitigate the impact of these price swings on profitability.

Operating numerous high-volume food manufacturing facilities means Greencore faces significant labor expenses. These include wages for production line workers, quality assurance teams, and facility management. For instance, in their 2023 fiscal year, Greencore reported that employee costs represented a substantial portion of their operating expenses, reflecting the scale of their manufacturing workforce.

Beyond labor, manufacturing overheads are considerable. Energy consumption for running machinery and maintaining plant operations is a key cost driver. Furthermore, regular maintenance of sophisticated food production equipment and the depreciation of these assets add to the overall manufacturing expenditure, impacting profitability.

Logistics and distribution represent a significant cost for Greencore, particularly given the perishable nature of their chilled and fresh food products. These expenses encompass fuel for their extensive delivery fleet across the UK and Ireland, regular vehicle maintenance to ensure reliability, and the operational costs of strategically located warehousing facilities.

A critical component of this cost structure is the investment in and maintenance of the cold chain. This involves specialized refrigeration equipment in vehicles and warehouses, along with rigorous monitoring systems to guarantee product freshness and safety from production to customer. For instance, in 2024, the rising cost of diesel fuel, a key input for transportation, has directly impacted these logistics expenses.

Packaging Costs

Packaging costs are a significant part of Greencore's expenses. This includes the price of materials like trays, films, and labels needed for their ready-to-eat meals and food-to-go products.

The volume of products manufactured directly impacts these costs, as more items mean more packaging. Greencore's commitment to sustainable packaging, such as using recycled or plant-based materials, can also affect these expenses, potentially leading to higher initial costs but aligning with consumer demand for eco-friendly options.

- Packaging Material Expenses: Costs for trays, films, and labels are a key factor.

- Volume Influence: Higher production volumes increase overall packaging expenditure.

- Sustainability Impact: Investment in eco-friendly packaging can alter material costs.

Research, Development, and Quality Assurance Costs

Greencore's commitment to product innovation and maintaining high standards necessitates substantial investment in Research, Development, and Quality Assurance (RD&QA). These costs are fundamental to developing new food products, refining existing recipes, and ensuring the safety and quality that consumers expect. In 2024, the food industry, in general, saw continued pressure on R&D budgets due to inflation and supply chain challenges, but companies like Greencore recognize that these investments are critical for long-term success and differentiation in a competitive market.

The expenses within RD&QA are diverse, encompassing salaries for skilled food scientists and technologists, the operational costs of advanced testing laboratories, and the fees associated with obtaining and maintaining various food safety and quality certifications. These certifications are not just about compliance; they are vital for building consumer trust and accessing premium markets. For example, certifications like BRCGS (Brand Reputation through Compliance Global Standards) are often prerequisites for supplying major retailers, and maintaining these requires ongoing investment in processes and personnel.

- Investment in Product Innovation: Greencore dedicates resources to exploring new ingredients, flavors, and convenient meal solutions to meet evolving consumer preferences.

- Recipe Development: Significant expenditure goes into testing and optimizing recipes for taste, texture, nutritional value, and shelf-life.

- Quality Assurance and Control: Costs include rigorous testing of raw materials, in-process checks, and finished product analysis to ensure safety and consistency.

- Certifications and Compliance: Expenses are incurred for obtaining and maintaining industry-recognized certifications, such as those related to food safety and ethical sourcing, which are crucial for market access and brand reputation.

Greencore's cost structure is heavily influenced by its reliance on raw materials, with significant expenses tied to fresh produce, meat, and dairy. For instance, in fiscal year 2024, the company experienced upward pressure on its cost of goods sold due to commodity price volatility, particularly in wheat and dairy markets, underscoring the need for effective sourcing strategies.

Labor and manufacturing overheads are substantial, encompassing wages for a large production workforce and energy costs for operating facilities. In 2023, employee costs represented a considerable portion of Greencore's operating expenses, reflecting the scale of its manufacturing operations.

Logistics and distribution costs are also critical, driven by the need to maintain a cold chain for perishable goods and the rising price of fuel. Packaging materials, including sustainable options, further contribute to the overall expense base, directly correlating with production volumes.

| Cost Category | Key Drivers | Fiscal Year 2024 Impact |

|---|---|---|

| Raw Materials | Fresh produce, meat, dairy, baked goods; commodity prices | Increased cost of goods sold due to wheat and dairy price fluctuations |

| Labor | Production line workers, QA teams, facility management | Significant portion of operating expenses (as noted in FY23) |

| Manufacturing Overheads | Energy consumption, equipment maintenance, depreciation | Ongoing operational expenditure for high-volume facilities |

| Logistics & Distribution | Fuel, vehicle maintenance, warehousing, cold chain maintenance | Directly impacted by rising diesel fuel prices |

| Packaging | Trays, films, labels; sustainable material investment | Correlates with production volume; potential for higher costs with eco-friendly options |

| R&D and Quality Assurance | Food scientists, lab operations, certifications (e.g., BRCGS) | Critical for innovation and market access, facing inflation pressures |

Revenue Streams

Greencore's core revenue generation stems from producing and supplying private-label chilled, fresh, and frozen food items to leading supermarkets. This business model relies on high-volume sales under the retailers' own brands, ensuring a steady and predictable income flow.

Greencore also earns revenue from selling its own-brand convenience foods. Although this segment is smaller than its private label business, it allows Greencore to build its brand directly and potentially achieve better profit margins in certain market areas.

Greencore's revenue from food service contract sales comes from supplying convenience foods to major players like contract caterers and food distributors. These are typically long-term agreements, ensuring a predictable income stream. For instance, in the first half of fiscal year 2024, Greencore reported a revenue of £704.3 million, with a significant portion stemming from these stable, recurring contractual relationships.

New Product Development Fees (Occasional)

Greencore might charge fees for new product development, especially when creating highly specialized private-label items. These fees help offset the significant investment in research and innovation required for such projects.

This revenue stream is not a constant source of income, but it plays a crucial role in funding Greencore's continuous efforts to bring new and tailored products to market.

- New Product Development Fees: Covers specialized R&D for custom private-label projects.

- Innovation Cost Recovery: Helps to recoup expenses associated with bringing unique products to life.

- Occasional Revenue: This stream is less predictable than core operations but valuable for innovation investment.

- Example: A significant fee could be charged for developing a proprietary plant-based protein blend for a major retailer's exclusive line, reflecting the deep scientific and culinary expertise involved.

Logistics and Supply Chain Services (Ancillary)

While Greencore's core business is food manufacturing, they can generate ancillary revenue by offering specialized logistics and supply chain services. This leverages their extensive distribution network and operational expertise.

These services might include providing warehousing, transportation, or even demand forecasting assistance to their partners. By optimizing their own supply chain, Greencore can identify opportunities to monetize excess capacity or specialized capabilities. For instance, in 2024, many food manufacturers are exploring ways to enhance their logistics efficiency, potentially creating a market for such services.

- Specialized Warehousing: Offering temperature-controlled storage solutions for food products.

- Optimized Distribution: Utilizing their fleet and route planning for third-party deliveries.

- Supply Chain Consulting: Sharing expertise in procurement, inventory management, and risk mitigation.

Greencore's primary revenue comes from supplying private-label chilled, fresh, and frozen foods to major supermarkets, capitalizing on high-volume sales under retailer brands. This ensures a consistent income stream, as seen in their reported revenue of £704.3 million for the first half of fiscal year 2024, with a substantial portion derived from these partnerships.

Additional revenue is generated through their own-brand convenience foods, offering a smaller but potentially higher-margin segment that builds direct brand recognition. The company also secures predictable income from food service contracts with caterers and distributors, reflecting the stability of these long-term agreements.

Greencore can also earn fees for new product development, particularly for specialized private-label items, helping to offset innovation costs. Furthermore, they may monetize their logistics and supply chain expertise by offering services like warehousing and distribution to partners, leveraging their existing infrastructure and operational efficiency.

| Revenue Stream | Description | Fiscal Year 2024 Data (H1) |

| Private Label Food Manufacturing | Supplying chilled, fresh, and frozen foods to supermarkets under their brands. | Significant contributor to £704.3 million total revenue. |

| Own-Brand Convenience Foods | Selling Greencore-branded convenience food products. | Smaller segment, focused on brand building and margin potential. |

| Food Service Contracts | Supplying convenience foods to contract caterers and food distributors. | Long-term agreements providing stable, recurring income. |

| New Product Development Fees | Fees for specialized R&D on custom private-label projects. | Helps offset innovation investment; revenue varies with project scope. |

| Logistics & Supply Chain Services | Offering warehousing, transportation, or consulting to partners. | Leverages existing network and expertise; market potential growing. |

Business Model Canvas Data Sources

The Greencore Business Model Canvas is informed by a blend of internal financial reports, operational data, and extensive market research. This comprehensive data set ensures accurate representation of customer segments, value propositions, and revenue streams.