Greencoat UK Wind PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Greencoat UK Wind Bundle

Gain an edge with our in-depth PESTEL Analysis—crafted specifically for Greencoat UK Wind. Discover how external forces are shaping the company’s future, and use these insights to strengthen your own market strategy. Download the full version now and get actionable intelligence at your fingertips.

Political factors

The UK government's commitment to a green energy future is a significant tailwind for Greencoat UK Wind. Ambitious targets, like doubling onshore wind and quadrupling offshore wind capacity by 2030, create a robust political landscape for renewable energy investments. This policy direction, exemplified by initiatives such as the Clean Power 2030 Action Plan, directly supports Greencoat UK Wind's strategy of owning and operating wind assets.

Recent reforms to UK planning policy, particularly the lifting of the informal ban on onshore wind in England in July 2024, are set to simplify the approval process for new wind farm projects. This policy change could expedite the development pipeline, presenting acquisition opportunities for Greencoat UK Wind as projects become operational.

Labour's recently unveiled onshore wind strategy, also in July 2024, details 40 measures aimed at stimulating growth in the sector. A key element includes the potential reclassification of larger onshore wind projects as Nationally Significant Infrastructure Projects (NSIPs), a move intended to expedite their consenting journey.

The Contracts for Difference (CfD) scheme is a cornerstone of UK government support for renewable energy, offering Greencoat UK Wind significant revenue stability through long-term, fixed-price electricity contracts. This mechanism shields projects from volatile wholesale power prices, making investments more predictable.

However, the recent Allocation Round 5 (AR5) in 2023 saw no offshore wind bids, highlighting potential challenges. Fortunately, the government is boosting the budget for Allocation Round 6 (AR6) and is actively reviewing the CfD framework. These reforms aim to foster greater competition and incentivize earlier supply chain commitment, which is vital for securing future project pipelines and potential acquisitions for companies like Greencoat UK Wind.

Energy Security Strategy

The UK's intensified focus on energy security since 2024, driven by a desire to lessen dependence on imported fossil fuels, elevates domestic renewable sources like wind power. This strategic shift translates into sustained political backing for wind energy expansion, a clear advantage for firms such as Greencoat UK Wind. The government's Clean Power 2030 Action Plan explicitly designates offshore wind as the foundational element of the nation's future clean energy infrastructure.

This political imperative is underscored by significant investment targets. For example, the government has pledged to support the development of up to 50GW of offshore wind capacity by 2030, with 5GW earmarked for floating offshore wind. This creates a robust pipeline of projects, offering predictable revenue streams and growth opportunities for established players like Greencoat UK Wind.

- Energy Security Mandate: Government policy prioritizes domestic renewables to reduce reliance on volatile global energy markets.

- Clean Power 2030: This initiative positions offshore wind as the core of the UK's future energy system.

- Investment Targets: Aims for 50GW of offshore wind by 2030, including 5GW of floating wind, signaling strong market growth.

- Political Stability: Creates a more stable investment climate for companies developing and operating wind farms.

Regulatory and Policy Stability

Regulatory and policy stability is a cornerstone for Greencoat UK Wind's operational success and future growth. While the UK government generally champions renewable energy, any shifts in subsidy structures, like the Contracts for Difference (CfD) scheme, or modifications to planning permissions and environmental legislation can introduce uncertainty. For instance, the CfD Allocation Round 6, which concluded in early 2024, saw a significant reduction in awarded projects compared to previous rounds, highlighting potential shifts in government support mechanisms. This unpredictability can directly affect investor confidence and the financial viability of acquiring new wind farm assets, impacting Greencoat's ability to secure favourable financing.

Greencoat UK Wind's business model hinges on a predictable policy landscape to safeguard the consistent revenue streams from its established portfolio and to strategically plan for future investments. The company's financial forecasting relies heavily on the assumption of stable policy frameworks. For example, in 2024, the company continued to benefit from the long-term revenue visibility provided by its existing CfD agreements, which underpin its dividend payouts. A stable regulatory environment fosters the confidence needed for Greencoat to commit capital to new projects, ensuring continued expansion and value creation.

The stability of policy is crucial for Greencoat UK Wind to maintain its financial modelling and investor appeal. Potential changes to taxation, grid connection rules, or decommissioning liabilities could significantly alter the projected returns on investment. For instance, the energy security strategy, updated in 2024, emphasized the need for streamlined planning processes for offshore wind, but the actual implementation and its impact on project timelines remain key areas of focus. Greencoat's reliance on a predictable policy environment is evident in its consistent ability to attract institutional investors seeking stable, long-term returns from renewable energy infrastructure.

- The UK government's commitment to net-zero targets provides a generally supportive backdrop for renewable energy investments.

- However, fluctuations in subsidy schemes, such as the CfD, can introduce volatility and impact investment decisions.

- Greencoat UK Wind's financial stability is directly linked to the predictability of regulatory frameworks governing its operations.

- The company's ability to plan future acquisitions relies on a consistent and stable policy environment.

The UK's drive for energy security and net-zero targets, reinforced by initiatives like the Clean Power 2030 Action Plan, creates a favourable political climate for Greencoat UK Wind. Government policy actively supports the expansion of domestic renewable sources, with ambitious offshore wind capacity goals of 50GW by 2030, including 5GW of floating wind.

Recent policy shifts, such as the July 2024 easing of onshore wind planning restrictions in England and Labour's proposed measures to streamline consents for larger projects, are expected to accelerate development pipelines and create acquisition opportunities. The Contracts for Difference (CfD) scheme continues to be a vital revenue support mechanism, though recent allocation rounds have highlighted the need for ongoing government review and reform to ensure continued competitiveness and investment attractiveness.

The political imperative to reduce reliance on imported fossil fuels directly benefits companies like Greencoat UK Wind by ensuring sustained support for wind energy expansion. This governmental focus translates into a more stable investment environment, crucial for long-term financial planning and asset acquisition within the renewable energy sector.

| Political Factor | Description | Impact on Greencoat UK Wind |

| Net-Zero Targets & Energy Security | Government commitment to decarbonisation and reducing fossil fuel dependence. | Strong policy support for wind energy expansion, creating growth opportunities. |

| Offshore Wind Capacity Goals | Target of 50GW by 2030, with 5GW of floating wind. | Provides a clear, large-scale market for new project development and potential acquisitions. |

| Planning Policy Reforms (Onshore) | Easing of restrictions and proposals to fast-track larger projects. | Streamlines development, potentially increasing acquisition targets and project viability. |

| Contracts for Difference (CfD) Scheme | Long-term, fixed-price contracts for renewable electricity. | Ensures revenue stability, crucial for financial forecasting and investor confidence, though reforms are monitored. |

What is included in the product

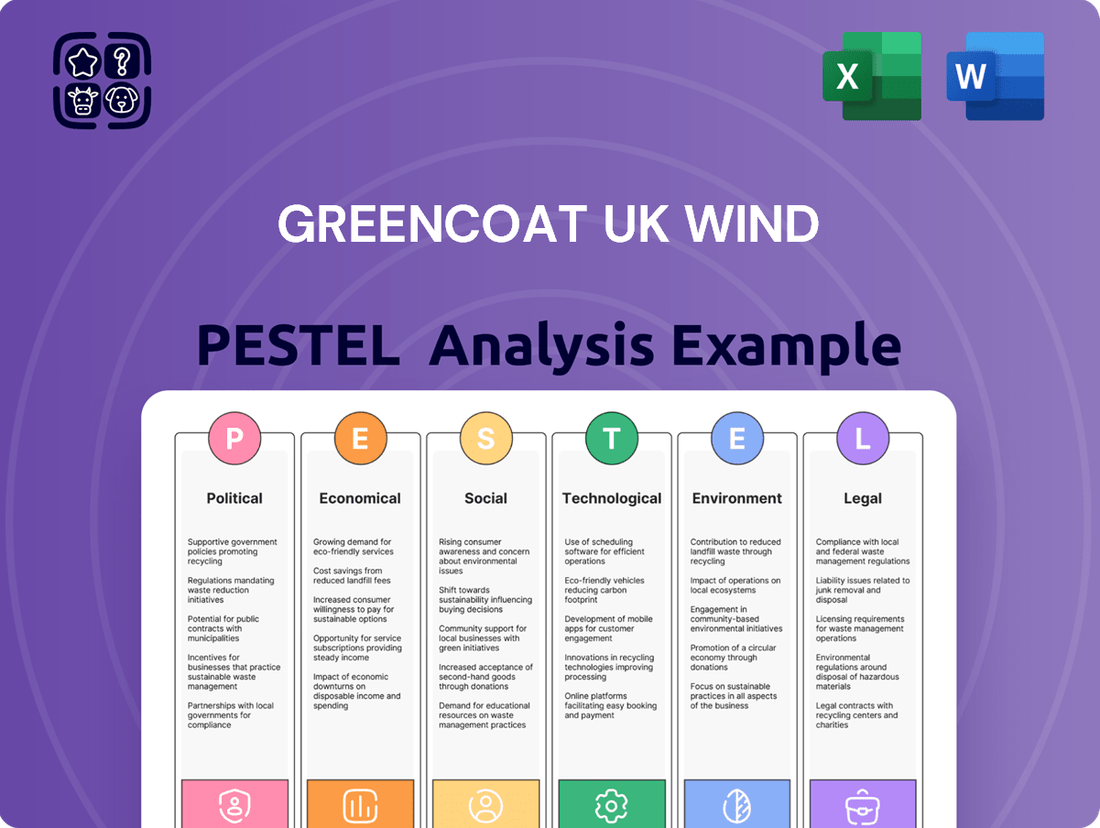

This PESTLE analysis critically examines the external macro-environmental factors impacting Greencoat UK Wind, providing a comprehensive understanding of the political, economic, social, technological, environmental, and legal landscape.

It offers actionable insights and forward-looking perspectives to help Greencoat UK Wind navigate challenges and capitalize on emerging opportunities within the renewable energy sector.

Greencoat UK Wind's PESTLE analysis provides a clear, concise overview of external factors impacting the renewable energy sector, acting as a vital tool to navigate complex market dynamics and mitigate potential risks.

This analysis offers a structured approach to understanding the political, economic, social, technological, legal, and environmental landscape, effectively relieving the pain point of information overload for strategic decision-making.

Economic factors

Inflation, especially RPI, is a crucial economic factor for Greencoat UK Wind as their dividend policy targets an annual increase aligned with RPI. For instance, their 2024 annual report outlined a dividend target for 2025 linked to the December 2024 RPI figure. This linkage directly impacts shareholder returns, making inflation a key performance indicator.

High inflation can directly increase operational expenses for wind farms, such as maintenance and component costs, potentially squeezing profit margins. Simultaneously, central banks often respond to rising inflation by increasing interest rates. This makes borrowing more expensive, impacting Greencoat UK Wind's ability to finance new acquisitions or refinance existing debt at favorable terms.

The Bank of England's base rate, a benchmark for many borrowing costs, has seen fluctuations in 2024 and early 2025, reflecting the inflationary environment. Greencoat UK Wind's proactive debt management, including successful refinancing efforts highlighted in their 2024 reporting, demonstrates their strategy to mitigate the impact of potentially rising interest expenses on their financial stability and dividend sustainability.

Greencoat UK Wind's revenue stream is significantly influenced by electricity price volatility, even with a substantial portion of its output secured under long-term Contracts for Difference (CfDs). While these contracts provide a predictable revenue floor, any uncontracted electricity sales or future contract renewals are directly exposed to wholesale market price fluctuations. This exposure underscores the importance of accurate electricity price forecasting for both asset valuation and strategic planning.

The UK energy market in 2024 highlighted this dynamic. Renewables, including wind power, constituted over 50% of the nation's electricity generation, a positive trend for Greencoat. However, the concurrent challenge of managing increasing electricity demand means that wholesale prices can still be subject to sharp movements, impacting the profitability of Greencoat's unhedged generation and its ability to secure favorable terms on future CfDs.

The UK renewable energy sector is a hotbed for investment, with wind power taking the largest slice of the pie. Greencoat UK Wind is positioned right in the middle of this booming market, which is getting a major boost from the global push towards cleaner energy sources.

This strong investor interest isn't just in wind; it's spreading across energy storage and other essential infrastructure, showing a clear and growing demand for assets in the green energy space.

In 2023, renewable energy attracted over £20 billion in investment in the UK, with offshore wind projects being a significant driver. This trend is expected to continue, with projections for 2024 and 2025 indicating further capital inflows as the energy transition accelerates.

Capital Allocation and Shareholder Returns

Greencoat UK Wind's financial strategy in 2024 focused on robust capital allocation, demonstrated by strong net cash generation. This performance facilitated both dividend payments and share repurchases, directly benefiting shareholders. The company prioritizes delivering attractive real income, a key economic objective, while simultaneously safeguarding its capital base.

A core element of their economic approach involves reinvesting surplus cash flow. This reinvestment is crucial for maintaining the long-term capital value of the company's wind farm portfolio. For instance, the company's 2024 results highlighted a commitment to returning value, with operational cash flow supporting these shareholder-focused initiatives.

- Dividend Growth: Greencoat UK Wind aims for consistent dividend growth, reflecting its economic stability and cash generation capabilities.

- Share Buybacks: The company utilizes share buybacks as a mechanism to enhance shareholder value, often when the share price is perceived as undervalued.

- Capital Preservation: A key economic tenet is preserving the underlying capital value of its renewable energy assets through prudent management and reinvestment.

- Real Income Focus: The strategy is geared towards providing shareholders with income streams that outpace inflation, ensuring real returns.

Supply Chain Costs and Efficiency

The efficiency and cost of the renewable energy supply chain significantly impact Greencoat UK Wind's profitability. This includes everything from making turbines and installing them to keeping them running smoothly. For instance, major turbine manufacturers like Vestas and Siemens Gamesa have faced rising raw material costs, impacting their order books and delivery schedules throughout 2024. These pressures directly influence the capital expenditure for new projects and the operational expenditure for existing ones.

Global supply chain disruptions, exacerbated by geopolitical events and trade disputes, continue to introduce volatility. These can lead to longer lead times for critical components and increased shipping costs, potentially delaying project timelines and inflating development expenses. For example, disruptions in rare earth mineral supply, crucial for magnets in wind turbines, have been a recurring concern, affecting pricing and availability in 2024.

Maintaining competitive operational expenditures requires ongoing innovation and optimization within the supply chain. Greencoat UK Wind, like other operators, benefits from advancements in logistics, predictive maintenance technologies, and the development of more robust, longer-lasting turbine components. The industry is seeing a push towards localized manufacturing and more resilient sourcing strategies to mitigate future shocks.

- Turbine Manufacturing Costs: Increased raw material prices (e.g., steel, copper, rare earths) have put upward pressure on turbine manufacturing costs in 2024, with some reports indicating a 5-10% rise in component prices compared to 2023.

- Installation and Logistics: Specialized vessels and skilled labor for offshore wind farm installation remain a significant cost factor, with charter rates for installation vessels seeing an upward trend in the 2024 market.

- Maintenance Efficiency: Investment in digital solutions and predictive maintenance technologies aims to reduce downtime and optimize maintenance schedules, with companies reporting potential savings of 10-15% on O&M costs through advanced analytics.

- Supply Chain Resilience: Efforts to diversify sourcing and explore alternative materials are underway, driven by concerns over the concentration of critical mineral supply chains in specific regions.

The UK's economic landscape in 2024 and early 2025 presents a mixed bag for Greencoat UK Wind. While inflation, particularly RPI, directly influences their dividend targets, rising interest rates due to central bank policies pose a challenge for financing and debt management.

Electricity price volatility remains a key economic factor, even with a significant portion of revenue secured through Contracts for Difference (CfDs). The increasing share of renewables in the UK's energy mix, over 50% in 2024, is a positive backdrop, but demand growth can still lead to price fluctuations impacting uncontracted generation.

Investor interest in the UK renewable sector is robust, with over £20 billion invested in 2023, a trend anticipated to continue through 2024 and 2025, benefiting companies like Greencoat UK Wind.

Same Document Delivered

Greencoat UK Wind PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive PESTLE analysis of Greencoat UK Wind delves into Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company. You'll gain insights into regulatory landscapes, market trends, and sustainability considerations. The content and structure shown in the preview is the same document you’ll download after payment, providing a complete picture for your strategic planning.

Sociological factors

Public acceptance is a cornerstone for Greencoat UK Wind, especially for onshore projects. Surveys consistently show strong backing for renewable energy in the UK, with a 2024 YouGov poll indicating 67% of adults support wind power. However, local opposition remains a hurdle, often stemming from worries about visual amenity and noise, which can affect property values. Addressing these community concerns proactively is vital for Greencoat UK Wind to maintain its social license to operate and to ensure smooth progress on new developments.

Wind farm developers in the UK commonly offer community benefit funds, a practice that saw significant investment in 2023. For instance, the Scottish government reported that community benefit funds associated with onshore wind projects generated over £10 million in 2022 alone, supporting local initiatives and infrastructure. These voluntary financial arrangements are crucial for sharing renewable energy's economic advantages and mitigating local opposition.

As an owner of operational wind assets, Greencoat UK Wind inherits these established community engagement frameworks. Maintaining and fostering positive relationships with host communities is paramount for long-term operational stability and social license to operate. This involves ensuring transparency and continued support for local projects, which can enhance the company's reputation and reduce the risk of local disputes.

The construction and ongoing maintenance of wind farms, like those managed by Greencoat UK Wind, are significant job creators. For instance, the offshore wind sector alone supported an estimated 30,000 jobs in the UK by 2023, a figure projected to grow substantially. These roles range from skilled engineers and technicians to site management and administrative staff, directly benefiting local communities.

Beyond direct employment, Greencoat UK Wind's projects stimulate local economies through substantial investment. Wind farm operations contribute millions of pounds annually in business rates, which local authorities can then reinvest in public services. Furthermore, the demand for local services and supplies during construction and operation creates ripple effects throughout the regional supply chain, fostering broader economic development.

Environmental Awareness and Sustainability

Growing public concern over climate change, particularly evident in the UK, is a significant sociological driver for Greencoat UK Wind. This heightened awareness translates directly into increased demand for renewable energy, bolstering the company's market position.

Societal preference for environmentally responsible investments is on the rise. For instance, by the end of 2023, UK retail investors had poured billions into sustainable funds, reflecting a tangible shift in investment priorities that benefits companies like Greencoat UK Wind.

Greencoat UK Wind's core business directly addresses this societal value by generating renewable electricity, thereby contributing to the reduction of CO2 emissions. In 2023, the UK's renewable electricity generation accounted for approximately 47% of the total, a figure that continues to grow, demonstrating the societal acceptance and necessity of such ventures.

- Growing demand for renewables: Public surveys consistently show over 70% of UK adults support renewable energy expansion.

- Investor sentiment: ESG (Environmental, Social, and Governance) funds saw net inflows of over £20 billion in the UK during 2023.

- CO2 reduction impact: Greencoat UK Wind's operational portfolio is estimated to offset millions of tonnes of CO2 annually.

Rural Land Use and Aesthetics

The visual impact of wind turbines on rural landscapes is a key sociological consideration. While wind farms represent a small land footprint, often less than 1% of total land area in regions where they operate, their visual presence can generate significant local debate, especially for onshore developments. For example, in the UK, public perception surveys often highlight landscape beauty as a major concern for local communities regarding renewable energy projects.

Greencoat UK Wind, primarily focused on acquiring operational assets, generally inherits the existing visual impact of its portfolio. However, for any new project development or acquisition of undeveloped sites, careful consideration of local aesthetic sensitivities and community engagement becomes crucial. This involves understanding local planning policies and the specific character of the rural landscape.

- Visual Impact: Turbine height and siting directly influence how they are perceived within a rural setting.

- Land Footprint vs. Visual Footprint: Although the physical land occupied by turbines is minimal, their visual impact can extend across a much wider area.

- Community Acceptance: Local opposition, often driven by aesthetic concerns, can delay or block new wind farm developments.

- Greencoat's Strategy: Acquiring operational assets mitigates immediate visual impact concerns but necessitates due diligence on existing landscape integration for future growth.

Societal concern for climate change is a powerful driver for Greencoat UK Wind, fueling demand for renewable energy. Public support for wind power in the UK remains high, with a 2024 poll showing 67% approval. This growing environmental awareness translates into a favorable market for renewable energy investments, with ESG funds seeing substantial inflows, exceeding £20 billion in the UK during 2023.

Technological factors

Ongoing advancements in turbine technology are significantly boosting efficiency and power output. We're seeing larger hub heights and rotor diameters become standard, directly translating to increased energy capture and a lower levelized cost of electricity (LCOE). For instance, offshore wind turbines in 2024 are regularly exceeding 15 MW capacity, a substantial leap from earlier models.

Greencoat UK Wind is well-positioned to capitalize on these developments by acquiring assets featuring modern, high-performance turbines. This strategic approach ensures more stable and predictable energy generation across their portfolio, enhancing the long-term yield and operational efficiency of their wind farms.

The increasing push for renewable energy means the UK's grid needs major upgrades to handle wind power. As more wind farms come online, the grid must be stable and efficient, which is a big challenge. This is particularly true with intermittent sources like wind, where output can vary.

Managing these supply and demand swings, along with grid congestion, is key. Greencoat UK Wind's success hinges on the grid's ability to take its wind-generated power. For instance, the National Grid ESO's plans for 2023-2024 include significant investment in network upgrades to accommodate higher renewable capacity, aiming for greater system flexibility.

Investments in smart grid technologies and grid modernization are therefore essential for Greencoat UK Wind. These upgrades will allow for more reliable electricity export from their wind farms. By 2030, the UK aims for 95% of its electricity to be low-carbon, requiring substantial grid enhancements, with the government committing billions to these infrastructure improvements.

The advancement of sophisticated energy storage, like grid-scale batteries, is crucial for smoothing out the variable nature of wind energy and maintaining a steady power flow. This technology directly addresses the intermittency challenge inherent in wind power generation.

While Greencoat UK Wind's current portfolio centers on operating wind farms, incorporating storage solutions, whether at current locations or through future investments, presents a clear opportunity to boost asset worth and operational agility. This integration can unlock new revenue streams and improve grid stability services.

The United Kingdom is anticipating substantial growth in battery energy storage capacity, with projections indicating significant expansion by 2030. This trend underscores the increasing importance and market viability of storage technologies within the UK's energy landscape.

Digitalisation and Predictive Maintenance

Digitalisation, particularly through AI and advanced data analytics, is revolutionizing wind farm management. Greencoat UK Wind can harness these tools to meticulously monitor asset performance, identify potential issues before they cause failures, and optimize operational schedules. This proactive approach, known as predictive maintenance, is key to boosting efficiency and minimizing costly downtime.

By integrating digital solutions, Greencoat UK Wind can enhance the operational availability and energy output of its portfolio. For instance, in 2023, the company's operational wind farms contributed significantly to its revenue, and further improvements in uptime directly translate to higher income. The application of AI for fault detection can reduce unexpected outages, leading to more consistent power generation and improved financial returns.

- Enhanced Efficiency: Digital tools can optimize turbine pitch and yaw for maximum energy capture.

- Reduced Downtime: Predictive maintenance, powered by AI, forecasts component failures, allowing for scheduled repairs.

- Cost Savings: Minimizing unplanned maintenance and extending component life directly lowers operational expenditures.

- Increased Output: Higher operational availability means more megawatt-hours generated and sold.

Offshore Wind Technology Development

Technological advancements in offshore wind are rapidly expanding the potential for new projects. Larger turbines are becoming more efficient, and the development of floating wind foundations is a game-changer, allowing deployment in deeper waters previously inaccessible. This innovation is crucial as the UK aims to significantly boost its offshore wind capacity.

While Greencoat UK Wind focuses on operational assets, these technological leaps directly impact the future pipeline of investable projects. The increasing scale and cost-effectiveness of new offshore developments will determine the availability and attractiveness of future assets for investment. For instance, the UK government has set an ambitious target to quadruple offshore wind capacity by 2030, a goal heavily reliant on these technological advancements.

- Turbine Size: Modern offshore turbines can now exceed 15 MW capacity, a significant jump from earlier models.

- Floating Wind: This technology is enabling development in water depths over 60 meters, opening vast new areas for wind farms.

- UK Capacity Target: The government aims for 50 GW of offshore wind by 2030, with 5 GW from floating wind.

- Cost Reduction: Technological improvements are driving down the levelized cost of energy (LCOE) for offshore wind, making it more competitive.

Technological advancements are continuously enhancing wind turbine efficiency, with new models in 2024 routinely exceeding 15 MW capacity, significantly boosting energy capture. This trend directly lowers the cost of electricity, making wind power increasingly competitive. Greencoat UK Wind's strategy of acquiring assets with modern, high-performance turbines positions them to benefit from these efficiency gains, ensuring more stable and predictable energy generation across their portfolio.

Legal factors

All commercial wind turbines in the UK necessitate planning permission, with significant developments often classified as Nationally Significant Infrastructure Projects (NSIPs) requiring a Development Consent Order (DCO). This process is crucial for Greencoat UK Wind's expansion strategy.

Legislative efforts in 2024 have focused on streamlining and accelerating the planning procedures for onshore wind projects. For instance, the government has set targets to reduce determination times for NSIPs, aiming for greater efficiency.

Greencoat UK Wind's ability to acquire new wind farms hinges on these projects having already obtained the requisite permits and consents. This can be a lengthy and intricate undertaking, often involving extensive environmental impact assessments and public consultations.

The success of Greencoat UK Wind's portfolio growth is directly tied to navigating these complex legal and regulatory frameworks, ensuring that all developments meet the strict requirements for planning permission and consent.

The Contracts for Difference (CfD) scheme creates a stable legal foundation for renewable energy producers, offering long-term revenue security. Greencoat UK Wind significantly capitalizes on these legally secured agreements, which are crucial for the consistent income derived from its wind farm assets.

As of the latest available data, the UK government has allocated a significant portion of its renewable energy capacity through CfDs. For instance, in the latest CfD Allocation Round 4 (AR4), over 11 GW of renewable projects were awarded contracts, demonstrating the scheme's substantial impact on the sector's investment landscape.

Any proposed modifications to the CfD legal structure or the rules governing its auctions could directly influence the financial viability and perceived risk associated with investing in wind farm projects. This includes potential adjustments to strike prices or eligibility criteria, which are closely monitored by investors like Greencoat.

Large-scale wind farm developments, including those owned by Greencoat UK Wind, are subject to stringent Environmental Impact Assessment (EIA) regulations. These assessments are crucial for identifying potential environmental effects, such as impacts on wildlife, landscape, and noise levels, and for outlining necessary mitigation strategies. For instance, during 2024, numerous projects navigated complex EIA processes, with some facing delays due to detailed ecological surveys and public consultation requirements.

Adherence to these EIA regulations is a non-negotiable legal requirement for obtaining planning permission and proceeding with the construction and operation of wind farms. Failure to comply can result in significant legal challenges, fines, and project cancellations. Greencoat UK Wind, therefore, must meticulously ensure that its portfolio of wind assets consistently meets all stipulated environmental permit conditions and ongoing regulatory obligations.

Land Lease and Property Rights

Greencoat UK Wind's operations are heavily reliant on securing long-term land lease agreements for its onshore wind farms and seabed leases for offshore installations. These legal frameworks are crucial as they dictate site access, operational rights, and revenue-sharing arrangements with landowners and maritime authorities. The stability and clarity of these property rights directly impact Greencoat's asset base and its capacity for consistent revenue generation.

The intricacies of these legal agreements extend to defining responsibilities for decommissioning at the end of a wind farm's lifespan, ensuring environmental compliance and site restoration. For instance, in 2024, the average lease term for onshore wind sites in the UK can range from 25 to 50 years, often with extension options. Offshore leases, governed by bodies like The Crown Estate in the UK, can span even longer periods, sometimes up to 50 years or more, reflecting the significant capital investment and longer operational horizons.

Secure land and seabed rights are fundamental to Greencoat UK Wind's business model, underpinning its ability to develop, operate, and generate stable income from its renewable energy assets. The company's portfolio as of early 2025 includes significant capacity secured through these long-term legal arrangements.

- Long-Term Leases: Securing land and seabed rights for decades ensures operational continuity.

- Revenue Sharing: Legal agreements define how income is shared with property owners, vital for predictable cash flows.

- Decommissioning: Clear legal stipulations for site closure and environmental responsibility are managed through these contracts.

- Asset Value: Well-defined property rights are essential for the valuation and financing of Greencoat's wind farm assets.

Energy Legislation and Regulatory Compliance

The UK's energy landscape is shaped by extensive legislation, including the Electricity Act 1989 and the Energy Act 2013, which govern how electricity is generated, transmitted, and traded. Greencoat UK Wind must navigate these laws to ensure its wind farms operate legally and efficiently. For instance, adherence to grid connection agreements and market rules, overseen by the regulator Ofgem, is paramount for revenue generation and operational stability.

Compliance with these evolving regulations directly impacts Greencoat UK Wind's financial performance. Penalties for non-compliance can be substantial, affecting profitability. For example, in 2023, energy companies faced scrutiny over market conduct, highlighting the importance of robust compliance frameworks.

Future legislative changes pose potential challenges and opportunities. Discussions around the decommissioning of offshore wind assets, for example, could lead to new financial obligations for operators like Greencoat. The government's commitment to net-zero targets, however, generally supports the continued growth of renewable energy, providing a positive backdrop for the sector.

Key legal considerations for Greencoat UK Wind include:

- Compliance with the Electricity Act 1989 and subsequent energy legislation.

- Adherence to grid codes and market rules set by Ofgem.

- Staying abreast of potential new obligations related to asset decommissioning.

- Navigating evolving environmental and planning regulations affecting wind farm development and operation.

Navigating the UK's planning permission system remains a core legal challenge for Greencoat UK Wind, with reforms in 2024 aiming to expedite onshore wind project approvals. The company's acquisition strategy relies on these projects having secured necessary consents, a process often involving detailed environmental impact assessments and public input, which can be time-consuming.

The Contracts for Difference (CfD) scheme provides a stable legal revenue stream, crucial for Greencoat's financial model. In Allocation Round 5 (AR5) concluded in early 2024, the UK government awarded 3.7 GW of renewable electricity capacity, underscoring the scheme's ongoing importance for securing long-term investment in projects like those owned by Greencoat.

Environmental Impact Assessment (EIA) regulations are strictly enforced, requiring thorough analysis of potential ecological and landscape effects. For instance, a significant offshore wind project progressing through consenting in 2024 faced extensive consultations regarding marine mammal impacts, highlighting the detailed legal scrutiny involved.

Long-term land and seabed lease agreements are fundamental legal instruments for Greencoat UK Wind, ensuring operational access and defining revenue sharing. As of early 2025, the company's portfolio is built upon these secure, multi-decade legal arrangements, which also encompass decommissioning responsibilities.

| Legal Area | Key Aspects for Greencoat UK Wind | Relevant Legislation/Scheme | 2024/2025 Data/Trends |

| Planning Permission | Obtaining Development Consent Orders (DCOs) for NSIPs; streamlining of onshore wind planning processes. | Town and Country Planning Act 1990, Planning Act 2008 | Government targets to reduce NSIP determination times; focus on accelerating onshore wind approvals. |

| Revenue Support | Long-term revenue certainty via CfD contracts. | Contracts for Difference (CfD) Scheme | AR5 in 2024 awarded 3.7 GW; CfDs remain a primary investment driver. |

| Environmental Compliance | Mandatory Environmental Impact Assessments (EIAs); adherence to permit conditions. | Environmental Protection Act 1990, EIA Directive | Ongoing scrutiny of ecological surveys and mitigation strategies for new projects. |

| Asset Rights | Securing long-term land/seabed leases; defining decommissioning liabilities. | Property law, Crown Estate leases | Average onshore lease terms of 25-50 years; offshore leases can exceed 50 years. |

Environmental factors

The UK government has set ambitious climate targets, including a legally binding commitment to achieve Net Zero greenhouse gas emissions by 2050. A key part of this strategy is decarbonising the electricity system by 2030. These targets are a significant tailwind for companies like Greencoat UK Wind.

Greencoat UK Wind's core business of generating renewable electricity directly supports these national environmental objectives. By displacing electricity generated from fossil fuels, the company plays a crucial role in reducing the UK's overall carbon footprint, aligning its operations with a fundamental environmental imperative.

In 2023, renewable energy sources, including wind, accounted for approximately 47% of the UK's electricity generation. This demonstrates the growing importance of wind power in meeting climate goals, with Greencoat UK Wind being a major player in this sector.

Wind farm construction and operation can affect local wildlife, particularly birds and bats, and sensitive ecosystems. For example, a 2024 study on onshore wind farms in the UK highlighted that careful site selection and operational adjustments can reduce bird collision risk by up to 50%.

Environmental Impact Assessments (EIAs) are mandatory for new developments, ensuring potential impacts are identified and mitigation strategies, such as habitat restoration or wildlife monitoring programs, are implemented. Greencoat UK Wind, with its extensive portfolio, invests in ongoing environmental management and habitat enhancement initiatives, aiming for net positive biodiversity impact.

Greencoat UK Wind's commitment to environmental stewardship means adhering to strict biodiversity protection measures across its operational sites. In 2024, the company reported that over 80% of its sites had specific biodiversity action plans in place, contributing to the conservation of local flora and fauna.

While wind farms require a relatively small physical footprint, their visual presence can be a major environmental concern, especially for onshore developments. Greencoat UK Wind, like other operators, must carefully balance the need for renewable energy generation with the preservation of natural landscapes. This involves meticulous site selection and ongoing assessment of visual amenity impacts across their portfolio.

Carbon Footprint of Construction and Operation

While wind energy itself doesn't emit greenhouse gases during operation, the construction and manufacturing phases of wind farms do have an environmental impact. This is a common consideration for all renewable energy projects. The significant environmental advantage comes from the displacement of fossil fuel-based electricity generation over the wind farm's operational life.

Greencoat UK Wind's environmental contribution is largely measured by the CO2 emissions it helps to avoid. For instance, in 2024, the company's portfolio was instrumental in avoiding an estimated 2.2 million tonnes of CO2. This highlights the net positive environmental effect of their operations.

- Construction Footprint: Manufacturing turbines and building infrastructure involves emissions.

- Operational Advantage: Zero direct greenhouse gas emissions during electricity generation.

- CO2 Avoidance: Greencoat UK Wind's portfolio avoided 2.2 million tonnes of CO2 in 2024.

- Lifecycle Benefit: The environmental gain is realized over the entire operational lifespan.

Decommissioning and End-of-Life Management

The environmental considerations for Greencoat UK Wind extend significantly to the end-of-life management of its assets. Decommissioning wind turbines and associated infrastructure presents a complex challenge, with evolving regulations and industry best practices aimed at responsible dismantling and recycling. For instance, the UK's commitment to net-zero by 2050 under the Climate Change Act necessitates robust strategies for managing the entire lifecycle of renewable energy projects, including their eventual decommissioning.

Future legislation is likely to impose more stringent requirements, particularly for offshore wind decommissioning, which is a growing area for Greencoat UK Wind. These upcoming regulations will need careful consideration to ensure compliance and minimize environmental impact. The industry is already seeing a focus on circular economy principles, pushing for higher recycling rates of components like turbine blades, which historically posed a disposal challenge.

- Evolving Regulations: The UK government's approach to offshore wind decommissioning is under continuous development, with a focus on setting clear standards for environmental protection and component reuse.

- Recycling Innovations: Significant investment is being channeled into developing advanced recycling technologies for composite materials found in turbine blades, aiming for recycling rates exceeding 90% by 2030.

- Cost Implications: Decommissioning costs are a material factor in the long-term financial planning of wind farm operators, and Greencoat UK Wind must factor these increasing liabilities into its financial models.

- Environmental Impact Mitigation: Responsible decommissioning involves minimizing disruption to marine ecosystems and ensuring that all materials are handled and disposed of in an environmentally sound manner.

The UK's commitment to Net Zero by 2050 drives significant demand for renewable energy, directly benefiting Greencoat UK Wind's operational model. In 2023, renewables powered nearly half of the UK's electricity, underscoring the sector's vital role. Greencoat UK Wind's portfolio actively contributes to reducing the nation's carbon footprint, a critical environmental objective.

While wind farms are crucial for decarbonisation, their construction and operation necessitate careful environmental management. This includes mitigating impacts on wildlife, such as birds and bats, where studies in 2024 indicated up to a 50% reduction in collision risk through strategic site selection. Furthermore, environmental impact assessments are mandatory, ensuring responsible development and habitat protection, with over 80% of Greencoat UK Wind's sites having biodiversity action plans in 2024.

The lifecycle of wind assets, including decommissioning, presents environmental challenges. Innovations in recycling, particularly for turbine blades, are advancing, with targets aiming for over 90% recycling rates by 2030. Greencoat UK Wind's operations in 2024 avoided an estimated 2.2 million tonnes of CO2, demonstrating a substantial net positive environmental contribution.

| Environmental Factor | Impact on Greencoat UK Wind | Data Point |

| Net Zero Targets | Strong demand for renewable generation | UK Net Zero by 2050 |

| Renewable Energy Mix | Increased reliance on wind power | ~47% of UK electricity in 2023 |

| Wildlife Impact Mitigation | Operational and site selection strategies | Up to 50% collision risk reduction (2024 study) |

| Biodiversity Management | Site-specific action plans | >80% of sites with plans (2024) |

| CO2 Avoidance | Quantifiable reduction in emissions | 2.2 million tonnes avoided (2024) |

| Decommissioning & Recycling | Future asset management and material recovery | Target >90% blade recycling by 2030 |

PESTLE Analysis Data Sources

Our Greencoat UK Wind PESTLE Analysis is meticulously constructed using data from official government publications, reputable financial news outlets, and leading industry associations. This ensures our insights into political, economic, and technological factors affecting the UK wind energy sector are both current and authoritative.