Greencoat UK Wind Marketing Mix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Greencoat UK Wind Bundle

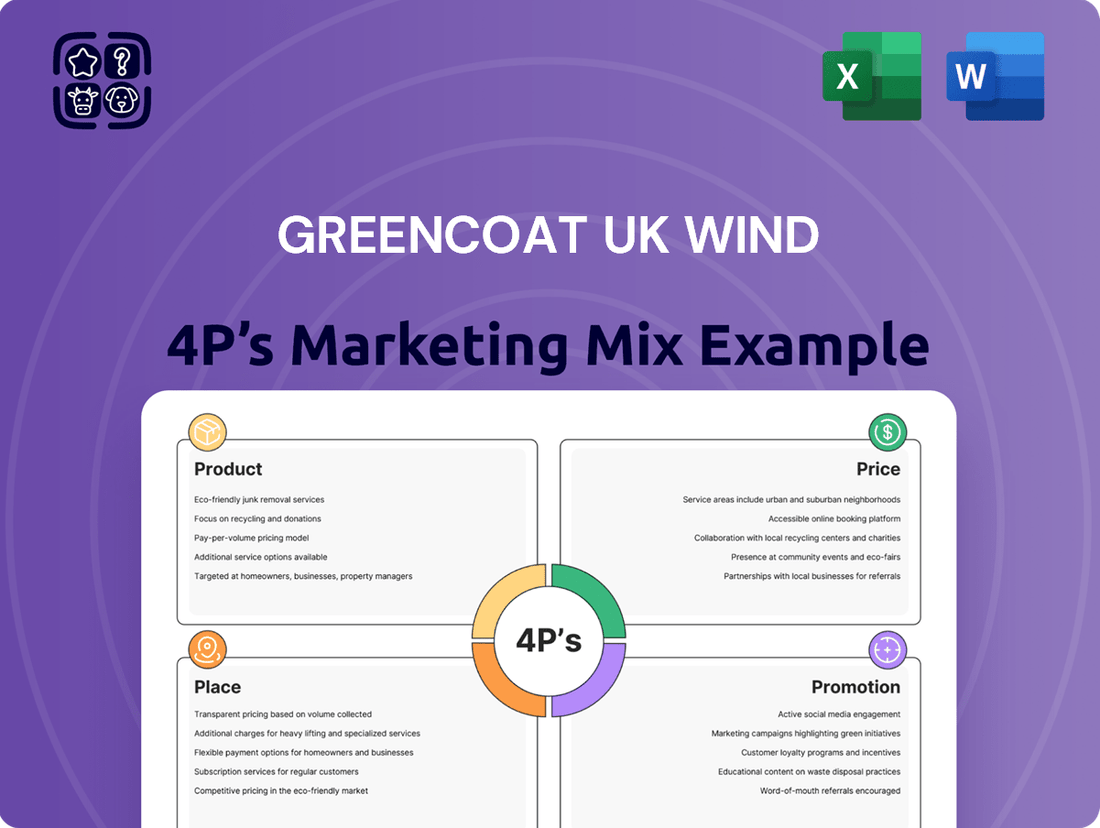

Greencoat UK Wind's marketing success hinges on a robust 4Ps strategy, from its diversified portfolio of renewable energy assets to its innovative pricing mechanisms. Understanding how they position their "product" of clean energy, their approach to "price" in a fluctuating market, their "place" in the investment landscape, and their "promotion" to attract stakeholders is key to grasping their market dominance.

Go beyond this glimpse—get access to an in-depth, ready-made Marketing Mix Analysis covering Greencoat UK Wind's Product, Price, Place, and Promotion strategies. Ideal for investors, business students, and energy sector professionals looking for strategic insights.

Product

Greencoat UK Wind's core offering is an investment in a diversified portfolio of operational wind farms across the UK. This provides a direct avenue for investors to participate in the burgeoning renewable energy sector, aligning with the nation's drive towards energy transition and net-zero goals.

The company emphasizes a straightforward, transparent, and low-risk investment approach. For instance, as of early 2024, Greencoat UK Wind managed a portfolio of over 40 wind farms, generating enough electricity to power more than 770,000 homes annually.

This tangible impact underscores the product's appeal beyond financial returns, offering investors a chance to contribute to a sustainable future. The company's consistent dividend payments, often linked to inflation, further enhance its attractiveness as a stable income-generating asset.

Stable income generation is a cornerstone of Greencoat UK Wind 4P's offering. This is primarily facilitated by long-term, fixed-price contracts for the electricity their wind farms produce, creating a predictable revenue stream. For the financial year ending December 31, 2023, Greencoat UK Wind reported a net asset value (NAV) per share of 173.6 pence, demonstrating the underlying value supporting its income generation.

The company is committed to delivering an annual dividend that is designed to grow in line with RPI inflation, providing investors with a hedge against rising living costs. In 2023, the company paid a total dividend of 7.4 pence per share, a 2.0% increase over the previous year, reflecting this commitment. This focus on inflation-linked income is a key differentiator for investors seeking consistent returns.

Capital preservation is a cornerstone of Greencoat UK Wind 4P's offering, designed to protect and grow shareholder capital in real terms over extended periods. This is achieved through a disciplined approach to reinvesting excess cash flow back into the existing portfolio or by strategically reallocating capital, such as through share buyback programs.

The company's commitment to capital preservation is further bolstered by its strong financial footing, evidenced by a robust balance sheet and a prudent low gearing policy. As of the latest available data, Greencoat UK Wind 4P maintains a healthy financial structure, ensuring resilience against market volatility and supporting its long-term capital preservation objectives.

ESG-Aligned Investment

Greencoat UK Wind's ESG-Aligned Investment offering is a cornerstone for investors prioritizing sustainability. It directly addresses the growing demand for responsible investment opportunities by focusing on renewable energy infrastructure.

This product inherently aligns with Environmental, Social, and Governance (ESG) investment principles. By investing in Greencoat UK Wind, investors are actively supporting the transition to a low-carbon economy, a critical component of modern investment strategies. For instance, in 2024, Greencoat UK Wind reported a portfolio of wind farms generating enough electricity to power approximately 1.2 million homes, significantly contributing to carbon emission reductions.

The direct contribution to reducing carbon emissions and powering homes with clean energy is a key differentiator. This aligns with ambitious global climate goals and provides investors with a tangible impact narrative. As of mid-2024, the UK's renewable energy sector, heavily influenced by companies like Greencoat, saw offshore wind capacity reach over 14 GW, a testament to the sector's growth and ESG appeal.

- Environmental Impact: Directly contributes to reducing carbon emissions by generating clean electricity.

- Social Responsibility: Powers homes with renewable energy, supporting community well-being.

- Governance Standards: Adheres to robust ESG principles in its operational and investment strategies.

- Market Alignment: Meets the increasing investor demand for sustainable and responsible investment vehicles.

Diversification and Low Volatility

Greencoat UK Wind (UKW) offers investors significant diversification benefits. Its revenue, primarily derived from operational wind farms under long-term agreements, often shows a low correlation with traditional asset classes like equities and bonds. This low correlation helps to smooth out overall portfolio returns, especially during periods of market turbulence. For instance, as of the first half of 2024, UKW's portfolio of operational wind farms continued to generate consistent cash flows, underscoring its role as a diversifier.

The company's focus on operational assets and the nature of its long-term power purchase agreements contribute to remarkably stable and predictable cash flows. This characteristic inherently reduces the volatility of an investor's portfolio. UKW's strategy aims to provide a defensive component, offering a reliable income stream that is less susceptible to the sharp fluctuations often seen in other market segments. This stability is a key attraction for investors seeking to temper overall portfolio risk.

- Diversification: Low correlation of wind farm income with traditional markets.

- Stability: Predictable cash flows from operational assets and long-term contracts.

- Volatility Reduction: Contributes to a less volatile overall portfolio.

- Reliable Income: Provides a defensive element to investment portfolios.

Greencoat UK Wind's product offers investors direct exposure to a diversified portfolio of operational wind farms. This provides a stable, inflation-linked income stream, underpinned by long-term power purchase agreements. Its core appeal lies in providing consistent returns while contributing to the UK's renewable energy transition.

| Key Product Features | Description | Supporting Data (2023/2024) |

|---|---|---|

| Investment Focus | Diversified portfolio of operational UK wind farms | Portfolio of over 40 wind farms (early 2024) |

| Income Generation | Stable, inflation-linked dividends | 2023 dividend: 7.4 pence per share (up 2.0%) |

| Capital Preservation | Disciplined reinvestment and prudent financial management | Net Asset Value (NAV) per share: 173.6 pence (31 Dec 2023) |

| ESG Alignment | Direct contribution to clean energy and carbon reduction | Portfolio powering ~1.2 million homes (2024) |

What is included in the product

This analysis provides a comprehensive breakdown of Greencoat UK Wind's marketing mix, detailing their product offerings, pricing strategies, distribution channels, and promotional activities within the renewable energy sector.

Simplifies the complex Greencoat UK Wind 4Ps into actionable insights, alleviating the pain of understanding their market strategy.

Provides a clear, concise overview of Greencoat UK Wind's 4Ps, easing the burden of strategic marketing comprehension for busy executives.

Place

Greencoat UK Wind PLC's listing on the London Stock Exchange (LSE: UKW) ensures broad investor access. As a FTSE 250 constituent, UKW benefits from enhanced market visibility and trading liquidity. This public listing subjects the company to stringent regulatory oversight, bolstering investor trust and transparency. For the period ending December 31, 2023, Greencoat UK Wind reported a net asset value of £3.4 billion, demonstrating its significant market presence.

Greencoat UK Wind's (UKW) ordinary shares are readily accessible to a wide range of investors through numerous investment platforms and brokerage accounts. This extensive availability ensures that both large institutional investors and individual retail investors can seamlessly integrate UKW shares into their existing investment portfolios.

Many of these platforms go further by offering detailed factsheets and up-to-date performance data, empowering investors with the necessary information to make well-informed decisions about their holdings in the company.

Greencoat UK Wind's presence in major indices like the FTSE 250, FTSE 350, and FTSE All-Share significantly boosts its visibility and appeal to investors. As of early 2024, these inclusions mean that Greencoat UK Wind is a component of numerous passively managed investment funds and Exchange Traded Funds (ETFs).

This structural advantage translates into consistent buying pressure for its shares, as index-tracking funds must purchase the stock to maintain their portfolio allocations. For example, by being a constituent of the FTSE 250, which tracks mid-cap companies, Greencoat UK Wind benefits from the inflows into funds designed to mirror this benchmark.

This broad market exposure not only increases liquidity but also provides a degree of stability to its share price, as demand is not solely reliant on active, discretionary investment decisions. The inclusion signifies a level of market acceptance and operational scale that is attractive to a wider investor base looking for exposure to the renewable energy sector.

Direct Investor Relations

Greencoat UK Wind actively cultivates direct investor relations through its website, offering a vital conduit for information beyond stock exchange listings. This dedicated investor relations portal acts as a central repository for critical company disclosures, ensuring transparency and accessibility for all stakeholders. For instance, in its 2023 annual report, the company highlighted its commitment to providing timely updates on operational performance and financial health directly to investors.

The website serves as a primary source for key documents, including:

- Annual Reports: Comprehensive overviews of financial performance, strategy, and governance.

- Interim Results: Regular updates on financial and operational progress.

- ESG Reports: Detailed information on environmental, social, and governance initiatives, reflecting the company's commitment to sustainability.

- Circulars and Announcements: Official notifications and shareholder communications.

This direct channel empowers individual investors, financial professionals, and other stakeholders with the data needed for thorough analysis and informed decision-making, bypassing the need to rely solely on third-party reporting. As of the first half of 2024, Greencoat UK Wind continued to emphasize this direct communication, ensuring investors had access to the latest operational metrics and financial statements.

Global Investor Reach

Greencoat UK Wind's strategic listing on the London Stock Exchange (LSE) and its consistent inclusion in prominent global indices like the FTSE 100 and FTSE 250 significantly broadens its appeal. This accessibility is crucial for attracting a diverse international investor base, from institutional funds to individual shareholders worldwide. By being part of these widely tracked benchmarks, the company automatically gains visibility and credibility, facilitating access to a larger pool of capital for future growth initiatives. For instance, as of early 2024, the LSE remains a primary hub for renewable energy investments, with Greencoat UK Wind being a key player.

This global reach directly translates into enhanced liquidity for its shares, making it easier for investors to buy and sell. A liquid market is attractive because it reduces the risk of being unable to exit an investment at a fair price. This benefit supports Greencoat UK Wind's ability to tap into capital markets efficiently for potential equity raises, which are vital for funding its pipeline of wind farm projects and acquisitions. The company's market capitalization, a key indicator of its scale and investor interest, has seen substantial growth, reflecting this broad investor engagement.

- Global Stock Exchange Listing: Primary listing on the London Stock Exchange (LSE).

- Inclusion in Major Indices: Component of FTSE 100 and FTSE 250, increasing global visibility.

- Capital Access: Facilitates broader access to international capital for growth funding.

- Enhanced Liquidity: Provides ease of trading for a global shareholder base.

Greencoat UK Wind's marketing mix heavily leverages its prominent listing on the London Stock Exchange, offering easy access to a broad investor base. Its inclusion in key indices like the FTSE 250 further amplifies its visibility and attracts passive investment flows. The company also maintains a direct investor relations channel via its website, providing transparent access to crucial company information.

This multi-faceted approach ensures that Greencoat UK Wind is readily available and well-understood by a diverse range of investors, from retail to institutional. The company's commitment to transparency, demonstrated by its comprehensive website disclosures and index inclusion, underpins investor confidence and facilitates capital raising for its growth objectives.

| Metric | Value (as of early 2024) | Significance |

|---|---|---|

| Primary Listing | London Stock Exchange (LSE) | Broad investor access, regulatory compliance |

| Index Constituents | FTSE 250, FTSE 350, FTSE All-Share | Enhanced visibility, passive fund inflows |

| Net Asset Value (as of Dec 31, 2023) | £3.4 billion | Demonstrates scale and financial strength |

What You See Is What You Get

Greencoat UK Wind 4P's Marketing Mix Analysis

The document you see here is not a sample; it's the final version you’ll get right after purchase. This Greencoat UK Wind 4P's Marketing Mix Analysis provides a comprehensive overview of their strategies across Product, Price, Place, and Promotion. You can trust that the insights and data presented are complete and ready for your immediate use.

Promotion

Greencoat UK Wind’s marketing mix emphasizes comprehensive investor reporting to showcase its investment proposition. This includes detailed annual reports, half-year results, and regular NAV factsheets, offering a transparent view of financial performance and operational metrics. For instance, as of December 31, 2023, Greencoat UK Wind reported a Net Asset Value (NAV) per share of 145.6 pence, demonstrating the tangible value for investors.

Greencoat UK Wind PLC leverages the Regulatory News Service (RNS) as a crucial channel for disseminating vital company updates. This includes announcements regarding dividend payments, strategic asset acquisitions or disposals, and significant operational performance indicators. For instance, RNS announcements in early 2024 detailed dividend payments and updates on the company's operational capacity, keeping investors informed.

Greencoat UK Wind actively connects with investors through roadshows and webcasts, particularly around its financial results. These sessions are crucial for direct interaction with the management team, enabling investors and analysts to pose questions and gain a clearer understanding of the company's strategic direction and operational achievements. For instance, during its FY2023 reporting, Greencoat UK Wind held several investor briefings, highlighting its robust performance and future growth prospects.

ESG and Sustainability Communications

Greencoat UK Wind's promotional efforts heavily feature its commitment to Environmental, Social, and Governance (ESG) principles. This is primarily communicated through detailed ESG reports and ongoing sustainability messaging, directly appealing to the increasing number of investors prioritizing responsible and sustainable investment opportunities.

The company's focus on ESG not only highlights its positive environmental impact but also serves as a key differentiator in the market. This strategy is particularly effective given the growing investor demand for transparency and verifiable commitment to sustainability, a trend expected to continue through 2025.

- ESG Reporting: Greencoat UK Wind regularly publishes comprehensive ESG reports, detailing its performance across environmental, social, and governance metrics.

- Investor Focus: The company actively targets investors seeking sustainable and ethical investment options, aligning its communication with their priorities.

- Environmental Impact: A core element of their promotion is showcasing the tangible positive environmental outcomes generated by their wind farm portfolio.

- Market Resonance: This approach resonates strongly with a growing segment of the investment community, particularly those influenced by long-term sustainability trends and regulatory shifts towards greener finance.

Financial Media Engagement and Analyst Coverage

Greencoat UK Wind plc (UKW) actively cultivates relationships with financial media outlets and solicits coverage from investment analysts. This strategic approach aims to amplify the company's visibility and reinforce its investment proposition. For instance, in the first half of 2024, UKW saw significant coverage in publications like the Financial Times and Bloomberg, highlighting its robust operational performance and dividend growth trajectory.

Positive media attention and analyst reports provide crucial third-party validation, enhancing UKW's credibility among potential investors and the wider financial community. During 2024, several prominent investment banks initiated or maintained coverage on UKW, with analysts frequently citing its stable, inflation-linked revenue streams from wind farm assets as a key attraction. This analyst endorsement directly contributes to building investor confidence and attracting capital.

- Increased Visibility: Media engagement in 2024, including interviews with company leadership on business news channels, helped broaden awareness of UKW's strategy and market position.

- Analyst Endorsements: Multiple equity research reports published in late 2024 and early 2025 maintained positive ratings, underscoring the company's consistent dividend policy and operational efficiency.

- Investor Confidence: Independent analysis and media commentary in 2024 consistently pointed to UKW's strong financial health and its role in the UK's renewable energy transition.

- Market Education: Efforts to engage with financial journalists in 2024 focused on explaining the nuances of the UK renewable energy market and UKW's specific asset portfolio.

Greencoat UK Wind's promotion strategy leverages consistent media engagement and analyst coverage to bolster its investment profile. By securing positive commentary in financial publications and maintaining strong analyst relationships, the company builds credibility and broadens its investor reach. This concerted effort in 2024 and early 2025 has highlighted its operational stability and attractive dividend prospects.

| Metric | Value (as of latest reporting) | Period |

|---|---|---|

| NAV per share | 145.6 pence | December 31, 2023 |

| Dividend per share | 7.00 pence | FY 2023 |

| Portfolio capacity | Over 1.1 GW | Early 2024 |

Price

Greencoat UK Wind's share price on the London Stock Exchange (LSE) serves as the direct reflection of its 'price' in the market, constantly adjusting based on buyer and seller activity. As of mid-2024, the company’s share price has experienced volatility, influenced by factors such as interest rate expectations and the broader renewable energy sector performance. For instance, during periods of rising interest rates, the value of assets like wind farms can be perceived as less attractive, potentially impacting the share price.

The company's market capitalisation, calculated by multiplying its current share price by the total number of shares outstanding, provides a clear indicator of its overall market valuation. In early 2024, Greencoat UK Wind maintained a significant market capitalisation, placing it among the larger renewable energy investment companies listed on the LSE. This substantial valuation underscores its scale and prominence within the UK's wind power infrastructure.

The dividend yield is a crucial part of Greencoat UK Wind's pricing strategy, directly appealing to investors seeking regular income. This yield is calculated by dividing the annual dividend per share by the current share price, making it a key metric for income-focused investors.

Greencoat UK Wind is committed to offering an attractive and consistently growing dividend. For 2025, the company has set a target of 10.35 pence per share, a figure that significantly influences investor decisions looking for reliable income streams.

This targeted dividend of 10.35 pence per share for 2025, when considered against its share price, offers a compelling yield. This makes Greencoat UK Wind a particularly appealing option for those prioritizing income generation within their investment portfolios.

The Net Asset Value (NAV) per share for Greencoat UK Wind (UKW) offers a foundational understanding of the worth of its wind farm portfolio. As of late 2024, UKW's NAV per share was approximately 160 pence, reflecting the value of its operational assets.

Observing the relationship between UKW's share price and its NAV is vital for investors. For much of 2024, UKW traded at a slight discount to its NAV, often around 5-10%, meaning the market valued the company's assets slightly less than their book value.

This premium or discount is a key indicator of investor sentiment and market perception of future earnings potential. A persistent discount, as seen in parts of 2024, can signal that investors anticipate challenges or lower growth prospects, impacting potential capital appreciation.

Conversely, if UKW were to trade at a premium to NAV, it would suggest strong investor confidence in the company's management and its ability to generate returns above the current asset valuation, potentially leading to capital gains.

Share Buyback Programmes

Greencoat UK Wind Plc (UKW) utilizes share buyback programs as a key element in its marketing mix, aiming to actively manage its share price and bolster shareholder returns. These buybacks are strategically employed when the board perceives UKW's shares to be trading at a discount to their Net Asset Value (NAV). This approach not only signals confidence in the company's underlying assets but also serves to reduce the NAV discount, thereby enhancing shareholder value.

The company's commitment to capital allocation is evident in its buyback strategy. For instance, during the first half of 2024, UKW completed a significant portion of its announced buyback program. As of June 30, 2024, UKW had repurchased approximately 101.6 million ordinary shares for a total consideration of £98.9 million, representing roughly 4.3% of its issued share capital at the time. This action directly addresses the market's perception of value and aims to create a more efficient capital structure.

- Share Buybacks as a Value Enhancement Tool: UKW repurchases shares when they trade below NAV, a strategy designed to uplift the share price and improve the NAV per share metric.

- Capital Allocation Discipline: Buybacks demonstrate prudent capital management, returning excess capital to shareholders in a manner that is accretive to value.

- Market Signaling: Executing buybacks signals management's belief in the company's intrinsic value, potentially attracting new investors and reassuring existing ones.

- Impact on Shareholder Returns: By reducing the number of outstanding shares and narrowing the discount to NAV, buybacks can lead to higher earnings per share and improved overall shareholder returns.

Management Fees and Cost of Capital

Greencoat UK Wind's pricing strategy considers management fees and its cost of capital, crucial for shareholder returns. For instance, in 2023, Greencoat UK Wind PLC reported total operating expenses, which include management fees, as a significant portion of their costs. Understanding these fees is vital for investors assessing the net yield.

The company's cost of capital, including debt financing, directly impacts profitability. By managing its debt efficiently, Greencoat aims to keep borrowing costs low. This focus on cost control is essential to ensure the investment remains competitive against other income-generating assets in the market.

- Transparent Fee Structures: Greencoat aims for clarity in how management fees are calculated.

- Debt Management: Efficiently managing debt financing helps control the overall cost of capital.

- Shareholder Returns: Lower costs directly translate to higher net returns for investors.

- Investment Attractiveness: Competitive cost of capital makes the investment more appealing.

Greencoat UK Wind's pricing strategy is multifaceted, directly reflecting in its share price and dividend policy. The company's commitment to a growing dividend, with a target of 10.35 pence per share for 2025, is a key draw for income-seeking investors. This dividend yield, calculated against the prevailing share price, positions UKW as an attractive income investment. Furthermore, the company actively manages its share price through buybacks when trading below Net Asset Value (NAV), as evidenced by repurchasing 101.6 million shares for £98.9 million in H1 2024.

| Metric | Value (as of mid-2024/early 2025) | Significance |

| Target Dividend Per Share (2025) | 10.35 pence | Key indicator for income investors |

| NAV Per Share (Late 2024) | ~160 pence | Underlying asset value |

| Share Buyback (H1 2024) | 101.6 million shares for £98.9 million | Management's view on undervaluation, NAV discount reduction |

4P's Marketing Mix Analysis Data Sources

Our Greencoat UK Wind 4P's Marketing Mix analysis is grounded in official company reports, investor relations materials, and industry-specific news. We meticulously review annual reports, financial disclosures, and public statements to accurately reflect their product offerings, pricing strategies, distribution channels, and promotional activities.