Greencoat UK Wind Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Greencoat UK Wind Bundle

Greencoat UK Wind navigates a competitive landscape shaped by powerful forces. Understanding the intensity of rivalry among existing players is crucial, as is the bargaining power of both suppliers and buyers in the renewable energy sector. The threat of substitute products, though perhaps less direct in wind energy, still merits consideration.

The full Porter's Five Forces Analysis reveals the real forces shaping Greencoat UK Wind’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

Suppliers of wind turbines and specialized maintenance services wield considerable bargaining power. This stems from the highly technical and often proprietary nature of their equipment and expertise, essential for operating assets like those in Greencoat UK Wind's portfolio. For instance, Vestas, a major turbine manufacturer, reported a significant order intake in 2024, indicating strong demand and their ability to command favorable terms.

Greencoat UK Wind's reliance on long-term Operations and Maintenance (O&M) contracts significantly shapes supplier bargaining power. These agreements, often spanning a decade or more, lock in service providers, making it costly and complex for Greencoat to switch O&M partners for its operational wind farms.

The substantial switching costs involved mean that established O&M suppliers can leverage their position to negotiate favorable terms, potentially impacting Greencoat's operational expenses. For instance, the specialized nature of wind turbine maintenance and the need for certified technicians create high barriers to entry for new providers, further solidifying the power of incumbent suppliers.

The supply chain for critical wind farm components like blades, gearboxes, and generators features a concentrated group of specialized manufacturers. This limited supplier base means Greencoat UK Wind faces potential cost increases or longer delivery times if these key suppliers encounter production challenges or opt to raise their prices. For instance, in 2024, a significant portion of the global wind turbine blade market is dominated by just a few major players, giving them considerable leverage.

Grid Connection and Infrastructure Providers

The bargaining power of suppliers in the grid connection and infrastructure sector significantly impacts Greencoat UK Wind. Access to and the ongoing maintenance of essential grid infrastructure are critical for the operational efficiency and revenue generation of wind farms. Providers in this space, often operating within highly regulated or monopolistic frameworks, possess substantial influence, thereby limiting Greencoat UK Wind's ability to negotiate favorable terms for connection and transmission services.

This supplier power is particularly evident in the UK, where entities like National Grid ESO play a pivotal role. Their control over the transmission network means wind farm operators have limited alternatives when it comes to connecting to the grid and transmitting electricity. Consequently, Greencoat UK Wind faces considerable leverage from these infrastructure providers regarding connection charges and ongoing transmission fees.

- Essential Infrastructure Dependency: Wind farms require direct access to the national grid for electricity export, making grid operators indispensable suppliers.

- Regulatory Control and Limited Competition: The monopolistic or highly regulated nature of grid operators restricts competitive pressures, enhancing their bargaining power. For instance, in the UK, National Grid ESO manages the transmission system, a critical bottleneck for renewable energy projects.

- High Switching Costs: Once a connection is established, the costs and complexities associated with changing grid connection points or transmission providers are prohibitively high for operators like Greencoat UK Wind.

- Impact on Profitability: Elevated connection and transmission fees directly reduce the profitability of wind farm assets, impacting Greencoat UK Wind's financial performance and ability to secure competitive returns for investors.

Land Lease Agreements

Landowners who lease sites for wind farms, like those operated by Greencoat UK Wind, hold significant bargaining power, particularly for already operational locations. These long-term lease agreements, often with built-in inflation adjustments, constitute a considerable fixed cost. The scarcity of desirable land suitable for wind energy projects and the intricate nature of local planning regulations further amplify this supplier power. For instance, in 2024, the average lease cost for prime onshore wind farm locations in the UK can range significantly, impacting the overall operational expenditure.

The bargaining power of suppliers in the context of land lease agreements for wind farms is a critical consideration for Greencoat UK Wind.

- Landowner Influence: Landowners possess leverage due to the specialized nature of wind farm sites and the long-term commitment required.

- Lease Agreement Structure: Contracts often include inflation-linked escalators, meaning lease payments automatically increase over time, adding to fixed costs.

- Scarcity and Regulation: Limited availability of suitable land and the complexities of planning permission in the UK contribute to higher lease costs.

- Cost Impact: These lease payments are a substantial component of operational expenses for wind farm operators like Greencoat UK Wind.

Suppliers of wind turbines and maintenance services hold considerable sway due to the specialized nature of their offerings. For instance, Vestas, a key turbine provider, saw substantial order growth in 2024, underscoring their market strength and ability to negotiate favorable terms with operators like Greencoat UK Wind.

Greencoat UK Wind's reliance on long-term Operations and Maintenance (O&M) contracts, often exceeding ten years, significantly bolsters the bargaining power of O&M providers. Switching these specialized service providers is complex and costly, allowing incumbents to maintain leverage over pricing and contract conditions.

The limited number of manufacturers for critical components like blades and gearboxes, with a few players dominating the market in 2024, grants them pricing power. Greencoat UK Wind faces potential cost escalations or delivery delays if these key suppliers experience production issues or adjust their pricing strategies.

The bargaining power of landowners who lease sites for wind farms is substantial, particularly for operational assets. Long-term lease agreements with inflation-linked adjustments represent a significant fixed cost, amplified by the scarcity of suitable land and stringent UK planning regulations, impacting Greencoat UK Wind's operational expenditures.

What is included in the product

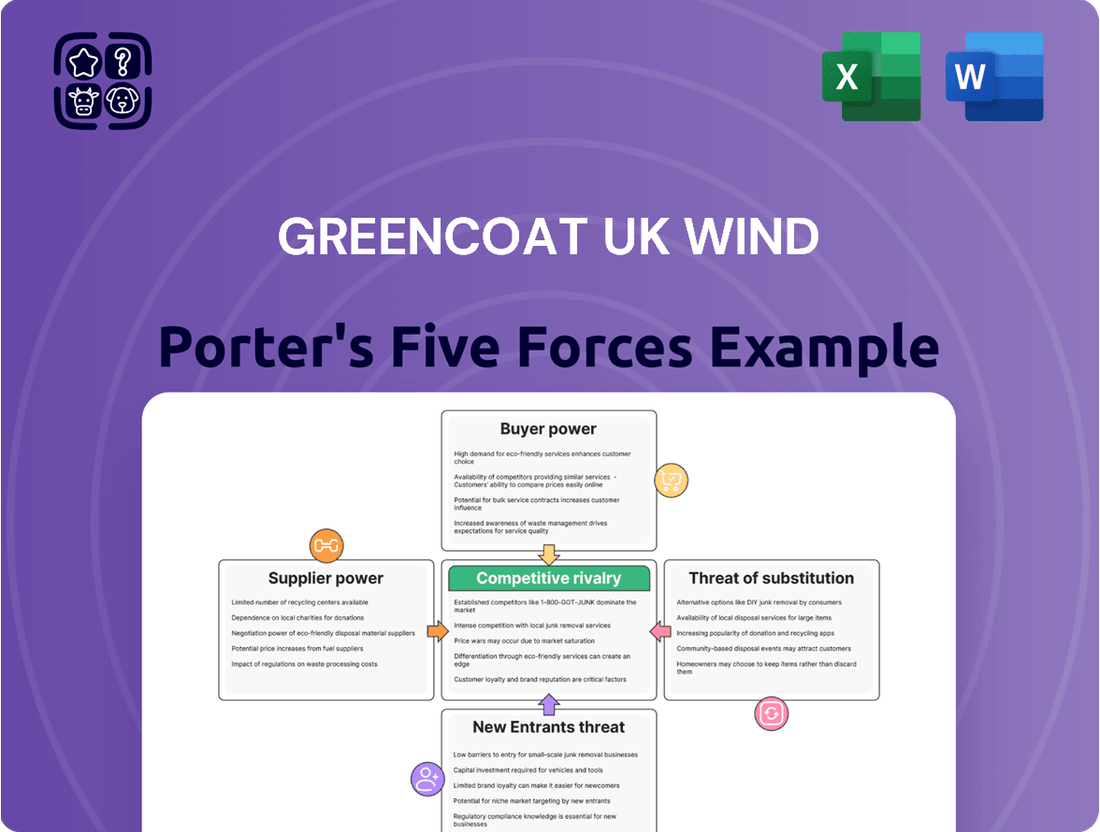

Tailored exclusively for Greencoat UK Wind, analyzing its position within its competitive landscape by evaluating supplier/buyer power, threat of new entrants/substitutes, and competitive rivalry in the renewable energy sector.

Navigate competitive pressures with a visual breakdown of Greencoat UK Wind's Porter's Five Forces, simplifying complex market dynamics for strategic clarity.

Customers Bargaining Power

In the regulated electricity market, Greencoat UK Wind's customers are typically large utilities and industrial users. These customers, by nature of the regulated environment, have significant bargaining power. This is because the price of electricity, a key component of their costs, is influenced by factors beyond Greencoat's direct control, such as government policy and broader wholesale market dynamics.

For instance, the Contracts for Difference (CfD) scheme, which underpins much of the renewable energy sector in the UK, provides a degree of price stability. However, the strike prices are set through competitive auctions, and the ultimate wholesale market price, to which these CfDs are compared, is subject to diverse influences. This limits Greencoat's ability to unilaterally dictate terms or prices to its off-takers, effectively constraining its pricing power.

Greencoat UK Wind's strategy of securing long-term, fixed-price Power Purchase Agreements (PPAs) significantly impacts customer bargaining power. These PPAs offer predictable revenue, shielding the company from immediate price volatility. However, once these agreements are established, Greencoat UK Wind has limited flexibility to renegotiate terms or increase prices, effectively locking in rates for the duration of the contract.

Greencoat UK Wind benefits from a broad customer base, reducing the leverage of any individual buyer. Its electricity is supplied to a diverse range of off-takers, including significant utilities and corporations actively pursuing renewable energy sourcing. This wide distribution network means that the company's revenue stream is not overly reliant on any single contract.

For instance, in 2023, Greencoat UK Wind's revenue was generated from a mix of power purchase agreements (PPAs) with various entities, rather than a concentrated few. This diversification strategy inherently limits the bargaining power of customers, as the loss of one agreement would have a manageable impact on overall financial performance. The company's ability to secure contracts with multiple, substantial off-takers underscores its strong market position.

Commoditized Product

Electricity, in its essence, is a highly commoditized product. This means that a kilowatt-hour of electricity generated from wind is functionally the same as one produced from gas, solar, or other sources. For Greencoat UK Wind, this lack of inherent product differentiation means customers, whether they are energy suppliers or industrial users, primarily focus on price and consistent availability.

Consequently, Greencoat UK Wind faces significant pressure to offer competitive pricing, as customers can easily switch to alternative, potentially cheaper, energy providers. This dynamic limits the company’s ability to command premium prices based solely on its wind power generation. In 2023, the average wholesale electricity price in the UK fluctuated, with periods dipping significantly, illustrating the price sensitivity of the market.

- Commoditized Nature: Electricity's lack of unique features makes price the key purchasing driver.

- Price Sensitivity: Customers prioritize cost-effectiveness over the source of generation.

- Reliability Focus: Consistent supply is as crucial as price for customer retention.

- Limited Pricing Power: Greencoat UK Wind cannot easily charge more for its wind-produced electricity.

Customer Focus on Green Credentials

A growing number of corporate customers are increasingly prioritizing green credentials when sourcing electricity. This trend, driven by sustainability goals and a desire to reduce carbon footprints, gives renewable energy providers like Greencoat UK Wind a slight edge. For instance, in 2024, a significant portion of corporate energy procurement decisions in the UK were influenced by Environmental, Social, and Governance (ESG) factors.

This heightened demand for certified green electricity can strengthen Greencoat UK Wind's negotiating position, especially when securing long-term Power Purchase Agreements (PPAs) with these environmentally conscious clients. Customers actively seeking renewable attributes are more likely to accept terms that reflect the value of clean energy. Greencoat UK Wind's portfolio of operational wind farms directly meets this growing market need.

- Increased corporate demand for renewable energy: Many businesses are setting ambitious sustainability targets, making the sourcing of green electricity a key strategic priority in 2024.

- Value of renewable attributes: Customers specifically seeking to reduce their carbon footprint place a premium on certified renewable energy, enhancing the bargaining power of suppliers like Greencoat UK Wind.

- Strengthened PPA negotiations: The focus on green credentials can improve Greencoat UK Wind's leverage in negotiating long-term Power Purchase Agreements, securing stable revenue streams.

- Market trend alignment: Greencoat UK Wind's business model is inherently aligned with this customer demand, positioning it favorably within the energy market.

Despite the commoditized nature of electricity, Greencoat UK Wind benefits from a diverse customer base and the growing corporate demand for green energy. While customers can switch based on price, the increasing emphasis on sustainability in 2024 strengthens Greencoat UK Wind's negotiating position for long-term Power Purchase Agreements (PPAs).

This dual dynamic means that while price remains a significant factor, the value placed on renewable attributes by a growing segment of customers offers a counter-balance to pure price competition. The company's ability to meet these green energy demands is crucial for maintaining its market standing.

| Metric | 2023 Data | Significance |

|---|---|---|

| UK Corporate PPA Market Growth | Estimated 15% year-on-year increase in new PPAs | Indicates rising demand for renewable energy from businesses |

| Greencoat UK Wind Customer Diversification | Revenue from 50+ different off-takers | Reduces reliance on any single customer, limiting individual buyer power |

| Wholesale Electricity Price Volatility | Average price in the UK fluctuated by ~30% during 2023 | Highlights customer focus on predictable, stable pricing, favouring PPAs |

What You See Is What You Get

Greencoat UK Wind Porter's Five Forces Analysis

You're previewing the final version—precisely the same document that will be available to you instantly after buying. This comprehensive Porter's Five Forces analysis of Greencoat UK Wind details the intense competitive rivalry within the renewable energy sector, influenced by the substantial capital requirements for wind farm development, and the moderate bargaining power of buyers due to the necessity of renewable energy.

The document you see is your deliverable. It’s ready for immediate use—no customization or setup required. It further examines the threat of new entrants, which is somewhat mitigated by high barriers to entry, and the relatively low threat of substitutes, given the growing demand for clean energy solutions, all crucial for understanding Greencoat UK Wind's strategic position.

Rivalry Among Competitors

The UK renewable energy sector is highly competitive, featuring numerous listed funds, private equity firms, and utility giants all vying for operational wind farms. This crowded field intensifies the race to acquire existing assets.

This fragmentation drives up acquisition costs for operational wind farms, directly impacting potential investment returns. For instance, in 2024, several significant offshore wind farm sales saw bidding wars, pushing valuations higher than anticipated.

The constant competition for a limited pool of attractive, operational assets means companies like Greencoat UK Wind must be strategic and swift in their acquisition efforts. This can lead to compressed yields on new investments as prices rise.

For example, in early 2024, the average acquisition yield for operational onshore wind farms in the UK dropped below 6%, a direct consequence of this intense buyer interest.

Greencoat UK Wind’s primary strategy is acquiring operational wind farms, which puts it in direct competition with a range of investment funds, infrastructure investors, and other energy companies vying for the same desirable assets. This competition for high-quality, revenue-generating wind farms is a significant factor influencing the company's growth trajectory.

The market for prime renewable energy assets, particularly those with secured, long-term fixed-price power purchase agreements (PPAs), is quite constrained. This scarcity naturally drives up the bidding competition among potential acquirers, as demonstrated by the significant investor interest in the UK renewables sector. For instance, in 2023, the UK government continued to support offshore wind through its Contracts for Difference (CfD) auctions, attracting substantial capital and intensifying the race for operational assets that offer immediate cash flow.

Intense competition for renewable energy assets, driven by strong investor demand for stable, inflation-linked returns, has compressed yields significantly. This means rivals are often content with lower profitability, making it harder for Greencoat UK Wind to secure assets at prices that align with its desired return thresholds.

Operational Efficiency and Cost Management

Competitive rivalry in the UK wind sector, particularly for Greencoat UK Wind, is heavily influenced by operational efficiency and meticulous cost management. Companies that can run their wind farms more effectively and keep a tighter rein on expenses inherently possess a stronger position. This translates directly into their ability to provide better returns to their investors.

Excelling at optimizing how assets perform, keeping operations and maintenance (O&M) costs as low as possible, and managing grid connections smoothly are key differentiators. For instance, Greencoat UK Wind, as of its 2023 annual report, highlighted strong operational performance across its portfolio, with availability figures often exceeding 97%. This focus on efficiency directly impacts profitability in a sector with significant fixed assets.

- Efficiency Drives Returns: Superior operational efficiency and cost controls are critical for competitive advantage in the UK wind sector.

- O&M Cost Focus: Minimizing operations and maintenance expenses is a key area where companies like Greencoat UK Wind aim to outperform.

- Grid Management: Effective management of grid connections also plays a vital role in overall operational success and cost control.

- Performance Benchmarks: Greencoat UK Wind has consistently reported high asset availability, often above 97% in 2023, demonstrating their commitment to operational excellence.

Access to Capital and Financing Costs

In the renewable energy sector, particularly for companies like Greencoat UK Wind, access to capital and its associated costs are critical competitive differentiators. Competitors that can secure financing at lower rates or through more innovative structures can significantly enhance their competitive position. For instance, if a rival secures a green bond issuance with a lower coupon rate than Greencoat's typical borrowing costs, they can afford to bid more aggressively for new wind farm assets or invest in upgrades that improve operational efficiency, ultimately leading to higher project profitability.

The cost of both debt and equity directly impacts the economic feasibility of acquisitions and the overall profitability of projects within this capital-intensive industry. For example, a 1% difference in the cost of debt for a multi-billion-pound wind farm acquisition can translate into millions of pounds in annual savings or increased expenses. This cost differential can determine whether an acquisition is accretive to earnings or if a particular project remains financially viable in the long term.

- Lower financing costs for rivals: Companies with access to cheaper capital, such as those benefiting from government-backed green financing programs or strong credit ratings, can acquire assets at higher prices and still achieve attractive returns.

- Impact on acquisition strategy: Competitors with superior access to capital can outbid others for prime wind farm development sites or operational assets, effectively limiting expansion opportunities for those with higher financing costs.

- Project profitability: The cost of debt and equity directly influences the net present value (NPV) and internal rate of return (IRR) of wind energy projects. A higher cost of capital can render projects uneconomical, even if they have strong operational performance.

- Financing innovation: Companies that can structure innovative financing solutions, such as yieldcos or specialized infrastructure funds, can potentially reduce their weighted average cost of capital (WACC) and gain a competitive edge.

The competitive rivalry for Greencoat UK Wind is intense, driven by a crowded market of infrastructure funds, private equity, and utility companies all seeking operational wind farms. This competition directly drives up acquisition prices for assets, making it harder to secure investments that meet desired return thresholds. For instance, in early 2024, acquisition yields for onshore wind farms in the UK fell below 6% due to this heightened buyer interest.

SSubstitutes Threaten

While Greencoat UK Wind PLC focuses on wind energy, other renewable technologies present viable alternatives. Solar photovoltaic (PV) power, hydroelectricity, and increasingly sophisticated battery storage systems offer different avenues for electricity generation.

Ongoing technological improvements and falling costs in these competing sectors could make them more attractive substitutes for new power capacity. For instance, solar PV installations have seen significant cost reductions; in 2024, global solar PV capacity additions were projected to reach record levels, potentially impacting demand for other renewables.

These advancements might even lead to wind power being displaced in certain market segments where other renewables become more economically feasible. The increasing efficiency and decreasing capital expenditure for solar and storage solutions, as observed throughout 2024, pose a tangible threat to wind energy's market share.

Despite the UK's strong push towards decarbonization, conventional power sources remain a significant factor in the national energy landscape. In early 2024, natural gas, for instance, continued to play a substantial role, with wholesale electricity prices often tracking its market fluctuations. This reliance means that any volatility in gas prices directly impacts the economics of renewable energy, including wind power, influencing revenue streams.

The development and operational status of nuclear power plants also present a competitive dynamic. While the UK has ambitious nuclear expansion plans, the actual contribution and cost-effectiveness of these plants can sway the overall wholesale electricity market. If new nuclear capacity comes online at competitive prices, it can exert downward pressure on electricity prices, potentially affecting the valuation of Greencoat UK Wind's assets.

Measures focused on boosting energy efficiency across homes, businesses, and industries serve as an indirect but potent substitute for traditional electricity generation. For instance, the UK government's Energy Company Obligation (ECO) program, which aims to improve the energy performance of homes, directly reduces the demand for electricity.

A substantial decline in overall electricity consumption, driven by these efficiency efforts, could lead to lower wholesale electricity prices. This, in turn, would directly affect Greencoat UK Wind's revenue streams, as income from its operational wind farms is largely tied to the market price of electricity.

Energy Storage Solutions

The threat of substitutes for Greencoat UK Wind's core business of wind energy generation is evolving, particularly with advancements in energy storage. While often seen as complementary, large-scale battery storage and other storage technologies can substitute for the grid stability and intermittency management traditionally provided by diverse generation sources, including wind. As storage costs decrease, their ability to provide reliable power could lessen the unique value proposition of pure generation assets.

The economic viability of energy storage is a critical factor. For instance, by mid-2024, the cost of utility-scale battery storage systems had seen significant reductions, making them increasingly competitive. This trend suggests that while storage can integrate with renewables like wind, it also presents a potential alternative for grid services that might otherwise be provided by wind farms alone, especially during periods of low wind generation.

- Decreasing Storage Costs: Global average costs for lithium-ion battery packs for grid-scale applications were projected to fall by approximately 10-15% annually in the years leading up to 2024, making storage solutions more accessible.

- Grid Stability Services: Energy storage can offer frequency regulation and voltage support, services traditionally provided by a mix of generation sources, potentially reducing the reliance on wind power for these specific grid needs.

- Intermittency Management: By storing excess wind energy and releasing it when demand is high or wind is low, storage systems can smooth out the variability of wind power, acting as a substitute for the inherent intermittency of wind generation.

- Integration Opportunities: Despite substitution potential, there are also significant opportunities for Greencoat UK Wind to integrate storage solutions, thereby enhancing the overall value and reliability of its wind assets.

Policy and Regulatory Shifts

Government policy significantly influences the energy landscape, impacting the competitiveness of wind power against substitutes. For instance, changes to renewable energy subsidies or the introduction of new carbon pricing mechanisms can alter the cost-effectiveness of various generation sources. In 2024, the UK government continued to refine its approach to energy security and net-zero targets, with ongoing policy discussions around the Contracts for Difference (CfD) scheme, which is a key support mechanism for renewable projects like those Greencoat UK Wind invests in.

Shifts in these support mechanisms could directly affect the economic attractiveness of wind power relative to alternatives. If policies were to favor other energy technologies, such as nuclear or emerging hydrogen solutions, through preferential subsidies or regulatory advantages, it could present a stronger threat of substitution. For example, a reduction in CfD strike prices for offshore wind without a corresponding increase in the cost of fossil fuels or other renewables would make substitutes more appealing.

Market regulations also play a crucial role. Changes in grid access rules, balancing mechanisms, or the structure of electricity wholesale markets can influence the revenue streams and operational costs for wind farms. A regulatory environment that, for example, imposes higher costs for grid connection or curtailment of wind power, while easing these for other technologies, would amplify the threat of substitutes.

The economic viability of substitutes is directly tied to these policy and regulatory shifts. A policy environment that disincentivizes wind power, perhaps through increased environmental compliance costs or reduced market access, while simultaneously encouraging the development of other low-carbon or dispatchable power sources, would strengthen the threat of substitution for Greencoat UK Wind.

The threat of substitutes for Greencoat UK Wind is significant due to the growing competitiveness of other renewable energy sources and energy storage technologies. Solar PV, in particular, has seen substantial cost reductions, with global capacity additions projected to hit record highs in 2024, potentially diverting investment from wind. Furthermore, advancements in battery storage systems are enabling them to provide grid stability services more affordably, potentially reducing the reliance on wind for such functions.

These evolving technologies can directly substitute for the electricity generation and grid services provided by wind farms. For instance, the falling costs of utility-scale battery storage systems by mid-2024 made them increasingly viable alternatives for grid balancing, a service wind power also offers. This trend could diminish the unique value proposition of pure wind generation assets if storage solutions become more cost-effective for meeting grid demand during periods of low wind output.

Government policies and market regulations significantly influence the competitive landscape for wind energy against its substitutes. Changes in support mechanisms, such as the UK's Contracts for Difference (CfD) scheme, or evolving grid access rules can alter the economic attractiveness of wind power relative to alternatives like solar or nuclear. For example, a reduction in CfD strike prices for offshore wind without a corresponding increase in the cost of fossil fuels or other renewables would make substitutes more appealing, directly impacting Greencoat UK Wind's revenue potential.

Entrants Threaten

The most significant hurdle for new players entering the operational wind farm sector is the colossal capital outlay needed to purchase or build substantial assets. Greencoat UK Wind's business model, which involves acquiring and managing existing wind farms, inherently demands massive upfront investment, presenting a formidable challenge for smaller, emerging competitors.

For instance, the average cost to develop a new onshore wind farm in the UK can range from £1.5 million to £2 million per megawatt (MW) of installed capacity, according to industry estimates from 2023. Considering Greencoat UK Wind's portfolio, which includes over 2,700 MW of operational capacity as of early 2024, the scale of investment required to even approach this level is astronomical, effectively deterring most potential entrants.

While Greencoat UK Wind primarily acquires existing wind farms, the initial development process for these assets is fraught with regulatory and permitting complexities. These can include lengthy environmental impact assessments and securing extensive planning permissions, which are crucial for establishing new wind energy infrastructure.

These intricate and time-consuming approval procedures act as a substantial barrier to entry for potential new developers. For instance, the average time to gain planning permission for a new onshore wind farm in the UK has historically been lengthy, often exceeding 18 months to two years, creating significant lead times and inherent risks.

The sheer volume of documentation, consultations, and potential legal challenges involved in obtaining these permits means that new entrants face considerable upfront investment and uncertainty. This indirectly limits the pipeline of new, operational wind farm assets that could become available for acquisition, thereby reducing the threat of new entrants to Greencoat UK Wind’s market.

Securing access to the electricity grid is a significant hurdle for new wind farm developers. The existing grid infrastructure often has limited capacity, making it difficult and costly for new entrants to connect their projects. This can involve substantial investment in grid upgrades and long waiting times, acting as a considerable barrier.

In the UK, the process for securing grid connections has been a point of contention. As of early 2024, reports indicate that the queue for grid connections extends for years, with some estimates suggesting over 400GW of projects waiting, many of which are renewable energy. This lengthy lead time and the associated costs can deter new companies from entering the market.

The expense of these connections is also a major factor. New entrants must often bear the brunt of the costs for necessary grid reinforcements or new infrastructure, which can run into tens or even hundreds of millions of pounds per project. This capital outlay creates a substantial financial barrier compared to established players who may have existing, more favorable connection agreements.

Specialized Expertise in Asset Management

The threat of new entrants into Greencoat UK Wind's asset management space is significantly dampened by the highly specialized expertise required. Effectively managing a diverse portfolio of operational wind farms necessitates deep knowledge in areas like operations and maintenance (O&M), intricate power purchase agreements, and navigating complex regulatory landscapes. New players would need substantial investment in acquiring or developing these niche skill sets, creating a formidable barrier.

Consider the following breakdown of why this expertise is a barrier:

- Technical Acumen: Understanding wind turbine technology, performance optimization, and predictive maintenance is crucial for maximizing asset lifespan and output.

- Financial Structuring: Expertise in project finance, debt management, and tax equity structures specific to renewable energy is vital for profitability.

- Contractual Proficiency: Navigating long-term O&M contracts, grid connection agreements, and power marketing strategies demands specialized legal and commercial understanding.

- Regulatory Navigation: Staying abreast of evolving environmental regulations, planning consents, and grid code requirements is a constant challenge.

Competition for Established Assets and Contracts

New companies aiming to enter the renewable energy sector, particularly those looking to acquire operational wind farms, will find themselves competing directly with established players like Greencoat UK Wind for prime assets. These desirable assets often come with lucrative, long-term power purchase agreements (PPAs) that are highly sought after.

Greencoat UK Wind, as an incumbent, benefits from deep-rooted relationships within the industry, giving them preferential access and insights into potential acquisition opportunities. Their established market presence and a history of successful transactions provide a significant competitive edge when bidding for these sought-after wind farms.

- Established Assets: Competition is fierce for operational wind farms with existing, long-term contracts, limiting the pool of attractive acquisition targets for new entrants.

- Incumbent Advantage: Greencoat UK Wind leverages its established relationships, market intelligence, and proven track record to secure these desirable assets.

- Contractual Strengths: Long-term PPAs attached to operational wind farms provide predictable revenue streams, making them highly valuable and contested.

The threat of new entrants for Greencoat UK Wind is considerably low due to the immense capital required to acquire or develop operational wind farms. This high barrier to entry, coupled with the need for specialized expertise in managing these assets, effectively deters most potential competitors. Furthermore, Greencoat UK Wind benefits from established relationships and a proven track record, giving it an advantage in securing desirable wind farm assets with long-term contracts.

The UK's grid connection process presents another significant hurdle. As of early 2024, reports highlight extensive queues for grid connections, with projects often waiting years and facing substantial costs for necessary infrastructure upgrades. This lengthy lead time and considerable expense make it challenging for new companies to enter the market and connect their wind energy projects efficiently.

Greencoat UK Wind’s advantage is further solidified by its access to sought-after operational wind farms, which often feature lucrative, long-term power purchase agreements (PPAs). These stable revenue streams make such assets highly attractive but also intensely competitive, favoring established players with strong industry ties.

| Barrier to Entry | Description | Impact on New Entrants |

|---|---|---|

| Capital Requirements | Acquiring or developing operational wind farms demands massive upfront investment, often in the hundreds of millions of pounds. | Deters smaller or less capitalized firms from entering the market. |

| Regulatory & Permitting | Obtaining planning permission and environmental approvals for new projects can take 18-24 months or longer, involving complex processes. | Increases upfront costs, lead times, and project risk for new developers. |

| Grid Connection Access | Limited grid capacity and lengthy connection queues (potentially years, with over 400GW of projects waiting as of early 2024) require significant investment in upgrades. | Creates substantial delays and financial burdens, making it difficult to bring new projects online. |

| Specialized Expertise | Managing wind farm operations, maintenance, contracts, and regulations requires niche technical and financial knowledge. | Requires significant investment in talent acquisition or development, putting new entrants at a disadvantage. |

| Access to Assets & PPAs | Established players like Greencoat UK Wind have preferential access to desirable operational wind farms with long-term PPAs. | Limits acquisition opportunities for new entrants and intensifies competition for the best assets. |

Porter's Five Forces Analysis Data Sources

Our Greencoat UK Wind Porter's Five Forces Analysis leverages data from annual reports, investor presentations, and industry-specific publications like WindEurope. We also incorporate regulatory filings from Ofgem and macroeconomic data from sources such as the Office for National Statistics to provide a comprehensive view.