Greencoat UK Wind Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Greencoat UK Wind Bundle

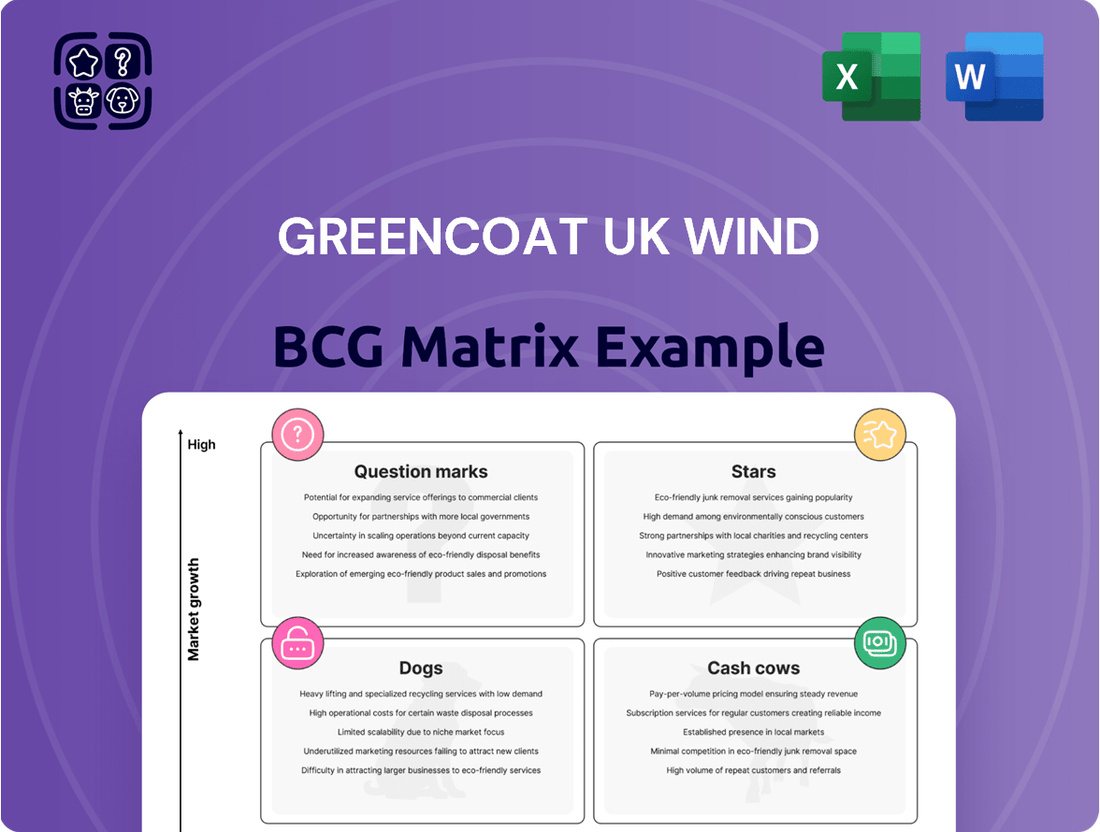

Curious about Greencoat UK Wind's strategic positioning? This glimpse into their BCG Matrix highlights key areas, but to truly understand their market dominance and growth potential, you need the full picture.

Discover which of their wind farms are leading the pack as Stars, which are generating consistent revenue as Cash Cows, and where potential challenges or exciting opportunities lie as Dogs and Question Marks.

This preview is just the beginning. Get the full BCG Matrix report to uncover detailed quadrant placements, data-backed recommendations, and a roadmap to smart investment and product decisions.

The complete BCG Matrix reveals exactly how Greencoat UK Wind is positioned in a fast-evolving market. With quadrant-by-quadrant insights and strategic takeaways, this report is your shortcut to competitive clarity.

Purchase now and get instant access to a beautifully designed BCG Matrix that’s both easy to understand and powerful in its insights—delivered in Word and Excel formats.

Stars

Greencoat UK Wind's strategic acquisition of an additional 15.6% stake in the Kype Muir Extension wind farm is a prime example of investing in a star asset. This move, effectively increasing their ownership in a high-growth area, underscores their commitment to expanding their footprint in the expanding UK wind energy market. Such accretive acquisitions are vital for Greencoat to bolster its revenue streams and maintain its competitive edge.

New offshore wind farm developments, particularly those in the UK, present a compelling "Star" opportunity for Greencoat UK Wind. The UK government's commitment to expanding offshore wind capacity, aiming for 41.5GW by 2030, highlights a robust and expanding market.

While Greencoat's core strategy is operational assets, strategic early-stage investments or partnerships in these burgeoning offshore projects would position the company to capitalize on future growth. This proactive approach could secure significant stakes in high-potential assets before they reach full operational maturity, offering substantial long-term capital appreciation.

Greencoat UK Wind might consider expanding into emerging renewable technologies to diversify its portfolio. This could involve investing in advanced battery storage solutions, often co-located with existing wind farms to enhance grid stability and capture value from intermittent generation.

Venturing into nascent areas like green hydrogen infrastructure presents another avenue for growth. The UK renewable energy sector, encompassing solar and green hydrogen, is anticipated to experience substantial expansion.

For instance, the UK government has set ambitious targets for green hydrogen production, aiming for 5GW of capacity by 2030. Early, strategic investments in these rapidly scaling, high-growth technologies could position Greencoat UK Wind as a future market leader.

This diversification aligns with the broader trend of integrated renewable energy systems, where multiple technologies work in synergy. Such moves would represent a strategic shift from a predominantly wind-focused strategy to a more comprehensive renewable energy investment approach.

Leveraging Enhanced Grid Connectivity Projects

Investments in wind farms with enhanced grid connectivity are positioned as stars within Greencoat UK Wind's BCG Matrix. These projects benefit from the resolution of historical grid capacity constraints that have slowed renewable energy development across the UK.

Assets with secured or preferential access to upgraded grid infrastructure are experiencing high demand and represent a significant growth area. This improved connectivity translates directly to better operational efficiency and broader market access for the wind farms.

- Enhanced Grid Connectivity: Projects with direct access to new or upgraded grid infrastructure.

- Reduced Curtailment Risk: Assets benefiting from increased capacity are less likely to face output reductions due to grid limitations.

- Improved Market Access: Better connectivity facilitates more reliable and profitable sales of generated electricity.

- Strong Growth Potential: These projects align with the UK's increasing need for grid modernization to support renewable expansion.

High-Performance, Newly Operational Wind Farms

Newly commissioned wind farms within Greencoat UK Wind's portfolio are demonstrating stellar performance, often surpassing initial generation forecasts. These high-performing assets are situated in the burgeoning UK wind energy market, a sector poised for significant growth. As of early 2024, the UK's offshore wind capacity alone was approaching 14 GW, with ambitious targets to reach 50 GW by 2030.

These operational assets are rapidly establishing a dominant internal market share within Greencoat's own portfolio. They are generating substantial cash flow, significantly outstripping their initial investment costs, especially when buoyed by robust power prices. For instance, in 2023, average wholesale electricity prices in the UK remained elevated compared to pre-2021 levels, providing a favorable revenue environment.

- Exceptional Generation: Farms exceeding predicted output.

- Favorable Market Conditions: Benefiting from strong UK wind energy market growth and elevated power prices.

- Strong Cash Flow Generation: High revenue relative to asset cost.

- Dominant Portfolio Position: Becoming key cash generators within Greencoat's overall holdings.

Newly commissioned wind farms within Greencoat UK Wind's portfolio are demonstrating stellar performance, often surpassing initial generation forecasts. These high-performing assets are situated in the burgeoning UK wind energy market, a sector poised for significant growth. As of early 2024, the UK's offshore wind capacity alone was approaching 14 GW, with ambitious targets to reach 50 GW by 2030.

These operational assets are rapidly establishing a dominant internal market share within Greencoat's own portfolio. They are generating substantial cash flow, significantly outstripping their initial investment costs, especially when buoyed by robust power prices. For instance, in 2023, average wholesale electricity prices in the UK remained elevated compared to pre-2021 levels, providing a favorable revenue environment.

Stars represent Greencoat UK Wind's most successful and rapidly growing assets, characterized by high market share and strong revenue generation. Their continued investment in operational wind farms, especially those with enhanced grid connectivity, solidifies their position in this category. The company's focus on existing, high-performing assets ensures consistent returns and growth within the expanding UK renewable energy sector.

| Asset Type | Market Growth | Greencoat's Share | Performance Indicator | Example |

|---|---|---|---|---|

| Operational Wind Farms | High (UK Wind Energy) | Dominant | Exceeding Generation Forecasts | Kype Muir Extension Stake |

| Offshore Wind Developments | Very High (Target 50 GW by 2030) | Growing (Strategic Investments) | Future Capital Appreciation | New offshore projects |

| Enhanced Grid Connectivity | High (Grid Modernization) | Secured/Preferential | Reduced Curtailment, Improved Access | Wind farms with upgraded infrastructure |

What is included in the product

This BCG Matrix analysis of Greencoat UK Wind categorizes its wind farms based on market growth and relative market share, guiding investment decisions.

The Greencoat UK Wind BCG Matrix provides a clear visual of asset performance, alleviating the pain of strategic uncertainty.

Cash Cows

Greencoat UK Wind's existing portfolio of 49 operational wind farms forms the bedrock of its operations, acting as a classic Cash Cow in the BCG matrix. These established assets are situated in a mature, yet robust, UK wind energy market, securing a significant market share for the company. The consistent and predictable revenue streams generated by these farms are the primary engine for Greencoat's strong cash flow, enabling reliable dividend distributions to shareholders. For instance, as of the first half of 2024, Greencoat reported generating 1,520 GWh of electricity from its operational portfolio, underscoring the substantial output and income-generating capacity of these wind farms.

Long-term fixed-price contracts, such as Contracts for Difference (CfDs) and Power Purchase Agreements (PPAs), are the bedrock of Greencoat UK Wind's "Cash Cows." These agreements provide remarkable revenue visibility and stability, crucial for a company operating in the renewable energy sector. For instance, as of early 2024, a significant portion of Greencoat's portfolio is secured under these long-term arrangements, shielding them from volatile wholesale electricity prices.

This de-risking of revenue streams is a key factor in maintaining high profit margins, ensuring that Greencoat can consistently meet its dividend commitments. The predictable cash flow generated from these contracts allows for robust financial planning and investor confidence. In 2023, Greencoat UK Wind reported a net profit of £339 million, a testament to the stability provided by these contractual arrangements.

Greencoat UK Wind's strategy of providing consistent, inflation-linked dividend payouts highlights its position as a Cash Cow within the BCG Matrix. This commitment to increasing annual dividends in line with RPI inflation underscores a mature, highly profitable, and stable business model, reflecting the low-growth, high-market share characteristics of its operational wind assets.

The company's consistent achievement of this objective demonstrates strong confidence in its ongoing profitability. For instance, Greencoat UK Wind has targeted a dividend of 10.35 pence per share for 2025, a clear indication of its ability to generate substantial and predictable cash flows from its established portfolio.

Diversified and Mature Asset Base

Greencoat UK Wind's diversified and mature asset base is a cornerstone of its Cash Cow status. The company manages a broad portfolio of onshore and offshore wind farms spread across numerous UK regions. This geographical and technological spread significantly reduces operational and market risks, contributing to predictable and stable energy generation.

This mature asset base is not just diverse; it's substantial. Greencoat UK Wind holds a significant share of the UK's total wind power capacity. As of the first half of 2024, the company had a portfolio of 45 operational wind farms with a total generating capacity of 1,167 MW, demonstrating its leadership and established presence in the market.

- Portfolio Diversification: Spans multiple UK regions and includes both onshore and offshore wind assets.

- Risk Mitigation: Diversification leads to more stable and predictable cash flows by reducing reliance on any single region or technology.

- Mature Asset Base: Represents a considerable portion of the UK's wind energy infrastructure, ensuring consistent generation.

- Leading Market Position: Greencoat's established footprint solidifies its status as a leader in the UK wind sector.

Strategic Reinvestment of Excess Cash Flow

For Greencoat UK Wind's Cash Cows, a key strategy is reinvesting excess cash flow to maintain capital value in real terms, not to chase rapid expansion. This focus is on keeping existing assets, which hold a significant market share, productive and efficient. The goal is to ensure these assets continue to deliver robust returns consistently.

- Preserving Capital Value: The strategy prioritizes safeguarding the purchasing power of generated cash, ensuring that the real value of the company's assets is maintained over time.

- Focus on Efficiency: Reinvestment efforts are directed towards optimizing the operational performance of established, high-market share wind farms.

- Stable Returns: This approach aims to guarantee a steady and predictable stream of income from these mature assets.

- Strategic Allocation: Funds are channeled into maintenance, upgrades, and efficiency improvements that support long-term cash generation.

Greencoat UK Wind's operational wind farms are its primary Cash Cows, generating stable, predictable revenue. These assets, representing a significant portion of the UK's wind capacity, are secured by long-term contracts like CfDs and PPAs, insulating them from market volatility. The company's strategy focuses on maintaining these established assets through reinvestment, ensuring consistent cash flow and supporting its commitment to increasing dividends.

| Metric | Value (H1 2024) | Significance |

|---|---|---|

| Operational Wind Farms | 49 | Core revenue-generating assets |

| Electricity Generated | 1,520 GWh | Demonstrates substantial income capacity |

| Total Generating Capacity | 1,167 MW | Highlights market leadership |

Preview = Final Product

Greencoat UK Wind BCG Matrix

The Greencoat UK Wind BCG Matrix preview you are currently viewing is the precise, fully formatted report you will receive upon purchase. This means no watermarks, no sample data, and no incomplete sections – just the comprehensive strategic analysis ready for your immediate business planning. You can trust that the insights and structure presented here are exactly what you'll be able to download and utilize without any further modifications or hidden content. This document is designed for professional application, offering clear strategic direction for Greencoat UK Wind's portfolio.

Dogs

Older wind farms in Greencoat UK Wind's portfolio that are underperforming due to age or diminishing wind speeds are potential Dogs. These assets also face challenges with expiring fixed-price contracts, limiting their future revenue certainty. For instance, a farm commissioned in the early 2010s might see its power purchase agreement (PPA) expire in 2027, potentially exposing it to volatile market prices.

These assets typically operate in a mature market with low growth prospects. Their contribution to overall cash flow might be minimal, especially when factoring in increased maintenance costs associated with aging infrastructure. For example, if an older asset's operational expenditure (OpEx) has risen by 15% over the last five years due to these factors, its net contribution shrinks.

Such underperforming assets could be candidates for divestiture to free up capital for more promising investments. Alternatively, they might require significant capital expenditure for repowering or upgrades to remain competitive and viable in the long term. Consider a scenario where a turbine upgrade costs £5 million per megawatt, a substantial investment for a low-yield asset.

Greencoat UK Wind has strategically divested certain assets, such as its partial interests in Douglas West and Dalquhandy wind farms. These disposals, even if conducted at Net Asset Value (NAV), signal a deliberate move away from assets that no longer fit the company's desired return profile or core strategic objectives.

This action of divesting non-core or low-return assets is a classic tactic for optimizing capital allocation. By shedding these underperforming or strategically misaligned holdings, Greencoat UK Wind can free up financial resources. These freed-up funds can then be reinvested into areas with higher growth potential or better alignment with the company's long-term vision, thereby enhancing overall portfolio performance.

Wind farms encountering recurring technical faults, like the export cable issue at Hornsea 1 in 2024, can become cash cows if these problems lead to prolonged underperformance and elevated maintenance expenses without a clear fix. These persistent issues, even if temporary, can substantially erode profitability and diminish market share across Greencoat UK Wind's operational portfolio.

Small, Isolated Assets with Limited Scalability

Small, isolated wind farm assets within Greencoat UK Wind's portfolio can be categorized as potential 'Dogs' in the BCG Matrix. These might be individual sites with a very small generating capacity, perhaps only a few turbines, or farms located in remote areas that make expansion or integration with larger projects difficult. Their limited scalability means they struggle to benefit from the economies of scale that larger, more consolidated wind farms enjoy.

These assets typically hold a negligible market share in the vast UK wind sector and exhibit minimal growth prospects. The management effort required to maintain and operate these small, isolated units can often outweigh the financial returns they generate. For instance, a single small farm might require dedicated site management, maintenance crews, and administrative oversight, all without the significant revenue streams or cost efficiencies seen in larger operations.

- Limited Capacity: Individual assets might generate less than 50 MW, a fraction of the 300-400 MW typical for larger, more efficient wind farms.

- Geographic Isolation: Remote locations can incur higher transportation and logistics costs for maintenance and repairs.

- Low Market Share: These assets contribute minimally to Greencoat UK Wind's overall installed capacity, which stood at over 2,500 MW by the end of 2023.

- Minimal Growth Potential: Lack of available land or grid connection constraints often prevents expansion.

Assets in Highly Saturated or Stagnant Local Markets

While the UK wind sector generally shows robust growth, some localized onshore wind farm markets are experiencing saturation. This means there's limited room for new development, often due to strict planning rules or local community objections. For instance, while the overall UK offshore wind capacity is projected to reach 50 GW by 2030, specific rural areas might already have a high concentration of turbines, making further approvals difficult.

Assets in these stagnant micro-markets face challenges. If an onshore wind farm cannot expand its capacity or significantly boost its energy output, its future value and growth potential become constrained. This situation can lead to a reduction in their attractiveness as investments, particularly if they are categorized as 'Dogs' in a BCG matrix analysis, suggesting low market share and low growth prospects within that specific local context.

- Limited Expansion: Difficulty in securing permits for additional turbines or repowering older ones.

- Stagnant Output: Inability to increase electricity generation due to site constraints or technological limitations.

- Reduced Investment Appeal: Lower future value and growth prospects compared to assets in more dynamic markets.

- BCG Matrix Classification: Assets in these areas risk being classified as 'Dogs' due to their low growth and potentially low market share within their specific local market.

Older wind farms with expiring contracts and rising operational costs represent 'Dogs' in Greencoat UK Wind's portfolio. These assets, often commissioned in the early 2010s, face diminishing revenue certainty as their Power Purchase Agreements (PPAs) conclude, potentially exposing them to volatile market prices. For example, a farm with a PPA expiring in 2027 could see its predictable income stream significantly altered.

These units operate in markets with limited growth, and their net cash flow can be minimal, especially when factoring in increased maintenance for aging infrastructure. If an older asset's operational expenditure has risen by 15% over five years, its profitability shrinks considerably.

Divesting underperforming assets or investing in upgrades like turbine replacements, which can cost £5 million per megawatt, are strategic options. Greencoat UK Wind has divested interests in farms like Douglas West, signaling a move away from assets not meeting their return profile.

| Asset Characteristic | Example Scenario | BCG Matrix Classification |

| Aging Infrastructure & Expiring PPAs | Farm commissioned in 2012, PPA expires 2027 | Dog |

| Rising Operational Costs | OpEx increase of 15% over 5 years for an older asset | Dog |

| Low Market Share & Growth | Small, isolated farm with <50 MW capacity | Dog |

| Stagnant Local Markets | Onshore farm in a saturated area with planning restrictions | Dog |

Question Marks

Greencoat UK Wind might strategically allocate small, exploratory investments into emerging sectors like floating offshore wind. This aligns with a "Question Mark" position in the BCG matrix due to its nascent stage, low current market share, but substantial projected growth. For instance, the UK government aims for 5 GW of floating offshore wind capacity by 2030, a significant increase from its current limited operational capacity, highlighting the high future growth prospects.

These investments would represent a calculated risk, acknowledging the high upfront costs and technological challenges inherent in scaling floating wind solutions. However, the long-term potential for this technology to unlock deeper, windier offshore sites makes it a critical area for future development. By investing early, Greencoat could gain valuable experience and potential first-mover advantages in a rapidly evolving market.

Greencoat UK Wind is exploring pilot projects for hybrid renewable energy systems, integrating wind power with technologies like battery storage and green hydrogen production. These ventures are crucial for Greencoat's strategic positioning but represent new frontiers in a rapidly evolving market. For instance, the UK government has committed £200 million to hydrogen production, indicating strong growth potential for green hydrogen projects.

While Greencoat's market share in these integrated systems would initially be low, these pilot projects are essential for demonstrating viability and securing future market share. The capital investment required is substantial, reflecting the early-stage nature of these technologies. However, the global battery energy storage market alone was valued at approximately $15 billion in 2023 and is projected to grow significantly, offering substantial upside for early movers.

Acquiring early-stage development rights or options for future wind farm projects, especially in emerging or technically challenging locations, positions Greencoat UK Wind within the 'Question Marks' quadrant of the BCG matrix. These opportunities represent high growth potential markets, as the demand for renewable energy continues to surge, but they carry significant upfront investment and execution risk, meaning they currently have a low market share. For instance, the UK government has set ambitious targets, aiming for 50GW of offshore wind capacity by 2030, creating a fertile ground for new developments.

International Expansion Exploration (if considered)

While Greencoat UK Wind primarily operates within the United Kingdom, any early-stage exploration into rapidly growing international wind farm markets, such as those in continental Europe with ambitious renewable energy targets, would position it as a Question Mark in the BCG Matrix. This scenario reflects a low market share in a high-growth geographical sector, necessitating significant strategic investment to build a foothold.

For instance, if Greencoat were to consider opportunities in Germany, a nation aiming for 80% renewable electricity by 2030, its presence would be nascent. The German onshore wind market saw significant additions in 2023, with approximately 1.6 GW of new capacity installed, according to Statista. Entering such a market would require substantial capital for project development and operational setup, mirroring the characteristics of a Question Mark.

- Low Market Share in High-Growth Market: Greencoat's established UK presence wouldn't translate to immediate dominance in a new international market, placing it in the Question Mark quadrant.

- Strategic Investment Required: Expansion into countries like Germany or France would demand considerable financial outlay for market entry, regulatory navigation, and project acquisition or development.

- Potential for Future Growth: These markets offer substantial growth potential, driven by strong policy support for renewables, aligning with the high-growth aspect of the Question Mark category.

- Risk and Uncertainty: International expansion inherently carries higher risks due to differing regulatory environments, currency fluctuations, and competitive landscapes, typical of Question Mark ventures.

Investments in Grid Infrastructure Solutions

Investments in grid infrastructure solutions by Greencoat UK Wind, while potentially beneficial for enhancing wind farm efficiency and facilitating new projects, represent a high-growth area for the broader energy sector. However, for Greencoat specifically, this would constitute a new venture with currently low market share, demanding substantial capital outlay. The UK's ongoing grid capacity challenges mean that any such direct investment would need careful strategic consideration.

Consider the context of UK energy investment trends. In 2024, the UK government committed to investing billions in grid upgrades to support its net-zero targets. For instance, National Grid ESO has outlined plans for significant investment in transmission infrastructure. Greencoat's direct participation in these smart grid solutions or infrastructure upgrades would place it in a nascent market position within its own operational scope.

- Strategic Fit: Direct investment in grid infrastructure could align with Greencoat's long-term goals of maximizing wind asset performance and enabling future development, but it diversifies away from core wind asset ownership.

- Capital Intensity: Smart grid technologies and infrastructure upgrades are capital-intensive, requiring significant upfront investment which could impact Greencoat's dividend payout policies.

- Market Share: Entering this space would mean Greencoat starting with a very small market share in grid solutions, posing a challenge against established players.

- Regulatory Environment: Investments in grid infrastructure are heavily influenced by regulatory frameworks and government policy, which can create both opportunities and risks.

Greencoat UK Wind's exploration into new technologies like green hydrogen production or advanced battery storage solutions positions them as Question Marks. These areas offer significant future growth potential, driven by global decarbonization efforts, but currently represent nascent markets with low market share for Greencoat.

The UK's commitment to green hydrogen, with a target of 10 GW of low-carbon hydrogen production capacity by 2030, underscores the high-growth trajectory of this sector. Greencoat’s early involvement, though capital-intensive and carrying inherent technological risks, could secure future market leadership.

Similarly, the expanding energy storage market, projected to reach over $100 billion globally by 2030, presents a compelling opportunity. Greencoat's strategic investments in this domain, despite an initial low market share, are crucial for capturing future value in grid stability and renewable integration.

These ventures demand substantial upfront investment and navigating evolving regulatory landscapes, characteristic of Question Marks. However, the long-term strategic advantage of building expertise and market presence in these emerging sectors is substantial.

BCG Matrix Data Sources

Our Greencoat UK Wind BCG Matrix leverages robust data from company annual reports, financial disclosures, and independent industry analysis to accurately position its wind farms.