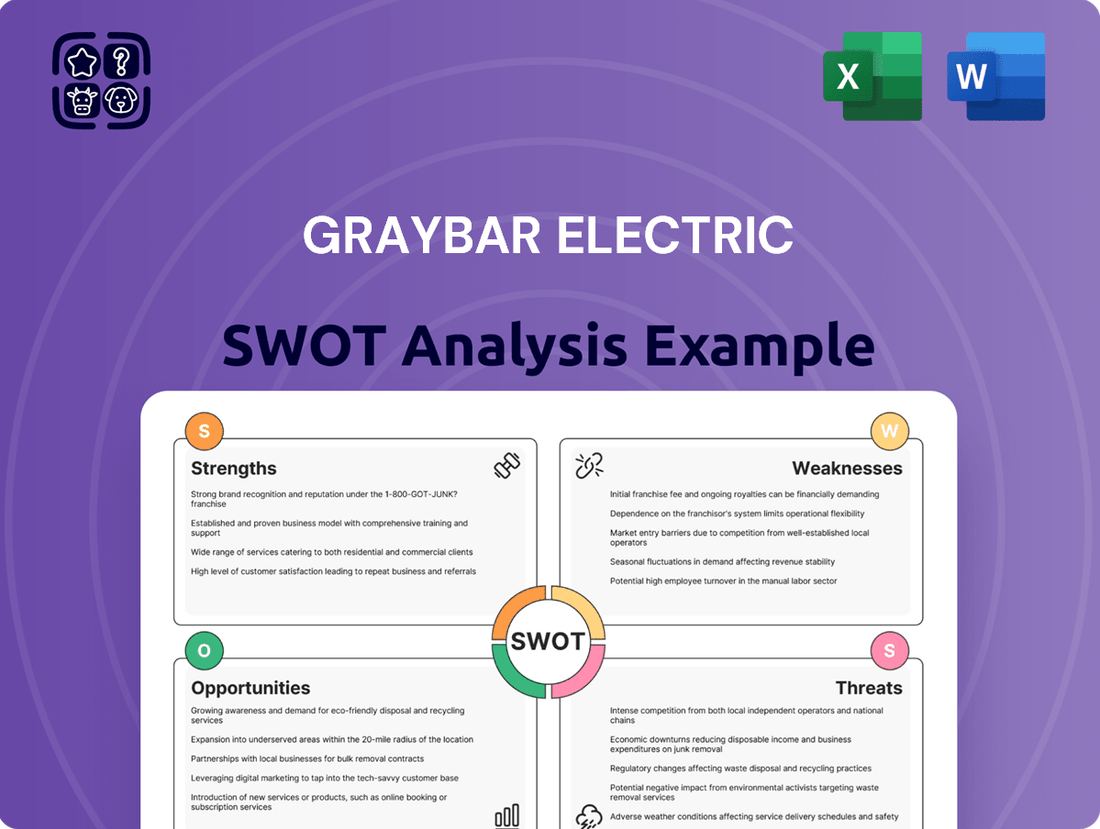

Graybar Electric SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Graybar Electric Bundle

Graybar Electric leverages its extensive distribution network and strong supplier relationships as key strengths, but faces potential threats from evolving technology and increased competition. Understand the full strategic landscape and unlock actionable insights by purchasing our comprehensive SWOT analysis.

Want the full story behind Graybar Electric's market position, including detailed opportunities and weaknesses? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support your strategic planning and investment decisions.

Strengths

Graybar Electric stands as a dominant force in North America, recognized as a premier distributor for electrical, communications, and data networking products. Their expansive infrastructure, comprising over 350 distribution centers across the continent, ensures convenient, localized access to an impressive inventory of roughly 110,000 products sourced from more than 4,600 manufacturers.

This robust market presence directly fuels their financial success. In 2024, Graybar reported record net sales of $11.6 billion, marking a significant 5.5% growth compared to the previous year, underscoring the strength of their established network and market leadership.

Graybar's 100% employee-owned structure, established in 1929, is a core strength. This model cultivates a deep sense of commitment and a long-term perspective among employees, directly linking their financial well-being to the company's success. This unique ownership structure allows Graybar to prioritize strategic investments for sustained growth, free from the short-term pressures often faced by publicly traded companies.

Graybar Electric has a strong track record of financial performance, with 12 of the last 13 years showing record net sales. In 2024, the company achieved a new high of $11.6 billion in net sales, underscoring its consistent revenue growth and market presence.

Despite a notable 8.7% decrease in net income for 2024, attributed to substantial investments in strategic transformation, the company still reported its third-highest net income historically. This financial resilience allows Graybar to navigate economic fluctuations and pursue future growth initiatives.

Strategic Investments in Technology and Acquisitions

Graybar's commitment to technological advancement is evident in its multi-year 'Graybar Connect' initiative. This project aims to modernize systems, improve data accessibility, and elevate both customer and employee digital experiences, including a significant push in digital commerce capabilities.

The company also strategically expands its reach and capabilities through acquisitions. In 2024 alone, Graybar completed key acquisitions, including Blazer Electric Supply, Dynamic Solutions, and Power Supply Company, demonstrating a clear strategy for diversified growth and market penetration.

- Graybar Connect: A multi-year business transformation focusing on technology modernization, data access, and enhanced digital customer/employee experiences.

- Strategic Acquisitions (2024): Acquired Blazer Electric Supply, Dynamic Solutions, and Power Supply Company to drive diversified growth.

- Digital Commerce Focus: Investments are geared towards improving online platforms and digital engagement.

Comprehensive Product and Service Offerings

Graybar's strength lies in its extensive product and service portfolio, extending far beyond simple product distribution. They provide integrated supply chain management and logistics solutions tailored for diverse sectors including contractors, utilities, telecommunications, and government entities.

This comprehensive approach, covering electrical, industrial, automation, and connectivity products, allows businesses to streamline inventory and procurement processes for critical infrastructure components. Graybar's ability to act as a single-source provider for essential materials solidifies its position as a valuable partner.

For instance, in 2023, Graybar reported net sales of $11.2 billion, reflecting the significant demand for their broad range of offerings. This robust performance underscores their capability to serve a wide array of customer needs effectively.

Key aspects of their comprehensive offerings include:

- Extensive Product Catalog: Access to a vast array of electrical, industrial, automation, and connectivity products from leading manufacturers.

- Supply Chain Solutions: Services designed to optimize inventory management, logistics, and procurement for clients.

- Sector-Specific Expertise: Tailored solutions for contractors, utilities, telecommunications, and government agencies.

- Value-Added Services: Support that goes beyond product delivery, including technical expertise and project management assistance.

Graybar's extensive distribution network, boasting over 350 locations, provides unparalleled market reach and accessibility for its vast product catalog. Their 100% employee-owned structure fosters deep commitment and a long-term strategic focus, differentiating them from competitors. The company's consistent financial performance, evidenced by 12 record net sales years out of the last 13, including $11.6 billion in 2024, highlights their market leadership and operational efficiency.

| Metric | 2023 | 2024 |

|---|---|---|

| Net Sales | $11.2 billion | $11.6 billion |

| Net Income | (Data not available for 2023 in provided text) | (Slight decrease due to investments, but still third-highest historically) |

What is included in the product

Delivers a strategic overview of Graybar Electric’s internal and external business factors, highlighting key strengths and opportunities alongside potential weaknesses and threats.

Offers a clear, actionable framework for identifying and mitigating Graybar's competitive challenges.

Weaknesses

Graybar's commitment to its strategic 'Graybar Connect' initiative, while promising for the future, has presented a short-term challenge. In 2024, the company experienced an 8.7% drop in net income, a direct consequence of the significant capital allocated to this business transformation. This dip in profitability underscores the immediate trade-off between investing in future growth and maintaining current earnings.

Graybar's future hinges significantly on the successful implementation of its multi-year business transformation project, Graybar Connect, slated for a core ERP system launch in 2025. This ambitious undertaking is designed to streamline operations and drive future profitability.

Any setbacks, such as project delays, budget overruns, or difficulties integrating the new system, could directly impede Graybar's operational efficiency and financial health, posing a substantial risk to its growth trajectory.

Graybar's extensive reliance on a global network of over 4,600 manufacturers and suppliers presents a significant vulnerability. Disruptions within this intricate supply chain, whether stemming from material shortages, shipping delays, or international political instability, directly threaten product availability and extend delivery times. This interdependence means Graybar could struggle to fulfill customer orders promptly, impacting its operational efficiency and market responsiveness.

Exposure to Commodity Price Fluctuations

Graybar Electric faces a significant weakness due to its exposure to commodity price fluctuations. The company purchases a wide array of products for resale, including essential items like wire and cable, conduit, enclosures, and fittings, all of which are subject to volatile market pricing.

These price swings directly impact Graybar's cost of goods sold. For instance, during periods of rising copper prices, a key component in wire and cable, Graybar's procurement costs increase. If these higher costs cannot be fully passed on to customers, it can compress the company's profit margins.

- Impact on Cost of Goods Sold: Fluctuations in raw material prices, such as copper and aluminum, directly affect the cost of products like wire and cable.

- Margin Compression: If Graybar cannot fully pass on increased commodity costs to its customers, its profit margins can be squeezed.

- Inventory Valuation: Changes in commodity prices can also affect the valuation of Graybar's inventory, potentially leading to gains or losses depending on market movements.

- Competitive Pricing Challenges: Unpredictable commodity costs can make it difficult for Graybar to maintain consistent and competitive pricing for its products.

Competition in a Fragmented Market

Graybar operates within a highly fragmented electrical and industrial distribution market, presenting a significant competitive challenge. While the company maintains a robust market presence, it contends with both large, established distributors and a multitude of smaller, regional competitors. This intense competition can exert downward pressure on pricing strategies and potentially impact market share gains.

The competitive environment is characterized by numerous players, each vying for market dominance. For instance, in 2024, the industrial distribution sector continued to see consolidation, but the presence of specialized regional distributors remained a key factor. These smaller entities often possess deep local market knowledge and agility, allowing them to compete effectively on specific product lines or customer segments.

- Intense Rivalry: Graybar faces competition from national players like WESCO International and Rexel, alongside a vast number of regional and specialized distributors.

- Price Sensitivity: The fragmented nature of the market often leads to price-based competition, impacting profit margins.

- Market Share Pressure: Smaller, agile competitors can erode market share in specific niches or geographic areas, requiring constant strategic adaptation.

Graybar's significant investment in its Graybar Connect initiative, aimed at transforming its business operations, has led to a notable decrease in profitability. In 2024, the company reported an 8.7% decline in net income, directly attributable to the substantial capital expenditure required for this multi-year project, highlighting the immediate financial strain of such ambitious upgrades.

The company's reliance on a vast global network, comprising over 4,600 manufacturers and suppliers, creates a considerable vulnerability. Any disruption within this complex supply chain, whether due to material shortages, shipping delays, or geopolitical events, directly impacts product availability and fulfillment times, potentially hindering operational efficiency and customer satisfaction.

Graybar's exposure to the volatility of commodity prices presents another key weakness. Fluctuations in the cost of essential materials like copper and aluminum, integral to products such as wire and cable, directly affect the cost of goods sold. If these increased costs cannot be fully passed on to customers, it can lead to significant compression of profit margins.

The highly fragmented nature of the electrical and industrial distribution market poses a constant competitive challenge for Graybar. The presence of numerous smaller, regional competitors, alongside larger national players, intensifies rivalry and can exert downward pressure on pricing, potentially impacting market share growth and profitability.

Full Version Awaits

Graybar Electric SWOT Analysis

You’re previewing the actual analysis document. Buy now to access the full, detailed report on Graybar Electric's Strengths, Weaknesses, Opportunities, and Threats.

This is the same SWOT analysis document included in your download. The full content, offering a comprehensive strategic overview, is unlocked after payment.

The file shown below is not a sample—it’s the real SWOT analysis you'll download post-purchase, in full detail, allowing for informed decision-making.

Opportunities

Graybar's commitment to digital transformation, evidenced by ongoing investment in Graybar Connect and the planned 2025 ERP system launch, offers a prime opportunity to bolster e-commerce. This strategic move is designed to streamline operations and elevate the customer experience.

The enhanced digital infrastructure is expected to drive significant efficiency gains and unlock advanced data analytics capabilities. This will not only optimize internal processes but also create new, impactful channels for customer interaction and engagement.

The accelerating adoption of artificial intelligence is fueling a massive expansion in data center construction and upgrades. This surge directly translates into increased demand for the electrical, communications, and data networking infrastructure that Graybar specializes in. The company's established relationships and robust supply chain position it to be a key partner in these critical projects.

Beyond AI, significant government investments in general infrastructure projects, such as grid modernization and telecommunications upgrades, present further avenues for growth. These large-scale initiatives, often requiring extensive electrical and connectivity solutions, have already bolstered Graybar's performance within the contractor market, demonstrating their capability to meet substantial project demands.

Graybar's robust balance sheet, evidenced by its consistent financial performance and ample liquidity, positions it well for opportunistic strategic acquisitions. This financial strength allows for the pursuit of targets that can enhance its existing business or open new avenues for expansion.

By acquiring companies with complementary technologies or market access, Graybar can accelerate its diversification beyond traditional electrical distribution. For instance, acquisitions in areas like data centers, smart buildings, or renewable energy infrastructure could significantly broaden its service and product portfolio, as seen in the growing demand for these specialized solutions throughout 2024 and into 2025.

Sustainability and Energy Efficiency Solutions

The growing emphasis on environmental responsibility presents a significant opportunity for Graybar to broaden its portfolio of energy-efficient products and services. By capitalizing on its established sustainability programs and technical know-how, Graybar can assist clients in lowering operational expenses and meeting their ecological targets, thereby opening up new avenues for growth.

Graybar is well-positioned to benefit from the increasing demand for smart building technologies and renewable energy integration. For instance, the global smart building market was valued at approximately $78.3 billion in 2023 and is projected to reach $240 billion by 2030, indicating substantial growth potential for companies offering related solutions.

- Expanding into smart grid technologies: Offering components and systems that enhance grid efficiency and reliability.

- Promoting LED lighting and controls: Providing solutions that significantly reduce energy consumption in commercial and industrial settings.

- Developing solutions for renewable energy infrastructure: Supplying electrical components for solar and wind power installations.

- Offering energy auditing and consulting services: Assisting customers in identifying and implementing energy-saving measures.

Leadership Development and Employee Empowerment

Investing in leadership development and employee empowerment presents a significant opportunity for Graybar. By nurturing future leaders through programs like their established leadership development initiatives and internships, Graybar can solidify its internal talent pipeline. This focus on growth ensures a continuity of skilled management and operational expertise.

The company's employee-owned structure is a powerful lever for empowerment. When employees feel invested and have a stake in the company's success, it naturally fuels innovation and boosts productivity. This sense of ownership can also cultivate a deeper, long-term commitment to Graybar's goals and values.

- Strengthened Talent Pipeline: Leadership programs and internships build a robust internal bench of future managers.

- Enhanced Innovation: Empowered employees, particularly those with ownership, are more likely to contribute novel ideas.

- Increased Productivity: A motivated and engaged workforce, driven by ownership, often achieves higher output.

- Improved Employee Retention: Investing in development and fostering empowerment can significantly reduce turnover.

Graybar's ongoing digital transformation, including investments in Graybar Connect and a planned 2025 ERP system launch, is set to enhance e-commerce capabilities and streamline operations. This focus on digital infrastructure is projected to unlock advanced data analytics, leading to improved efficiency and customer engagement.

The burgeoning demand for data center infrastructure, driven by AI advancements, presents a significant growth avenue for Graybar. Furthermore, substantial government investments in infrastructure, such as grid modernization and telecommunications upgrades, are expected to continue bolstering demand for Graybar's specialized electrical and connectivity solutions through 2025.

Graybar's financial strength allows for strategic acquisitions to expand its product and service offerings, particularly in high-growth areas like smart buildings and renewable energy. The company's commitment to sustainability also opens opportunities to provide energy-efficient solutions, aligning with client goals for reduced operational costs and environmental responsibility.

Investing in employee development and fostering an empowered workforce, especially given its employee-owned structure, is a key opportunity. This approach strengthens the talent pipeline, drives innovation, and enhances productivity, contributing to long-term organizational success.

| Opportunity Area | Key Drivers | 2024/2025 Outlook |

|---|---|---|

| Digital Transformation & E-commerce | ERP system launch (2025), Graybar Connect | Increased operational efficiency, enhanced customer experience |

| Data Center & AI Infrastructure | AI adoption, data center construction/upgrades | Growing demand for electrical and data networking solutions |

| Infrastructure Investment | Government spending on grid modernization, telecom upgrades | Continued growth in contractor market demand |

| Smart Buildings & Renewables | Global smart building market growth (projected $240B by 2030) | Expansion of energy-efficient and renewable energy product portfolios |

| Talent Development & Empowerment | Leadership programs, employee ownership | Strengthened talent pipeline, increased innovation and productivity |

Threats

The current business landscape is marked by considerable complexity and persistent market uncertainty, a significant challenge for companies like Graybar Electric. This environment can make forecasting and strategic planning exceptionally difficult.

An anticipated economic slowdown presents a direct threat, potentially dampening demand across Graybar's key sectors. Specifically, a downturn in construction, utilities, and telecommunications could translate into reduced sales volumes and, consequently, lower profitability for the company.

For instance, if the US GDP growth, projected to be around 2.3% in 2024 according to the Congressional Budget Office, were to significantly decelerate in 2025, this would directly impact infrastructure spending, affecting Graybar's order book.

The electrical distribution sector is highly competitive, with Graybar facing significant pressure from both long-standing competitors and emerging players. This fierce rivalry often translates into intense pricing pressures, which can directly impact Graybar's profit margins and necessitate greater investment in sales and marketing efforts to maintain market share.

The electrical distribution industry is experiencing swift technological advancements, and while Graybar is actively pursuing digital transformation, the sheer speed of change presents a significant challenge. If Graybar's adaptation to new technologies lags, it could fall behind competitors who are quicker to integrate innovative solutions.

Emerging technologies and novel business models from rivals pose a direct threat to Graybar's established distribution channels. For instance, the rise of direct-to-consumer online platforms or advanced supply chain automation could bypass traditional distributors, impacting market share and revenue streams.

Supply Chain Volatility and Geopolitical Risks

Global events, shifting trade policies, and ongoing geopolitical tensions are creating significant turbulence in supply chains, directly impacting product availability and pricing. For a distributor like Graybar Electric, this means potential disruptions that could raise operating expenses or even lead to customer dissatisfaction due to product shortages.

The ongoing conflict in Eastern Europe, for example, continued to affect the availability of certain electronic components and raw materials throughout 2024, with some analysts predicting lingering effects into 2025. This volatility directly translates to increased costs for businesses reliant on these supply chains.

- Supply Chain Disruptions: Geopolitical instability can halt or delay the movement of goods, impacting Graybar's ability to secure inventory.

- Increased Costs: Tariffs, shipping surcharges, and the need for alternative sourcing drive up the cost of goods sold.

- Inventory Management Challenges: Predicting demand becomes harder when lead times are unpredictable, potentially leading to stockouts or excess inventory.

Cybersecurity Risks and Data Breaches

Graybar Electric's ongoing digital transformation, which involves managing vast amounts of sensitive customer and operational data, exposes it to significant cybersecurity risks. A successful cyberattack could result in substantial financial losses due to remediation costs, potential regulatory fines, and business interruption. For instance, the average cost of a data breach in 2024 reached $4.73 million, a figure that underscores the potential financial impact.

Beyond financial implications, a data breach can severely damage Graybar's reputation and erode customer trust. This loss of confidence can lead to customer attrition and make it harder to attract new business. In 2024, companies experiencing breaches saw an average increase in customer churn of 3.5% in the six months following the incident.

- Cybersecurity Threats: Increased reliance on digital platforms and cloud services heightens vulnerability to ransomware, phishing, and other cyberattacks.

- Data Breach Impact: Potential for significant financial losses, operational disruptions, and severe reputational damage.

- Customer Trust Erosion: Breaches can lead to a loss of customer confidence, impacting long-term relationships and market position.

- Regulatory Penalties: Non-compliance with data protection regulations, such as GDPR or CCPA, can result in substantial fines.

Intensifying competition from both established players and new market entrants poses a significant threat to Graybar's market share and pricing power. Furthermore, the rapid pace of technological change in the electrical distribution sector requires continuous adaptation, as lagging behind could cede ground to more agile competitors. Emerging digital business models, such as direct-to-consumer sales or advanced automation, could also disrupt Graybar's traditional distribution channels.

| Threat Category | Specific Threat | Potential Impact on Graybar | Data/Context (2024-2025) |

| Competition | Increased rivalry from new entrants and online platforms | Erosion of market share, price pressure | The electrical distribution market remains highly fragmented, with ongoing consolidation and new digital-native competitors emerging. |

| Technological Disruption | Rapid advancements in automation and digital sales models | Risk of obsolescence, need for significant investment in new technologies | Investment in AI and automation in supply chains is projected to grow significantly through 2025, impacting operational efficiency and customer engagement. |

| Economic Factors | Potential economic slowdown impacting construction and infrastructure spending | Reduced sales volumes, lower revenue | While US GDP growth was around 2.3% in 2024, projections for 2025 indicate a potential moderation, which could affect capital expenditures in key Graybar sectors. |

| Supply Chain Volatility | Geopolitical tensions and trade policy shifts | Increased costs, product availability issues | Global supply chain disruptions continued to impact component availability and shipping costs throughout 2024, with lingering effects expected into 2025. |

SWOT Analysis Data Sources

This analysis is built on a foundation of reliable data, including Graybar's official financial filings, comprehensive market research reports, and expert industry commentary to provide a robust and accurate SWOT assessment.