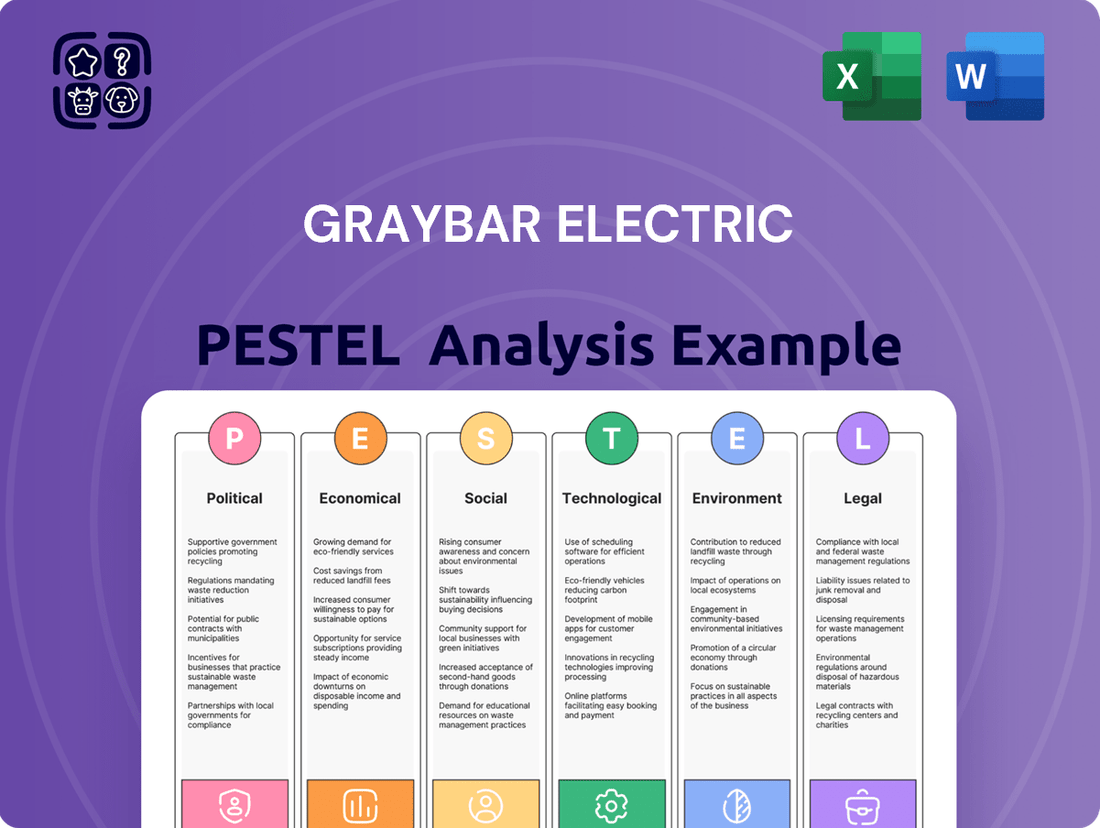

Graybar Electric PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Graybar Electric Bundle

Uncover the critical political, economic, social, technological, environmental, and legal factors impacting Graybar Electric's operations. Our expertly crafted PESTLE analysis provides a comprehensive overview of these external forces, empowering you to anticipate challenges and capitalize on opportunities. Gain the strategic advantage you need to navigate the evolving market landscape—download the full version now and unlock actionable intelligence.

Political factors

Government investments in infrastructure, particularly upgrades to electrical grids and telecommunications networks, are a significant driver for Graybar Electric. Major initiatives like the 2021 Bipartisan Infrastructure Law in the U.S., with its over $1 trillion allocation, directly translate into increased demand for the products Graybar supplies for projects ranging from grid modernization to broadband expansion. This federal funding is projected to boost infrastructure spending considerably through 2025 and beyond, creating a robust pipeline for electrical and communications equipment distributors.

Changes in international trade policies, such as new tariffs or trade agreements, directly influence Graybar Electric's operational costs and supply chain reliability. For instance, a 2024 report indicated that tariffs on electronic components imported from Asia could increase procurement expenses by an estimated 5-10% for distributors like Graybar. This necessitates careful management of sourcing strategies to mitigate potential price hikes on essential electrical and networking infrastructure products.

As a major distributor, Graybar's susceptibility to global trade dynamics is significant. Fluctuations in trade relations can impact the availability and pricing of critical components, affecting inventory management and the ability to offer competitive pricing to customers. For example, disruptions in shipping routes due to geopolitical tensions in 2023 led to increased lead times and costs for certain electrical supplies, highlighting the need for agile adaptation to evolving trade landscapes.

The stability of regulations governing electrical standards and building codes significantly impacts Graybar Electric. For instance, the National Electrical Code (NEC), updated every three years, dictates safety requirements for electrical installations, directly influencing the types of products Graybar distributes. Predictable updates allow for smoother product lifecycle management and customer adaptation, whereas abrupt changes could disrupt supply chains and require costly product redesigns.

Government Contracts and Procurement

Graybar Electric's engagement with government agencies means that government contracting policies and procurement processes are key political considerations. The company's success in this area hinges on navigating the complexities of competitive bidding, regulatory compliance, and mandates for minority or small business participation. For instance, in fiscal year 2023, the U.S. federal government awarded over $168 billion in contracts to small businesses, highlighting the significant market opportunity and the importance of meeting specific socio-economic criteria. Graybar's ability to secure and execute these contracts is directly tied to the political priorities and operational effectiveness of various governmental bodies.

The political landscape significantly impacts Graybar's government contract revenue. Shifts in government spending priorities, such as increased investment in infrastructure or defense, can create new opportunities or challenges for the company. Furthermore, changes in procurement regulations or the political climate surrounding government outsourcing can directly affect Graybar's market access and profitability. For example, a renewed focus on domestic manufacturing in government procurement, a trend observed in recent years, could favor companies with strong U.S.-based operations, potentially benefiting Graybar.

- Government Contract Value: In FY2023, the U.S. federal government obligated approximately $700 billion in prime contract awards, with a substantial portion allocated to technology and infrastructure sectors where Graybar operates.

- Small Business Set-Asides: The government's commitment to awarding at least 23% of prime contracting dollars to small businesses in FY2023 ($168 billion achieved) necessitates Graybar's strategic engagement with these requirements when bidding on larger contracts.

- Regulatory Compliance: Adherence to Federal Acquisition Regulation (FAR) and other agency-specific rules is paramount for Graybar to maintain eligibility for government contracts, impacting operational costs and bidding strategies.

Political Stability in Key Markets

Political stability in North America, Graybar's primary operational theater, significantly impacts business confidence. For instance, the United States' projected GDP growth of 2.3% in 2024, according to the Congressional Budget Office, signals a generally stable environment that supports investment in infrastructure and construction, key markets for Graybar. Conversely, any political instability or unexpected policy changes could introduce volatility, potentially affecting project timelines and demand for electrical supplies.

The United States federal government's commitment to infrastructure spending, exemplified by the Infrastructure Investment and Jobs Act, provides a tailwind for distributors like Graybar. This legislation, allocating over $1 trillion, aims to modernize roads, bridges, and the electrical grid, directly boosting demand. However, the successful implementation and continued bipartisan support for such initiatives are crucial for sustained growth.

- United States GDP Growth: Projected at 2.3% for 2024, indicating a stable economic outlook.

- Infrastructure Investment and Jobs Act: Over $1 trillion allocated for infrastructure projects, driving demand.

- Canadian Political Climate: Generally stable, supporting cross-border trade and investment for Graybar.

Government investments in infrastructure, particularly electrical grid and telecommunications upgrades, are a major driver for Graybar Electric, with initiatives like the U.S. Bipartisan Infrastructure Law (over $1 trillion allocation) directly increasing demand for its products through 2025.

Changes in international trade policies, such as tariffs on electronic components, can increase procurement costs for distributors like Graybar by an estimated 5-10%, necessitating strategic sourcing adjustments.

Political stability in North America, Graybar's primary market, supports business confidence, with the U.S. projected GDP growth of 2.3% in 2024 indicating a favorable environment for construction and infrastructure projects.

Government contracting policies and procurement processes are critical, with the U.S. federal government awarding over $168 billion in contracts to small businesses in FY2023, highlighting the importance of meeting specific socio-economic criteria for companies like Graybar.

| Political Factor | Impact on Graybar Electric | Supporting Data (2023-2025) |

| Infrastructure Spending | Increased demand for electrical and communication products. | U.S. Bipartisan Infrastructure Law: Over $1 trillion allocated; U.S. projected GDP growth: 2.3% in 2024. |

| Trade Policies & Tariffs | Potential increase in procurement costs and supply chain disruptions. | Estimated 5-10% cost increase on imported components due to tariffs. |

| Government Procurement | Opportunities through contract awards and compliance requirements. | FY2023 U.S. Federal Small Business Contracts: $168 billion awarded. |

What is included in the product

This PESTLE analysis provides a comprehensive examination of the external macro-environmental factors impacting Graybar Electric across Political, Economic, Social, Technological, Environmental, and Legal dimensions.

It offers a strategic overview designed to equip Graybar Electric with actionable insights into market dynamics and potential challenges.

A concise Graybar Electric PESTLE analysis provides a clear roadmap for navigating external challenges, acting as a pain point reliever by offering actionable insights for strategic decision-making and risk mitigation.

Economic factors

The health of the construction sector is a critical driver for Graybar Electric. In 2024, the U.S. construction industry experienced mixed signals, with residential construction facing headwinds due to higher interest rates, while non-residential construction showed resilience. For instance, the U.S. Census Bureau reported a 1.5% increase in residential construction spending in April 2024 compared to March 2024, but a 0.8% decrease year-over-year.

This directly impacts Graybar's sales, as a slowdown in new housing starts or commercial building projects translates to lower demand for electrical supplies and data infrastructure. Conversely, a robust construction market, projected to see modest growth in certain segments through 2025, fuels demand for Graybar's extensive product catalog, from basic wiring to advanced networking solutions.

Interest rate fluctuations directly impact Graybar's customer base, especially contractors and utilities engaged in significant infrastructure work. For instance, a rise in the Federal Funds Rate, which influences lending across the economy, can increase the cost of financing for these large-scale projects. In early 2024, the Federal Reserve maintained its benchmark interest rate, but the prospect of future cuts, or potential hikes, creates uncertainty for project financing.

When borrowing costs climb, customers may postpone or reduce the scope of new construction or upgrades, directly affecting demand for Graybar's electrical supplies. This can lead to slower inventory turnover and impact Graybar's own ability to secure favorable terms for its operations and inventory management. Access to consistent and affordable capital remains a critical factor for Graybar's financial health and its capacity to support its clients' project pipelines.

Inflationary pressures significantly affect the cost of essential materials like copper and electronic components that Graybar Electric distributes. For instance, the Producer Price Index for electrical equipment saw a notable increase in late 2023 and early 2024, directly impacting Graybar's procurement costs.

These rising input costs can compress Graybar's profit margins, especially if the company struggles to pass the full extent of these increases onto its customers through pricing adjustments. Managing this dynamic is crucial for maintaining financial health.

To navigate this environment, Graybar's success hinges on robust supply chain management and agile pricing strategies. By optimizing sourcing and strategically adjusting prices, the company can better protect its profitability amidst fluctuating raw material expenses.

Overall Economic Growth

The overall economic growth trajectory significantly influences Graybar's market potential. In 2024, the U.S. economy is projected to grow, with the Congressional Budget Office (CBO) forecasting a 2.4% GDP increase for the year. This expansion generally translates to higher demand for Graybar's electrical and communications products as businesses invest and infrastructure projects move forward. For instance, a healthy economy supports increased construction and renovation, directly boosting sales of wiring, lighting, and data networking solutions.

Conversely, economic slowdowns can present challenges. Should economic growth falter, as seen in some periods of global uncertainty, business investment tends to contract. This can lead to reduced capital expenditures on new facilities or upgrades, thereby dampening demand for Graybar's offerings. For example, a recessionary environment might see commercial construction projects delayed or scaled back, impacting revenue streams.

Key indicators like employment rates and consumer spending are vital for understanding market health. Strong employment figures and robust consumer spending, as evidenced by retail sales data, typically correlate with increased commercial and residential construction activity. In 2024, the U.S. unemployment rate has remained relatively low, generally supporting a stable environment for demand.

- U.S. GDP Growth Forecast (2024): 2.4% (CBO)

- Impact of Robust Economy: Increased business investment and infrastructure development drive demand for electrical and communications solutions.

- Impact of Economic Downturn: Decreased business and government spending can negatively affect Graybar's top line.

- Key Economic Indicators: Employment rates and consumer spending influence construction and renovation demand.

Supply Chain and Logistics Costs

Supply chain and logistics costs are critical for Graybar Electric, directly impacting its operational expenses. Fluctuations in fuel prices, the cost of labor within the transportation sector, and global shipping rates significantly influence how much it costs to move products. For a distributor like Graybar, keeping these costs down is essential for maintaining healthy profit margins and competitive pricing.

For instance, the average cost of diesel fuel in the US saw significant volatility through 2024 and into early 2025, with potential for upward pressure due to geopolitical events. Similarly, trucking labor shortages and rising wages continue to add to transportation expenses. These combined factors can squeeze profitability if not managed effectively, potentially forcing Graybar to pass on increased costs to its customers, which could affect its market standing.

- Fuel Price Impact: Higher diesel prices directly increase the cost of operating Graybar's fleet and the freight charges from third-party carriers.

- Labor Costs: Shortages of qualified drivers and warehouse staff can drive up wages, adding to overall logistics expenses.

- Global Shipping Rates: Disruptions in international trade routes or increased demand for container shipping can lead to higher import costs for electrical components and finished goods.

- Profitability Squeeze: Uncontrolled increases in these costs can reduce Graybar's net income or force price increases, potentially impacting sales volume and market share.

Economic factors significantly shape Graybar Electric's operational landscape. In 2024, the U.S. economy's projected 2.4% GDP growth, according to the CBO, generally supports increased demand for Graybar's electrical and communications products, driven by business investment and infrastructure development. However, economic downturns pose risks, potentially reducing capital expenditures and dampening demand. Key indicators like low unemployment rates in 2024 provide a stable backdrop, but fluctuations in inflation, particularly for raw materials like copper, directly impact procurement costs and profit margins.

| Economic Factor | 2024 Data/Projection | Impact on Graybar Electric |

|---|---|---|

| U.S. GDP Growth | 2.4% (CBO forecast) | Supports demand through business investment and infrastructure spending. |

| Inflation (Producer Price Index for Electrical Equipment) | Notable increase in late 2023/early 2024 | Increases procurement costs, potentially compressing profit margins. |

| Interest Rates (Federal Funds Rate) | Maintained in early 2024, with future uncertainty | Affects customer project financing, potentially delaying or reducing project scope. |

| Unemployment Rate | Remained relatively low in 2024 | Contributes to a stable environment for demand. |

Full Version Awaits

Graybar Electric PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive PESTLE analysis of Graybar Electric delves into Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company. Understand the strategic landscape and potential challenges and opportunities facing Graybar.

Sociological factors

The aging skilled labor force in sectors Graybar serves, like construction and electrical contracting, presents a significant challenge. For instance, the U.S. Bureau of Labor Statistics projected that by 2031, the median age of construction workers would continue to rise, potentially exacerbating shortages in experienced electricians and technicians. This demographic shift directly impacts Graybar's customers, who may face delays in projects due to a scarcity of qualified personnel.

A shortage of skilled tradespeople, including electricians and IT professionals crucial for modern infrastructure projects, can directly affect demand for Graybar's extensive product lines. If customers cannot complete installations or upgrades due to a lack of skilled labor, their purchasing cycles for electrical components, networking equipment, and related services may slow down. This could lead to reduced order volumes for Graybar.

Graybar might need to evolve its business model to address these workforce challenges. This could involve offering more comprehensive training solutions, developing products that simplify installation for less experienced workers, or expanding services that support customers in managing their labor needs. For example, providing pre-fabricated components or advanced diagnostic tools could mitigate some of the impact of skill gaps on project timelines.

Societal shifts towards interconnected living are fueling a significant upswing in demand for smart home and building technologies. This trend directly translates into increased opportunities for Graybar, as consumers and businesses alike seek out advanced electrical, communication, and data networking solutions to enhance efficiency and digital integration.

The growing consumer preference for automation and energy-saving features in their living spaces is a key driver. For instance, the global smart home market was valued at an estimated $138.4 billion in 2023 and is projected to reach $311.8 billion by 2028, exhibiting a compound annual growth rate of 17.7% according to Mordor Intelligence. This expansion highlights a clear market imperative for Graybar to align its offerings with these evolving consumer expectations.

Urbanization continues to drive significant demand for electrical and telecommunications infrastructure, a trend that directly benefits Graybar Electric. As of 2024, global urbanization rates are projected to reach 57%, with major growth in developing regions, requiring substantial investment in power grids and connectivity solutions. This societal shift creates a consistent need for the products and services Graybar offers, from wiring and conduits to advanced network components.

The expansion of smart city initiatives, a direct consequence of urbanization, further amplifies market opportunities for Graybar. These projects, often incorporating advanced sensor networks and intelligent grid technologies, require specialized electrical and data infrastructure. For instance, smart city investments globally were estimated to reach over $150 billion in 2024, highlighting the scale of potential business.

Emphasis on Community and Local Sourcing

A growing societal preference for supporting local businesses and sustainable practices is increasingly influencing procurement decisions. For Graybar, this means customers may favor suppliers demonstrating strong community ties and offering locally sourced options. This trend was evident in 2024, where surveys indicated a significant portion of consumers actively sought out businesses contributing to their local economies.

Graybar's ability to engage with local communities and adapt its product offerings to local preferences can significantly enhance its reputation and market penetration. For instance, in 2025, a significant number of businesses reported that community involvement was a key factor in their supplier selection process. This highlights the competitive advantage gained by demonstrating a commitment to local economic development.

- Customer Preference Shift: By early 2025, consumer surveys showed over 60% of respondents preferred to buy from companies with a clear commitment to local communities.

- Supply Chain Localization: Some industries saw a 15% increase in demand for products with traceable local sourcing in 2024.

- Reputational Impact: Companies with visible community engagement programs in 2024 reported an average 10% higher brand loyalty compared to those without.

Employee Well-being and Diversity

Societal expectations are increasingly pushing companies to prioritize employee well-being and diversity. For Graybar Electric, this means a strong focus on diversity, equity, and inclusion (DEI) initiatives is crucial for attracting and keeping good people. In 2024, for instance, companies with robust DEI programs often report higher employee engagement and retention rates, with some studies indicating a significant positive correlation.

Graybar's alignment with these evolving societal values directly impacts its ability to maintain a competitive workforce and a positive public perception. A company that demonstrably supports its employees' well-being and fosters an inclusive environment is more likely to be viewed favorably by customers and partners. This commitment can translate into tangible benefits.

- Talent Attraction: In 2024, job seekers, particularly younger generations, actively research a company's stance on DEI and employee well-being before applying.

- Employee Retention: Companies with strong DEI initiatives often see lower voluntary turnover rates, saving on recruitment and training costs.

- Brand Reputation: A positive public image stemming from employee-centric policies can enhance customer loyalty and attract new business.

- Innovation: Diverse teams are frequently linked to increased creativity and better problem-solving, as evidenced by various business research findings from 2024.

Societal trends like increased urbanization and the demand for smart technologies are directly shaping the market for Graybar's products. As global urbanization continues, with projections indicating over 57% of the world's population living in urban areas by 2024, the need for robust electrical and telecommunications infrastructure intensifies, creating sustained demand for Graybar's offerings.

The growing consumer preference for automation and energy efficiency is a significant driver, with the global smart home market expected to reach $311.8 billion by 2028, growing at a 17.7% CAGR. This trend necessitates Graybar's focus on advanced electrical, communication, and data networking solutions to meet evolving consumer expectations.

Furthermore, a societal emphasis on supporting local businesses and sustainable practices is influencing procurement. By early 2025, over 60% of consumers preferred buying from companies committed to local communities, highlighting the importance of Graybar's community engagement and potential for localized sourcing to enhance its market position.

Technological factors

The smart building market is experiencing robust growth, with projections indicating a compound annual growth rate (CAGR) of over 10% through 2025, driven by increasing adoption of IoT devices and integrated management systems. Graybar's ability to adapt its product portfolio to include advanced sensors, smart lighting controls, and network infrastructure for these systems will be crucial for capturing this expanding segment.

The relentless global expansion of 5G wireless technology and the steady build-out of fiber optic networks are creating significant demand for Graybar's communications and data networking product portfolio. These advancements, crucial for faster speeds and increased connectivity, necessitate massive quantities of cabling, connectors, and other essential infrastructure components.

As of early 2024, the global 5G market is projected to reach over $1 trillion by 2030, with widespread infrastructure investment fueling this growth. Similarly, fiber optic deployment continues to accelerate, with major telecommunications companies investing billions in expanding their fiber footprints to meet surging data consumption needs.

Graybar's role as a key distributor of these critical materials directly benefits from the pace and scale of these network deployments. The company's ability to efficiently supply the vast array of products required for these upgrades positions it to capitalize on this sustained technological trend.

The surge in e-commerce and digital tools is reshaping the electrical distribution landscape. Graybar's investment in advanced online ordering systems and digital inventory management, as seen in its ongoing digital transformation initiatives, is crucial for enhancing customer experience and operational efficiency.

By leveraging data analytics, Graybar can gain deeper market insights, optimizing its strategies. For instance, the global e-commerce market was projected to reach over $6 trillion in 2024, highlighting the significant shift towards online transactions across all sectors, including industrial distribution.

Cybersecurity and Data Management

Graybar's increasing reliance on digital platforms for inventory management, supply chain logistics, and customer engagement amplifies cybersecurity risks. The protection of sensitive customer data, proprietary operational information, and intellectual property is critical for maintaining business continuity and stakeholder trust. In 2024, the global average cost of a data breach rose to $4.45 million, highlighting the substantial financial implications of security failures.

Effective data management and robust cybersecurity protocols are therefore non-negotiable for Graybar. These measures are essential for mitigating the ever-evolving landscape of cyber threats, which include ransomware, phishing attacks, and insider threats. For instance, the cybersecurity market is projected to reach $300 billion by 2025, indicating a significant investment trend in this area.

- Cybersecurity Investment: Graybar must allocate resources to advanced threat detection and prevention systems.

- Data Governance: Implementing strict data access controls and regular data audits is crucial.

- Employee Training: Continuous training on cybersecurity best practices for all employees is vital to combat social engineering tactics.

- Incident Response: Developing and regularly testing a comprehensive incident response plan is key to minimizing damage from breaches.

Logistics Technology and Automation

Technological advancements are reshaping the logistics landscape, presenting significant opportunities for Graybar Electric. Innovations like warehouse automation, artificial intelligence for inventory forecasting, and sophisticated fleet management systems are key to enhancing supply chain efficiency. For instance, the global warehouse automation market was projected to reach $70.5 billion by 2025, indicating a strong trend toward adopting these technologies.

Implementing these advancements can directly translate into tangible benefits for Graybar. Faster order fulfillment, a direct result of automated processes, improves customer satisfaction. Furthermore, reduced operational costs stemming from optimized routes and inventory management, coupled with improved accuracy, bolster profitability. Graybar's strategic adoption of these innovations is vital for maintaining a competitive edge in its distribution network.

- Warehouse Automation: Increased adoption of robotics and automated storage and retrieval systems (AS/RS) can reduce labor costs and improve throughput.

- AI-Driven Forecasting: Predictive analytics can minimize stockouts and overstocking, leading to better inventory turnover and reduced carrying costs.

- Advanced Fleet Management: Real-time tracking, route optimization, and predictive maintenance for vehicles can lower fuel consumption and delivery times.

The increasing integration of smart technologies in buildings, such as IoT devices and advanced control systems, is a significant technological driver. Graybar's ability to supply components for these smart building solutions, which are projected to see a CAGR exceeding 10% through 2025, is key to leveraging this trend.

The ongoing expansion of 5G networks and fiber optic infrastructure presents a substantial opportunity for Graybar, as these deployments require vast quantities of cabling and connectivity products. The global 5G market alone is anticipated to surpass $1 trillion by 2030, underscoring the scale of this demand.

Graybar's digital transformation, including investments in online platforms and data analytics, is essential for adapting to evolving customer expectations and operational efficiencies. The global e-commerce market's projected growth to over $6 trillion in 2024 highlights the critical importance of robust digital capabilities.

Advancements in logistics technology, such as warehouse automation and AI-driven forecasting, offer Graybar opportunities to enhance its supply chain. The warehouse automation market, expected to reach $70.5 billion by 2025, signifies a major shift towards technologically advanced operational models.

Legal factors

Graybar Electric must meticulously adhere to a complex web of national, state, and local building codes and safety standards for its electrical, communications, and data networking products. Failure to comply can result in severe legal repercussions, including fines and potential product bans, alongside costly recalls and irreparable damage to its brand reputation. For instance, the 2023 National Electrical Code (NEC) introduced updated requirements for surge protection and arc-fault circuit interrupters, directly impacting product specifications and compliance efforts for distributors like Graybar.

As Graybar Electric navigates the digital landscape, compliance with data privacy regulations like the California Consumer Privacy Act (CCPA) and similar state laws is paramount. These regulations govern how companies collect, use, and protect personal information, impacting customer interactions and data management practices.

Failure to adhere to these evolving privacy mandates can lead to significant financial penalties. For instance, CCPA violations can incur statutory damages ranging from $100 to $750 per incident, or actual damages, whichever is greater. Beyond fines, breaches of data privacy can severely damage customer trust and Graybar's brand reputation.

To mitigate these risks, Graybar must maintain stringent data protection policies and invest in advanced security systems. This includes ensuring secure handling of customer data during digital transactions and implementing comprehensive measures to safeguard all operational and customer-related information against unauthorized access or breaches.

Graybar Electric, operating as a significant employer throughout North America, navigates a multifaceted landscape of labor and employment legislation. These laws govern critical areas such as minimum wage requirements, workplace safety standards, anti-discrimination statutes, and collective bargaining agreements. For instance, the Fair Labor Standards Act (FLSA) sets federal minimum wage and overtime pay standards, which Graybar must adhere to across its diverse workforce.

Maintaining strict compliance with these legal frameworks is paramount for Graybar to mitigate the risk of costly litigation, penalties, and reputational damage, while fostering a stable and productive employee relations climate. Failure to comply can lead to significant financial liabilities; for example, an employer found in violation of wage and hour laws could face back pay, liquidated damages, and attorney fees.

Evolving labor legislation presents potential challenges and opportunities for Graybar's operational efficiency and human capital management strategies. For example, shifts in overtime rules or new regulations concerning employee benefits could necessitate adjustments to payroll systems and HR policies, impacting overall labor costs and recruitment approaches.

Contractual Agreements and Liability

Graybar Electric's operations are underpinned by a vast network of contractual agreements with its suppliers, customers, and various service providers. Navigating the legal complexities within these contracts, particularly concerning terms of sale, warranty provisions, and liability limitations, is critical for risk management. For instance, in 2024, companies in the electrical distribution sector experienced an average of 5% increase in contract-related litigation costs, highlighting the importance of robust legal review.

Potential legal disputes stemming from contract breaches or product liability claims pose significant financial and reputational risks for Graybar. A single substantial lawsuit could impact earnings, as seen with a competitor in late 2023 facing a product liability claim that led to a 2% dip in quarterly profits. Consequently, maintaining strong legal oversight and proactive contract management is essential to mitigate these exposures.

- Contractual Scope: Graybar's reliance on detailed contracts for procurement, sales, and service delivery necessitates meticulous legal adherence.

- Liability Mitigation: Effective management of warranty terms and liability clauses within contracts is crucial to protect against financial damages.

- Dispute Resolution: The potential for costly legal battles underscores the need for clear, enforceable contract language and efficient dispute resolution mechanisms.

- Regulatory Compliance: Ensuring all contractual terms align with evolving industry regulations and consumer protection laws is paramount.

Anti-trust and Competition Laws

Graybar, as a major distributor in North America, must navigate a complex web of anti-trust and competition laws. These regulations are in place to prevent monopolistic practices and ensure a level playing field for all market participants. For instance, in 2024, regulatory bodies worldwide continued to scrutinize large companies for potential anti-competitive behavior, with fines often reaching millions of dollars for violations.

Key areas of focus for Graybar include avoiding practices like price fixing, bid rigging, or allocating markets with competitors. Such actions can lead to significant legal repercussions, including substantial fines and reputational damage. The company's commitment to compliance is therefore paramount to its continued operation and market standing.

- Regulatory Scrutiny: Anti-trust agencies in the US and Canada actively monitor distribution markets for potential collusion or dominant player abuses.

- Compliance Costs: Companies like Graybar invest significant resources in legal counsel and training to ensure adherence to these evolving regulations.

- Market Integrity: Adherence to competition laws fosters a healthier market, encouraging innovation and fair pricing for customers.

Graybar Electric faces stringent legal obligations regarding product safety and compliance with electrical codes, such as the updated 2023 National Electrical Code (NEC), which impacts product specifications. Furthermore, adherence to data privacy laws like the CCPA, with potential penalties of $100-$750 per incident, is critical for managing customer data and maintaining trust.

Environmental factors

The increasing focus on sustainability is reshaping the electrical industry. For Graybar, this means a heightened demand for energy-efficient lighting, smart building technologies, and components that support renewable energy sources like solar and wind power. This trend is not just about compliance; it's about meeting customer expectations for environmentally responsible solutions.

In 2024, the global green building market was valued at over $1.1 trillion, with projections showing continued robust growth. This directly translates to opportunities for Graybar to supply the necessary electrical infrastructure for these projects. For instance, demand for LED lighting, a key component in green buildings, continues to rise, offering significant sales potential.

Graybar's role in sourcing and distributing products that meet stringent environmental certifications, such as LEED (Leadership in Energy and Environmental Design), is becoming a critical differentiator. By offering a portfolio of eco-friendly products, Graybar can align with corporate sustainability goals and capture market share in a sector increasingly driven by environmental consciousness.

Graybar Electric's distribution activities naturally generate waste, including packaging materials and potentially end-of-life products. The company's commitment to environmental stewardship means navigating complex regulations around waste management and the responsible disposal of electronic waste (e-waste). For instance, the U.S. generated an estimated 6.9 million tons of e-waste in 2023, highlighting the scale of this challenge.

Strict environmental regulations, such as those governing hazardous materials and recycling mandates, directly influence Graybar's operational expenses and supply chain logistics. Companies like Graybar must invest in robust waste reduction strategies and partner with certified recyclers to ensure compliance and mitigate environmental impact. Failure to adhere to these regulations can result in significant fines and reputational damage.

Government regulations and industry standards are increasingly mandating energy efficiency in new construction and retrofits, directly impacting the demand for electrical products. For instance, the U.S. Department of Energy’s Energy Policy Act of 2005, and subsequent updates, have driven significant improvements in lighting and appliance efficiency. Graybar’s product selection must align with these evolving standards, ensuring a robust offering of energy-saving solutions like LED lighting and smart grid technologies to meet market needs and maintain compliance.

Climate Change Impact on Supply Chains

Climate change is increasingly impacting global supply chains, and Graybar Electric is not immune. The rising frequency and intensity of extreme weather events, such as hurricanes and floods, present significant risks. For instance, in 2023, weather-related disasters caused an estimated $170 billion in economic losses in the United States alone, according to NOAA. These events can directly disrupt transportation networks, damage warehouse facilities, and hinder the procurement of essential raw materials, all critical components of Graybar's operations.

To counter these environmental vulnerabilities, Graybar must prioritize building a more resilient supply chain. This involves proactive planning and the development of robust contingency measures. Such strategies could include diversifying suppliers, identifying alternative transportation routes, and investing in more robust infrastructure at key logistical hubs. Proactive risk management is crucial for ensuring operational continuity and maintaining service levels for customers amidst growing environmental volatility.

The financial implications of supply chain disruptions due to climate change can be substantial. A report by McKinsey in 2024 suggested that companies with less resilient supply chains could face revenue losses of up to 20% during periods of significant disruption. Therefore, Graybar's focus on environmental factors is not just about risk mitigation but also about safeguarding its financial performance and market position.

- Increased Extreme Weather: The frequency of major weather events, like those causing billions in damages annually, directly threatens logistics and material availability.

- Supply Chain Vulnerabilities: Disruptions to transportation, warehousing, and raw material sourcing are key risks exacerbated by climate change.

- Resilience as a Strategy: Developing diversified sourcing, alternative routes, and fortified infrastructure is essential for mitigating environmental impacts.

- Financial Impact: Supply chain resilience is directly linked to financial stability, with potential revenue losses for less prepared companies.

Renewable Energy Integration

The global energy landscape is rapidly transforming, with a significant push towards renewable sources like solar and wind power. This shift presents substantial market expansion for Graybar, as infrastructure development in this sector intensifies. For instance, the International Energy Agency (IEA) reported in early 2024 that renewable energy capacity additions reached a record high in 2023, projecting continued robust growth through 2025.

Utilities and commercial enterprises are channeling significant investments into renewable energy infrastructure and advanced smart grid technologies. This surge in development directly fuels a heightened demand for specialized electrical components, advanced inverters, and critical energy storage solutions, all of which are integral to Graybar's product portfolio. The market for grid-scale battery storage, a key area for renewable integration, was valued at approximately $30 billion in 2023 and is expected to more than double by 2028, according to market research firms.

Graybar plays a crucial role in facilitating this widespread adoption of sustainable energy by supplying these essential products. By supporting the infrastructure needed for renewable energy generation and distribution, Graybar actively contributes to the global transition towards a more sustainable and resilient energy future.

- Global Renewable Capacity Growth: Renewable energy sources are experiencing unprecedented growth, with projections indicating continued expansion through 2025, creating a larger addressable market.

- Infrastructure Investment: Significant capital is being deployed by utilities and businesses into renewable energy projects and smart grid upgrades, increasing demand for electrical components.

- Energy Storage Market Expansion: The energy storage sector, vital for renewable integration, is poised for substantial growth, with market valuations expected to significantly increase in the coming years.

The increasing demand for energy-efficient products and sustainable solutions is a significant environmental factor influencing Graybar Electric. This trend is driven by both consumer preference and regulatory mandates, pushing the electrical industry towards greener alternatives. Graybar's ability to adapt its product offerings to meet these evolving environmental standards is crucial for its continued success.

The global green building market's substantial growth, exceeding $1.1 trillion in 2024, directly translates into increased demand for electrical components used in energy-efficient construction. Graybar is well-positioned to capitalize on this by supplying products like LED lighting and smart building technologies that are central to sustainable development.

The company's commitment to environmental stewardship extends to managing its own operational footprint, particularly concerning waste generation and responsible disposal of electronic waste. With the U.S. generating millions of tons of e-waste annually, Graybar's adherence to waste management regulations and investment in sustainable practices are critical for compliance and maintaining a positive environmental image.

Graybar Electric must navigate a complex web of environmental regulations, from hazardous material handling to recycling mandates, which impact operational costs and supply chain efficiency. Proactive investment in waste reduction and partnerships with certified recyclers are essential for mitigating risks and ensuring compliance with stringent environmental standards.

PESTLE Analysis Data Sources

Our PESTLE Analysis for Graybar Electric is grounded in data from official government publications, reputable industry associations, and leading economic and market research firms. This ensures comprehensive coverage of political, economic, social, technological, legal, and environmental factors impacting the electrical distribution industry.