Graybar Electric Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Graybar Electric Bundle

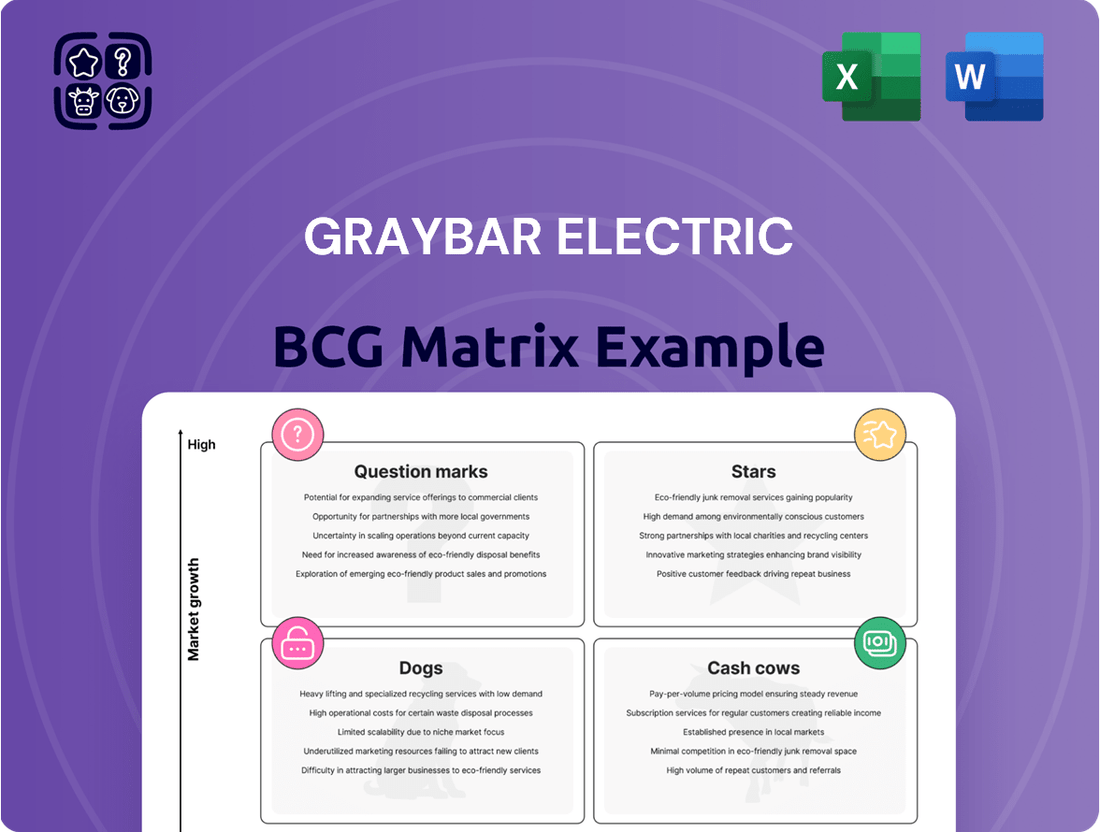

Curious about Graybar Electric's product portfolio performance? Our BCG Matrix analysis reveals which segments are driving growth (Stars), generating consistent profits (Cash Cows), lagging behind (Dogs), or present potential opportunities (Question Marks). This snapshot is just the beginning of understanding their strategic positioning.

Unlock the full potential of Graybar Electric's strategic landscape by purchasing the complete BCG Matrix. Gain detailed quadrant insights, understand the underlying market dynamics, and receive actionable recommendations to optimize your investments and product development strategies.

Don't miss out on the complete breakdown of Graybar Electric's BCG Matrix. This comprehensive report provides the clarity you need to make informed decisions, identify growth areas, and manage underperforming assets effectively. Purchase now for a strategic advantage.

Stars

Graybar Electric's Data Center Infrastructure Solutions hold a strong position as a Star within the BCG matrix. This is largely due to their extensive distribution of electrical and data networking products crucial for the booming data center industry.

The global data center construction market is experiencing robust expansion, valued at an estimated $240.97 billion in 2024. This growth is significantly fueled by the escalating demand for artificial intelligence and cloud computing services, creating a fertile ground for Graybar's offerings.

Graybar is strategically positioned to benefit from this high-growth sector by supplying essential components. Their product portfolio includes vital elements such as power distribution units, advanced cabling, and critical cooling solutions, all indispensable for modern data center operations.

The rapid global rollout of 5G networks positions Graybar within a burgeoning market. The 5G infrastructure sector is expected to see a substantial compound annual growth rate (CAGR) from 2024 through 2033, with North America leading in adoption.

As a key distributor of communications and data networking supplies, Graybar is instrumental in furnishing the essential cables, connectors, and electrical components required for this expanding infrastructure. For instance, the global 5G infrastructure market was valued at approximately $30 billion in 2023 and is projected to reach over $100 billion by 2030, showcasing the immense opportunity.

Graybar Electric's smart building technology and solutions are positioned as a star in the BCG matrix, tapping into a burgeoning market. Their offerings, which seamlessly blend electrical, communications, and data networking products, cater to the increasing demand for integrated building intelligence. The global smart building market itself is a significant growth area, with projections placing its value between $103 billion and $117.4 billion in 2024. This expansion is fueled by a growing emphasis on energy efficiency, the pervasive integration of the Internet of Things (IoT), and the burgeoning influence of artificial intelligence (AI) in building management.

Graybar's comprehensive approach, enabling them to deliver complete solutions for intelligent lighting, advanced HVAC controls, and robust security systems, places them in a favorable position within this dynamic and evolving sector. Their ability to bundle these critical components allows them to meet the complex needs of modern construction and renovation projects, further solidifying their star status.

Electric Vehicle (EV) Charging Infrastructure

The electric vehicle (EV) charging infrastructure market is a prime example of a burgeoning industry, fueled by the rapid increase in EV adoption. This sector is poised for significant expansion, reflecting a strong demand for the necessary components.

The global EV charging infrastructure market was valued at an estimated $32.97 billion in 2024. Projections indicate this market will surge to over $277.76 billion by 2034, demonstrating a compound annual growth rate of 23.75% starting in 2025. This robust growth trajectory highlights the immense potential within this segment.

- Market Growth: The EV charging infrastructure market is experiencing unprecedented expansion.

- Financial Projections: Estimated at $32.97 billion in 2024, with a projected rise to $277.76 billion by 2034.

- Growth Rate: A compound annual growth rate (CAGR) of 23.75% is anticipated from 2025.

- Graybar's Role: Graybar's distribution of essential electrical components, such as wiring and switchgear, positions it favorably in this high-potential area.

Renewable Energy Electrical Components

Renewable energy electrical components represent a significant growth area within the BCG Matrix, likely categorized as a Star. The global shift to sustainable energy sources is driving substantial demand for the necessary electrical infrastructure. In 2024, the renewable energy market reached an impressive $1,237.21 billion, with projections indicating a compound annual growth rate of 8.7% from 2025 through 2032.

Graybar Electric's involvement in distributing essential electrical products for solar, wind, and energy storage systems places it squarely in this expanding market. The company can effectively utilize its established supply chain and distribution capabilities to capitalize on this trend.

- Market Value: $1,237.21 billion in 2024.

- Projected Growth: 8.7% CAGR from 2025-2032.

- Graybar's Position: Distribution of components for solar, wind, and energy storage.

- Strategic Advantage: Leveraging existing supply chain expertise in a high-growth sector.

Graybar Electric's focus on Data Center Infrastructure Solutions, 5G deployment, smart building technologies, EV charging infrastructure, and renewable energy electrical components positions them strongly as Stars in the BCG matrix. These sectors are experiencing significant growth, driven by technological advancements and global trends towards digitalization and sustainability.

| Business Segment | Market Value (2024 Est.) | Projected Growth (CAGR) | Graybar's Role |

|---|---|---|---|

| Data Center Infrastructure | $240.97 billion | High (AI & Cloud Demand) | Distributor of power, cabling, cooling |

| 5G Infrastructure | $30 billion (2023) to >$100 billion (2030) | Substantial | Supplier of cables, connectors, electrical components |

| Smart Building Technology | $103 - $117.4 billion | Significant | Provider of integrated electrical, comms, data solutions |

| EV Charging Infrastructure | $32.97 billion | 23.75% (2025-2034) | Distributor of wiring, switchgear |

| Renewable Energy Electrical Components | $1,237.21 billion | 8.7% (2025-2032) | Distributor for solar, wind, storage |

What is included in the product

Strategic assessment of Graybar's business units, categorizing them as Stars, Cash Cows, Question Marks, or Dogs.

Identifies investment priorities and divestment opportunities within Graybar's portfolio.

Graybar's BCG Matrix provides a clear, visual roadmap, relieving the pain of strategic uncertainty by identifying Stars, Cash Cows, Question Marks, and Dogs.

Cash Cows

Graybar's traditional electrical distribution to contractors is a classic cash cow, a bedrock of its business. This segment is the engine that consistently fuels the company's growth and profitability. In 2024, this core business was instrumental in Graybar achieving record net sales of $11.6 billion.

Despite a projected national electrical sales growth of approximately 2% for 2025, Graybar's established dominance in this sector remains. Its deep market penetration and robust contractor relationships mean it can continue to harvest significant returns with relatively modest investment. This stability allows Graybar to fund growth in other areas.

Established Communications & Data Networking Products are Graybar Electric's cash cows. These are the bread-and-butter items like copper and fiber optic cables, racks, and patch panels that keep existing networks running and getting upgraded. Think of them as the essential plumbing of the digital world.

The demand for these products is consistent because businesses always need to maintain and improve their data infrastructure. In 2024, the global structured cabling market alone was valued at approximately $13.8 billion and is projected to grow steadily, underscoring the ongoing need for these fundamental networking components.

Graybar's strength here lies in its vast product selection and a well-oiled supply chain. This allows them to reliably meet the ongoing demand from commercial and industrial clients, ensuring steady profits from a market that, while mature, remains vital and predictable.

Graybar's Supply Chain Management & Logistics Services are a prime example of a Cash Cow within their business. These services are mature, meaning they've been around for a while and are well-established, consistently bringing in steady money. Think of them as the reliable workhorses of the company.

These offerings are crucial for customers looking to streamline how they get and manage their products. By helping businesses with inventory and procurement, Graybar's logistics services are tightly woven into their core distribution operations. This integration means they've already built the systems and processes to do this efficiently, making them very cost-effective.

The demand for efficient delivery and inventory management isn't going anywhere. Industries across the board, from construction to telecommunications, always need these services to keep their operations running smoothly. This consistent demand means Graybar can count on these services to generate cash without needing to pour a lot of new investment into them for growth.

Utility Transmission & Distribution Products

Graybar's Utility Transmission & Distribution Products segment functions as a cash cow, generating steady revenue from the maintenance and upgrades of existing power grids. While the pace of new grid modernization is picking up, the foundational need for components like transformers, switchgear, and wires for current infrastructure ensures consistent demand. This stability is bolstered by Graybar's deep-rooted relationships with utility companies, solidifying its market position.

For instance, in 2023, the U.S. electric utility sector invested an estimated $150 billion in capital expenditures, a significant portion of which directly supports transmission and distribution infrastructure maintenance and upgrades. Graybar's established presence in this market means it captures a reliable share of these ongoing investments.

- Stable Demand: The ongoing need to maintain and upgrade existing utility transmission and distribution infrastructure provides a predictable revenue stream.

- Market Share: Graybar's strong relationships with utility customers contribute to a robust market share in this essential segment.

- Consistent Revenue: While growth may be moderate, the segment consistently contributes to Graybar's overall financial performance.

Maintenance, Repair, and Operations (MRO) Supplies

Graybar's distribution of Maintenance, Repair, and Operations (MRO) electrical supplies represents a significant Cash Cow within its business portfolio. This segment consistently generates revenue by serving industrial and commercial facilities, where these products are essential for daily operations and ongoing upkeep. The mature nature of this market ensures recurring demand, allowing Graybar to benefit from stable cash flow without requiring substantial new investment for market expansion. The company's focus here is on optimizing service efficiency and ensuring high product availability.

In 2024, the MRO electrical supplies sector continued to demonstrate resilience. For instance, the industrial MRO market size was projected to reach over $50 billion globally, with electrical components forming a substantial portion. Graybar's established distribution network and strong customer relationships in this segment enable it to capture a significant share of this steady market. This stability allows for predictable earnings, funding other strategic initiatives within the company.

- Consistent Revenue Stream: Graybar's MRO electrical supplies are critical for the ongoing operations of numerous industrial and commercial clients, resulting in a reliable and predictable income source.

- Mature Market Stability: The demand for MRO products is consistent in a mature market, meaning Graybar can generate steady cash flow with lower risk and less need for aggressive growth strategies in this area.

- Efficient Operations Focus: Instead of heavy investment in market expansion, Graybar leverages its existing infrastructure to maximize efficiency and product availability, enhancing profitability in this Cash Cow segment.

- Financial Contribution: This segment's stability provides a strong foundation for Graybar's overall financial health, supporting investments in other business units or research and development.

Graybar's established electrical distribution to contractors remains a cornerstone cash cow, consistently generating substantial revenue. This segment, vital for the company's profitability, contributed significantly to Graybar's record net sales of $11.6 billion in 2024, even as national electrical sales growth was projected around 2% for 2025.

The company's mature Communications & Data Networking Products, including essential cabling and connectivity hardware, also function as reliable cash cows. These products support the ongoing maintenance and upgrades of critical digital infrastructure, a market valued at approximately $13.8 billion globally in 2024 and showing steady growth.

Graybar's Supply Chain Management & Logistics Services and its Utility Transmission & Distribution Products are further examples of strong cash cows. These segments benefit from consistent demand for essential services and infrastructure components, with the U.S. electric utility sector investing an estimated $150 billion in capital expenditures in 2023, much of which supports existing grids.

Finally, the distribution of Maintenance, Repair, and Operations (MRO) electrical supplies is a significant cash cow, providing steady income from industrial and commercial clients. This sector, with the global industrial MRO market projected to exceed $50 billion, allows Graybar to leverage its existing infrastructure for efficient, profitable operations.

| Business Segment | BCG Category | Key Characteristics | 2024/Recent Data Point |

| Electrical Distribution to Contractors | Cash Cow | Mature, high market share, consistent revenue | Record net sales of $11.6 billion |

| Communications & Data Networking Products | Cash Cow | Essential infrastructure, steady demand | Global structured cabling market ~$13.8 billion |

| Supply Chain Management & Logistics | Cash Cow | Mature services, operational efficiency | Integral to core distribution operations |

| Utility Transmission & Distribution Products | Cash Cow | Grid maintenance, stable utility spending | U.S. utility capex ~$150 billion (2023) |

| MRO Electrical Supplies | Cash Cow | Industrial/commercial necessity, recurring demand | Global industrial MRO market >$50 billion |

Delivered as Shown

Graybar Electric BCG Matrix

The Graybar Electric BCG Matrix preview you are viewing is the exact, fully completed document you will receive upon purchase. This means no watermarks, no placeholder text, and no missing information – just the comprehensive strategic analysis ready for your immediate use. You can be confident that the detailed breakdown of Graybar Electric's business units, categorized by market share and growth rate, is precisely what you'll download. This ensures you get a polished, professional report that’s instantly applicable to your business planning and decision-making processes.

Dogs

Obsolete analog communication equipment represents a declining segment within the broader telecommunications market. As the industry aggressively transitions to digital and IP-based solutions, the demand for older analog systems is shrinking considerably. Graybar's involvement in this area, characterized by a low market share and virtually no growth potential, would be classified as a Dog in the BCG Matrix. Continued investment here would likely drain resources with little prospect of significant returns, making it a prime candidate for divestment or phased discontinuation.

Certain highly specialized, non-networked legacy industrial control components or parts for outdated machinery can be classified as 'Dogs' in the BCG Matrix. As industries increasingly embrace modern, integrated automation systems, the demand for these isolated, older components naturally shrinks.

Graybar Electric likely holds a minimal market share in these diminishing niches. The cost of maintaining inventory and sales efforts for these products may outweigh the revenue generated, making them prime candidates for divestiture or discontinuation to prevent them from becoming cash traps.

In segments of basic electrical supplies, where products are highly commoditized and competition centers on price, Graybar Electric might find itself with 'Dog' characteristics. This is particularly true if the market for these items is experiencing slow growth.

If Graybar can't effectively use its considerable scale or service advantages in these low-differentiation areas, these products could result in low margins and a diminished market share. For instance, reports from 2024 indicated that the electrical distribution market, while robust overall, saw intense price pressure in its more basic product categories.

Managing these 'Dog' segments requires a sharp focus on minimizing inventory and operational expenditures. This proactive approach is crucial to avoid becoming a drain on resources within Graybar's broader portfolio.

Underperforming Geographic Markets without Strategic Value

Underperforming geographic markets with limited strategic value represent areas where Graybar Electric might have a smaller footprint and sees little to no growth in demand for its main products. These locations, if they consistently fail to meet performance expectations and don't fit into the company's larger expansion or acquisition strategies, could be candidates for streamlining operations or even sale to boost overall financial health.

For instance, if a particular smaller city or region in 2024 showed a sales decline of 5% year-over-year for electrical supplies and Graybar's market share there remained below 3%, it would fit this category. Such markets might lack the potential for significant future growth or synergies with other Graybar operations, making them less attractive for continued investment.

- Stagnant or Declining Local Demand: Markets where demand for electrical products has seen minimal or negative growth, potentially due to local economic factors or demographic shifts.

- Limited Market Share: Geographic areas where Graybar's presence is small, and capturing a substantial market share is unlikely or prohibitively expensive.

- Lack of Strategic Alignment: Locations that do not contribute to Graybar's broader goals, such as expansion into new product categories, key customer segments, or emerging technological trends.

- Resource Reallocation Potential: Divesting or optimizing underperforming markets allows Graybar to redirect capital and management focus toward more promising opportunities, potentially improving overall profitability and resource efficiency.

Low-Demand, High-Inventory Stocking Units

Within Graybar Electric's product portfolio, certain stock-keeping units (SKUs) represent classic examples of low-demand, high-inventory stocking units. These are items that consistently show minimal sales volume, yet they occupy significant warehouse space and tie up valuable capital. For instance, specialized industrial connectors or outdated electrical components that have been superseded by newer technologies often fall into this category. The challenge for Graybar is that these products offer low returns on investment while incurring carrying costs, such as storage and potential obsolescence.

Managing these underperforming SKUs is crucial for optimizing Graybar's operational efficiency and financial health. In 2024, companies across the distribution sector are increasingly focused on inventory turnover ratios, with many aiming for ratios above 6. For Graybar, SKUs with significantly lower turnover rates, perhaps below 2, would be flagged. The strategic options are clear: reducing stock levels to minimize holding costs, initiating liquidation sales to recover capital, or outright discontinuing the product line to free up resources for more profitable items. This proactive approach is essential to prevent capital from being locked in slow-moving or dead inventory.

- Low Sales Volume: SKUs with less than 10 units sold per quarter in 2024.

- High Inventory Holding Costs: Items with carrying costs exceeding 15% of their value annually.

- Limited Future Growth Potential: Products lacking clear market demand or technological relevance.

- Capital Tie-Up: Inventory value that could be reinvested in faster-moving, higher-margin products.

Graybar Electric's 'Dogs' are products or market segments with low market share and little to no growth prospects. These often include obsolete analog communication equipment, specialized legacy industrial components, and highly commoditized basic electrical supplies facing intense price competition. For instance, in 2024, basic electrical items experienced significant price pressure, impacting margins for distributors like Graybar if they couldn't leverage scale effectively.

| Category | Market Share | Growth Rate | Strategic Recommendation |

| Obsolete Analog Equipment | Low | Declining | Divest or Discontinue |

| Legacy Industrial Components | Minimal | Shrinking | Minimize Inventory, Consider Divestment |

| Commoditized Basic Electrical Supplies | Low to Moderate | Slow | Focus on Efficiency, Optimize Inventory |

Question Marks

The niche market for advanced AI-specific cooling and power solutions, while a burgeoning opportunity, represents a potential Question Mark for Graybar. The demand for these specialized systems, designed to handle the immense heat and power draw of high-density AI servers, is exploding. For instance, the global data center cooling market was projected to reach $15.9 billion by 2027, with AI workloads being a significant driver of this growth.

Graybar’s position in this cutting-edge segment might be less established compared to its broader data center offerings. Capturing a larger share necessitates substantial investment in developing specialized technical expertise and forging strategic alliances with manufacturers of these often proprietary technologies. This investment is crucial to navigate the rapid technological advancements and secure a competitive foothold.

Graybar's strategic acquisitions of companies like Valin Corporation and Advantage Industrial Automation have introduced highly specialized industrial automation and robotics product lines. These new offerings, while promising high growth, currently represent question marks within Graybar's BCG matrix. The market share in these specific niches is still being established, requiring significant investment and integration efforts to potentially transition them into stars.

Graybar is investing heavily in its digital transformation, particularly with the Graybar Connect project, which focuses on upgrading its core ERP system to improve customer experience. This internal overhaul is laying the groundwork for potential external digital platforms or proprietary software services that Graybar could offer to its clients.

The success of any such external digital offerings hinges on their ability to gain market adoption and stand out from competitors. This will necessitate considerable investment in both development to create truly differentiated solutions and marketing to ensure customers are aware of and choose these new services.

Emerging Smart City Infrastructure Components (Beyond Buildings)

The broader smart city infrastructure market, extending beyond individual smart buildings to encompass areas like smart street lighting and intelligent traffic management, presents a significant growth opportunity. This sector, often characterized by complex public-private partnerships, requires specialized solutions and substantial investment for market leadership. For instance, the global smart city market was projected to reach over $2.5 trillion by 2026, indicating substantial potential for companies like Graybar.

- Smart Street Lighting: These systems offer energy savings and data collection capabilities, with the global smart street lighting market expected to grow significantly, potentially reaching tens of billions of dollars by the late 2020s.

- Intelligent Traffic Management: Solutions like adaptive traffic signals and real-time monitoring aim to reduce congestion and emissions, contributing to a growing market segment within smart cities.

- City-wide IoT Deployments: The integration of various sensors and connected devices across urban environments is a foundational element, driving demand for robust network infrastructure and management platforms.

- Public-Private Partnerships (PPPs): These collaborations are crucial for funding and implementing large-scale smart city projects, often involving long-term contracts and specialized expertise.

Microgrid & Distributed Energy Resource Components

The market for microgrids and distributed energy resources (DERs) is experiencing robust growth, fueled by increasing demand for energy resilience and sustainability initiatives. For Graybar Electric, this segment, while linked to the broader renewable energy market (a Star), represents a distinct area focusing on integrated solutions for complex microgrid deployments.

While renewables are a strong category, the specific components and specialized integration services for microgrids may currently represent a smaller market share for Graybar. Capturing this high-growth potential requires substantial investment in advanced product offerings, specialized technical knowledge, and enhanced project execution capabilities to elevate this segment to a Star performer.

Key components within this market include:

- Advanced Control Systems: Sophisticated software and hardware for managing energy flow and optimizing resource utilization within a microgrid.

- Energy Storage Solutions: Batteries, flywheels, and other technologies that store energy for later use, crucial for grid stability and reliability.

- Distributed Generation Assets: Solar panels, wind turbines, and other localized power sources that contribute to the microgrid's energy supply.

- Grid Interconnection Equipment: Specialized switchgear, transformers, and protective devices that enable safe and efficient connection to the main utility grid or islanded operation.

Graybar's potential foray into offering proprietary digital platforms or software services, stemming from its Graybar Connect initiative, currently sits as a Question Mark. The success of these ventures depends on their ability to capture market share and differentiate themselves from existing solutions.

Significant investment in both development to ensure unique offerings and marketing to drive awareness and adoption is crucial for these digital services to transition from potential growth areas to established revenue streams.

The smart city infrastructure market, encompassing smart street lighting and intelligent traffic management, represents a significant growth opportunity for Graybar. While the overall market is expanding, Graybar's specific market share within these specialized segments is still developing.

Graybar's investments in specialized areas like AI cooling and microgrids, while promising, are currently categorized as Question Marks. These segments require substantial capital and expertise to establish a dominant market position.

| Segment | Current Status | Key Considerations |

| AI-Specific Cooling & Power | Question Mark | High growth potential, but requires specialized expertise and alliances. Data center cooling market projected to reach $15.9 billion by 2027. |

| Industrial Automation & Robotics | Question Mark | New offerings from acquisitions require integration and market share development. |

| Proprietary Digital Services | Question Mark | Dependent on market adoption and differentiation; requires significant development and marketing investment. |

| Smart City Infrastructure | Question Mark | Broad market opportunity, but Graybar's specific share in niches like smart lighting and traffic management is nascent. Global smart city market projected over $2.5 trillion by 2026. |

| Microgrids & DERs | Question Mark | High growth, but specialized integration services and advanced components require investment to compete effectively. |

BCG Matrix Data Sources

Our Graybar Electric BCG Matrix is built on comprehensive market intelligence, integrating financial reports, industry research, and competitor analysis to provide strategic insights.