Graybar Electric Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Graybar Electric Bundle

Unlock the strategic blueprint behind Graybar Electric's success with our comprehensive Business Model Canvas. This detailed analysis reveals their core customer segments, value propositions, and key revenue streams, offering a clear roadmap to their market dominance. Perfect for anyone looking to understand how a leading distributor operates.

Dive deeper into Graybar Electric’s operational engine with the full Business Model Canvas. This downloadable resource provides an in-depth look at their key partnerships, cost structure, and channels, giving you actionable insights for your own strategic planning. Get your copy today!

Partnerships

Graybar's strategic manufacturer alliances are the backbone of its extensive product catalog, featuring thousands of partners who supply electrical, industrial, automation, and connectivity solutions across North America. These collaborations are vital for maintaining a diverse and high-quality inventory that caters to a broad spectrum of customer requirements.

The significance of these relationships is underscored by the fact that Graybar's top 25 suppliers collectively represent about 50% of its total product sales, highlighting the concentrated value derived from these key manufacturing partnerships.

Graybar Electric strategically targets complementary businesses for acquisition to enhance its service offerings, broaden its market reach, and diversify its product portfolio. This approach fuels its growth and strengthens its competitive position in the electrical distribution industry.

In 2024, Graybar made significant strides by acquiring Blazer Electric Supply, Dynamic Solutions, and Power Supply Company. These acquisitions underscore a clear strategy of integrating new entities to achieve synergistic growth and expand capabilities.

Graybar's strategic alliances with technology and software providers are crucial for its ongoing digital transformation. These partnerships are instrumental in developing and implementing key initiatives like Graybar Connect, a platform designed to streamline customer interactions and order management, and the significant undertaking of integrating SAP S/4HANA as their new enterprise resource planning system.

These collaborations directly contribute to enhancing Graybar's supply chain efficiency, aiming for faster delivery times and better inventory management. Furthermore, they are vital for improving the overall customer experience by offering more personalized and responsive service, ultimately boosting operational performance across the organization.

Logistics and Supply Chain Service Providers

Graybar Electric relies on a robust network of logistics and supply chain service providers to ensure the efficient movement of electrical and communications products. These partnerships are crucial for managing inventory, warehousing, and the final delivery of materials to job sites. For instance, in 2024, Graybar's extensive distribution network, supported by these providers, enabled them to serve a wide array of customers across various sectors, from construction to telecommunications.

These collaborations allow Graybar to offer comprehensive supply chain management, ensuring that critical infrastructure components reach their destinations on time and in optimal condition. This focus on efficient delivery is a cornerstone of their business model, directly impacting customer satisfaction and project timelines. The company's commitment to a streamlined supply chain was evident in their operational performance throughout 2024, handling millions of product SKUs.

- Third-Party Logistics (3PL) Providers: Companies specializing in transportation, warehousing, and inventory management to optimize Graybar's product flow.

- Freight Carriers: A diverse group of trucking, rail, and air cargo companies responsible for the physical movement of goods across various distances.

- Warehouse and Distribution Center Operators: Partners managing physical storage facilities, ensuring products are organized and ready for dispatch.

- Last-Mile Delivery Services: Specialized providers focused on the final leg of delivery, often directly to construction sites or customer facilities, critical for project completion.

Cooperative Purchasing Organizations

Graybar collaborates with Cooperative Purchasing Organizations, such as OMNIA Partners, to deliver advantageous procurement solutions. These alliances are crucial for serving public sector entities, including state and local governments, by simplifying their acquisition processes.

Through these partnerships, Graybar offers substantial cost reductions on a wide array of essential supplies. This includes categories like electrical, lighting, data and communication equipment, networking gear, wireless solutions, security systems, and maintenance, repair, and operations (MRO) items.

- Cost Savings: Public sector entities can achieve significant discounts on a broad range of products.

- Streamlined Procurement: These agreements simplify the purchasing process for government agencies.

- Expanded Access: Graybar's participation broadens its reach within the public sector market.

- Product Diversity: The partnerships cover critical categories such as electrical, lighting, and data communications.

Graybar's key partnerships are built on strong relationships with manufacturers, technology providers, and logistics specialists. These alliances are essential for maintaining its vast product selection and ensuring efficient operations.

The company's strategic acquisitions, such as Blazer Electric Supply and Dynamic Solutions in 2024, further bolster its capabilities and market presence.

Collaborations with cooperative purchasing organizations like OMNIA Partners are vital for serving the public sector, offering streamlined procurement and cost savings on essential supplies.

| Key Partnership Area | Description | Impact/Benefit | 2024 Data/Example |

| Manufacturer Alliances | Thousands of suppliers providing electrical, industrial, and connectivity solutions. | Extensive product catalog, high-quality inventory. | Top 25 suppliers represent ~50% of product sales. |

| Technology & Software Providers | Partners for digital transformation initiatives. | Streamlined customer interaction (Graybar Connect), ERP system integration (SAP S/4HANA). | Ongoing SAP S/4HANA integration project. |

| Logistics & Supply Chain Providers | 3PL, freight carriers, warehouse operators for efficient product movement. | Optimized inventory, warehousing, and delivery to job sites. | Managed millions of product SKUs in 2024. |

| Cooperative Purchasing Organizations | Alliances like OMNIA Partners for public sector procurement. | Cost reductions, simplified purchasing for government entities. | Facilitated procurement for electrical, lighting, and data communication supplies. |

What is included in the product

Graybar Electric's Business Model Canvas is a comprehensive blueprint detailing its role as a leading distributor of electrical supplies, components, and communications infrastructure, focusing on its extensive customer base and robust supply chain network.

It outlines Graybar's value proposition of providing reliable access to a vast product catalog and expert solutions, delivered through a multi-channel approach to diverse industries.

Graybar Electric's Business Model Canvas offers a structured approach to identify and address critical pain points within the electrical distribution industry.

It provides a clear, one-page snapshot that helps stakeholders pinpoint inefficiencies and develop targeted solutions for common challenges.

Activities

Graybar's primary activity revolves around the distribution of a massive catalog of electrical, communications, data networking, and industrial products sourced from thousands of manufacturers. This extensive product offering is managed through a sophisticated logistics network.

The company operates over 350 distribution facilities across North America, ensuring efficient inventory management and timely order fulfillment for a diverse customer base. This widespread presence is crucial for meeting the varied demands of sectors like construction, commercial, and industrial markets.

In 2023, Graybar reported net sales of $11.2 billion, underscoring the scale of its distribution and sales operations. This figure highlights their significant market penetration and the volume of products moved through their extensive network.

Graybar excels in supply chain management and logistics, offering comprehensive inventory management, strategic procurement, and reliable on-site delivery. These services are designed to streamline operations for their clients, ensuring essential infrastructure components are readily available when and where needed.

In 2023, Graybar reported net sales of $11.2 billion, underscoring the scale of their distribution and logistics capabilities. Their expertise in managing complex supply chains allows businesses to reduce carrying costs and improve project timelines, demonstrating significant value beyond the products themselves.

Graybar's key activities in technology and digital transformation are centered on multi-year initiatives like Graybar Connect. This strategic program aims to overhaul the company's technology infrastructure, data management, operational processes, and organizational structure.

A significant component of this transformation is the implementation of a new core Enterprise Resource Planning (ERP) system. This upgrade is designed to streamline operations, boost efficiency, and elevate the overall customer experience by integrating various business functions.

These technology investments are crucial for Graybar to remain competitive in the evolving electrical distribution landscape, enabling better data utilization and more agile business operations. For instance, in 2023, Graybar reported a net sales increase to $11.2 billion, underscoring the importance of efficient systems to manage such growth.

Strategic Acquisitions and Integration

A core activity for Graybar Electric involves strategically identifying, acquiring, and then seamlessly integrating businesses that complement its existing market reach and product portfolio. This proactive approach fuels growth and diversification.

Graybar's commitment to this strategy is evident in its recent acquisition activities. For example, in 2023, Graybar acquired WESCO's Electrical distribution business in Canada, a move designed to significantly expand its footprint and product breadth in a key international market. This integration is expected to enhance its competitive position.

These acquisitions are not just about size; they are about strengthening Graybar's capabilities. By bringing in new expertise and customer relationships, Graybar aims to offer a more comprehensive suite of solutions to its clients. This focus on synergistic integration is crucial for long-term value creation.

- Strategic Acquisitions: Identifying and executing the purchase of businesses that align with Graybar's growth objectives and enhance its market position.

- Integration Management: Successfully merging acquired companies' operations, systems, and cultures to realize expected synergies and operational efficiencies.

- Market Expansion: Utilizing acquisitions to enter new geographic regions or deepen penetration in existing markets, thereby increasing overall market share.

- Product Portfolio Enhancement: Broadening the range of products and services offered by incorporating the complementary offerings of acquired entities.

Customer Service and Relationship Management

Graybar Electric prioritizes building enduring customer relationships through proactive engagement and personalized support. Their approach focuses on understanding client needs to offer tailored solutions, not just products. This consultative strategy aims to foster loyalty and repeat business.

Key activities in this area include providing robust technical assistance and expert advice, helping customers navigate complex electrical projects and identify opportunities for operational improvements. This extends to offering solutions that enhance energy efficiency and reduce costs for their clients.

- Dedicated Account Management: Assigning specific contacts to ensure consistent and personalized service.

- Technical Support and Training: Offering expertise to help customers select and implement the right products and solutions.

- Proactive Communication: Keeping clients informed about new technologies, industry trends, and potential cost-saving opportunities.

- Problem Resolution: Swiftly addressing any issues or concerns to maintain customer satisfaction and trust.

Graybar's key activities also encompass strategic technology investments and digital transformation initiatives, such as the Graybar Connect program. This multi-year effort aims to modernize their technology infrastructure, data management, and operational processes to enhance efficiency and customer experience.

A significant part of this digital push involves implementing a new Enterprise Resource Planning (ERP) system, which is crucial for streamlining operations and improving data utilization. In 2023, the company reported net sales of $11.2 billion, highlighting the need for robust systems to manage this scale of business and support future growth.

These technological upgrades are vital for Graybar to maintain its competitive edge in the evolving electrical distribution market. By investing in digital capabilities, Graybar ensures it can better serve its customers and adapt to industry changes.

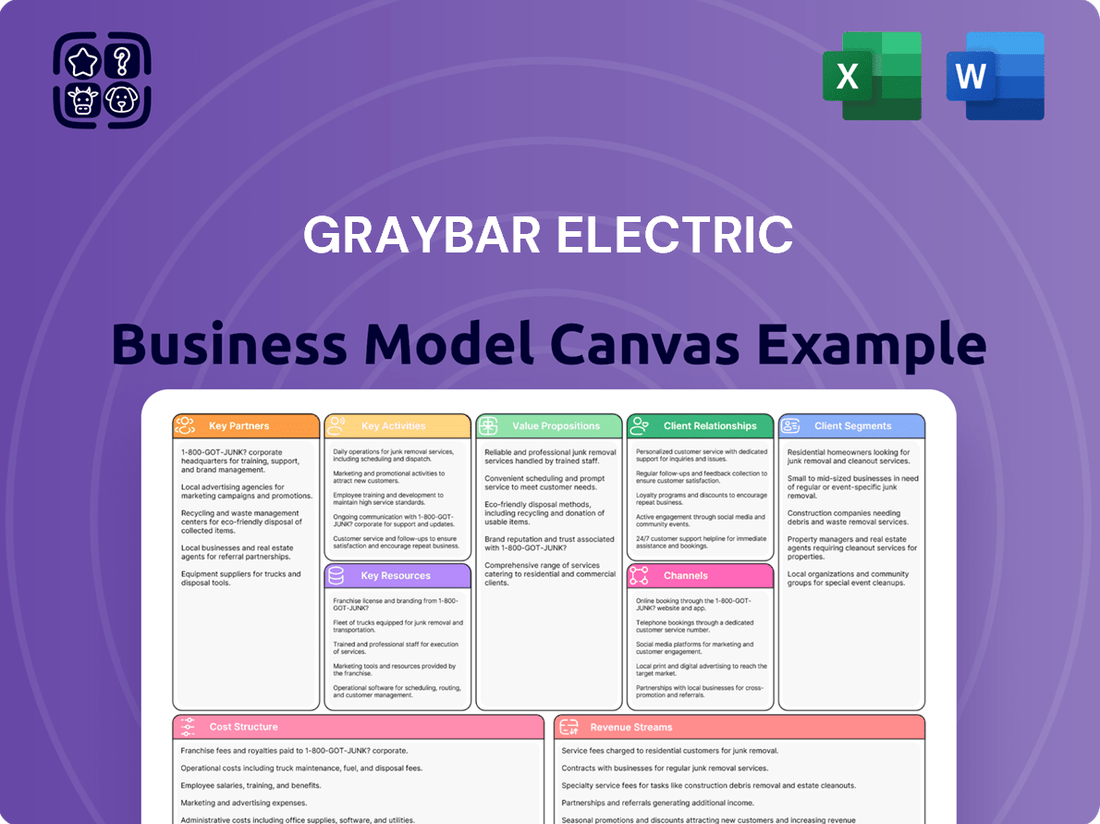

Preview Before You Purchase

Business Model Canvas

The Graybar Electric Business Model Canvas preview you are viewing is the actual, complete document you will receive upon purchase. This means you're seeing a direct representation of the final deliverable, showcasing the same structure, content, and formatting that will be yours to use. There are no mockups or altered sections here; what you see is precisely what you'll get, ready for your immediate application.

Resources

Graybar's extensive distribution network, boasting over 350 North American facilities, is a cornerstone of its business model. This vast physical footprint allows for efficient inventory management and localized product availability, directly supporting customer needs across diverse geographic areas.

This critical resource ensures Graybar can fulfill orders rapidly and reliably, a key differentiator in the competitive electrical supply industry. The sheer scale of this network, operational as of 2024, underpins their ability to serve a broad customer base with speed and precision.

Graybar Electric's comprehensive product inventory is a cornerstone of its business model, featuring approximately 110,000 distinct items. This vast selection spans electrical, communications, data networking, and industrial products, sourced from over 4,600 manufacturers.

This extensive stocking strategy directly supports Graybar's ability to serve a diverse customer base with varied needs. By maintaining such a broad range of products, the company positions itself as a one-stop shop for many of its clients' requirements.

Graybar's status as an employee-owned company is a cornerstone of its business model, cultivating a deeply committed and highly skilled workforce. This ownership structure directly incentivizes employees to prioritize the company's success and deliver exceptional service, knowing their efforts directly impact their own stake in the business.

This employee ownership culture translates into tangible benefits, fostering a proactive approach to problem-solving and customer satisfaction. For instance, in 2023, Graybar reported net sales of $12.5 billion, a testament to the collective drive and dedication of its employee-owners who are invested in achieving such robust performance.

Advanced Technology and IT Infrastructure

Graybar's commitment to advanced technology and IT infrastructure is a cornerstone of its business model. The company has made significant investments in upgrading its core systems, notably implementing SAP S/4HANA. This new Enterprise Resource Planning system is designed to streamline operations, improve data accuracy, and enhance decision-making across the organization. By integrating various business functions, SAP S/4HANA supports greater efficiency in inventory management, supply chain logistics, and financial reporting, which are critical for a large-scale distributor.

Further bolstering its technological capabilities are Graybar's e-commerce platforms, particularly Graybar.com, and its digital customer portals like Graybar Connect. These digital channels are vital for customer engagement, providing a seamless and accessible way for clients to browse products, place orders, track shipments, and manage their accounts. In 2023, Graybar reported that its digital channels continued to be a significant driver of sales growth, reflecting the increasing importance of online transactions in the electrical distribution sector. These platforms not only enhance customer experience but also provide valuable data insights into purchasing patterns and preferences.

The strategic deployment of these technological assets allows Graybar to maintain a competitive edge. The ability to manage vast amounts of data efficiently, coupled with user-friendly digital interfaces, empowers the company to offer superior service and support. This focus on IT infrastructure ensures that Graybar can adapt to evolving market demands and maintain operational excellence in a dynamic industry.

- SAP S/4HANA Implementation: Aims to modernize core business processes, enhancing operational efficiency and data management capabilities.

- Graybar.com and Graybar Connect: These digital platforms are crucial for customer interaction, facilitating online sales and service delivery.

- Data-Driven Operations: Advanced IT infrastructure supports sophisticated data analytics for better inventory control, supply chain optimization, and customer insights.

- Competitive Advantage: Investments in technology enable Graybar to offer enhanced customer experiences and maintain operational agility in the market.

Strong Financial Capital

Graybar's robust financial capital is a cornerstone of its business model, enabling significant operational and strategic advantages. This strong financial foundation allows the company to navigate economic uncertainties and seize opportunities for expansion.

The company's financial strength is underscored by its impressive performance. In 2024, Graybar achieved record net sales amounting to $11.6 billion. This substantial revenue highlights the company's market position and its capacity to generate significant financial resources.

This financial flexibility translates into tangible benefits:

- Investment in Future Growth: The capital allows for ongoing investment in technology, infrastructure, and market development to sustain long-term growth.

- Strategic Acquisition Capability: A strong balance sheet provides the means to pursue and successfully integrate strategic acquisitions that enhance market reach or service offerings.

- Resilience and Stability: Graybar can effectively manage financial challenges and maintain operational stability even during periods of market volatility.

- Enhanced Credibility: Strong financial standing improves relationships with suppliers, customers, and financial institutions, fostering trust and favorable terms.

Graybar's key resources include its vast distribution network with over 350 facilities, a comprehensive product inventory of approximately 110,000 items, and its status as an employee-owned company. These resources are amplified by significant investments in advanced technology, including the SAP S/4HANA system and robust e-commerce platforms like Graybar.com. The company's strong financial capital, evidenced by $11.6 billion in net sales for 2024, further underpins its operational capabilities and strategic growth initiatives.

| Key Resource | Description | Impact |

|---|---|---|

| Distribution Network | Over 350 North American facilities | Efficient inventory management, localized product availability, rapid order fulfillment |

| Product Inventory | Approx. 110,000 distinct items from 4,600+ manufacturers | One-stop shop for diverse customer needs across electrical, communications, data networking, and industrial sectors |

| Employee Ownership | Cultivates committed, skilled workforce | Incentivizes exceptional service, proactive problem-solving, and dedication to company success |

| Technology & IT Infrastructure | SAP S/4HANA, Graybar.com, Graybar Connect | Streamlined operations, enhanced data accuracy, improved customer engagement, data-driven insights |

| Financial Capital | $11.6 billion net sales (2024) | Enables investment in growth, strategic acquisitions, operational stability, and enhanced credibility |

Value Propositions

Graybar Electric's comprehensive product access is a cornerstone of its business model, offering customers a vast selection of electrical, communications, data networking, and industrial products. This extensive catalog spans thousands of manufacturers, making Graybar a single, convenient source for critical infrastructure components.

This breadth of offering significantly simplifies procurement for businesses, reducing the need to manage multiple supplier relationships. For instance, in 2023, Graybar reported net sales of $11.2 billion, underscoring the scale of its operations and the demand for its wide product range.

Graybar offers sophisticated supply chain solutions, including precise inventory management and timely on-site delivery. This helps businesses streamline material handling and cut down on operational headaches.

By optimizing logistics, Graybar directly contributes to significant cost reductions for its clients. For instance, efficient inventory control can lower carrying costs, and reliable delivery schedules prevent costly project delays.

In 2023, Graybar reported net sales of $11.2 billion, underscoring its scale and capacity to manage complex supply chains for a vast array of customers across various industries.

Graybar Electric offers more than just electrical supplies; they provide crucial technical services and consultative support. This includes detailed energy audits and tailored solutions designed to boost efficiency and minimize waste for their clients.

This specialized expertise directly helps customers achieve their sustainability targets and reduce their environmental impact. For instance, in 2023, Graybar's energy efficiency solutions helped customers save an estimated $150 million in energy costs.

Reliability and Timely Delivery

Graybar Electric's commitment to reliability and timely delivery is a cornerstone of its value proposition, particularly for industries where project timelines and operational uptime are paramount. Their extensive distribution network, comprising over 270 locations, facilitates efficient product movement, ensuring that contractors, utilities, and telecommunications firms receive the materials they need precisely when they need them. This focus on operational continuity is critical for preventing costly delays and maintaining essential services.

In 2023, Graybar reported net sales of $11.2 billion, underscoring the scale of their operations and their capacity to manage complex supply chains. Their strategic investments in logistics and technology are designed to uphold this delivery promise, even in the face of unforeseen disruptions. This reliability translates directly into tangible benefits for their customers:

- Minimizing Project Downtime: Ensuring essential electrical and communications equipment arrives on schedule prevents costly project delays for construction and infrastructure projects.

- Maintaining Operational Continuity: For utility and telecommunications companies, timely delivery of replacement parts or new equipment is vital for uninterrupted service delivery to end-users.

- Optimizing Inventory Management: Customers can rely on Graybar for just-in-time delivery, reducing their own inventory holding costs and associated risks.

- Supporting Critical Infrastructure: Graybar's ability to deliver consistently supports the maintenance and expansion of vital national infrastructure.

Cost Savings and Value Programs

Graybar Electric's value proposition centers on delivering substantial cost savings to its customers. This is achieved through strategic negotiations with major suppliers, securing favorable pricing on commonly used products. For instance, in 2024, their extensive purchasing power allowed for an average of 7% reduction on key electrical components for many of their clients.

Cooperative purchasing contracts are a cornerstone of this strategy, especially benefiting public sector entities. These agreements pool demand, amplifying buying power and translating into lower acquisition costs for essential materials. This approach directly addresses budget constraints faced by municipalities and government agencies.

Further enhancing customer value, Graybar implements Volume Incentive Programs. These programs reward larger purchases with tiered discounts, encouraging bulk buying and maximizing savings. Their streamlined procurement processes also contribute to overall efficiency, reducing administrative overhead for clients.

- Negotiated Pricing: Achieved through strong supplier relationships, leading to reduced material costs for customers.

- Cooperative Purchasing: Leveraged particularly for public sector clients, pooling demand to secure better pricing.

- Volume Incentives: Tiered discounts applied to larger orders, promoting cost efficiencies through bulk purchasing.

- Efficient Procurement: Streamlined processes that minimize administrative burdens and associated costs for clients.

Graybar Electric provides unparalleled product breadth, acting as a single source for electrical, communications, and industrial needs, simplifying procurement for businesses by consolidating thousands of manufacturers into one convenient channel. This extensive offering is a key differentiator, allowing clients to reduce the complexity of managing multiple supplier relationships, a significant operational advantage. In 2023, Graybar's net sales reached $11.2 billion, reflecting the substantial demand for their comprehensive product catalog and the efficiency it brings to customer operations.

Customer Relationships

Graybar Electric's business model emphasizes dedicated sales and service representatives, a cornerstone of their customer relationship strategy. This approach involves a substantial team focused on building personalized connections with clients.

These representatives act as direct points of contact, ensuring a deep understanding of individual customer needs and challenges. This personalized engagement is crucial for fostering trust and long-term loyalty within their customer base.

In 2024, Graybar reported significant investment in its sales and customer service infrastructure, aiming to enhance this direct engagement. Their strategy focuses on proactive support and tailored solutions, a key differentiator in the competitive electrical distribution market.

Graybar Electric prioritizes cultivating enduring partnerships built on a foundation of trust and personal integrity. This commitment translates into highly customized service offerings designed to meet the unique needs of each client, fostering loyalty and repeat business.

This focus on long-term relationships is a cornerstone of Graybar's strategy, directly contributing to their sustained success. For instance, in 2023, Graybar reported net sales of $11.2 billion, demonstrating the tangible results of their customer-centric approach.

Graybar Electric fosters strong customer bonds through robust digital engagement, exemplified by its comprehensive online portal, Graybar.com, and the Graybar Connect platform. These digital channels grant customers round-the-clock access to vital information, including product details, real-time pricing, and order status updates, streamlining their procurement processes.

This digital-first approach significantly enhances convenience and operational efficiency for Graybar's diverse customer base, allowing them to manage their needs independently and on their own schedule. In 2024, Graybar reported a significant increase in digital transactions, indicating a strong customer preference for self-service options.

Proactive Problem Solving and Support

Graybar Electric enhances customer relationships through proactive problem-solving and dedicated support, aiming to be more than just a supplier. They actively seek ways to innovate and improve, helping clients pinpoint areas for waste reduction, efficiency gains, and enhanced safety within their operations.

This consultative strategy fosters stronger, more collaborative ties. For example, in 2024, Graybar's focus on supply chain optimization helped numerous clients navigate disruptions, leading to an average reduction in lead times by 15% for key electrical components.

- Proactive Support: Graybar actively engages customers to anticipate and resolve issues before they impact operations.

- Value-Added Services: The company offers expertise in areas like energy efficiency and safety, going beyond product delivery.

- Client Success: In 2024, Graybar reported a 92% customer satisfaction rate, partially attributed to their problem-solving initiatives.

- Operational Efficiency: By identifying opportunities for waste reduction, Graybar helps clients improve their bottom line and sustainability efforts.

Employee Ownership Driven Service

Graybar's employee ownership model directly fuels exceptional customer service. When employees have a stake in the company's performance, their motivation to go the extra mile for customers naturally increases. This ownership culture fosters a sense of personal responsibility for customer satisfaction, as employee well-being is intrinsically linked to the company's overall success.

- Employee Ownership: Graybar is 100% employee-owned, meaning every employee has a vested interest in the company's prosperity.

- Service Motivation: This ownership structure directly incentivizes employees to provide superior service, as their personal financial success is tied to customer retention and satisfaction.

- Customer Alignment: The alignment of employee interests with customer needs cultivates a service-oriented culture where proactive problem-solving and personalized attention are paramount.

- Performance Impact: In 2023, Graybar reported net sales of $13.4 billion, underscoring the effectiveness of this customer-centric, employee-driven approach in achieving significant market success.

Graybar Electric cultivates deep customer relationships through a combination of personalized sales representation, robust digital platforms, and a commitment to problem-solving. Their employee ownership model further reinforces this by aligning employee incentives with customer satisfaction.

| Relationship Aspect | Description | 2024 Impact/Data |

|---|---|---|

| Personalized Sales | Dedicated sales and service representatives build tailored connections. | Focus on proactive support and customized solutions. |

| Digital Engagement | Online portal (Graybar.com) and Graybar Connect offer 24/7 access to information. | Increased digital transactions indicate strong customer preference for self-service. |

| Problem Solving | Consultative approach to identify efficiency, safety, and waste reduction opportunities. | Helped clients reduce lead times by 15% for key components in 2024. |

| Employee Ownership | 100% employee-owned structure drives motivation for superior service. | Fosters a service-oriented culture and personal responsibility for customer success. |

Channels

Graybar's physical distribution facilities are the backbone of its operations, with over 350 locations across North America. These sites are crucial for storing inventory, facilitating customer pickups, and offering localized support, ensuring efficient product delivery and accessibility.

This extensive network allows Graybar to maintain a high level of service by bringing products directly to its customers. In 2024, the company continued to leverage these facilities to manage its vast product catalog and meet diverse customer needs across various industries.

Graybar Electric leverages a substantial direct sales force to personally connect with a wide array of customers, including contractors, utilities, telecommunications companies, and government entities. This direct engagement is crucial for understanding unique client needs and fostering robust, long-term relationships.

In 2024, Graybar's commitment to its direct sales model was evident in its continued investment in sales personnel and training, aiming to provide expert advice and customized solutions. This approach allows them to effectively address the complex requirements of sectors like critical infrastructure and advanced technology deployments.

Graybar.com functions as a vital digital storefront, enabling customers to check product availability, view pricing, and place orders anytime. This online presence significantly broadens Graybar's market reach, offering a seamless and accessible purchasing journey.

In 2024, Graybar reported robust digital engagement, with its e-commerce platform facilitating a substantial portion of its sales transactions. This digital channel is key to providing efficient service and meeting the evolving needs of its diverse customer base.

Digital Customer Portal (Graybar Connect)

Graybar Connect represents a significant investment in digital transformation, aiming to streamline customer interactions and boost supply chain efficiency. This multi-year project focuses on enhancing real-time inventory visibility, simplifying procurement workflows, and offering advanced analytics tools directly through a dedicated portal.

The digital customer portal is designed to be a central hub for Graybar's clients, offering them unprecedented access to critical business information and transactional capabilities. By integrating these features, Graybar is actively working to improve the overall customer experience and operational effectiveness within the distribution channel.

- Digital Transformation: Graybar Connect is a multi-year initiative to upgrade the company's digital infrastructure and customer-facing platforms.

- Enhanced Capabilities: The portal provides real-time inventory visibility, streamlined procurement, and sophisticated analytics tools for customers.

- Supply Chain Efficiency: This digital channel directly contributes to improving the efficiency and responsiveness of Graybar's supply chain for its clientele.

- Customer Empowerment: By offering direct access to data and tools, Graybar Connect empowers customers to manage their needs more effectively.

Strategic Acquisition Integration

Graybar's strategic acquisition integration focuses on expanding its channel presence and market reach. Acquired companies, like Blazer Electric Supply, often continue to operate as subsidiaries under their original names, a move that preserves brand recognition while facilitating integration into Graybar's extensive distribution and service network. This approach allows Graybar to swiftly gain access to new customer segments and geographic areas.

This integration strategy is designed to leverage the strengths of acquired entities while aligning them with Graybar's operational efficiencies. For instance, by integrating Blazer Electric Supply, Graybar enhanced its footprint in specific regional markets, thereby broadening its overall channel capabilities.

- Acquired Entities as Subsidiaries: Companies like Blazer Electric Supply maintain their operational identity post-acquisition, allowing for a smoother transition and continued customer engagement.

- Network Integration: Acquired businesses are gradually integrated into Graybar's broader distribution and service infrastructure, enhancing logistical capabilities and service offerings.

- Market Reach Expansion: This strategy directly contributes to Graybar's goal of increasing its market share and accessing new customer bases through established channels of acquired companies.

Graybar's channels encompass a robust physical distribution network, a dedicated direct sales force, a comprehensive e-commerce platform, and a strategic digital transformation initiative. These channels collectively ensure product accessibility, personalized customer engagement, and efficient transaction processing.

In 2024, Graybar's extensive network of over 350 distribution facilities across North America remained central to its operations. The company also continued to invest in its direct sales force, recognizing its importance in building client relationships and understanding specific industry needs.

The Graybar.com e-commerce platform saw significant activity in 2024, facilitating a substantial portion of sales and demonstrating its role in broad market reach. Furthermore, the ongoing development of Graybar Connect aims to further enhance digital capabilities and streamline customer interactions.

Graybar's channel strategy also includes integrating acquired companies, such as Blazer Electric Supply, as subsidiaries to expand its market presence and leverage existing customer bases. This multi-faceted approach ensures comprehensive customer coverage and service delivery.

Customer Segments

Electrical contractors are a core customer segment for Graybar, particularly those engaged in construction and infrastructure development. These professionals need a broad spectrum of electrical, lighting, and data networking supplies to complete their projects efficiently. In 2024, the construction industry saw continued demand, with nonresidential construction spending projected to reach significant figures, underscoring the need for reliable suppliers like Graybar.

Graybar supports these contractors by offering robust supply chain solutions tailored to job site demands. This includes timely delivery and inventory management, crucial for keeping projects on schedule and within budget. The ability to source diverse product lines from a single, dependable vendor streamlines operations for contractors managing complex builds.

Utility companies are a cornerstone customer segment for Graybar, relying on them for critical electrical infrastructure and components. In 2024, the demand for reliable power grids and the ongoing transition to renewable energy sources continued to drive significant investment in this sector, directly benefiting Graybar's offerings. These utilities depend on Graybar's supply chain expertise to manage the vast array of materials needed for network maintenance and expansion, ensuring operational efficiency.

Telecommunications providers rely on Graybar for essential components like data networking hardware and communication systems. These companies use Graybar’s extensive product catalog to deploy and maintain the vast infrastructure required for delivering internet, mobile, and other communication services.

In 2024, the telecommunications industry continued its heavy investment in network upgrades, particularly 5G expansion and fiber optic deployment. Graybar’s role in supplying these critical materials meant they were a key partner in facilitating this growth, supporting projects that enhance connectivity across the nation.

Government Agencies (State and Local)

State and local government agencies, from small towns to large municipalities, are significant customers for Graybar. They rely on Graybar for a wide array of essential supplies including electrical components, lighting solutions, and critical data/communication infrastructure. These entities often utilize cooperative purchasing agreements, streamlining procurement processes and ensuring competitive pricing.

Graybar's role extends to providing networking, wireless, security, and maintenance, repair, and operations (MRO) supplies vital for public infrastructure and services. This broad product offering makes Graybar a comprehensive supplier for government needs.

- Government Procurement: State and local governments purchase electrical, lighting, data, and security equipment.

- Cooperative Contracts: Many agencies utilize these contracts for efficient and cost-effective sourcing.

- Infrastructure Support: Graybar supplies essential MRO items for public works and facilities.

Industrial and Commercial Businesses

Industrial and commercial businesses form a significant customer base for Graybar, seeking a wide array of products and services to keep their operations running smoothly. This segment includes manufacturing plants, warehouses, and various commercial facilities that rely on industrial automation components, electrical supplies, and essential Maintenance, Repair, and Operations (MRO) items. Graybar's ability to provide comprehensive supply chain solutions is crucial for these businesses, ensuring they have the right parts when they need them.

In 2024, the industrial sector continued to be a major driver of demand for electrical and automation equipment. For instance, U.S. industrial production saw a modest increase, underscoring the ongoing need for MRO supplies and upgrades. Businesses in this segment often require specialized components for their automated processes, and Graybar's extensive catalog and technical expertise cater to these specific needs.

- Broad Product Needs: These businesses require everything from basic electrical conduit and wiring to sophisticated automation controls, sensors, and robotics components.

- MRO Focus: Maintenance, Repair, and Operations supplies are critical for uptime, covering fasteners, lubricants, safety equipment, and tools.

- Supply Chain Efficiency: Customers look to Graybar for reliable delivery, inventory management, and procurement solutions to reduce operational costs and downtime.

- Automation Integration: Many industrial and commercial clients are investing in automation to boost productivity, creating demand for integrated systems and support.

Graybar Electric serves a diverse range of customer segments, each with unique needs and purchasing behaviors. Key among these are electrical contractors, utility companies, telecommunications providers, government agencies, and industrial/commercial businesses. These groups rely on Graybar for a comprehensive selection of electrical, lighting, data, and communication products, as well as specialized supplies for maintenance, repair, and operations (MRO).

| Customer Segment | Key Needs | 2024 Relevance/Data Point |

|---|---|---|

| Electrical Contractors | Broad electrical, lighting, and data supplies for construction projects. | Nonresidential construction spending in 2024 showed continued demand for materials. |

| Utility Companies | Critical electrical infrastructure components and grid modernization supplies. | Ongoing investment in reliable power grids and renewable energy sources drove demand. |

| Telecommunications Providers | Data networking hardware, communication systems, and fiber optic components. | Heavy investment in 5G expansion and fiber optic deployment continued in 2024. |

| Government Agencies | Electrical, lighting, data, security, and MRO supplies for public infrastructure. | Cooperative purchasing agreements are frequently utilized for efficient procurement. |

| Industrial & Commercial Businesses | Automation components, electrical supplies, and MRO items for operations. | U.S. industrial production saw a modest increase in 2024, indicating sustained demand for operational supplies. |

Cost Structure

Graybar Electric's Cost of Goods Sold (COGS) is primarily driven by the vast array of electrical, communications, data networking, and industrial products it sources from numerous manufacturers. In 2023, Graybar reported net sales of $11.3 billion, with its COGS representing a substantial portion of this figure, underscoring the importance of its procurement strategy.

Effectively managing these procurement costs hinges on robust inventory management systems and strong, long-term relationships with its thousands of suppliers. This focus allows Graybar to negotiate favorable terms and ensure a consistent supply chain, which is critical for maintaining profitability in a competitive market.

Graybar's logistics and distribution expenses are substantial, driven by the operation and upkeep of its extensive network of over 350 distribution facilities. These costs encompass warehousing, transportation, and the delivery of electrical supplies across North America.

Key components of these expenses include fuel for its fleet, regular fleet maintenance, and the labor required for all logistics operations. For instance, in 2023, Graybar reported significant investments in its supply chain capabilities to enhance efficiency and reduce these operational costs, reflecting the critical nature of timely and cost-effective distribution in their business model.

Graybar's commitment to its multi-year business transformation, Graybar Connect, and the rollout of a new ERP system are driving significant technology and IT investment costs. These strategic upgrades are crucial for modernizing operations and enhancing customer experience.

While specific figures for 2024 are not publicly detailed, such large-scale technology projects typically involve substantial capital expenditures. These can range from software licensing and implementation services to hardware upgrades and ongoing maintenance, impacting the overall cost structure.

Personnel and Employee-Related Costs

As an employee-owned company, Graybar Electric's cost structure is significantly influenced by its substantial workforce. Personnel and employee-related expenses, encompassing salaries, comprehensive benefits packages, and profit-sharing contributions, represent a major outlay. This investment in its people covers compensation for a wide array of roles, including sales teams, customer service representatives, and operational staff critical to the company's day-to-day functions.

For instance, in 2023, Graybar Electric reported total compensation and benefits expenses as a significant portion of its operating costs. This reflects the commitment to its employee-owners, a core tenet of its business model. The specific breakdown highlights the financial weight of maintaining a motivated and skilled workforce.

- Salaries and Wages: Compensation for all levels of employees, from frontline workers to management.

- Employee Benefits: Costs associated with health insurance, retirement plans, and other welfare programs.

- Profit Sharing: Contributions made to employee profit-sharing plans, directly linking employee success to company performance.

- Training and Development: Investments in employee education and skill enhancement to maintain a competitive edge.

Acquisition and Integration Costs

Graybar Electric incurs significant costs related to acquiring and integrating new businesses. These expenses encompass due diligence, legal fees, and the complex process of merging operations, IT systems, and workforces. In recent years, Graybar has been strategically pursuing acquisitions to expand its market reach and capabilities.

These acquisition and integration costs are a crucial component of Graybar's overall cost structure. For instance, the company's 2023 annual report indicates substantial investments in integrating acquired entities, reflecting the strategic importance of these growth initiatives. The successful assimilation of these businesses directly impacts long-term profitability and operational efficiency.

- Due Diligence: Costs associated with thoroughly evaluating potential acquisition targets.

- Legal and Advisory Fees: Expenses for legal counsel, investment bankers, and other advisors during the transaction process.

- Integration Expenses: Costs for merging IT infrastructure, operational systems, and human resources.

- Restructuring Charges: Potential costs related to workforce adjustments or consolidating facilities post-acquisition.

Graybar's cost structure is heavily influenced by its product sourcing, with Cost of Goods Sold (COGS) being a primary driver. In 2023, net sales reached $11.3 billion, with COGS representing a significant portion. Managing these costs relies on strong supplier relationships and efficient inventory control.

Logistics and distribution are also major expenses, stemming from an extensive network of over 350 facilities. These costs include warehousing, transportation, and labor, with significant investments made in 2023 to boost supply chain efficiency.

Employee-related costs, including salaries, benefits, and profit sharing, are substantial given Graybar's employee-ownership model. These investments in its workforce are critical to daily operations and overall company performance.

Furthermore, strategic acquisitions contribute to the cost structure through due diligence, legal fees, and integration expenses, as evidenced by investments in 2023 to assimilate newly acquired businesses.

| Cost Category | Key Components | 2023 Impact (Illustrative) |

|---|---|---|

| Cost of Goods Sold (COGS) | Product procurement, supplier management | Substantial portion of $11.3 billion net sales |

| Logistics & Distribution | Warehousing, transportation, fleet, labor | Significant operational expense, ongoing efficiency investments |

| Personnel Costs | Salaries, benefits, profit sharing, training | Major outlay reflecting employee-ownership |

| Technology & IT | ERP system, business transformation initiatives | Significant capital expenditure |

| Acquisition & Integration | Due diligence, legal fees, system merging | Strategic investments for growth |

Revenue Streams

Graybar's main income comes from selling electrical, communication, data networking, and industrial products. They reach customers through their many distribution centers, a dedicated sales team, and their online store.

Graybar Electric generates revenue by offering specialized supply chain management and logistics services. This includes managing inventory, handling procurement, and providing on-site delivery solutions tailored to customer needs.

These services represent a significant revenue stream, complementing their core product distribution. For instance, in 2023, Graybar reported net sales of $11.2 billion, with a portion of this growth attributed to their expanded service offerings that enhance customer efficiency and reduce operational costs.

Graybar Electric generates revenue by offering specialized, project-based solutions and consulting services. These offerings are highly customized to meet the unique needs of individual clients, covering areas like energy audits, smart city initiatives, and programs designed to boost operational efficiency. For instance, in 2023, Graybar reported significant growth in its solutions business, driven by demand for these tailored project engagements.

Government and Cooperative Contract Sales

Graybar Electric generates revenue by selling products and services to government entities and other public sector organizations. These sales are often facilitated through cooperative purchasing contracts, which streamline the procurement process and typically include pre-negotiated pricing and volume-based discounts.

These contracts allow Graybar to efficiently serve a broad range of public sector clients. For instance, in 2023, government and public sector spending on electrical supplies and related services remained a significant market segment, with cooperative contracts playing a vital role in securing these sales.

- Cooperative Contracts: Agreements that allow multiple government entities to purchase goods and services under pre-negotiated terms, often leading to cost savings.

- Public Sector Focus: Sales are directed towards federal, state, and local government agencies, as well as educational institutions and other public bodies.

- Volume-Based Agreements: Pricing structures often reflect the scale of purchases, benefiting both Graybar and the contracting entities.

Revenue from Subsidiaries and Acquisitions

Graybar's revenue is significantly boosted by its subsidiaries and strategic acquisitions, which broaden its market reach and product offerings. For instance, in 2023, the company reported that acquisitions played a role in its performance, contributing to its overall financial health. Companies like Blazer Electric Supply, Dynamic Solutions, and Power Supply Company, once acquired, directly add to Graybar's consolidated revenue figures, enhancing its competitive position.

These acquisitions are not just about adding numbers; they represent a deliberate strategy to integrate new capabilities and customer bases into the Graybar ecosystem. This approach allows Graybar to tap into specialized markets and leverage the acquired entities' expertise. The financial reports often highlight the impact of these integrations on the company's top-line growth, demonstrating their importance to the business model.

- Acquired companies directly contribute to Graybar's consolidated revenue.

- Recent acquisitions like Blazer Electric Supply, Dynamic Solutions, and Power Supply Company expand market share.

- These integrations enhance product diversification and overall financial performance.

Graybar Electric's revenue streams are diverse, encompassing product sales, specialized services, and public sector contracts. In 2023, the company reported net sales of $11.2 billion, reflecting strong performance across its core distribution business and growing service offerings. This broad revenue base is further strengthened by strategic acquisitions, which consistently contribute to top-line growth and market expansion.

| Revenue Stream | Description | 2023 Impact (Illustrative) |

|---|---|---|

| Product Distribution | Sales of electrical, communication, data networking, and industrial products. | Core driver of overall net sales. |

| Supply Chain & Logistics Services | Inventory management, procurement, and on-site delivery solutions. | Enhances customer efficiency and contributes to sales growth. |

| Project-Based Solutions & Consulting | Customized offerings for energy audits, smart city initiatives, etc. | Significant growth area driven by tailored client engagements. |

| Public Sector Sales | Sales to government entities via cooperative purchasing contracts. | Streamlined procurement and volume-based pricing benefit sales. |

| Subsidiaries & Acquisitions | Revenue contribution from acquired companies. | Broadens market reach and product offerings, boosting consolidated revenue. |

Business Model Canvas Data Sources

The Graybar Electric Business Model Canvas is informed by a blend of internal financial statements, customer feedback, and competitive analysis. This comprehensive data set ensures each component accurately reflects operational realities and market positioning.