Grafton Group SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Grafton Group Bundle

Grafton Group, a leader in the building materials and home improvement sectors, possesses significant strengths in its established brands and extensive retail network. However, it faces opportunities in market consolidation and potential threats from economic downturns and evolving consumer preferences.

Want the full story behind Grafton Group's strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

Grafton Group’s geographic diversification is a significant strength, with operations spanning the UK, Ireland, the Netherlands, Finland, and a recent expansion into Spain through the acquisition of Salvador Escoda. This broad international footprint acts as a natural hedge against localized economic volatility. For instance, robust performance in Ireland during 2024 helped to counterbalance weaker trading conditions experienced in other markets, demonstrating the resilience afforded by its multi-market strategy.

Grafton Group's financial health is a significant advantage, evidenced by its strong balance sheet and substantial net cash position as of the first half of 2024. This financial robustness allows the company considerable flexibility to pursue strategic growth opportunities and navigate market uncertainties.

The company's ability to convert profits into free cash flow remains impressive. In the first half of 2024, Grafton Group reported a robust free cash flow, which directly translates into its capacity to reward shareholders. This strong cash generation underpins the company's commitment to returning capital through share repurchases and dividend increases, enhancing shareholder value.

Grafton Group benefits significantly from its diversified business model, operating across distribution, DIY retail, and manufacturing. This broad operational scope allows it to cater to a wide array of customers, from trade professionals and DIY enthusiasts to general homeowners, mitigating risks associated with over-reliance on any single market segment.

Strategic Acquisitions for Growth

Grafton Group has actively pursued strategic acquisitions to fuel its growth trajectory. For instance, the acquisition of Salvador Escoda in Spain, finalized in October 2024, and HSS Hire Ireland, completed in May 2025, exemplify this proactive approach to inorganic expansion. These moves not only broaden Grafton's geographical footprint but also diversify its product and service portfolio, opening up new avenues for sustained development and market penetration.

These strategic acquisitions are instrumental in enhancing Grafton's market position. The integration of Salvador Escoda, a significant player in the Spanish market, is expected to bolster Grafton's presence in continental Europe. Similarly, the acquisition of HSS Hire Ireland strengthens its foothold in the Irish market, adding complementary services and customer bases. Such strategic integrations are key to achieving economies of scale and driving revenue growth.

- Geographic Expansion: Salvador Escoda acquisition in Spain (Oct 2024) and HSS Hire Ireland (May 2025) extend Grafton's reach into new European markets.

- Product Diversification: These acquisitions introduce new product lines and services, reducing reliance on existing offerings and creating cross-selling opportunities.

- Synergistic Growth: The integration of acquired businesses aims to achieve operational synergies, improve cost efficiencies, and enhance overall profitability, contributing to a stronger market presence.

Market Leading Brands and Operational Excellence

Grafton Group boasts a strong stable of market-leading brands, including Chadwicks and Woodie's in Ireland, and Selco Builders Warehouse in the UK. These brands are recognized for their quality and customer loyalty.

Operational excellence is a key strength, evident in Grafton's commitment to extensive product availability and superior service levels. This focus ensures a consistent and positive customer experience across all its brands.

In 2023, Grafton Group reported a revenue of £3.2 billion, underscoring the market's trust in its brands and operational efficiency. The company's strategic brand positioning allows it to command strong market share.

- Market Dominance: Leading brands like Selco in the UK and Chadwicks in Ireland provide significant competitive advantages.

- Customer Loyalty: High service levels and product availability foster strong customer relationships, driving repeat business.

- Brand Recognition: Well-established brands translate into premium pricing potential and greater market penetration.

Grafton Group’s portfolio of strong, market-leading brands represents a significant competitive advantage. Brands such as Selco Builders Warehouse in the UK and Chadwicks and Woodie's in Ireland have cultivated substantial customer loyalty and recognition. This brand equity allows Grafton to maintain strong market positions and offers potential for premium pricing, as demonstrated by its £3.2 billion revenue in 2023.

| Brand | Primary Market | Key Strength |

|---|---|---|

| Selco Builders Warehouse | UK | Dominant position in trade supplies, extensive product range |

| Chadwicks | Ireland | Leading building materials distributor, strong trade relationships |

| Woodie's | Ireland | Popular DIY and home improvement retailer, broad consumer appeal |

What is included in the product

Delivers a strategic overview of Grafton Group’s internal and external business factors, highlighting key strengths, weaknesses, opportunities, and threats.

Offers a clear, actionable framework to identify and address Grafton Group's strategic challenges and opportunities.

Weaknesses

Grafton Group faced a revenue dip in 2024, with total revenue falling 1.6% to £2.28 billion from £2.32 billion the prior year. This decline was primarily attributed to tough market conditions and price drops in the UK and Finland. These results highlight the company's susceptibility to economic downturns in these specific geographic areas.

Grafton's UK distribution business, a core component of its operations, experienced a subdued Repair, Maintenance, and Improvement (RMI) market throughout 2024. This weakness manifested as a decline in average daily like-for-like revenue for the segment.

The downturn in the RMI market can be attributed to persistently low consumer confidence and a general reluctance among households to invest in home improvement projects, directly impacting sales volumes.

Grafton Group is contending with persistent cost inflation, notably in labor expenses, which is squeezing its profitability. The company anticipates that any increases in product pricing will likely lag behind the overall rate of inflation, potentially leading to reduced profit margins.

Vulnerability to Construction Sector Cycles

Grafton Group's reliance on the construction sector makes it susceptible to economic downturns and fluctuations in building activity. For instance, a slowdown in the Dutch housing market towards the end of 2024 directly impacted demand for Grafton's materials, demonstrating this vulnerability.

This cyclicality means that periods of robust growth can be followed by sharp contractions, affecting revenue and profitability.

- Cyclical Dependency: Grafton's financial performance is closely tied to the ups and downs of the construction industry.

- Geographic Exposure: Weaknesses in specific regional markets, like the Netherlands in late 2024, underscore the impact of localized construction slowdowns.

- Project-Related Activity: Reduced investment in new building projects directly translates to lower sales volumes for the group.

Moderating Product Price Deflation Impact

While Grafton Group saw product price deflation ease in the latter half of 2024, the forecast for pricing increases remains subdued. This environment, combined with persistent cost inflation, could pressure gross margins if the company doesn't achieve a substantial uplift in sales volumes.

The company faces a challenge in maintaining profitability when input costs are rising but the ability to pass these costs onto customers through higher prices is limited. For instance, if Grafton Group's cost of goods sold increases by 3% while selling prices can only be raised by 1%, this directly impacts their margin.

- Modest Pricing Growth: The outlook for product price increases is expected to remain modest throughout 2025.

- Cost Inflation Pressure: Ongoing increases in operational and material costs continue to be a factor.

- Margin Squeeze Risk: A combination of limited pricing power and rising costs creates a risk of reduced gross margins.

- Volume Dependency: Significant volume growth is crucial to offset potential margin erosion.

Grafton Group's profitability faces pressure from persistent cost inflation, particularly in labor, with limited ability to pass these increases to customers. This dynamic, coupled with subdued product price growth forecasts for 2025, creates a risk of margin erosion, especially if sales volumes do not significantly increase to offset these pressures. The company's reliance on the construction sector also exposes it to cyclical downturns, as seen with the impact of a slowdown in the Dutch housing market in late 2024.

| Weakness | Impact | Data Point |

| Cost Inflation | Squeezed Profitability | Anticipated lag in product pricing behind overall inflation. |

| Subdued Pricing Growth | Margin Pressure | Forecasts for product price increases remain modest for 2025. |

| Cyclical Dependency (Construction) | Revenue Volatility | Slowdown in Dutch housing market impacted demand in late 2024. |

| UK RMI Market Weakness | Reduced Sales | Decline in average daily like-for-like revenue for the segment in 2024. |

What You See Is What You Get

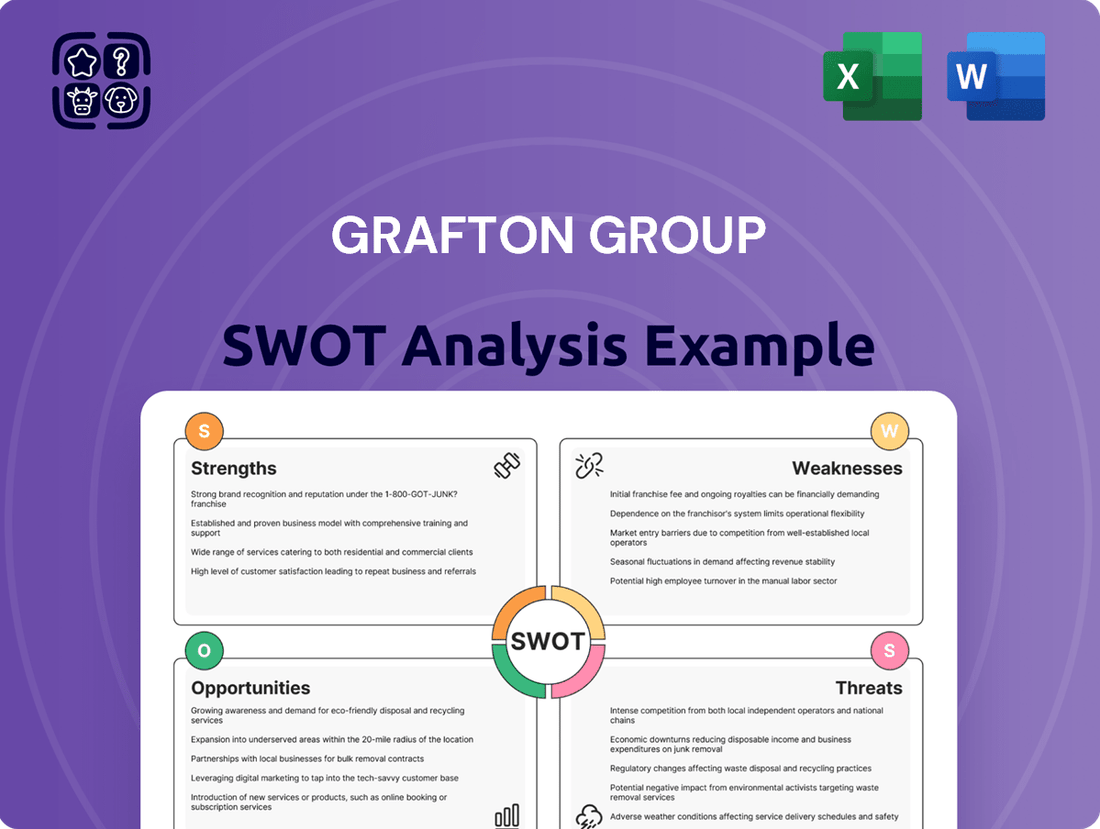

Grafton Group SWOT Analysis

This is the actual SWOT analysis document you’ll receive upon purchase—no surprises, just professional quality. It provides a comprehensive overview of Grafton Group's Strengths, Weaknesses, Opportunities, and Threats, offering actionable insights for strategic planning.

The preview below is taken directly from the full SWOT report you'll get. Purchase unlocks the entire in-depth version, detailing key factors influencing Grafton Group's market position and future growth potential.

Opportunities

Grafton Group is well-positioned to capitalize on persistent housing shortages across its operating markets, a trend anticipated to fuel sustained demand for construction materials and services through at least 2025. This fundamental imbalance between supply and demand for residential properties underpins a robust outlook for new build activity.

The company's distribution and manufacturing segments are set to benefit directly from this increased construction pipeline. For instance, the UK, a key market for Grafton, faced a deficit of approximately 1.4 million new homes as of early 2024, according to government estimates, highlighting the scale of the opportunity.

Following several years of subdued household spending on home improvements, a natural cyclical upturn in repair, maintenance, and improvement (RMI) demand is anticipated. This trend is a direct opportunity for Grafton's DIY retail and distribution segments.

For instance, in the UK, the Construction Products Association reported that RMI output was projected to grow by 2.1% in 2024, a notable shift from previous years. This recovery is expected to bolster sales for Grafton's extensive network of stores and trade counters.

Grafton's robust financial health, evidenced by its strong free cash flow conversion, positions it well for strategic growth. This financial strength allows the company to actively explore and execute both organic expansion initiatives and further strategic acquisitions.

The company is particularly focused on building scale in fragmented markets, such as the Iberian Peninsula. This strategy was notably reinforced by the recent acquisition of Salvador Escoda, a move that enhances Grafton's market presence and competitive standing in the region.

Growth in Sustainable Building Materials and Practices

Grafton Group's commitment to achieving net-zero greenhouse gas emissions by 2050, supported by its EcoVadis Silver Sustainability Rating, positions it to benefit from the increasing market for eco-friendly construction solutions. This strategic alignment with environmental goals resonates with both regulatory bodies and a growing consumer base prioritizing sustainability.

The construction sector is witnessing a significant shift towards greener materials and methods. For instance, the global green building materials market was valued at approximately USD 285.3 billion in 2023 and is projected to grow substantially, with estimates suggesting a compound annual growth rate (CAGR) of around 8-10% through 2030. This trend is driven by factors such as stricter environmental regulations, rising energy costs, and increased consumer awareness regarding the environmental impact of buildings.

Grafton Group is well-placed to leverage this trend through several avenues:

- Expanding product lines to include more recycled, low-carbon, and sustainably sourced building materials.

- Developing partnerships with manufacturers specializing in innovative green construction technologies.

- Educating customers on the benefits and availability of sustainable options, thereby driving demand.

- Integrating sustainable practices throughout its supply chain and operations to enhance its overall environmental credentials.

Positive Outlook in the Irish Market

The Irish market presents a robust opportunity for Grafton Group, underpinned by a consistently strong economic performance and a thriving construction sector. Government initiatives focused on boosting housing supply and infrastructure development are actively fueling this growth, creating a stable and expanding environment for Grafton's operations within the country.

Specifically, Ireland's GDP growth has been projected to remain healthy, with forecasts suggesting continued expansion through 2024 and into 2025, providing a solid foundation for consumer spending and investment in construction. The Irish construction sector itself is experiencing a significant uplift, driven by pent-up demand and public investment programs.

- Housing Demand: Ireland faces a considerable housing deficit, with government targets aiming to deliver tens of thousands of new homes annually, directly benefiting building material suppliers like Grafton.

- Infrastructure Investment: Significant public funding is allocated to infrastructure projects, including transportation and utilities, creating ongoing demand for construction services and materials.

- Economic Resilience: Despite global economic uncertainties, Ireland has demonstrated remarkable economic resilience, supported by its strong export sector and foreign direct investment, which indirectly bolsters domestic construction activity.

Grafton Group can capitalize on the growing demand for sustainable building solutions, a market projected for significant expansion. The company's focus on eco-friendly products and practices aligns with increasing regulatory and consumer preferences for green construction.

The company's strategic acquisitions, such as the recent purchase in the Iberian Peninsula, enhance its market position and provide avenues for further growth in fragmented regions. This expansion strategy, coupled with a strong financial footing, enables Grafton to pursue both organic development and targeted M&A activities.

| Market Segment | Key Opportunity | Supporting Data (2024/2025 Projections) |

|---|---|---|

| Housing Shortages | Sustained demand for new builds | UK housing deficit ~1.4 million homes (early 2024) |

| RMI Sector | Cyclical upturn in home improvement | UK RMI output projected 2.1% growth (2024) |

| Green Construction | Increasing market for eco-friendly solutions | Global green building materials market valued ~$285.3 billion (2023), ~8-10% CAGR projected |

| Iberian Peninsula | Building scale in fragmented markets | Acquisition of Salvador Escoda enhancing presence |

| Irish Market | Strong economic and construction sector growth | Healthy GDP growth projections for Ireland through 2025 |

Threats

Grafton Group is navigating a landscape of persistent economic uncertainty, with particularly sluggish growth observed in crucial markets like the UK and Finland. This economic climate, characterized by what some analysts describe as 'insipid' growth, directly impacts consumer confidence and the willingness of businesses to invest, potentially dampening demand for Grafton's products and services.

Spikes in global uncertainties, as seen in May and June 2025, can rapidly affect customer confidence and alter trading patterns for Grafton Group. These unpredictable external shocks can cause abrupt changes in the market demand for building materials, impacting sales volumes and revenue streams.

Despite generally positive long-term market fundamentals, Grafton Group's construction supply expansion faces hurdles from external constraints. Planning delays, a perennial issue, can significantly slow down project timelines. For instance, in the UK during 2024, average planning approval times remained a concern, impacting the speed at which new developments can commence.

Furthermore, securing timely utility connections, such as electricity and water, continues to be a bottleneck for many construction sites. This is exacerbated by ongoing labor shortages across various trades, a trend expected to persist into 2025. These combined factors can directly impede project progress and consequently moderate the demand for construction materials that Grafton Group supplies.

Intense Competitive Landscape

Grafton Group faces a highly competitive market, contending with major players such as CRH Plc, Kingfisher Plc, Hornbach Holding AG & Co KGaA, and Travis Perkins Plc. This intense rivalry can exert considerable pressure on pricing strategies and market share, necessitating ongoing improvements in operational efficiency and a commitment to innovation to maintain a competitive edge.

The UK building materials and home improvement sectors, where Grafton primarily operates, are characterized by established brands and significant market penetration by competitors. For instance, in the fiscal year ending December 2023, Kingfisher Plc reported revenue of £13.0 billion, highlighting the scale of operations of key rivals.

- Intense Rivalry: Grafton competes with large, well-established companies like CRH Plc and Kingfisher Plc.

- Pricing Pressure: The competitive landscape often leads to price wars, impacting profit margins.

- Market Share Dynamics: Maintaining and growing market share requires continuous investment in customer service and product offerings.

- Operational Efficiency: Competitors' scale can allow for greater purchasing power and economies of scale, demanding Grafton to optimize its own operations.

Potential Impact of Trade Tariffs

The imposition of trade tariffs, particularly by major economies like the United States, presents a significant threat to Grafton Group. Given its substantial operational footprint in Ireland, any broad-based trade policy shifts could indirectly impact market conditions and investment appetite within the region. For instance, a slowdown in the broader Irish economy due to external trade disputes could dampen consumer spending on home improvement products, a core segment for Grafton.

These external pressures can also influence future strategic investment decisions for Grafton. Uncertainty stemming from evolving trade landscapes might lead to a more cautious approach regarding capital expenditure or expansion plans, especially in markets directly or indirectly affected by tariff regimes. The potential for retaliatory tariffs could also disrupt supply chains for building materials and fixtures, increasing costs for Grafton and potentially impacting its pricing strategies.

The specific impact on Grafton Group's Irish operations can be illustrated by considering the broader economic outlook. For example, if US tariffs lead to a contraction in global trade, Ireland, as an open economy, could experience reduced export demand and slower GDP growth in 2024-2025. This economic deceleration would naturally translate into a more challenging operating environment for retailers like Grafton.

Key considerations regarding trade tariffs for Grafton Group include:

- Increased operational costs: Tariffs on imported raw materials or finished goods could raise Grafton's cost of sales.

- Reduced consumer demand: A weaker Irish economy due to trade disputes might lead to lower discretionary spending on home improvement.

- Supply chain disruptions: Tariffs can complicate sourcing and increase lead times for essential products.

- Uncertainty in investment planning: Volatile trade policies may necessitate a more conservative approach to capital allocation and expansion.

Grafton faces significant threats from intense competition, particularly from established players like CRH Plc and Kingfisher Plc, whose substantial revenues, such as Kingfisher's £13.0 billion in FY2023, exert considerable pricing pressure. This rivalry necessitates continuous operational efficiency improvements and innovation to maintain market share. Furthermore, persistent economic uncertainty and sluggish growth in key markets like the UK and Finland dampen consumer confidence and business investment, directly impacting demand for Grafton's products and services.

External constraints, including planning delays and utility connection bottlenecks, continue to impede construction project timelines, affecting the demand for building materials. Labor shortages, a trend expected to persist into 2025, further exacerbate these project delays. The imposition of trade tariffs by major economies also poses a risk, potentially increasing operational costs, disrupting supply chains, and reducing consumer demand in markets like Ireland, which is an open economy sensitive to global trade shifts.

| Threat Category | Specific Threat | Impact on Grafton | Example/Data Point |

|---|---|---|---|

| Competition | Intense Rivalry | Pricing pressure, market share erosion | Kingfisher Plc FY2023 Revenue: £13.0 billion |

| Economic Conditions | Sluggish Growth (UK, Finland) | Reduced consumer confidence, lower demand | Persistent economic uncertainty in key markets |

| Operational Constraints | Planning Delays & Utility Issues | Slower project timelines, moderated demand | UK planning approval times remain a concern (2024) |

| Trade Policy | Imposition of Tariffs | Increased costs, supply chain disruption | Potential impact on Irish economy due to global trade disputes |

SWOT Analysis Data Sources

This SWOT analysis for Grafton Group is built upon a foundation of comprehensive financial reports, detailed market intelligence, and insights from industry experts. These sources provide a robust understanding of the company's performance and its operating environment.