Grafton Group Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Grafton Group Bundle

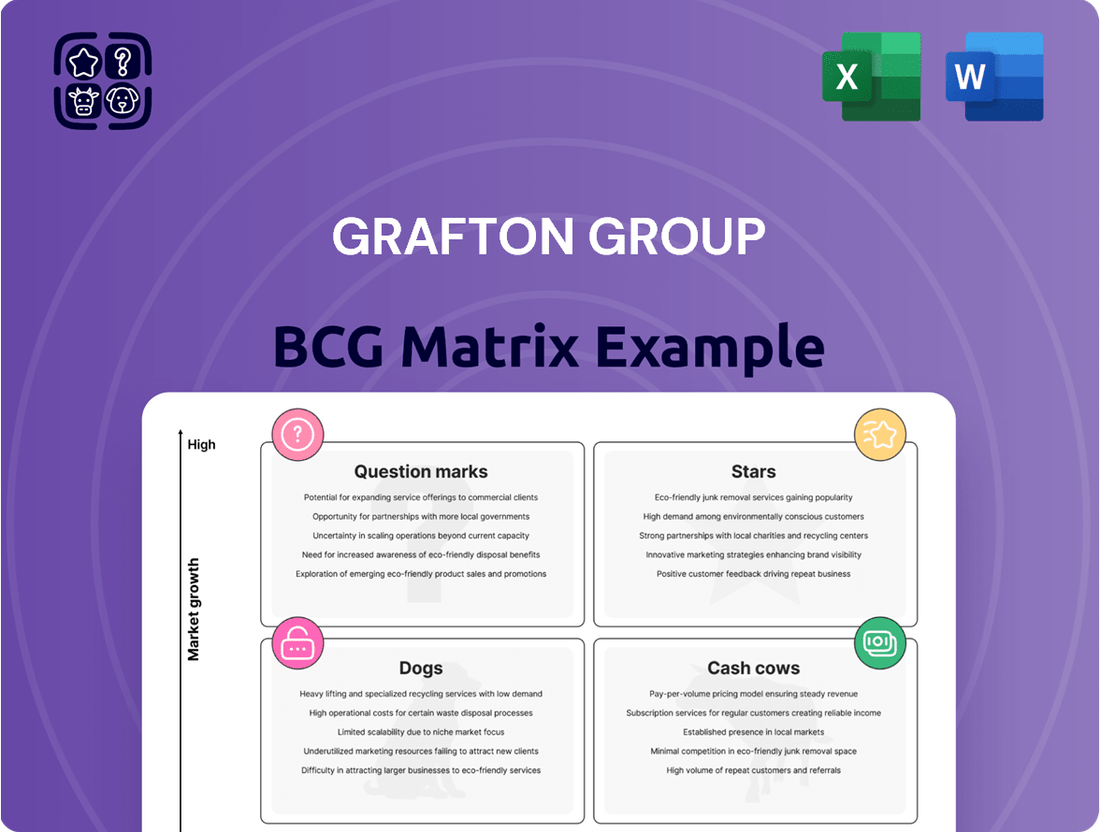

Uncover the strategic positioning of Grafton Group's product portfolio with our comprehensive BCG Matrix analysis. See at a glance which segments are driving growth, which are generating steady income, and which require careful consideration. This preview offers a glimpse into the power of understanding your market share and growth potential.

Dive deeper into this company’s BCG Matrix and gain a clear view of where its products stand—Stars, Cash Cows, Dogs, or Question Marks. Purchase the full version for a complete breakdown and strategic insights you can act on.

Stars

Salvador Escoda, acquired in October 2024, represents a strategic move by Grafton Group into Spain's burgeoning HVAC, water, and renewable products market. This acquisition immediately positions Grafton within a sector characterized by significant growth and fragmentation.

The Spanish entity, Salvador Escoda, boasts a robust market standing, which is crucial for Grafton's expansion. Its contribution to Grafton's revenue in early 2025 is expected to be substantial, reflecting the platform's strong performance and Grafton's successful integration strategy.

This investment underscores Grafton's ambition to establish and fortify a leading presence in this dynamic and expanding European market. Salvador Escoda's integration is a key pillar in achieving this objective.

Woodie's, a key player in Irish retailing, is performing exceptionally well. In the first four months of 2025, it achieved a 10% like-for-like revenue increase, reflecting strong consumer spending in Ireland.

Its prominent brand, especially in home and garden segments, suggests a leading market position within a thriving Irish retail landscape. This robust performance solidifies its standing as a 'Star' in the BCG matrix, supported by a positive economic outlook for Ireland.

Chadwicks, Grafton Group's Irish distribution arm, is a strong performer, demonstrating consistent like-for-like revenue growth. Early 2025 saw a 3.5% increase, followed by 3.7% in the first half of the year. This success is fueled by a favorable construction market in Ireland, supported by government initiatives for housing and infrastructure.

Manufacturing Segment (CPI EuroMix)

Grafton's manufacturing segment, notably CPI EuroMix, has demonstrated robust performance. In the first quarter of 2025, average daily like-for-like revenue saw a healthy increase of 6.5%. This positive trend continued into the first half of 2025, with a 5.2% rise in the same metric.

This growth is underpinned by increasing demand from housebuilding clients, reflecting a gradual recovery in the new housing market. The segment benefits from its specialized product range and established market positions within specific niches, which are key drivers for its high growth and market share.

- Strong Revenue Growth: CPI EuroMix achieved 6.5% like-for-like revenue growth in Q1 2025 and 5.2% in H1 2025.

- Market Drivers: Increased volumes from housebuilders in a recovering new housing sector are fueling this expansion.

- Competitive Advantage: Specialized products and strong niche market positions contribute to high growth and market share.

Strategic Acquisitions for Growth

Grafton's strategic acquisitions are a key element in its growth strategy, aiming to build new business areas. By targeting fragmented and growing markets, Grafton seeks to establish strong footholds. The acquisition of Salvador Escoda, for instance, highlights this strategy by expanding geographic reach and targeting high-growth segments.

This proactive acquisition approach is designed to secure leading positions in niche markets, anticipating future leadership opportunities. These moves are crucial for diversifying Grafton's operations and enhancing its competitive landscape.

- Acquisition of Salvador Escoda: This move in 2023 expanded Grafton's presence in Spain and Portugal, adding to its existing UK and Ireland operations.

- Focus on Fragmented Markets: Grafton actively seeks opportunities in markets where consolidation is possible, allowing for rapid market share gains.

- Geographic Diversification: Acquisitions like Salvador Escoda are instrumental in reducing reliance on any single geographic region.

- Bolt-on Acquisitions: These smaller, targeted acquisitions complement existing businesses, adding capabilities or market access.

Woodie's stands out as a 'Star' within Grafton Group's portfolio, demonstrating exceptional performance in the Irish retail market. Its like-for-like revenue growth of 10% in the first four months of 2025 highlights strong consumer demand and a leading market position, particularly in home and garden sectors. This robust performance is bolstered by a positive economic outlook for Ireland, solidifying Woodie's status as a high-growth, high-market-share business.

What is included in the product

Highlights which Grafton Group units to invest in, hold, or divest based on market share and growth.

A clear Grafton Group BCG Matrix visually clarifies which business units are cash cows needing minimal investment, alleviating the pain of resource allocation confusion.

Cash Cows

Within Grafton Group's UK Distribution segment, core brands like Selco, MacBlair, Leyland, and TG Lynes are crucial revenue generators. These businesses are likely to hold strong market positions and produce consistent cash flow, even amidst economic headwinds, owing to their established presence and customer loyalty.

For instance, Selco, a leading builder’s merchant, reported significant growth in recent years, contributing substantially to Grafton's overall performance. In 2023, Grafton Group reported total revenue of £3.2 billion, with the UK Distribution segment playing a vital role in this figure, underscoring the importance of these established brands.

Grafton Group's ability to generate strong free cash flow is a key indicator of its financial health. In 2024, the company achieved a remarkable £178.2 million in free cash flow, with an impressive 100% conversion rate from profit to cash. This means that for every pound of profit earned, a pound of cash was generated, highlighting exceptional operational efficiency.

This robust cash generation capability is a hallmark of mature and well-established businesses that possess strong market positions. It provides Grafton with the financial flexibility to reward shareholders through dividends and share buybacks. The consistent and high conversion rate underscores the underlying financial strength derived from its efficient and stable operations.

Grafton Group's diversified geographic presence, including the UK, Ireland, and the Netherlands, alongside a broad customer base encompassing trade, DIY, and homeowners, underpins its Cash Cow status. This wide reach significantly stabilizes revenue streams, as downturns in one region or customer segment are often offset by strength in others. For instance, in 2023, Grafton's total revenue reached £3.4 billion, demonstrating the resilience provided by this multi-faceted approach.

Netherlands Distribution (Isero/Polvo)

Isero/Polvo stands out as a dominant force in the Dutch building materials distribution market, a mature segment within Europe. Its leadership position suggests a substantial market share, translating into consistent and robust cash flows.

While the Dutch construction market's growth might be steady rather than explosive, projections for 2025 indicate an improving trend. This positive outlook, coupled with Isero/Polvo's established efficiency, underpins its status as a cash cow for the Grafton Group.

- Market Leadership: Isero/Polvo holds a leading position in the Netherlands building materials distribution sector.

- Mature Market Dynamics: Operates within a developed European market, characterized by stable demand.

- Profitability: High market share and operational efficiency likely yield strong profit margins and reliable cash generation.

- Positive Outlook: The Dutch construction sector is expected to see improved performance in 2025, benefiting Isero/Polvo.

Operational Excellence and Cost Discipline

Grafton Group's established businesses are true cash cows, consistently generating substantial profits through a relentless focus on operational excellence. This means they are exceptionally good at running their day-to-day operations smoothly and efficiently.

A key element of this success is their active management of gross margin, ensuring they get the most value from what they sell. Coupled with tight cost control, this disciplined approach allows these mature segments to maintain high profit margins, even when market growth slows down.

For instance, in 2024, Grafton Group reported strong financial performance, with its mature businesses being significant contributors to overall profitability. This highlights their ability to maximize efficiency and profitability within these established operations.

- Operational Excellence: Grafton prioritizes efficient operations in its mature businesses.

- Gross Margin Management: Actively works to optimize the difference between revenue and cost of goods sold.

- Cost Discipline: Implements strict cost control measures to boost profitability.

- Cash Generation: These factors ensure consistent, significant cash flow even in slower growth markets.

Grafton Group's mature, market-leading businesses function as its cash cows, reliably generating substantial profits and consistent cash flow. These operations excel through meticulous gross margin management and stringent cost control, ensuring high profitability even in stable or slower-growing markets.

For example, Selco, a key player in the UK builder's merchant sector, exemplifies this. In 2024, Grafton Group reported a remarkable £178.2 million in free cash flow, with a 100% conversion rate from profit to cash, a testament to the efficiency of these established units. This strong cash generation allows for shareholder returns and reinvestment.

The Dutch market, served by Isero/Polvo, also represents a significant cash cow. Despite being a mature market, Isero/Polvo's leading position and operational efficiency contribute robustly to Grafton's financial health. Projections for 2025 suggest an improving Dutch construction market, further bolstering the cash cow status of this segment.

| Business Segment | Market Position | Cash Flow Generation | Key Drivers |

|---|---|---|---|

| UK Distribution (Selco, MacBlair) | Strong, established | Consistent, high | Market leadership, customer loyalty, operational efficiency |

| Netherlands Distribution (Isero/Polvo) | Leading | Robust | Dominant market share, mature market stability, efficiency |

Full Transparency, Always

Grafton Group BCG Matrix

The Grafton Group BCG Matrix preview you are currently viewing is the exact, unadulterated document you will receive immediately after purchase. This comprehensive analysis, meticulously crafted by industry experts, will be delivered to you in its final, fully formatted state, ready for immediate strategic application. Rest assured, there are no watermarks, demo content, or hidden surprises; you are seeing the complete, professional-grade report that will empower your business decisions.

Dogs

The UK Repair, Maintenance, and Improvement (RMI) market, a segment where Grafton Group operates, has shown signs of weakness. In 2024, the UK Distribution sector specifically saw a 5.9% drop in like-for-like revenue, pointing to a subdued demand environment.

This trend suggests a low-growth market. For Grafton, this could mean that some of its UK-based RMI operations, especially those that are less specialized or smaller in scale, might be struggling with market share and consequently, generating substantial returns.

Grafton's Finnish operations are currently facing headwinds due to economic weakness. Sales saw a decline in 2024, and the first half of 2025 continued this trend with a 4.2% drop in average daily like-for-like revenue. This performance suggests these units might be struggling to maintain momentum in a challenging market.

While modest economic growth is anticipated for Finland, Grafton's position within specific market segments is crucial. If their market share isn't leading in these areas, the Finnish operations could be classified as question marks in the BCG matrix, necessitating a strategic review to determine their future viability and potential for growth.

Underperforming niche product lines within Grafton Group's broad distribution network could be categorized as Dogs. These are segments that experience persistent price deflation or consistently low demand, lacking a distinct competitive edge. For instance, if a specific range of specialized building materials, perhaps those with declining construction relevance, faces intense price competition and shrinking customer interest, it would fit this profile.

Such product lines can become a drain on resources, tying up capital without generating sufficient returns. In 2024, a hypothetical scenario might see a particular line of traditional joinery supplies, for example, experiencing a 5% year-on-year decline in sales volume due to shifts towards pre-fabricated components, while also facing a 3% price reduction from competitors, leading to a negative growth rate and low profitability.

Less Efficient Legacy Branches

Less Efficient Legacy Branches represent older or underperforming locations within Grafton Group's network. These might be found in markets that are not growing or are intensely competitive, making it difficult for them to thrive.

These branches could be consuming resources without generating significant returns, potentially impacting the group's overall financial health. Grafton Group's strategy to modernize its branches indicates a move to improve the efficiency and profitability of its entire network.

- Stagnant Market Presence: Older branches in mature or declining local markets may struggle to attract new customers or increase sales volume.

- Suboptimal Investment Returns: These units might demand substantial capital for upgrades or operational improvements that yield only modest financial benefits.

- Competitive Disadvantage: Legacy branches may lack the modern amenities, product range, or operational efficiency to compete effectively against newer, more agile rivals.

- Impact on Profitability: Their lower revenue generation and potentially higher operating costs can dilute the profitability of the broader Grafton Group.

Segments with Persistent Volume Declines

Grafton Group's portfolio likely contains segments experiencing persistent volume declines. These are businesses that consistently show negative like-for-like volume growth across multiple reporting periods. Such underperforming units, particularly if they aren't market leaders, are categorized as 'Dogs' in a BCG Matrix analysis.

These 'Dog' segments drain valuable resources, including capital and management attention, without offering significant contributions to overall growth or generating substantial positive cash flow. Their continued operation often hinders the performance of stronger business units within the group.

For Grafton Group, identifying these 'Dogs' is crucial for strategic decision-making. Potential actions include:

- Divestiture: Selling off these underperforming units to focus resources on more promising areas.

- Restructuring: Implementing significant operational changes to improve efficiency and potentially revive growth, though this often involves substantial investment and risk.

- Harvesting: Minimizing investment and extracting remaining value before eventual closure.

While specific Grafton Group segment data for 2024 regarding persistent volume declines isn't publicly detailed in a way that directly maps to a BCG Matrix 'Dog' classification without further analysis, the general principle applies. Companies of Grafton's scale often manage diverse portfolios where some segments naturally mature or face competitive pressures leading to volume erosion.

Segments within Grafton Group that exhibit low market share in low-growth industries are classified as Dogs. These are typically characterized by stagnant or declining sales volumes and profitability, often due to intense competition or changing consumer preferences.

For example, a niche product line facing persistent price deflation, like traditional hardware supplies in a market shifting towards integrated smart home solutions, would fit this 'Dog' profile. Such units consume resources without generating significant returns, impacting the overall financial health of the group.

Grafton's 2024 performance in the UK Distribution sector, which saw a 5.9% drop in like-for-like revenue, highlights a subdued demand environment that could push certain segments into the 'Dog' category if they lack competitive differentiation.

These underperforming units require careful strategic management, which could involve divestiture, restructuring, or a harvesting approach to minimize resource drain and optimize the overall portfolio.

Question Marks

The acquisition of HSS Hire Ireland, completed in May 2025, positions Grafton Group within the Irish tool hire sector, a relatively new market for the company. While the Irish construction industry is projected for robust growth, with a forecast of 4.5% expansion in 2024 according to the CIF, Grafton's current market share in this niche is nascent and small.

This venture into tool hire presents a high-growth opportunity for Grafton Group, aligning with the positive trajectory of the Irish construction market. However, achieving a significant market presence will necessitate substantial capital investment to build scale and competitive advantage.

Grafton Group's strategy involves actively opening new branches and enhancing existing ones, a move particularly evident in burgeoning markets like Ireland. These new locations, while representing significant investment, begin with a modest market share in their immediate areas.

The company's investment in these new branches, coupled with strategic marketing efforts, aims to cultivate them into future high-growth 'Stars' within the BCG matrix. For instance, Grafton reported a 10.1% increase in revenue for its UK & Ireland division in the first half of 2024, signaling successful expansion and market penetration in key regions.

Grafton Group's digital transformation initiatives, focusing on IT infrastructure and customer experience, are geared towards expanding its digital sales channels and boosting operational efficiency. These efforts are crucial as the building materials market increasingly moves online, presenting high-growth potential.

While these digital ventures represent significant growth opportunities, Grafton's current market share in purely online sales may still be relatively modest. This suggests a need for substantial investment to capture a larger portion of this rapidly expanding digital market.

Future Bolt-on Acquisitions in New Niches

Grafton actively explores bolt-on acquisitions to expand into new product categories or specialized sub-sectors within construction and home improvement. These strategic moves aim to tap into high-growth niches, positioning Grafton to capture emerging market opportunities. For instance, a potential acquisition in the sustainable building materials sector in 2024, a market projected to grow significantly, would likely see Grafton entering with a nascent market share but targeting substantial future expansion.

These future ventures would typically begin with a low market share in their specific niches but are strategically chosen for their high-growth potential. This aligns with the characteristics of a 'Star' in the BCG matrix, albeit with the inherent uncertainty of new market entries. Grafton's approach involves identifying these nascent, high-potential areas, much like their recent expansion into modular construction components, a segment experiencing robust demand.

- Expansion into sustainable building materials: Grafton could acquire companies specializing in eco-friendly insulation or recycled construction products, tapping into a market driven by environmental regulations and consumer preference.

- Entry into smart home technology integration: Acquiring a firm that offers smart home installation services or smart building components would position Grafton in a rapidly evolving, high-growth segment.

- Focus on specialized renovation services: Targeting niche renovation markets, such as historic property restoration or energy-efficient retrofitting, could offer high margins and specialized expertise.

Sustainability-Focused Product Offerings and Services

Grafton Group's commitment to net-zero emissions by 2050 and enhanced ESG efforts directly fuels the development of sustainability-focused product offerings. This includes a growing range of eco-friendly building materials and services, tapping into an expanding market segment. While Grafton's current market share in these emerging sustainable areas may be modest, the significant growth potential necessitates strategic investment to secure future demand and establish market leadership.

The company's strategic focus on sustainability is evident in initiatives aimed at reducing its environmental footprint across operations. This aligns with broader industry trends and increasing consumer demand for greener building solutions. Grafton's investment in research and development for sustainable materials is crucial for capturing this evolving market.

- Market Growth: The global green building materials market is projected to reach USD 400 billion by 2027, indicating substantial growth potential for Grafton's sustainable product lines.

- ESG Integration: Grafton's ESG targets, such as reducing Scope 1 and 2 emissions by 50% by 2030, directly support the business case for sustainable product development.

- Innovation Investment: Allocating capital towards R&D for recycled content materials and energy-efficient building components will be key to capturing market share.

- Competitive Landscape: While currently a nascent area, competitors are also investing in sustainable offerings, making early market entry and product differentiation vital.

Question Marks represent new ventures or product lines with low market share but operating in high-growth industries. Grafton's expansion into the Irish tool hire market via HSS Hire Ireland, despite its nascent market share, exemplifies this category due to the Irish construction sector's projected 4.5% growth in 2024. Similarly, their digital sales channel development, while promising, starts with a modest share in a rapidly expanding online market.

BCG Matrix Data Sources

Our Grafton Group BCG Matrix is built on comprehensive data, integrating company financial reports, market research, and industry growth trends for accurate strategic insights.