Grafton Group PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Grafton Group Bundle

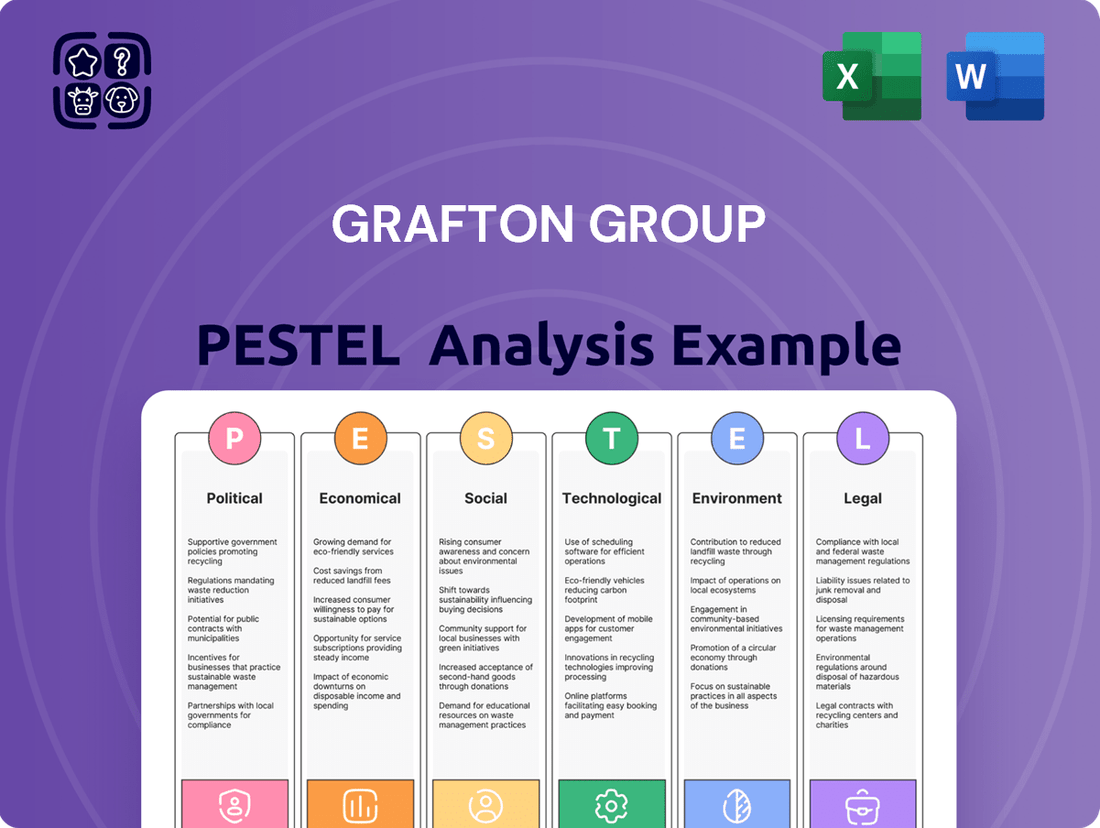

Navigate the complex external environment impacting Grafton Group with our comprehensive PESTLE analysis. Understand the political, economic, social, technological, legal, and environmental factors shaping their strategic landscape. Gain a competitive advantage by leveraging these insights for your own market planning. Download the full report now for actionable intelligence.

Political factors

The UK government's commitment to building 1.5 million new homes by the mid-2020s, supported by planning reforms and brownfield development, directly boosts demand for building materials. This ambitious target is a key driver for distributors like Grafton Group.

In Ireland, ongoing government support for housing supply and infrastructure projects creates a favorable environment for Grafton's business. These initiatives translate into sustained demand for construction materials and services across the island.

Upcoming building safety regulations, like the UK's Building Safety Levy slated for Autumn 2025, are set to significantly influence the construction sector. These new rules will mandate more stringent material testing and demand enhanced transparency in how building safety is managed.

The financial implications are considerable, with expectations of increased costs for compliant materials and adherence to new standards. For instance, the Building Safety Levy is anticipated to add an average of £3,000 to £10,000 per unit for new developments, impacting overall project budgets.

However, these regulatory shifts also present opportunities. Companies that can supply materials meeting the elevated safety benchmarks or offer innovative compliance solutions may find themselves in a stronger market position.

The political climate in Grafton Group's primary markets, especially the UK, presents potential for volatility. A general election, anticipated in late 2024 or early 2025, could significantly alter government policies and influence investor sentiment, impacting sectors like construction and retail where Grafton operates.

While Grafton demonstrated resilience through 2024's economic headwinds, the pace of market recovery is closely tied to overall political and economic stability. For instance, the UK construction sector, a key market for Grafton, is sensitive to government spending and regulatory frameworks, which can shift with political changes.

Grafton's growth trajectory relies on policy consistency, particularly regarding housing and infrastructure investment. Clear and sustained government support for the construction industry, as seen in previous years' initiatives, is vital for maintaining momentum and fostering investor confidence in the sector's long-term prospects.

Trade Policies and Tariffs

Global trade policy shifts, including potential US tariffs on construction materials, present a significant risk to the Irish economy and, by extension, Grafton Group's operations. These tariffs could directly inflate the cost of essential building supplies, impacting project budgets and potentially delaying investment decisions. For instance, a hypothetical 10% tariff on imported steel could add millions to large-scale construction projects.

While Grafton Group has a generally optimistic medium-term outlook, these trade uncertainties introduce volatility. The risk of increased material costs and disruptions to supply chains necessitates careful strategic planning and proactive procurement strategies to mitigate potential impacts on project timelines and profitability. The company's reliance on imported materials makes it particularly susceptible to such policy changes.

- Tariff Impact: Potential US tariffs on key construction materials could increase Grafton Group's procurement costs.

- Supply Chain Risk: Trade policy changes can lead to disruptions in the availability and timely delivery of essential materials.

- Investment Uncertainty: Global economic and political instability can influence future investment decisions for large projects.

- Strategic Monitoring: Continuous monitoring of international trade policies is crucial for effective risk management and operational planning.

EU Policy on Sustainable Construction

The European Green Deal, a cornerstone of EU policy, is significantly reshaping the construction sector. It champions sustainable practices and circular economy principles, pushing for reduced environmental footprints in buildings. This translates into a growing demand for recycled, bio-based materials and stricter standards for material efficiency, impacting product development and operational strategies for companies like Grafton Group.

By 2025, the EU aims to boost the renovation rate of buildings by 2% per year to accelerate energy efficiency upgrades. This directive, coupled with the push for sustainable materials, presents both challenges and opportunities for Grafton Group. For instance, the EU's Circular Economy Action Plan targets increasing the use of recycled materials in construction, with specific goals for concrete and other building components.

- EU Green Deal Targets: Focus on reducing carbon emissions in buildings by 55% by 2030.

- Circular Economy Push: Increased emphasis on material reuse and recycling in construction projects.

- Renovation Wave Initiative: Aiming to double energy efficiency renovation rates by 2025.

- Sustainable Materials Demand: Growing market for products made from recycled content and bio-based sources.

Government housing targets, such as the UK's 1.5 million new homes by mid-2020s, directly fuel demand for Grafton Group's building materials. Ireland's ongoing support for housing and infrastructure projects also provides a stable market. Upcoming regulations like the UK's Building Safety Levy, expected in Autumn 2025, will increase material costs and demand for compliant products, potentially adding £3,000-£10,000 per unit.

What is included in the product

This PESTLE analysis provides a comprehensive examination of how external macro-environmental factors, including Political, Economic, Social, Technological, Environmental, and Legal influences, impact the Grafton Group's operations and strategic direction.

It offers forward-looking insights and actionable recommendations to help the Grafton Group navigate emerging threats and capitalize on opportunities within its operating landscape.

A PESTLE analysis for Grafton Group that highlights key external factors, allowing for proactive strategy development and mitigating potential market disruptions.

Economic factors

Persistent inflation and elevated interest rates in Europe have created a challenging landscape for the construction sector, especially in residential building. This economic climate has understandably dampened both consumer and business confidence, making new projects less appealing.

While the intense cost increases for construction materials seen previously have begun to ease, the threat of ongoing inflation remains a concern for 2025. This could continue to squeeze profit margins and impact the affordability of building projects.

The European Central Bank's key interest rate, for instance, has been held at 4.50% as of early 2024, reflecting efforts to combat inflation but also contributing to higher borrowing costs for developers and buyers. This environment directly affects demand for building materials and the overall feasibility of new construction ventures.

Grafton Group faced headwinds in 2024, with sales dipping in the UK and Finland amidst broader economic slowdowns. This contrasts with Ireland, where a robust housing market, bolstered by government investment, fueled strong growth for Grafton's operations.

The Dutch market, while generally positive, experienced a recent slowdown in growth. This moderation is attributed to delays in significant construction projects, impacting demand for materials and services in the region.

Construction output in Western Europe experienced a downturn in 2024, with many regions seeing contractions due to persistent economic headwinds and lingering supply chain disruptions. This slowdown impacted material demand across the sector.

However, the outlook for 2025 is more optimistic, with forecasts pointing to a rebound driven by significant investment in transport and infrastructure upgrades. For instance, the European Union's Recovery and Resilience Facility is expected to channel substantial funds into these projects.

Grafton Group's medium-term prospects are bolstered by this anticipated infrastructure spending and the persistent housing shortages in its core markets like the UK and Ireland. These factors are expected to sustain demand for building materials and services.

Materials Price Volatility

While the sharp material price deflation seen in 2022-2023 has eased, and timber and steel prices have found a more stable footing, volatility in metal markets remains a significant factor for Grafton Group. Elevated prices for key commodities like copper and aluminum, coupled with unpredictable stainless steel costs, directly influence the cost of goods for building materials distributors.

This ongoing price fluctuation necessitates a robust approach to procurement and cost control. For instance, the London Metal Exchange (LME) cash prices for copper averaged around $9,500 per metric ton in early 2024, a notable increase from earlier periods, while aluminum prices also saw upward pressure. Effective management of these inputs is therefore crucial for maintaining profitability and competitive pricing within the sector.

- Copper Price Trend: LME cash prices for copper were approximately $9,500/metric ton in early 2024, indicating continued elevated levels.

- Aluminum Price Trend: Aluminum prices also experienced upward pressure in early 2024, impacting raw material costs.

- Stainless Steel Fluctuations: Ongoing volatility in stainless steel pricing adds another layer of cost management complexity for distributors.

- Procurement Strategy: Grafton Group's ability to navigate these material price shifts through strategic sourcing and cost management is paramount.

Consumer Spending and DIY Market

The European DIY home improvement market is set for robust growth, with projections indicating a rise between 2025 and 2029. This expansion is fueled by a growing enthusiasm for personal home improvement projects and renovations across the continent.

This surge in DIY activity, alongside a healthy increase in home purchases, directly translates to higher demand for essential DIY materials and tools. For retailers like Grafton Group's Woodie's, this presents a significant opportunity to capture increased sales within their retail segment.

However, a notable challenge emerges from the burgeoning 'Do-It-For-Me' (DIFM) sector. As more consumers opt to hire professional services for their home improvement needs, this trend could potentially divert spending away from the DIY market, impacting companies like Grafton.

- Projected Growth: The European DIY market is expected to expand significantly between 2025-2029.

- Key Drivers: Rising interest in DIY projects and increased home purchases are primary growth catalysts.

- Retail Benefit: This trend directly benefits Grafton's retail operations, such as Woodie's, through increased demand for materials and tools.

- Competitive Threat: The growing 'Do-It-For-Me' (DIFM) industry presents a challenge by offering professional alternatives to DIY.

Persistent inflation and higher interest rates in key European markets continued to temper construction activity in 2024, particularly impacting residential building and dampening consumer confidence. While the extreme material cost increases of previous years have subsided, the risk of ongoing inflationary pressures in 2025 remains a concern for Grafton Group, potentially affecting profit margins and project affordability.

The European Central Bank's decision to hold its key interest rate at 4.50% through early 2024, while aimed at inflation control, has led to increased borrowing costs for developers and buyers, directly influencing demand for building materials and the viability of new construction projects.

Grafton Group experienced varied performance across its markets in 2024, with sales declines in the UK and Finland due to economic slowdowns, contrasting with strong growth in Ireland driven by a robust housing market and government investment.

The outlook for 2025 shows a more positive trend, with forecasts anticipating a rebound in construction output, largely supported by substantial investments in transport and infrastructure upgrades across Europe, such as those funded by the EU's Recovery and Resilience Facility.

| Economic Factor | 2024 Impact | 2025 Outlook | Data Point/Trend |

|---|---|---|---|

| Inflation | Persistent, impacting confidence and costs | Ongoing concern, potential margin squeeze | ECB rate at 4.50% (early 2024) |

| Interest Rates | Elevated, increasing borrowing costs | Likely to remain a factor influencing affordability | ECB rate at 4.50% (early 2024) |

| Material Costs | Easing from peaks, but volatility persists | Stability expected, but metal markets remain a concern | Copper LME cash ~$9,500/mt (early 2024) |

| Construction Output | Downturn in Western Europe | Projected rebound driven by infrastructure spending | EU Recovery and Resilience Facility funding |

| DIY Market | Growing interest in home improvement | Projected robust growth (2025-2029) | Increased demand for materials and tools |

What You See Is What You Get

Grafton Group PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive Grafton Group PESTLE analysis delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company's operations and strategic planning.

This is a real screenshot of the product you’re buying—delivered exactly as shown, no surprises. You'll gain immediate access to a detailed breakdown of how external forces shape the Grafton Group's market position and future growth opportunities.

The content and structure shown in the preview is the same document you’ll download after payment. This PESTLE analysis provides actionable insights for understanding the broader business landscape relevant to Grafton Group.

Sociological factors

The do-it-yourself (DIY) culture shows no signs of slowing down across Europe. Homeowners are increasingly tackling renovation and repair projects themselves, driven by a desire to personalize their homes and manage budgets more effectively. This trend, amplified by shifts in lifestyle following the pandemic, directly fuels demand for building materials and related supplies.

Grafton Group's DIY retail operations are well-positioned to capitalize on this enduring interest. In 2023, the Group reported that its DIY segment continued to perform strongly, with a notable uptick in online sales, indicating a growing preference for digital channels in acquiring home improvement goods.

Consumers are increasingly prioritizing sustainability, with a significant portion adopting zero-waste practices and actively seeking building materials that minimize plastic and hazardous chemicals. This shift directly impacts purchasing decisions within the DIY and construction industries.

For instance, a 2024 report indicated that 65% of consumers consider a brand's environmental impact when making purchasing decisions, a notable increase from previous years. This growing eco-consciousness presents a clear opportunity for Grafton Group to highlight and broaden its offerings of environmentally friendly products, aligning with market demand and potentially capturing a larger share of this conscious consumer base.

The construction sector, including companies like Grafton Group, is grappling with a significant shortage of skilled workers, a situation exacerbated by an aging population. This demographic trend means fewer experienced individuals are available, directly affecting project completion times and the integration of innovative building techniques. For instance, in the UK, the Office for National Statistics reported that in 2023, the average age of construction workers was 45, with a notable proportion nearing retirement age.

Addressing this challenge requires a strategic focus on expanding workforce development initiatives. Grafton Group must invest more heavily in training programs and apprenticeships to cultivate a new generation of skilled tradespeople. This proactive approach is crucial for maintaining operational efficiency and adapting to evolving industry demands, especially as the demand for construction services remains robust, with UK construction output projected to grow by 2.1% in 2024 according to the Construction Products Association.

Urbanization and Housing Demand

The ongoing trend of urbanization across Europe is a significant driver for housing demand, especially in cities. This demographic shift is expected to maintain a robust demand for new construction, benefiting building material suppliers like Grafton Group. For instance, as of early 2024, many major European cities are still grappling with significant housing deficits, with some estimates suggesting millions of new homes are needed by 2030 to meet demand.

Governments in Grafton's key markets, including the UK and Ireland, continue to prioritize addressing housing shortages. This focus translates into potential policy support and investment in the construction sector. For example, the UK government's housing targets, while subject to revision, consistently aim for hundreds of thousands of new homes annually, signaling sustained activity.

- Urbanization Trend: Continued migration to urban centers in Europe fuels a persistent need for new housing.

- Government Priorities: Addressing housing shortages is a key policy objective for governments in Grafton's operating regions.

- Market Impact: This sustained demand supports a positive long-term outlook for construction and building material distribution.

Changing Lifestyles and Work Patterns

The shift towards more time spent at home post-pandemic continues to fuel demand for home improvement. Consumers are investing in their living spaces, leading to increased interest in products like modular furniture and energy-efficient lighting solutions. Grafton Group's broad product range, from building materials to home furnishings, positions it well to capitalize on these enduring lifestyle changes.

For instance, in the UK, the home improvement market saw significant growth, with DIY spending reaching an estimated £5.7 billion in 2023, a testament to sustained consumer interest in enhancing their homes. This trend is expected to continue into 2024 and 2025, driven by a desire for greater comfort and functionality in domestic environments.

- Sustained Home Improvement Focus: Post-pandemic lifestyles have cemented a strong emphasis on enhancing living spaces.

- Demand for Specific Products: This includes a growing preference for adaptable modular furniture and energy-saving lighting options.

- Grafton's Strategic Alignment: The company's diverse offerings align with these evolving consumer preferences and changing daily routines.

- Market Indicators: The UK DIY market's robust performance, valued at billions annually, underscores the ongoing consumer commitment to home upgrades.

The increasing emphasis on home improvement and renovation, a trend amplified by post-pandemic lifestyle shifts, directly benefits Grafton Group. Consumers are actively investing in their living spaces, driving demand for a wide array of building materials and home enhancement products. This sustained consumer focus on domestic environments is a key sociological driver for the company's core markets.

The growing consumer preference for sustainable and eco-friendly products is a significant sociological factor influencing purchasing decisions. As more individuals prioritize environmental impact, Grafton Group has an opportunity to highlight and expand its range of green building materials, aligning with evolving consumer values and market demands.

Demographic shifts, particularly the aging population and the resulting shortage of skilled labor in the construction sector, present a challenge. This necessitates strategic investment in training and development programs to ensure a pipeline of qualified workers, crucial for maintaining operational capacity and adapting to industry advancements.

Urbanization trends across Europe continue to fuel housing demand, creating a consistent need for new construction projects. Governments are actively addressing housing shortages, which translates into supportive policies and investment in the construction industry, benefiting suppliers like Grafton Group.

Technological factors

The construction sector is actively embracing digital tools to streamline its supply chains. This includes the adoption of digital procurement platforms, advanced supply chain management software, and real-time tracking systems, all of which are fundamentally changing how construction materials are sourced and managed. For instance, in 2023, the global construction technology market was valued at over $10 billion, with supply chain optimization being a key driver of growth.

Grafton Group can capitalize on these technological advancements to boost operational efficiency, gain clearer visibility across its supply network, and achieve significant cost reductions. By integrating these digital solutions, the company can better manage inventory, reduce lead times, and improve overall project delivery, reflecting a broader industry trend where companies investing in digital supply chain solutions have reported up to a 15% increase in on-time deliveries.

Artificial intelligence and machine learning are revolutionizing supply chains, with applications in demand forecasting and inventory management. For instance, companies are seeing significant improvements in forecast accuracy, with some reporting reductions in stockouts by up to 15% through AI-driven insights. This technology also helps in identifying potential disruptions before they impact operations, ensuring greater resilience.

In the DIY retail space, AI is enhancing the customer journey. AI-powered search functions can help customers find products more efficiently, while augmented reality (AR) virtual showrooms allow for immersive product visualization. This leads to better engagement and potentially higher conversion rates, with early adopters seeing double-digit percentage increases in online sales attributed to these features.

Grafton Group can leverage these technological advancements to refine its operational efficiency and customer interaction. By integrating AI for better demand prediction, the group can optimize stock levels, reducing carrying costs and improving product availability. Furthermore, AI-driven personalization and AR experiences can significantly boost customer satisfaction and loyalty in a competitive market.

Technological advancements in DIY tools, such as cordless power tools with improved battery life and precision laser levels, are making home improvement projects more accessible and efficient for consumers. This trend is amplified by the growing popularity of smart home systems, which integrate seamlessly with DIY installations, offering enhanced functionality and user experience. For instance, smart thermostats and lighting systems are increasingly popular DIY installations, driving demand for compatible tools and materials.

Building Information Modelling (BIM) and Digital Twins

Building Information Modelling (BIM) is revolutionizing construction, streamlining project workflows and boosting quality. For instance, the UK government mandated BIM Level 2 for all centrally procured public projects from 2016, driving widespread adoption and demonstrating its value in efficiency gains. Digital twins are also gaining traction, offering dynamic virtual replicas of physical assets to optimize performance and maintenance throughout a building's life. This technological shift allows for better material tracking and management, supporting sustainability goals.

Grafton Group can leverage these digital advancements to enhance its offering to trade customers. By integrating BIM and digital twin technologies, Grafton can provide more accurate project planning, reduce waste, and improve the overall client experience. The construction sector's increasing reliance on digital tools, with the global BIM market projected to reach over $10 billion by 2027, underscores the strategic importance of embracing these innovations to maintain a competitive edge.

- BIM Adoption: Mandated for public projects in the UK since 2016, driving industry-wide integration.

- Digital Twins: Emerging tools for lifecycle asset management and performance optimization.

- Market Growth: Global BIM market expected to exceed $10 billion by 2027, indicating significant industry investment.

- Value Proposition: Enhancing Grafton's services through digital solutions for trade customers.

Blockchain Technology for Transparency

Blockchain technology is increasingly being explored to enhance transparency and efficiency within the construction sector, directly impacting areas like supply chain management and contract execution. Its ability to create immutable records can automate processes and verify the authenticity of documents, leading to streamlined workflows. For Grafton Group, adopting blockchain could mean more secure and transparent tracking of materials throughout their projects.

The construction industry is seeing significant advancements in blockchain applications. For instance, by 2024, it's projected that the global blockchain in construction market will reach over $1.5 billion, indicating growing adoption and investment in this technology. This growth is driven by the need for better project management and reduced disputes.

- Enhanced Supply Chain Visibility: Blockchain can provide a single, shared ledger for tracking materials from origin to site, reducing fraud and ensuring quality.

- Automated Contract Execution: Smart contracts, powered by blockchain, can automatically trigger payments or actions upon verification of project milestones, speeding up financial processes.

- Improved Document Authenticity: Securing project documentation, such as permits and certifications, on a blockchain ensures their integrity and accessibility, minimizing delays caused by lost or tampered records.

Technological factors are reshaping the construction and DIY sectors, with digital tools like BIM and AI becoming central to operational efficiency and customer engagement. Grafton Group can leverage these advancements to streamline supply chains, improve project delivery, and enhance customer experiences through personalized offerings and virtual showrooms. The increasing adoption of these technologies, evidenced by the projected growth of the global BIM market to over $10 billion by 2027, highlights their strategic importance for maintaining a competitive edge.

Legal factors

The Corporate Sustainability Reporting Directive (CSRD) is significantly reshaping how companies report on their environmental, social, and governance (ESG) performance, with the initial wave of large companies beginning their disclosures in 2025. This directive mandates a 'double materiality' approach, meaning Grafton Group must evaluate not only how sustainability issues affect its financial performance but also its impact on people and the planet. This requires a comprehensive overhaul of data collection and assurance processes to meet the new, stringent reporting requirements.

Starting January 2025, large companies like Grafton Group face new mandatory financial disclosure requirements concerning climate impacts. These regulations are designed to offer investors standardized data on how companies are managing and are exposed to climate-related financial risks.

Grafton Group's annual reporting will therefore need to feature more comprehensive climate statements and accompanying financial notes. This shift reflects a growing emphasis on environmental, social, and governance (ESG) factors within financial markets, with many investors actively seeking this level of transparency to inform their decisions.

A new Construction Products Regulation (CPR) is set to take effect in 2024, establishing a unified technical framework for evaluating construction product performance. This updated regulation specifically incorporates circular economy principles, enabling professionals like architects and engineers to select more sustainable materials with greater confidence.

Grafton Group must proactively align its entire product range with these forthcoming CPR standards. For instance, in 2023, the UK's construction sector saw a 2.5% increase in output, highlighting the importance of compliance for continued market access and growth within this expanding industry.

Waste Management Regulations and Levies

Stricter waste management regulations are increasingly shaping the construction sector. For instance, Ireland implemented a €10 per tonne levy on greenfield soil and stone disposed of in municipal landfills starting January 1, 2025. This directly impacts the cost of waste disposal for companies like Grafton Group.

The European Union's Waste Framework Directive places a significant emphasis on construction and demolition waste, promoting a circular economy approach. This directive encourages practices such as material reuse and recycling throughout the construction lifecycle.

These evolving legal requirements necessitate that Grafton Group adapt its operations and supply chain strategies. The focus on waste reduction and material circularity influences how the company sources its products and manages its construction activities.

- Increased Costs: The €10/tonne levy on soil and stone waste in Ireland from January 1, 2025, adds direct operational expenses.

- Regulatory Compliance: Adherence to the EU's Waste Framework Directive is mandatory, impacting waste handling protocols.

- Shift to Circularity: Regulations are driving a move towards greater reuse and recycling of construction materials.

- Supply Chain Influence: Legal frameworks influence Grafton's sourcing decisions and material management practices.

Building Energy Performance Directives (EPBD)

The revised Energy Performance of Buildings Directive (EPBD) sets a clear target for a fully decarbonized building stock by 2050. This directive is a significant driver for increased renovation activity and mandates the disclosure of whole-life cycle carbon emissions for new constructions. For Grafton Group, this translates into a growing demand for energy-efficient and low-carbon building materials and solutions, directly impacting their product development and supply chain strategies.

The EPBD's focus on decarbonization will shape market preferences, favoring products that contribute to improved building energy performance. Grafton Group's ability to adapt and supply these materials will be crucial for its continued success and market positioning. This regulatory shift is expected to create opportunities for innovation in sustainable building technologies.

Key implications for Grafton Group include:

- Increased demand for insulation and energy-saving materials: As buildings are retrofitted and new ones built to higher efficiency standards, demand for products like advanced insulation, high-performance glazing, and efficient heating/cooling systems will rise.

- Focus on low-embodied carbon materials: The directive’s emphasis on whole-life cycle emissions will push for materials with lower embodied carbon, potentially favoring timber, recycled content, and innovative bio-based products.

- Need for technical expertise and support: Grafton Group may need to enhance its offering of technical advice and support to customers navigating the complexities of energy performance regulations and product selection.

The Corporate Sustainability Reporting Directive (CSRD) mandates comprehensive ESG disclosures from 2025, requiring Grafton Group to report on its impacts and how sustainability affects its finances. New regulations from January 2025 will also require standardized financial disclosures on climate-related risks, pushing for more detailed climate statements in annual reports.

A revised Construction Products Regulation (CPR) taking effect in 2024 will standardize performance evaluations and integrate circular economy principles, influencing material selection for sustainability. This comes as the UK construction sector saw a 2.5% output increase in 2023, underscoring the need for compliance.

Stricter waste management, like Ireland's €10/tonne levy on greenfield soil disposal from January 2025, directly increases operational costs for Grafton Group. Similarly, the EU's Waste Framework Directive promotes construction waste reduction and material reuse, influencing Grafton's sourcing and operational strategies.

The updated Energy Performance of Buildings Directive (EPBD) targets decarbonized buildings by 2050, increasing demand for energy-efficient materials and low-carbon solutions. This directive will likely boost demand for insulation and materials with lower embodied carbon, necessitating technical support for customers.

Environmental factors

Grafton Group has set a clear goal to achieve net-zero greenhouse gas emissions throughout its entire value chain by 2050. This ambitious target is further supported by near and long-term objectives that have been validated by the Science-Based Targets initiative, demonstrating a serious commitment to environmental responsibility.

This dedication to net-zero is actively reshaping Grafton's internal operations, from energy consumption in its branches to logistics and waste management. It also extends outwards, influencing how the company collaborates with its supply chain partners and what types of products and services it prioritizes, pushing for more sustainable options.

The broader construction industry, where Grafton operates, is facing intense scrutiny and regulatory pressure to significantly reduce its substantial carbon footprint. As of 2023, construction and building operations were responsible for approximately 37% of global energy-related CO2 emissions, highlighting the critical need for companies like Grafton to lead the transition towards lower-carbon practices.

The European Union's push for circular economy principles in construction, emphasizing waste reduction and material reuse, directly impacts Grafton Group. This regulatory shift encourages practices like designing for deconstruction and incorporating recycled content, aligning with the company's stated aim to pilot circular business models and promote sustainable products. For instance, the EU aims to double resource productivity by 2030 as part of its Green Deal, a significant driver for companies like Grafton to adapt their material sourcing and product lifecycles.

There's a significant push in construction for materials that are kinder to the environment, reflecting a broader societal demand for sustainability. This trend directly impacts companies like Grafton Group, which operate within a sector that's a major user of raw materials and a generator of waste.

The construction industry's substantial resource consumption and waste generation are key environmental concerns. For instance, in 2023, the UK construction sector generated an estimated 118 million tonnes of waste, according to government statistics, highlighting the scale of the challenge.

Grafton Group's commitment to responsible sourcing, especially for timber, positions them well to navigate this evolving landscape. Their focus on timber, a renewable resource when managed sustainably, aligns with the industry's growing emphasis on resource efficiency and reducing its environmental footprint.

Waste Reduction and Management

The construction and demolition sector is a significant contributor to waste, representing roughly one-third of all waste generated across Europe. This substantial volume underscores the environmental impact of building activities.

Increasingly stringent regulations and proactive initiatives are driving the industry towards higher recycling and reuse rates for construction waste. For instance, the European Union's Circular Economy Action Plan sets ambitious targets for waste prevention and resource efficiency within the sector.

As a key distributor, Grafton Group is strategically positioned to influence waste management practices. The company can champion products that facilitate waste reduction and actively support its customer base in adopting more efficient waste management strategies throughout the construction lifecycle.

- Construction and demolition waste accounts for approximately 33% of total waste in Europe.

- EU policies aim to increase recycling rates for construction and demolition waste, with targets often exceeding 70% for certain materials.

- Grafton Group can promote sustainable building materials that minimize waste generation during installation and deconstruction.

- The company's logistics network can be leveraged to support efficient collection and recycling of waste materials from construction sites.

Climate Change Adaptation and Resilience

The escalating recognition of climate change's impacts necessitates a shift towards more resilient building materials and construction methods. Grafton Group's product innovation and sustainability strategies must align with this trend, focusing on solutions that enhance building resilience.

Initiatives like the EU Green Deal, with its ambitious renovation wave targeting energy efficiency, underscore the growing demand for sustainable building practices. Grafton Group's offerings should support these objectives, contributing to a more climate-resilient built environment.

- Increased demand for materials resistant to extreme weather events.

- Focus on energy-efficient building solutions to reduce operational carbon footprints.

- Potential for new product lines supporting retrofitting and green building standards.

Environmental factors significantly influence Grafton Group's operations, particularly within the construction sector, which is a major contributor to global emissions and waste. The company's commitment to net-zero emissions by 2050, validated by the Science-Based Targets initiative, directly addresses these concerns.

The industry faces mounting pressure to reduce its carbon footprint, with construction and building operations accounting for around 37% of global energy-related CO2 emissions as of 2023. Grafton's focus on sustainable materials, like responsibly sourced timber, aligns with the growing demand for environmentally friendlier options.

The European Union's circular economy principles, aiming to double resource productivity by 2030, are also a key driver. This encourages practices like waste reduction and material reuse, with construction and demolition waste making up about a third of total waste in Europe, underscoring the need for Grafton to champion efficient waste management and promote products that facilitate this.

| Environmental Factor | Impact on Grafton Group | Supporting Data/Initiatives |

|---|---|---|

| Climate Change & Emissions | Pressure to reduce carbon footprint, drive for net-zero operations. | Grafton's net-zero by 2050 target; Construction accounts for 37% of global energy-related CO2 emissions (2023). |

| Waste Management & Circularity | Need to minimize waste, promote reuse and recycling of materials. | EU Circular Economy Action Plan; Construction & Demolition waste is ~33% of total waste in Europe. |

| Resource Scarcity & Sustainable Materials | Demand for eco-friendly materials, focus on renewable resources. | Grafton's focus on responsibly sourced timber; EU aims to double resource productivity by 2030. |

PESTLE Analysis Data Sources

Our PESTLE Analysis for Grafton Group draws upon a diverse range of data, including official government publications, reputable financial news outlets, and industry-specific market research reports. This ensures a comprehensive understanding of the political, economic, social, technological, legal, and environmental factors impacting the business.