W. L. Gore & Associates SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

W. L. Gore & Associates Bundle

W. L. Gore & Associates boasts strong brand recognition and a culture of innovation, but faces challenges in diversifying its product portfolio and adapting to rapid technological shifts. Understanding these dynamics is crucial for navigating its competitive landscape.

Want the full story behind Gore's unique culture, potential market threats, and strategic opportunities? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support your strategic planning and investment decisions.

Strengths

W. L. Gore & Associates, especially with its GORE-TEX fabric, is a powerhouse in high-performance materials. This brand is practically a household name, instantly associated with top-tier quality, rugged durability, and continuous innovation. This powerful brand equity significantly bolsters its standing in the market and fosters unwavering customer loyalty across a wide array of sectors.

The GORE-TEX brand, a true pioneer, has been setting the standard in the textile industry since its introduction in 1976. It's renowned globally for its exceptional waterproof, breathable, and windproof properties, making it a go-to choice for demanding applications.

W. L. Gore & Associates' primary strength is its mastery of fluoropolymer technology, particularly polytetrafluoroethylene (PTFE). This expertise allows them to create a diverse range of high-performance products across various industries, from medical devices to electronics and performance fabrics.

The company's commitment to innovation is substantial, backed by a significant portfolio of over 15,000 patents. This dedication to research and development fuels continuous improvement and the creation of novel solutions for challenging applications, ensuring a competitive edge.

W. L. Gore & Associates boasts a remarkably diverse product portfolio, spanning critical sectors like medical devices, high-performance fabrics, advanced electronics, and various industrial applications. This broad market reach significantly reduces their exposure to downturns in any single industry, providing a stable foundation for growth.

Their material science expertise, particularly with expanded polytetrafluoroethylene (ePTFE), is a versatile asset. Gore effectively translates this core competency across a wide array of demanding fields, including aerospace, automotive, healthcare, and consumer products, showcasing their ability to innovate and adapt their technology to meet distinct market needs.

Unique Corporate Culture and Employee Engagement

W. L. Gore & Associates' distinctive corporate culture, characterized by a flat organizational structure, significantly boosts employee engagement. This setup encourages open communication and collaboration, empowering associates with a strong sense of ownership over their work.

This commitment to its people is reflected in consistent accolades; for instance, Gore has been named to Fortune's 100 Best Companies to Work For list multiple times, underscoring the effectiveness of its employee-centric approach. This environment is a key driver of the company's innovation pipeline.

- Flat Hierarchy: Encourages direct communication and faster decision-making.

- Associate Ownership: Fosters a sense of responsibility and commitment.

- Innovation Focus: A culture that supports and rewards creative problem-solving.

- Recognition: Consistently ranked among top workplaces, attracting and retaining talent.

Commitment to Sustainability and Environmental Stewardship

W. L. Gore & Associates is demonstrating a strong commitment to sustainability, aiming for a PFAS-free consumer fabrics portfolio by 2025. This proactive approach reflects a dedication to environmental stewardship. The company has also made tangible progress in reducing its carbon footprint and increasing the use of renewable electricity across its manufacturing facilities.

Their sustainability initiatives are not just aspirational; they are backed by concrete actions and clear targets. For instance, by 2025, Gore plans to have phased out PFAS in its consumer fabric products, a significant move towards more environmentally sound materials. This commitment is crucial in an industry where consumer demand for eco-friendly options is rapidly growing.

- Targeting a PFAS-free consumer fabrics portfolio by 2025

- Actively reducing carbon emissions in manufacturing operations

- Increasing the proportion of renewable electricity used in its plants

W. L. Gore & Associates' core strength lies in its proprietary material science, particularly its mastery of expanded polytetrafluoroethylene (ePTFE). This deep technical expertise allows for the creation of highly specialized, high-performance products across diverse markets, from medical implants to aerospace components and its iconic GORE-TEX fabrics.

The company's commitment to research and development is substantial, evidenced by its extensive patent portfolio, which exceeded 15,000 patents as of recent reports. This focus on innovation ensures a continuous pipeline of new materials and applications, maintaining a competitive advantage.

Gore's strong brand equity, especially with GORE-TEX, translates into significant market recognition and customer loyalty. This brand power allows the company to command premium pricing and maintain strong market positions even in competitive landscapes.

The company's unique, associate-driven culture fosters high levels of engagement and innovation. Consistently recognized as a top workplace, this environment attracts and retains top talent, crucial for sustaining its technological leadership.

What is included in the product

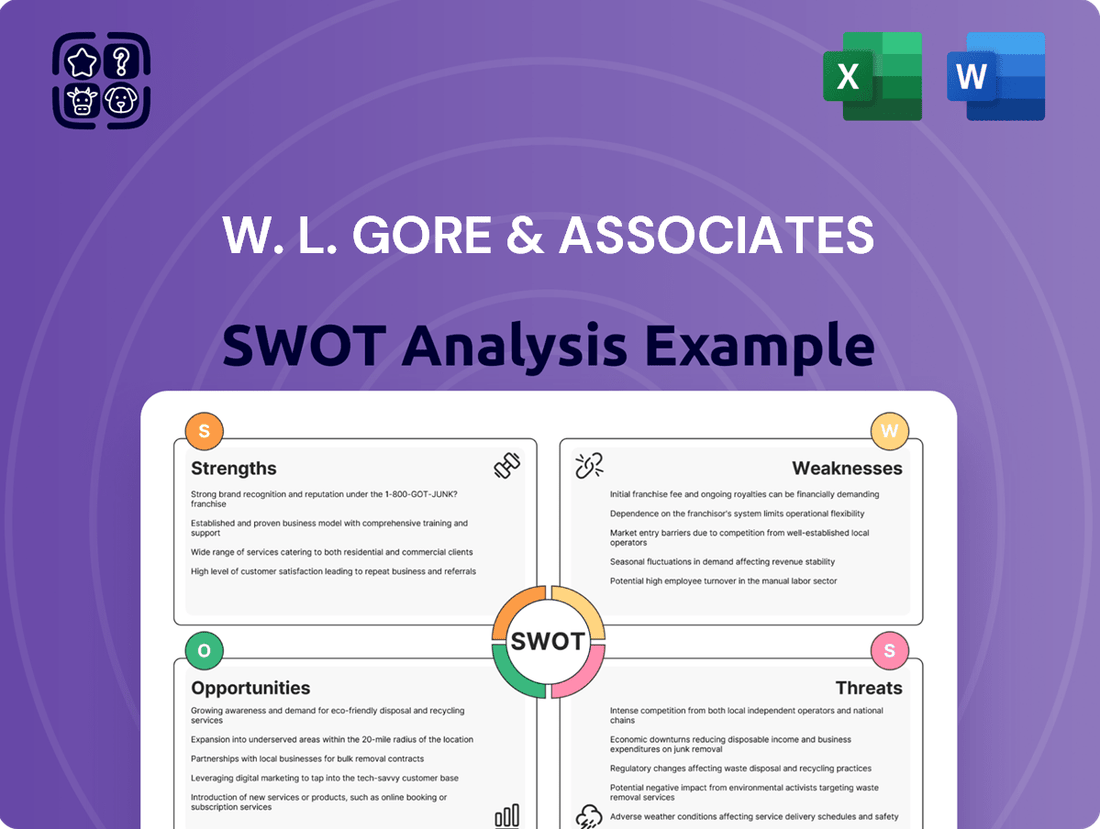

Delivers a strategic overview of W. L. Gore & Associates’s internal strengths and weaknesses alongside external market opportunities and threats.

Gives a high-level overview of Gore's competitive landscape, simplifying complex internal and external factors for faster strategic decision-making.

Weaknesses

W. L. Gore & Associates' deep reliance on fluoropolymer technology, particularly PTFE, while a historical strength, now poses a significant weakness. This dependence brings substantial challenges due to growing global concerns and regulations surrounding PFAS chemicals, which are integral to many of their products.

The company faces mounting legal pressure, with numerous lawsuits filed alleging PFAS contamination and questioning their environmental sustainability claims. These legal battles, coupled with increasing regulatory scrutiny, create operational and reputational risks that could impact future growth and market access.

W. L. Gore & Associates faces significant challenges due to the inherently high production costs associated with its specialized fluoropolymer products. The intricate manufacturing processes for materials like polytetrafluoroethylene (PTFE) demand specialized equipment and expertise, contributing to elevated operational expenses.

Furthermore, the company's reliance on key raw materials, such as fluorspar, exposes it to considerable price volatility. For instance, fluorspar prices have seen significant swings, with reports indicating potential increases of 10-20% in 2024 due to supply constraints and growing demand in sectors like electric vehicles and renewable energy, directly impacting Gore's cost structure and potentially squeezing profit margins.

W. L. Gore & Associates operates in highly competitive, technology-driven sectors, facing pressure from both established giants and nimble newcomers. For instance, in the performance apparel market, rivals like Columbia Sportswear and Patagonia consistently invest in new materials and designs, forcing Gore to continually innovate to maintain its market position.

The medical device industry, another key area for Gore, sees intense rivalry from companies such as Medtronic and Abbott Laboratories, which also dedicate significant resources to research and development. This constant innovation cycle necessitates substantial and ongoing investment in R&D for Gore to differentiate its products and retain its competitive edge across its diverse product lines.

Challenges with Public Perception and Litigation

W. L. Gore & Associates faces significant headwinds from public perception issues, particularly concerning environmental litigation. Recent lawsuits, including those alleging PFAS contamination and 'greenwashing' claims, can erode brand trust and influence consumer choices. For instance, ongoing legal battles in various jurisdictions highlight the financial and reputational risks associated with these environmental concerns, demanding substantial resources for defense and remediation.

These legal challenges necessitate a robust and transparent communication strategy to mitigate reputational damage. The company's ability to effectively address public concerns and demonstrate commitment to environmental responsibility will be crucial in navigating these complex issues. The financial implications of these litigations, including potential settlements and increased compliance costs, represent a notable weakness that could impact future profitability and investment.

- PFAS Litigation: Ongoing lawsuits related to per- and polyfluoroalkyl substances (PFAS) contamination pose a significant legal and financial risk.

- Greenwashing Allegations: Claims of misleading environmental marketing practices can damage brand reputation and consumer confidence.

- Reputational Impact: Negative publicity from these issues can deter customers and investors, affecting market position.

- Resource Allocation: Addressing legal battles and rebuilding public trust requires substantial financial and management resources.

Privately Held Company with Limited Public Financial Data

As a privately held entity, W. L. Gore & Associates' lack of extensive public financial disclosures presents a notable weakness. This limits the depth of analysis available to external parties, including potential investors and financial analysts who rely on detailed reporting for thorough evaluations. While industry estimates place their annual revenues in the billions, the absence of comprehensive financial statements makes precise valuation and performance benchmarking more difficult.

This opacity can create challenges in several key areas:

- Limited Investor Attractiveness: Potential investors seeking transparent financial metrics may find Gore less appealing compared to publicly traded competitors.

- Analyst Constraints: Financial analysts face difficulties in conducting in-depth valuation models and comparative analyses due to the restricted data.

- Perception of Transparency: The lack of public data can sometimes lead to perceptions of reduced transparency, even if the company operates efficiently internally.

- Benchmarking Difficulties: Accurately comparing Gore's financial performance against industry peers is hampered by the limited availability of specific financial data points.

W. L. Gore & Associates' significant reliance on PFAS, particularly PTFE, presents a major weakness due to increasing global regulatory scrutiny and public health concerns. This dependence exposes the company to substantial legal risks, with ongoing lawsuits alleging contamination and challenging environmental claims, potentially impacting future market access and growth.

The company faces high production costs for its specialized fluoropolymer products, stemming from complex manufacturing processes and the need for specialized equipment and expertise. Furthermore, volatility in key raw material prices, such as fluorspar, directly impacts Gore's cost structure, with potential price increases of 10-20% anticipated in 2024 due to supply constraints.

Intense competition in technology-driven sectors like performance apparel and medical devices necessitates continuous, substantial R&D investment to maintain market position against rivals such as Columbia Sportswear, Patagonia, Medtronic, and Abbott Laboratories.

The private nature of W. L. Gore & Associates limits public financial disclosures, hindering in-depth analysis by external parties and potentially reducing investor attractiveness. This lack of transparency makes precise valuation and performance benchmarking against publicly traded competitors more challenging.

Same Document Delivered

W. L. Gore & Associates SWOT Analysis

The preview you see is the actual W. L. Gore & Associates SWOT analysis document you'll receive upon purchase. This ensures you know exactly what you're getting—a professional, detailed, and actionable report. No surprises, just the complete analysis ready for your strategic planning.

Opportunities

The global advanced materials market is poised for substantial expansion, with projections indicating a compound annual growth rate (CAGR) of over 8% through 2028, reaching an estimated $200 billion. This growth is largely fueled by escalating demand in critical sectors such as aerospace, automotive, particularly electric vehicles, and the burgeoning clean energy industry. W. L. Gore & Associates, with its established proficiency in high-performance fluoropolymers and specialized materials, is strategically positioned to leverage these expanding market opportunities.

The medical device market is booming, driven by constant technological advancements, especially in areas like implantable devices and minimally invasive surgeries. This trend presents a significant opportunity for W. L. Gore & Associates.

With over 40 million medical implants performed globally each year, and a strong company focus on developing innovative healing solutions, Gore is well-positioned to capitalize on this expanding high-growth sector.

The growing global demand for environmentally friendly products, coupled with increasing regulatory scrutiny on per- and polyfluoroalkyl substances (PFAS), creates a substantial opening for W. L. Gore & Associates. By investing in and promoting their development of PFAS-free alternatives, like the recently introduced ePE membrane for GORE-TEX, the company can capture market share and solidify its position as an innovator in sustainable materials.

Leveraging Nanotechnology and Smart Materials Integration

W. L. Gore & Associates can capitalize on the rapid advancements in nanotechnology and smart materials. These innovations present significant opportunities to develop novel products and elevate the performance of existing ones.

By combining its deep expertise in fluoropolymers with cutting-edge nanotechnology, Gore can engineer next-generation materials. These materials could offer superior properties, such as self-healing capabilities, enhanced thermal management, or improved electrical conductivity, opening doors to new markets and applications.

- Nanomaterial Market Growth: The global nanotechnology market was valued at approximately $24.4 billion in 2023 and is projected to reach over $100 billion by 2030, indicating substantial growth potential for integrated solutions.

- Smart Materials Applications: Smart materials are finding increasing use in sectors like aerospace, automotive, and medical devices, areas where Gore already has a strong presence.

- Performance Enhancement: Integrating nanomaterials can lead to products with significantly improved durability, lighter weight, and advanced functionalities, providing a competitive edge.

Strategic Partnerships and Acquisitions

W. L. Gore & Associates actively pursues strategic partnerships and acquisitions to fuel growth and expand into emerging markets. Through initiatives like Gore Ventures, the company makes targeted investments in high-growth sectors, including the hydrogen economy, advanced battery technologies, carbon capture solutions, and sustainable fabrics. This approach allows Gore to tap into external innovation and accelerate its market entry into these promising areas.

Acquisitions further bolster Gore's market presence and technological capabilities. A notable example is the acquisition of InnAVasc Medical, which strengthens their position within the medical devices sector. These strategic moves are designed to enhance their product portfolios and solidify their competitive standing across various industries.

- Gore Ventures: Focuses on strategic investments in key growth areas like hydrogen, batteries, carbon capture, and sustainable fabrics, aiming to accelerate innovation and market penetration.

- Acquisitions: Examples like InnAVasc Medical demonstrate a strategy to strengthen market position and acquire complementary technologies, particularly within the medical sector.

- Market Expansion: These partnerships and acquisitions are crucial for entering new, high-potential markets and diversifying revenue streams beyond existing core businesses.

W. L. Gore & Associates is well-positioned to capitalize on the expanding global advanced materials market, projected to exceed $200 billion by 2028 with an 8% CAGR. The company's expertise in fluoropolymers and specialized materials aligns perfectly with growth in aerospace, automotive (especially EVs), and clean energy sectors. Furthermore, the booming medical device market, with over 40 million implants annually, presents a significant opportunity for Gore's innovative healing solutions. The company's strategic investments through Gore Ventures in areas like hydrogen, advanced batteries, and sustainable fabrics, alongside acquisitions such as InnAVasc Medical, are key to unlocking new market potential and diversifying revenue streams.

Threats

W. L. Gore & Associates faces significant headwinds from increasing regulatory scrutiny surrounding per- and polyfluoroalkyl substances (PFAS). As of early 2024, numerous jurisdictions globally are implementing stricter environmental regulations, impacting the use and disposal of PFAS-containing materials, which could affect Gore's product lines and manufacturing processes.

The company is also exposed to substantial litigation risks stemming from past and potential future lawsuits related to PFAS contamination and health impacts. For instance, settlements in the broader PFAS litigation landscape, like those involving other major chemical companies, suggest that potential liabilities for companies like Gore could run into billions of dollars, impacting profitability and cash flow.

The high-performance materials sector faces significant pricing pressure from substitutes. Many alternative materials, often with different environmental characteristics, are entering the market at lower price points, directly challenging Gore's premium offerings. This dynamic is particularly evident in the PTFE market, where Chinese manufacturers are aggressively competing on price, potentially squeezing profit margins for established players like W. L. Gore.

Geopolitical tensions and trade route disruptions, such as those seen in the Red Sea impacting shipping in early 2024, pose a significant threat to W. L. Gore & Associates' supply chain. Limited access to critical raw materials, like fluorspar—essential for PTFE production—which is heavily concentrated in countries like China, can exacerbate these vulnerabilities. For instance, China's export restrictions on fluorspar in 2023 led to a sharp increase in prices, directly affecting production costs for companies reliant on this material.

Rapid Technological Advancements by Competitors

The advanced materials sector is characterized by a breakneck pace of innovation. Competitors are constantly striving to develop next-generation materials that offer enhanced performance or greater sustainability. For instance, in the high-performance polymer space, advancements in areas like bio-based feedstocks and circular economy processing techniques could yield alternatives that challenge Gore's established product lines. Failure to keep pace with these developments, which saw the global advanced materials market valued at approximately $115 billion in 2023 and projected to grow significantly, could lead to a dilution of Gore's market position.

Emerging processing technologies also present a significant threat. Innovations in additive manufacturing, for example, could enable competitors to produce complex geometries or customized materials more efficiently, potentially disrupting traditional manufacturing methods. This means Gore must not only innovate in material science but also in how those materials are brought to market.

- Competitors may introduce superior or more sustainable advanced materials.

- New processing techniques could offer efficiency advantages to rivals.

- The advanced materials market saw significant growth in 2023, highlighting the competitive landscape.

Economic Downturns and Market Volatility

W. L. Gore & Associates faces significant threats from global economic uncertainties, including high inflation rates and fluctuating consumer confidence, which can dampen demand across its served industries. For instance, a slowdown in the automotive sector, a key market for Gore's advanced materials, directly impacts sales volumes.

Market volatility further exacerbates these risks. As of early 2024, persistent inflation and geopolitical tensions continue to create an unpredictable economic landscape. This environment makes forecasting demand and managing inventory challenging for companies reliant on specialized, high-performance materials.

- Global economic slowdown: Projections for global GDP growth in 2024 have been revised downwards by various institutions due to persistent inflationary pressures and tighter monetary policies.

- Sector-specific downturns: Key industries for Gore, such as automotive and consumer electronics, are experiencing supply chain disruptions and reduced consumer spending, directly affecting demand for their components.

- Inflationary impact: Rising raw material and energy costs due to inflation can squeeze profit margins if not effectively passed on to customers, impacting Gore's pricing strategies.

- Consumer confidence erosion: Declining consumer confidence, particularly in major markets, can lead to postponed purchases of durable goods, indirectly reducing the need for advanced materials in those products.

The company faces intense competition from rivals introducing advanced materials that may offer superior performance or enhanced sustainability. Furthermore, emerging processing technologies, such as additive manufacturing, could grant competitors efficiency advantages in production. The global advanced materials market, valued at approximately $115 billion in 2023, underscores the dynamic and competitive nature of this industry.

SWOT Analysis Data Sources

This SWOT analysis is built upon a foundation of credible data, drawing from W. L. Gore & Associates' official financial reports, comprehensive market research, and insights from industry experts.