W. L. Gore & Associates PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

W. L. Gore & Associates Bundle

W. L. Gore & Associates operates within a dynamic global environment, influenced by political stability, economic fluctuations, and evolving social attitudes towards innovation and sustainability. Understanding these external forces is crucial for strategic planning and risk mitigation. Our comprehensive PESTLE analysis delves into these critical factors, offering actionable intelligence to guide your decisions.

Unlock the full potential of W. L. Gore & Associates's market position by grasping the intricate interplay of political, economic, social, technological, legal, and environmental factors. This expert-crafted PESTLE analysis provides the deep-dive insights you need to anticipate challenges and capitalize on opportunities. Download the complete report now and gain a decisive competitive advantage.

Political factors

Changes in international trade agreements, such as potential shifts in tariffs or import/export restrictions, can directly influence W. L. Gore & Associates' global supply chain and its ability to access key markets. For instance, the USMCA agreement, which replaced NAFTA in 2020, has reshaped trade dynamics in North America, requiring companies like Gore to adapt their sourcing and distribution strategies.

Fluctuations in political stability within crucial manufacturing or sales regions present significant operational risks for W. L. Gore & Associates. Geopolitical events, like the ongoing trade tensions between major economic blocs or regional conflicts, can disrupt production, increase logistical costs, and impact consumer demand, as seen with supply chain disruptions in various parts of Asia during 2023-2024.

W. L. Gore & Associates, operating with a substantial global footprint, must adeptly navigate a complex and evolving landscape of national and international policies. These regulations affect everything from material sourcing and compliance with environmental standards to product distribution and market entry, impacting cost structures and competitive positioning.

W. L. Gore & Associates' medical devices segment is significantly impacted by evolving healthcare policies and reimbursement structures. For instance, changes in Medicare and Medicaid reimbursement rates for procedures utilizing Gore's cardiovascular devices can directly affect sales volumes and profitability. In 2024, ongoing discussions around value-based care models and potential adjustments to device coverage by payers like CMS (Centers for Medicare & Medicaid Services) remain a key area of focus, influencing market access and pricing strategies.

Global pressure for environmental protection is intensifying, prompting stricter regulations on manufacturing, waste, and materials. This means companies like W. L. Gore must navigate evolving chemical restrictions and circular economy principles, impacting their operational footprint.

W. L. Gore's reliance on high-performance fluoropolymers could face increased scrutiny under these new environmental mandates. Adherence to emerging chemical safety standards and a commitment to circular economy practices will be crucial for continued market access and innovation.

Compliance with these environmental policies is more than just a legal necessity; it's a significant factor in maintaining W. L. Gore's reputation. For instance, the European Union's Green Deal, aiming for climate neutrality by 2050, sets a precedent for stringent environmental oversight that many global markets are likely to follow, impacting supply chains and product lifecycles.

Geopolitical Stability and International Relations

Global political tensions, including ongoing conflicts and the imposition of sanctions, pose a significant risk to W. L. Gore's international operations. These events can directly impact the availability and cost of critical raw materials, disrupt established shipping routes, and complicate strategies for entering or expanding in new markets. For instance, the ongoing geopolitical shifts in Eastern Europe have led to increased volatility in supply chains for various industrial components, potentially affecting Gore's material sourcing.

As a company with a substantial global footprint, W. L. Gore's operational resilience is intrinsically linked to its capacity to navigate and adapt to a constantly evolving geopolitical landscape. The company's ability to maintain flexibility in its supply chain and manufacturing locations is paramount. For example, in 2024, many multinational corporations were re-evaluating their exposure to regions with heightened political instability, leading to diversification efforts across different geographical bases.

Continuous monitoring of international relations, trade agreements, and the potential imposition of new trade barriers is crucial for W. L. Gore's risk mitigation and long-term strategic planning. The rise of protectionist policies in various economies, as observed in recent trade disputes, necessitates proactive scenario planning to anticipate and counter potential market access challenges. Understanding these dynamics allows for the development of more robust and adaptive business strategies.

- Supply Chain Disruptions: Geopolitical events can directly impact the sourcing of specialized materials, with disruptions potentially increasing lead times and costs for products like GORE-TEX fabrics.

- Market Access & Tariffs: Changes in international trade policies and the imposition of tariffs can affect the competitiveness of Gore's products in key global markets, influencing pricing strategies.

- Operational Footprint: W. L. Gore's manufacturing and sales presence in various countries means it must constantly assess and adapt to local political stability and regulatory environments.

- International Collaboration: The company's reliance on global partnerships and research collaborations can be influenced by diplomatic relations and sanctions between nations.

Industrial Policy and Innovation Support

Government initiatives to boost domestic manufacturing and research and development are crucial for companies like W. L. Gore. For instance, the U.S. CHIPS and Science Act, passed in 2022, allocates billions to semiconductor research and manufacturing, which could indirectly benefit Gore's advanced materials if they are used in semiconductor production. Similarly, European Union programs supporting advanced materials innovation provide potential avenues for grants and collaborations.

Policies that specifically target sectors where Gore operates, such as advanced textiles, medical devices, or electronics, can offer significant advantages. Tax credits for R&D spending, as seen in various countries, directly reduce operational costs and encourage further innovation. For example, the UK's R&D tax credit scheme offers substantial relief for qualifying expenditure.

- Government R&D incentives can lower Gore's innovation costs.

- Subsidies for advanced materials manufacturing can create competitive advantages.

- Trade policies favoring specific material types could impact Gore's supply chain.

Political stability and government policies significantly shape W. L. Gore's operational landscape, influencing everything from global trade dynamics to domestic manufacturing incentives. Changes in international trade agreements, like potential tariff adjustments, directly impact Gore's supply chain and market access, as seen with the ongoing evolution of global trade relations in 2024-2025. Furthermore, government R&D incentives and subsidies for advanced materials manufacturing, such as those seen in the U.S. and EU, can offer substantial competitive advantages and reduce innovation costs for the company.

What is included in the product

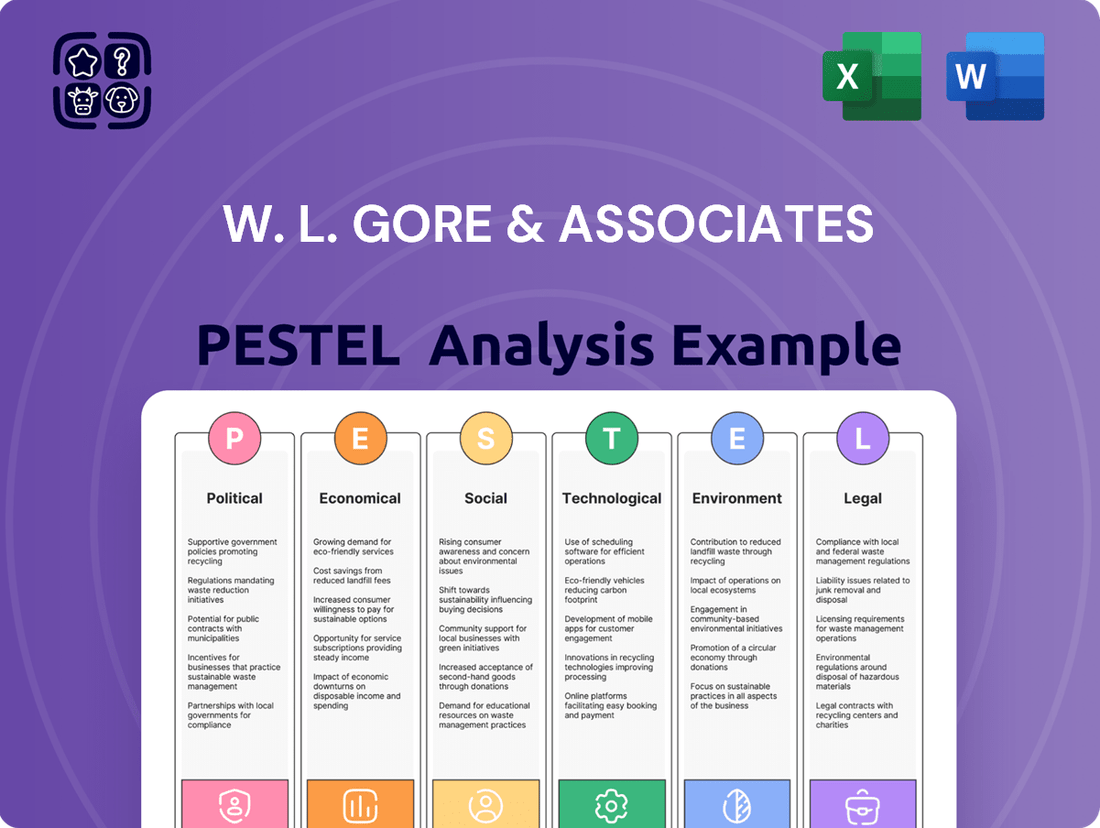

This PESTLE analysis examines the external macro-environmental factors influencing W. L. Gore & Associates, covering Political, Economic, Social, Technological, Environmental, and Legal dimensions to identify strategic opportunities and threats.

A clear, actionable PESTLE analysis of W. L. Gore & Associates provides a structured framework to identify and mitigate external threats, thereby relieving the pain point of uncertainty in strategic planning.

Economic factors

W. L. Gore & Associates operates across diverse sectors, from high-performance fabrics to advanced electronics, making its revenue streams inherently tied to the global economic climate and consumer spending habits. A strong global economy typically fuels demand for Gore's premium offerings, such as GORE-TEX apparel, as consumers have more disposable income. For instance, global GDP growth projections for 2024 and 2025, estimated around 2.7% and 2.8% respectively by the IMF, indicate a generally supportive environment, though regional variations will be key.

Conversely, economic slowdowns or recessions can significantly impact sales by reducing discretionary spending on non-essential, albeit high-quality, goods. Observing consumer confidence indices, like the Conference Board Consumer Confidence Index which showed fluctuations throughout 2024, provides crucial insight into potential shifts in purchasing behavior that could affect Gore's performance in its key markets.

Currency exchange rate fluctuations significantly impact W. L. Gore & Associates, a global entity. For instance, during 2024, the US dollar experienced periods of strength against major currencies like the Euro and Yen. This could translate to higher manufacturing costs in regions where Gore operates if those local currencies weaken relative to the dollar, while simultaneously making Gore's products more expensive for international buyers in their local currency.

Conversely, a weaker dollar in 2024 or early 2025 could bolster Gore's reported international sales when converted back into US dollars. However, this also means that profits earned in stronger foreign currencies would be worth less when repatriated. Companies like W. L. Gore must actively manage this exposure; for example, by diversifying their manufacturing footprint across various currency zones and employing financial instruments to hedge against adverse movements.

Rising inflation directly impacts W. L. Gore's operational costs. For instance, the US Producer Price Index (PPI) for manufactured goods saw a notable increase in early 2024, reflecting higher input costs. This surge in raw material, energy, and labor expenses can squeeze Gore's profit margins, especially given its specialized fluoropolymer production.

W. L. Gore's dependence on specific fluoropolymers necessitates constant vigilance over commodity prices and the reliability of its suppliers. Fluctuations in the price of key feedstocks, like fluorspar, can significantly alter production economics. For example, global fluorspar prices experienced volatility in late 2023 and early 2024 due to supply chain disruptions and increased demand from various industries.

The company's resilience hinges on its capacity to either absorb these escalating costs or effectively transfer them to consumers. Strategic cost management and process optimization are paramount. In 2024, many manufacturing firms focused on supply chain diversification and automation to mitigate inflationary pressures, a strategy likely adopted by Gore to maintain competitiveness.

Interest Rates and Access to Capital

Interest rate fluctuations directly impact W. L. Gore's cost of capital. For instance, if the Federal Reserve maintains its target range for the federal funds rate at 5.25%-5.50% through 2024 and potentially into 2025, as indicated by projections, borrowing for significant R&D or manufacturing upgrades becomes more expensive. This can temper the pace of expansion or acquisition strategies.

Higher borrowing costs can squeeze margins on new projects, forcing a more conservative approach to capital allocation. For W. L. Gore, which relies on innovation and capacity building, this means carefully scrutinizing the return on investment for any new ventures funded by debt. The company's ability to secure favorable credit terms remains a cornerstone of its capacity to execute long-term strategic investments.

- Impact on R&D Funding: Increased interest rates can make it costlier for W. L. Gore to finance its extensive research and development activities, potentially leading to a more selective approach to innovation projects.

- Manufacturing Expansion Costs: Higher borrowing costs directly translate to more expensive financing for building new facilities or upgrading existing ones, potentially slowing down the company's physical growth.

- Acquisition Viability: Elevated interest rates can reduce the attractiveness of acquisitions by increasing the cost of debt financing, impacting W. L. Gore's inorganic growth opportunities.

- Financial Health and Credit Access: W. L. Gore's strong balance sheet and access to favorable credit lines are crucial for navigating periods of rising interest rates and continuing its strategic investments.

Supply Chain Disruptions and Resilience

Global events like the COVID-19 pandemic and ongoing geopolitical tensions have underscored the fragility of supply chains. For W. L. Gore, this translates to potential shortages and increased costs for raw materials and specialized components essential for its advanced materials and products. For instance, in 2023, disruptions in semiconductor manufacturing, a critical input for some advanced electronics, continued to impact various industries, leading to extended lead times and price hikes.

To mitigate these risks, W. L. Gore's strategy likely involves building a robust and diversified supply chain. This means not relying on single suppliers or geographic regions. By cultivating relationships with multiple vendors and strategically managing inventory levels, the company can better absorb shocks and maintain production continuity. This approach is vital for ensuring consistent delivery of their high-performance products to a global customer base.

The emphasis on supply chain resilience is not just about avoiding disruptions; it's a strategic imperative. Companies that can adapt and maintain operations during crises gain a competitive edge. For example, a 2024 report by McKinsey highlighted that companies with highly resilient supply chains experienced revenue declines that were, on average, 15% lower than those with less resilient chains during periods of significant disruption.

- Diversification of Suppliers: Reducing reliance on single-source suppliers for critical materials.

- Strategic Inventory Management: Balancing the cost of holding inventory with the risk of stockouts.

- Geographic Diversification: Spreading sourcing and manufacturing across different regions to avoid localized disruptions.

- Supplier Collaboration: Building strong partnerships with key suppliers to enhance transparency and responsiveness.

Economic growth directly influences demand for W. L. Gore's premium products, with global GDP projected to grow around 2.7% in 2024 and 2.8% in 2025, signaling a generally favorable market. However, economic downturns can reduce consumer spending on non-essential items, impacting sales, as seen in fluctuating consumer confidence indices throughout 2024. Inflationary pressures, evidenced by rising producer prices for manufactured goods in early 2024, increase operational costs for Gore, particularly for specialized materials like fluoropolymers, necessitating careful cost management and supply chain optimization.

Currency exchange rates present another significant factor, with the US dollar's strength in 2024 affecting manufacturing costs and international pricing for Gore. Fluctuations in interest rates, with the federal funds rate potentially remaining between 5.25%-5.50% through 2024-2025, increase the cost of capital, impacting R&D funding and expansion plans. Supply chain disruptions, highlighted by events like the pandemic and geopolitical tensions, necessitate diversified sourcing and strategic inventory management to ensure production continuity, a strategy proven effective as resilient supply chains saw 15% lower revenue declines during disruptions according to a 2024 McKinsey report.

| Economic Factor | 2024/2025 Data/Trend | Impact on W. L. Gore |

| Global GDP Growth | Projected ~2.7% (2024), ~2.8% (2025) | Supports demand for premium products |

| Inflation (US PPI for manufactured goods) | Notable increase early 2024 | Increases operational costs, squeezes margins |

| Interest Rates (Federal Funds Rate) | Projected 5.25%-5.50% range (2024-2025) | Raises cost of capital for R&D and expansion |

| Supply Chain Resilience | Companies with resilient chains saw 15% lower revenue declines during disruptions (McKinsey, 2024) | Mitigates impact of disruptions, ensures continuity |

Same Document Delivered

W. L. Gore & Associates PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive PESTLE analysis of W. L. Gore & Associates delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company. You'll gain a deep understanding of the external forces shaping Gore's strategic landscape.

Sociological factors

Consumers worldwide are increasingly prioritizing products that are good for the planet and made responsibly. This shift is a significant sociological factor influencing companies like W. L. Gore.

For W. L. Gore, especially with its well-known GORE-TEX brand, this translates into a strong need to showcase its commitment to sustainability. This includes everything from where it gets its materials to how it manufactures products and what happens to them after use.

Meeting this growing consumer demand means W. L. Gore must be open about its practices and consistently develop new, eco-friendly materials. For instance, a 2024 report indicated that 73% of global consumers are willing to change their consumption habits to reduce their environmental impact, a trend directly impacting brands like Gore.

Societal shifts towards health and wellness are significantly impacting consumer choices, directly benefiting companies like W. L. Gore & Associates. The growing emphasis on active lifestyles, from rigorous sports to everyday outdoor pursuits, fuels a robust demand for high-performance, durable, and comfortable materials. For instance, the global outdoor apparel market was valued at approximately $40 billion in 2023 and is projected to grow, indicating a strong market for Gore-Tex and similar fabric technologies.

Furthermore, the increasing awareness and investment in personal health and medical outcomes create substantial opportunities for Gore's medical device segment. Products designed to improve patient comfort, facilitate recovery, and offer advanced protective solutions resonate deeply with a health-conscious population. The global medical devices market is expected to reach over $800 billion by 2028, showcasing the vast potential for innovation in areas like cardiovascular implants and surgical meshes.

W. L. Gore can strategically leverage these evolving societal trends by continuing to innovate and expand its product offerings. Developing new applications for its advanced materials in areas such as wearable health technology or enhancing the performance and sustainability of existing lines will be key. Aligning product development with the desire for enhanced comfort, superior protection, and improved medical results positions Gore favorably to capture market share among health-focused consumers and patients.

Demographic shifts are a significant sociological factor, with developed nations experiencing notably aging populations. This trend directly translates to a heightened demand for sophisticated medical devices and comprehensive healthcare solutions. W. L. Gore & Associates, with its established proficiency in medical implants and devices, is strategically positioned to cater to the evolving healthcare requirements of this growing older demographic, presenting substantial long-term growth prospects for its medical division.

Workforce Demographics and Talent Attraction

Attracting and retaining a skilled workforce, particularly in demanding areas like materials science and engineering, presents a significant sociological hurdle for W. L. Gore. The company's distinctive culture and established reputation as a leader in innovation are vital assets in drawing top talent. For instance, in 2024, the demand for specialized engineers in advanced materials remained exceptionally high, with reports indicating a shortage of over 200,000 skilled engineers in the US alone.

W. L. Gore's ability to adapt to evolving workforce expectations, including a greater emphasis on work-life balance, flexibility, and diversity and inclusion, is paramount for sustaining its competitive advantage. As of early 2025, surveys indicate that over 70% of the global workforce prioritizes flexible work arrangements, and companies with strong DEI initiatives are seen as more attractive employers.

- Talent Acquisition: W. L. Gore's innovation-driven culture is a primary draw for specialized talent in fields like advanced materials and engineering.

- Workforce Expectations: Adapting to demands for flexibility and diversity is crucial for maintaining a competitive edge in talent attraction.

- Market Trends: The continued high demand for specialized engineers in 2024 and the growing workforce preference for flexibility in 2025 highlight the importance of these sociological factors.

Public Perception and Brand Reputation

Public perception of W. L. Gore & Associates is deeply tied to its core products, particularly fluoropolymers like PTFE, often recognized by its brand name Teflon. Societal values increasingly emphasize environmental sustainability and product safety, meaning public opinion on the manufacturing processes and end-of-life disposal of these materials can directly impact Gore's brand reputation. For instance, concerns about PFAS (per- and polyfluoroalkyl substances), a broader category that includes some fluoropolymers, have led to increased scrutiny from consumers and regulators alike.

Maintaining a positive brand image requires Gore to proactively address these societal concerns. This involves transparent communication regarding the safety of their products, their commitment to environmental stewardship, and their overall corporate social responsibility efforts. For example, in 2024, many companies in the chemical industry have been investing in sustainability initiatives and reporting on their progress, a trend Gore is likely following to bolster public trust.

- Brand Trust: Public concern over PFAS chemicals, a group including some fluoropolymers, can erode consumer trust if not effectively addressed.

- Environmental Scrutiny: Societal pressure for sustainable practices means Gore faces expectations regarding the environmental impact of its fluoropolymer production and product lifecycle.

- Corporate Responsibility: Demonstrating commitment to product safety and environmental stewardship through transparent reporting and initiatives is crucial for maintaining a favorable public perception.

- Market Impact: Negative public perception, amplified by social media and environmental advocacy groups, can translate into reduced sales and market share for products perceived as harmful or unsustainable.

Societal shifts towards health and wellness are significantly impacting consumer choices, directly benefiting companies like W. L. Gore & Associates. The growing emphasis on active lifestyles fuels demand for high-performance materials, with the global outdoor apparel market valued at approximately $40 billion in 2023. Furthermore, Gore's medical device segment benefits from increased investment in personal health, as the global medical devices market is expected to exceed $800 billion by 2028.

Demographic shifts, particularly aging populations in developed nations, create a heightened demand for sophisticated medical devices. W. L. Gore's expertise in medical implants positions it well to serve this growing demographic, offering substantial long-term growth prospects for its medical division.

Attracting and retaining skilled talent, especially in materials science and engineering, is a key sociological consideration. In 2024, the demand for specialized engineers remained high, with a reported shortage of over 200,000 in the US alone. Adapting to workforce expectations for flexibility and diversity is crucial, as over 70% of the global workforce prioritizes flexible arrangements as of early 2025.

Public perception of W. L. Gore is influenced by societal emphasis on sustainability and product safety, particularly concerning fluoropolymers like PTFE. Concerns about PFAS have led to increased scrutiny, making transparent communication about product safety and environmental stewardship vital for maintaining public trust. Companies in the chemical industry are increasingly investing in sustainability initiatives, a trend Gore is likely following.

Technological factors

W. L. Gore & Associates' success is deeply rooted in its mastery of advanced materials science, especially with fluoropolymers like PTFE. The company's commitment to innovation in this area, including advancements in nanotechnology, directly impacts product performance and opens doors to entirely new markets. For instance, continued research into novel polymer structures and composites is key to developing next-generation materials for critical applications.

W. L. Gore & Associates is increasingly integrating advanced manufacturing technologies like robotics and AI to boost production efficiency and cut costs. For instance, companies in the advanced materials sector, where Gore operates, saw an average productivity increase of 15-20% in 2024 through targeted automation initiatives.

These technological upgrades directly translate to higher quality products and a quicker path to market, crucial for maintaining a competitive edge. By streamlining operations, Gore can respond more agilely to customer demands and market shifts.

Adopting Industry 4.0 principles, which emphasize interconnectedness and data-driven decision-making in manufacturing, is paramount for W. L. Gore's pursuit of operational excellence. This approach allows for real-time monitoring and optimization of the entire production lifecycle.

W. L. Gore & Associates can leverage big data analytics, artificial intelligence, and machine learning to gain deeper insights into evolving market trends, understand customer preferences more precisely, and optimize its complex supply chain operations. This technological advancement is crucial for staying competitive in a rapidly changing global landscape.

The ongoing digitalization across W. L. Gore's research and development, manufacturing processes, and sales channels promises to enhance decision-making capabilities significantly. Furthermore, it enables the personalization of customer experiences, fostering stronger relationships and potentially increasing customer loyalty.

By embracing data-driven innovation, W. L. Gore can expect to accelerate its product development cycles. For instance, in 2024, companies that effectively utilized AI in R&D saw an average reduction of 15% in time-to-market for new products, a metric W. L. Gore can aim to replicate or surpass.

Biotechnology and Medical Device Innovation

W. L. Gore & Associates' medical division thrives on the relentless pace of technological evolution. Rapid advancements in biotechnology and the development of biocompatible materials directly shape the performance and potential of its product lines. For instance, the increasing sophistication of tissue engineering and the integration of smart technologies into implants present significant avenues for new product development and market penetration.

The company's strategic engagement with these technological shifts is paramount. Innovations in minimally invasive surgical techniques, for example, directly influence the demand for Gore's advanced medical devices, such as its vascular grafts and surgical meshes. Staying ahead requires deep collaboration with leading healthcare institutions and research centers, ensuring Gore remains at the cutting edge of medical device innovation.

Consider these key technological drivers:

- Biotechnology Advancements: Growth in areas like regenerative medicine and advanced biomaterials opens doors for novel implantable devices. The global biotechnology market was projected to reach over $1.9 trillion by 2025, indicating substantial growth potential.

- Medical Device Innovation: The development of smart implants, capable of real-time monitoring and data feedback, is transforming patient care and creating new market segments. The global medical device market is anticipated to exceed $600 billion by 2025.

- Surgical Technique Evolution: The increasing adoption of minimally invasive procedures necessitates the development of smaller, more precise, and highly functional medical devices, a core area for Gore.

Competitive Technological Disruption

W. L. Gore & Associates faces ongoing competitive technological disruption. The development of novel materials and advanced manufacturing processes by rivals presents a persistent challenge, requiring constant vigilance. For instance, advancements in polymer science by competitors could offer superior performance characteristics in applications where Gore's materials currently dominate.

To navigate this, Gore must actively monitor the technological frontier. A proactive stance, including significant investment in research and development, is crucial. In 2024, the advanced materials sector saw R&D spending increase, with many companies allocating over 10% of revenue to innovation to stay ahead of emerging threats and opportunities.

Strategic partnerships and collaborations are also vital for maintaining a competitive edge. By joining forces with research institutions or other innovative companies, Gore can accelerate its own technological development and mitigate the risk of obsolescence. This approach allows for shared risk and access to specialized expertise, fostering a more robust innovation pipeline.

Key technological factors impacting W. L. Gore include:

- Emergence of new high-performance materials from competitors that could challenge Gore's existing product lines.

- Adoption of advanced manufacturing techniques, such as additive manufacturing (3D printing), by rivals, potentially leading to faster production and customized solutions.

- Development of disruptive technologies in adjacent markets that could redefine industry standards and customer expectations.

- Increased pace of innovation across the advanced materials sector, necessitating continuous investment in R&D to maintain market leadership.

W. L. Gore & Associates' technological landscape is shaped by its core expertise in fluoropolymers and a growing embrace of advanced manufacturing and data analytics. The company's commitment to materials science innovation, including nanotechnology, directly fuels product performance and market expansion. For instance, continued research into novel polymer structures is essential for next-generation materials in critical applications.

The integration of Industry 4.0 principles, such as AI and robotics in manufacturing, aims to boost efficiency and reduce costs. Companies in Gore's sector saw an average productivity increase of 15-20% in 2024 through targeted automation. This digitalization enhances decision-making and allows for personalized customer experiences.

In its medical division, technological evolution in biotechnology and biocompatible materials is paramount. Advancements in tissue engineering and smart implantable devices present significant growth opportunities. The global medical device market was projected to exceed $600 billion by 2025, highlighting the potential for Gore's innovative products.

Gore must also contend with competitive technological disruption, necessitating continuous R&D investment. In 2024, the advanced materials sector saw R&D spending increase, with many companies allocating over 10% of revenue to innovation to stay ahead of emerging threats and opportunities.

| Technological Factor | Impact on W. L. Gore & Associates | Supporting Data/Trend (2024-2025) |

| Materials Science Innovation | Enhances product performance, creates new market opportunities. | Continued investment in polymer science and nanotechnology is critical. |

| Advanced Manufacturing (AI, Robotics) | Increases production efficiency, reduces costs, improves product quality. | Sector productivity gains of 15-20% from automation in 2024. |

| Data Analytics & Digitalization | Improves market insights, customer understanding, supply chain optimization. | Companies using AI in R&D saw a 15% reduction in time-to-market in 2024. |

| Biotechnology & Medical Device Evolution | Drives innovation in medical products, opens new market segments. | Global medical device market projected to exceed $600 billion by 2025. |

| Competitive Technological Disruption | Requires continuous R&D investment and strategic partnerships. | Advanced materials sector R&D spending increased, with >10% revenue allocation in 2024. |

Legal factors

W. L. Gore & Associates heavily relies on its proprietary fluoropolymer technologies and the unique designs of its products. Safeguarding this intellectual property through patents, trademarks, and trade secrets is paramount to preserving its competitive advantage in the market.

The company's commitment to innovation means a strong legal framework is essential. For instance, in 2023, the global litigation spending on intellectual property reached an estimated $30 billion, highlighting the significant investment companies make in protecting their innovations, a figure Gore likely mirrors in its own strategic legal operations.

Vigilance against any form of infringement and the maintenance of a strong legal strategy for intellectual property defense are crucial. This ensures that Gore's groundbreaking innovations remain secure and continue to drive its business forward, preventing competitors from unfairly benefiting from its research and development efforts.

W. L. Gore & Associates, as a manufacturer of medical devices, performance fabrics, and industrial components, navigates a complex web of product liability and safety regulations. For instance, in the medical device sector, the U.S. Food and Drug Administration (FDA) imposes strict pre-market approval processes and post-market surveillance requirements. Failure to adhere to these can result in significant penalties and product recalls, impacting their market presence.

The company must ensure its materials, like those used in aerospace or automotive applications, meet specific industry safety standards, such as those set by the Society of Automotive Engineers (SAE) or the Federal Aviation Administration (FAA). In 2023, product liability claims in the manufacturing sector saw an average jury award of $1.7 million, highlighting the financial risks associated with product failures and the critical need for robust safety protocols at Gore.

W. L. Gore & Associates navigates a landscape of stringent Environmental, Health, and Safety (EHS) regulations. These rules govern everything from how they handle chemicals and dispose of waste to managing air emissions and ensuring worker safety. For instance, adherence to frameworks like REACH (Registration, Evaluation, Authorisation and Restriction of Chemicals) in Europe and RoHS (Restriction of Hazardous Substances) is paramount for market access and responsible operations.

Failure to comply can result in significant penalties, operational disruptions, and reputational damage. In 2024, the global cost of non-compliance with environmental regulations alone was estimated to be in the billions, underscoring the financial imperative of robust EHS management. Gore's commitment to proactive risk management and continuous improvement in its EHS practices is therefore essential not only for legal standing but also for maintaining its operational licenses and fostering stakeholder trust.

Data Privacy and Cybersecurity Laws

W. L. Gore & Associates operates in an environment increasingly shaped by stringent data privacy and cybersecurity laws. Regulations like the General Data Protection Regulation (GDPR) in Europe and the California Consumer Privacy Act (CCPA) in the United States dictate how the company must handle customer and employee personal data, impacting everything from data collection to storage and processing. Failure to adhere to these evolving legal frameworks can lead to substantial financial penalties, with GDPR fines potentially reaching 4% of annual global turnover or €20 million, whichever is higher.

The company must maintain robust cybersecurity protocols to safeguard sensitive information against increasingly sophisticated threats. A significant data breach can not only result in regulatory fines but also severely damage customer trust and brand reputation. For instance, in 2023, the average cost of a data breach globally reached $4.45 million, underscoring the financial imperative of strong cybersecurity measures for businesses like Gore.

- GDPR and CCPA Compliance: W. L. Gore must ensure its data handling practices align with global privacy standards.

- Cybersecurity Investment: Significant resources are needed to protect against data breaches and maintain operational integrity.

- Reputational Risk: Non-compliance and data breaches can erode customer trust and negatively impact market standing.

- Financial Penalties: Regulatory fines for data privacy violations can be substantial, affecting profitability.

Labor Laws and Employment Regulations

W. L. Gore & Associates, as a global enterprise, must rigorously adhere to a complex web of labor laws and employment regulations across its various operating regions. These laws dictate critical aspects such as minimum wage requirements, workplace safety standards, anti-discrimination policies, and fundamental employee rights. For instance, in 2024, the International Labour Organization (ILO) reported that over 100 countries had ratified conventions related to fair wages and working conditions, underscoring the global commitment to these principles.

Navigating these diverse legal frameworks is paramount to preventing costly legal entanglements, cultivating a supportive and productive workplace culture, and securing a competitive edge in attracting and retaining skilled professionals. Failure to comply can result in significant fines and reputational damage, impacting the company's ability to operate smoothly and attract top talent. For example, a significant breach of labor laws in a major market could lead to multi-million dollar settlements and lengthy legal battles, as seen in some high-profile cases within the manufacturing sector.

To maintain compliance and foster a positive employment environment, W. L. Gore needs to continuously monitor and adapt its employment practices in response to evolving legal landscapes. This proactive approach ensures the company remains aligned with current standards and best practices. In 2025, many jurisdictions are expected to introduce new legislation concerning remote work policies and data privacy for employees, requiring companies to update their internal guidelines.

- Global Compliance: Adherence to varying wage, working condition, and discrimination laws in countries like Germany, the United States, and Japan is crucial.

- Risk Mitigation: Avoiding legal disputes and penalties by staying current with labor legislation, such as the EU's proposed directives on work-life balance in 2024.

- Talent Acquisition: Maintaining a reputation for fair employment practices to attract and retain a high-caliber workforce, especially in competitive markets.

- Adaptability: Regularly updating HR policies to reflect changes in employment law, including new regulations on gig economy workers or employee benefits.

W. L. Gore & Associates must navigate a complex regulatory environment, particularly concerning product safety and liability. As a manufacturer of diverse products, from medical devices to industrial materials, adherence to standards set by bodies like the FDA, FAA, and SAE is critical. In 2023, the average jury award for product liability claims in manufacturing reached $1.7 million, underscoring the significant financial risks associated with non-compliance and product failures.

Environmental factors

W. L. Gore & Associates faces challenges with resource scarcity, especially concerning petroleum-derived materials crucial for its fluoropolymers. Fluctuations in oil prices, which averaged around $80-$90 per barrel in late 2024, directly impact raw material costs. The company must navigate environmental regulations and geopolitical factors affecting global supply chains for these specialized inputs.

Assessing supply chain sustainability is paramount for Gore. By 2025, many industries are seeing increased pressure to adopt circular economy principles. Gore can mitigate risks by exploring bio-based or recycled feedstocks and investing in advanced recycling technologies for its materials.

Diversifying raw material sourcing geographically and promoting material circularity are key strategies. This approach not only reduces reliance on single sources but also enhances resilience against supply disruptions, a growing concern in the volatile global market of 2024-2025.

W. L. Gore & Associates, like many global manufacturers, faces operational risks from climate change and the escalating frequency of extreme weather events. These disruptions can impact everything from raw material sourcing to product delivery, potentially affecting production schedules and increasing logistical costs. For instance, in 2024, various regions experienced unprecedented heatwaves and severe storms, leading to supply chain bottlenecks for many industries.

The company is also under increasing scrutiny and pressure from stakeholders, including investors and consumers, to demonstrate a commitment to sustainability. This includes reducing its carbon footprint and exploring the adoption of renewable energy sources for its manufacturing facilities. Many companies are setting ambitious net-zero targets, with Gore likely evaluating similar strategies to align with global environmental goals and maintain its corporate reputation.

Adapting to these evolving climate risks and actively participating in mitigation efforts is becoming a critical component of long-term business strategy. This could involve investing in more resilient infrastructure, diversifying supply chains to reduce reliance on climate-vulnerable regions, and innovating materials and processes that have a lower environmental impact. For example, by 2025, many companies are expected to have detailed plans for climate risk adaptation and emission reduction in place.

W. L. Gore & Associates' manufacturing of fluoropolymer products creates waste streams that need diligent management and disposal. In 2024, the global waste management market reached an estimated $1.6 trillion, highlighting the significant operational costs and regulatory scrutiny involved.

Stricter environmental regulations, particularly concerning chemical waste and emissions, are increasingly pushing companies like Gore to adopt advanced pollution control technologies. For instance, the US Environmental Protection Agency (EPA) continues to refine regulations on volatile organic compounds (VOCs) and hazardous air pollutants, directly impacting manufacturing processes.

To minimize its environmental footprint and comply with evolving standards, W. L. Gore must continue investing in sustainable waste management practices. This includes exploring innovative waste reduction strategies, such as material recycling and process optimization, which can also lead to cost efficiencies in the long run.

Biodiversity Loss and Ecosystem Impact

While W. L. Gore & Associates does not directly engage in land-intensive activities that would immediately impact biodiversity, the chemical composition of some of its advanced materials warrants careful consideration. For instance, the production and disposal of certain fluoropolymers, while offering unique performance benefits, could pose indirect risks to ecosystems if not handled with stringent environmental controls. Reports in 2024 highlighted the growing concern over the environmental persistence of PFAS chemicals, a category that includes some materials Gore utilizes, with regulatory bodies worldwide intensifying their focus on these substances.

The company faces increasing scrutiny regarding the potential for its product components to persist in the environment or bioaccumulate. As of early 2025, several major markets are implementing stricter regulations on chemicals with these characteristics, pushing industries towards greater transparency and accountability in their supply chains. This trend necessitates a proactive approach from Gore to assess and mitigate any potential long-term ecological effects.

To address these environmental factors, W. L. Gore & Associates is increasingly focused on the entire life cycle of its products. This includes exploring and developing more sustainable and environmentally benign alternatives for its material science innovations. For example, ongoing research and development efforts, with investments in sustainable chemistry showing a notable uptick in 2024, aim to reduce the environmental footprint of its operations and product offerings.

- Growing regulatory pressure on PFAS chemicals, impacting material sourcing and product design.

- Increased investor and consumer demand for products with reduced environmental persistence and bioaccumulation potential.

- Industry-wide push for life cycle assessments to evaluate and minimize the ecological impact of advanced materials.

- Investment in R&D for developing more sustainable alternatives to existing high-performance materials.

Water Usage and Wastewater Treatment

W. L. Gore & Associates' manufacturing processes, particularly those involving advanced materials, can be quite water-intensive. Ensuring that discharged wastewater meets strict environmental quality standards is paramount to avoid contaminating local water sources. For instance, in 2024, many manufacturing sectors faced increased scrutiny on water discharge quality, with some regions implementing stricter limits on chemical oxygen demand (COD) and total suspended solids (TSS).

To address this, Gore must continue to invest in and implement robust water management systems. This includes exploring advanced water recycling technologies to reduce overall consumption and employing sophisticated wastewater treatment methods to purify effluent before discharge. Companies in similar industries have reported significant cost savings and improved environmental footprints by adopting closed-loop water systems. For example, a chemical manufacturer in Europe saw a 20% reduction in water intake after implementing advanced membrane filtration in 2023.

Responsible water stewardship is not just about regulatory compliance; it's a cornerstone of long-term operational sustainability. By proactively managing water resources and minimizing wastewater impact, Gore can enhance its brand reputation and mitigate risks associated with water scarcity or stricter regulations. The global water treatment market was valued at over $700 billion in 2024 and is projected to grow, indicating a strong market focus on these solutions.

- Water Intensity: Advanced material manufacturing often requires significant water for cooling, cleaning, and processing.

- Wastewater Standards: Discharge permits typically specify limits for pollutants like heavy metals, organic compounds, and suspended solids.

- Water Management Solutions: Technologies like reverse osmosis, ultrafiltration, and ion exchange are key for recycling and treatment.

- Sustainability Impact: Efficient water use reduces operational costs and enhances corporate social responsibility.

W. L. Gore & Associates faces increasing scrutiny regarding the environmental persistence and potential bioaccumulation of its advanced materials, particularly fluoropolymers. As of early 2025, regulatory bodies worldwide are intensifying focus on substances like PFAS, prompting stricter controls and a demand for greater supply chain transparency. This necessitates a proactive approach from Gore to assess and mitigate any long-term ecological effects associated with its product life cycles.

PESTLE Analysis Data Sources

Our PESTLE Analysis for W. L. Gore & Associates is informed by a robust blend of data from government agencies, international organizations, and reputable financial news outlets. This ensures comprehensive coverage of political, economic, social, technological, legal, and environmental factors impacting the company.