W. L. Gore & Associates Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

W. L. Gore & Associates Bundle

W. L. Gore & Associates navigates a landscape shaped by intense rivalry and the constant threat of substitutes, particularly in its advanced materials sectors. Understanding the nuances of buyer power and supplier leverage is crucial for sustained success.

The complete report reveals the real forces shaping W. L. Gore & Associates’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

W. L. Gore & Associates' reliance on specialized materials, especially fluoropolymers like PTFE, places them in a position where supplier concentration significantly impacts their bargaining power. The limited number of global producers for these critical inputs means suppliers can exert considerable influence.

The scarcity of viable alternatives further amplifies this supplier leverage. With PTFE alone holding a substantial 38% share of the fluoropolymer market in 2024, the few companies that can produce it effectively hold a strong hand in price negotiations and supply availability.

W. L. Gore & Associates relies on highly specialized fluoropolymer inputs for its performance fabrics and medical devices. The unique nature of these materials, essential for Gore's proprietary technologies like GORE-TEX, means suppliers of these inputs hold considerable bargaining power if few alternatives exist.

The intricate manufacturing processes for high-performance fluoropolymers significantly restrict the pool of potential suppliers. This scarcity, coupled with the critical role of these inputs in Gore's product differentiation, amplifies supplier leverage in negotiations.

Switching suppliers for specialized materials like PTFE presents significant hurdles for W. L. Gore & Associates. These hurdles include the costs associated with re-qualifying new suppliers, potential investments in new tooling, and the risk of impacting product performance or existing certifications. These substantial switching costs can effectively tie Gore to its current suppliers, thereby strengthening the suppliers' bargaining position.

Threat of Forward Integration

The threat of forward integration by suppliers of key fluoropolymer raw materials poses a significant challenge to W. L. Gore & Associates. If these suppliers were to develop their own finished products, they could directly compete with Gore's diverse product lines, thereby diminishing Gore's market share and profitability.

While the highly specialized nature of Gore's components might deter some suppliers, the potential for higher margins in Gore's end markets could incentivize such a move. This integration would not only introduce direct competition but also substantially bolster the bargaining power of these suppliers.

- Potential for Direct Competition: Suppliers entering Gore's markets could offer competing fluoropolymer-based products, impacting Gore's sales.

- Increased Supplier Leverage: Forward integration by suppliers would grant them greater control over pricing and product availability.

- Market Disruption: A supplier's entry could disrupt existing supply chains and competitive dynamics within Gore's served industries.

Importance of Supplier's Input to Gore's Cost Structure

The bargaining power of suppliers is a critical factor for W. L. Gore & Associates, particularly concerning its specialized fluoropolymer raw materials, such as polytetrafluoroethylene (PTFE). While Gore's end products are high-value, these essential inputs can constitute a substantial part of its cost structure. For instance, in 2024, the global PTFE market experienced price volatility driven by supply chain disruptions and increased demand, directly impacting manufacturers like Gore.

If raw material costs escalate and Gore faces challenges in fully passing these increases to its diverse customer base, profit margins can be squeezed. The company's reliance on a limited number of specialized suppliers for these advanced materials amplifies this risk. For example, in early 2024, reports indicated that key fluorochemical producers faced production constraints, leading to higher input costs for downstream users.

- Significant Input Costs: Specialized fluoropolymer raw materials can represent a material portion of Gore's overall production expenses.

- Price Sensitivity: Gore's ability to absorb or pass on rising raw material costs directly affects its profitability.

- Market Volatility: Fluctuations in the price of PTFE, influenced by factors like energy costs and regulatory changes, pose an ongoing challenge for Gore.

- Supplier Dependence: Reliance on a concentrated supplier base for critical inputs grants those suppliers considerable leverage.

The bargaining power of suppliers is a significant consideration for W. L. Gore & Associates due to its reliance on specialized fluoropolymers like PTFE. The limited number of global manufacturers for these critical inputs, coupled with the high switching costs for Gore, grants these suppliers considerable leverage in pricing and supply. For example, the global PTFE market saw price increases in early 2024 due to production issues, directly impacting Gore's input costs.

The concentration of suppliers in the fluoropolymer market, particularly for PTFE which held a substantial 38% market share in 2024, means few companies can meet Gore's stringent material requirements. This scarcity of alternatives amplifies supplier influence, potentially squeezing Gore's profit margins if cost increases cannot be fully passed on to customers.

| Supplier Characteristic | Impact on Gore | 2024 Data/Trend |

|---|---|---|

| Supplier Concentration | Increased leverage for suppliers | Limited global producers for specialized fluoropolymers |

| Switching Costs | Ties Gore to existing suppliers | Re-qualification, tooling, performance risks |

| Material Scarcity | Amplifies supplier pricing power | PTFE is a critical, hard-to-substitute input |

| Input Cost Volatility | Affects Gore's profitability | PTFE prices rose in early 2024 due to supply constraints |

What is included in the product

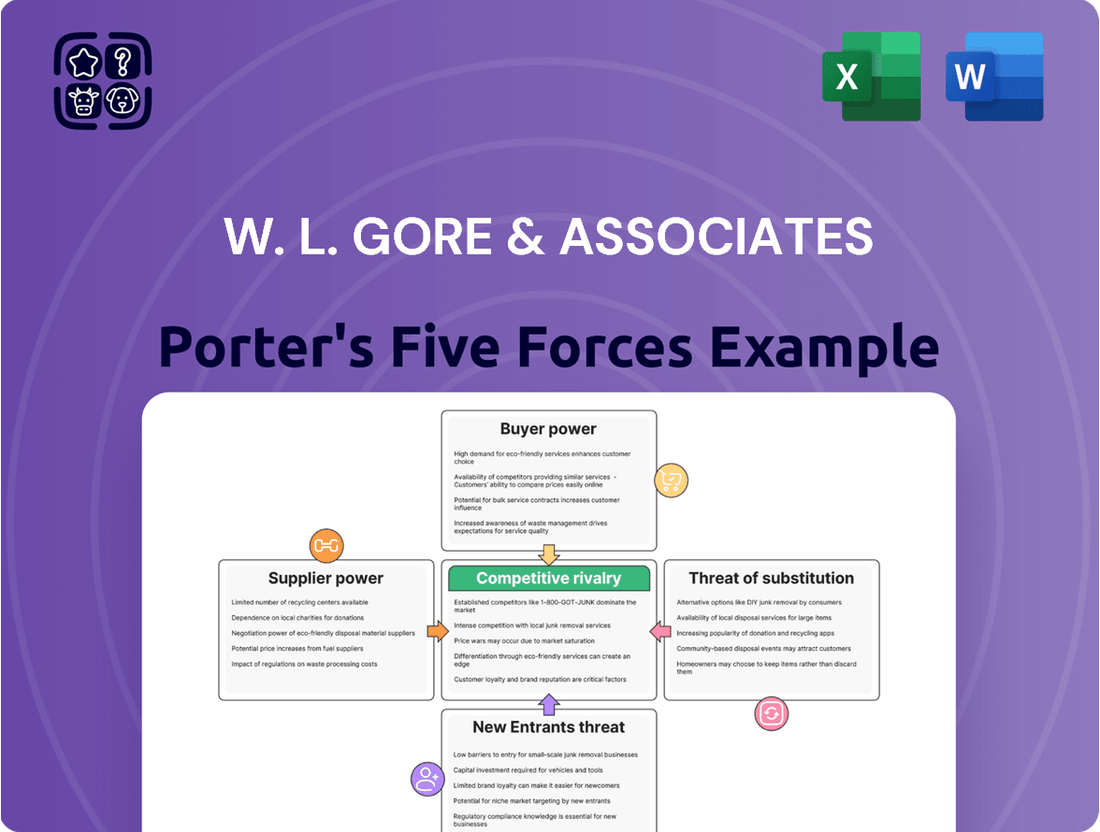

This analysis examines the competitive intensity and profitability potential for W. L. Gore & Associates by dissecting industry rivalry, buyer and supplier power, threat of new entrants, and the availability of substitutes.

Instantly visualize competitive pressures with a dynamic, interactive five forces model, simplifying complex strategic analysis for W. L. Gore & Associates.

Customers Bargaining Power

W. L. Gore & Associates operates across various sectors like medical, textiles, and industrial, which generally spreads its customer base. However, within niche, high-tech markets, a few major clients could represent a substantial chunk of revenue, granting them increased bargaining power. This concentration allows these key customers to press for better pricing or more favorable contract conditions.

Customers gain significant bargaining power when a wide array of substitute products are readily available. If customers can easily switch to alternative materials or products that deliver similar performance at a competitive or even lower price point, their leverage over W. L. Gore & Associates increases substantially. This is particularly relevant in industries where material innovation is rapid.

While Gore has historically excelled with its high-performance fluoropolymer solutions, the landscape of alternative materials is constantly evolving. For instance, ongoing research and development in non-stick coatings are yielding new options that aim to match the performance of traditional PFAS-based coatings but with significantly reduced or eliminated 'forever chemicals'. This trend could present more choices for customers, thereby amplifying their bargaining power.

W. L. Gore & Associates navigates varying buyer price sensitivity. In markets where its products are perceived as commodities, customers may indeed push for lower prices. For example, if Gore's materials are used in a less critical component of a larger assembly, the buyer's focus might shift to cost containment.

However, this sensitivity dramatically decreases in high-stakes applications. For medical implants, where patient safety and device efficacy are non-negotiable, customers prioritize Gore's reputation for quality, reliability, and stringent certifications over minor price differences. Similarly, in specialized aerospace, the cost of failure far outweighs the cost of premium materials, making performance the primary driver.

The medical device sector, a key area for Gore, exemplifies this. Demand for enhanced diagnostics and monitoring is robust, driving innovation and requiring expanded device availability. In 2024, the global medical devices market was valued at over $500 billion, underscoring the immense value placed on advanced technology and dependable components, where Gore's specialized materials play a critical role, reducing price sensitivity.

Buyer's Ability to Backward Integrate

W. L. Gore & Associates faces potential pressure from large customers who might consider backward integration to produce their own fluoropolymer components. This is particularly relevant for major players in sectors like automotive and electronics.

While the significant capital investment and specialized knowledge in advanced materials science present a substantial hurdle, the possibility exists for very large, vertically integrated clients to explore this avenue. The global advanced materials market is expected to see robust growth, with projections indicating a compound annual growth rate (CAGR) of around 8.5% through 2030, reaching an estimated value of $245 billion. This expansion underscores the strategic importance of these materials across diverse industries.

- Customer Integration Threat: Large automotive and electronics manufacturers could potentially develop in-house capabilities for certain fluoropolymer components.

- High Barriers to Entry: The specialized expertise and substantial capital required for advanced materials production act as a significant deterrent to backward integration.

- Market Growth Context: The projected growth of the advanced materials market, estimated to reach $245 billion by 2030, highlights the strategic value of these products and the potential for large customers to seek greater control over their supply chain.

- Theoretical Consideration: Despite the difficulties, the potential for backward integration remains a theoretical, albeit low-probability, threat for W. L. Gore & Associates from its largest, most resource-rich customers.

Information Availability to Buyers

Buyers increasingly leverage readily available market data, including pricing and product specifications from numerous suppliers. This transparency significantly enhances their capacity to compare offerings and negotiate more effectively. For instance, in the broader fluoropolymer market, which is undergoing substantial shifts due to sustainability and technological progress, buyers can readily access comparative data that strengthens their position.

However, for highly specialized or proprietary solutions developed by W. L. Gore & Associates, such as advanced medical implants or high-performance electronic components, the information advantage often still rests with Gore. This information asymmetry can limit the bargaining power of customers in these specific niche segments.

- Increased Market Transparency: Buyers can access more pricing and product details from various vendors.

- Enhanced Negotiation Power: Greater information allows customers to compare and negotiate terms more effectively.

- Information Asymmetry for Proprietary Products: Gore maintains an advantage for highly customized or unique solutions.

- Market Dynamics: The fluoropolymer sector's transformation impacts buyer information access and negotiation leverage.

The bargaining power of W. L. Gore & Associates' customers is influenced by several factors, notably the availability of substitutes and price sensitivity. While Gore's specialized products often command premium pricing due to their performance and reliability, especially in sectors like medical devices, the broader market for materials is seeing an increase in alternative options. This evolving landscape means that for less critical applications, customers may exert more pressure on pricing, leveraging available market data to negotiate better terms.

In 2024, the global medical devices market, a key sector for Gore, was valued at over $500 billion. This significant market size highlights the critical importance of advanced, reliable components where customers prioritize performance and safety over minor cost variations. However, in other segments, such as industrial or textile applications, customers might have more flexibility to switch to alternative materials if pricing becomes a major concern, especially as new, potentially lower-cost substitutes emerge.

The threat of backward integration, while generally low due to high capital and expertise requirements, remains a theoretical consideration for Gore's largest and most resource-rich clients, particularly in the automotive and electronics sectors. The advanced materials market, projected to reach $245 billion by 2030, signifies the strategic importance of these products, potentially encouraging major players to explore greater supply chain control.

| Factor | Impact on Gore's Customer Bargaining Power | Supporting Data/Context |

|---|---|---|

| Availability of Substitutes | Increases power, especially for less specialized applications. | Rapid innovation in non-stick coatings offers alternatives to PFAS-based materials. |

| Price Sensitivity | High in commodity-like applications, low in critical, high-stakes uses. | Medical device sector (over $500 billion market in 2024) shows low price sensitivity for critical components. |

| Customer Information Access | Increases power due to market transparency. | Buyers can easily compare pricing and specifications in the broader fluoropolymer market. |

| Backward Integration Threat | Low but present for very large, well-resourced customers. | Advanced materials market growth ($245 billion by 2030) highlights strategic value. |

What You See Is What You Get

W. L. Gore & Associates Porter's Five Forces Analysis

This preview shows the exact document you'll receive immediately after purchase—no surprises, no placeholders. It details W. L. Gore & Associates' Porter's Five Forces Analysis, covering the bargaining power of buyers and suppliers, the threat of new entrants and substitutes, and the intensity of rivalry within its markets.

Rivalry Among Competitors

W. L. Gore & Associates faces a competitive landscape populated by both specialized players and larger, diversified chemical giants. Companies like DuPont, 3M, and Toray Industries are significant competitors, possessing substantial resources and market reach, ensuring a robust rivalry despite Gore's innovative strengths.

The global fluoropolymer market, a key area for Gore, is particularly competitive. Major players such as Arkema, Daikin Industries, Solvay, and The Chemours Company are active participants, each contributing to the intense competition for market share and technological advancement.

The advanced materials and fluoropolymer markets, where W. L. Gore & Associates operates, are currently experiencing robust growth. This expansion often tempers direct competitive rivalry, as there's ample room for multiple companies to thrive and capture market share. The global fluoropolymer market, for instance, is projected to reach USD 5.67 billion by 2029, with a Compound Annual Growth Rate (CAGR) of 7.92% starting from 2024.

This favorable market trajectory means that while competition exists, the sheer size of the growing pie can alleviate some of the pressure that might otherwise lead to aggressive price wars or intense market share battles. Even within specific segments, such as performance fabrics, steady growth contributes to a less cutthroat competitive environment.

W. L. Gore & Associates leverages a powerful brand identity, most notably with GORE-TEX, which signifies innovation and superior performance. This strong differentiation shields the company from intense price wars by creating a loyal customer base that values quality over cost.

Gore's unwavering commitment to high-quality, performance-driven products is a cornerstone of its competitive advantage. This focus on excellence, exemplified by its materials science innovations, allows it to command premium pricing and fosters deep customer trust.

Switching Costs for Customers

For customers, particularly in demanding sectors such as medical devices or specialized industrial applications, the transition away from W. L. Gore & Associates' established products to those of competitors can incur substantial expenses. These costs often stem from the rigorous processes of performance validation, obtaining necessary regulatory approvals, and mitigating potential risks associated with new materials or systems. This creates a significant hurdle for customers contemplating a switch.

The demonstrable product performance, user-friendliness, and the consistent quality of service offered by Gore translate into tangible, ongoing cost savings for healthcare professionals, hospitals, and insurance providers. These benefits make it economically sensible for them to remain with Gore's solutions rather than incur the upfront and ongoing costs of switching.

- High Validation Costs: Medical device manufacturers often face millions in costs to re-validate components for FDA or equivalent regulatory body approval after switching suppliers.

- Performance Risk: In critical applications, a competitor's product might not meet the same stringent performance benchmarks, leading to potential product failures and associated recall costs.

- Training and Integration: Implementing new materials or technologies can require significant investment in training personnel and integrating new systems, further increasing switching costs.

Exit Barriers

W. L. Gore & Associates operates in a sector where exit barriers are notably high, primarily due to substantial investments in specialized manufacturing and research. For instance, the intricate processes involved in producing high-performance fluoropolymers require highly specialized equipment and extensive R&D, locking in capital.

These significant upfront and ongoing costs, including maintaining a highly skilled workforce crucial for advanced materials, make it economically challenging for firms to simply cease operations. This situation can compel companies to remain competitive even when market conditions are less favorable, thereby intensifying the rivalry among existing players.

- High Fixed Costs: Specialized manufacturing facilities and R&D for advanced materials represent substantial capital outlays.

- Skilled Workforce Dependency: The need for a highly trained workforce adds to operational costs and makes labor mobility difficult.

- Complex Manufacturing: Advanced materials production, like fluoropolymers, demands specialized, often proprietary, equipment.

- Intensified Rivalry: High exit barriers can lead to prolonged competition, even in periods of reduced profitability.

While W. L. Gore & Associates faces competition from established giants like DuPont and 3M, and specialized players in the fluoropolymer market such as Arkema and Daikin, the robust growth in advanced materials and fluoropolymers, projected to reach USD 5.67 billion by 2029 with a 7.92% CAGR from 2024, tempers the intensity of direct rivalry.

Gore's strong brand, particularly GORE-TEX, and unwavering commitment to high-quality, performance-driven products allow it to command premium pricing and foster customer loyalty, mitigating aggressive price wars.

High switching costs for customers, especially in regulated sectors like medical devices, due to validation and integration expenses, further reduce the immediate threat of competitors capturing market share.

Additionally, high exit barriers in specialized manufacturing and R&D for advanced materials compel existing firms to remain competitive, contributing to sustained rivalry among current players.

SSubstitutes Threaten

The threat of substitutes for W. L. Gore & Associates hinges on whether alternative materials or technologies can match the performance of Gore's fluoropolymer products while offering a more attractive price point. For instance, while PTFE remains a benchmark for chemical resistance and thermal stability, the market is seeing innovation in more eco-friendly or budget-friendly materials that could challenge Gore's market share.

Customer propensity to substitute for W. L. Gore & Associates products hinges on several factors. Awareness of viable alternatives plays a significant role; if customers are well-informed about other options, their willingness to switch increases. The perceived risk associated with switching is also critical. For instance, in highly specialized or critical applications, like those in the aerospace or medical fields, customers are often hesitant to adopt substitutes unless the new offering provides a demonstrably superior benefit or a substantial cost reduction, mitigating the inherent risks of unproven alternatives.

The importance of Gore's product within the customer's overall solution is another key determinant. If Gore's materials are integral to a product's performance, reliability, or safety, customers will likely exhibit a lower propensity to substitute. Conversely, if Gore's products are more commoditized or less central to the end-product's functionality, the threat of substitutes becomes more pronounced. For example, while Gore-Tex fabric in high-performance outdoor gear faces competition, its reputation and established performance standards can deter casual switching.

The evolving landscape of material science also influences this propensity. The medical device industry, for example, is increasingly prioritizing sustainable solutions, with a notable focus on biodegradable materials. This trend could present a substitution threat to traditional, non-biodegradable materials if Gore does not adapt its product portfolio or if competitors emerge with more environmentally friendly alternatives that meet performance requirements. The global market for biodegradable polymers, for instance, was projected to reach over $10 billion by 2024, indicating a growing customer demand for sustainable options.

In the performance fabrics sector, ongoing textile engineering breakthroughs are yielding materials with multifunctional capabilities that could potentially replace some of GORE-TEX's established uses. For instance, research into advanced weaving techniques and new fiber compositions is creating fabrics with enhanced breathability, waterproofing, and durability, directly challenging GORE-TEX's market position.

For W. L. Gore & Associates' industrial and medical divisions, the threat of substitutes is significant. Emerging materials such as high-performance composites, advanced ceramics, and even graphene-infused solutions offer unique properties that could serve as alternatives in demanding applications where GORE-TEX products are currently utilized.

Furthermore, the development of novel non-stick materials that demonstrate performance comparable to PFAS-based coatings, which are central to many GORE-TEX products, presents another avenue for substitution. This innovation could impact sectors relying on non-stick properties, potentially reducing demand for Gore's specialized solutions.

Evolution of Regulatory Landscape

The increasing global focus on environmental and health impacts, particularly concerning per- and polyfluoroalkyl substances (PFAS) like PTFE, is a significant threat. Governments worldwide are tightening regulations. For instance, in 2024, several European Union member states proposed stricter limits on PFAS in consumer goods and industrial emissions, signaling a trend that could impact W. L. Gore’s core materials.

This evolving regulatory landscape is actively spurring innovation in alternative materials. Companies are investing heavily in developing and marketing PFAS-free replacements across various applications, from cookware to industrial coatings. This push for substitutes means that customers may soon have viable, compliant alternatives to PTFE-based products, potentially eroding market share.

- Regulatory pressure on PFAS is intensifying globally, with proposed stricter limits in key markets like the EU in 2024.

- Environmental and health concerns are driving significant R&D investment into PFAS-free alternatives.

- The availability of viable substitutes poses a direct threat to the demand for PTFE-based products.

- Companies are actively marketing PTFE-free replacements, creating competitive pressure.

Innovation in Substitute Materials

The threat of substitutes for W. L. Gore & Associates is heightened by ongoing innovation in materials science. New materials with superior performance characteristics or a reduced environmental footprint are continually being developed, potentially displacing Gore's existing product lines.

For instance, advancements in silicone-based polymers and graphene oxide solutions are actively exploring their potential as replacements for traditional fluoropolymers in a variety of applications, including electronics and medical devices. This constant evolution means that Gore must remain vigilant in adapting its own material science research and development to stay competitive.

The market for high-performance materials is dynamic, with companies investing heavily in R&D. For example, in 2024, global spending on materials science research and development is projected to exceed $200 billion, indicating a strong focus on creating novel solutions that could serve as substitutes for established materials.

- Emerging Material Technologies: Silicone polymers and graphene oxide are showing promise as alternatives to fluoropolymers.

- Performance and Sustainability Drivers: Innovations often focus on improving material properties or reducing environmental impact.

- R&D Investment: Significant global investment in materials science fuels the development of potential substitutes.

- Competitive Landscape: Continuous material advancements necessitate ongoing adaptation by established players like W. L. Gore & Associates.

The threat of substitutes for W. L. Gore & Associates is substantial, driven by both technological advancements and growing regulatory pressures. As of 2024, the increasing scrutiny and proposed stricter regulations on PFAS chemicals in regions like the EU are compelling industries to seek alternatives. This regulatory push, coupled with significant global R&D investments exceeding $200 billion in materials science for 2024, is accelerating the development and market introduction of PFAS-free materials. Companies are actively marketing these substitutes, directly challenging Gore's core fluoropolymer-based products across various sectors.

| Factor | Impact on Gore | Example | 2024 Relevance |

|---|---|---|---|

| Regulatory Pressure on PFAS | High | Stricter limits on PFAS in consumer goods and industrial emissions proposed in the EU. | Spurs demand for PFAS-free alternatives. |

| Material Science Innovation | Medium to High | Development of silicone-based polymers and graphene oxide as potential replacements for fluoropolymers. | Global R&D spending in materials science projected over $200 billion, fueling new solutions. |

| Customer Propensity to Substitute | Varies by Application | Hesitancy in critical sectors like aerospace and medical vs. potential switching in less demanding applications. | Growing customer demand for sustainable and compliant materials. |

| Emerging Alternative Materials | Medium | High-performance composites, advanced ceramics, and novel non-stick materials. | These materials offer unique properties that can compete in niche applications. |

Entrants Threaten

Entering the advanced materials and fluoropolymer manufacturing sector, where W. L. Gore & Associates operates, demands significant upfront capital. This includes substantial investments in research and development, the establishment of highly specialized production facilities, and the acquisition or development of crucial intellectual property.

These considerable capital requirements act as a formidable barrier, effectively deterring many potential new competitors from entering the market. The sheer scale of investment needed to compete means only well-funded entities can realistically consider challenging established players like Gore.

The global advanced materials market itself is a testament to this, projected to reach USD 69.41 billion in 2024, indicating the substantial financial resources already deployed and required to operate within this lucrative, yet capital-intensive, industry.

W. L. Gore & Associates' robust portfolio of patents and deeply ingrained proprietary knowledge in fluoropolymer science and manufacturing presents a formidable hurdle for potential new entrants. This technological moat, built over decades, makes it exceptionally difficult for newcomers to replicate Gore's product quality and performance standards without substantial investment in research and development, and facing potential patent infringement litigation.

Newcomers face significant hurdles in securing access to established distribution channels, a critical factor for success across Gore's diverse markets. For instance, penetrating the highly regulated medical device sector requires navigating complex supply chains and gaining trust from healthcare providers, a process that can take years. Similarly, establishing a foothold in the performance apparel or industrial materials markets necessitates building relationships with key retailers and manufacturers who often have long-standing agreements with incumbent players like Gore.

Economies of Scale and Experience Curve

W. L. Gore & Associates benefits significantly from established economies of scale in its advanced manufacturing processes for high-performance fluoropolymers. This scale allows for lower per-unit production costs compared to potential newcomers. For instance, in 2024, the global fluoropolymer market was valued at approximately $10.5 billion, with significant investments in production capacity by established players like Gore.

Furthermore, Gore has cultivated a deep experience curve in developing and refining its specialized fluoropolymer technologies. This accumulated knowledge translates into operational efficiencies and product quality that are difficult for new entrants to replicate quickly. The technical expertise required for consistent, high-quality output acts as a substantial barrier.

- Economies of Scale: Gore's large-scale production facilities reduce manufacturing costs per unit, making it challenging for new entrants to compete on price.

- Experience Curve: Decades of operational experience have optimized Gore's processes, leading to higher efficiency and product consistency.

- Manufacturing Complexity: The intricate nature of producing advanced fluoropolymers requires specialized equipment and know-how, deterring potential new competitors.

- Market Dominance: Established players, including Gore, have built strong supply chains and distribution networks, further increasing the hurdles for new market entrants.

Brand Loyalty and Customer Relationships

W. L. Gore & Associates benefits from exceptionally strong brand loyalty and deeply entrenched customer relationships. This is a significant barrier to new entrants. Their reputation for consistent, high-performance products, particularly in demanding sectors like aerospace and medical devices, fosters a trust that new competitors struggle to replicate.

Gore's customer-centric philosophy, focused on understanding and meeting specific client needs, further solidifies these bonds. This approach means new players must not only offer comparable products but also invest heavily in building similar levels of trust and understanding, a process that can take years.

- Brand Reputation: Gore's brand is synonymous with quality and reliability, a hard-won asset that deters new entrants.

- Customer Relationships: Long-standing partnerships built on trust and performance create significant switching costs for customers.

- Market Penetration Difficulty: New companies face a steep climb to gain traction against Gore's established customer base and brand equity.

The threat of new entrants into W. L. Gore & Associates' markets is generally low due to significant barriers. High capital requirements for specialized manufacturing and R&D, coupled with a complex global advanced materials market valued at USD 69.41 billion in 2024, mean only well-capitalized firms can consider entry. Gore's extensive patent portfolio and proprietary knowledge in fluoropolymers create a substantial technological moat, making it difficult and costly for newcomers to match their product performance and avoid legal challenges.

Porter's Five Forces Analysis Data Sources

Our W. L. Gore & Associates Porter's Five Forces analysis is built upon a foundation of diverse and credible data sources, including W. L. Gore's annual reports, industry-specific trade publications, and market research reports from leading firms.

We also leverage publicly available financial data from regulatory filings, economic indicators, and competitor analysis reports to provide a comprehensive understanding of the competitive landscape.