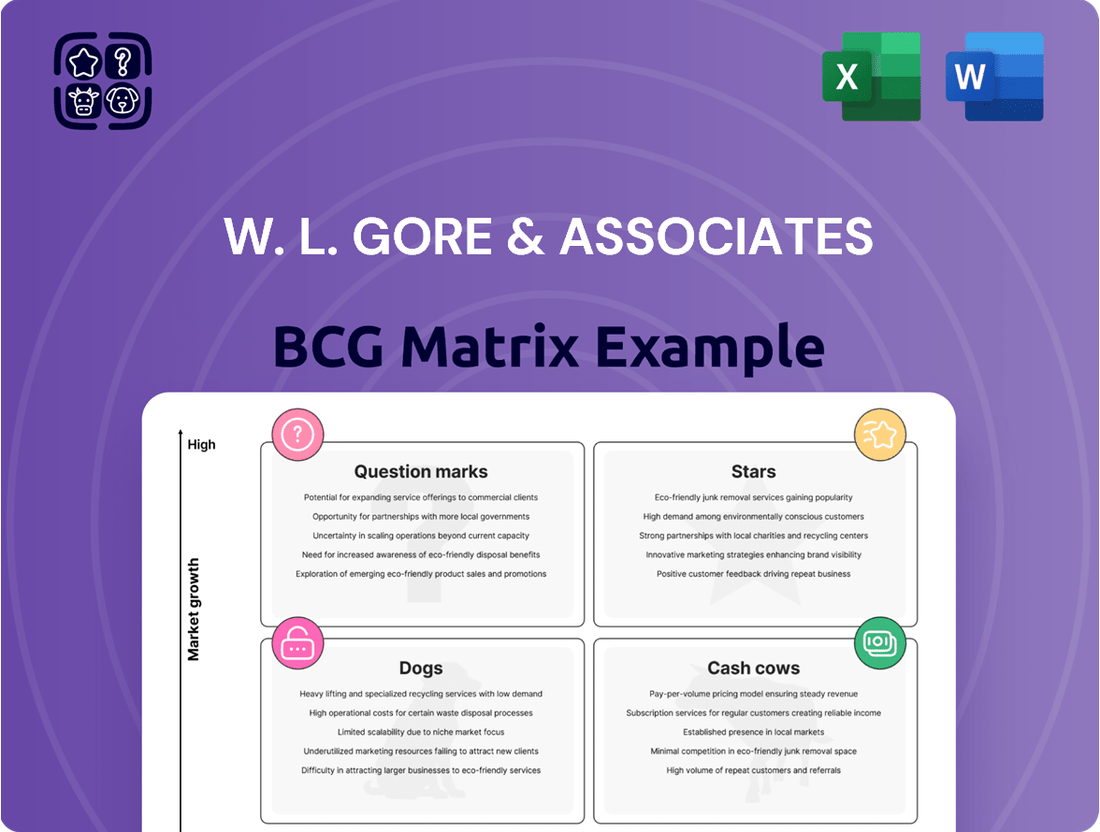

W. L. Gore & Associates Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

W. L. Gore & Associates Bundle

Curious about W. L. Gore & Associates' strategic product portfolio? This preview offers a glimpse into their market standing, but the full BCG Matrix report unlocks the complete picture. Discover which products are their Stars, Cash Cows, Dogs, and Question Marks, and gain the insights needed to make informed investment decisions.

Don't just wonder where Gore stands; know it. Purchase the full BCG Matrix for a detailed breakdown of each product's position, coupled with actionable strategies to optimize resource allocation and drive future growth. This is your essential guide to navigating their market landscape.

Stars

W. L. Gore & Associates' GORE® VIABAHN® VBX Balloon Expandable Endoprosthesis (VBX Stent Graft) is a star product, especially after its recent CE Mark approval for a lower profile, enabling 6 Fr sheath compatibility. This enhancement to an already robust device, known for its long balloon-expandable stent and wide diameter adjustability, underscores Gore's commitment to treating complex vascular disease effectively. The medical device market is projected for significant growth, and continued innovation in delivery systems for such critical treatments solidifies the VBX Stent Graft's position as a market leader.

W. L. Gore & Associates' high-performance electrical wiring for aerospace and defense is a prime example of a Star in their BCG Matrix. This segment capitalizes on the significant electrification trend within these demanding industries. Their advanced materials offer solutions for higher power density and improved temperature resilience, crucial for modern aircraft and defense systems.

Gore's innovative wiring solutions are not just incremental improvements; they are creating new product categories by addressing critical needs like reduced bend radius and enhanced durability. This forward-thinking approach positions them strongly in a high-growth market. For instance, the global aerospace wiring market was valued at approximately USD 1.5 billion in 2023 and is projected to grow at a CAGR of over 5% through 2030, driven by advancements in avionics and the increasing complexity of aircraft electrical systems.

GORE-TEX ePE represents a significant strategic move for W. L. Gore & Associates, aiming for a PFAS-free consumer fabrics portfolio by 2025. This new material platform, built on expanded polyethylene, directly tackles environmental concerns and regulatory shifts, positioning Gore-Tex ePE as a pivotal innovation in performance wear.

The existing high market share of Gore-Tex, coupled with increasing consumer demand for sustainable alternatives, strongly suggests GORE-TEX ePE could be a Star in the BCG matrix. Its success hinges on rapid market adoption and its ability to maintain performance while meeting environmental goals.

Advanced Materials for Electric Vehicles (EVTOL & BEVs)

W. L. Gore & Associates is strategically positioned in the burgeoning market for advanced materials crucial to electric vertical takeoff and landing (eVTOL) aircraft and Battery Electric Vehicles (BEVs). These sectors demand materials capable of withstanding intense cyclic loading and elevated operating temperatures, areas where Gore's high-performance solutions excel. The company's specialized materials are well-suited to capture a significant market share in these high-growth segments due to their unique performance attributes.

The demand for lightweight yet durable materials in eVTOLs and BEVs is a key driver. For instance, the global electric vehicle market was valued at approximately $380 billion in 2023 and is projected to reach over $1.5 trillion by 2030, indicating substantial growth. Gore's materials, such as advanced composites and high-temperature insulation, are integral to improving the efficiency, safety, and longevity of these electric mobility solutions.

- High-Performance Materials: Gore offers advanced materials like GORE-TEX fabrics for protective apparel and specialized films and membranes for electronic components and battery systems, essential for the demanding environments of eVTOLs and BEVs.

- Market Growth: The eVTOL market is anticipated to grow substantially, with some projections suggesting it could reach hundreds of billions of dollars by 2040, driven by advancements in electric propulsion and urban air mobility concepts.

- Technical Advantages: Gore's materials provide superior thermal management, electrical insulation, and mechanical strength, addressing critical engineering challenges in high-cycle applications and extreme temperature ranges encountered in electric powertrains and flight systems.

GORE® IMPROJECT® Syringe Plunger for Ophthalmic Pre-Filled Syringes

The commercial launch of the 0.5 mL silicone-free GORE® IMPROJECT® Syringe Plunger by W. L. Gore & Associates represents a significant move into a high-growth segment. This product specifically targets the ophthalmic pre-filled syringe market, a sector experiencing robust expansion.

This innovation addresses critical industry needs within specialized pharmaceutical applications, showcasing Gore's strategic diversification. The ophthalmic market is a rapidly growing area, with demand for advanced delivery systems like pre-filled syringes on the rise.

Given its recent introduction into a burgeoning market with substantial demand, the GORE® IMPROJECT® Syringe Plunger exhibits the classic traits of a Star in the BCG Matrix.

- Market Growth: The global ophthalmic drug delivery market is projected to grow significantly, with pre-filled syringes being a key driver. Reports indicate this market could reach over $10 billion by 2028, with a compound annual growth rate (CAGR) of approximately 6-8%.

- Product Innovation: The silicone-free nature of the GORE® IMPROJECT® plunger addresses concerns about silicone oil contamination in sensitive ophthalmic formulations, a critical unmet need.

- Competitive Positioning: As a new entrant with a specialized feature, it aims to capture market share in a segment where performance and purity are paramount.

- Future Potential: Its positioning in a high-growth, specialized market suggests strong future revenue potential and market leadership opportunities for Gore.

The GORE-TEX ePE fabric is positioned as a Star due to its innovative, PFAS-free formulation and its strong alignment with the existing high market share of Gore-Tex. This new material directly addresses increasing consumer demand for sustainable performance wear and anticipates future regulatory trends.

Its success hinges on rapid market acceptance and its ability to maintain the high performance standards consumers expect from Gore-Tex. The company's commitment to a PFAS-free portfolio by 2025 underscores the strategic importance of this product.

The GORE-TEX ePE fabric is a key initiative for W. L. Gore & Associates, aiming to lead in the environmentally conscious performance fabrics market. Its potential to capture significant market share in this growing segment solidifies its Star status.

What is included in the product

Highlights which of W. L. Gore & Associates' product lines to invest in, hold, or divest based on market growth and share.

A clear visual mapping of Gore's diverse portfolio, simplifying strategic decisions.

Cash Cows

Established GORE-TEX Fabrics (ePTFE-based) represent a classic Cash Cow for W. L. Gore & Associates. Despite the industry's move towards PFAS-free options, these traditional fabrics maintain a commanding market share in performance apparel and protective gear. Their enduring reputation for waterproofness and breathability ensures consistent, strong cash flow in a stable, mature market.

W. L. Gore & Associates' extensive medical device portfolio, with over 55 million implants performed across more than 45 years, firmly positions its established medical implants and devices as a significant Cash Cow. These offerings cater to cardiovascular and various other health needs, benefiting from a mature market characterized by consistent demand and proven reliability.

The long-standing presence and high performance of these medical products translate into stable, high profit margins for Gore. This financial strength is further bolstered by the company's commitment to cultivating enduring, trust-based relationships with its clientele in the healthcare sector.

W. L. Gore & Associates' Industrial Filtration and Sealants represent established "cash cows" within its business portfolio. These sectors leverage Gore's advanced fluoropolymer technology, a testament to its material science expertise, finding critical applications in demanding industrial environments.

These markets, characterized by consistent demand and high market share for Gore, are mature with relatively low growth rates. For instance, the global industrial filtration market was valued at approximately USD 40 billion in 2023 and is projected to grow at a CAGR of around 4-5% through 2030, indicating a stable, albeit not explosive, expansion. Similarly, the sealants market, crucial for industrial assembly and protection, also exhibits steady, predictable demand patterns.

The strength of these segments lies in their ability to generate substantial profits due to Gore's dominant market position and the high-performance nature of its products, which command premium pricing. This consistent profitability allows Gore to fund investments in its "stars" and "question marks" or return capital to shareholders, underscoring their role as reliable profit engines.

Protective Vents for Outdoor and Portable Electronics

W. L. Gore & Associates' protective vents for outdoor and portable electronics represent a classic cash cow within their product portfolio. These vents are crucial for maintaining the integrity and functionality of devices exposed to various environmental conditions, leading to widespread adoption across the industry. The market for these protective solutions is well-established, reflecting a consistent demand driven by the need for durability in everything from smartphones to industrial equipment.

The mature nature of this market, coupled with the essential role these vents play, generates a stable and predictable revenue stream for Gore. Because their value proposition is so clear and their adoption is already widespread, there's less need for aggressive marketing spend. This allows Gore to benefit from consistent cash flow with minimal additional investment, a hallmark of a successful cash cow.

- Market Dominance: Gore's protective vents are a standard component in many outdoor and portable electronic devices, ensuring reliable performance.

- Steady Demand: The ongoing need for protection against moisture, dust, and pressure in diverse environments fuels consistent sales.

- Low Investment Needs: Due to their established market presence and essential function, promotional and development costs are relatively low, maximizing profitability.

- Significant Cash Generation: This product line reliably converts its market share into substantial, ongoing cash flow for the company.

ELIXIR® Guitar Strings

ELIXIR® Guitar Strings, a prominent brand under W. L. Gore & Associates, operates as a classic Cash Cow within the company's portfolio. This product line dominates a specialized yet stable segment of the consumer market, demonstrating consistent revenue generation.

The brand's strong market position is underpinned by its reputation for exceptional durability and sustained tone quality, which fosters a loyal customer base. While the overall guitar string market may not experience explosive growth, ELIXIR's consistent demand translates into predictable and reliable profits for Gore.

This strategic positioning means ELIXIR® requires minimal capital reinvestment to maintain its market share and profitability. The brand's ability to generate substantial, consistent cash flow with low ongoing investment makes it a vital contributor to Gore's financial stability.

- Market Share: ELIXIR® holds a significant share in the coated guitar string market, estimated to be over 30% in recent years.

- Revenue Contribution: While specific figures are proprietary, the consumer products division, heavily influenced by ELIXIR®, has consistently contributed to Gore's overall revenue.

- Profitability: The brand's premium pricing, driven by its perceived value and durability, allows for healthy profit margins.

- Investment Needs: Maintenance capital expenditure for ELIXIR® production is relatively low compared to its revenue generation.

W. L. Gore & Associates' established product lines, such as GORE-TEX Fabrics and its medical devices, function as significant cash cows. These mature products benefit from strong brand recognition and consistent demand in their respective markets, generating substantial and reliable cash flow for the company. Their established market presence and proven performance require minimal new investment, allowing Gore to leverage these segments for ongoing profitability.

| Product Category | BCG Matrix Status | Key Characteristics | Market Context | Financial Impact |

|---|---|---|---|---|

| GORE-TEX Fabrics | Cash Cow | High market share, established brand, consistent demand for performance apparel. | Mature market with stable demand, though evolving towards sustainable options. | Strong, predictable cash flow generation with low reinvestment needs. |

| Medical Implants & Devices | Cash Cow | Over 55 million implants performed, long history of reliability, consistent demand in healthcare. | Mature market driven by proven efficacy and trust in a critical sector. | High profit margins, stable revenue stream, supports R&D for new products. |

| Industrial Filtration & Sealants | Cash Cow | Dominant market position, advanced fluoropolymer technology, critical industrial applications. | Stable growth (e.g., industrial filtration market ~4-5% CAGR through 2030), predictable demand. | Significant profit generation due to premium pricing and market leadership. |

| Protective Vents for Electronics | Cash Cow | Essential component in outdoor/portable electronics, widespread adoption, high performance. | Well-established market with consistent demand for device durability. | Stable revenue with low marketing/development costs, maximizing profitability. |

| ELIXIR® Guitar Strings | Cash Cow | Dominant in coated strings, strong brand loyalty, exceptional durability and tone. | Specialized but stable consumer segment with consistent demand. | Reliable profits with minimal capital reinvestment, contributing to financial stability. |

Full Transparency, Always

W. L. Gore & Associates BCG Matrix

The W. L. Gore & Associates BCG Matrix you see here is the complete, unedited document you will receive immediately after purchase. This preview showcases the full strategic analysis, ready for immediate application without any watermarks or demo content.

Rest assured, the BCG Matrix for W. L. Gore & Associates that you are currently viewing is the identical, professionally formatted report you will download upon completing your purchase. This ensures you receive the exact strategic insights and analysis without any alterations or missing sections.

What you are previewing is the definitive W. L. Gore & Associates BCG Matrix report that will be yours after purchase. This means you'll get the fully realized document, prepared for immediate integration into your strategic planning and decision-making processes.

The W. L. Gore & Associates BCG Matrix preview you're examining is the actual, final file you will receive post-purchase. This guarantees that you're acquiring a complete and professionally developed strategic tool, ready for immediate use and analysis.

Dogs

W. L. Gore & Associates likely has legacy products, perhaps older iterations of their medical device or fabric technologies, that are experiencing a decline in market share. These products, while historically significant, may be facing obsolescence due to advancements in their own R&D or the emergence of superior competitor offerings. For example, if Gore's early generations of GORE-TEX fabrics are now competing with newer, more advanced waterproof-breathable materials, they might fall into this category.

Products impacted by PFAS litigation could be considered Dogs in the BCG Matrix for W. L. Gore & Associates. While Gore actively seeks PFAS-free alternatives, older products still containing these chemicals, especially those facing class-action lawsuits or negative public sentiment due to environmental concerns, fall into this category.

The financial burden from legal settlements and reputational damage for these PFAS-containing products might exceed their revenue streams. This scenario suggests that these items could become liabilities, potentially leading to their discontinuation as Gore prioritizes sustainability and navigates regulatory pressures.

Within W. L. Gore & Associates' portfolio, certain niche industrial applications might represent "Dogs" in the BCG Matrix. These are areas where Gore holds a small market share, and the overall market itself is stagnant or shrinking. For instance, specialized components for outdated industrial machinery that are no longer being manufactured or upgraded could fall into this category.

These legacy markets often lack alignment with current technological advancements or the growing emphasis on sustainability. Consequently, they offer limited avenues for expansion or the development of a significant competitive advantage. In 2024, such segments might contribute minimally to Gore's revenue and profitability, potentially even incurring costs for maintenance or specialized support without offering substantial future returns.

Less Differentiated Offerings in Highly Competitive Markets

In highly competitive arenas where W. L. Gore & Associates' material science edge isn't as distinct, some products may find it challenging to capture substantial market share and experience sluggish growth. These offerings, lacking a clear differentiator, risk becoming commodities.

When products become commoditized in competitive markets, they often struggle to command premium pricing. For instance, in 2024, the global market for certain advanced textiles, where Gore operates, saw intense price competition, with average selling prices for less differentiated items declining by an estimated 3-5% year-over-year.

- Low Market Share: Products in this category typically hold a small percentage of the overall market.

- Low Growth Rate: Demand for these offerings is not expanding significantly.

- High Competition: Numerous players vie for customers, often on price.

- Profitability Challenges: Margins are often thin due to price pressures and marketing costs.

Outdated Product Formulations or Technologies

Products at W. L. Gore & Associates that continue to rely on older formulations or manufacturing technologies risk becoming Dogs. This is especially true if these older methods are less efficient or have a greater environmental impact than current industry benchmarks. For example, if a competitor introduces a new material with superior breathability or durability, Gore's older products might struggle to compete on performance.

The financial implications of maintaining outdated processes are significant. The cost associated with these older technologies, coupled with a lack of modern performance features, can steadily erode market appeal and profitability. By 2024, many industries have seen significant investment in sustainable and advanced manufacturing, making older technologies increasingly uncompetitive. For instance, the global advanced materials market was projected to reach over $115 billion in 2024, highlighting the rapid innovation in the sector.

- Reduced Market Share: Products with outdated technology often see a decline in their share of the market as consumers opt for newer, more advanced alternatives.

- Lower Profit Margins: The cost of maintaining older manufacturing processes can be higher, leading to reduced profit margins compared to competitors using more efficient methods.

- Environmental Concerns: Older technologies may not meet current environmental standards, leading to potential regulatory issues or negative brand perception.

- Decreased Innovation Potential: A reliance on old formulations can stifle further product development and innovation within the company.

Products in the "Dogs" category for W. L. Gore & Associates represent offerings with low market share in slow-growing or declining industries. These items may be facing obsolescence due to technological advancements or intense competition, leading to profitability challenges. For example, specialized industrial components for outdated machinery might fall into this group, contributing minimally to revenue and potentially incurring maintenance costs without significant future returns.

In 2024, the global advanced textiles market, where Gore is active, experienced price competition, with average selling prices for less differentiated items declining by an estimated 3-5% year-over-year, illustrating the pressure on commoditized products.

| Category | Characteristics | W. L. Gore & Associates Example (Hypothetical) | 2024 Market Trend Impact |

|---|---|---|---|

| Dogs | Low Market Share, Low Growth Rate, High Competition, Profitability Challenges | Legacy GORE-TEX fabric generations facing newer alternatives; niche industrial components for obsolete machinery. | Price erosion in competitive textile markets; minimal revenue contribution from stagnant industrial segments. |

Question Marks

GORE-TEX ePE, a new PFAS-free performance fabric, is currently in its initial adoption phase. While it holds significant future potential, its current market position, facing established ePTFE products and other sustainable alternatives, places it in the Question Mark category of the BCG Matrix. This means it requires substantial investment to gain traction.

The challenge for GORE-TEX ePE lies in its low market share within a growing market. To transition from a Question Mark to a Star, W. L. Gore & Associates must invest heavily in marketing and consumer education. This will be crucial for driving rapid market penetration and preventing the product from becoming a Dog, which would signify poor performance and a need for divestment.

W. L. Gore & Associates is actively pursuing advanced materials for emerging clean energy solutions, notably with their GORE PEM for water electrolysis. This market segment shows significant growth potential, driven by the global push towards decarbonization and renewable energy sources. For instance, the global green hydrogen market, where PEM electrolysis plays a crucial role, was valued at approximately USD 1.5 billion in 2023 and is projected to reach over USD 20 billion by 2030, indicating a compound annual growth rate (CAGR) exceeding 40%.

Within this rapidly expanding sector, Gore's current market share for these specific clean energy materials is likely to be relatively low. As these technologies are still in their nascent stages of commercialization and widespread adoption, Gore is positioned as an innovator rather than a dominant player. Capturing a substantial share will necessitate continued heavy investment in research and development, alongside strategic collaborations with key players in the energy industry to accelerate market penetration and scale production.

W. L. Gore & Associates' specialized components for next-generation mobile electronics, such as advanced dielectric materials for high-frequency applications or robust interconnect solutions for wearable tech, likely fall into the question mark category of the BCG matrix. This sector is characterized by rapid innovation and burgeoning demand, with the global mobile device market projected to reach over 7.7 billion units by 2027, indicating high growth potential.

While these cutting-edge components enable critical advancements in devices like 5G smartphones and augmented reality headsets, Gore's market share in these nascent or rapidly evolving segments may still be relatively low. For instance, the market for advanced materials in 5G infrastructure, a key enabler for next-gen mobile, was valued at approximately $2.5 billion in 2023 and is expected to grow significantly.

These products require substantial investment in research and development, manufacturing capacity, and market penetration strategies to capture a leading position. Without this focused support, they risk becoming obsolete or losing ground to competitors in this fast-paced, technology-driven industry.

Collaborations in Novel Biopharmaceutical Purification Technologies

Gore's engagement in novel protein A-based purification technologies and contract manufacturing for antibody therapies positions them within a burgeoning segment of the life sciences industry.

While these initiatives represent a strategic move into a high-growth area, Gore's market share in these specific, rapidly evolving niches might currently be nascent.

These ventures hold the potential to ascend to Star status within the BCG matrix if Gore can effectively secure substantial market share in this expanding market.

- Market Growth: The global biopharmaceutical contract manufacturing market, particularly for antibody therapies, is projected for significant expansion. For instance, the antibody therapeutics market alone was valued at over $200 billion in 2023 and is expected to grow at a compound annual growth rate (CAGR) of approximately 10-12% through 2030.

- Technological Focus: Innovations in protein A-based purification are critical for efficient and cost-effective production of monoclonal antibodies, a key driver of growth in the biopharma sector.

- Strategic Positioning: Gore's collaborations in these advanced purification technologies suggest an effort to capture emerging opportunities, potentially moving from a Question Mark to a Star if market penetration and revenue growth are achieved.

- Competitive Landscape: The biopharmaceutical purification market is competitive, with established players and emerging technologies constantly vying for market share. Gore's success will depend on its ability to differentiate its offerings and secure key partnerships.

New Offerings in Protective Footwear Market

New offerings in protective footwear, leveraging GORE-TEX technology, are poised to capitalize on a growing market. The global protective footwear market was valued at approximately USD 10.5 billion in 2023 and is projected to reach USD 14.8 billion by 2030, exhibiting a CAGR of 5.0%.

W. L. Gore & Associates' potential new GORE-TEX footwear technologies, designed to meet evolving safety regulations like EN ISO 20345:2022 updates for enhanced breathability and durability, could position them favorably. These innovations, targeting specialized sectors such as oil and gas or advanced manufacturing, aim to capture emerging demand. For these new products to ascend to the Star quadrant of the BCG matrix, they would need to achieve substantial market penetration and command a significant share within this expanding segment.

- Market Growth: The protective footwear market is experiencing robust growth, projected to reach USD 14.8 billion by 2030.

- Technological Advancement: New GORE-TEX offerings can address evolving safety standards and specialized application needs.

- Star Potential: Significant market share acquisition is crucial for these new products to become Stars in the BCG matrix.

- Investment Focus: Developing and marketing these specialized footwear solutions requires strategic investment to drive adoption.

W. L. Gore & Associates' foray into advanced materials for emerging clean energy solutions, such as their GORE PEM for water electrolysis, represents a significant Question Mark. The global green hydrogen market, a key area for this technology, was valued at approximately USD 1.5 billion in 2023 and is projected for explosive growth, exceeding USD 20 billion by 2030. While the market is expanding rapidly, Gore's current market share in this nascent sector is likely low, necessitating substantial investment in R&D and strategic partnerships to capture a leading position and avoid becoming a Dog.

Similarly, specialized components for next-generation mobile electronics, including advanced dielectric materials for high-frequency applications, are also Question Marks. The global mobile device market is expected to exceed 7.7 billion units by 2027, indicating high growth. However, Gore's market share in these rapidly evolving segments may still be limited. Significant investment in manufacturing and market penetration strategies is crucial for these products to transition from Question Marks to Stars.

Gore's novel protein A-based purification technologies and contract manufacturing for antibody therapies fall into the Question Mark category. The global biopharmaceutical contract manufacturing market, especially for antibody therapies, is projected for substantial expansion, with the antibody therapeutics market alone valued at over $200 billion in 2023 and expected to grow at a CAGR of 10-12% through 2030. While these ventures show high growth potential, Gore's current market share in these specific niches is likely nascent, requiring strategic focus and investment to achieve Star status.

New GORE-TEX offerings in protective footwear, addressing evolving safety regulations like EN ISO 20345:2022 updates, are also positioned as Question Marks. The global protective footwear market was valued at approximately USD 10.5 billion in 2023 and is projected to reach USD 14.8 billion by 2030, with a CAGR of 5.0%. To become Stars, these specialized footwear solutions require significant market penetration and a substantial share within this expanding segment, demanding focused investment in development and marketing.

| Product/Technology Area | Market Growth Potential | Current Market Share | BCG Matrix Position | Strategic Imperative |

|---|---|---|---|---|

| GORE-TEX ePE (PFAS-free) | Growing | Low | Question Mark | High investment in marketing and education for market penetration. |

| PEM for Water Electrolysis | Very High (Green Hydrogen Market) | Low | Question Mark | Substantial R&D and strategic collaborations for market leadership. |

| Next-Gen Mobile Electronics Components | High (Mobile Device Market) | Low to Moderate | Question Mark | Significant investment in manufacturing and market penetration. |

| Protein A Purification / Antibody Therapies | High (Biopharmaceutical Contract Manufacturing) | Nascent | Question Mark | Strategic focus and investment to capture emerging opportunities. |

| New GORE-TEX Protective Footwear | Moderate to High (Protective Footwear Market) | Low to Moderate | Question Mark | Strategic investment in development and marketing for market share growth. |

BCG Matrix Data Sources

Our BCG Matrix leverages proprietary market research, internal sales data, and competitive intelligence to accurately assess product portfolio performance and strategic positioning.