Goldman Sachs Group Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Goldman Sachs Group Bundle

Goldman Sachs Group operates in a dynamic financial landscape, facing intense competition and evolving client demands. Understanding the interplay of buyer power, supplier influence, and the threat of new entrants is crucial for navigating this complex market.

The complete report reveals the real forces shaping Goldman Sachs Group’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

Goldman Sachs, like many top financial institutions, faces significant bargaining power from highly skilled talent. Professionals specializing in areas such as mergers and acquisitions (M&A), quantitative analysis, and complex derivatives are in high demand and short supply. This scarcity allows these individuals to negotiate substantial compensation packages and favorable working conditions, directly impacting the firm's operational costs.

In 2024, the competition for top talent in investment banking and asset management remained fierce. For instance, entry-level analyst salaries at major firms like Goldman Sachs often exceed $100,000, with bonuses pushing total compensation much higher. This trend extends to experienced professionals, where specialized skills can command multi-million dollar compensation, illustrating the leverage these individuals hold.

This reliance on elite human capital is a critical factor for Goldman Sachs' competitive edge. The firm's ability to attract and retain these top performers is essential for delivering high-value advisory services and innovative financial products. However, managing these high labor costs is a constant challenge, directly influencing profitability and strategic resource allocation.

Advanced technology and data providers, including specialized software vendors, data analytics firms, and cloud service providers, wield significant bargaining power over Goldman Sachs. The proprietary nature of certain critical infrastructure and market intelligence platforms, coupled with high switching costs, makes it challenging for Goldman Sachs to easily change suppliers. This dependence grants these providers leverage in price negotiations and contract terms.

For instance, the reliance on sophisticated trading platforms and real-time market data feeds, often developed by a limited number of specialized firms, means that any disruption or significant price increase from these suppliers can directly impact Goldman Sachs' operational efficiency and profitability. Cybersecurity solution providers also hold considerable sway, as maintaining robust defenses against increasingly sophisticated cyber threats is paramount, creating a strong demand for their specialized services.

Goldman Sachs' capital providers, including institutional investors and bondholders, wield significant influence. Their decisions on where to allocate capital directly impact the cost and availability of funding for Goldman's extensive operations and trading activities. For instance, in early 2024, the prevailing interest rate environment, with central banks maintaining higher rates, increased the cost of borrowing for financial institutions like Goldman Sachs, thereby enhancing the leverage of its debt providers.

Market conditions and Goldman Sachs' credit rating are crucial determinants of supplier power. A strong credit rating, such as Goldman's A+ from S&P as of late 2023, generally reduces its borrowing costs and broadens access to capital, somewhat mitigating supplier leverage. However, shifts in global economic sentiment or a downgrade in its rating could empower bondholders and other lenders, demanding higher yields for the perceived increased risk, thus impacting the firm's profitability.

The interbank lending market and central bank policies also play a vital role in shaping the bargaining power of capital providers. Access to liquidity through central bank facilities or the interbank market can be a critical lifeline, especially during periods of market stress. When these sources tighten, the power of those willing to lend, even at a premium, increases substantially, directly affecting Goldman Sachs' ability to fund its balance sheet and execute trades.

Regulatory Bodies and Compliance Services

Regulatory bodies and the compliance services they necessitate act as powerful, albeit non-traditional, suppliers to Goldman Sachs. The ever-changing landscape of financial regulation, particularly evident with increased scrutiny following the 2008 financial crisis and ongoing developments in 2024, significantly impacts operational costs and strategic direction. For instance, the cost of compliance for large financial institutions has been a substantial factor, with many reporting billions spent annually on meeting regulatory requirements.

These external forces dictate significant expenditures and strategic choices for Goldman Sachs. The necessity for robust compliance services, including legal counsel and specialized consulting firms, creates a powerful external force that shapes business operations. In 2024, firms continue to invest heavily in technology and personnel to manage complex reporting obligations and adapt to new rules, directly impacting profitability.

- Regulatory Burden: Evolving financial regulations necessitate substantial investment in compliance infrastructure and personnel, increasing operating expenses.

- Compliance Costs: The financial services industry, including major players like Goldman Sachs, dedicates significant resources to meeting reporting and adherence requirements.

- Strategic Influence: Regulatory frameworks directly influence product development, market entry, and overall business strategy, limiting flexibility.

Real Estate and Infrastructure Providers

Goldman Sachs, like many large financial institutions, faces significant bargaining power from real estate and infrastructure providers. The cost of prime office space in global financial centers such as New York, London, and Hong Kong remains exceptionally high. For instance, average prime office rents in Manhattan in early 2024 hovered around $80-$100+ per square foot annually, representing a substantial operational expense.

Furthermore, the specialized requirements for secure, high-capacity data centers essential for financial operations, including robust cybersecurity and advanced networking, limit the number of suitable providers. This specialization, coupled with the long-term nature of leases and the intricate setup involved in establishing such infrastructure, grants these suppliers considerable leverage. The need for continuity and the high switching costs associated with relocating or re-establishing critical IT infrastructure further solidify this supplier power.

- High Cost of Prime Real Estate: Prime office space in major financial hubs like New York and London commands premium rents, impacting operating expenses.

- Specialized Infrastructure Needs: Financial firms require secure, high-capacity data centers, narrowing the pool of qualified providers.

- Long-Term Commitments and Switching Costs: Extended lease agreements and the complexity of relocating critical infrastructure increase supplier leverage.

- Limited Provider Options: The specialized nature of services and the global footprint required can result in fewer competitive suppliers.

The bargaining power of suppliers for Goldman Sachs is primarily influenced by the scarcity of specialized talent, critical technology providers, capital sources, regulatory compliance services, and real estate/infrastructure providers. These groups can command favorable terms due to high demand, unique offerings, or essential services.

In 2024, the competition for top-tier financial talent remained intense, with specialized roles commanding premium compensation. For example, skilled quantitative analysts and M&A experts often negotiate lucrative packages, directly impacting Goldman Sachs' labor costs. Similarly, providers of essential market data and sophisticated trading platforms hold significant sway due to the proprietary nature of their offerings and high switching costs.

Capital providers, such as bondholders, saw their leverage increase in early 2024 due to higher interest rates, increasing Goldman Sachs' cost of funding. Furthermore, the extensive regulatory environment necessitates significant investment in compliance services, granting these specialized providers considerable influence over operational expenditures and strategic decisions.

| Supplier Category | Factors Influencing Power | Impact on Goldman Sachs |

|---|---|---|

| Specialized Talent | High demand, low supply of experts (e.g., quants, M&A) | Increased compensation costs, reliance on key individuals |

| Technology & Data Providers | Proprietary systems, high switching costs, critical infrastructure | Price leverage, dependence on specific platforms (e.g., market data feeds) |

| Capital Providers | Interest rate environment, credit ratings, market sentiment | Cost of funding, access to liquidity |

| Regulatory Compliance | Complex regulations, specialized services (legal, consulting) | High compliance costs, influence on strategy and operations |

| Real Estate & Infrastructure | Prime locations, specialized data centers, long-term leases | High operational expenses, limited provider options |

What is included in the product

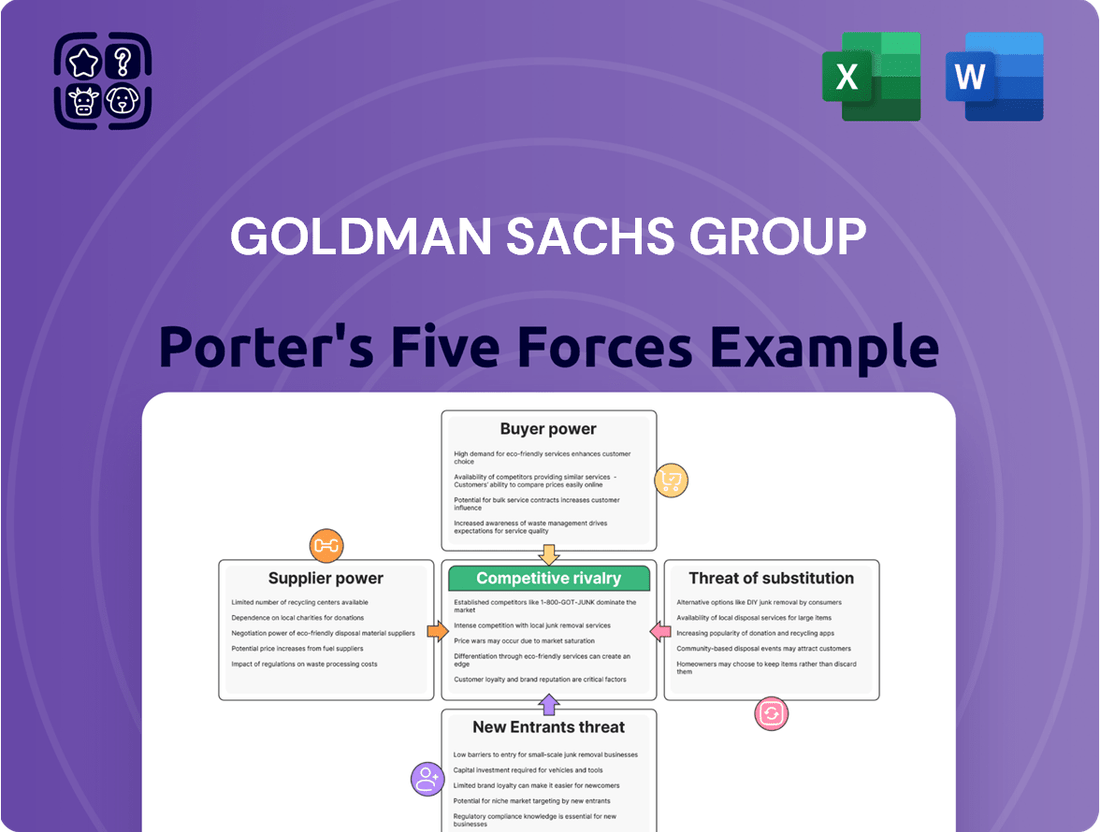

This Porter's Five Forces analysis for Goldman Sachs Group dissects the competitive intensity, buyer and supplier power, threat of new entrants, and the impact of substitutes within the investment banking and financial services industry.

Instantly identify and mitigate competitive threats with a dynamic Porter's Five Forces analysis, providing a clear roadmap for strategic advantage.

Customers Bargaining Power

Large institutional clients, including major corporations, sovereign wealth funds, and substantial asset managers, wield significant bargaining power over Goldman Sachs. Their immense deal volume and the potential to seek bids from numerous financial institutions allow them to negotiate more favorable terms and fee structures. For instance, in 2023, the global mergers and acquisitions advisory market saw intense competition, with Goldman Sachs vying for mandates from these large players.

Sophisticated high-net-worth and ultra-high-net-worth individuals wield significant bargaining power over Goldman Sachs. These clients, often possessing extensive financial knowledge and access to numerous alternative wealth management providers, can negotiate for highly personalized services and more competitive fee structures.

Their ability to compare offerings across various institutions, including boutique firms and other global banks, intensifies this pressure. Goldman Sachs must therefore focus on client retention through superior service and value to mitigate the risk of these valuable clients seeking services elsewhere.

Governments and public sector entities wield significant bargaining power with financial institutions like Goldman Sachs, particularly when engaging in debt issuance, privatization, or strategic advisory. The sheer scale and prestige associated with these mandates, often involving billions of dollars in transactions, give these clients leverage over service scope and pricing. For instance, in 2023, Goldman Sachs advised on numerous sovereign debt issuances globally, where the terms were heavily influenced by the issuing nation's fiscal health and market conditions.

The politically sensitive nature of many government engagements further amplifies their influence. Goldman Sachs must navigate complex regulatory environments and public scrutiny, which can translate into greater demands regarding transparency and fee structures. Long-term relationships and the potential for future, high-profile mandates also incentivize firms to accommodate governmental preferences, as evidenced by Goldman Sachs' continued involvement in advising various countries on their economic development strategies.

Access to Alternative Financial Services

Goldman Sachs' customers, whether individuals or corporations, benefit from a widening array of financial service providers. The rise of fintech, alongside traditional competitors, means clients can readily compare offerings and pricing, significantly boosting their bargaining power. This increased accessibility allows for greater negotiation leverage on fees and service terms.

The proliferation of financial tools and enhanced market transparency empowers clients by providing them with more choices and better information. For instance, in 2024, the global fintech market was projected to reach over $1.1 trillion, indicating a vast landscape of alternative solutions available to consumers and businesses alike. This competitive environment forces established players like Goldman Sachs to remain competitive on service and pricing.

- Increased Client Options: Clients can easily switch between or leverage multiple providers, including bulge bracket banks, boutique firms, and specialized fintech companies, for various financial needs.

- Market Transparency: Greater access to information on pricing, services, and performance benchmarks allows clients to make more informed decisions and negotiate effectively.

- Fintech Disruption: The rapid growth of fintech solutions offers innovative and often lower-cost alternatives, directly challenging traditional financial institutions and enhancing customer leverage.

- Multi-Bank Relationships: The prevalence of companies working with several financial institutions means no single bank has complete control over a client's business, further strengthening the client's position.

Price Sensitivity and Fee Compression

Customers are increasingly price-sensitive, scrutinizing fees across advisory, underwriting, and asset management services. This heightened awareness, fueled by market transparency and greater competition, puts significant pressure on firms like Goldman Sachs to compress fees, directly impacting profit margins.

For instance, the trend in passive investing, which typically carries lower fees than active management, has grown substantially. In 2023, global passive assets under management reached approximately $13.7 trillion, a notable increase from previous years, demonstrating a clear customer preference for lower-cost investment solutions.

- Increased Scrutiny: Clients are more actively comparing fees for similar services across different providers.

- Fee Compression: This leads to a downward pressure on the percentage fees Goldman Sachs can charge for its offerings.

- Demand for Value: Customers expect demonstrable value and performance to justify advisory and management charges.

- Impact on Margins: Lower fees directly squeeze profit margins, necessitating greater operational efficiency for Goldman Sachs.

The bargaining power of customers for Goldman Sachs is substantial, driven by increased client options and market transparency. Clients can easily compare services and fees across numerous providers, including fintech firms, which offers them significant leverage. This dynamic forces Goldman Sachs to focus on delivering superior value and competitive pricing to retain its client base.

| Customer Segment | Bargaining Power Drivers | Impact on Goldman Sachs |

|---|---|---|

| Institutional Clients | Large deal volume, ability to solicit multiple bids, potential for alternative providers | Negotiate lower fees, demand customized solutions |

| High-Net-Worth Individuals | Extensive financial knowledge, access to numerous wealth managers, preference for personalized service | Negotiate fee structures, expect tailored advice and premium service |

| Governments/Public Sector | Scale of transactions, political sensitivity, prestige of mandates | Influence scope of services, negotiate pricing, require transparency |

| Retail/Mass Affluent | Access to fintech alternatives, demand for lower fees, increased market information | Pressure to compress fees, focus on digital offerings, demonstrate clear value proposition |

Preview the Actual Deliverable

Goldman Sachs Group Porter's Five Forces Analysis

This preview showcases the complete Porter's Five Forces analysis for Goldman Sachs Group, detailing the competitive landscape and strategic implications. The document you see here is the exact, professionally formatted report you will receive immediately upon purchase, offering an in-depth examination of industry rivalry, buyer and supplier power, threat of new entrants, and substitute products. Rest assured, there are no placeholders or samples; what you preview is precisely what you'll download, ready for your immediate use.

Rivalry Among Competitors

The competitive rivalry among global bulge bracket investment banks, including giants like JP Morgan Chase, Morgan Stanley, Bank of America, and Citi, is exceptionally intense. These firms vie for dominance across all key financial services, from underwriting and M&A advisory to trading and wealth management.

This fierce competition translates into aggressive bidding for lucrative mandates and a constant battle for top talent. For instance, in 2024, the global investment banking fees market remained highly contested, with these major players consistently securing the largest portions of deal revenues, demonstrating their ongoing struggle for market share and premium clients worldwide.

Boutique investment banks and advisory firms present a significant competitive force. These specialized players, often focusing on niche sectors like technology or healthcare, can leverage deep industry knowledge and agility. For instance, firms like Evercore and Moelis & Company, despite their smaller size compared to giants like Goldman Sachs, consistently win mandates for complex M&A advisory, demonstrating their ability to attract high-value business through specialized expertise.

Their competitive edge often stems from lower overheads and a perception of reduced conflicts of interest, which can be particularly appealing to clients seeking unbiased advice. This allows them to compete effectively for specific advisory mandates, often in areas where larger banks might be perceived as too broad or conflicted. Their focused approach enables them to offer tailored solutions that resonate with clients looking for specialized strategic guidance.

Goldman Sachs faces intense rivalry from other large, diversified asset and wealth management firms such as BlackRock, Vanguard, and Fidelity. These competitors vie for client assets by offering a broad spectrum of investment products, emphasizing strong performance, and employing competitive fee structures. For instance, BlackRock managed a staggering $10.5 trillion in assets as of the first quarter of 2024, showcasing its immense scale and market influence, which directly challenges Goldman Sachs' client acquisition and retention efforts.

Fintech Companies and Digital Platforms

Fintech companies and digital platforms are intensifying competition for Goldman Sachs. These agile players leverage technology to offer streamlined, lower-cost services, directly challenging traditional models in areas like payments and wealth management. For instance, the global fintech market was valued at approximately $2.5 trillion in 2023 and is projected to grow significantly, indicating a robust and expanding competitive landscape.

These disruptors often focus on niche markets or specific customer segments, providing specialized solutions that can be more appealing than broad-based offerings. This forces established institutions like Goldman Sachs to innovate and adapt to maintain market share. The rapid pace of technological advancement means this rivalry is dynamic and constantly evolving.

- Digital Payment Growth: The global digital payments market is expanding rapidly, with transaction values expected to exceed $15 trillion by 2027, directly impacting traditional banking services.

- Robo-Advisory Adoption: Assets under management in robo-advisory services are projected to reach over $4 trillion globally by 2027, presenting a direct challenge to Goldman Sachs' wealth management divisions.

- Lending Platforms: Online lending platforms have seen substantial growth, facilitating billions in loans annually, often with faster approval times and lower overhead than traditional banks.

- Open Banking Initiatives: Regulatory push for open banking allows third-party providers to access customer financial data (with consent), fostering new fintech services that compete with incumbent offerings.

Regional and Niche Financial Institutions

Regional and niche financial institutions present a significant competitive rivalry for Goldman Sachs. These entities often possess deep local market knowledge and specialized expertise, allowing them to effectively compete for specific client segments or mandates within their domains. This can fragment the market, making it challenging for larger, globally focused institutions to capture all available business.

For instance, community banks and credit unions, while smaller, have strong relationships within their local communities, often serving small to medium-sized businesses and individual clients with personalized service. In 2024, the US saw over 4,500 community banks, many of which are highly profitable and hold significant local market share in deposits and loans. Specialized firms, such as boutique investment banks or wealth management firms focusing on specific industries or asset classes, can also offer tailored solutions that attract clients seeking unique expertise.

- Localized Expertise: Regional banks understand local economic conditions and client needs better than global players.

- Niche Specialization: Boutique firms excel in specific financial services, attracting clients seeking tailored solutions.

- Client Fragmentation: These institutions carve out market share, limiting the reach of larger competitors.

- Agility and Responsiveness: Smaller firms can often adapt more quickly to local market changes and client demands.

Goldman Sachs faces intense competition from global bulge bracket banks, boutique firms, asset managers, fintech innovators, and regional players. This rivalry spans all financial services, driving aggressive strategies for talent and market share. The market for investment banking fees in 2024 remained highly contested, with major players consistently vying for top deal revenues.

Boutique firms like Evercore and Moelis & Company leverage specialized expertise to win complex mandates, often outmaneuvering larger institutions in niche areas. BlackRock, managing over $10.5 trillion in assets by Q1 2024, exemplifies the scale of competition from asset managers. Fintech’s rapid growth, with the market valued at approximately $2.5 trillion in 2023, further intensifies this landscape, forcing traditional players to innovate.

| Competitor Type | Key Characteristics | Impact on Goldman Sachs | 2024/2025 Data Point |

|---|---|---|---|

| Bulge Bracket Banks | Global reach, diversified services, large client base | Direct competition for mandates, talent, and market share | Global investment banking fees market remains highly contested. |

| Boutique Firms | Niche specialization, agility, deep industry knowledge | Win high-value advisory mandates in specific sectors | Evercore and Moelis & Company consistently secure complex M&A deals. |

| Asset Managers | Scale, broad product offerings, competitive fees | Compete for client assets and wealth management market share | BlackRock managed $10.5 trillion in assets (Q1 2024). |

| Fintech Companies | Technology-driven, lower costs, agile | Disrupt traditional models in payments, wealth management | Global fintech market valued at ~$2.5 trillion (2023), projected growth. |

SSubstitutes Threaten

Corporations are increasingly exploring alternative routes to raise capital, bypassing traditional investment banking. Direct listings, SPACs, and crowdfunding platforms offer these companies more control and potentially lower costs. This trend directly challenges Goldman Sachs' traditional role and fee structure in IPOs and secondary offerings.

For instance, in 2024, several high-profile companies opted for direct listings, reducing the need for underwriting fees that would typically benefit firms like Goldman Sachs. The evolving regulatory environment, with bodies like the SEC continually reviewing and adapting rules for these new capital-raising methods, further influences the competitive landscape, making it crucial for Goldman Sachs to adapt its service offerings.

Large corporations are increasingly building robust in-house finance teams, potentially reducing their reliance on external advisors like Goldman Sachs for corporate finance, treasury, and M&A. For instance, many Fortune 500 companies now have dedicated M&A departments capable of managing complex transactions internally.

This trend is driven by a cost-benefit analysis where companies weigh the expense of retaining specialized internal talent against the fees charged by external investment banks. The ability to control information flow and maintain confidentiality also plays a role.

For example, in 2024, companies that previously outsourced all their capital raising might now leverage their internal treasury teams to manage debt issuance, thereby capturing savings that would otherwise go to external advisors.

Robo-advisors and passive investment vehicles like ETFs present a significant threat of substitution for Goldman Sachs. These platforms offer automated, low-cost investment management, appealing to investors prioritizing simplicity and reduced fees. For instance, the global ETF market reached an estimated $10 trillion in assets under management by the end of 2023, showcasing the increasing investor adoption of passive strategies.

Decentralized Finance (DeFi) and Blockchain Solutions

The rise of Decentralized Finance (DeFi) and blockchain solutions presents a significant threat of substitution for traditional financial institutions like Goldman Sachs. These technologies aim to remove intermediaries, potentially offering more efficient and transparent avenues for lending, borrowing, and asset trading. For instance, the total value locked (TVL) in DeFi protocols reached over $200 billion in late 2021, demonstrating substantial user adoption and capital flow outside traditional systems, though it has seen fluctuations since then.

DeFi platforms can disintermediate many services currently offered by Goldman Sachs, such as investment banking, asset management, and trading. Blockchain's ability to tokenize assets could create new, more accessible markets for various financial instruments. While still navigating regulatory uncertainties and technological evolution, the long-term potential for these decentralized alternatives to capture market share is considerable.

- DeFi's Disintermediation Potential: DeFi platforms aim to cut out traditional financial intermediaries, offering peer-to-peer transactions for services like lending and trading.

- Asset Tokenization: Blockchain technology enables the tokenization of real-world assets, potentially creating new markets and increasing liquidity for previously illiquid assets.

- Market Adoption and Growth: Despite volatility, the DeFi sector has seen significant growth, with total value locked (TVL) in DeFi protocols reaching hundreds of billions of dollars at its peak, indicating a growing user base and capital commitment.

- Regulatory and Technological Hurdles: The long-term impact of DeFi is contingent on its ability to overcome regulatory challenges and achieve greater technological maturity and scalability.

Alternative Lending Platforms and Private Markets

The threat from alternative lending platforms and increasingly sophisticated private markets is a significant factor for Goldman Sachs. These non-bank lenders, including private credit funds, offer businesses direct access to capital, often bypassing traditional bank financing and the associated advisory services. This trend is particularly pronounced in 2024, with private credit markets experiencing substantial growth.

The expansion of private markets represents a viable substitute for public market activities and conventional debt financing. For instance, by the end of 2023, global private equity assets under management reached an estimated $13.2 trillion, demonstrating a clear shift in capital allocation away from traditional avenues. This suggests that companies seeking funding may increasingly turn to these alternatives.

- Growing Private Credit Market: The global private credit market saw significant inflows in 2023, with estimates suggesting it could reach $2.2 trillion by 2027, posing a direct alternative to bank loans.

- Direct Lending Growth: Businesses are increasingly utilizing direct lending platforms for funding needs, with some reports indicating a substantial increase in deal volume for middle-market companies in 2024.

- Sophistication of Private Capital: Private equity and venture capital firms are becoming more adept at structuring complex deals, offering tailored financing solutions that can compete with or surpass traditional bank offerings.

The rise of robo-advisors and passive investment vehicles like ETFs presents a significant threat of substitution for Goldman Sachs. These platforms offer automated, low-cost investment management, appealing to investors prioritizing simplicity and reduced fees.

The global ETF market reached an estimated $10 trillion in assets under management by the end of 2023, showcasing the increasing investor adoption of passive strategies. This trend directly impacts Goldman Sachs' wealth management and advisory services.

Furthermore, the burgeoning Decentralized Finance (DeFi) sector offers alternative avenues for lending, borrowing, and asset trading, potentially disintermediating traditional financial institutions. While still evolving, DeFi's ability to tokenize assets and create new markets poses a long-term challenge.

The increasing sophistication and growth of private credit markets also offer a viable substitute for traditional bank financing and advisory services. Companies are increasingly turning to these non-bank lenders for capital, as evidenced by the substantial growth in private credit deal volume in 2024.

Entrants Threaten

Establishing a global financial institution akin to Goldman Sachs demands immense capital, particularly for core activities like securities underwriting, market making, and principal investing. These operations require billions of dollars in initial investment and ongoing liquidity, creating a formidable barrier.

For instance, regulatory capital requirements, such as those mandated by Basel III, necessitate significant reserves, adding to the already high cost of entry. In 2024, major investment banks like Goldman Sachs maintained substantial Tier 1 capital ratios, underscoring the sheer financial muscle needed to operate and compete at this level.

The financial services industry, including giants like Goldman Sachs, is heavily regulated, creating substantial barriers for newcomers. Obtaining necessary licenses and navigating complex compliance requirements, such as Anti-Money Laundering (AML) and Know Your Customer (KYC) regulations, demand significant upfront investment and ongoing operational costs.

New entrants must also contend with stringent capital adequacy rules and data privacy laws, like GDPR, which add further layers of complexity and expense. For instance, in 2024, the global financial sector continued to see increased regulatory scrutiny, with compliance costs for financial institutions estimated to be in the tens of billions annually, making it exceptionally difficult for smaller or unestablished firms to compete effectively.

For Goldman Sachs, a strong brand reputation and deep client trust are formidable barriers to entry. Building decades of credibility and relationships with high-value corporate, institutional, and high-net-worth clients is a monumental task for any new entrant. This trust is often solidified through consistent performance and effective crisis management, aspects where established firms like Goldman Sachs have institutional memory and proven track records. For instance, in 2023, Goldman Sachs reported revenue of $46.3 billion, underscoring its significant market presence built over many years.

Difficulty in Attracting Top Talent and Building Global Networks

New entrants face a significant hurdle in attracting and retaining the highly specialized talent needed in financial services. Building a robust team with the requisite expertise in areas like investment banking, asset management, and trading requires substantial investment in recruitment and compensation. For instance, in 2024, the demand for experienced financial analysts and quantitative researchers remained exceptionally high, with average salaries in top-tier financial hubs often exceeding $150,000 annually, plus bonuses, making it a costly endeavor for newcomers.

Goldman Sachs, conversely, benefits from its established employer brand, competitive compensation packages, and a deep pool of experienced professionals cultivated over decades. This allows them to maintain a strong talent pipeline and foster a global network of offices and relationships that are difficult and expensive for new firms to replicate quickly. The competitive landscape for human capital is fierce, with established players like Goldman Sachs having a distinct advantage in securing and retaining top-tier talent.

- Talent Acquisition Costs: New firms must contend with the high costs associated with attracting experienced financial professionals, including competitive salaries, signing bonuses, and benefits packages, which can easily run into millions for a core team.

- Established Talent Pipelines: Goldman Sachs leverages its long-standing relationships with top universities and its internal development programs to create a consistent flow of skilled employees, a resource that is time-consuming and expensive for new entrants to build.

- Global Network Advantage: The ability to tap into a global network of clients, partners, and industry experts is crucial. New entrants struggle to establish these extensive international connections, which Goldman Sachs has cultivated over many years, facilitating cross-border deals and market access.

- Compensation Benchmarking: In 2024, compensation for managing directors in investment banking at major firms like Goldman Sachs could reach upwards of $5 million annually when including bonuses and long-term incentives, setting a high benchmark that new entrants must meet or exceed to attract comparable talent.

Advanced Technological Infrastructure and Scale

The threat of new entrants into the investment banking sector, particularly for a firm like Goldman Sachs, is significantly mitigated by the immense capital required for advanced technological infrastructure. This includes sophisticated trading platforms, robust data analytics capabilities, and state-of-the-art cybersecurity measures. For instance, major financial institutions invest billions annually in technology to maintain a competitive edge and ensure operational resilience.

Goldman Sachs' existing scale provides a critical advantage in the efficient utilization and continuous reinvestment in cutting-edge technology. This scale allows for greater economies of scale in technology deployment, creating a substantial cost barrier for smaller or newer entrants. In 2023, the financial services industry saw continued high levels of IT spending, with many firms allocating over 20% of their operating expenses to technology.

The importance of proprietary technology cannot be overstated. Goldman Sachs develops and refines its own technological solutions, which are often deeply integrated into its business processes and provide unique competitive advantages. These proprietary systems, honed over years of operation and significant R&D investment, are difficult and costly for new entrants to replicate, further deterring market entry.

- Massive Capital Outlay: New entrants face substantial upfront costs for technology infrastructure, often running into hundreds of millions, if not billions, of dollars.

- Economies of Scale: Goldman Sachs leverages its size to spread technology costs over a larger revenue base, achieving lower per-unit technology expenses.

- Proprietary Advantage: The firm's investment in unique, in-house developed technology creates a differentiated offering and operational efficiency that is hard to match.

- Cybersecurity Imperative: The escalating threat landscape necessitates continuous, heavy investment in cybersecurity, a burden that is disproportionately challenging for new, smaller entities.

The threat of new entrants for Goldman Sachs is significantly low due to the immense capital requirements for operations, regulatory compliance, and talent acquisition. Building a global financial institution requires billions in initial investment and ongoing liquidity, a substantial barrier for newcomers.

Regulatory hurdles, including capital adequacy rules and stringent compliance mandates like AML and KYC, add layers of complexity and expense. In 2024, the global financial sector's compliance costs remained in the tens of billions annually, making it exceptionally difficult for smaller firms to compete.

Furthermore, the need for highly specialized talent, with top-tier financial professionals commanding salaries exceeding $150,000 plus bonuses in 2024, presents another significant cost for new entrants.

Goldman Sachs' established brand reputation and deep client trust, built over decades, are also formidable barriers. Replicating this level of credibility and relationships is a monumental and time-consuming task for any new entrant.

| Barrier Type | Description | Estimated Cost/Challenge for New Entrants (Illustrative) | Goldman Sachs Advantage |

|---|---|---|---|

| Capital Requirements | Billions needed for securities underwriting, market making, principal investing. | $1B+ initial capital | Established liquidity and access to capital markets. |

| Regulatory Compliance | Navigating licenses, AML, KYC, data privacy laws. | Tens of billions annually in global compliance costs. | Expertise and infrastructure to manage complex regulations efficiently. |

| Talent Acquisition | Attracting and retaining specialized financial professionals. | $150k+ annual salary + bonuses for experienced talent. | Strong employer brand, competitive compensation, and internal development programs. |

| Brand Reputation & Client Trust | Building credibility and long-term relationships. | Decades of effort required. | Long-standing history and proven track record. |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for Goldman Sachs Group is built upon a foundation of publicly available financial statements, annual reports, and SEC filings. We also integrate insights from reputable financial news outlets, industry-specific research reports, and macroeconomic data to provide a comprehensive view of the competitive landscape.