Goldman Sachs Group Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Goldman Sachs Group Bundle

Unlock the strategic core of Goldman Sachs Group with our comprehensive Business Model Canvas. This detailed breakdown reveals their intricate web of customer relationships, revenue streams, and key resources that fuel their global financial dominance. Discover how they create and deliver value to diverse client segments.

Ready to dissect the engine of a financial titan? Our full Goldman Sachs Group Business Model Canvas offers an in-depth look at their value propositions, cost structure, and key activities. Gain unparalleled insights into their operational blueprint and competitive advantages.

See how Goldman Sachs Group masterfully navigates the financial world. This complete Business Model Canvas lays bare their strategic partnerships, channels, and customer segments, offering a clear roadmap of their success. Download the full version to accelerate your own strategic planning.

Partnerships

Goldman Sachs actively partners with technology providers and fintech firms to bolster its digital capabilities. These collaborations are crucial for integrating advanced AI solutions and streamlining operations, as seen in their 2024 strategic focus on AI infrastructure.

These partnerships extend to leveraging cloud services and co-developing new financial technologies, directly supporting Goldman Sachs' ongoing digital transformation initiatives.

Goldman Sachs cultivates key partnerships with institutional investors and fund managers, crucial for its Asset & Wealth Management arm. These collaborations enable co-investments in alternative assets and the distribution of various investment products. For instance, in the first quarter of 2024, Goldman Sachs reported record assets under supervision in its Asset & Wealth Management division, reaching $2.8 trillion, a testament to the strength of these relationships.

Goldman Sachs serves as a vital partner for corporations and governments, offering expert advisory services in investment banking. This includes crucial support for mergers and acquisitions, divestitures, and raising capital. In 2023, Goldman Sachs advised on a substantial number of global M&A deals, underscoring their deep integration with these entities.

Regulatory Bodies and Industry Associations

Goldman Sachs actively engages with key regulatory bodies like the Securities and Exchange Commission (SEC) and the Federal Reserve. In 2024, for instance, the firm's compliance efforts are paramount, given ongoing scrutiny of capital requirements and market conduct. These relationships are crucial for understanding and adhering to evolving financial regulations, ensuring operational stability.

Participation in industry associations, such as the Securities Industry and Financial Markets Association (SIFMA), allows Goldman Sachs to contribute to policy discussions. These forums are vital for shaping the future regulatory landscape, advocating for market-friendly policies, and fostering industry best practices. Such involvement helps maintain a level playing field and promotes responsible financial innovation.

- Regulatory Compliance: Maintaining robust relationships with entities like the SEC and Federal Reserve ensures adherence to financial laws, a critical aspect of Goldman Sachs' operations.

- Policy Influence: Active participation in associations like SIFMA allows the firm to shape industry standards and regulatory frameworks.

- Risk Mitigation: Proactive engagement with regulators helps in anticipating and mitigating potential compliance risks, safeguarding the firm's reputation and financial health.

Academic Institutions and Research Organizations

Goldman Sachs actively collaborates with academic institutions and research organizations to foster innovation, especially in cutting-edge fields like artificial intelligence and advanced financial modeling. These partnerships are crucial for staying ahead in a rapidly evolving financial landscape.

These collaborations also serve as a vital pipeline for recruiting top-tier talent. By engaging with universities, Goldman Sachs can identify and attract promising graduates with specialized skills, ensuring a continuous influx of expertise.

Furthermore, Goldman Sachs' internal research and market outlooks frequently incorporate insights gleaned from leading academic and industry experts. This reliance on external thought leadership underscores the importance of these key partnerships in shaping the firm's strategic direction and client advice.

- Talent Acquisition: Universities provide a direct channel for recruiting skilled graduates in finance, data science, and technology.

- Innovation Hubs: Partnerships with research institutions drive advancements in AI, machine learning, and quantitative finance.

- Thought Leadership: Access to academic research and expert opinions informs Goldman Sachs' market analysis and strategic planning.

Goldman Sachs' key partnerships are multifaceted, extending to technology providers for digital advancement, institutional investors for asset management growth, and corporations for investment banking services. These relationships are vital for innovation, capital raising, and market access.

In 2024, the firm continues to emphasize collaborations with fintechs and AI specialists to enhance client offerings and operational efficiency. Their Asset & Wealth Management division, which saw assets under supervision reach $2.8 trillion in Q1 2024, heavily relies on partnerships with fund managers and institutional investors for product distribution and co-investment opportunities.

| Partner Type | Purpose | 2024 Relevance/Data Point |

|---|---|---|

| Technology Providers & Fintechs | Digital transformation, AI integration, operational efficiency | Strategic focus on AI infrastructure development. |

| Institutional Investors & Fund Managers | Asset & Wealth Management growth, co-investments, product distribution | Supported $2.8 trillion in AUM in Q1 2024. |

| Corporations & Governments | Investment banking advisory (M&A, capital raising) | Advised on numerous global M&A deals in 2023. |

What is included in the product

Goldman Sachs' business model canvas centers on providing a wide range of financial services to a diverse clientele, leveraging its strong brand and global reach.

It details how the firm creates, delivers, and captures value through investment banking, trading, asset management, and consumer banking, supported by robust infrastructure and risk management.

Goldman Sachs' Business Model Canvas acts as a pain point reliever by providing a structured, visual framework to analyze and optimize complex financial operations, thereby streamlining decision-making.

It offers a clear, one-page snapshot of Goldman Sachs' intricate business, simplifying the identification and resolution of operational bottlenecks and strategic challenges.

Activities

Goldman Sachs' investment banking division is a cornerstone of its business model, focusing on advisory services for mergers, acquisitions, divestitures, and corporate restructurings. The firm's expertise in navigating complex financial transactions positions it as a leading advisor in the market.

Underwriting securities for both public offerings and private placements is another critical activity. In 2024, Goldman Sachs continued to be a dominant force in capital markets, demonstrating its capacity to facilitate significant fundraising for corporations and governments.

The firm's advisory backlog saw an increase in 2024, reflecting ongoing deal activity and client demand for strategic financial guidance. Goldman Sachs consistently ranks among the top M&A advisors globally, underscoring its deep market penetration and client trust.

Goldman Sachs actively trades a wide array of financial products, including bonds, foreign exchange, raw materials, and stocks, while also executing trades for its clients. This dual role allows them to facilitate client transactions and manage their own market positions.

The firm acts as a market maker, ensuring there are always buyers and sellers available, and intermediates risk to assist clients in navigating market fluctuations and securing access to liquidity. In the first quarter of 2024, Goldman Sachs reported significant trading revenues, with its Global Markets division demonstrating robust performance, contributing substantially to the firm's overall profitability.

Goldman Sachs actively manages a broad spectrum of assets for a diverse clientele, including large institutions, financial advisors, and affluent individuals. This core activity involves developing and implementing various investment strategies tailored to client needs.

The firm's asset and wealth management segment focuses on generating fee-based revenues by offering customized advisory services and private banking solutions. A key objective is the continuous growth of assets under supervision, a critical metric for the business's success.

As of the first quarter of 2024, Goldman Sachs reported record assets under supervision in its Asset & Wealth Management division, reaching $2.8 trillion. This highlights the significant scale and client trust in their management capabilities.

Lending and Financing Solutions

Goldman Sachs offers a comprehensive suite of lending and financing solutions designed to support its diverse client base. These solutions encompass relationship lending, acquisition financing, secured lending, and specialized commodity financing. This strategic focus is a key driver for growing durable revenues within the Global Banking & Markets segment.

- Relationship Lending: Building long-term partnerships by providing tailored credit facilities.

- Acquisition Financing: Facilitating mergers and acquisitions through robust debt solutions.

- Secured Lending: Offering financing backed by collateral to mitigate risk.

- Commodity Financing: Providing specialized financing for the trading and storage of commodities.

For the first quarter of 2024, Goldman Sachs reported significant growth in its Global Banking & Markets segment, with net revenues from the bank’s lending and financing activities contributing substantially to this performance. The firm’s commitment to expanding these durable financing revenues underscores its strategic emphasis on this core business area.

Technology and Digital Platform Development

Goldman Sachs actively invests in and develops cutting-edge technology, with a significant focus on artificial intelligence infrastructure and robust digital platforms. This strategic emphasis is crucial for streamlining operations, creating innovative client offerings, and maintaining a competitive edge in the financial services landscape.

The firm's commitment to technology extends to both internal AI adoption, aiming to boost productivity and analytical capabilities, and the development of external digital solutions that can generate new revenue streams. For instance, in 2024, Goldman Sachs continued to expand its digital client offerings, enhancing user experience and providing more sophisticated tools for wealth management and trading.

- AI Infrastructure Investment: Goldman Sachs is channeling resources into building and enhancing its AI capabilities to drive efficiency and develop predictive analytics.

- Digital Platform Enhancement: Continuous improvement of digital platforms is a key activity, ensuring seamless client interactions and access to advanced financial tools.

- Internal AI Adoption: The firm is integrating AI across its internal processes to optimize workflows and decision-making.

- External Platform Solutions: Goldman Sachs explores opportunities to offer its technological solutions and platforms to external clients, creating new business avenues.

Goldman Sachs' core activities revolve around providing financial advisory services, underwriting securities, and engaging in trading across various asset classes. The firm also manages assets for a diverse client base and offers a comprehensive suite of lending and financing solutions. Significant investment in technology, particularly AI, underpins these operations.

| Key Activity | Description | 2024 Data/Insight |

| Investment Banking & Advisory | Mergers, acquisitions, divestitures, restructuring advice. | Advisory backlog increased, solidifying its position as a top global M&A advisor. |

| Capital Markets Underwriting | Issuing and selling securities for clients. | Remained a dominant force in capital markets, facilitating significant fundraising. |

| Global Markets (Trading) | Trading bonds, FX, commodities, equities for clients and firm. | Robust performance in Q1 2024, with significant trading revenues reported. |

| Asset & Wealth Management | Managing investments for institutions and individuals. | Assets under supervision reached $2.8 trillion in Q1 2024, a record high. |

| Lending & Financing | Providing credit facilities, acquisition financing, etc. | Lending and financing activities contributed substantially to Global Banking & Markets segment revenues in Q1 2024. |

| Technology & Digital Platforms | Investing in AI and enhancing digital client offerings. | Continued expansion of digital client offerings and internal AI adoption in 2024. |

Preview Before You Purchase

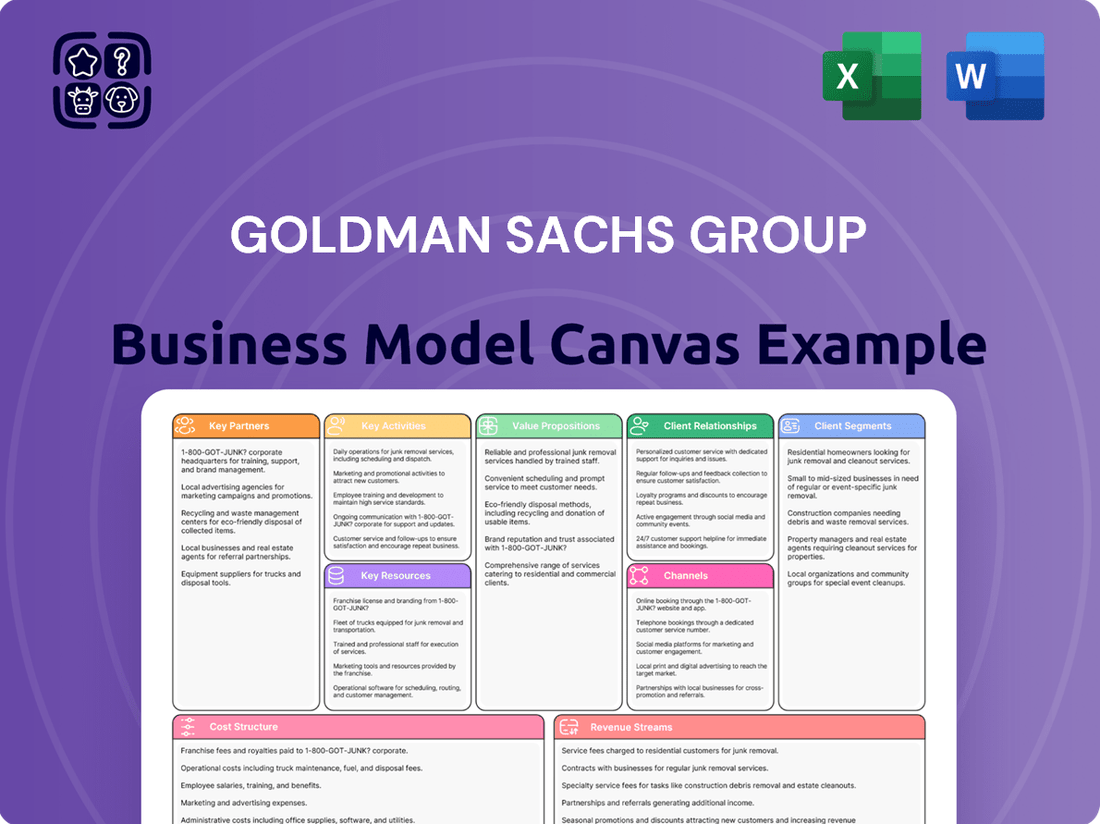

Business Model Canvas

The Goldman Sachs Group Business Model Canvas you are previewing is the identical document you will receive upon purchase. This means you're seeing the actual structure, content, and formatting that will be delivered, ensuring no discrepancies or surprises. Once your order is complete, you'll gain full access to this comprehensive analysis, ready for your immediate use and strategic planning.

Resources

Goldman Sachs' most valuable resource is undoubtedly its people. This includes a vast network of partners, seasoned financial professionals, and cutting-edge technology experts, all contributing deep industry insights and exceptional client service.

The firm's commitment to nurturing talent is evident in its rigorous partner selection process, a testament to the critical role human capital plays in its success. This focus ensures a consistently high level of expertise across all operations.

In 2023, Goldman Sachs reported total compensation and benefits expenses of $22.0 billion, highlighting the significant investment made in its workforce, which is crucial for maintaining its competitive edge in the financial services industry.

Goldman Sachs' extensive global network, spanning over 50 offices across 25 countries, is a cornerstone of its business model. This vast reach allows the firm to serve a diverse international client base and execute cross-border transactions with unparalleled efficiency.

The firm's brand reputation, cultivated over 150 years of operation, acts as a powerful magnet for clients and talent alike. This trust and recognition are critical in attracting high-net-worth individuals, corporations, and institutional investors, underpinning its ability to command premium services and fees.

In 2024, Goldman Sachs continued to leverage this global presence and reputation to facilitate significant deals. For instance, its investment banking division advised on numerous landmark mergers and acquisitions, demonstrating the tangible value of its established network and credibility in navigating complex financial landscapes.

Goldman Sachs leverages advanced proprietary technology, including sophisticated trading platforms and cutting-edge data analytics tools, to gain crucial market insights and manage risk effectively. These technological assets are fundamental to developing innovative client solutions.

Significant investments in AI infrastructure are actively enhancing these capabilities, allowing for more predictive analytics and streamlined operations. For instance, in 2024, the firm continued to prioritize technology spending to maintain a competitive edge in the rapidly evolving financial landscape.

Financial Capital and Balance Sheet Strength

Goldman Sachs Group’s financial capital and balance sheet strength are fundamental to its operations, enabling the firm to underwrite significant transactions and manage substantial market risks. This robust financial foundation allows for the provision of critical liquidity to clients and markets.

The firm's commitment to effective capital management is a cornerstone of its strategy, ensuring it can absorb potential losses and seize opportunities. This flexibility is crucial in navigating the dynamic financial landscape.

Goldman Sachs also emphasizes returning capital to shareholders, demonstrating confidence in its financial health and long-term prospects. For instance, as of the first quarter of 2024, the firm repurchased approximately $1.5 billion of its common stock, reinforcing its strong capital position.

- Robust Capital Base: Essential for underwriting large deals and managing market risks.

- Balance Sheet Strength: Underpins the firm's ability to provide liquidity and financial stability.

- Capital Management Flexibility: Allows for strategic deployment and risk mitigation.

- Shareholder Returns: Reflects strong financial performance and capital adequacy, with $1.5 billion in stock repurchases in Q1 2024.

Intellectual Property and Market Insights

Goldman Sachs leverages proprietary research and deep market insights as critical resources. These elements are fundamental to shaping its investment strategies and providing informed guidance to clients. This intellectual capital is a significant differentiator in the competitive financial landscape.

The firm's commitment to thought leadership is evident in its regular publications. These analyses offer perspectives on global economic shifts and market trends, directly informing client decisions and reinforcing Goldman Sachs' position as a trusted advisor.

- Proprietary Research: Goldman Sachs' internal teams generate unique data and analytical frameworks.

- Market Insights: The firm synthesizes vast amounts of information to identify emerging trends and opportunities.

- Thought Leadership: Regular publications and commentary shape market understanding and client strategies.

- Client Guidance: These resources directly support investment recommendations and strategic advice provided to clients.

Goldman Sachs' key resources also encompass its extensive global network and strong brand reputation. The firm's presence in over 50 offices across 25 countries facilitates cross-border transactions and serves a diverse international clientele. This global reach, coupled with a 150-year legacy of trust, attracts both clients and top talent, enabling premium service offerings and fee structures.

Value Propositions

Goldman Sachs provides top-tier financial advisory services, excelling in intricate mergers, acquisitions, and capital markets deals. Their strategic guidance and seamless execution are hallmarks of their premier offering.

The firm's consistent position as a leading M&A advisor worldwide underscores its deep expertise. For instance, in 2023, Goldman Sachs advised on numerous high-profile transactions, solidifying its reputation for delivering exceptional results.

Goldman Sachs offers clients unparalleled access to global capital markets, facilitating the raising of significant financing and the execution of complex trades across a vast array of asset classes. This extensive reach empowers corporations, financial institutions, and governments to navigate international finance effectively.

In 2024, the firm continued to demonstrate its robust capabilities in this area, underwriting billions in debt and equity offerings for a diverse client base worldwide. For instance, Goldman Sachs played a pivotal role in several major IPOs and secondary offerings, showcasing its deep market penetration and advisory strength.

Goldman Sachs offers advanced investment management and wealth advisory services, specifically designed for institutional clients and individuals with substantial assets. Their strategy emphasizes achieving superior returns and fostering long-term asset expansion through expertise in areas like alternative investments and customized financial planning.

In 2024, Goldman Sachs Asset Management reported approximately $2.7 trillion in assets under supervision, showcasing the scale of their sophisticated investment solutions. This includes a significant push into private markets and thematic investing, catering to evolving client demands for diversified portfolios and specialized financial guidance.

Risk Management and Market Intermediation

Goldman Sachs excels in risk management, offering sophisticated tools and expertise to help clients navigate complex financial markets. This function is crucial for maintaining stability and confidence, especially during periods of heightened volatility. For instance, in 2024, the firm's ability to manage counterparty risk and market exposures remained a cornerstone of its client service offering.

As a primary market intermediary, Goldman Sachs facilitates the flow of capital and provides essential liquidity. This role allows clients to execute trades, manage portfolios, and access diverse investment opportunities efficiently. Their deep market knowledge and extensive network are vital in connecting buyers and sellers across various asset classes.

- Risk Management: Goldman Sachs provides clients with sophisticated tools and advisory services to identify, assess, and mitigate financial risks, including market, credit, and operational risks.

- Market Intermediation: The firm acts as a crucial intermediary, facilitating transactions and providing liquidity across global capital markets, enabling clients to access diverse investment opportunities.

- Client Stability: By effectively managing exposures and navigating market volatility, Goldman Sachs offers clients a degree of stability and confidence in dynamic financial environments.

- 2024 Focus: Throughout 2024, the firm continued to emphasize its risk management capabilities, particularly in light of evolving economic conditions and geopolitical uncertainties, supporting client strategies for capital preservation and growth.

Innovative Technology and Data-Driven Insights

Goldman Sachs leverages cutting-edge technology and advanced data analytics to deliver innovative solutions, offering clients unparalleled market insights and boosting the efficiency of their financial operations. This dedication to technological advancement, particularly in artificial intelligence, is a cornerstone of their strategy, opening new avenues for growth and significantly improving client experiences.

The firm's investment in technology is evident in its ongoing development of proprietary platforms and data infrastructure. For instance, in 2024, Goldman Sachs continued to enhance its AI capabilities, aiming to automate complex financial tasks and personalize client interactions. This focus is crucial for maintaining a competitive edge in a rapidly evolving financial landscape.

- AI-Powered Trading: Implementing AI algorithms to identify trading opportunities and manage risk more effectively, leading to potentially higher returns for clients.

- Data Analytics for Market Insights: Utilizing vast datasets to uncover trends and provide clients with predictive analytics for better investment decisions.

- Digital Client Platforms: Developing intuitive digital interfaces that offer seamless access to research, trading tools, and personalized advice, enhancing client engagement.

Goldman Sachs offers comprehensive financial advisory, specializing in complex mergers, acquisitions, and capital markets transactions, providing strategic guidance and seamless execution. Their global leadership in M&A, evidenced by advising on numerous high-profile deals in 2023, highlights their deep expertise.

The firm grants clients exceptional access to global capital markets, facilitating substantial financing and intricate trades across diverse asset classes, empowering effective international finance navigation. In 2024, Goldman Sachs underwrote billions in debt and equity offerings, playing a key role in major IPOs and secondary offerings.

Goldman Sachs provides advanced investment management and wealth advisory for institutional clients and high-net-worth individuals, focusing on superior returns and long-term asset growth through alternative investments and personalized planning. In 2024, their Asset Management division oversaw approximately $2.7 trillion in assets, with significant expansion into private markets and thematic investing.

The firm excels in risk management, offering sophisticated tools and expertise to help clients navigate market volatility and manage exposures, crucial for maintaining stability. Throughout 2024, their risk management capabilities remained a core service, supporting client strategies amid economic uncertainties.

| Value Proposition | Description | 2023/2024 Data Point |

|---|---|---|

| Financial Advisory | Expert guidance on M&A, capital markets, and strategic transactions. | Led numerous high-profile M&A deals in 2023. |

| Capital Markets Access | Facilitating raising significant financing and executing complex trades globally. | Underwrote billions in debt and equity offerings in 2024. |

| Investment & Wealth Management | Sophisticated solutions for institutional and individual clients seeking superior returns. | Managed approx. $2.7 trillion in assets under supervision in 2024. |

| Risk Management | Advanced tools and expertise to mitigate financial risks and ensure stability. | Continued emphasis on risk management capabilities throughout 2024. |

Customer Relationships

Goldman Sachs cultivates advisory-centric, long-term partnerships, positioning itself as a trusted advisor for clients navigating complex financial and strategic landscapes. This approach prioritizes ongoing engagement and bespoke solutions over fleeting transactions, fostering deep client loyalty.

In 2024, this commitment is reflected in the firm's continued focus on client retention and the expansion of its wealth management and investment banking services. For instance, Goldman Sachs Asset Management reported significant inflows into its long-term investment strategies, underscoring client confidence in the firm's advisory capabilities and enduring partnerships.

Goldman Sachs emphasizes dedicated client service teams, offering personalized attention and comprehensive support across its wide range of financial products and services. This high-touch model is a cornerstone of its strategy, particularly for its wealth management and institutional client segments.

In 2024, the firm continued to invest in its client-facing infrastructure, aiming to deepen relationships and provide tailored solutions. This commitment to personalized service helps retain and attract high-net-worth individuals and large institutional investors.

Goldman Sachs is enhancing client accessibility by offering robust digital platforms and self-service tools, complementing its traditional high-touch approach. This strategy allows for greater efficiency and scalability, particularly for specific client segments.

In 2024, the firm continued to invest in its digital infrastructure, aiming to provide seamless online experiences for wealth management and investment banking clients. This digital push is crucial for meeting evolving client expectations for immediate access and control over their financial interactions.

Community Engagement and Corporate Responsibility

Goldman Sachs extends its customer relationships beyond direct client interactions by actively engaging with communities. This commitment is exemplified by initiatives such as its Community Reinvestment Act Strategic Plan, which aims to foster broader stakeholder relationships and underscore its corporate responsibility. This engagement enhances its brand reputation and societal impact.

In 2024, Goldman Sachs continued to invest in community development. For instance, the firm committed significant capital towards affordable housing projects and small business support, aligning with its CRA obligations and broader ESG (Environmental, Social, and Governance) goals. These efforts are crucial for building trust and long-term value with a wider audience.

- Community Reinvestment Act (CRA) Initiatives: Goldman Sachs actively pursues CRA-eligible activities, demonstrating a commitment to serving low- and moderate-income communities.

- Philanthropic and Investment Programs: The firm supports various philanthropic endeavors and impact investments aimed at social and economic development.

- Employee Volunteerism: Encouraging employee participation in community service further strengthens these relationships and reinforces corporate values.

One Goldman Sachs Approach

Goldman Sachs is actively cultivating a unified client experience through its 'One Goldman Sachs' initiative. This strategy emphasizes leveraging the firm's entire spectrum of services and expertise across all business segments to benefit each client. For instance, in 2023, the firm highlighted how this integrated approach was instrumental in winning significant mandates, reflecting a deeper client engagement model.

The core objective is to foster more profound and enduring client relationships by providing holistic, tailored solutions. This integrated strategy aims to move beyond siloed product offerings to deliver comprehensive advice and execution capabilities. This is evident in their client engagement metrics, which show increased cross-divisional product penetration.

- Integrated Service Delivery: Clients benefit from a seamless experience, accessing the firm's full capabilities through a single point of contact or coordinated effort.

- Deepened Client Relationships: By understanding a client's entire financial landscape, Goldman Sachs can offer more strategic and impactful solutions, fostering loyalty.

- Cross-Divisional Synergy: The 'One Goldman Sachs' approach encourages collaboration between investment banking, asset management, global markets, and consumer and wealth management to create value.

- Comprehensive Solutions: This model allows the firm to address complex client needs with a wider array of tools and expertise, moving from transactional to advisory partnerships.

Goldman Sachs prioritizes building deep, advisory-centric relationships, moving beyond transactional engagements to become a trusted partner. This focus on long-term value is evident in their 2024 strategy, which emphasizes client retention and expanding wealth management services. The firm’s commitment to personalized attention through dedicated client teams, particularly for high-net-worth and institutional clients, underpins this relationship-driven model.

In 2024, Goldman Sachs continued to invest in enhancing client experiences through integrated digital platforms and a unified service approach under the 'One Goldman Sachs' initiative. This strategy aims to leverage the firm's full capabilities across all segments to deliver holistic, tailored solutions, thereby fostering deeper client loyalty and increasing cross-divisional product penetration.

| Client Relationship Strategy | Key Initiatives (2024 Focus) | Impact/Evidence |

| Advisory-Centric Partnerships | Long-term engagement, bespoke solutions | Increased client retention, growth in wealth management inflows |

| High-Touch Service Model | Dedicated client teams, personalized support | Strengthened relationships with HNWIs and institutional clients |

| Digital Enhancement & Integration | Robust digital platforms, 'One Goldman Sachs' | Improved client accessibility, seamless cross-divisional service delivery |

Channels

Goldman Sachs leverages direct sales and dedicated relationship managers to cater to its institutional, corporate, government, and high-net-worth individual clients. This approach fosters personalized service and direct engagement, crucial for addressing complex financial requirements and building long-term partnerships.

In 2024, Goldman Sachs reported that its Asset & Wealth Management division, which heavily relies on these direct client relationships, saw significant inflows. For instance, the firm's wealth management business alone serves a substantial number of ultra-high-net-worth individuals, underscoring the importance of this channel for client retention and growth.

Goldman Sachs operates a vast network of offices across key global financial hubs. This physical presence, including locations in New York, London, and Hong Kong, is crucial for serving its international clientele and accessing diverse markets. As of the first quarter of 2024, the firm reported operating in over 20 countries, underscoring its extensive global reach.

Goldman Sachs leverages proprietary digital platforms and online portals as key channels for client interaction. These platforms offer access to market intelligence, sophisticated investment tools, and seamless account management, enhancing client experience and operational efficiency.

In 2024, digital engagement is paramount, with a significant portion of client interactions and transactions occurring through these online interfaces. This digital focus allows for scalable service delivery and deeper client relationships, reflecting a strategic shift towards technology-driven client solutions.

Industry Conferences and Thought Leadership Events

Goldman Sachs actively participates in and hosts numerous industry conferences, seminars, and thought leadership events. These gatherings are crucial for client acquisition, allowing the firm to showcase its expertise and build relationships with potential and existing clients. For instance, in 2024, the firm hosted its annual Global Healthcare Conference, drawing significant investor and corporate attention.

These events serve as a vital channel for knowledge sharing, where Goldman Sachs professionals present market insights and strategic analysis. This reinforces the firm's position as a leader in financial services and enhances its brand reputation. The firm's presence at events like the World Economic Forum in Davos also underscores its global influence and commitment to shaping economic discourse.

The strategic value of these channels extends to reinforcing Goldman Sachs' expertise and market influence. By sharing proprietary research and facilitating discussions on key economic trends, the firm solidifies its standing as a trusted advisor. In 2024, Goldman Sachs analysts were featured speakers at over 50 major financial and industry-specific conferences worldwide.

- Client Acquisition: Direct engagement with potential clients at industry events.

- Knowledge Sharing: Presenting market insights and research to a broad audience.

- Brand Building: Reinforcing expertise and market leadership through visibility.

- Networking: Facilitating connections with industry peers, clients, and policymakers.

Partnerships and Joint Ventures

Goldman Sachs leverages strategic partnerships and joint ventures as key channels to broaden its market presence and deliver specialized financial solutions. These collaborations extend across various sectors, including other financial institutions, cutting-edge technology firms, and established real estate developers. This approach allows the firm to tap into new customer segments and offer integrated services that might be outside its core competencies.

For instance, in 2024, Goldman Sachs continued to explore collaborations in areas like student accommodation financing, providing capital and expertise to developers. Furthermore, its engagement with fintech companies aims to enhance digital offerings and streamline client experiences. These ventures are crucial for staying competitive and adapting to the evolving financial landscape.

- Expanded Reach: Partnerships allow Goldman Sachs to access new customer bases and geographic markets, as seen in its 2024 real estate financing initiatives.

- Service Specialization: Collaborating with fintechs enables the offering of advanced digital tools and services, enhancing client value.

- Risk Sharing: Joint ventures can distribute the financial and operational risks associated with new ventures, such as large-scale real estate projects.

- Innovation Acceleration: By teaming up with technology partners, Goldman Sachs can more rapidly develop and deploy innovative financial products and platforms.

Goldman Sachs utilizes a multi-faceted channel strategy, combining direct client engagement with digital platforms and strategic partnerships to serve its diverse clientele. These channels are crucial for client acquisition, service delivery, and reinforcing the firm's market position.

| Channel Type | Key Activities | 2024 Relevance/Data |

|---|---|---|

| Direct Sales & Relationship Management | Personalized service for institutional, corporate, government, and HNW clients. | Asset & Wealth Management division saw significant inflows; serves a substantial number of ultra-high-net-worth individuals. |

| Digital Platforms & Online Portals | Market intelligence, investment tools, account management. | Significant portion of client interactions and transactions occur digitally; scalable service delivery. |

| Industry Events & Thought Leadership | Client acquisition, knowledge sharing, brand building. | Hosted Global Healthcare Conference; analysts featured speakers at over 50 global conferences. |

| Strategic Partnerships & Joint Ventures | Broaden market presence, deliver specialized solutions. | Continued exploration in student accommodation financing; engagement with fintechs to enhance digital offerings. |

Customer Segments

Corporations represent a cornerstone customer segment for Goldman Sachs, encompassing a broad range from massive multinational enterprises to growing mid-sized firms and ambitious emerging businesses. These entities rely on Goldman Sachs for critical investment banking services, including facilitating capital raises through debt and equity offerings, and for expert strategic advisory on mergers, acquisitions, and other significant corporate actions.

In 2024, Goldman Sachs continued to demonstrate its strength in advising corporations on major deals. For instance, the firm was a lead advisor in several high-profile M&A transactions, reflecting the ongoing demand for strategic guidance in a dynamic economic landscape. Their ability to navigate complex regulatory environments and provide tailored financial solutions makes them an indispensable partner for corporate growth and restructuring.

Financial Institutions, a cornerstone of Goldman Sachs' business model, includes a diverse clientele such as banks, hedge funds, asset managers, pension funds, and insurance companies. These entities leverage Goldman Sachs' extensive global markets capabilities, prime brokerage services, and sophisticated investment management solutions. For instance, in 2023, Goldman Sachs' Global Markets division reported net revenues of $33.1 billion, demonstrating the significant demand for these services from institutional clients.

These institutions frequently engage with Goldman Sachs for complex financial engineering and bespoke solutions tailored to their specific needs, often involving intricate risk management or capital allocation strategies. The firm's ability to provide deep market liquidity and access to a wide range of financial products makes it an indispensable partner for these sophisticated players in the financial ecosystem.

Goldman Sachs actively engages with governments and public sector entities globally, offering crucial financial advisory and underwriting services. For instance, in 2024, the firm continued its role in assisting national governments with significant debt issuances to fund infrastructure projects and manage public finances. This segment relies on Goldman Sachs for expertise in areas like privatization, helping public entities transition to private ownership and optimize their operations.

High-Net-Worth and Ultra-High-Net-Worth Individuals

Goldman Sachs caters to High-Net-Worth (HNW) and Ultra-High-Net-Worth (UHNW) individuals, offering bespoke wealth management, private banking, and advanced investment advisory. This segment demands highly personalized strategies to preserve and grow substantial assets.

The Asset & Wealth Management division is central to serving these clients. As of the first quarter of 2024, Goldman Sachs reported record assets under supervision (AUS) in its Consumer & Wealth Management division, reaching $1.0 trillion, underscoring the significant scale of its operations within this segment.

- Personalized Wealth Management: Tailored financial planning and investment solutions.

- Private Banking Services: Access to credit, lending, and liquidity management.

- Sophisticated Investment Advisory: Expert guidance on alternative investments, global markets, and estate planning.

- Global Reach: Services designed for internationally diversified portfolios.

Retail and Consumer Clients (Platform Solutions)

Goldman Sachs’ Platform Solutions segment extends its reach to a wider consumer audience through innovative offerings like credit cards and transaction banking services tailored for both individual consumers and corporate clients. This strategic move allows the firm to leverage its financial expertise beyond traditional institutional services.

While Goldman Sachs has strategically refined its consumer banking operations, certain key products and services continue to be offered, demonstrating a commitment to serving diverse client needs. For instance, in 2024, the firm continued to manage its portfolio of consumer-facing financial products.

- Credit Card Partnerships: Goldman Sachs continues to engage in strategic partnerships for its credit card offerings, aiming to provide value and convenience to cardholders.

- Transaction Banking for Corporates: The segment offers robust transaction banking solutions designed to streamline financial operations for corporate and institutional clients.

- Consumer Engagement: Efforts are focused on engaging a broader consumer base through accessible financial tools and services, adapting to evolving market demands.

Goldman Sachs serves a diverse range of client segments, from large corporations and financial institutions to high-net-worth individuals and governments. The firm also engages with a broader consumer base through its Platform Solutions segment.

In 2024, the firm continued to focus on its core institutional clients while strategically managing its consumer offerings. The Asset & Wealth Management division saw significant growth, with assets under supervision reaching $1.0 trillion in Q1 2024.

Key services provided include investment banking, global markets, asset management, wealth management, and transaction banking. These offerings are tailored to meet the complex financial needs of each distinct customer segment.

| Customer Segment | Key Services | 2024 Highlights/Data |

|---|---|---|

| Corporations | Investment Banking, M&A Advisory, Capital Raising | Lead advisor in major M&A transactions, reflecting strong demand for strategic guidance. |

| Financial Institutions | Global Markets, Prime Brokerage, Investment Management | Significant demand for these services, as evidenced by $33.1 billion in Global Markets net revenues in 2023. |

| Governments & Public Sector | Financial Advisory, Debt Issuance, Privatization | Assisted national governments with significant debt issuances for infrastructure and public finance management. |

| High-Net-Worth Individuals | Wealth Management, Private Banking, Investment Advisory | Assets under supervision in Consumer & Wealth Management reached $1.0 trillion in Q1 2024. |

| Platform Solutions (Broader Consumer/Corporate) | Credit Card Partnerships, Transaction Banking | Continued management of consumer-facing financial products and robust transaction banking for corporates. |

Cost Structure

Employee compensation and benefits represent a substantial cost for Goldman Sachs, underscoring its reliance on highly skilled professionals. In 2023, compensation and benefits expenses amounted to $21.9 billion, a significant portion of its total operating expenses.

This figure reflects not only competitive salaries but also substantial bonuses and comprehensive benefits packages designed to attract and retain top talent in the financial services industry. The firm’s human capital is its primary asset, driving its advisory, trading, and investment management services.

Goldman Sachs allocates significant capital to technology and infrastructure, a key component of its cost structure. These investments are crucial for maintaining a competitive edge in the financial industry.

In 2024, the firm continued its substantial spending on data centers, advanced software development, and cutting-edge AI infrastructure, reflecting a strategic focus on digital transformation and operational efficiency.

This ongoing enhancement of digital capabilities is designed to streamline operations, improve client services, and drive innovation across all business lines, ensuring Goldman Sachs remains at the forefront of financial technology.

Goldman Sachs faces substantial regulatory and compliance expenses, a direct consequence of operating within the heavily scrutinized financial sector. These costs encompass legal fees, risk management frameworks, and the ongoing effort to adhere to diverse global regulations, ensuring operational integrity and investor protection.

In 2024, the financial industry's compliance burden remains high. For instance, adhering to regulations such as the Community Reinvestment Act, which mandates banks to meet the credit needs of the communities in which they operate, including low- and moderate-income neighborhoods, translates into specific operational expenditures for institutions like Goldman Sachs.

Marketing and Business Development

Goldman Sachs invests significantly in marketing and business development to sustain its market position and attract new clients. These expenses cover a range of activities aimed at enhancing brand visibility and fostering client relationships.

In 2023, Goldman Sachs reported total operating expenses of $37.1 billion. A portion of this is allocated to marketing and business development, which is crucial for client acquisition and retention in the competitive financial services landscape.

- Brand Building: Expenses incurred for advertising, public relations, and sponsorships to strengthen Goldman Sachs' global brand reputation.

- Client Acquisition: Costs associated with outreach, sales efforts, and onboarding new institutional and individual clients.

- Industry Engagement: Investment in participation and sponsorship of key financial industry conferences and events to network and showcase expertise.

- Digital Marketing: Spending on online advertising, content marketing, and social media engagement to reach a wider audience.

Office and Operational Expenses

Goldman Sachs incurs significant costs maintaining its extensive global office network and operational infrastructure. These expenses cover everything from prime real estate leases in major financial hubs to the essential administrative and support staff that keep the firm running smoothly.

In 2023, Goldman Sachs reported total operating expenses of $31.5 billion. A portion of this is directly attributable to the firm's physical presence and the day-to-day running of its operations worldwide. Efficiently managing these overheads is crucial for maintaining healthy profit margins.

- Real Estate Costs: Significant expenditure on leasing and maintaining office spaces in key global financial centers.

- Administrative Support: Costs associated with personnel, IT infrastructure, and general administrative functions.

- Operational Overheads: Expenses related to technology, security, compliance, and other essential operational services.

Beyond compensation and technology, Goldman Sachs' cost structure includes significant outlays for data and analytics, essential for market insights and client solutions. These investments fuel proprietary trading strategies and informed investment advice.

Furthermore, interest expenses on borrowings represent a substantial cost, particularly given the firm's leverage and its role in facilitating financial transactions. Managing this cost is critical for profitability.

Goldman Sachs also incurs costs related to its various investment management and lending activities, including potential loan loss provisions and the operational expenses of managing diverse portfolios.

| Cost Component | 2023 Expense (in billions USD) | Key Drivers |

| Employee Compensation & Benefits | 21.9 | Talent acquisition and retention, bonuses |

| Technology & Infrastructure | Significant investment | Digital transformation, AI, data centers |

| Regulatory & Compliance | Ongoing expenditure | Adherence to global financial regulations |

| Marketing & Business Development | Portion of operating expenses | Brand building, client acquisition |

| Real Estate & Operations | Portion of operating expenses | Global office network, administrative support |

Revenue Streams

Goldman Sachs Group generates substantial revenue from investment banking fees, primarily through financial advisory services like Mergers & Acquisitions (M&A) and underwriting services for equity and debt issuances. These fees are a cornerstone of their business model, reflecting the firm's expertise in facilitating complex financial transactions.

In 2023, Goldman Sachs reported investment banking fees of $7.1 billion, a notable portion of its total revenue, underscoring the consistent importance of this segment. This figure highlights the ongoing demand for their advisory and underwriting capabilities in capital markets.

Goldman Sachs generates substantial income from its global markets division, which includes client-driven trading across fixed income, currencies, commodities, and equities. This segment also profits from market-making and risk intermediation services. For instance, in the first quarter of 2024, Goldman Sachs reported significant trading revenues, with their Global Markets division seeing a notable increase compared to the previous year, driven by strong performance in equities and fixed income, currencies, and commodities (FICC) trading.

Goldman Sachs generates substantial revenue from asset and wealth management fees. These fees, derived from managing client assets and providing private banking services, form a consistent and expanding income source for the firm.

In 2024, the firm reported robust net inflows into its fee-generating assets, underscoring the stability and growth potential of this segment. This trend highlights client trust and the ongoing demand for sophisticated wealth management solutions.

Lending and Financing Income

Goldman Sachs generates substantial revenue through its lending and financing activities. This includes income from interest charged on loans and various fees associated with providing capital to clients. The firm emphasizes building and expanding its more stable, recurring financing revenues.

These income streams are critical to Goldman Sachs' overall financial health. The firm actively engages in relationship lending, providing tailored financing solutions to corporations and individuals. Additionally, secured lending, where loans are backed by collateral, forms another significant component of its financing operations.

In 2024, Goldman Sachs continued to focus on these durable revenue streams. For instance, the firm reported significant net interest income, reflecting the breadth of its lending portfolio. This segment is a cornerstone of its business model, providing consistent income generation.

- Interest Income: Earnings derived from loans and other credit facilities extended to clients.

- Financing Fees: Charges for structuring, underwriting, and managing financing transactions.

- Relationship Lending: Tailored credit solutions provided to key corporate and institutional clients.

- Secured Lending: Loans collateralized by assets, offering a lower-risk profile.

Platform Solutions Revenues

Goldman Sachs' Platform Solutions segment generates revenue from a growing suite of offerings. This includes credit card partnerships and transaction banking services tailored for corporate clients, broadening the firm's income sources beyond traditional investment banking and trading. These newer ventures are key to diversifying the revenue base.

While some consumer-focused initiatives have been adjusted, the core of Platform Solutions continues to contribute significantly. For instance, in 2024, Goldman Sachs reported substantial growth in its consumer and wealth management division, which encompasses many of these platform solutions, demonstrating their increasing importance to the firm's overall financial performance.

- Credit Card Partnerships: Revenue generated from co-branded credit card agreements with various partners.

- Transaction Banking: Fees and interest income from providing payment, collection, and liquidity management services to businesses.

- Digital Platform Services: Income derived from the use of Goldman Sachs' technology platforms by clients for various financial operations.

- Consumer Banking Ventures: While some have been streamlined, remaining consumer-facing banking products contribute to this revenue stream.

Goldman Sachs' revenue streams are diverse, spanning investment banking, global markets, asset and wealth management, and lending and financing. The firm also leverages its Platform Solutions for additional income.

In 2023, Goldman Sachs generated $7.1 billion in investment banking fees and saw significant contributions from its Global Markets division, with strong trading revenues in early 2024. Asset and wealth management also experienced robust net inflows in 2024, indicating growing client trust and demand for its services.

| Revenue Stream | 2023 (USD Billions) | Key Drivers |

|---|---|---|

| Investment Banking | 7.1 | M&A advisory, Equity & Debt underwriting |

| Global Markets | N/A* | Client trading (FICC, Equities), Market-making |

| Asset & Wealth Management | N/A* | Management fees, Private banking |

| Lending & Financing | N/A* | Net interest income, Financing fees |

| Platform Solutions | N/A* | Credit card partnerships, Transaction banking |

*Specific segment breakdowns for 2023 and 2024 are not directly provided in the prompt for all categories, but the qualitative descriptions highlight their revenue-generating importance.

Business Model Canvas Data Sources

The Goldman Sachs Group Business Model Canvas is informed by a robust blend of internal financial disclosures, extensive market research reports, and proprietary strategic analysis. These diverse data sources ensure a comprehensive and accurate representation of the firm's operations and market positioning.