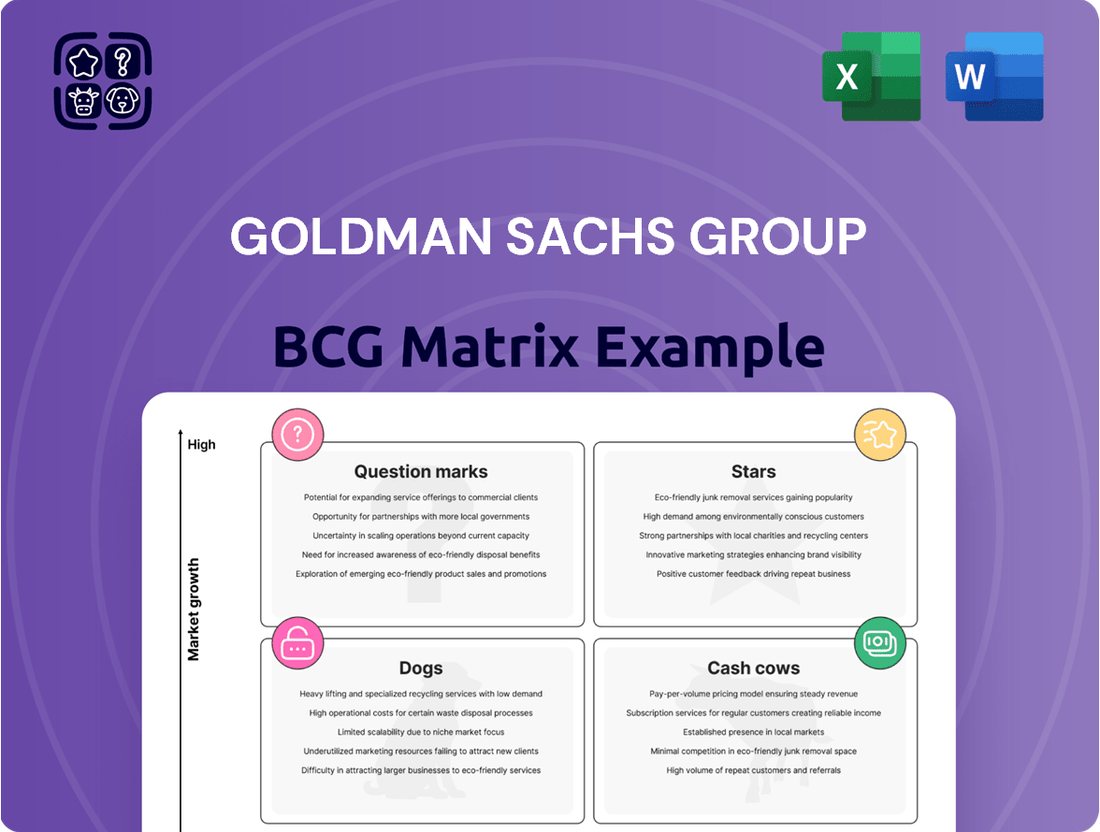

Goldman Sachs Group Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Goldman Sachs Group Bundle

Unlock the strategic power of the Goldman Sachs Group BCG Matrix. This essential tool categorizes their business units into Stars, Cash Cows, Dogs, and Question Marks, offering a clear snapshot of their market performance and potential. Don't miss out on the full analysis that reveals where their capital is best deployed for maximum growth and stability.

Dive deeper into this company’s BCG Matrix and gain a clear view of where its products stand—Stars, Cash Cows, Dogs, or Question Marks. Purchase the full version for a complete breakdown and strategic insights you can act on.

Stars

Goldman Sachs' Investment Banking Advisory, particularly in Mergers & Acquisitions (M&A), is a standout performer. As the top M&A advisor globally, the firm commands a significant market share in a sector characterized by high growth and substantial revenue generation.

The M&A advisory segment is a key driver of Goldman Sachs' financial success, consistently contributing significant fees. Projections for the latter half of 2025 anticipate a strong market for M&A, fueled by an anticipated resurgence in deal-making.

Goldman Sachs' deep expertise and established client relationships solidify its leadership in M&A advisory. This strategic advantage allows them to navigate complex transactions and capitalize on market opportunities, reinforcing their dominant position.

Goldman Sachs' equities trading business is a clear star in its BCG matrix. Revenues saw a substantial jump in 2024, with this positive momentum carrying into the first quarter of 2025. This robust performance is fueled by persistent market volatility and clients actively adjusting their portfolios, leading to increased trading volumes.

The firm's strategic advantage lies in its adeptness at profiting from market fluctuations and its exceptional execution services. These factors solidify equities trading as a segment with both high growth potential and a dominant market share for Goldman Sachs.

Goldman Sachs is aggressively targeting a substantial expansion of its private credit business, with a goal to reach $300 billion in assets under management by 2029. This ambitious target represents a significant increase from its current $110 billion portfolio. This strategic push is directly aligned with the booming private credit market, which has seen remarkable growth.

The surge in private credit is largely fueled by middle-market companies that find traditional bank lending channels less accessible. Goldman Sachs' expansion aims to capture a larger share of this underserved market, positioning itself for substantial growth and increased profitability in a dynamic financial environment.

Asset & Wealth Management (Alternatives)

Goldman Sachs' Asset & Wealth Management division, especially its alternatives segment, represents a significant growth engine for the firm. This area is characterized by its strong market position and high growth potential.

The firm has demonstrated robust fundraising capabilities within alternatives, with expectations for continued strong performance in 2025. This optimism stems from increased penetration among institutional clients and a growing presence in the wealth management channel.

- Record Assets Under Supervision: As of the first quarter of 2024, Goldman Sachs reported record assets under supervision (AUS) in its Asset & Wealth Management division, exceeding $2.8 trillion.

- Alternatives Fundraising Momentum: The firm successfully raised over $100 billion in alternative capital in 2023, a testament to strong investor demand.

- Projected Annual Growth: Goldman Sachs anticipates high-single-digit annual growth for its Asset & Wealth Management business, driven by strategic initiatives and market opportunities.

- Focus on Institutional and Wealth Clients: Continued expansion into institutional mandates and the wealth channel are key drivers for sustained fundraising and asset growth in alternatives.

Digital Assets & Tokenization Initiatives

Goldman Sachs is aggressively pursuing digital asset expansion, notably through tokenization. Key initiatives are underway in the U.S. fund sector and European debt markets, aiming to build marketplaces for these new asset classes. These efforts leverage permissioned blockchain technology to boost capital efficiency and liquidity.

The firm's strategic investments in this high-growth, emerging market underscore a commitment to innovation. For example, by mid-2024, Goldman Sachs had completed several pilot programs for tokenized securities, demonstrating tangible progress. This focus positions them to capture value as the digital asset ecosystem matures.

- Marketplace Development: Building infrastructure for trading tokenized assets.

- U.S. Fund Sector Focus: Exploring tokenization of investment funds.

- European Debt Markets: Engaging in tokenization of sovereign and corporate debt.

- Blockchain Utilization: Employing permissioned networks for enhanced control and efficiency.

Goldman Sachs' digital asset initiatives, particularly in tokenization, are positioned as a future star. The firm is actively developing marketplaces for tokenized securities, with pilot programs completed by mid-2024. This strategic focus on an emerging, high-growth market aims to enhance capital efficiency and liquidity through permissioned blockchain technology.

The firm's commitment to innovation in digital assets, especially tokenization, marks it as a potential star within the BCG matrix. By mid-2024, Goldman Sachs had successfully executed several pilot programs for tokenized securities, demonstrating tangible progress in building infrastructure for these new asset classes.

Goldman Sachs' engagement in tokenizing investment funds in the U.S. and debt in European markets highlights its proactive approach to a high-growth, emerging sector. This strategic push, leveraging permissioned blockchain technology, aims to unlock greater capital efficiency and liquidity.

The digital asset space, with its emphasis on tokenization, represents a significant growth opportunity for Goldman Sachs. By mid-2024, the firm had advanced its tokenization efforts through several pilot programs, signaling a strong commitment to this evolving market.

| Initiative | Market Focus | Technology | Progress (Mid-2024) |

|---|---|---|---|

| Tokenization | U.S. Fund Sector, European Debt | Permissioned Blockchain | Multiple pilot programs completed |

What is included in the product

This BCG Matrix overview analyzes Goldman Sachs' business units, categorizing them to guide investment decisions.

The Goldman Sachs Group BCG Matrix provides a clear, visual overview of business unit performance, alleviating the pain of complex strategic analysis.

Cash Cows

Goldman Sachs' Fixed Income, Currency, and Commodities (FICC) trading division is a powerhouse, consistently delivering robust performance within the Global Banking & Markets segment. This business unit acts as a significant cash cow for the firm, characterized by its established market presence and substantial, reliable revenue streams, even if its growth trajectory isn't as steep as newer ventures.

The firm's strategic focus on enhancing relationships with its most important clients in FICC has paid dividends, solidifying its competitive position. This client-centric approach underpins the stability of the cash flows generated by this segment, making it a dependable contributor to Goldman Sachs' overall financial health.

Goldman Sachs' debt and equity underwriting operations are firmly established as cash cows, commanding a significant market share in the mature capital markets. These divisions consistently generate substantial fee-based income, a trend that is expected to continue as dealmaking activity rebounds. For instance, in the first quarter of 2024, Goldman Sachs reported investment banking revenue of $1.97 billion, with underwriting contributing a notable portion of this figure.

The firm's deep-rooted client relationships and extensive experience in navigating complex transactions provide a stable foundation for ongoing cash generation, even amidst fluctuating market growth. This consistent performance underscores their position as reliable income streams within the broader Goldman Sachs portfolio. The firm’s underwriting pipeline remained robust throughout 2023, indicating sustained demand for their services.

Goldman Sachs' Global Banking & Markets Financing segment, particularly FICC and Equities financing, functions as a robust cash cow. These areas consistently generate substantial net revenues, underscoring their maturity and high market share within the industry. This translates into predictable, recurring income for the firm.

In 2023, Goldman Sachs reported that its Global Banking & Markets division, which includes these financing activities, saw significant contributions to its overall revenue. For instance, the firm's financing revenues within this segment have historically been a stable pillar, providing essential capital solutions to a broad client base of institutional and corporate entities.

Traditional Asset Management Products (Long-Term Fee-Based Inflows)

Goldman Sachs' traditional asset management products represent a strong cash cow within their BCG matrix. These offerings consistently generate long-term fee-based net inflows, a testament to a stable and mature client base that fuels reliable revenue streams.

While this segment might not always exhibit the highest growth rates, its substantial assets under supervision and dependable inflows solidify its position as a significant cash generator for the firm.

- Consistent Fee-Based Inflows: Goldman Sachs' Asset & Wealth Management division reported substantial net inflows in its long-term fee-based products throughout 2024, underscoring client retention and trust.

- Stable Revenue Generation: These products, characterized by their mature market presence, contribute significantly to the firm's recurring revenue, providing a predictable income source.

- Assets Under Supervision (AUS): As of the first quarter of 2025, Goldman Sachs managed over $2.7 trillion in assets, with a considerable portion attributed to these traditional, fee-generating strategies.

- Strategic Importance: Despite lower growth potential compared to other segments, the stability and cash-generating capacity of these products are crucial for funding investments in high-growth areas.

Wealth Management for Ultra-High Net Worth Individuals

Goldman Sachs’ ultra-high net worth (UHNW) wealth management business is a prime example of a cash cow within its broader portfolio. This segment caters to clients with substantial assets, often exceeding $30 million, and represents a mature, well-established market where the firm has cultivated a dominant presence.

The UHNW segment consistently delivers stable, recurring fee income through asset management and advisory services. This predictable revenue stream, coupled with the firm's strong client relationships and specialized offerings, solidifies its role as a reliable cash cow.

As of the first quarter of 2024, Goldman Sachs reported record assets under supervision (AUS) in its Consumer & Wealth Management division, reaching $1.7 trillion. A significant portion of this AUS is attributable to its UHNW clientele, underscoring the scale and stability of this business line.

- Dominant Market Position: Goldman Sachs holds a leading position in serving ultra-high net worth individuals, a segment characterized by high loyalty and substantial asset bases.

- Stable Recurring Revenue: The business generates consistent fee-based income from asset management, financial planning, and trust services, providing a predictable revenue stream.

- High Client Asset Value: The UHNW segment manages significant client assets, contributing substantially to the firm's overall AUS, which reached $1.7 trillion in Q1 2024 for the Consumer & Wealth Management division.

- Mature and Profitable: This segment operates in a mature market, allowing Goldman Sachs to leverage its established infrastructure and expertise for consistent profitability.

Goldman Sachs' established asset management products, particularly those catering to traditional investment strategies, function as significant cash cows. These offerings benefit from a mature market presence and a loyal client base, leading to consistent fee-based net inflows. This stability is vital for the firm's financial health, providing a reliable revenue stream even when growth in other areas may be more dynamic.

The firm's commitment to client relationships within these mature segments ensures sustained engagement and asset retention. This focus underpins the predictable cash generation, making these products a cornerstone of Goldman Sachs' diversified revenue model.

In 2023, Goldman Sachs' Asset & Wealth Management division reported strong net inflows into its long-term fee-based products. These inflows, coupled with substantial Assets Under Supervision (AUS), which stood at over $2.7 trillion by Q1 2025, highlight the enduring appeal and revenue-generating capacity of these established offerings.

These cash cows, while not always exhibiting the highest growth rates, are crucial for funding innovation and expansion into newer, higher-growth market segments, demonstrating a balanced strategic approach to portfolio management.

| Segment | Role in BCG Matrix | Key Characteristics | 2024 Data Highlight | 2025 Data Highlight |

|---|---|---|---|---|

| Traditional Asset Management | Cash Cow | Mature market, stable client base, consistent fee-based inflows | Strong net inflows in fee-based products | Assets Under Supervision (AUS) exceeding $2.7 trillion (Q1 2025) |

| Ultra-High Net Worth (UHNW) Wealth Management | Cash Cow | Dominant market position, recurring fee income, high client asset value | Record AUS in Consumer & Wealth Management ($1.7 trillion in Q1 2024) | Continued stable fee generation from advisory services |

Preview = Final Product

Goldman Sachs Group BCG Matrix

The Goldman Sachs Group BCG Matrix preview you are viewing is the exact, fully formatted document you will receive immediately after purchase. This means no watermarks, no demo content, and no hidden surprises – just a comprehensive, analysis-ready report designed for strategic decision-making. You can confidently proceed with your purchase knowing that the professional insights and clear visualizations presented here will be yours to utilize without alteration. This is the complete, ready-to-deploy strategic tool you need to effectively analyze Goldman Sachs' business portfolio.

Dogs

Goldman Sachs' divestiture of GreenSky and Marcus personal loans signals a strategic shift away from lower-growth consumer lending. In 2023, Goldman Sachs announced the sale of GreenSky, a home improvement loan platform, to Sixth Street Partners. This move aligns with the firm's broader strategy to streamline its operations and focus on its core strengths in investment banking and wealth management.

The decision to exit these consumer lending businesses reflects their classification as potential "Dogs" within a BCG Matrix framework, characterized by low market share and low growth prospects. Goldman Sachs aims to reallocate capital from these areas to more profitable and strategically aligned ventures, such as its asset and wealth management divisions.

The reported advanced talks for JPMorgan Chase to take over Apple's credit card program from Goldman Sachs strongly indicate this partnership was a low-growth or problematic area for Goldman Sachs' consumer banking ambitions. Goldman Sachs' strategic pivot away from consumer finance, evident in this move, suggests the Apple Card partnership was not a high-performing segment within their portfolio.

Goldman Sachs' decision to transfer its Marcus Invest digital investment accounts to Betterment suggests this segment was a "Dog" in the BCG Matrix. This implies the business had low relative market share and was in a low-growth industry, making it a less attractive investment for the firm.

In 2023, Goldman Sachs reported a significant shift in its consumer banking strategy, including the sale of its GreenSky loan origination platform and the aforementioned transfer of Marcus Invest. This aligns with a focus on more profitable and strategically aligned business lines.

The Marcus Invest offering, while digital, did not achieve the scale or market penetration necessary to compete effectively against established robo-advisors. This is a common characteristic of "Dog" business units, which often require substantial investment to gain traction but yield limited returns.

General Motors Credit Card Business

Goldman Sachs’ divestiture of its General Motors (GM) credit card business in 2024 signifies a strategic move, placing this venture into the 'Dogs' category of the BCG Matrix. This action aligns with the matrix's definition of 'Dogs' as low-growth, low-market-share entities that often consume more resources than they generate. The sale suggests that the GM credit card portfolio was not meeting Goldman Sachs' growth or profitability expectations within its broader consumer finance strategy.

The exit from the GM credit card business underscores Goldman Sachs' ongoing refinement of its consumer banking footprint. This strategic pivot aims to concentrate resources on areas with higher potential for growth and market leadership. By shedding non-core or underperforming assets, the firm can reallocate capital towards more promising ventures, enhancing overall portfolio efficiency.

The financial implications of such a divestiture can be significant. While specific deal terms for the GM credit card business were not widely publicized, similar transactions often involve a sale at a discount or a recognition of impairment charges. This move is consistent with Goldman Sachs' stated strategy to streamline its operations and focus on its core strengths in investment banking and wealth management.

- Divestiture in 2024: Goldman Sachs sold its GM credit card portfolio, classifying it as a 'Dog' in the BCG matrix.

- Strategic Retreat: This sale reflects a broader strategy to exit less profitable or non-strategic consumer finance ventures.

- Resource Reallocation: The move allows Goldman Sachs to focus capital and management attention on higher-growth business areas.

- Market Position: The GM credit card business, while having brand association, likely faced intense competition and limited growth prospects within Goldman's portfolio.

Legacy Investments with Low Returns

Goldman Sachs has been actively working to divest from its legacy investments that generate low returns. The firm's strategic goal was to shrink this portfolio, which functions as a 'dog' in the BCG matrix, from approximately $30 billion down to below $15 billion by the close of 2024.

These holdings are typically assets that are not performing well or no longer align with Goldman Sachs' evolving business strategy. By reducing exposure to these underperforming areas, the firm aims to free up capital and focus resources on more promising growth opportunities.

The reduction in these legacy investments reflects a broader effort by Goldman Sachs to optimize its asset allocation and improve overall profitability.

- Target Reduction: Aiming to cut legacy investments from $30 billion to under $15 billion by year-end 2024.

- Strategic Rationale: Divesting underperforming assets that no longer fit strategic objectives.

- BCG Matrix Classification: These investments are categorized as 'dogs' due to their low market share and low growth prospects.

- Financial Impact: Expected to improve capital efficiency and focus resources on higher-return areas.

Goldman Sachs' strategic decision to divest its General Motors (GM) credit card business in 2024 firmly places this venture into the 'Dogs' category of the BCG Matrix. This classification highlights its low market share and limited growth potential, often requiring significant resources without commensurate returns. The sale underscores Goldman Sachs' commitment to refining its consumer banking operations and concentrating on more lucrative segments.

The divestiture of the GM credit card portfolio is part of a larger initiative by Goldman Sachs to reduce its exposure to legacy investments that yield low returns. The firm had a target to shrink this portfolio, identified as 'dogs,' from approximately $30 billion to below $15 billion by the end of 2024. This strategic pruning aims to free up capital and enhance overall profitability by focusing on higher-growth opportunities.

| Business Unit | BCG Category | Strategic Action | Rationale | Year |

| GreenSky | Dog | Divested | Low growth, focus on core strengths | 2023 |

| Marcus Personal Loans | Dog | Divested | Low growth, strategic shift | 2023 |

| Apple Card Program | Dog (implied) | Potential Sale/Transfer | Not a high-performing segment | 2024 (reported) |

| Marcus Invest | Dog | Transferred to Betterment | Low market share, competitive landscape | 2023 |

| GM Credit Card Business | Dog | Divested | Low growth, not meeting expectations | 2024 |

Question Marks

Goldman Sachs' Platform Solutions segment, a newer venture, is positioned as a potential growth area, focusing on areas like transaction banking and enterprise platforms. While it shows promise, its market share and profitability are still in the development phase, making its long-term market leadership uncertain.

Goldman Sachs is actively pursuing growth in the broader retail wealth management sector, aiming to capture a larger share of the affluent client market beyond its established ultra-high net worth (UHNW) base. This strategic pivot acknowledges the significant untapped potential within this expanding segment.

While Goldman Sachs possesses considerable brand equity and expertise, its current market penetration in the broader affluent segment is still developing. This positions the expansion as a 'question mark' within the BCG matrix, requiring substantial investment and strategic focus to realize its full potential.

In 2024, the global wealth management market for affluent individuals is projected to continue its robust growth, with a significant portion of assets managed by firms that cater to a wider client base. Goldman Sachs' 2023 annual report indicated a strategic emphasis on scaling its consumer and wealth management divisions, signaling a commitment to this area.

Goldman Sachs' exploration of spinning off its Digital Assets Platform (GS DAP) into an industry-owned blockchain venture positions it as a question mark within the BCG matrix. This move acknowledges the substantial growth prospects in digital assets, a sector projected to reach trillions in value by the end of the decade, with some estimates suggesting a market capitalization of over $5 trillion by 2030.

However, the nascent stage of this venture and the broader digital asset ecosystem means its future market share and profitability are far from guaranteed. Significant investment will be necessary to establish market presence and overcome the inherent uncertainties of a rapidly evolving technological landscape, typical of question mark assets that need nurturing to become stars.

Specific Niche Market Expansions within Investment Banking

Goldman Sachs is actively exploring niche market expansions within its investment banking division to capture greater client wallet share. These initiatives, while targeting growing sectors, are currently characterized by substantial investment requirements and a strategic need to build significant market presence, positioning them as Question Marks in a BCG matrix framework.

For instance, Goldman Sachs' expansion into specialized areas like sustainable finance advisory or digital asset banking represents investments in burgeoning markets. These sectors hold immense potential but demand considerable capital and strategic focus to carve out substantial market share and transition into Stars.

- Sustainable Finance Advisory: This segment is experiencing rapid growth, with global sustainable debt issuance reaching an estimated $1.5 trillion in 2024, up from $1.2 trillion in 2023. Goldman Sachs aims to be a leader in advising companies on ESG strategies and green bond issuance.

- Digital Asset Banking: While still nascent, the digital asset market is attracting significant institutional interest. Goldman Sachs is investing in capabilities to support clients in areas like tokenization and digital asset custody, recognizing its long-term potential.

- Fintech Investment Banking: The firm is bolstering its coverage of the fintech sector, advising on mergers, acquisitions, and capital raises for a rapidly evolving industry. In 2024, fintech M&A activity, though fluctuating, continues to present opportunities for specialized banking services.

AI-driven Data Center Infrastructure Investments

Goldman Sachs Asset Management highlights AI-driven data center demand as a key real asset theme for 2025, anticipating substantial growth. This sector is experiencing a rapid expansion, driven by the insatiable appetite for computing power required by artificial intelligence applications.

However, this burgeoning market falls into the 'Question Mark' category within the BCG Matrix due to inherent uncertainties. While the growth potential is high, the precise market size, the pace of technological evolution, and the critical factor of power availability present significant variables that could impact an investor's ability to capture market share and achieve desired returns.

- Market Growth: The global data center market is projected to reach approximately $300 billion by 2026, with AI workloads expected to be a major catalyst.

- Technological Influence: Advancements in AI hardware, such as specialized AI chips, are driving demand for higher-density computing and more efficient cooling solutions.

- Power Availability: Securing sufficient and sustainable power sources is a critical bottleneck, with some regions facing limitations due to grid capacity and renewable energy availability.

- Investment Uncertainty: The rapid pace of change in AI technology and infrastructure requirements means that investments made today might need significant adaptation or upgrades in the near future, creating a risk profile typical of a Question Mark.

Goldman Sachs' expansion into broader affluent wealth management and its digital asset ventures are currently classified as Question Marks in the BCG matrix.

These areas represent significant growth opportunities but require substantial investment and strategic development to achieve market leadership and profitability.

The firm's focus on these segments in 2024 reflects a deliberate strategy to diversify and capture new revenue streams in evolving markets.

The success of these Question Marks hinges on navigating technological advancements, regulatory landscapes, and competitive pressures effectively.

| Business Area | Market Growth Potential | Current Market Share | Investment Required | BCG Classification |

| Platform Solutions | High | Low | High | Question Mark |

| Affluent Wealth Management | High | Developing | High | Question Mark |

| Digital Asset Ventures | Very High | Nascent | High | Question Mark |

| Sustainable Finance Advisory | High | Developing | Medium | Question Mark |

| Data Center Infrastructure (AI-driven) | Very High | Developing | High | Question Mark |

BCG Matrix Data Sources

Our BCG Matrix is built on verified market intelligence, combining financial data, industry research, official reports, and expert commentary to ensure reliable, high-impact insights.