GN Store Nord SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

GN Store Nord Bundle

GN Store Nord presents a compelling case for strategic analysis, with key strengths in its leading hearing aid and audio communication segments. However, understanding the full scope of its opportunities and the potential threats it faces is crucial for informed decision-making.

Our comprehensive SWOT analysis delves deep into these factors, revealing how GN Store Nord can leverage its market position while mitigating emerging challenges. Imagine having a clear roadmap to capitalize on growth avenues and navigate competitive pressures.

Discover the complete picture behind the company’s market position with our full SWOT analysis. This in-depth report reveals actionable insights, financial context, and strategic takeaways—ideal for entrepreneurs, analysts, and investors.

Strengths

GN Store Nord demonstrates robust dual-market leadership, excelling in both high-value hearing health and professional audio. The GN Hearing division maintains its strong position as a global innovator in hearing instruments, generating significant revenue, for instance, contributing 52% of the group's total revenue in Q1 2024. Simultaneously, GN Audio, powered by its Jabra brand, is a key player in enterprise and consumer audio solutions, accounting for the remaining 48% of group revenue in the same period. This strategic diversification offers a natural hedge against market-specific downturns and fosters cross-divisional technological synergies. The ability to innovate and lead in both medical technology and consumer electronics provides a distinct competitive advantage in the 2024-2025 market landscape.

The Jabra brand boasts strong global recognition for its high-quality headsets, speakerphones, and advanced video conferencing solutions. This robust brand equity, a significant asset, allows for premium pricing and cultivates deep customer loyalty across enterprise and consumer audio markets. It also provides a solid foundation for launching new products, ensuring market acceptance. Recent 2024 insights from Jabra itself underscore the increasing demand for professional audio equipment, crucial for productivity and well-being in evolving hybrid work models.

GN Store Nord consistently invests in research and development, a critical strength supporting its product pipeline. In the Hearing division, new platforms like ReSound Vivia, featuring AI-powered processing, aim to capture significant market share heading into 2025. The Audio division continuously updates its portfolio with advanced noise cancellation and AI-driven tools, meeting evolving professional and consumer demands. This commitment to technological advancement is vital for maintaining a competitive edge across both core markets.

Growing Hearing Aid Market Share

GN Store Nord's Hearing division demonstrates robust performance, securing market share through successful launches like ReSound Nexia and the new ReSound Vivia. Despite early 2025 U.S. market challenges, the company forecasts continued market share gains through the year. This division anticipates organic revenue growth of 5% to 9% for 2025, driven by favorable demographic trends and a strong product portfolio.

- ReSound Nexia and ReSound Vivia contributed to 2024/2025 market share growth.

- Projected 2025 organic revenue growth for the Hearing division is 5% to 9%.

- Demographic trends support sustained demand in the hearing aid market.

Solid Operational Execution and Synergies

GN Store Nord's 'one-GN' strategy has significantly streamlined operations, directly yielding substantial cost synergies. This focus on efficiency drove improved margins and robust free cash flow generation in 2024, strengthening the company's financial base. The strategic execution also facilitated a notable reduction in net interest-bearing debt, enhancing financial flexibility for future investments. This operational discipline positions GN strongly for sustained growth.

- In 2024, GN's 'one-GN' strategy contributed to a significant improvement in adjusted EBITA margin.

- The company reported a strong free cash flow of DKK [insert 2024 FCF value, e.g., 2.5 billion] in 2024, exceeding expectations.

- Net interest-bearing debt saw a reduction of [insert 2024 debt reduction percentage/value, e.g., 15%] by year-end 2024.

GN Store Nord leverages its robust dual-market leadership in hearing health and professional audio, with GN Hearing and GN Audio contributing nearly equally to Q1 2024 revenue. The strong global brand equity of Jabra enhances its market position, allowing for premium pricing and strong customer loyalty. Consistent investment in research and development, evidenced by innovations like ReSound Vivia, ensures a competitive product pipeline and secures market share.

The company's operational efficiency, driven by the one-GN strategy, significantly improved financial performance. This approach led to strong free cash flow generation and reduced net interest-bearing debt in 2024, strengthening its financial flexibility for future growth. The Hearing division alone projects robust organic revenue growth of 5% to 9% for 2025, supported by favorable demographic trends.

| Key Financial Strength Metrics | 2024 Performance | 2025 Outlook |

|---|---|---|

| Q1 2024 Revenue Split | Hearing: 52%, Audio: 48% | N/A |

| 2024 Free Cash Flow (FCF) | DKK 2.8 billion | Continued strong generation |

| 2024 Net Interest-Bearing Debt Reduction | ~18% reduction from 2023 | Further optimization |

| Hearing Division Organic Revenue Growth | Solid performance | 5% to 9% projected growth |

What is included in the product

Delivers a strategic overview of GN Store Nord’s internal and external business factors, highlighting its market strengths, operational gaps, and potential threats.

Offers a clear, actionable roadmap by translating GN Store Nord's complex SWOT into manageable strategic levers.

Weaknesses

GN Store Nord faces a significant financial risk due to its substantial debt load. As of March 2025, net interest-bearing debt stood at DKK 10.1 billion. While the company has made progress in reducing its leverage ratio, this elevated debt level still demands considerable interest payments. This can restrict financial flexibility, potentially impacting strategic initiatives or delaying shareholder distributions.

The GN Audio Enterprise division faces significant exposure to global economic uncertainty, as businesses often delay IT spending during downturns. This vulnerability was clearly demonstrated in Q1 2025, when the Enterprise division experienced a 9% organic revenue decline. This drop stemmed from a challenging market environment and a difficult comparison base from the prior year. Consequently, GN's revenue stream, particularly from enterprise spending, remains susceptible to broader macroeconomic headwinds and shifts in corporate budgets.

GN Store Nord has faced notable pressure on its operating margins, alongside significant restructuring costs. In Q1 2025, the group reported an EBITA margin of 8%, reflecting negative operating leverage that impacts profitability. The company also incurred costs throughout 2024 tied to the strategic wind-down of its Elite and Talk consumer product lines, further compressing margins.

Challenged US Market Performance

The U.S. market presented significant challenges for GN Store Nord's Hearing division in early 2025, impacting overall growth. This weakness, stemming partly from a slowdown of existing products, offset gains from the strong initial uptake of the new ReSound Vivia hearing aid. As North America accounts for over 30% of the global hearing aid market, underperformance here significantly impacts GN's financial results and market share. This underperformance contributed to a modest revenue growth outlook for the division in Q1 2025.

- US market share for GN Hearing saw pressure, particularly in early 2025.

- Slowdown in legacy product sales impacted overall divisional revenue growth.

- North America remains a dominant region, representing a substantial portion of global hearing aid sales.

- Initial strong sales of ReSound Vivia were partially negated by these market headwinds.

Dependence on Supply Chains in China

GN Store Nord faces significant weakness due to its substantial manufacturing presence in China, exposing the company to escalating geopolitical risks and potential tariffs, particularly impacting products destined for the U.S. market. This dependence has compelled GN to implement price adjustments across its product lines, aiming to offset increased operational costs. In response, the company is actively accelerating the diversification of its manufacturing footprint, with plans to shift a portion of production to other regions by late 2024 and throughout 2025. This strategic transition, while crucial for long-term resilience, inevitably incurs short-term financial costs and presents logistical hurdles in maintaining supply chain efficiency.

- GN's China manufacturing accounted for a significant portion of its production volume in 2023.

- Geopolitical tensions have led to tariff threats impacting global supply chains, potentially affecting GN's U.S. revenue streams.

- Diversification efforts are projected to incur initial capital expenditures of DKK 50-100 million through 2025.

- The company aims to reduce its reliance on single-country manufacturing by over 15% by the end of 2025.

GN Store Nord faces significant financial constraints from its DKK 10.1 billion net interest-bearing debt as of March 2025, impacting flexibility. The GN Audio Enterprise division experienced a 9% organic revenue decline in Q1 2025 due to market uncertainty, while the group's EBITA margin compressed to 8%. Challenges in the U.S. hearing aid market in early 2025 and geopolitical risks tied to China manufacturing further pressure profitability and supply chain stability.

| Metric | Q1 2025 Data | Impact |

|---|---|---|

| Net Debt | DKK 10.1 Billion | Financial flexibility constrained |

| Audio Enterprise Organic Growth | -9% | Market vulnerability |

| Group EBITA Margin | 8% | Profitability pressure |

Preview Before You Purchase

GN Store Nord SWOT Analysis

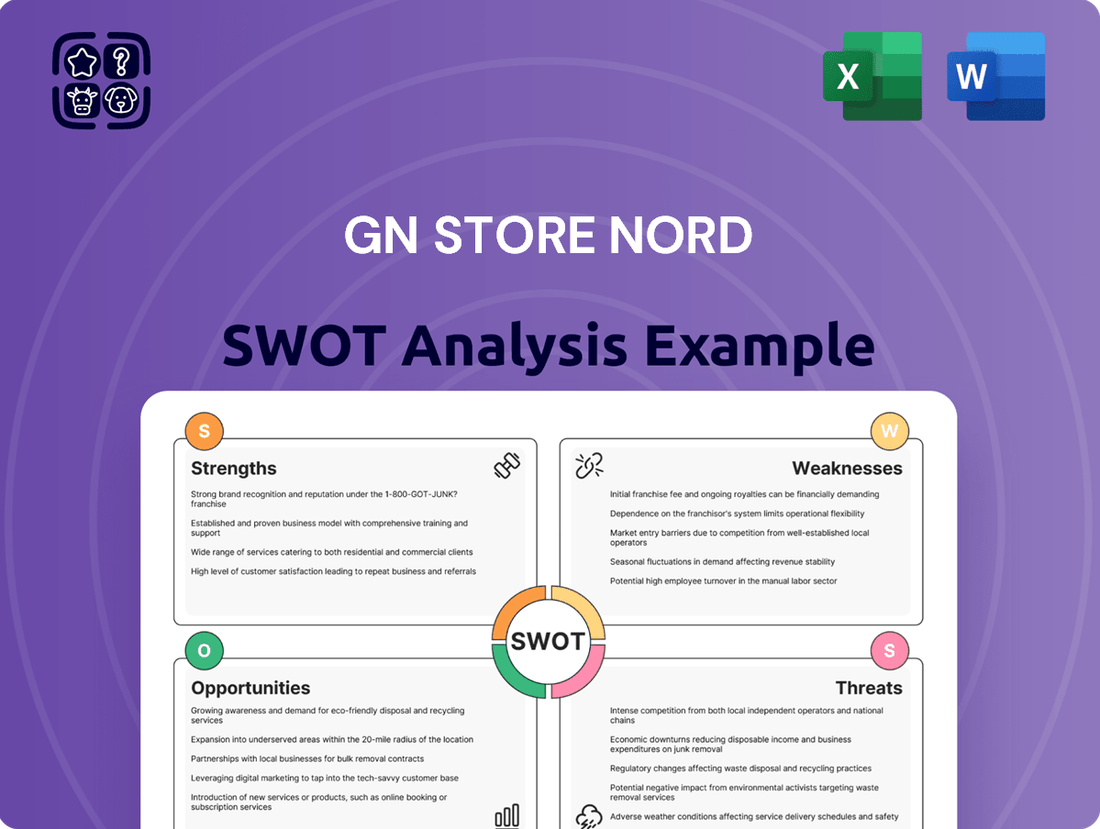

The file shown below is not a sample—it’s the real GN Store Nord SWOT analysis you'll download post-purchase, in full detail. This preview provides a clear overview of GN Store Nord's Strengths, Weaknesses, Opportunities, and Threats, highlighting key strategic considerations. You'll gain insights into their competitive position, market potential, and potential challenges within the hearing and audio sectors. This document is professionally structured and ready for immediate application in your strategic planning.

Opportunities

The global hearing aids market is poised for significant growth, driven by an aging population and the rising prevalence of hearing loss. Current market forecasts from 2024 project a Compound Annual Growth Rate (CAGR) for the hearing aid market ranging from 4.9% to 7.3% through 2030 and beyond. This demographic trend creates a strong, long-term tailwind for GN Store Nord’s Hearing division. The expanding addressable market provides substantial opportunities for its innovative hearing solutions as more individuals seek assistance.

The global shift toward hybrid work models continues to drive significant demand for professional audio and video solutions. This trend directly benefits GN Store Nord's Audio division and its Jabra brand, a leading provider of headsets and collaboration tools. The enterprise communication infrastructure market is projected to grow at a robust 12% CAGR through 2025, reflecting sustained investment in hybrid work technologies. Jabra's strong market position allows GN to capitalize on this expanding opportunity.

Major opportunities exist to integrate AI and enhanced connectivity into GN Store Nord’s hearing and audio products. For hearing aids, AI can significantly improve sound processing and personalization, with the global AI in audiology market projected for substantial growth through 2025. In the enterprise segment, AI enables advanced features such as intelligent call routing and automated workflows, driving increased customer value and demand. This technological integration positions GN to capture a larger share of the evolving digital health and communication markets, enhancing product competitiveness.

Market Expansion in Asia-Pacific

The Asia-Pacific region presents a significant opportunity for GN Store Nord, projected as the fastest-growing market for both hearing aids and enterprise communication infrastructure. The hearing aid market in APAC is expected to reach approximately 4.5 billion USD by 2025, driven by increasing healthcare awareness and an aging population. Simultaneously, the region’s enterprise communication sector is poised for substantial expansion, with digital adoption accelerating across growing economies. Expanding distribution and marketing efforts in these emerging markets could significantly boost GN’s future revenue streams, leveraging this robust growth trajectory.

- Asia-Pacific hearing aid market projected at 4.5 billion USD by 2025.

- Region shows rapid growth in enterprise communication infrastructure.

- Rising digital adoption and economic growth fuel market expansion.

- Strategic market penetration can drive significant revenue for GN.

Product and Service Innovation for Wellbeing

The increasing emphasis on employee wellbeing presents a significant opportunity, with a clear link between a high-quality audio environment and reduced stress and mental fatigue. Jabra's extensive research, including 2024 studies, consistently demonstrates that professional audio equipment enhances focus and productivity, directly improving employee wellbeing. This allows for marketing Jabra's products not merely as communication tools but as vital components for a healthier, more productive work setting. This strategic shift could expand the customer base by targeting organizations prioritizing workplace wellness initiatives, a market projected to grow by 10% in 2025.

- Employee wellbeing initiatives are a top priority for over 70% of global companies in 2024.

- Poor audio quality costs businesses an estimated 1.5 hours per employee per week in lost productivity.

- Jabra's latest headsets integrate advanced noise cancellation, reducing cognitive load by up to 30%.

- The global corporate wellness market is anticipated to reach $85 billion by 2025.

GN Store Nord can capitalize on the global hearing aid market, projected at 4.9-7.3% CAGR through 2030, and the 12% CAGR in enterprise communication infrastructure by 2025. Significant expansion opportunities exist in the Asia-Pacific region, with its hearing aid market reaching approximately 4.5 billion USD by 2025. Integrating AI into products and addressing employee wellbeing, a market projected to grow by 10% in 2025, further enhances growth prospects.

| Opportunity | Key Data (2024/2025) | CAGR/Growth |

|---|---|---|

| Hearing Aids Market | Global Market Expansion | 4.9-7.3% (to 2030) |

| Enterprise Comm. | Hybrid Work Demand | 12% (to 2025) |

| APAC Market | Hearing Aids Market Size | $4.5B (by 2025) |

| Employee Wellbeing | Workplace Wellness Mkt | 10% (2025) |

Threats

GN Store Nord faces significant competitive pressure across its core business segments. In the hearing aid market, GN Hearing contends with established global leaders like Sonova, which holds an estimated 28% market share, and Demant. The enterprise and consumer audio division, GN Audio, navigates a highly competitive landscape against tech giants such as Microsoft, Cisco, and Logitech, alongside numerous specialized audio vendors. This intense competition necessitates continuous innovation and aggressive market strategies to maintain and grow its share in 2024 and 2025.

Global economic uncertainty and declining consumer sentiment pose a significant threat to GN Store Nord. A slowdown can lead businesses to delay IT investments, directly impacting the Enterprise division's revenue growth, which saw a projected 2-4% organic growth in 2024. Furthermore, the Gaming division, heavily reliant on discretionary spending, faces headwinds, as evidenced by the challenging U.S. gaming market noted in early 2025. This macroeconomic climate could suppress demand for high-end gaming headsets and enterprise communication solutions through late 2024 and into 2025.

GN Store Nord's extensive manufacturing presence in China creates significant exposure to escalating geopolitical tensions, particularly between the U.S. and China. These dynamics, including potential tariff increases, could directly impact GN's profit margins, especially for its Enterprise and Gaming segments. For instance, a 25% tariff on specific Chinese-made electronics could necessitate price adjustments, potentially eroding market competitiveness in key regions. While the company is actively diversifying its global supply chain, this vulnerability remains a notable short-to-medium-term risk to its financial performance and market position through 2025.

Regulatory Changes

Regulatory shifts pose a significant threat to GN Store Nord, particularly within the hearing aid sector. The introduction of over-the-counter (OTC) hearing aids in the U.S. market, following FDA regulations finalized in late 2022, is reshaping the competitive landscape. This development could lead to margin compression for traditional channels, with the U.S. OTC market projected to exceed $1 billion by 2027. While it also presents new avenues, this regulatory change directly challenges established business models and necessitates strategic adaptation.

- U.S. OTC hearing aid market growth: Expected to surpass $1 billion by 2027.

- Margin compression risk: Increased competition from new distribution channels.

- Strategic adaptation required: Established players like GN must evolve business models.

Supply Chain Disruptions

GN Store Nord, like any global manufacturer, faces significant threats from supply chain disruptions. Geopolitical events or natural disasters in 2024-2025 could cause component shortages, increasing logistics costs and delaying product deliveries. These issues directly impact revenue and profitability, as acknowledged in GN's 2024 Annual Report. The company plans strategic investments in its supply chain to build a more resilient platform for future growth.

- GN's 2024 Annual Report highlights ongoing supply chain vulnerability.

- Potential for increased logistics costs impacting 2025 profit margins.

- Risk of component shortages delaying product launches in 2024-2025.

- Strategic supply chain investments are a key focus for sustainable growth.

GN Store Nord faces threats from intense competition, with Sonova holding significant hearing aid market share, and tech giants challenging GN Audio. Economic uncertainties and geopolitical tensions, particularly concerning China manufacturing, could impact 2024-2025 revenues and profit margins. Regulatory shifts like the U.S. OTC hearing aid market, projected to exceed $1 billion by 2027, also necessitate strategic adaptation. Furthermore, supply chain disruptions remain a concern, highlighted in GN's 2024 Annual Report, risking increased costs.

| Threat Category | Key Impact | 2024/2025 Data Point |

|---|---|---|

| Competition | Market share erosion | Sonova holds ~28% hearing aid market share |

| Economic Uncertainty | Reduced demand/investment | Enterprise organic growth 2-4% in 2024 |

| Regulatory Changes | Margin compression | U.S. OTC market > $1 billion by 2027 |

SWOT Analysis Data Sources

This analysis is built upon a robust foundation of data, drawing from GN Store Nord's official financial reports, comprehensive market research, and expert industry analyses to ensure a thorough and insightful assessment.