GN Store Nord Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

GN Store Nord Bundle

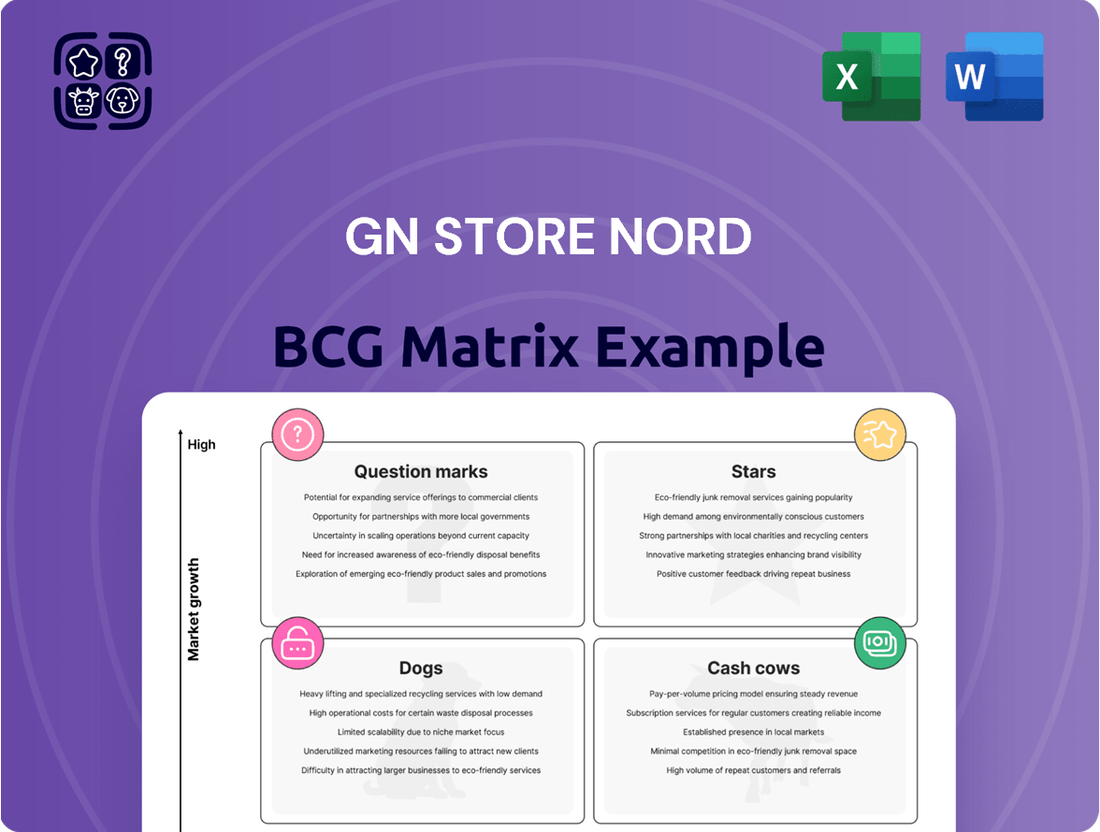

Uncover GN Store Nord's product portfolio with a glimpse into its BCG Matrix. See how its key offerings are categorized: Stars, Cash Cows, Dogs, or Question Marks. This sneak peek only scratches the surface of their strategic positioning.

The full BCG Matrix unveils a detailed quadrant breakdown. It reveals data-backed recommendations, and a roadmap to smarter decisions.

Stars

The ReSound Nexia, a product of GN Hearing, shines as a "Star" in the BCG matrix. It boosted GN Hearing's 2024 organic revenue by 10%, increasing market share. Its success highlights its strong market position and growth potential.

ReSound Vivia and Savi, new AI-powered hearing aids, are poised to drive GN Hearing's growth. Their launch in Q1 2025, despite a tough U.S. market, indicates strong potential. GN Hearing's revenue was DKK 2,514 million in Q1 2024. These products could significantly boost revenue.

Jabra, a key player in GN Store Nord's portfolio, holds a strong position in the enterprise headset market. Despite market fluctuations, Jabra's brand strength and compatibility with platforms like Microsoft Teams have been beneficial. In 2024, Jabra's revenue showed resilience, reflecting its market leadership. The enterprise headset market is expected to grow, further solidifying Jabra's strategic importance.

Jabra Enterprise Video Communication Systems

Jabra's enterprise video communication systems represent a growing area for GN Store Nord. GN is strategically expanding its presence in this sector, aiming to capture a larger market share. The enterprise video market is experiencing growth, making it a key focus for GN Audio. This aligns with the company's strategy to capitalize on expanding communication needs.

- GN Store Nord's revenue in 2023 was DKK 16.4 billion.

- GN Audio's revenue grew by 7% organically in 2023.

- The enterprise video market is projected to reach $20 billion by 2027.

- GN is investing in product development and marketing to boost sales.

SteelSeries Gaming Gear

SteelSeries, within GN Store Nord's portfolio, shines as a star. The gaming division saw robust organic revenue growth, especially in Q4 2024. They're gaining market share in a booming gaming gear market thanks to innovation and brand power. This positions SteelSeries strongly for future growth.

- Q4 2024 saw strong revenue growth for SteelSeries.

- The gaming gear market is experiencing overall expansion.

- SteelSeries is increasing its market share.

ReSound Nexia significantly boosted GN Hearing's 2024 organic revenue by 10%, affirming its strong market position. SteelSeries achieved robust organic revenue growth in Q4 2024, capturing increased market share in gaming gear. Jabra maintained its strong standing in the enterprise headset market with resilient 2024 revenue. New products like ReSound Vivia and Savi, launched in Q1 2025, are poised to further drive GN Hearing's growth.

| Product/Division | 2024 Performance | Impact | ||

|---|---|---|---|---|

| ReSound Nexia | 10% organic revenue boost | Increased GN Hearing market share | ||

| SteelSeries | Robust Q4 2024 revenue growth | Gaining gaming market share | ||

| GN Hearing | DKK 2,514M in Q1 2024 | New products launching Q1 2025 |

What is included in the product

Analysis of GN Store Nord's products across the BCG Matrix.

Printable summary optimized for A4 and mobile PDFs, enabling easy distribution and accessible insights.

Cash Cows

The established GN Hearing aid portfolio, excluding Nexia, Vivia, and Savi, is a cash cow. These products generate substantial, reliable cash flow. They have a strong market presence, ensuring consistent revenue. In 2024, GN Hearing's revenue reached DKK 9,786 million.

Mature Jabra headset lines, excluding the latest enterprise models, likely act as cash cows. These established products benefit from Jabra's market leadership, providing a stable revenue stream. In 2024, the global headset market was valued at approximately $20 billion, with Jabra holding a significant share. This steady cash flow requires minimal new investment, perfect for the BCG Matrix.

Accessories and services for GN Store Nord's Hearing and Audio divisions are cash cows. These likely provide a consistent revenue stream. In 2024, the global hearing aids market was valued at approximately $10 billion. The accessories market often has a lower growth rate, but it has a strong, established market presence. These services can generate stable cash flow.

Regional Market Strongholds

GN Store Nord could have strongholds in specific regions. These areas might show high market share alongside steady market growth, creating a reliable cash flow. For example, GN's revenue in 2024 reached DKK 20.5 billion. This financial stability supports their "Cash Cows" status. Their hearing aid business, with strong market positions, likely contributes significantly.

- Strong market share in key regions.

- Stable market growth provides consistent revenue.

- Revenue of DKK 20.5 billion in 2024.

- Hearing aid segment as a key cash generator.

Certain Legacy Enterprise Audio Products

Certain legacy enterprise audio products, though not rapidly expanding, maintain a strong market presence and generate steady cash flow. These products, like specific headsets or conferencing systems, cater to established customer bases. They are often in mature markets with predictable demand. In 2024, these segments saw stable revenue streams, contributing to overall profitability.

- Steady Revenue: Consistent sales from established products.

- Market Share: Strong position in their niche.

- Cash Generation: Reliable cash flow for the company.

- Mature Market: Predictable demand and customer base.

GN Store Nord's cash cows encompass established GN Hearing aids and mature Jabra headsets, which consistently generate robust cash flow. These segments, along with accessories and regional strongholds, maintain high market share in stable markets. In 2024, GN Hearing contributed DKK 9,786 million, supporting the company's overall DKK 20.5 billion revenue. These mature products require minimal investment while providing substantial financial returns.

| Category | Key Products | 2024 Revenue Contribution |

|---|---|---|

| Hearing Aids | Established GN Hearing portfolio | DKK 9,786 million (GN Hearing) |

| Audio Headsets | Mature Jabra lines | Significant share of $20 billion global market |

| Total Company | Overall GN Store Nord | DKK 20.5 billion |

What You See Is What You Get

GN Store Nord BCG Matrix

This preview showcases the complete GN Store Nord BCG Matrix report you'll receive. Upon purchase, you'll get the same, fully functional, ready-to-use document designed for detailed market analysis and strategic decision-making.

Dogs

GN Store Nord has been phasing out the Elite and Talk product lines, which were part of its Gaming and Consumer division. These lines, marked as "Dogs" in a BCG matrix, faced challenges, including low or negative organic revenue growth. In 2024, GN reported a decline in revenue from these product lines due to the strategic wind-down. This decision aligns with the company's focus on more profitable segments.

Within GN Store Nord's hearing aid segment, certain older models may exhibit low market share and growth. This positioning aligns with the 'dogs' quadrant of the BCG matrix. These models could consume resources without significant returns. In 2024, such models might contribute minimally to overall revenue, potentially less than 5% of total hearing aid sales.

In 2024, GN Store Nord's Consumer division, excluding Gaming, faced substantial negative organic revenue growth. This downturn was largely due to the phasing out of certain product lines.

Products in this shrinking segment with low market share are categorized as dogs within the BCG matrix.

This indicates a strategic need for the company to re-evaluate its consumer audio product portfolio.

The goal is to either divest or reposition these underperforming assets to improve overall financial health.

Specifically, the decline was pronounced, reflecting challenges in competitive markets.

Products Facing Intense Price Competition

In the context of GN Store Nord's BCG matrix, products facing intense price competition, with minimal differentiation and declining profitability, would be categorized as dogs. These products often require ongoing investment just to maintain market share, but offer low returns. The hearing aid market, where GN Store Nord operates, has seen increased competition, impacting profitability. For example, in 2024, the average selling price of hearing aids decreased by approximately 3% due to competitive pricing pressures. This puts pressure on margins, making these product lines less attractive.

- Price erosion in competitive markets leads to reduced profitability.

- Hearing aid market faces increasing competition.

- Ongoing investments yield low returns.

- GN Store Nord's products are affected by price competition.

Non-Core or Divested Assets

Non-core or divested assets, like Dansk HøreCenter, are considered dogs. These assets no longer fit GN's core strategy. In 2024, GN focused on its core business, divesting non-strategic units to streamline operations. This shift aims to boost profitability and concentrate on high-growth areas. It helps GN allocate resources more effectively.

- Dansk HøreCenter was divested.

- Focus on core business.

- Streamlining operations.

- Boosting profitability.

GN Store Nord's Dogs include phased-out consumer audio lines like Elite and Talk, exhibiting negative organic revenue growth in 2024. Older hearing aid models and highly price-competitive products also fall into this category due to low market share and profitability. These segments, including divested assets like Dansk HøreCenter, require re-evaluation or divestment to optimize resource allocation and improve overall financial health.

| Segment | 2024 Performance | BCG Status |

|---|---|---|

| Elite/Talk Product Lines | Declining Revenue | Dog |

| Older Hearing Aid Models | Minimal Revenue Contribution (<5%) | Dog |

| Dansk HøreCenter | Divested | Dog |

Question Marks

ReSound Vivia and Savi's AI features are question marks. GN Store Nord's investment in these technologies is ongoing. Market adoption and future success remain uncertain. GN's 2024 revenue was DKK 20.9 billion, with hearing aid sales crucial. Continued investment is key for these AI platforms.

GN Store Nord's enterprise video communication systems face challenges. While aiming for market share gains, it requires significant investment. The speed of capturing market share poses a question mark. In 2024, the video conferencing market was valued at $10.5 billion, reflecting growth potential.

Geographic market expansion for GN Store Nord involves uncertainty in new regions. Such initiatives are question marks in the BCG Matrix. Careful resource allocation is crucial. Consider the challenges of market share and profitability. For example, in 2024, GN Store Nord's expansion into Asia Pacific saw varied success rates.

Development of Integrated Audio and Hearing Solutions

GN Store Nord's foray into integrated audio and hearing solutions lands squarely in "Question Mark" territory within the BCG matrix. This signifies high growth potential but uncertain market acceptance and substantial investment needs. For example, the global hearing aids market was valued at $9.8 billion in 2023, with projections reaching $14.1 billion by 2029. The company faces challenges in securing market share while investing in research and development.

- Market acceptance is uncertain, requiring significant marketing efforts.

- High R&D investments are needed to develop cutting-edge technology.

- Competition from established players poses a threat.

- The potential for high growth is balanced by significant risk.

Future Gaming Market Segments or Product Categories

Venturing into new gaming segments or product categories is a classic question mark for GN Store Nord. These areas offer high growth potential but come with significant uncertainty. Success hinges on factors like market acceptance and effective execution. Consider the rise of cloud gaming, which could significantly alter the market.

- Market research firm Newzoo projected the global games market to reach $189.3 billion in 2023.

- The expansion into virtual reality (VR) gaming is another area of interest.

- The success of GN Store Nord in these areas is not guaranteed.

GN Store Nord's dive into new gaming and VR segments represents a classic question mark, holding high growth potential but also significant uncertainty. Success depends on market acceptance and execution, especially with the evolving cloud gaming landscape. The global games market was projected to reach $189.3 billion in 2023, with VR gaming seeing a 2024 valuation of approximately $19 billion. GN's success in these ventures remains unproven.

| Segment | Growth Potential | Market Size 2024 (Est.) |

|---|---|---|

| New Gaming | High | $190B+ (Global Games) |

| VR Gaming | Very High | $19B (Global VR Gaming) |

| Cloud Gaming | Emerging | Significant Growth |

BCG Matrix Data Sources

GN Store Nord's BCG Matrix relies on financial reports, market analyses, and expert evaluations. This ensures data-driven, strategic insights.