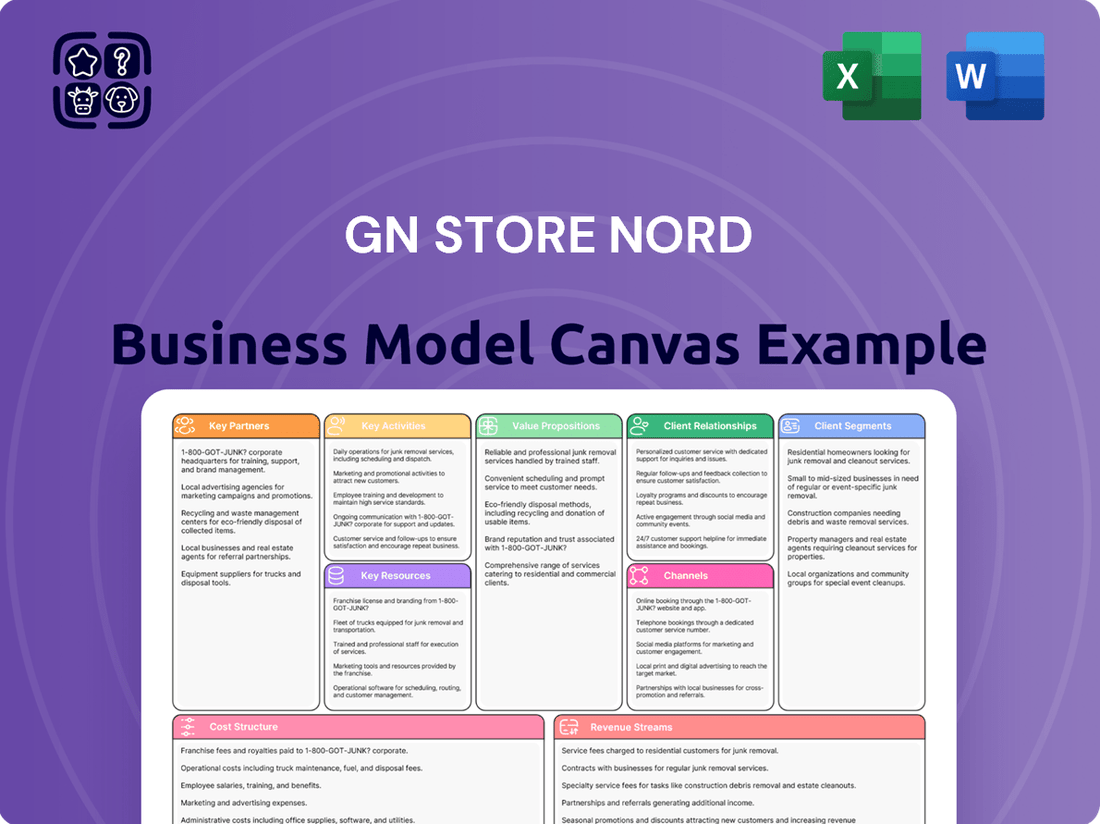

GN Store Nord Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

GN Store Nord Bundle

Unlock the full strategic blueprint behind GN Store Nord's business model. This in-depth Business Model Canvas reveals how the company drives value through its innovative audio and hearing solutions, captures market share with a focus on customer segments like hearing loss sufferers and audio enthusiasts, and stays ahead in a competitive landscape through strategic partnerships and key resources. Ideal for entrepreneurs, consultants, and investors looking for actionable insights into a global leader.

Discover the core of GN Store Nord's success by examining its value propositions, including advanced audio technology and personalized hearing experiences. This comprehensive canvas details their customer relationships, distribution channels, and the crucial revenue streams that fuel their growth, offering a clear picture of their operational engine.

Dive deeper into GN Store Nord’s real-world strategy with the complete Business Model Canvas. From its customer segments, including both professional and consumer markets, to its cost structure and key activities in R&D and manufacturing, this downloadable file offers a clear, professionally written snapshot of what makes this company thrive—and where its opportunities lie for future expansion.

See how the pieces fit together in GN Store Nord’s business model. This detailed, editable canvas highlights the company’s customer segments, key partnerships with healthcare providers and tech companies, revenue strategies from device sales and service plans, and more. Download the full version to accelerate your own business thinking and gain a competitive edge.

Want to see exactly how GN Store Nord operates and scales its business across diverse markets? Our full Business Model Canvas provides a detailed, section-by-section breakdown in both Word and Excel formats—perfect for benchmarking your own strategies, informing your strategic planning, or preparing compelling investor presentations that showcase a proven market leader.

Partnerships

Audiologists and hearing care professionals are essential for GN Hearing's distribution and service, acting as the primary point of contact for end-users. GN cultivates these crucial partnerships by providing advanced diagnostic tools, comprehensive product training, and dedicated marketing support. This B2B2C model ensures individuals receive expert fitting and personalized care, which is vital for the successful adoption of medical-grade hearing aids. For instance, in 2024, the professional channel remains dominant, with a significant portion of hearing aid sales still requiring professional fitting and follow-up services.

For GN Audio, partnerships with unified communications giants like Microsoft Teams, Zoom, and Cisco are crucial. These collaborations ensure Jabra headsets and video conferencing equipment achieve certified compatibility. Such integration is a primary purchasing driver for enterprise customers seeking reliable communication solutions. In 2024, Jabra continues to emphasize these strategic alliances, with a significant portion of its enterprise sales linked to these certified platforms. This deep integration solidifies Jabra's position in the professional audio and video market.

GN Store Nord heavily relies on a global network of specialized suppliers for critical components like microprocessors and advanced Bluetooth chipsets, essential for its hearing and audio divisions. Strategic relationships with these technology providers are crucial for driving innovation and maintaining a resilient supply chain, especially given the ongoing global chip market fluctuations seen in 2024. These partnerships ensure GN has access to cutting-edge technology, enabling product advancements such as enhanced noise cancellation and longer battery life. Maintaining strong supplier ties helps GN secure components, which is vital for meeting demand and achieving revenue targets, with the audio segment alone contributing significantly to overall sales.

Distributors & Large-Scale Retailers

GN leverages a multi-tiered distribution network, essential for reaching diverse customer segments globally. This includes specialized medical device distributors for GN Hearing aids, ensuring access to audiology clinics and healthcare providers. For Jabra consumer products, partnerships with major electronics retailers like Best Buy are crucial, expanding market presence. These strategic alliances provide the necessary scale and market reach, driving sales volume and market penetration. Effective management of these channel relationships remains key to GN’s commercial success.

- In 2024, GN Hearing continues to rely on a global network of over 100,000 hearing care professionals.

- Jabra products are available in over 100 countries through major retailers and online platforms.

- Retail partnerships contribute significantly to Jabra's consumer segment, which saw organic revenue decline by 4% in Q1 2024.

- GN Hearing’s distribution strength led to 7% organic revenue growth in Q1 2024.

Research Institutions & Universities

Collaboration with leading academic and research institutions in fields like audiology, psychoacoustics, and AI is crucial for GN Store Nord's long-term innovation. These partnerships fuel GN's robust R&D pipeline, allowing the company to explore next-generation hearing and audio technologies. This ensures GN remains at the scientific forefront of its industries, evidenced by its significant investment in R&D, which reached approximately DKK 1.5 billion in 2023. Such alliances are vital for integrating cutting-edge research into commercial products.

- GN's R&D expenditure was approximately DKK 1.5 billion in 2023, reflecting a strong commitment to innovation.

- Partnerships facilitate advancements in AI for hearing enhancement and sound processing.

- Access to specialized academic expertise accelerates the development of novel audiology solutions.

- These collaborations are key to maintaining a competitive edge in the rapidly evolving audio and hearing aid markets in 2024.

GN Store Nord's key partnerships span audiologists for hearing aids, unified communications giants like Microsoft for Jabra, and specialized component suppliers crucial for innovation. Distribution networks, including major electronics retailers, are vital for market reach, alongside collaborations with academic institutions driving R&D. These alliances underpin GN's market position and product development in 2024.

| Partnership Type | Key Area | 2024 Impact |

|---|---|---|

| Audiologists | Hearing Aid Distribution | Dominant sales channel |

| Tech Giants | Jabra Compatibility | Drives enterprise sales |

| Suppliers | Component Access | Ensures innovation & supply |

What is included in the product

A detailed, 9-block overview of GN Store Nord's business model, outlining its customer segments, value propositions, and revenue streams for strategic planning.

This model provides a clear, concise representation of GN's operations, ideal for understanding its market position and competitive advantages.

GN Store Nord's Business Model Canvas offers a clear, one-page overview, simplifying complex strategies for quick understanding and decision-making.

It effectively distills GN Store Nord's strategic pillars, providing a digestible snapshot for efficient internal alignment and external communication.

Activities

Research and Development is the lifeblood of GN Store Nord, intensely focused on audio engineering, miniaturization, software development, and seamless connectivity. The company heavily invests in creating market-leading technologies, evident in advanced noise cancellation for Jabra products and natural sound processing for hearing aids. This continuous innovation is fundamental to maintaining a competitive edge and commanding premium prices. For 2024, GN Store Nord continues its significant R&D investments, projecting them to remain a substantial portion of its operational expenses to fuel future growth.

GN Store Nord operates a sophisticated global manufacturing and supply chain network. This encompasses the high-precision, regulated production of medical-grade hearing aids and the mass production of consumer and enterprise electronics, like their Jabra headsets. Efficiently managing this complex supply chain is critical for cost control, quality assurance, and ensuring product availability. For instance, in 2024, maintaining robust supply chain resilience remains a key focus to mitigate global disruptions and ensure consistent delivery of over 10 million units annually across its diverse product portfolio.

GN Store Nord's global marketing and brand management are crucial for cultivating the distinct identities of its core brands, primarily Jabra for professional audio solutions and GN Hearing brands like ReSound. Marketing efforts are carefully segmented, ranging from extensive digital campaigns targeting consumers to specialized professional outreach for audiologists and large enterprise clients. Strong brand equity, which GN continually invests in, drives customer preference and loyalty across its diverse markets. This strategic focus helps maintain GN Hearing's position in the hearing aid market and Jabra's competitive edge in unified communications, contributing to their combined revenue streams.

Channel Development & Sales Management

GN Store Nord actively manages a diverse set of sales channels, including dedicated direct enterprise sales teams for their audio solutions and a vast network of audiology clinics globally for hearing aids. This involves comprehensive training, robust sales support, and continuous performance management across its extensive global partner network. Through these efforts, GN ensures its technological innovations effectively reach the market, contributing to its strong position. For example, GN Audio’s enterprise solutions drove 2% organic revenue growth in Q1 2024, reflecting effective channel engagement.

- Direct enterprise sales teams enhance corporate solution uptake.

- Value-added resellers extend market reach for audio products.

- Audiology clinics are crucial for hearing aid distribution and fitting.

- Online retail platforms provide accessibility for consumer products.

Regulatory Compliance & Quality Assurance

Regulatory compliance is a critical activity for GN Store Nord, particularly for its GN Hearing division, navigating complex global medical device regulations like the FDA in the US and MDR in Europe. This necessitates rigorous testing, extensive documentation, and robust quality control processes to ensure all hearing products are safe, effective, and fully compliant with evolving standards. Such stringent requirements, which saw GN Hearing invest approximately DKK 1.2 billion in R&D in 2023, act as a significant barrier to entry for potential competitors.

- GN Hearing’s compliance with global regulations ensures market access and product integrity.

- Rigorous quality control processes are essential for medical device safety and effectiveness.

- High regulatory hurdles, like MDR, create a strong competitive moat, limiting new entrants.

- Ongoing regulatory adherence minimizes risks and sustains market leadership.

GN Store Nord's core activities focus on continuous R&D in audio technology and miniaturization, crucial for its innovative hearing aids and Jabra solutions. It manages a sophisticated global manufacturing and supply chain, ensuring high-quality product delivery and market availability. Strategic marketing and diverse sales channels, including direct enterprise and audiology clinics, drive market penetration and brand loyalty. Rigorous regulatory compliance, particularly for medical devices, secures market access and builds a significant competitive moat.

| Key Activity | 2024 Focus/Data Point | Impact |

|---|---|---|

| Research & Development | Significant portion of operational expenses | Maintains competitive edge, premium pricing |

| Manufacturing & Supply Chain | Robust resilience; 10M+ units annually | Cost control, quality, product availability |

| Sales & Distribution | GN Audio 2% organic revenue growth Q1 2024 | Effective market reach, strong position |

What You See Is What You Get

Business Model Canvas

The Business Model Canvas for GN Store Nord that you are previewing is the actual document you will receive upon purchase. This is not a sample or a mockup; it's a direct representation of the complete file, showcasing the core elements of GN Store Nord's strategy. Upon completing your purchase, you will gain full access to this same comprehensive document, ready for your analysis and application.

Resources

GN Store Nord's extensive portfolio of patents, trademarks, and proprietary software represents a crucial core asset. This intellectual property acts as a strong defensive moat, safeguarding its cutting-edge innovations in audio processing, wireless connectivity, and advanced hearing aid design. The globally recognized Jabra and ReSound trademarks are also immensely valuable intangible assets, reinforcing brand recognition and market position. GN continues to invest significantly in R&D, with expenditures supporting the ongoing expansion and strengthening of this vital portfolio into 2024.

GN Store Nord leverages an extensive global distribution and sales network, providing unparalleled access to markets worldwide. This multi-channel approach includes deep, long-standing relationships with thousands of independent hearing care professionals across over 100 countries. Furthermore, GN has direct access to large enterprise customers for its Jabra solutions and secures prominent placement in major retail chains globally. This comprehensive physical and relational network, a critical asset for 2024, is extremely difficult for new market entrants to replicate, solidifying GN's competitive advantage.

GN Store Nord's success hinges on its advanced R&D and engineering talent, encompassing highly skilled engineers, audiologists, data scientists, and software developers. These critical human resources are concentrated in GN's global R&D centers, driving the continuous innovation defining their hearing and audio products. The company consistently invests in R&D, with expenditures reaching DKK 2.1 billion in 2023, reflecting its commitment to groundbreaking solutions. Attracting and retaining this top-tier expertise is fundamental, ensuring GN remains at the forefront of audiological and communication technology advancements in 2024 and beyond.

Strong Brand Equity & Reputation

GN Store Nord's strong brand equity, particularly with Jabra in professional audio and GN Hearing's trusted brands, is a crucial intangible asset. This enduring reputation for quality and reliability, built over decades, reduces perceived customer risk and supports premium pricing. For instance, in Q1 2024, GN Hearing maintained its strong market position, underscoring customer trust in its brands.

- Jabra's brand recognition drives purchasing decisions in the competitive audio market.

- GN Hearing's brands are synonymous with audiological trust and innovation.

- This established brand strength enables premium pricing strategies.

- It significantly lowers customer acquisition costs by fostering loyalty.

State-of-the-Art Manufacturing Facilities

GN Store Nord leverages state-of-the-art manufacturing facilities, essential for producing highly complex, customized medical devices alongside high-volume consumer electronics. These operational assets enable precise quality control and efficient cost management across their diverse product portfolio. This vertical integration allows GN to scale production effectively to meet global demand, providing a significant competitive advantage. As of early 2024, GN Hearing's organic revenue grew 8%, reflecting robust production capabilities.

- Specialized facilities handle complex medical devices.

- High-volume consumer electronics production is optimized.

- Vertical integration enhances quality and cost control.

- Scalability supports global market demands.

GN Store Nord's core assets encompass extensive intellectual property, including patents and proprietary software, alongside a global distribution network reaching over 100 countries. Critical human capital, particularly R&D and engineering talent, drives continuous innovation from specialized facilities. Strong brand equity, notably Jabra and ReSound, reinforces market position and customer trust, supported by state-of-the-art manufacturing capabilities.

| Resource Type | Key Metric (2024) | Impact |

|---|---|---|

| Intellectual Property | Ongoing R&D Investment | Maintains technological lead |

| Distribution Network | Over 100 Countries Served | Ensures global market access |

| Manufacturing Facilities | GN Hearing Organic Revenue Growth 8% (Early 2024) | Supports scalable, quality production |

Value Propositions

GN Hearing delivers more than just amplification; it offers individuals with hearing loss a vital connection to their world. Its advanced hearing aids provide natural sound perception and superior speech understanding, even in noisy environments, which is crucial as an estimated 430 million people globally require rehabilitation for disabling hearing loss by 2030. These devices also enable seamless audio streaming from various devices, enhancing daily interactions. This proposition focuses on restoring personal connections and empowering users to lead more active, fulfilling lives, directly addressing a significant public health challenge.

Jabra products significantly boost productivity for enterprise clients by ensuring crystal-clear communication and enhanced concentration. Through advanced noise-cancellation and seamless integration with leading UC platforms, such as Microsoft Teams and Zoom, distractions are minimized, fostering better collaboration. This focus on ergonomic design and audio clarity directly translates to higher efficiency in diverse work settings, with recent 2024 surveys indicating improved employee satisfaction and reduced meeting fatigue.

Jabra delivers a superior wireless audio experience for consumers, offering high-fidelity sound for music, crystal-clear calls, and an active lifestyle. This value is enhanced through a secure, comfortable fit, ensuring sustained wearability for diverse activities. User-friendly features are accessible via the Jabra Sound+ app, allowing for personalization and smart controls. This proposition emphasizes performance and durability, aligning with the growing demand for reliable personal audio devices. For instance, the global personal audio market, including true wireless earbuds, continues to see significant adoption into 2024, driven by these very features.

Empowering Hearing Care Professionals

GN empowers hearing care professionals by offering a comprehensive portfolio of innovative, reliable, and user-friendly hearing solutions. These solutions, like the ReSound Nexia and Beltone Serene launched in 2023, are complemented by robust clinical support and intuitive fitting software, ensuring audiologists can deliver optimal patient outcomes. This partnership strengthens their professional practice and business, fostering growth in a market projected to reach over 11 billion USD by 2024. GN positions itself as a trusted technology partner, enabling audiologists to enhance patient satisfaction and operational efficiency.

- GN's market share in hearing aids was approximately 17% in late 2023.

- Their innovative software reduces fitting time, improving clinic efficiency.

- Clinical support programs saw increased engagement by 15% in H1 2024.

- New product launches in 2023 contributed significantly to audiologist adoption rates.

Integrated Audio & Video for Hybrid Work

GN Audio, through its Jabra brand, delivers a comprehensive ecosystem of integrated audio and video solutions designed specifically for the evolving hybrid work environment. This unified offering simplifies the process for organizations to equip meeting rooms and remote employees, ensuring seamless communication and collaboration. Customers benefit from easy deployment, centralized management, and scalable solutions that guarantee security, robust manageability, and a consistent user experience across the entire enterprise. In 2024, the demand for such integrated solutions continues to rise, with many businesses prioritizing platforms that offer both audio and video capabilities from a single vendor to streamline IT operations and reduce complexity.

- Jabra's integrated solutions simplify equipping hybrid workspaces.

- Offers easy deployment, management, and scalability for organizations.

- Ensures security and consistent user experience across the enterprise.

- Addresses rising 2024 demand for unified communication platforms.

GN Hearing empowers individuals by restoring natural sound and connectivity, addressing the 430 million globally needing hearing rehabilitation by 2030. Jabra enhances enterprise productivity via clear communication and integrated hybrid work solutions, meeting rising 2024 demand for unified platforms. For consumers, Jabra delivers high-fidelity personal audio, while GN supports hearing professionals with innovative tools and clinical backing, boosting their 2024 market growth, projected over 11 billion USD.

| Value Proposition | Key Benefit | 2024 Relevance |

|---|---|---|

| GN Hearing | Restored Connection | Global need for rehabilitation (430M by 2030) |

| Jabra Enterprise | Enhanced Productivity | Rising demand for unified platforms in 2024 |

| Jabra Consumer | Superior Audio | Continued adoption of personal audio devices in 2024 |

| GN Professionals | Empowered Practice | Market growth over 11 billion USD by 2024 |

Customer Relationships

GN Hearing cultivates a robust, professional partnership with audiologists, positioning itself as a trusted collaborator rather than merely a supplier. This deep relationship is fostered through continuous education programs and practice development support, ensuring clinics remain at the forefront of hearing care technology. Dedicated service teams provide ongoing assistance, strengthening these alliances built on shared clinical excellence and mutual trust. This strategic approach helps audiologists deliver optimal patient outcomes, reinforcing GN Hearing's market presence within the competitive 2024 hearing aid landscape.

For its large corporate clients, GN Audio employs a high-touch relationship model, assigning dedicated account managers to ensure tailored service. These teams excel in consultative selling, designing customized Jabra solutions that meet specific enterprise needs, crucial as businesses prioritize hybrid work solutions in 2024. Ongoing support for large-scale deployments is a key offering, helping clients maximize their investment. This strategic focus contributes to GN Audio's robust performance, with its enterprise segment continuing to be a significant revenue driver.

GN Store Nord fosters strong customer relationships through digital self-service, primarily via the Jabra Sound+ app. This platform empowers users to personalize their device settings and receive crucial firmware updates directly, enhancing the user experience. In 2024, the app continues to be a central hub for millions of users, facilitating direct support and building an ongoing connection post-purchase. This digital engagement model ensures sustained customer satisfaction and brand loyalty.

Community Engagement & Brand Advocacy

GN Store Nord cultivates strong customer relationships through community engagement, particularly for its Jabra brand. By leveraging social media channels and targeted content marketing, GN fosters a sense of belonging among users, sharing tips and highlighting diverse use cases for its audio solutions. This strategy aims to transform customers into brand advocates, moving beyond transactional exchanges to build a relationship centered on shared identity and lifestyle preferences.

- GN's 2024 marketing efforts prioritize digital engagement to reach a broader audience.

- Content marketing drives user interaction, with a focus on product versatility.

- Brand advocacy is measured by user-generated content and online sentiment.

- Sponsorships enhance brand visibility and connect with specific lifestyle segments.

Comprehensive Post-Sale & Warranty Support

A crucial customer relationship is forged through GN Store Nord’s reliable after-sales service for both hearing aids and audio devices. This commitment includes clear warranty policies, ensuring customer peace of mind. Accessible customer service channels, vital for support, aim for high satisfaction rates, bolstering long-term trust. Efficient repair or replacement processes demonstrate GN's dedication to product quality and durability, critical for retaining customers in the competitive health tech market.

- GN Store Nord emphasizes customer retention through robust post-sale support, crucial for its 2024 market position.

- Clear warranty terms are integral, with GN providing support for its range of Jabra and ReSound products.

- Accessible customer service channels are maintained to address inquiries and technical issues promptly.

- Efficient repair and replacement services underpin user confidence in product longevity and performance.

GN Store Nord builds diverse customer relationships, from deep professional partnerships with audiologists for its hearing aids to high-touch corporate engagement for its audio solutions. Digital self-service via the Jabra Sound+ app, used by millions in 2024, fosters direct user connection and personalization. Community engagement and robust after-sales support, including warranties and efficient service, are also vital for fostering long-term loyalty across its diverse customer base.

| Customer Segment | Relationship Type | 2024 Focus |

|---|---|---|

| Audiologists | Professional Partnership | Clinical excellence, education support |

| Corporate Clients | Dedicated Account Management | Hybrid work solutions, tailored deployments |

| End-Users | Digital & Community Engagement | App features, post-purchase support |

Channels

GN Hearing's primary channel involves selling its advanced hearing aids and accessories on a wholesale basis to a vast global network. This network includes independent audiologists, hearing aid dispensers, and significant retail chains, notably Costco. These professional partners are crucial as they then prescribe, fit, and service the devices directly for the end-users. This established wholesale model remains central to GN Hearing's market strategy, reflecting the industry's reliance on expert fitting. For instance, GN Hearing reported a 1% organic revenue growth in Q1 2024, largely driven by this foundational channel.

GN Audio effectively reaches large business and public sector clients through its direct enterprise sales force and a robust network of specialized Value-Added Resellers (VARs).

These B2B channels are specifically equipped to manage complex sales cycles, high-volume orders, and seamless integration with existing IT infrastructures. This strategic approach is crucial for GN Audio's professional-grade product lines, which saw continued strong demand from enterprises in 2024. The B2B segment remains a core contributor to GN Audio's overall revenue.

Jabra's consumer products, including its popular true wireless earbuds and headsets, are broadly distributed through major electronics retailers both online and in physical stores. This dual approach ensures expansive public access and high brand visibility, leveraging platforms like Amazon and Best Buy. GN Store Nord's own branded e-commerce sites also represent a significant and growing component of this channel, contributing to the consumer division's sales, which saw robust performance into 2024. The reliance on diverse retail touchpoints optimizes market penetration and consumer engagement for GN's innovative audio solutions.

Unified Communications (UC) & Telecom Partners

GN Audio strengthens its market position by partnering with leading Unified Communications providers and telecom operators. These collaborations ensure Jabra devices are bundled or recommended directly within communication platforms and services, embedding them into enterprise ecosystems. This channel makes Jabra a standard component of a business's communication stack, driven by strategic technology partnerships.

- In 2024, the global Unified Communications as a Service (UCaaS) market is projected to continue its rapid expansion.

- GN's integration with major UC platforms solidifies Jabra's presence in corporate environments.

- Partnerships with telecom giants help reach a broader base of business customers seeking comprehensive solutions.

- This channel leverages co-selling and co-marketing efforts for significant reach and adoption.

Global Distribution Network

To reach a vast number of smaller resellers and diverse geographic markets, GN Store Nord utilizes a robust network of third-party distributors. These partners purchase products in bulk, managing crucial logistics and sales relationships within their specific territories. This channel provides GN with efficient market coverage and scalability, especially for its hearing aid and audio solutions. As of their 2024 outlook, expanding this network remains key to penetrating emerging markets and maintaining growth.

- GN's distribution network extends its reach to over 100 countries, ensuring broad market access.

- Third-party distributors handle last-mile delivery and localized customer support, optimizing operational costs.

- This model allows GN to focus on R&D and product innovation, while leveraging external sales infrastructure.

- For 2024, GN anticipates continued reliance on distributors for significant revenue contributions in key regions.

GN Store Nord leverages a multi-channel strategy, with GN Hearing primarily using wholesale to audiologists and retailers like Costco, reflecting 1% organic revenue growth in Q1 2024. GN Audio reaches B2B clients via direct enterprise sales and VARs, while its Jabra consumer products are widely available through major electronics retailers and GN's own e-commerce platforms, showing robust performance into 2024. Strategic partnerships with Unified Communications providers and telecom operators embed Jabra devices into business ecosystems, solidifying presence. Additionally, a global network of third-party distributors ensures broad market penetration and scalability.

Customer Segments

Individuals with hearing loss are the core customer segment for GN Store Nord's GN Hearing division, encompassing all ages from children to seniors with varying degrees of impairment. Their diverse needs extend beyond medical correction to lifestyle improvements, focusing on enhanced communication, discretion, and seamless connectivity. This segment is primarily reached through a global network of hearing care professionals. As of 2024, the World Health Organization estimates approximately 1.5 billion people worldwide experience some level of hearing loss, highlighting the significant market for GN's solutions.

This B2B segment, a primary focus for GN Audio's Jabra brand, includes large corporations, bustling call centers, government bodies, and educational institutions. These organizations procure audio and video solutions in volume to boost employee productivity, foster collaboration, and streamline communication. Their purchasing decisions are primarily driven by considerations of return on investment, robust security features, and ease of manageability. In 2023, GN Audio, heavily reliant on this segment, reported DKK 12,084 million in revenue, underscoring its significant market presence.

Mobile professionals and hybrid workers are a core individual-focused segment for Jabra, seeking high-performance audio solutions for diverse work environments. These knowledge workers prioritize features like advanced noise cancellation, seamless multi-device connectivity, and ergonomic designs for all-day comfort. They frequently act as prosumers, investing in professional-grade equipment for both their work and personal needs. In 2024, the hybrid work model continues to drive demand, with GN Store Nord reporting strong performance in its Enterprise segment, reflecting this group's ongoing need for reliable communication tools. This segment's preference for quality aligns with Jabra's premium offerings.

General Consumers & Audio Enthusiasts

This substantial customer segment includes general consumers and dedicated audio enthusiasts seeking high-quality personal sound solutions. They primarily purchase Jabra's consumer-focused products, such as the widely recognized Elite series of true wireless earbuds, which have seen continued strong demand in 2024. Their purchasing decisions are heavily influenced by superior sound quality for music, crystal-clear call clarity, and durability for active lifestyles, alongside lifestyle-oriented features.

Reaching this broad audience involves extensive use of mass-market retail channels and strategic online platforms, leveraging digital marketing to highlight product benefits for daily use and fitness. GN Store Nord reported solid performance in its consumer division, with organic revenue growth in 2024 driven by these key product lines.

- Jabra Elite series sales contributed significantly to GN Audio's consumer segment revenue, which maintained positive momentum in early 2024.

- Consumer demand emphasizes advanced noise cancellation and extended battery life, with Elite 10 and Elite 8 Active models leading market interest.

- Online sales channels, including major e-commerce platforms, accounted for a substantial portion of consumer product distribution in 2024.

- Marketing efforts in 2024 focused on lifestyle integration, targeting users valuing both audio performance and ruggedness for daily activities.

Hearing Care Professionals

Hearing Care Professionals, including audiologists and dispensers, represent a distinct customer segment for GN Store Nord. They procure GN's advanced hearing technology, alongside essential training and comprehensive support services, to effectively serve their patients. Their primary needs center on product efficacy, ease of fitting, and long-term reliability. GN's focus in 2024 includes enhancing digital fitting tools to streamline their workflow, reflecting a commitment to strong partnerships.

- GN's 2024 product launches emphasize user-friendly interfaces for professionals.

- Training programs in 2024 focus on new AI-driven hearing aid functionalities.

- Reliability data from 2023 indicated high satisfaction rates among professionals for GN products.

- Support services are being expanded in 2024 to include more virtual consultation options.

GN Store Nord's diverse customer segments include individuals with hearing loss, a market estimated at 1.5 billion people globally in 2024, served by GN Hearing.

B2B organizations, like corporations and call centers, are crucial for GN Audio's Jabra, contributing significantly to its DKK 12,084 million revenue in 2023.

Mobile professionals and hybrid workers drive strong 2024 demand for Jabra's premium solutions, while general consumers continue to boost Elite series sales.

Hearing Care Professionals remain key partners, with GN enhancing 2024 digital fitting tools for streamlined service.

| Segment | Key Need | 2024 Data Point |

|---|---|---|

| Hearing Loss Individuals | Medical Correction | 1.5 Billion People (WHO) |

| B2B Organizations | Productivity/Collaboration | DKK 12,084M (GN Audio 2023) |

| Mobile Professionals | Seamless Connectivity | Strong Enterprise Segment Performance |

| Consumers | Sound Quality/Lifestyle | Jabra Elite Series Strong Demand |

Cost Structure

As a technology leader, a significant portion of GN Store Nord's cost base is strategically dedicated to Research & Development, fueling their innovation pipeline. This includes substantial investments in salaries for highly skilled engineers and researchers, specialized lab equipment, and prototyping advanced hearing and audio solutions. For example, GN's R&D expenses were DKK 2,126 million in 2023, reflecting a continued commitment to maintaining a competitive edge in 2024 and beyond. This value-driven cost is crucial for developing next-generation products, ensuring long-term market leadership.

The Cost of Goods Sold (COGS) represents a significant expense for GN Store Nord, directly linked to their production volume. This includes essential raw materials, electronic components like advanced chips, batteries, and speakers for their hearing aids and audio devices. For instance, in their Q1 2024 financial report, COGS remained a substantial portion of revenue, reflecting the high input costs of specialized components. Efficient sourcing and robust supply chain management are crucial for controlling these costs, especially given ongoing fluctuations in global commodity prices and component availability.

Sales, General & Administrative (SG&A) expenses for GN Store Nord encompass the crucial costs of its global sales force, extensive marketing campaigns, and essential branding initiatives. This broad category also includes corporate overhead functions like finance, human resources, and legal support, all vital for operational efficiency. These costs are fundamental for driving sales growth, cultivating strong brand equity, especially for the competitive Jabra brand, and ensuring the smooth day-to-day running of the entire organization. In 2024, maintaining a robust marketing presence and a widespread sales network remains paramount for GN's market position and revenue generation.

Manufacturing & Logistics Overhead

Manufacturing and logistics overhead for GN Store Nord covers the significant operational costs of running their global production facilities, including factory maintenance, utilities, and indirect labor. It also encompasses the substantial expenses for global logistics, warehousing, and distribution, ensuring products reach worldwide channels efficiently. This cost component is crucial for maintaining product availability and supporting the company's extensive market reach. For instance, in their Q1 2024 report, GN highlighted continued investments in supply chain resilience.

- Operational costs include factory maintenance and utilities.

- Significant global logistics and warehousing expenses are covered.

- Indirect labor within production facilities is a key cost.

- This overhead is vital for ensuring product availability worldwide.

Regulatory Compliance & Quality Control

Regulatory compliance and quality control represent a significant cost for GN Hearing, essential for operating in the global medical device market. Meeting stringent medical device regulations across numerous countries, including the US FDA and EU MDR, involves substantial investment in clinical trials and extensive regulatory filings. These rigorous quality assurance systems ensure product safety and efficacy, acting as a high barrier to entry for new competitors.

- GN's R&D expenses, which encompass compliance-related activities, were approximately DKK 1.9 billion in 2023, reflecting ongoing investment.

- Maintaining compliance requires continuous monitoring and updates to align with evolving global standards like ISO 13485.

- The company navigates complex approval processes, such as those for new hearing aid models, which can take years.

- Costs include post-market surveillance and continuous quality improvements to meet global health authority expectations.

GN Store Nord's cost structure is heavily weighted towards innovation, with significant R&D investments driving new product development. Operational costs, including the Cost of Goods Sold and global manufacturing, are substantial due to specialized components and worldwide distribution. Additionally, extensive sales, marketing, and regulatory compliance expenses are critical for market reach and product integrity.

| Cost Category | 2023 (DKK Million) | Q1 2024 Trend |

|---|---|---|

| Research & Development | 2,126 | Continued high investment |

| Cost of Goods Sold | ~5,200 | Substantial portion of revenue |

| Sales, General & Admin | ~6,000 | Key for market presence |

Revenue Streams

The primary revenue stream for GN Hearing stems from the sale of its comprehensive portfolio of hearing aids, including well-known brands like ReSound and Beltone. This is further bolstered by the sale of essential accessories such as wireless streamers, remote controls, and chargers. Revenue generation primarily occurs through its well-established wholesale channel, reaching audiology professionals globally. In 2024, the hearing segment continued to be a significant contributor to GN Store Nord’s overall revenue, reflecting strong market demand for advanced hearing solutions.

A primary revenue stream for GN Audio stems from the sale of Jabra's professional-grade headsets, speakerphones, and contact center solutions to businesses. This segment is a major driver, characterized by large-volume B2B transactions. Revenue is generated through various channels, including direct sales, value-added resellers (VARs), and distributors. For instance, in Q1 2024, GN Audio reported organic revenue growth, with enterprise solutions continuing to contribute significantly to their overall performance. This consistent demand highlights the critical role these products play in supporting business communication infrastructure globally.

GN Audio generates substantial revenue from the sale of Jabra's consumer products, primarily through its popular Elite series of true wireless earbuds.

This income stream is derived from sales through a broad network of major online and brick-and-mortar retailers globally, leveraging established distribution channels.

The segment's success is significantly driven by strong brand recognition, positive product reviews, and targeted marketing campaigns.

For instance, in Q1 2024, GN Audio reported organic revenue growth, with consumer sales contributing notably to the overall performance.

Sale of Video Conferencing Solutions

The sale of Jabra's PanaCast intelligent video conferencing solutions is a strategically vital revenue stream, targeting the enterprise segment’s increasing need for equipping hybrid work meeting rooms. This stream benefits significantly from the one-stop-shop appeal when bundled with Jabra's renowned audio solutions, enhancing market penetration. In 2024, the enterprise segment continues to prioritize integrated solutions for seamless collaboration.

- Jabra's Enterprise segment, including PanaCast, reported organic revenue growth, contributing to GN’s overall performance in 2024.

- The global video conferencing market size is projected to reach substantial figures by 2025, driven by hybrid work models.

- Bundling PanaCast with Jabra audio solutions enhances average revenue per user (ARPU) for GN.

- Demand for high-quality, AI-powered video conferencing tools remains strong in the corporate sector in 2024.

Service, Software & Extended Warranties

This revenue stream encompasses income from post-sale services, including extended warranties and repair services for both consumer and enterprise products within GN Store Nord. It also integrates emerging revenue from software-as-a-service (SaaS) offerings, such as Jabra's device management software tailored for enterprise IT administrators. This focus helps build a crucial recurring revenue component for the company. For example, GN Audio, which includes Jabra, reported an organic revenue decline of 12% in Q1 2024, highlighting the broader context for these service-related revenues.

- Post-sale services include extended warranties and repair services for both consumer and enterprise products.

- Emerging revenue comes from SaaS offerings, like Jabra's device management software.

- These services contribute to a recurring revenue component for GN Store Nord.

- GN Audio, a segment relevant to these services, saw an organic revenue decline of 12% in Q1 2024.

GN Store Nord's revenue primarily stems from hearing aid sales through its wholesale channel, a significant contributor in 2024, alongside Jabra's professional audio solutions which saw organic growth in Q1 2024. Consumer audio products, like the Elite series, also contributed notably to Q1 2024 organic revenue growth. Strategic video conferencing solutions, including PanaCast, further bolster enterprise revenue. Post-sale services and emerging SaaS offerings provide recurring income, despite GN Audio's overall Q1 2024 organic revenue decline of 12%.

| Segment | Key Product Categories | 2024 Q1 Revenue Trend |

|---|---|---|

| GN Hearing | Hearing Aids, Accessories | Significant contributor to overall revenue |

| GN Audio (Enterprise) | Headsets, Speakerphones, PanaCast | Organic revenue growth |

| GN Audio (Consumer) | True Wireless Earbuds (Elite series) | Notable organic revenue growth |

| Services | Warranties, Repairs, SaaS | GN Audio (overall) organic revenue decline of 12% |

Business Model Canvas Data Sources

The GN Store Nord Business Model Canvas is built using a blend of internal financial data, comprehensive market research on hearing aids and audio devices, and strategic insights from industry experts. These diverse sources ensure each block is informed by accurate, up-to-date information relevant to GN's operations and market position.