GN Store Nord Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

GN Store Nord Bundle

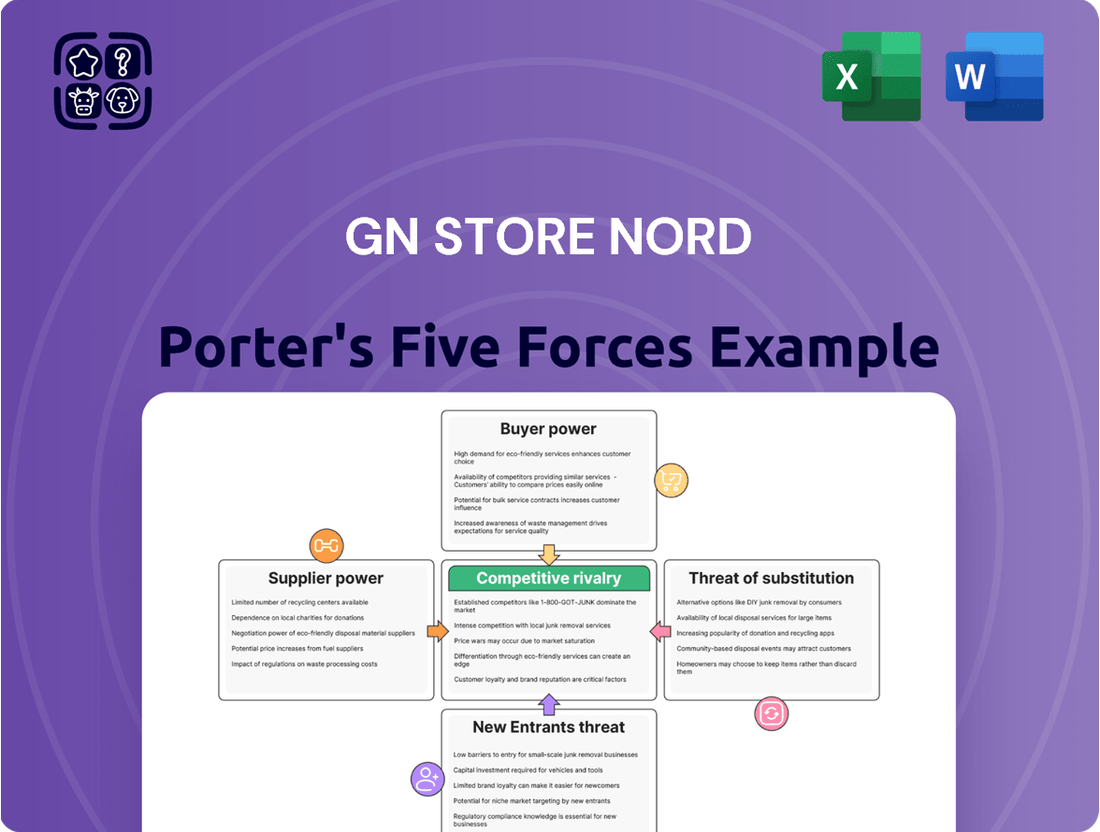

GN Store Nord operates in a dynamic market where understanding competitive forces is crucial for success. Our Porter's Five Forces analysis delves into the intensity of rivalry, the bargaining power of buyers and suppliers, and the threats posed by new entrants and substitutes.

This brief snapshot only scratches the surface. Unlock the full Porter's Five Forces Analysis to explore GN Store Nord’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

GN Store Nord heavily relies on specialized components like microchips and digital signal processors for its advanced hearing aids. Suppliers of these critical, often proprietary technologies wield substantial power due to limited substitutes. Recent supply chain challenges, such as those noted in 2023 financial reports, impacted component costs and gross margins, with GN reporting a gross margin of 47.9% for the full year. GN's strategic diversification of sourcing and robust supplier relationship management are essential to mitigate this supplier power and ensure stable production in 2024.

The production of GN Store Nord's hearing aids and audio equipment relies on various raw materials, where price fluctuations directly influence manufacturing costs and profit margins. To mitigate supplier bargaining power and enhance cost stability, GN is strategically increasing its use of recycled materials across its product portfolio. This initiative not only contributes to a reduced environmental footprint but also fortifies a more stable and cost-effective supply chain. As of 2024, GN's continued focus on circular economy principles helps buffer against raw material volatility.

While GN Store Nord maintains internal production, it strategically relies on external manufacturing and assembly partners for specific components and processes. These suppliers' strict adherence to GN's high quality standards and precise production timelines is critically important for operational continuity and product delivery. In 2024, GN continued to mandate that all its suppliers comply with its comprehensive Code of Conduct, which includes robust provisions for human and labor rights, effectively mitigating supply chain risks.

Dependence on a Concentrated Supplier Base

GN Store Nord faces significant supplier bargaining power due to its dependence on a concentrated base for specialized medical and professional audio components. For critical items like advanced chipsets and miniature transducers, there are often only a few qualified global suppliers. This limited pool gives these firms considerable leverage in negotiating prices and delivery terms. For example, in 2024, the medical device sector continued to see supply chain pressures, impacting component availability and costs for companies like GN. This concentration means GN has fewer alternatives, potentially affecting production costs and timelines.

- Limited alternative sources for high-tech components.

- Potential for increased component costs and lead times.

- Reliance on a few key global suppliers for critical parts.

- Supply chain resilience remains a strategic focus for 2024.

Innovation and R&D from Suppliers

Suppliers driving innovation and technology hold considerable power over companies like GN Store Nord. GN Hearing benefits from being a key innovation partner with major players such as Apple and Google, crucial for features like seamless connectivity in their hearing aids. While these are strategic collaborations, GN's reliance on external R&D for advanced functionalities, including Bluetooth LE Audio adoption by 2024, grants these technology partners significant influence. This dependency underscores the bargaining power of these innovative suppliers.

- GN Hearing's 2024 product roadmap relies on advanced connectivity from partners.

- Strategic collaborations with Apple and Google are vital for competitive features.

- Reliance on external R&D for features like Bluetooth LE Audio strengthens supplier influence.

- GN's market position is bolstered by integrating cutting-edge supplier technology.

GN Store Nord faces significant supplier power due to its reliance on a concentrated base for specialized components like advanced chipsets, where limited alternatives exist. This dependency can lead to increased component costs and impact production timelines, as seen with ongoing supply chain pressures in 2024. Strategic collaborations with innovation partners like Apple and Google also grant these technology providers considerable influence over GN's product roadmap, including features like Bluetooth LE Audio adoption. Mitigating this power is critical for GN's operational stability and profitability.

| Supplier Power Factor | 2024 Impact | Key Data Point |

|---|---|---|

| Specialized Component Scarcity | Potential cost increases, lead times | Sector-wide supply chain pressure |

| Concentrated Supplier Base | Limited negotiation leverage | Few qualified global suppliers |

| Technology Innovation Dependence | Reliance on external R&D | Bluetooth LE Audio adoption |

What is included in the product

Tailored exclusively for GN Store Nord, this analysis dissects the five forces shaping its competitive environment, revealing insights into buyer power, supplier leverage, new entrant threats, substitute products, and the intensity of rivalry.

Effortlessly identify and mitigate competitive threats by visualizing GN Store Nord's five forces, simplifying strategic planning.

Customers Bargaining Power

In the hearing aid market, particularly with the expanding over-the-counter (OTC) options, customers demonstrate high price sensitivity. The US OTC hearing aid market, projected to reach $1 billion by 2024, exemplifies this shift, putting pressure on traditional manufacturers. Low switching costs allow consumers to easily change between brands, significantly increasing their bargaining power. The availability of a wide range of products online with transparent pricing further empowers customers to seek the best value for their investment. This dynamic forces companies like GN Store Nord to remain competitive on pricing and features.

Large enterprise clients and major distributors, particularly for GN Audio's Jabra products, wield substantial bargaining power. These customers, often purchasing volumes exceeding millions of dollars annually, can negotiate aggressively for favorable pricing and extended payment terms due to the sheer scale of their orders. Similarly, within the hearing aid division, large retail chains and significant healthcare providers, such as the UK's NHS, exert considerable influence, often representing a substantial portion of sales channels and dictating terms. This power impacts GN Store Nord's profitability and market access.

Today's customers for GN Store Nord are exceptionally well-informed, leveraging easy online access to product reviews, direct comparisons, and pricing information across various channels. This transparency empowers them to make highly educated purchasing decisions, significantly increasing their bargaining power. For instance, the global hearing aid market, projected to reach $12.3 billion by 2024, sees consumers actively researching options from major players like GN. Growing awareness about hearing health, amplified by digital campaigns and increased public discourse, contributes to a more discerning and powerful customer base demanding tailored solutions and competitive pricing.

Diverse Customer Base with Specific Needs

GN Store Nord serves a broad customer spectrum, including individuals with hearing loss and large enterprise clients requiring advanced communication systems. This diverse base, with varied needs, influences customer bargaining power. For instance, enterprise customers, representing a significant portion of GN Audio's revenue, demand solutions that integrate seamlessly with their existing IT infrastructure, giving them leverage for customized and compatible products. The company's 2024 financial outlook anticipates continued growth in both its Hearing and Audio divisions, indicating ongoing engagement with these distinct customer segments.

- GN Hearing serves over 500 million people with disabling hearing loss globally.

- GN Audio’s enterprise solutions cater to millions of daily users in corporate settings.

- Customer demands for integration drive product development, as seen with new hybrid work solutions in 2024.

- Specific enterprise contracts often involve tailored service level agreements, reflecting customer influence.

Rise of Third-Party Payers and Insurance

The rise of third-party payers, like insurance companies and government programs, significantly increases customer bargaining power in the hearing aid market. These entities aggregate consumer demand, influencing prices and purchase terms for GN Store Nord. For instance, in 2024, the expansion of Medicare Advantage plans covering hearing aids continues to shift purchasing dynamics, making customers less price sensitive directly but more dependent on plan benefits. This means the actual cost to the individual is often mediated, impacting their decision-making process.

- Approximately 75% of private health plans in the US offered some hearing aid benefit in 2024, altering direct consumer price sensitivity.

- Government programs, like Medicare Advantage, increasingly cover hearing aids, with enrollment projected to exceed 36 million in 2024.

- These payers negotiate bulk discounts, impacting manufacturers' average selling prices.

- Customer choices are heavily influenced by their insurance coverage details and out-of-pocket costs.

Customers wield substantial bargaining power over GN Store Nord due to transparent market pricing, low switching costs, and the increasing availability of Over-The-Counter (OTC) options. Large enterprise clients and third-party payers further amplify this power, leveraging bulk purchasing and aggregated demand. This dynamic necessitates GN Store Nord to continually innovate and offer competitive solutions across its diverse customer base. Informed consumers, empowered by digital access to product comparisons, drive demand for value and tailored features.

| Customer Segment | Bargaining Lever | 2024 Market Impact | ||

|---|---|---|---|---|

| Individual Consumers | Price Sensitivity, Low Switching Costs | US OTC hearing aid market projected to reach $1 billion. | Global hearing aid market projected to reach $12.3 billion. | |

| Enterprise Clients | Volume Purchases, Integration Demands | GN Audio's enterprise solutions cater to millions of users. | New hybrid work solutions drive product development. | |

| Third-Party Payers | Aggregated Demand, Negotiation Power | 75% of US private health plans offer hearing aid benefits. | Medicare Advantage enrollment projected to exceed 36 million. |

What You See Is What You Get

GN Store Nord Porter's Five Forces Analysis

This preview shows the exact GN Store Nord Porter's Five Forces Analysis you'll receive immediately after purchase—no surprises, no placeholders. It details the competitive landscape, including the threat of new entrants, the bargaining power of buyers, the bargaining power of suppliers, the threat of substitute products or services, and the intensity of rivalry among existing competitors within the hearing aid and audio solutions market. This comprehensive analysis provides actionable insights into the strategic positioning and potential challenges for GN Store Nord.

Rivalry Among Competitors

GN Store Nord faces intense competitive rivalry across its Hearing and Audio segments. The global hearing aid market, valued at approximately $7.9 billion in 2024, is dominated by a few major players, leading to fierce competition for market share and innovation. Similarly, the professional audio market experiences high rivalry from numerous established and emerging companies. This competitive landscape mandates continuous product development and strategic pricing to maintain GN’s position.

Continuous innovation in technology, product features, and design is a critical driver for competitive rivalry, especially for GN Store Nord. In the dynamic hearing aid market, advancements like AI integration, enhanced connectivity, and increasingly discreet designs are key differentiators, with new models in early 2024 showcasing improved sound processing. For Jabra, a focus on developing advanced features for headsets and video conferencing solutions, such as AI-powered noise cancellation and real-time transcription services, remains crucial for market leadership. This constant push for innovation fuels competition and shapes market share.

Strong brand recognition is a significant competitive edge, especially for established players. GN Store Nord leverages its Jabra brand, a well-known name in professional audio solutions, directly competing with industry giants like Logitech and Poly. For instance, in the enterprise headset market, Jabra holds a substantial position, maintaining a competitive share against rivals in 2024. In the hearing aid sector, brand trust and deep-rooted relationships with audiologists and hearing care professionals are absolutely essential for market penetration and customer loyalty, given the long-term nature of these medical devices and the direct patient-provider interaction.

Price Competition and Margin Pressure

The intense competitive environment in both the professional audio and hearing aid markets significantly drives price pressure for GN Store Nord. In professional audio, the proliferation of more affordable consumer-grade alternatives, such as advanced headphones and earbuds, increasingly challenges the market share of premium, high-end solutions. Similarly, the hearing aid segment faces heightened price competition, notably spurred by the growing availability of Over-The-Counter (OTC) hearing aids that offer lower-cost options to consumers. This dynamic forces companies to balance innovation with competitive pricing to maintain margins.

- The global OTC hearing aid market is projected to expand significantly, with estimates suggesting considerable growth in 2024 following the 2022 FDA ruling.

- GN Store Nord reported a 10% organic revenue decline in GN Audio in Q1 2024, partly impacted by market price sensitivity.

- The average selling price (ASP) for hearing aids has seen downward pressure in various markets through 2023 and early 2024.

- Consumer-grade audio devices continue to innovate, offering features that blur lines with professional use, increasing competitive pressure.

Consolidation and Strategic Partnerships

The hearing aid and audio industries where GN operates have experienced ongoing consolidation and the formation of strategic alliances. Major players have engaged in forward integration, acquiring retail chains; for example, Demant's retail network exceeded 3,000 clinics globally by early 2024. Strategic partnerships, like GN Hearing's collaboration with Cochlear for implant solutions, Apple for Made for iPhone compatibility, and Google for Android integration, are crucial for driving innovation and maintaining a competitive edge in 2024.

- Major hearing aid players continue forward integration into retail, expanding their clinic networks.

- GN Hearing's collaboration with Apple ensures access to the vast iOS ecosystem.

- Partnerships with Google enhance Android compatibility for GN's hearing solutions.

- Strategic alliances, such as with Cochlear, are vital for advancing hearing technology in 2024.

GN Store Nord faces significant competitive rivalry across its Hearing and Audio divisions, where continuous innovation and strong brand recognition are critical for maintaining market share. The hearing aid sector, valued at approximately $7.9 billion in 2024, sees fierce competition from a few major players, while the professional audio market contends with numerous established brands and emerging alternatives. This environment creates intense price pressure, exemplified by GN Audio’s 10% organic revenue decline in Q1 2024, partly due to market price sensitivity. Strategic alliances and industry consolidation further shape this highly competitive landscape for GN.

| Metric | Value (2024 Data) | Impact on Rivalry |

|---|---|---|

| Global Hearing Aid Market Value | ~$7.9 billion | Drives intense competition among dominant players. |

| GN Audio Organic Revenue (Q1 2024) | -10% decline | Reflects market price sensitivity and competitive pressure. |

| OTC Hearing Aid Market | Projected significant growth | Increases price competition and broadens market access. |

SSubstitutes Threaten

Over-the-counter (OTC) hearing devices and personal sound amplification products (PSAPs) pose a significant substitute threat to traditional hearing aids for GN Store Nord. These alternatives are often more affordable, with some OTC options available for as little as a few hundred dollars, making them highly accessible. The legalization of OTC hearing aids in the U.S. in 2022 has further expanded their availability, particularly for consumers with mild to moderate hearing loss. This market shift is expected to continue impacting traditional hearing aid sales, with projections suggesting OTC sales could reach billions by 2027.

A significant threat to GN Audio, operating under the Jabra brand, arises from the proliferation of high-quality consumer electronics. Many standard headphones and earbuds now integrate advanced features, such as active noise cancellation and superior audio fidelity, making them sufficiently effective for certain professional applications. This increasing functionality, evident in devices like the latest premium consumer earbuds, blurs the distinction between consumer-grade and professional-grade communication solutions. The availability of these versatile consumer options, often at competitive price points, presents a direct alternative for users who might otherwise opt for dedicated professional headsets, impacting market share.

In the enterprise sector, the threat of substitutes for Jabra's video conferencing hardware primarily stems from software-based communication platforms. Many businesses opt for purely software solutions, leveraging built-in computer cameras and microphones, especially given the convenience and lower upfront cost. The continuous enhancement of these integrated technologies, with improved camera resolutions and microphone arrays common in 2024 laptop models, presents an ongoing and significant substitute threat. This trend can impact hardware sales as organizations prioritize cost-effective, integrated solutions for basic communication needs.

'Doing Without' or Delaying Adoption

The threat from consumers choosing to 'do without' a hearing solution or delaying adoption is significant for GN Store Nord. Many individuals with hearing loss opt not to purchase hearing aids, often due to perceived stigma, the high cost, or a belief that their condition is not severe enough, despite clear benefits. This inaction represents a potent form of substitution, where the consumer chooses no product over a specialized one. Similarly, within the enterprise segment, some businesses might forgo advanced audio equipment, instead relying on more basic or existing communication methods to manage costs or perceived complexity.

- Only about 25% of adults with hearing loss globally use hearing aids in 2024.

- Cost and stigma remain primary barriers, with over-the-counter options slowly impacting adoption.

- A substantial portion of the population delays seeking treatment for an average of seven years.

- Businesses may defer specialized audio upgrades, prioritizing general IT spending in 2024.

Surgical Options and Implantable Devices

Surgical options, like cochlear implants, present a growing threat of substitution for traditional hearing aids, especially for individuals with severe hearing loss. While historically serving a distinct, more severe market segment, ongoing advancements in implant technology are making these solutions more accessible and effective. GN Store Nord recognizes this trend, highlighted by its 2024 innovation partnership with Cochlear, aiming to integrate hearing aid and implant technologies for improved patient outcomes.

- The global cochlear implant market was valued at approximately $1.6 billion in 2024.

- Technological advancements are expanding candidacy criteria for implantable devices beyond profound hearing loss.

- GN's collaboration with Cochlear focuses on developing integrated solutions and connectivity.

- These surgical alternatives offer direct sound stimulation, bypassing damaged parts of the ear.

The threat of substitutes for GN Store Nord is multifaceted, spanning affordable OTC hearing aids, advanced consumer electronics for audio, and software-based video solutions. Many individuals also delay or forgo hearing solutions, with only about 25% of adults with hearing loss using aids in 2024. Surgical options like cochlear implants, a $1.6 billion global market in 2024, also present a growing alternative.

| Substitute Type | Impact on GN Hearing | Impact on GN Audio |

|---|---|---|

| OTC Devices/PSAPs | High; cost-effective, accessible, post-2022 US legalization. | N/A |

| Consumer Electronics | N/A | High; advanced features, competitive pricing. |

| Software/Integrated Tech | N/A | High; lower cost, enhanced 2024 laptop features. |

| No Adoption/Delay | High; 25% global usage, 7-year average delay. | Medium; businesses deferring upgrades. |

| Cochlear Implants | Medium; $1.6B global market in 2024, growing tech. | N/A |

Entrants Threaten

The hearing aid industry poses high barriers for new entrants. Stringent regulatory requirements, such as FDA approval for medical devices, necessitate extensive and costly clinical trials, often spanning several years. Significant research and development investment is crucial; leading firms annually dedicate hundreds of millions, ensuring cutting-edge technology. Established relationships with audiologists and robust distribution channels are also essential, alongside strong brand loyalty and extensive patent portfolios protecting core innovations. For instance, the global hearing aid market, valued at approximately $8 billion in 2024, is dominated by a few key players, making market penetration difficult for newcomers.

While high-end professional audio demands significant expertise, the broader audio market, particularly consumer-grade products, faces lower entry barriers. New companies can easily emerge with innovative designs, targeting niches like true wireless earbuds, a segment valued at over $30 billion globally in 2024. The rise of e-commerce further simplifies market entry, enabling direct-to-consumer sales channels and bypassing traditional retail, as evidenced by the surge in DTC audio brands. This trend allows smaller firms to quickly gain market share with specialized offerings, increasing competitive pressure on established players like GN Store Nord.

Developing advanced audio solutions, like those for hearing and communication, demands substantial research and development investment. Any new entrant would face the challenge of competing with established players such as GN Store Nord, which has extensive R&D capabilities and a deep patent portfolio. For instance, GN's Jabra brand continues to integrate AI-powered features into its headsets, a testament to its significant expertise in audio engineering and software development. This high barrier to entry, requiring years of specialized knowledge and considerable capital outlay, significantly diminishes the threat posed by potential new competitors in the market.

Established Distribution Channels and Brand Reputation

Incumbent firms like GN Store Nord possess extensive global distribution networks and robust brand recognition, making market entry difficult for newcomers. GN Hearing, for instance, leverages its deep relationships with over 200,000 hearing care professionals worldwide, a network built over decades. New entrants face the formidable task of replicating such established channels and earning the trust of both consumers and professional distributors. This significant barrier to entry is evident as GN Hearing reported strong organic revenue growth in Q1 2024, underpinned by these enduring relationships.

- GN Hearing's global reach includes a network of over 200,000 hearing care professionals.

- Building comparable distribution channels for new entrants requires substantial capital and time.

- Brand loyalty and trust, cultivated over decades, are significant barriers to consumer adoption for new brands.

- GN Store Nord's Q1 2024 results reflect the strength of its established market position.

Economies of Scale and Cost Advantages

Economies of Scale and Cost Advantages

Established manufacturers like GN Store Nord leverage significant economies of scale across production, procurement, and global distribution networks. This allows them to maintain a lower cost base per unit, a considerable barrier for potential new entrants. A new company would likely face substantially higher per-unit costs, making it difficult to compete on price without massive initial capital investment. For instance, in 2024, the capital expenditure required to set up a competitive manufacturing footprint in the hearing aid sector remains substantial, reinforcing this barrier.

- GN's established supply chains reduce raw material and component costs.

- Large-scale production facilities minimize per-unit manufacturing expenses.

- Extensive distribution networks offer cost efficiencies in market reach.

- New entrants face significant R&D and marketing investment hurdles.

The threat of new entrants to GN Store Nord is bifurcated; the hearing aid sector maintains high barriers due to stringent regulations and significant R&D, limiting new competition. However, the broader consumer audio market faces lower entry hurdles, especially with e-commerce facilitating niche players. GN's established distribution networks and economies of scale further deter newcomers in its core segments. The company's robust patent portfolio and deep expertise also present formidable challenges for any potential competitor.

| Market Segment | Entry Barrier Level | Key Deterrents (2024) | ||

|---|---|---|---|---|

| Hearing Aids | High | FDA approval, $100M+ R&D, 200k+ audiologist network, market valued at ~$8B | ||

| Consumer Audio | Moderate/Low | Established brands, deep R&D for advanced features, true wireless market ~$30B | ||

| Professional Audio | High | Specialized expertise, AI integration, extensive patent portfolios |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for GN Store Nord is built upon a foundation of comprehensive data, including the company's official annual reports, investor presentations, and regulatory filings.

We supplement this internal data with insights from reputable industry analysis firms, market research reports, and news articles to provide a robust understanding of the competitive landscape.