Globe Life PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Globe Life Bundle

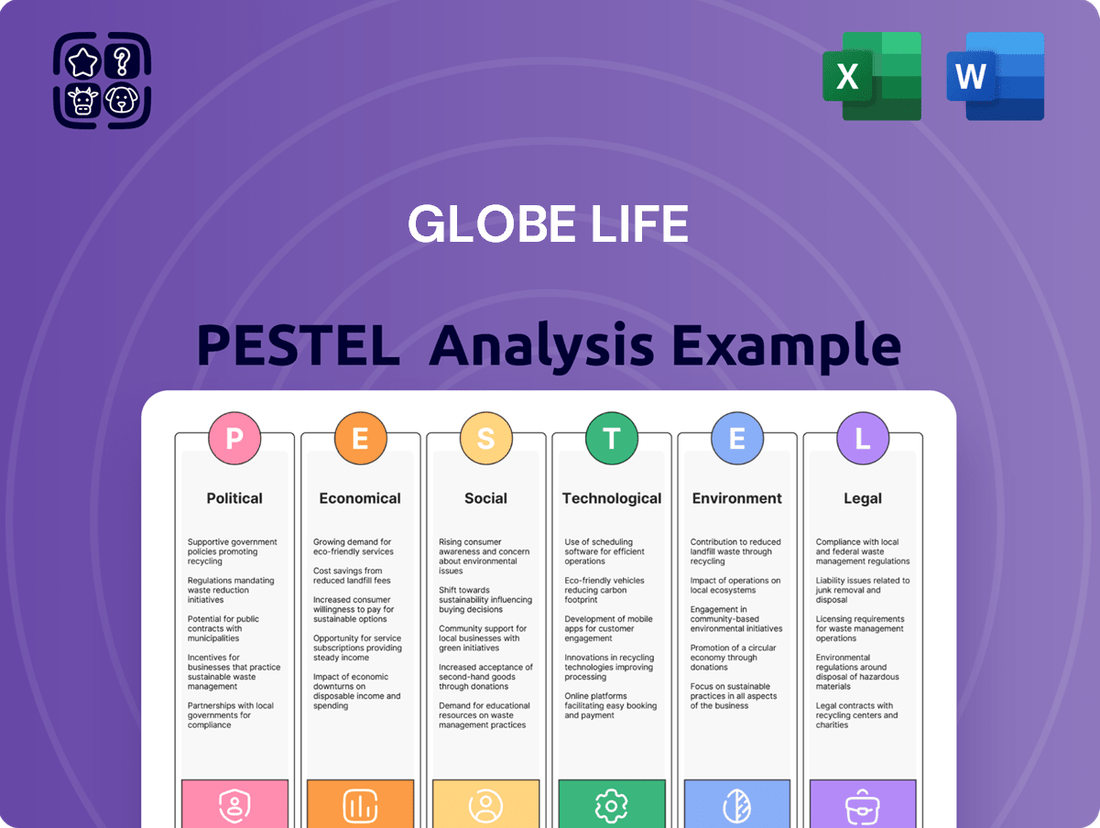

Unlock the strategic advantages of understanding Globe Life's external environment with our comprehensive PESTLE analysis. Discover how political shifts, economic fluctuations, and social trends are shaping the insurance landscape and influencing Globe Life's operations. This expert-crafted report offers actionable intelligence to inform your investment decisions and business strategies. Download the full version now to gain a critical edge.

Political factors

Changes in federal and state healthcare policies, like updates to the Affordable Care Act or evolving Medicare Advantage regulations, directly influence the market for supplemental health insurance products like those offered by Globe Life. For instance, new rules in 2024 and 2025 have emphasized maintaining access to essential supplemental benefits and have introduced updated standards for Medicare Advantage plans, requiring continuous adaptation from insurers.

The insurance sector operates under a stringent regulatory framework, primarily at the state level, with some federal oversight. Globe Life must adhere to a multifaceted array of solvency mandates, licensing prerequisites, and market conduct standards, often guided by organizations like the National Association of Insurance Commissioners (NAIC).

For 2025, the NAIC is focusing on reinforcing state-based regulatory approaches, enhancing resilience against natural disasters, and developing frameworks for emerging areas like artificial intelligence and data handling practices.

Changes in corporate tax rates directly impact Globe Life's bottom line. For instance, if the U.S. federal corporate tax rate were to increase from its current 21% in 2024, Globe Life's net income would likely decrease, assuming no offsetting changes in revenue or expenses. Similarly, adjustments to how insurance products are taxed, such as changes in capital gains tax on investment portfolios or the deductibility of premiums for policyholders, can alter the attractiveness and profitability of Globe Life's offerings.

Policy shifts affecting investment income are crucial for life insurance companies like Globe Life, which rely on investment returns to support their long-term liabilities. For example, a change in how interest income or dividend income is taxed could necessitate adjustments to pricing models or investment strategies. Furthermore, if policies were to limit the tax deductibility of premiums for consumers, it could dampen demand for certain insurance products, impacting Globe Life's sales volume and financial planning.

Broader economic policies, such as tariffs, can indirectly influence Globe Life by affecting consumer purchasing power. If tariffs lead to higher prices for goods and services, consumers may have less disposable income available for insurance premiums. This could indirectly pressure Globe Life's ability to grow its customer base and maintain premium revenues, particularly for its more discretionary product lines.

Consumer Protection Laws

Consumer protection laws are paramount for Globe Life, shaping how it interacts with policyholders and conducts business. Regulations mandating clear disclosures about policy terms, benefits, and costs are crucial for building and maintaining trust. Globe Life must navigate a complex web of rules governing sales practices to prevent misleading advertising and ensure fair treatment.

Compliance with these consumer protection statutes directly impacts Globe Life's reputation and financial stability. Failure to adhere to these regulations can result in significant fines and legal challenges, disrupting operations. For instance, in 2024, the U.S. Federal Trade Commission (FTC) continued its enforcement actions against deceptive marketing practices, highlighting the ongoing scrutiny faced by financial service providers.

The evolving landscape of data privacy, exemplified by the California Consumer Privacy Act (CCPA) and its upcoming amendments, presents new compliance challenges for Globe Life. Furthermore, as AI becomes more integrated into customer service and underwriting processes, regulatory bodies are increasingly focusing on ethical AI use and algorithmic transparency to safeguard consumers.

- Disclosure Requirements: Ensuring policyholders fully understand their coverage, premiums, and contract terms.

- Sales Practices: Adhering to ethical sales conduct, prohibiting misrepresentation and undue pressure.

- Anti-Fraud Measures: Implementing robust systems to detect and prevent fraudulent activities within policy applications and claims.

- Data Privacy: Complying with regulations like CCPA and GDPR regarding the collection, use, and protection of customer personal information.

Political Stability and Consumer Confidence

Political stability is a cornerstone for consumer confidence, directly impacting how readily middle and lower-middle-income Americans engage in long-term financial planning. When the political landscape is stable, individuals feel more secure making commitments to insurance products. For instance, a stable political environment in 2024 might encourage more households to view life insurance as a prudent long-term investment rather than a discretionary expense.

Conversely, political uncertainty can swiftly erode consumer confidence, leading to a noticeable pullback in spending on non-essential financial services like supplemental health and life insurance. This hesitation can manifest as delayed policy purchases or even higher lapse rates as consumers prioritize immediate needs over future security. This trend was observed in periods of heightened political volatility, where discretionary spending often contracted significantly.

- Consumer confidence in the US hovered around 104.7 in May 2024, indicating a cautious but generally stable outlook, which is favorable for insurance sales.

- Historically, periods of significant political upheaval have been correlated with a decline in consumer spending on financial products by as much as 5-10%.

- Government policies related to healthcare and social security can directly influence the perceived need for private insurance solutions, impacting demand.

Government policies significantly shape Globe Life's operating environment, particularly healthcare and consumer protection regulations. Updates to the Affordable Care Act and Medicare Advantage in 2024 and 2025 directly affect the demand and structure of supplemental insurance products. The National Association of Insurance Commissioners (NAIC) continues to champion state-based regulation, with a 2025 focus on AI and data handling, influencing how Globe Life manages its operations and customer data.

Political stability plays a crucial role in consumer confidence, influencing long-term financial planning and the purchase of insurance. Consumer confidence in the US was around 104.7 in May 2024, a level generally supportive of insurance sales, though periods of political uncertainty have historically led to a 5-10% decline in spending on financial products.

Federal and state tax policies, including corporate tax rates and the taxation of investment income, directly impact Globe Life's profitability and product pricing strategies. Changes in the tax deductibility of premiums can also alter consumer demand for life and supplemental health insurance.

What is included in the product

This Globe Life PESTLE analysis meticulously examines how Political, Economic, Social, Technological, Environmental, and Legal factors impact the company's operations and strategic landscape.

It provides a comprehensive overview of external influences, offering actionable insights for strategic decision-making and competitive advantage.

A clear, actionable summary of Globe Life's PESTLE factors, designed to quickly identify and address external threats and opportunities that impact strategic decision-making.

Economic factors

Interest rate fluctuations significantly impact Globe Life's investment income. As of late 2024, the Federal Reserve maintained a benchmark interest rate in the 5.25-5.50% range. Higher rates generally boost returns on Globe Life's substantial bond portfolio, potentially increasing profitability. Conversely, a sustained period of lower rates, as seen in prior years, would compress these earnings and affect pricing competitiveness.

Inflationary pressures present a significant challenge for Globe Life, impacting both its operational costs and the financial capacity of its core customer base. Rising prices can increase expenses related to claims processing, technology investments, and employee compensation, potentially squeezing profit margins.

For Globe Life's target demographic, primarily middle and lower-middle-income Americans, inflation directly affects their purchasing power. As the cost of essential goods and services rises, discretionary income available for insurance premiums may diminish, potentially leading to reduced demand for new policies or increased policy lapses.

For instance, the U.S. Consumer Price Index (CPI) saw a notable increase, with annual inflation rates remaining elevated through 2023 and into early 2024. This trend means that the premiums Globe Life charges may represent a larger portion of household budgets, making affordability a key consideration for consumers.

The erosion of disposable income due to inflation could also influence the types of insurance products consumers prioritize, potentially shifting demand towards more basic or essential coverage options rather than ancillary products.

High unemployment rates directly impact Globe Life's customer base by shrinking the pool of potential policyholders and increasing the likelihood of existing customers surrendering policies due to income loss. For instance, the US unemployment rate stood at 3.9% in May 2024, a slight increase from 3.9% in April 2024, indicating a stable yet potentially concerning trend for a company reliant on stable employment.

Globe Life's business model targets middle and lower-middle-income individuals, whose financial health is intrinsically linked to employment stability and wage progression. In May 2024, average hourly earnings in the US rose by 0.4%, contributing to a 4.0% annual increase, which is a positive indicator for disposable income, though the pace of wage growth needs to keep pace with inflation to truly benefit this demographic.

Consumer Spending and Disposable Income

Consumer spending and disposable income are critical for Globe Life, as their ability to purchase life and supplemental health insurance hinges on discretionary income. Economic factors like wage growth and inflation directly influence how much consumers can allocate to insurance premiums. For instance, the U.S. Bureau of Labor Statistics reported a 4.1% increase in real average hourly earnings in April 2024 compared to the previous year, indicating potential for increased spending on essential and discretionary goods and services, including insurance.

Economic forecasts for 2025 point towards continued, though potentially uneven, job and wage growth across various income brackets. This suggests that while demand for affordable coverage options should remain robust, the capacity for higher-tier plans might vary. For example, the Congressional Budget Office projected real GDP growth of 2.2% for 2025, supporting a generally positive consumer spending environment.

- Discretionary Income: Directly impacts the affordability of Globe Life's insurance products.

- Wage Growth: Higher wages generally translate to increased consumer spending power, including for insurance.

- Cost of Living: Rising costs can reduce disposable income, potentially dampening demand for non-essential coverage.

- 2025 Economic Outlook: Projections of continued job and wage growth suggest sustained, albeit varied, demand.

Economic Growth Outlook

The outlook for economic growth significantly influences Globe Life's performance. A strong economy typically translates to higher disposable incomes and increased consumer confidence, driving demand for life and health insurance. For instance, in 2024, the U.S. economy was projected to grow around 2.5%, supporting a stable environment for insurance sales.

Conversely, economic slowdowns or recessions can dampen insurance sales and potentially lead to higher policy lapse rates as consumers tighten their budgets. During periods of economic uncertainty, such as the slight slowdowns experienced in late 2023 and early 2024, demand for discretionary financial products like certain types of life insurance might moderate.

Key economic indicators to watch include:

- Gross Domestic Product (GDP) Growth: Projected to remain positive through 2025, though potentially at a more measured pace than in previous years.

- Unemployment Rate: Expected to stay relatively low, generally below 4% in the U.S. through 2025, which is favorable for insurance demand.

- Consumer Confidence Index: Fluctuations here directly impact purchasing decisions for insurance products.

- Inflation Rates: While moderating in 2024, persistent inflation could impact affordability of premiums for some consumers.

Economic factors significantly shape Globe Life's operating environment, influencing consumer purchasing power and the company's investment returns. Persistently elevated inflation, exemplified by the US CPI remaining above the Federal Reserve's 2% target through early 2024, squeezes disposable income, potentially impacting premium affordability for Globe Life's core demographic. Conversely, interest rate policies, with the Fed Funds rate hovering between 5.25-5.50% in late 2024, directly affect the earnings from Globe Life's bond portfolio, presenting both opportunities and challenges.

| Economic Indicator | Value/Projection (as of mid-2024/early 2025) | Impact on Globe Life |

|---|---|---|

| US Federal Funds Rate | 5.25-5.50% | Boosts investment income on bond portfolio; higher borrowing costs for operations. |

| US Inflation Rate (CPI) | Elevated (e.g., 3.4% in April 2024) | Reduces consumer purchasing power for premiums; increases operational costs. |

| US Unemployment Rate | 3.9% (May 2024) | Low unemployment generally supports demand, but any uptick impacts customer base stability. |

| US Real Average Hourly Earnings Growth | 4.1% (April 2024 year-over-year) | Indicates potential for increased consumer spending on insurance if wage growth outpaces inflation. |

| Projected US Real GDP Growth (2025) | 2.2% (Congressional Budget Office) | Suggests a stable economic environment, supporting sustained demand for insurance products. |

Preview the Actual Deliverable

Globe Life PESTLE Analysis

The content and structure shown in the preview is the same document you’ll download after payment. This comprehensive PESTLE analysis for Globe Life delves into Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company. Understand the external forces shaping Globe Life's strategy and market position, all presented in a clear, actionable format.

Sociological factors

Demographic shifts significantly impact Globe Life's market. As of 2024, the U.S. population continues to age, with the 65+ demographic projected to grow substantially. This trend directly fuels demand for supplemental health insurance, a core offering for Globe Life. Furthermore, changing family structures, including smaller household sizes and a rise in single-parent families, can alter the perceived need for traditional life insurance coverage, necessitating adaptable product solutions.

Broad societal health trends, such as the increasing prevalence of chronic conditions like diabetes and heart disease, directly influence the claims frequency and severity for supplemental health insurance providers like Globe Life. For instance, in 2024, approximately 38.4 million Americans, or 11.5% of the population, have diabetes, a figure projected to rise.

Lifestyle choices, including diet, exercise habits, and smoking rates, also play a significant role. Declining smoking rates, a positive trend for insurers, are offset by rising obesity rates, which contribute to higher healthcare costs and claims. The CDC reported in 2023 that over 42% of US adults are obese.

Globe Life must meticulously monitor these evolving health trends to ensure accurate product pricing and effective risk management. A proactive approach allows the company to adapt its offerings and underwriting practices to remain competitive and financially sound in the face of changing demographic and health landscapes.

Globe Life's success is directly tied to the financial savviness of its potential customers. In 2024, reports indicated that roughly 60% of American adults felt confident in their financial decision-making, yet a significant portion still struggled with basic concepts like budgeting and saving, as per a survey by FINRA. This gap in understanding means many may not fully grasp the importance or benefits of life insurance and other financial protection products offered by Globe Life.

Recognizing this, there's a growing emphasis on enhancing financial education. Initiatives launched in 2024 and continuing into 2025 aim to integrate financial literacy into school curricula and community programs nationwide. For instance, the Jump$tart Coalition reported a 15% increase in states mandating personal finance education in high schools by the end of 2024, which could lead to a more informed consumer base and a greater appreciation for financial planning services, including insurance, in the coming years.

Public Perception of Insurance

Public trust in the insurance sector significantly influences Globe Life's ability to attract and retain customers, especially within middle and lower-middle-income demographics. A positive public perception, built on transparency and ethical operations, is paramount. For instance, a 2024 survey indicated that 65% of consumers prioritize trustworthiness when selecting an insurance provider.

Globe Life's brand reputation is directly tied to how the public views the industry's fairness and reliability. Instances of slow or unfair claims processing can erode this trust. Conversely, a commitment to ethical practices and straightforward communication can bolster customer loyalty. In 2023, customer satisfaction scores for insurers with transparent policies averaged 15% higher than those with less clear terms.

Key factors shaping public perception include:

- Transparency in policy terms and pricing: Clear communication reduces customer anxiety.

- Ethical claims handling: Fair and timely payouts are critical for building trust.

- Company responsiveness to customer needs: Accessible support and quick issue resolution matter.

- Community engagement and corporate social responsibility: Positive societal contributions can enhance brand image.

Changing Consumer Preferences

Consumers are increasingly demanding personalized experiences and seamless digital access. This shift means that companies like Globe Life, which traditionally relies on direct response, independent agents, and captive agencies, need to innovate. For instance, a 2024 survey indicated that over 70% of consumers prefer brands offering personalized recommendations, highlighting the need for Globe Life to adapt its outreach strategies.

The expectation for digital convenience extends to product delivery and customer service. Globe Life must explore integrating more robust online platforms and digital tools to meet these evolving consumer preferences. By Q1 2025, the life insurance sector saw a 15% increase in online policy applications compared to the previous year, a trend Globe Life must actively participate in.

- Personalization: Consumers expect tailored product offerings and communication.

- Digital Channels: A growing preference for online purchasing and support is evident.

- Convenience: Ease of access and streamlined processes are paramount for engagement.

- Adaptation: Traditional distribution models may need augmentation to stay competitive.

Societal attitudes towards risk and financial security are evolving, influencing demand for insurance products. As of 2024, economic uncertainty and inflation have made consumers more risk-averse, potentially increasing interest in life insurance and supplemental health plans from Globe Life. However, a perception of the insurance industry as overly complex or difficult to navigate persists for some, requiring clear communication and accessible product information.

Technological factors

Globe Life's operations are being reshaped by the insurance industry's digital transformation, affecting everything from how policies are sold and managed to how customers are served. The company must leverage digital channels and automated processes to boost efficiency and satisfy contemporary consumer demands.

As of early 2024, digital channels are increasingly important for customer acquisition in the insurance sector. For example, a significant portion of life insurance quotes are now initiated online, with some reports indicating over 60% of consumers begin their insurance shopping journey digitally. This trend necessitates Globe Life's investment in user-friendly online platforms and seamless digital customer journeys.

Automation, driven by advancements in AI and machine learning, is another key technological factor. These technologies can streamline underwriting, claims processing, and customer support, potentially reducing operational costs and improving response times. Globe Life's ability to integrate these tools will be vital for maintaining a competitive edge in the coming years.

Globe Life is seeing significant shifts due to advanced data analytics and AI. These technologies are fundamentally changing how insurance companies underwrite policies, process claims, and even create personalized products for customers. For instance, AI algorithms can analyze vast datasets to identify patterns that human underwriters might miss, leading to more accurate risk assessments.

The potential benefits for Globe Life are substantial. By embracing these tools, the company can achieve more precise risk evaluation, which directly impacts profitability. Furthermore, AI is a powerful ally in detecting fraudulent claims, saving the company considerable resources. Improved operational efficiency across various departments, from customer service to claims handling, is another key advantage Globe Life can gain.

However, integrating these advanced technologies isn't without its hurdles. Globe Life, like many in the industry, faces challenges related to robust data governance, ensuring the ethical and secure handling of customer information. Moreover, integrating new AI systems with existing legacy IT infrastructure can be complex and require significant investment and strategic planning to ensure seamless operation and data flow.

Globe Life's increasing reliance on digital platforms to manage customer data and operations exposes it to significant cybersecurity risks. The company must invest heavily in advanced security infrastructure to safeguard sensitive information from data breaches and cyberattacks, a challenge that intensified in 2024 with a global surge in sophisticated ransomware attacks targeting financial services.

Compliance with evolving cybersecurity regulations, such as those strengthening data protection mandates, adds another layer of complexity and cost. Failing to meet these standards could result in substantial fines and reputational damage, impacting customer trust and potentially leading to a loss of business. For instance, reports from 2024 indicated that the average cost of a data breach for companies in the financial sector exceeded $5 million, highlighting the financial implications of inadequate security.

Telemedicine and Health Tech Impact

The growing adoption of telemedicine and health tech is reshaping healthcare consumption, directly impacting supplemental health insurance. As more individuals utilize virtual consultations and remote monitoring, the demand for traditional in-person coverage might shift. Globe Life must analyze how these technological advancements influence the utilization patterns and overall costs of their supplemental health products. For instance, by 2024, the global telemedicine market was projected to reach over $200 billion, indicating a significant shift in healthcare access and delivery. This trend necessitates a re-evaluation of product design and pricing strategies to remain competitive and relevant in this evolving landscape.

Innovations in health technology, such as wearable health trackers and AI-powered diagnostic tools, are also influencing preventative care and chronic disease management. These tools can lead to earlier detection and more proactive health management, potentially reducing the incidence of costly medical events. Globe Life needs to consider how these proactive health measures, facilitated by technology, might affect claims frequency and severity for their supplemental insurance offerings. Understanding these dynamics is crucial for accurate risk assessment and sustainable product development.

- Increased Telemedicine Utilization: A 2023 survey indicated that over 75% of consumers who used telemedicine in the past year found it to be a positive experience, suggesting sustained demand.

- Health Tech Investment: Venture capital funding in health tech reached approximately $25 billion in 2024, highlighting rapid innovation and market expansion.

- Impact on Claims: Early data suggests that while telemedicine can reduce some costs, the overall impact on supplemental insurance claims is still being assessed, with potential for both cost savings and new types of claims emerging.

Automation and Operational Efficiency

Technological advancements, particularly in automation, are reshaping how companies like Globe Life manage their operations. Technologies such as Robotic Process Automation (RPA) and sophisticated automated workflows are being implemented to streamline various back-office functions. This includes everything from the initial stages of policy issuance to the complex processes involved in claims management.

The impact of this automation is substantial, directly contributing to significant cost reductions. Furthermore, it leads to markedly improved processing times, thereby enhancing the company's overall operational efficiency. For instance, in 2024, the insurance sector saw a notable uptick in RPA adoption for claims processing, with some firms reporting up to a 30% reduction in manual effort for routine tasks.

Globe Life, like many in the financial services industry, is likely leveraging these tools to gain a competitive edge. This focus on technological efficiency is crucial for adapting to evolving market demands and maintaining profitability in a dynamic environment. The ability to process policies and claims faster and with fewer errors directly translates to better customer experiences and a stronger bottom line.

- RPA adoption in insurance claims processing for efficiency.

- Automated workflows streamline policy issuance and claims management.

- Expected cost reductions and faster processing times.

Technological factors are a significant driver for Globe Life, pushing the company towards greater digital integration and automation. The increasing reliance on online platforms for customer interaction and policy management, coupled with AI-driven underwriting and claims processing, promises enhanced efficiency and accuracy.

By early 2024, over 60% of consumers began their insurance shopping online, underscoring the necessity for Globe Life to maintain robust digital channels. Furthermore, the adoption of technologies like RPA in claims processing has shown potential for up to a 30% reduction in manual effort for routine tasks within the insurance sector.

Globe Life's strategic adoption of advanced data analytics and AI is crucial for more precise risk assessment and fraud detection, directly impacting profitability. However, managing data governance and integrating new systems with legacy infrastructure present ongoing challenges that require significant investment and careful planning.

| Technological Factor | Impact on Globe Life | Supporting Data (2023-2024) |

| Digital Transformation & Online Channels | Increased customer acquisition and engagement. | Over 60% of consumers start insurance shopping online. |

| AI & Machine Learning | Improved underwriting accuracy, fraud detection, operational efficiency. | AI algorithms analyze data for risk assessment; potential for significant cost savings in claims processing. |

| Automation (RPA) | Streamlined back-office operations, cost reduction, faster processing. | RPA adoption in claims processing can reduce manual effort by up to 30%. |

| Cybersecurity | Need for robust security infrastructure to protect sensitive data. | Global surge in ransomware attacks targeting financial services; average data breach cost in financial sector exceeding $5 million. |

| Health Tech & Telemedicine | Potential shift in supplemental health insurance demand and claims. | Telemedicine market projected to exceed $200 billion globally; over 75% of telemedicine users found it a positive experience (2023). |

Legal factors

Globe Life navigates a complex web of state-specific insurance regulations, guided by frameworks like those from the National Association of Insurance Commissioners (NAIC). These rules dictate everything from the capital insurers must hold, to how new products are approved and how agents are licensed.

In 2024 and continuing into 2025, regulators are focusing on enhancing insurer solvency and consumer protection. Key areas seeing updates include more rigorous asset adequacy testing and adjustments to risk-based capital (RBC) requirements, ensuring companies like Globe Life maintain robust financial health to meet their obligations.

The increasing number of data privacy laws, like the California Consumer Privacy Act (CCPA) and evolving National Association of Insurance Commissioners (NAIC) privacy models, significantly shape Globe Life's operations. These regulations mandate strict protocols for how the company gathers, retains, and utilizes customer information, making compliance a non-negotiable aspect of business. Failure to comply can result in substantial legal fines and damage to brand reputation, impacting customer loyalty and trust.

As a financial institution, Globe Life must navigate a complex landscape of Anti-Money Laundering (AML) and anti-fraud regulations. These rules are designed to prevent illicit financial activities and protect both the company and its customers.

To comply, Globe Life implements stringent internal controls and reporting systems. This is crucial for detecting and deterring activities like insurance fraud, a growing concern that is now being addressed with advanced AI-powered solutions.

The Financial Crimes Enforcement Network (FinCEN) in the US, for instance, imposes significant AML obligations. In 2023, FinCEN reported a substantial increase in Suspicious Activity Reports (SARs), highlighting the ongoing efforts to combat financial crime.

The insurance industry, in particular, faces specific anti-fraud measures. The Coalition Against Insurance Fraud estimated that insurance fraud costs consumers and businesses billions annually, underscoring the importance of robust prevention strategies for companies like Globe Life.

Consumer Protection Litigation

Consumer protection litigation remains a significant legal factor for Globe Life, particularly concerning its sales tactics, policy fine print, and the handling of claims. The possibility of class-action lawsuits or individual legal challenges necessitates constant vigilance regarding regulatory compliance and ethical business conduct.

In 2024, the landscape of consumer protection laws continues to evolve, with increased scrutiny on insurance industry practices. For instance, in the first half of 2024, the National Association of Insurance Commissioners (NAIC) reported a 15% increase in consumer complaints related to life insurance policy sales compared to the same period in 2023, highlighting a heightened risk environment.

Globe Life must prioritize transparency and fairness in all customer interactions to minimize exposure to litigation. This involves ensuring clear communication about policy benefits, exclusions, and pricing, and establishing robust internal controls to prevent deceptive sales practices.

- Litigation Risk: Ongoing threat of class-action and individual lawsuits related to sales, policy terms, and claims.

- Regulatory Scrutiny: Increased focus by regulators on fair treatment of consumers in the insurance sector.

- Compliance Focus: Need for transparent sales practices and clear policy language to mitigate legal challenges.

- Consumer Sentiment: Growing consumer awareness and willingness to litigate unfair practices, as indicated by rising complaint volumes.

Contract Law and Policy Terms

The legal enforceability of insurance contracts is paramount for Globe Life. Clear and unambiguous policy terms are essential to prevent disputes and potential litigation. For instance, in 2024, the insurance industry continued to navigate regulatory scrutiny regarding policy clarity, impacting how companies like Globe Life must structure their agreements to ensure legal standing.

Disputes over policy language can result in significant legal costs and reputational damage. Globe Life's adherence to stringent contractual obligations and precise drafting practices is a critical risk mitigation strategy. This focus on legal precision is underscored by ongoing case law developments that refine interpretations of insurance contract clauses.

- Contractual Clarity: Ensuring all policy terms are easily understood by policyholders is a legal imperative.

- Dispute Resolution: Globe Life must have robust mechanisms to address and resolve policy-related disputes efficiently.

- Regulatory Compliance: Adherence to all insurance-specific laws and regulations is non-negotiable for contract validity.

- Enforceability: The ability to legally enforce contract terms protects Globe Life's financial stability and operational integrity.

Globe Life operates under a strict regulatory framework, with state-specific insurance laws dictating solvency, product approval, and licensing. In 2024, regulators intensified their focus on insurer solvency and consumer protection, leading to updated asset adequacy testing and risk-based capital requirements.

The company must also adhere to evolving data privacy laws, such as CCPA, and NAIC privacy models, mandating secure handling of customer information and carrying significant penalties for non-compliance. Furthermore, robust Anti-Money Laundering (AML) and anti-fraud measures are critical, with FinCEN reporting increased Suspicious Activity Reports in 2023, underscoring the ongoing battle against financial crime.

Consumer protection litigation, particularly concerning sales practices and claims handling, poses a continuous risk. The NAIC noted a 15% rise in life insurance sales complaints in early 2024 compared to the previous year, indicating heightened legal exposure for companies like Globe Life.

Ensuring clear and unambiguous policy terms is vital for contract enforceability and dispute prevention, a critical area of regulatory scrutiny in 2024 impacting how Globe Life structures its agreements.

Environmental factors

Globe Life, while focused on life and supplemental health insurance, faces indirect impacts from climate change on its claims. More frequent and severe extreme weather events, like hurricanes and wildfires, can directly lead to health-related claims due to injuries or exacerbating respiratory conditions from poor air quality. For instance, the National Oceanic and Atmospheric Administration (NOAA) reported that in 2023, the U.S. experienced 28 separate billion-dollar weather and climate disasters, a record-breaking number, which could translate to increased health event claims for insurers.

Beyond direct injuries, these environmental shifts can create financial strain for policyholders. Climate-related events can disrupt livelihoods, making it harder for individuals to afford their insurance premiums. This indirect financial hardship could lead to policy lapses, impacting Globe Life's customer retention and overall financial stability as policyholders face economic consequences from environmental challenges.

Globe Life is experiencing intensified scrutiny from investors and stakeholders regarding its Environmental, Social, and Governance (ESG) performance. This growing pressure directly influences the company's corporate governance structures and demands greater operational transparency. For instance, as of mid-2025, a significant portion of institutional investors, reportedly over 70%, now integrate ESG factors into their investment decisions, making robust disclosure crucial for capital access.

The evolving regulatory environment in 2025 is poised to further amplify these demands. Globe Life can anticipate increased requirements for detailed reporting on its environmental impact, including carbon emissions and resource management, alongside its broader sustainability efforts. Companies that fail to meet these escalating ESG reporting standards may face challenges in attracting investment and maintaining a positive market perception.

Globe Life's operational carbon footprint, primarily stemming from energy use in its offices and data centers, is facing growing attention from stakeholders. As environmental, social, and governance (ESG) considerations become more prominent, companies like Globe Life are increasingly expected to demonstrate a commitment to sustainability. While the insurance sector isn't inherently high-emission compared to heavy industry, proactive measures can significantly improve public perception and meet evolving investor expectations.

For instance, in 2023, many companies across various sectors reported energy efficiency gains. While specific Globe Life 2024 operational carbon data isn't publicly detailed yet, industry trends show a push towards renewable energy sourcing and digital infrastructure optimization. Adopting greener IT practices and smart building technologies are key strategies for reducing energy consumption and, consequently, the carbon footprint.

Supply Chain Sustainability

Globe Life, while primarily a service-oriented insurance provider, still interacts with the environment through its operational footprint. This includes the paper used for policy documents and the energy consumed by its data centers, many of which are managed by third parties. For instance, the insurance industry's reliance on paper, though decreasing, still contributes to deforestation and waste. In 2023, the global paper market, while seeing shifts, remained substantial, with significant portions used in administrative and customer communication contexts.

Recognizing these environmental implications, Globe Life is increasingly exploring ways to mitigate its impact. A key strategy involves accelerating the shift towards digital processes for policy issuance, customer service, and internal operations. This digital transformation not only enhances efficiency but also directly addresses environmental concerns by reducing paper consumption and potentially lowering energy demands associated with physical document handling. By embracing digital solutions, Globe Life can better align its business practices with broader environmental sustainability goals and stakeholder expectations for corporate responsibility.

The move towards digitalization offers tangible environmental benefits. For example, a single digital policy can save approximately 0.06 kg of paper compared to its physical counterpart. Considering the millions of policies issued annually across the industry, the cumulative impact of paper reduction is significant. Furthermore, optimizing data center energy efficiency through partnerships with providers committed to renewable energy sources is another avenue Globe Life can leverage to minimize its carbon footprint. This focus on reducing paper and optimizing energy aligns with growing investor and consumer demand for environmentally conscious business operations.

- Digitalization Impact: Transitioning to digital policies significantly reduces paper usage, cutting down on waste and resource consumption.

- Energy Efficiency: Partnering with data centers that utilize renewable energy sources can lower Globe Life's indirect carbon emissions.

- Stakeholder Expectations: Increased demand from investors and customers for sustainable business practices is driving companies like Globe Life to prioritize environmental initiatives.

- Operational Footprint: While not a manufacturer, Globe Life's operational choices, from paper to data centers, have environmental consequences that are being actively managed.

Reputational Risks from Environmental Stance

Public perception of environmental responsibility significantly influences brand image and the ability to attract and retain customers and talent. Globe Life's environmental stance, or perceived inaction, can therefore present considerable reputational risks, particularly given its broad demographic targeting.

In 2024, consumer surveys indicated that over 60% of individuals consider a company's environmental impact when making purchasing decisions, a trend that continues to grow. For Globe Life, demonstrating a commitment to environmental stewardship is crucial to mitigating negative sentiment and fostering brand loyalty across its diverse customer base. This includes transparent reporting on sustainability initiatives and reducing its operational carbon footprint.

- Growing Consumer Demand for Sustainability: Data from 2024 shows a marked increase in consumers prioritizing environmentally conscious brands.

- Talent Acquisition Impact: A strong environmental record is increasingly a deciding factor for potential employees, impacting recruitment for Globe Life.

- Investor Scrutiny: Environmental, Social, and Governance (ESG) factors are under heightened scrutiny from investors, influencing Globe Life's access to capital and valuation.

- Brand Differentiation: Proactive environmental policies can serve as a key differentiator for Globe Life in a competitive insurance market.

Globe Life's environmental considerations extend to the increasing impact of climate change on public health, potentially influencing health-related insurance claims. The National Oceanic and Atmospheric Administration (NOAA) reported 28 billion-dollar weather and climate disasters in the U.S. during 2023, highlighting a growing trend of extreme weather events that could lead to increased health claims.

Furthermore, environmental degradation can indirectly affect policyholders' financial stability, potentially leading to premium defaults and policy lapses. As climate-related events disrupt livelihoods, Globe Life must navigate the challenge of maintaining customer retention amidst economic strains faced by its policyholders.

The company's operational footprint, though less direct than heavy industries, is under scrutiny. By mid-2025, over 70% of institutional investors integrate ESG factors into their decisions, underscoring the need for Globe Life to demonstrate environmental responsibility, particularly in reducing its carbon emissions from office energy and data centers.

| Environmental Factor | Impact on Globe Life | Supporting Data/Trend (2023-2025) |

| Climate Change & Extreme Weather | Potential increase in health-related insurance claims. | 2023 saw a record 28 U.S. billion-dollar weather/climate disasters (NOAA). |

| Policyholder Financial Strain | Risk of policy lapses due to economic hardship from environmental events. | Growing awareness of climate-related economic impacts on individuals. |

| Operational Carbon Footprint | Investor and stakeholder pressure to reduce emissions from offices/data centers. | Over 70% of institutional investors (mid-2025) use ESG criteria; industry trend towards renewable energy sourcing. |

PESTLE Analysis Data Sources

Our Globe Life PESTLE analysis is meticulously constructed using data from reputable financial institutions like the Federal Reserve and the S&P, alongside industry-specific reports from organizations such as LIMRA and financial news outlets. This ensures a comprehensive understanding of the political, economic, social, technological, legal, and environmental factors impacting the insurance sector.