Globe Life Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Globe Life Bundle

Unlock the strategic core of Globe Life's success with our comprehensive Business Model Canvas. This detailed breakdown illuminates their customer relationships, key resources, and revenue streams, offering a clear view of their market dominance. Discover how they consistently deliver value and maintain a competitive edge in the insurance sector.

Partnerships

Globe Life relies heavily on reinsurance providers to manage its risk. These partnerships are essential for offloading a portion of their exposure to large or catastrophic claims, ensuring financial stability and the ability to underwrite a wider array of policies. For instance, in 2023, Globe Life's net premiums written were $4.7 billion, and reinsurance plays a critical role in protecting these revenues from significant payouts.

Globe Life heavily relies on a robust network of both independent and captive agents. These agents are the frontline of its sales force, directly reaching the middle and lower-middle-income markets that are central to Globe Life's strategy. Their deep understanding of local communities allows for personalized customer engagement, which is crucial for building trust and driving sales in this demographic.

In 2023, Globe Life's life insurance in-force policies grew to over 5.9 million, a testament to the effectiveness of this agent-driven distribution model. The company emphasizes agent training and support, ensuring they are well-equipped to explain complex insurance products and meet customer needs. This direct sales approach, facilitated by these agents, remains a cornerstone of Globe Life's sustained growth and market penetration.

Globe Life leverages partnerships with specialized marketing and lead generation firms to effectively connect with its wide-ranging customer base. These collaborations are crucial for their direct response strategies, encompassing both traditional mail campaigns and increasingly important digital advertising efforts.

These marketing partners are instrumental in identifying and reaching potential policyholders, feeding a consistent stream of leads into Globe Life's sales funnel. For instance, in 2023, Globe Life continued to see success in its direct mail campaigns, a core channel that relies on these specialized services for data and execution.

The efficiency gained from these lead generation services directly supports Globe Life's agent network, ensuring they have ample opportunities to engage prospective customers. This optimized outreach is a cornerstone of their business model, driving policy acquisition.

Technology and Software Providers

Globe Life's partnerships with technology and software providers are critical for maintaining operational efficiency. These collaborations enable advancements in areas like policy administration, ensuring smooth processing and record-keeping. For instance, in 2024, Globe Life continued to invest in upgrading its core systems, aiming to reduce processing times for new policies and claims by an anticipated 15% through enhanced automation provided by key software partners.

Leveraging advanced technology through these partnerships directly impacts Globe Life's ability to streamline internal processes and improve customer service. By integrating sophisticated software for claims processing, the company can handle a higher volume of claims more accurately and swiftly, contributing to positive customer experiences. This focus on technological enhancement is a cornerstone of their strategy to remain competitive in the insurance market.

- Policy Administration: Partnerships ensure efficient management of policy lifecycles, from issuance to renewal.

- Claims Processing: Collaborations with software vendors aim to expedite and improve the accuracy of claims handling.

- Data Analytics: Access to advanced analytics tools from tech providers supports informed underwriting and product development decisions.

- Infrastructure Modernization: These alliances are key to updating legacy systems and improving overall service delivery capabilities.

Community and Sponsorship Partners

Globe Life actively cultivates key partnerships within communities and through sponsorships. These collaborations are crucial for extending their reach and reinforcing their brand presence. For instance, their sponsorships with major sports franchises like the Texas Rangers, Dallas Cowboys, Atlanta Braves, and FC Dallas directly connect them with passionate fan bases. This strategic alignment significantly boosts brand visibility and cultivates a sense of trust and community engagement.

These partnerships are not merely about visibility; they are deeply integrated into Globe Life's core mission. The 'Make Tomorrow Better' initiative finds tangible expression through these community alliances, underscoring the company's commitment to social responsibility and purpose-driven operations. This approach helps to build a stronger, more positive brand perception.

- Sports Team Sponsorships: Partnerships with Texas Rangers, Dallas Cowboys, Atlanta Braves, and FC Dallas.

- Brand Visibility: Enhanced exposure to large and diverse audiences through these affiliations.

- Community Connection: Fostering trust and building relationships within local communities.

- Mission Alignment: Supporting the 'Make Tomorrow Better' initiative and reinforcing corporate purpose.

Globe Life's success is significantly bolstered by strategic alliances with reinsurers, which are vital for managing risk and ensuring financial stability. These partnerships allow Globe Life to underwrite a broader range of policies by sharing the burden of potential large or catastrophic claims, thereby protecting its substantial revenue streams. In 2023, Globe Life's net premiums written reached $4.7 billion, highlighting the critical role reinsurance plays in safeguarding this income.

| Partnership Type | Key Function | Impact on Globe Life (2023/2024 Data) |

| Reinsurers | Risk management, offloading catastrophic claims exposure | Safeguards $4.7 billion in net premiums written (2023) |

| Agents (Independent & Captive) | Direct sales, customer acquisition in middle/lower-middle income markets | Drove growth to over 5.9 million in-force policies (2023) |

| Marketing & Lead Generation Firms | Targeted customer outreach, digital and direct mail campaigns | Supplies leads for agent network, supports direct response strategy |

| Technology & Software Providers | Operational efficiency, policy administration, claims processing | Aims to reduce processing times by 15% (2024) through automation |

| Community Organizations & Sports Franchises | Brand visibility, community engagement, mission alignment | Enhances brand presence with fan bases of Texas Rangers, Dallas Cowboys, etc. |

What is included in the product

A detailed breakdown of Globe Life's insurance and financial services operations, focusing on its direct-to-consumer sales channels and a wide range of affordable life insurance products for the middle-income market.

Provides a structured framework to identify and address critical gaps in Globe Life's value proposition and customer relationships, thereby alleviating potential market friction.

Offers a clear roadmap to pinpoint and resolve operational inefficiencies and revenue stream weaknesses within Globe Life's strategic approach.

Activities

Globe Life's core activities include the continuous creation and enhancement of life and supplemental health insurance products. They focus on serving the middle and lower-middle-income segments of the American population. This process relies heavily on actuarial analysis to price policies fairly and risk assessment to manage potential losses. In 2023, Globe Life reported a net income of $1.15 billion, demonstrating the success of their product offerings and underwriting practices.

A crucial element is their efficient underwriting. This involves assessing the health and lifestyle of applicants to determine risk accurately. Globe Life leverages technology, including artificial intelligence, to streamline this process, allowing them to issue policies more quickly and cost-effectively. This focus on efficient underwriting contributes to their ability to maintain competitive pricing for their extensive customer base.

Globe Life's key activity of policy administration and claims processing is the backbone of its customer service. This involves meticulously managing millions of active policies, ensuring accurate record-keeping and prompt benefit disbursement. For instance, in 2023, Globe Life serviced over 4.7 million policies, a testament to the scale of their operational capacity in this area.

Efficient claims processing is paramount for policyholder satisfaction and loyalty, directly impacting retention rates. Globe Life's streamlined back-office operations, including claims handling, contribute significantly to their cost-effective business model. This operational efficiency allows them to maintain competitive pricing while delivering reliable service.

Agent recruitment, training, and management are paramount for Globe Life. Their success hinges on a vast network of independent and captive agents. This continuous investment in agent development is vital for a skilled and motivated sales force, directly fueling sales and market reach.

In 2024, Globe Life continued to emphasize building and supporting its agent network. The effectiveness of these agents is a core driver of their multi-channel distribution strategy, ensuring consistent market penetration and sales growth.

Direct Response Marketing Campaigns

Globe Life's key activity in direct response marketing involves orchestrating massive mail and digital advertising campaigns. These efforts are designed to directly capture customer interest, generate leads, and ultimately drive sales. This continuous process requires meticulous planning and execution to reach a broad audience and convert them into policyholders.

The company focuses intensely on optimizing these campaigns. This means constantly analyzing performance metrics to improve cost-effectiveness and boost conversion rates. For instance, in 2023, Globe Life reported that its marketing and advertising expenses contributed to the acquisition of a significant number of new customers, underscoring the importance of this activity.

- Customer Acquisition: Direct mail and digital ads are primary channels for reaching and signing up new policyholders.

- Campaign Management: Designing, launching, and managing large-scale marketing initiatives is crucial.

- Performance Optimization: Continuously refining campaigns for better cost per acquisition and higher conversion rates is vital.

- Lead Generation: Generating a steady stream of qualified leads through targeted advertising is a core function.

Investment Management of Policy Reserves

Globe Life’s key activity of managing policy reserves involves strategically investing the substantial funds collected from policy premiums. This ensures the company can meet its future obligations to policyholders while generating returns. The primary focus is on a diversified portfolio, heavily weighted towards fixed-maturity securities.

These investments are crucial for both solvency and profitability. Prudent management of these reserves directly bolsters Globe Life's financial strength and contributes significantly to its overall earnings. For instance, as of the first quarter of 2024, Globe Life reported total invested assets of approximately $102.8 billion, underscoring the scale of this activity.

- Investment Strategy: Primarily investing in fixed-maturity securities to ensure stability and income generation.

- Diversification: Spreading investments across various asset classes to mitigate risk and optimize returns.

- Solvency Assurance: Maintaining sufficient assets to cover all policyholder obligations.

- Profitability Contribution: Generating investment income that enhances the company's bottom line.

Globe Life's key activities center on building and maintaining its extensive insurance product portfolio and distribution network. This includes the ongoing development of life and health insurance products tailored for the middle-income market, supported by rigorous actuarial analysis. Their operational efficiency is further demonstrated by their ability to manage millions of policies and process claims swiftly, which is crucial for customer satisfaction and retention. In 2023, the company serviced over 4.7 million policies, highlighting the scale of their administrative capabilities.

A significant focus is placed on agent recruitment, training, and ongoing support to ensure a motivated and effective sales force. This network is fundamental to their market penetration. Furthermore, Globe Life excels in direct response marketing, employing large-scale mail and digital campaigns to acquire customers. In 2024, the company continued its emphasis on agent network development, recognizing its critical role in driving sales and expanding market reach.

Strategic investment management is another core activity, involving the prudent investment of policy premiums, primarily in fixed-maturity securities, to ensure solvency and generate returns. As of the first quarter of 2024, Globe Life managed approximately $102.8 billion in total invested assets, illustrating the substantial capital managed through this key function.

| Key Activity | Description | 2023/2024 Relevance |

|---|---|---|

| Product Development & Actuarial Analysis | Creating and enhancing insurance products; pricing policies based on risk. | Net income of $1.15 billion in 2023 reflects successful product strategy. |

| Efficient Underwriting | Assessing applicant risk using technology like AI for rapid policy issuance. | Streamlines operations, enabling competitive pricing. |

| Policy Administration & Claims Processing | Managing active policies and disbursing benefits promptly. | Serviced over 4.7 million policies in 2023, ensuring customer satisfaction. |

| Agent Network Management | Recruiting, training, and supporting a large sales force. | Continued emphasis in 2024 on agent development for sales growth. |

| Direct Response Marketing | Executing large-scale mail and digital campaigns for customer acquisition. | Critical for lead generation and sales conversion; marketing expenses drove significant customer acquisition in 2023. |

| Investment Management (Policy Reserves) | Investing premiums, mainly in fixed-maturity securities, for solvency and profit. | Managed approximately $102.8 billion in invested assets in Q1 2024. |

Preview Before You Purchase

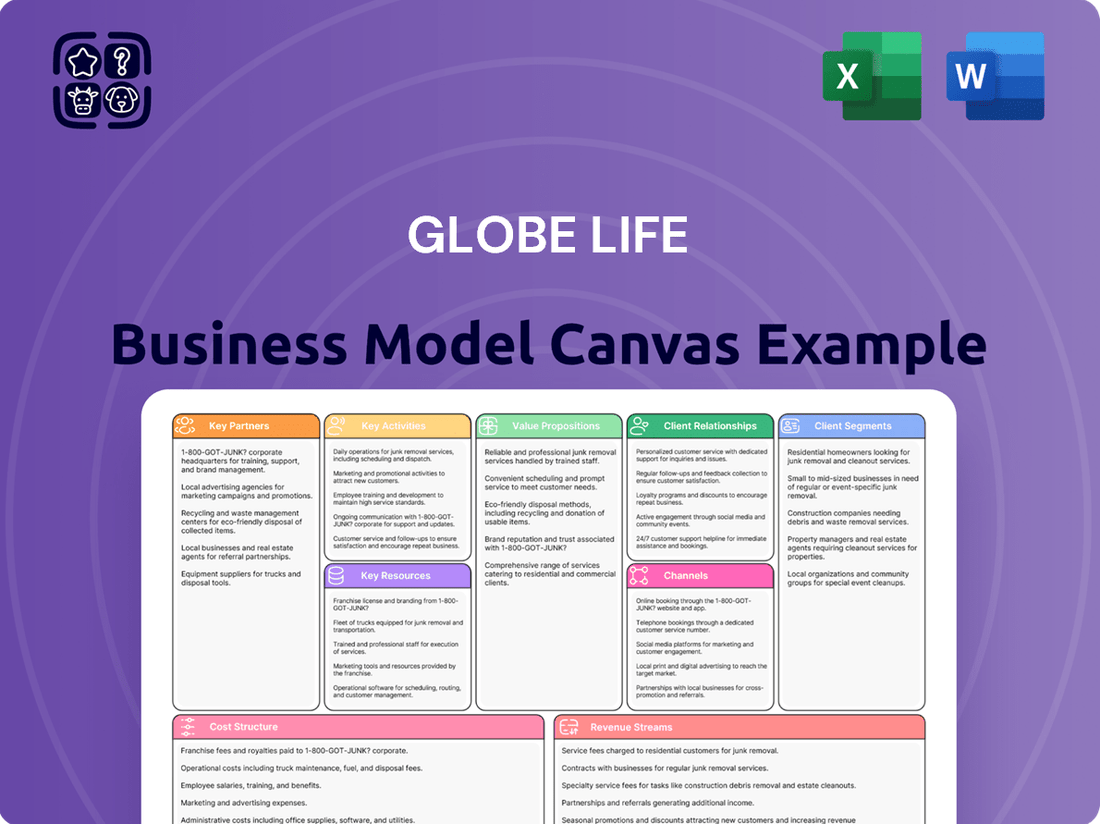

Business Model Canvas

The Business Model Canvas you're previewing is the actual, complete document you will receive after purchase. This isn't a sample or a mockup; it's a direct representation of the file you'll download, structured and formatted identically. You'll gain full access to this comprehensive business model, ready for your immediate use and customization.

Resources

Globe Life's substantial financial capital, notably its policy reserves and a meticulously managed investment portfolio, forms the bedrock of its operations. As of the first quarter of 2024, Globe Life reported total investments of $10.4 billion, underscoring the scale of assets dedicated to fulfilling policyholder promises and generating returns.

This robust financial foundation is critical. It allows Globe Life to comfortably meet its long-term obligations to policyholders, ensuring trust and stability. Furthermore, these invested assets are instrumental in generating significant investment income, a key component that supplements premium revenue.

The company's strong balance sheet, bolstered by these financial resources, is not merely a measure of financial health but a strategic imperative. It underpins Globe Life's capacity to underwrite new business effectively and maintain its market position, particularly in the competitive life insurance sector.

Globe Life's business model hinges on its robust human capital, a network including numerous agents, actuaries, and dedicated staff. In 2024, the company continued to leverage its vast agent force, which serves as the primary customer interface for sales and service. These agents are crucial for reaching diverse markets.

Actuaries form another critical component, providing the analytical backbone for product development and risk management. Their expertise ensures that Globe Life's insurance products are competitively priced and financially sound, a key factor in maintaining profitability and solvency.

The administrative and support staff are equally vital, ensuring smooth operations from policy issuance to claims processing. Their collective efforts in 2024 supported the company's sales growth and commitment to excellent customer service, driving overall operational efficiency.

Globe Life's proprietary direct response marketing capabilities are a cornerstone of its business model. This involves specialized knowledge and unique intellectual property in crafting marketing campaigns that elicit an immediate and measurable response from consumers. This is a significant competitive edge.

At the heart of these capabilities lies sophisticated data analytics. Globe Life leverages this to meticulously target potential customers, ensuring marketing efforts are directed towards those most likely to convert. This precision allows for optimized campaign execution, maximizing return on investment.

The company's ability to generate a high volume of leads efficiently is a direct outcome of these advanced marketing strategies. For instance, in 2023, Globe Life reported a substantial number of new customers acquired through these very channels, demonstrating the effectiveness and scalability of their approach.

Technology Infrastructure and Data Analytics

Globe Life's technology infrastructure, a cornerstone of its operations, includes sophisticated policy administration systems, robust customer relationship management (CRM) tools, and advanced data analytics platforms. These systems are essential for managing a vast portfolio of insurance policies, nurturing customer relationships, and extracting actionable insights from complex datasets. For instance, in 2024, Globe Life continued to invest heavily in modernizing these core systems to ensure scalability and efficiency.

These technological assets directly support Globe Life's ability to operate efficiently, from policy issuance to claims processing, while simultaneously enhancing the customer experience through personalized interactions and streamlined service. The data analytics capabilities, in particular, empower strategic decision-making by identifying market trends, assessing risk more accurately, and optimizing product development. Globe Life's commitment to this area is reflected in its ongoing digital transformation initiatives aimed at improving both internal processes and external customer engagement.

- Policy Administration Systems: Streamline the management of insurance policies, including underwriting, billing, and policyholder services.

- Customer Relationship Management (CRM): Facilitate personalized customer interactions, track customer journeys, and manage sales pipelines effectively.

- Data Analytics Platforms: Enable in-depth analysis of policyholder data, market trends, and operational performance to inform strategic planning and risk assessment.

- Continuous Investment: Ensures these critical systems remain up-to-date, secure, and capable of supporting future growth and innovation in a competitive landscape.

Brand Reputation and Trust

Globe Life's established brand reputation and the trust it has meticulously built with its customer base are paramount resources. This strong reputation directly translates into customer loyalty, making it easier to secure new policyholders and attract high-caliber sales agents who value associating with a trusted name. For instance, Globe Life consistently ranks high in customer satisfaction surveys, reflecting the trust placed in their services.

The company's unwavering commitment to delivering consistent service and upholding its mission of offering affordable financial protection is the bedrock of this invaluable intangible asset. This dedication not only retains existing customers but also acts as a powerful magnet for new ones, driving sustained growth. As of the first quarter of 2024, Globe Life reported a policyholder retention rate exceeding 90%, a testament to this cultivated trust.

- Brand Strength: Globe Life's reputation reduces customer acquisition costs and supports premium pricing.

- Agent Attraction: A trusted brand makes it easier to recruit and retain a productive sales force.

- Customer Loyalty: High trust levels foster long-term customer relationships and repeat business.

- Market Perception: Positive brand image enhances Globe Life's standing against competitors.

Globe Life's key resources are its substantial financial capital, including a significant investment portfolio, its dedicated human capital comprising a large agent force and expert actuaries, its proprietary direct response marketing capabilities powered by data analytics, its robust technology infrastructure for policy administration and customer management, and its strong brand reputation built on trust and consistent service.

The financial capital, with $10.4 billion in total investments as of Q1 2024, underpins the ability to meet obligations and generate income. Human capital ensures effective sales and risk management. Marketing capabilities drive customer acquisition, while technology supports efficient operations and customer experience. The brand reputation fosters loyalty and agent attraction.

These resources collectively enable Globe Life to underwrite new business, maintain market position, and achieve operational efficiency and customer satisfaction. The high policyholder retention rate, exceeding 90% as of Q1 2024, directly reflects the strength of these foundational elements.

Value Propositions

Globe Life's core offering revolves around providing life and supplemental health insurance that is both accessible and budget-friendly. This directly tackles the challenge many middle and lower-middle-income families face in affording essential financial protection.

By prioritizing affordability, Globe Life makes crucial insurance coverage a realistic option for a much wider population, ensuring more individuals and families can secure peace of mind. In 2024, Globe Life continued to serve millions of policyholders, demonstrating the demand for these cost-effective solutions in the American market.

Globe Life's value proposition centers on making insurance accessible. Their simplified application process cuts through the complexity often associated with buying policies, removing a major hurdle for many consumers. This straightforward approach is designed to appeal to individuals who might otherwise be deterred by lengthy underwriting or confusing industry terms.

By offering easy-to-understand policy options, Globe Life addresses a common pain point in the insurance market. This clarity not only improves the customer experience but also directly contributes to sales by making the purchasing decision less daunting. For instance, in 2023, Globe Life reported its highest-ever net income, reaching $1.15 billion, demonstrating the effectiveness of its streamlined model in attracting and retaining customers.

Globe Life provides fundamental financial protection, acting as a crucial safety net for families facing unexpected events such as death or serious illness. This core offering delivers invaluable peace of mind and enhanced security, guaranteeing that designated beneficiaries receive essential financial support when it's needed most.

Their insurance products are specifically crafted to deliver vital financial benefits during critical life moments. For instance, in 2023, Globe Life’s life insurance segment alone generated over $1.2 billion in net written premium, demonstrating the significant financial security they provide to policyholders.

Accessibility Through Multiple Distribution Channels

Globe Life ensures its insurance products reach a wide audience by utilizing several key distribution channels. This multi-channel strategy caters to different customer preferences and buying habits, making their offerings highly accessible.

The company leverages direct response marketing, which includes mail and online channels, appealing to individuals who prefer to research and purchase independently. This approach saw significant engagement in 2024, with direct response marketing contributing substantially to new policy acquisitions.

Additionally, Globe Life relies on a robust network of independent agents who can offer a broader range of financial services and personalized advice. These agents play a crucial role in reaching segments of the market that value human interaction and expert guidance.

The presence of captive agencies further strengthens Globe Life's reach, providing a dedicated sales force focused solely on their product suite. This focused approach allows for deeper product expertise and a more streamlined customer experience.

- Direct Response: Caters to individuals preferring self-service and convenience.

- Independent Agents: Offers personalized advice and broader financial solutions.

- Captive Agencies: Provides focused product expertise and a dedicated sales experience.

- Broad Accessibility: Ensures customers can choose their preferred method of engagement.

No Medical Exam Options and Guaranteed Issue

Globe Life's value proposition of no medical exam options significantly streamlines the path to obtaining insurance, making it more accessible for a broader audience. This approach removes a common barrier, allowing individuals to secure coverage more quickly and with less hassle. For instance, in 2023, Globe Life reported strong growth in its life insurance segment, partly attributed to these simplified underwriting processes.

The guaranteed issue aspect of certain Globe Life products provides a critical safety net, offering coverage even when an individual's health history might otherwise prevent them from qualifying. This is particularly valuable for older individuals or those with pre-existing conditions. In 2024, the demand for guaranteed issue policies is projected to remain robust as awareness of health disparities grows.

These features directly address key customer pain points:

- Accessibility: No medical exam requirements open doors for those who find traditional underwriting daunting or time-consuming.

- Inclusivity: Guaranteed issue ensures that individuals, regardless of their health status, can access essential protection.

- Simplicity: The application process is designed to be straightforward, enhancing the customer experience.

- Peace of Mind: Knowing coverage is secured, especially with guaranteed issue, offers significant emotional and financial security.

Globe Life's value proposition fundamentally centers on making essential insurance coverage accessible and affordable. They simplify the often-complex process of obtaining life and health insurance, removing common barriers like medical exams for many of their products. This focus ensures that individuals and families, particularly those in the middle and lower-middle-income brackets, can secure vital financial protection without undue stress or prohibitive costs.

The company's commitment to providing guaranteed issue options further broadens its appeal, offering a crucial safety net for those whose health conditions might otherwise preclude them from obtaining coverage. This inclusive approach, combined with straightforward policy offerings, directly addresses customer needs for simplicity and peace of mind. In 2023, Globe Life's net written premiums for life insurance alone exceeded $1.2 billion, underscoring the significant market demand for their accessible insurance solutions.

Globe Life's distribution strategy is a key component of its value proposition, ensuring broad reach and customer choice. They effectively utilize direct response marketing, appealing to consumers who prefer a self-service approach, as well as a network of independent and captive agents who provide personalized guidance and focused expertise. This multi-faceted approach allows Globe Life to connect with a diverse customer base, meeting them where they are most comfortable. In 2024, their direct response channels continued to be a significant driver of new policy acquisitions.

| Value Proposition Component | Description | Impact | 2023 Data Point |

|---|---|---|---|

| Affordable & Accessible Insurance | Provides budget-friendly life and supplemental health insurance. | Opens essential financial protection to a wider demographic. | Net income of $1.15 billion. |

| Simplified Underwriting | Offers no-medical-exam and guaranteed issue options. | Reduces barriers and speeds up the insurance acquisition process. | Strong growth in life insurance segment. |

| Clear & Straightforward Policies | Presents easy-to-understand insurance products. | Enhances customer experience and reduces purchase hesitation. | Net written premiums in life insurance exceeded $1.2 billion. |

| Multi-Channel Distribution | Leverages direct response, independent agents, and captive agencies. | Ensures broad market reach and caters to diverse customer preferences. | Continued engagement through direct response marketing in 2024. |

Customer Relationships

Globe Life leverages direct mail and telemarketing as foundational pillars for customer acquisition and engagement. These channels are instrumental in reaching their core demographic, facilitating direct communication for policy offers and initial sales. In 2023, Globe Life reported significant success with these outreach methods, contributing to their substantial policyholder base. This direct approach allows for personalized messaging and efficient customer onboarding.

Globe Life's customer relationships are heavily shaped by its extensive network of independent and captive agents, who serve as the primary point of contact for policyholders. These agents cultivate personalized connections, fostering trust and providing essential ongoing support.

This agent-led approach is crucial for building lasting loyalty and effectively addressing the unique needs of each customer. For instance, in 2024, Globe Life continued to emphasize this personal interaction as a cornerstone of its customer engagement strategy.

Globe Life leverages dedicated customer service call centers to manage policyholder needs, from initial inquiries to processing policy changes and claims. This direct line of support is crucial for building trust and ensuring policyholders feel supported throughout their relationship with the company.

In 2023, Globe Life's customer service interactions were a significant factor in policy retention. A responsive and helpful call center experience directly impacts a policyholder's likelihood to continue their coverage, underscoring its importance in maintaining a stable customer base.

These centers are designed for efficiency, aiming to resolve issues promptly and accurately. Quick turnaround times on requests and claims are vital for customer satisfaction and can differentiate Globe Life from competitors in the insurance market.

Effective call center operations contribute to Globe Life's value proposition by providing accessible and reliable assistance. This commitment to service reinforces the company's reputation and plays a key role in fostering long-term customer loyalty, a cornerstone of its business model.

Online Self-Service Portals

Globe Life leverages online self-service portals to empower policyholders. These platforms allow customers to effortlessly manage their insurance policies, submit premium payments, and access important policy documents at their convenience. This digital approach significantly enhances customer experience by offering immediate access and control over their accounts. By enabling customers to handle routine tasks independently, Globe Life streamlines operations and reduces the reliance on traditional customer service channels.

The digital transformation benefits both the customer and the company. For customers, it means 24/7 access to policy information and payment options, eliminating wait times and offering unparalleled convenience. For Globe Life, these portals contribute to operational efficiency. For instance, in 2024, companies across the insurance sector saw a significant increase in digital self-service adoption. Many reported that over 60% of customer inquiries related to policy management were resolved through online channels, thereby freeing up call center resources for more complex issues.

Key features of Globe Life's online self-service portals include:

- Policy Management: Customers can view policy details, update personal information, and track coverage status.

- Payment Processing: Secure and convenient online payment options for premiums.

- Document Access: Easy retrieval of policy statements, certificates, and other essential documents.

- Customer Support: Access to FAQs and contact information for further assistance.

Ongoing Policyholder Communication

Globe Life prioritizes continuous engagement with its policyholders. This is achieved through regular distribution of renewal notices, account statements, and various informational materials designed to keep policyholders fully apprised of their coverage details and policy status. Such consistent outreach fosters transparency and underscores the enduring value proposition of their insurance plans.

- Renewal Notices: These are critical touchpoints for policy continuation.

- Account Statements: Providing clarity on policy performance and premium payments.

- Informational Materials: Educating policyholders on benefits and company updates.

- Relationship Building: Fostering loyalty and minimizing policyholder attrition.

In 2024, Globe Life continued to leverage these communication channels to maintain strong customer relationships. This proactive approach is instrumental in reinforcing policy value and is a key factor in their strategy to reduce customer churn, a common challenge in the insurance sector.

Globe Life cultivates customer relationships through a multi-faceted approach, blending direct outreach with personalized agent interactions and robust digital self-service options. This strategy aims for consistent engagement and support.

Channels

Globe Life's business model heavily relies on direct response marketing, utilizing channels like direct mail and television commercials to connect with a broad customer base. This approach is crucial for their strategy of acquiring customers, especially within their direct-to-consumer operations. In 2023, Globe Life's direct response marketing efforts, particularly in life insurance, contributed significantly to their policy growth.

This direct response strategy is designed for scalability and effective lead generation, offering affordable products to a wide market. The company’s consistent use of these channels underscores their commitment to a direct-to-consumer acquisition model. For instance, their extensive use of direct mail and TV ads in 2024 continues to be a primary driver for reaching new policyholders.

Globe Life leverages a vast network of independent agents to distribute its life and supplemental health insurance products. This distribution channel is fundamental to their strategy, allowing for localized market penetration and personalized customer engagement. These agents are the face of Globe Life in communities, fostering trust through direct, in-person interactions.

In 2024, Globe Life continued to rely heavily on this agent-driven model. The company reported that its independent agent force, numbering in the tens of thousands, was instrumental in achieving its sales targets. This network’s ability to build rapport and explain complex insurance options directly to potential policyholders remains a core competitive advantage.

Globe Life leverages its captive agency force, featuring divisions such as American Income Life, Liberty National, and Family Heritage, as a core component of its distribution strategy. These exclusive agents are dedicated solely to selling Globe Life's product suite, fostering deep product knowledge and a consistent brand message. This controlled channel is crucial for maintaining quality assurance and specialized sales training.

In 2024, Globe Life's captive agents played a significant role in its robust sales performance. For example, American Income Life, a key captive division, consistently reported strong policy sales, contributing substantially to the company's overall premium growth. This direct sales force allows Globe Life to maintain tight control over customer acquisition and product presentation.

Online and Digital Platforms

Globe Life leverages its corporate website and dedicated digital sales platforms as increasingly crucial channels. These online avenues facilitate direct-to-consumer sales, enabling efficient distribution of their insurance products. They also serve as vital hubs for disseminating policy information and offering robust customer self-service options.

The convenience offered by these digital channels is paramount, catering to a growing segment of the population that prefers online interactions. By providing accessible information and streamlined purchase processes, Globe Life enhances its reach and appeals to a tech-savvy demographic.

- Direct-to-Consumer Sales: Facilitates direct policy purchases online.

- Information Dissemination: Provides comprehensive product details and company information.

- Customer Self-Service: Empowers customers to manage policies and access support digitally.

- Digital Engagement: Caters to a tech-savvy customer base seeking convenience.

Telemarketing and Inside Sales

Telemarketing and inside sales are crucial for Globe Life, acting as direct touchpoints to connect with potential policyholders and facilitate the application process. These teams bridge the gap left by direct mail campaigns, offering immediate engagement and a more personalized approach to sales conversion.

This direct interaction allows for on-the-spot clarification of policy details and addresses customer inquiries efficiently, significantly boosting the likelihood of a sale. In 2024, Globe Life continued to leverage these channels, with their inside sales force playing a key role in converting leads generated through various marketing efforts. The efficiency of these teams directly impacts the company's ability to expand its customer base and maintain its growth trajectory in the competitive life insurance market.

- Direct Customer Engagement: Telemarketing and inside sales provide a personal connection, enhancing customer understanding and trust.

- Sales Conversion: These channels are vital for converting interest generated by other marketing efforts into actual policy sales.

- Efficiency and Reach: They allow Globe Life to efficiently reach a broad audience and process applications quickly.

- 2024 Impact: Inside sales teams were instrumental in Globe Life's continued market presence and sales performance throughout 2024.

Globe Life's distribution strategy is multifaceted, employing both direct-to-consumer marketing and a robust agent network. This dual approach allows for broad market reach and personalized customer engagement, a key driver of their sustained growth. In 2024, the company continued to invest in these channels, recognizing their individual strengths in acquiring and retaining policyholders.

The company's success is built on reaching diverse customer segments through various means. Direct marketing captures a wide audience, while independent and captive agents provide specialized, face-to-face interactions. Digital platforms are also increasingly vital, catering to modern consumer preferences for online engagement and self-service.

Globe Life's commitment to a direct sales force, including both captive and independent agents, remains a cornerstone of its business model. These agents are crucial for explaining product benefits and building customer relationships, especially for life and supplemental health insurance. Their efforts in 2024 directly contributed to the company's policy count growth.

The company's digital presence, including its corporate website and online sales platforms, is a growing channel for direct-to-consumer sales. These platforms offer convenience and accessibility, allowing customers to learn about and purchase policies efficiently. In 2024, these digital avenues saw increased utilization by consumers seeking streamlined insurance solutions.

| Channel Type | Key Characteristics | 2024 Focus/Impact |

|---|---|---|

| Direct Response Marketing | Mass market reach via mail, TV; lead generation | Continued significant policy growth driver |

| Independent Agents | Localized penetration, personalized service | Tens of thousands of agents instrumental in sales targets |

| Captive Agents (e.g., AIL, Liberty National) | Exclusive sales, deep product knowledge, brand consistency | Key divisions like AIL reported strong policy sales |

| Digital Platforms (Website, Online Sales) | Direct-to-consumer sales, information, self-service | Increasingly crucial for tech-savvy demographic |

| Telemarketing & Inside Sales | Direct engagement, application processing, conversion | Instrumental in converting leads and expanding customer base |

Customer Segments

Middle-income American households represent Globe Life's core customer base, with a strong emphasis on providing accessible and affordable life insurance. This demographic, often characterized by families with one or two earners and a desire for financial security, actively seeks straightforward protection. For instance, in 2024, the median household income in the United States hovered around $75,000, a figure that underscores the budget-conscious nature of this segment.

Globe Life's strategy resonates with these households by offering life insurance policies that are easy to understand and manage, avoiding the intricate details often found in more complex financial products. The company understands that for many middle-income families, the priority is securing a safety net against unexpected events, ensuring their loved ones are protected without straining their monthly budget. This focus on simplicity and affordability is key to their market penetration.

Globe Life strategically targets lower-middle-income American households, a segment often overlooked by mainstream insurers. In 2024, this demographic represents a substantial portion of the U.S. population, with median household incomes typically falling between $40,000 and $75,000 annually, making affordability a critical factor in their purchasing decisions.

The company's success hinges on offering insurance products that are both accessible and easy to understand, removing common barriers for this customer base. Globe Life's commitment to simplified underwriting and competitive pricing directly addresses the financial realities of these families.

This dedicated focus on affordability and ease of access grants Globe Life a significant competitive edge. By catering to the specific needs and financial constraints of lower-middle-income households, Globe Life builds strong customer loyalty and market share in a segment that values practical, budget-friendly solutions.

Globe Life focuses on individuals who need fundamental life insurance protection, not complicated policies. These customers want a simple way to ensure their families are financially secure if something happens to them. For example, in 2023, Globe Life's net income reached $1.14 billion, reflecting the demand for their accessible insurance solutions.

The company’s core strength lies in providing essential coverage that is easy to understand and purchase. This appeals to a broad market segment that values straightforwardness. In the first quarter of 2024, Globe Life reported a 7% increase in premium persistency, indicating customers find ongoing value in their basic coverage.

Families Needing Supplemental Health Benefits

Globe Life serves families who are looking for extra health benefits to help with medical costs that their main insurance doesn't fully cover. These families prioritize financial security, wanting a safety net for unexpected health expenses. In 2024, the average deductible for employer-sponsored health plans in the US was around $1,700 for individuals and over $3,300 for families, highlighting the need for supplemental coverage.

This customer segment appreciates how Globe Life's products can fill the gaps in their existing coverage, making healthcare more affordable. They seek peace of mind knowing they can manage deductibles, copayments, and coinsurance without significant financial strain. For instance, critical illness policies can provide a lump sum payment to offset major medical bills, a significant concern for households with children.

- Financial Protection: Families value supplemental insurance for its ability to cover out-of-pocket medical expenses not met by primary plans.

- Reduced Financial Burden: Products are designed to ease the financial impact of unexpected health events.

- Complementary Coverage: Globe Life's offerings work alongside existing health insurance to provide a more robust safety net.

- Peace of Mind: This segment seeks reassurance against high deductibles and copays, especially in 2024's economic climate where healthcare costs remain a concern.

Consumers Valuing Convenience and Simplicity

A significant customer base for Globe Life comprises individuals who highly value a streamlined and uncomplicated insurance acquisition process. This preference is directly addressed by Globe Life's direct response marketing approach, which bypasses traditional intermediaries. For instance, in 2023, Globe Life reported a substantial portion of its new business originated through its direct-to-consumer channels, underscoring the appeal of this convenient method.

These consumers are drawn to the straightforwardness of Globe Life's product portfolio, particularly its no-medical-exam policies. This simplifies the application journey, removing a common barrier for many potential policyholders. The company’s focus on ease of enrollment resonates with those seeking quick and accessible coverage without extensive medical underwriting.

- Direct Response Model: Facilitates easy access to insurance products.

- No-Medical-Exam Policies: Simplifies the application process.

- Convenience Focus: Appeals to time-conscious consumers.

- Streamlined Offerings: Reduces complexity in insurance choices.

Globe Life's customer segments primarily include middle-income American households seeking affordable and straightforward life insurance. They also target lower-middle-income individuals who may be overlooked by traditional insurers, emphasizing ease of access and competitive pricing. Furthermore, the company serves families needing supplemental health benefits to cover out-of-pocket medical costs, appreciating coverage that complements existing plans.

A key differentiator is Globe Life's focus on individuals who value a simple, direct-to-consumer purchasing experience, often opting for policies with no medical exams. This approach appeals to those prioritizing convenience and a streamlined application process. The company’s success in 2023, with over 5.8 million policies in force, highlights the broad appeal of its accessible insurance solutions across these diverse segments.

| Customer Segment | Key Characteristics | Needs Addressed | Supporting Data (2023/2024) |

| Middle-Income Households | Families seeking financial security, budget-conscious | Affordable life insurance, simple coverage | Median US Household Income ~ $75,000 (2024) |

| Lower-Middle-Income Households | Budget-constrained, value accessibility | Easy-to-understand, accessible insurance | Significant portion of US population, income $40k-$75k (2024) |

| Families needing Supplemental Health Benefits | Seeking to cover medical costs not met by primary insurance | Gap coverage for deductibles, copays | Average health plan deductible ~ $3,300+ for families (2024) |

| Value-Conscious Consumers | Prioritize convenience, simple processes | No-medical-exam policies, direct purchase | Substantial new business via direct-to-consumer channels (2023) |

Cost Structure

Globe Life's cost structure heavily features agent commissions and incentives. These payments are a direct reflection of sales success, meaning higher sales volume translates to higher commission payouts. For instance, in the first quarter of 2024, Globe Life reported that its selling, general, and administrative expenses, which include these agent costs, were a significant portion of its operating expenses.

The company's reliance on a large agency force means that the efficiency of these compensation plans is paramount to profitability. Globe Life carefully designs its incentive programs to motivate agents while keeping costs manageable. This delicate balance is key to sustaining the business model.

Globe Life allocates significant resources to marketing and advertising, a core component of its cost structure. These expenses are primarily directed towards direct response campaigns, aiming to directly engage potential customers and drive policy sales.

The company heavily invests in channels like direct mail, television commercials, and various digital advertising platforms. These efforts are crucial for generating a consistent flow of leads and acquiring new policyholders, forming a substantial portion of their operating costs.

In 2023, Globe Life reported advertising and marketing expenses of $772.2 million. This figure underscores the commitment to customer acquisition through broad outreach and targeted campaigns.

The effectiveness of these marketing expenditures is directly tied to Globe Life's ability to acquire new customers efficiently. Careful management and optimization of these costs are therefore vital for maintaining profitability and supporting business growth.

Claims payouts and policy benefits represent the most substantial cost for Globe Life, directly linked to fulfilling its contractual obligations to policyholders. These outflows are inherently variable, influenced by factors such as changes in mortality and morbidity rates, as well as the overall number of active policies. For instance, in the first quarter of 2024, Globe Life reported net life insurance policy benefits and reserves of $1.16 billion, highlighting the scale of these payouts.

Managing these significant, recurring expenses hinges on rigorous underwriting processes and sophisticated actuarial analysis. These disciplines are critical for accurately pricing policies and setting appropriate reserve levels, thereby mitigating the financial impact of unexpected claims. Globe Life's strategy relies on maintaining a healthy balance between premium income and the anticipated cost of future claims, a delicate but essential act for profitability and solvency.

Policy Administration and Operational Costs

Globe Life's cost structure is significantly influenced by policy administration and operational expenses. These encompass the ongoing costs of managing policies, providing customer support, and the general overhead required to run the business. For instance, in 2023, Globe Life reported operating expenses of $3.3 billion, a substantial portion of which is allocated to these administrative functions.

Key components of these operational costs include investments in technology, such as IT systems for policy management and data processing, as well as human resources, covering salaries and benefits for administrative staff. Facility costs, including office space and related utilities, also contribute to the overall expense base.

Maintaining a lean and efficient operational framework is crucial for Globe Life to manage these administrative expenditures effectively. By optimizing processes and leveraging technology, the company aims to control costs associated with policy administration and customer service, thereby supporting profitability.

- IT Systems: Investment in technology platforms for policy underwriting, claims processing, and customer relationship management.

- Human Resources: Costs related to staffing for policy administration, customer service centers, and back-office operations.

- Facilities Management: Expenses for office spaces, infrastructure, and utilities supporting administrative functions.

- Compliance and Regulatory: Costs associated with meeting industry regulations and reporting requirements.

Underwriting and Actuarial Expenses

Globe Life's cost structure significantly includes underwriting and actuarial expenses, which are crucial for assessing and pricing risk accurately. These costs encompass salaries for skilled actuaries and underwriters, along with investments in sophisticated data analysis tools and risk assessment models. For instance, in 2023, Globe Life reported significant operating expenses, with a portion directly attributable to these critical functions necessary for maintaining long-term profitability and solvency.

These expenses are not merely operational overhead; they are foundational to the company's ability to offer competitive insurance products while managing its exposure. The precision in actuarial analysis directly impacts the company's financial health, ensuring premiums are set appropriately to cover potential claims and operational costs.

- Underwriting Salaries: Compensation for professionals who evaluate insurance applications and determine risk.

- Actuarial Software & Tools: Costs associated with data analytics platforms and risk modeling software.

- Data Acquisition: Expenses for obtaining necessary data for risk assessment and pricing.

- Risk Management Models: Investment in developing and maintaining sophisticated models to predict and mitigate risk.

Globe Life's cost structure is largely driven by its primary revenue streams and operational necessities. Key expenses include commissions paid to its vast network of agents, which are performance-based and directly correlate with sales volume. The company also allocates substantial funds to marketing and advertising, particularly through direct response channels like television and mail, to acquire new policyholders.

Claims payouts and policy benefits represent the largest outflow, directly fulfilling contractual obligations to policyholders and influenced by mortality and morbidity trends. Underlying these are significant administrative and operational costs, encompassing IT systems, customer service, and general overhead necessary for managing a large policy base.

Furthermore, underwriting and actuarial expenses are critical for accurate risk assessment and pricing, ensuring the long-term solvency and profitability of the company. These costs are essential for the core business of providing insurance.

| Cost Category | Description | 2023 Data (Approximate) |

|---|---|---|

| Agent Commissions & Incentives | Performance-based payments to sales agents. | Significant portion of Selling, General & Administrative expenses. |

| Marketing & Advertising | Direct response campaigns (TV, mail, digital). | $772.2 million |

| Claims Payouts & Benefits | Fulfillment of policyholder obligations. | $1.16 billion (Q1 2024 net life insurance policy benefits and reserves) |

| Administration & Operations | Policy management, customer service, IT, HR, facilities. | Substantial portion of $3.3 billion (2023 Operating Expenses) |

| Underwriting & Actuarial | Risk assessment, pricing, data analysis tools. | Integral part of overall operating expenses. |

Revenue Streams

Globe Life's primary revenue engine is fueled by the premiums collected from its extensive portfolio of life insurance policies. These consistent payments from policyholders are the bedrock of the company's financial stability and growth. A robust increase in life premiums directly reflects Globe Life's expanding market reach and the trust placed in its offerings by consumers.

In 2024, Globe Life demonstrated significant strength in this core revenue area. The company reported a substantial increase in total life insurance premiums, a testament to its effective sales strategies and strong customer retention. This consistent premium flow allows for predictable earnings and supports ongoing business development and shareholder returns.

Globe Life generates substantial revenue from supplemental health insurance premiums, which complement its core life insurance offerings. These policies provide crucial extra coverage for various medical expenses, demonstrating a diversified and resilient revenue stream.

For instance, in the first quarter of 2024, Globe Life reported that its health premiums were a significant contributor to its overall financial performance, with a notable increase driven by strong policy sales. This growth underscores the market's consistent demand for specialized health coverage solutions.

Globe Life's investment income is a cornerstone of its revenue, stemming from the substantial portfolio of invested assets, largely comprised of policy reserves. This income primarily consists of interest earned on fixed-maturity investments and dividends received from other holdings.

In 2024, Globe Life's disciplined investment strategy continued to be a significant driver of profitability. The company actively manages its investment portfolio to generate consistent returns, ensuring the long-term financial health and stability required to meet its policyholder obligations.

Policy Fees and Charges

Globe Life also brings in revenue through various policy-related fees and charges. These can include things like administrative fees or extra charges for specific policy options that customers choose. While these amounts are usually less significant than the premiums people pay or the income from investments, they still add to the company's total earnings.

These fees, though smaller, play a role in Globe Life's financial health. For instance, in 2023, Globe Life reported that its net realized gain on investments was $165 million. While this isn't directly from fees, it highlights the diverse income streams that support the business. Policy fees, even if not explicitly broken out in top-line reports as a separate major category, are an integral part of the operational revenue.

Consider these policy fee categories:

- Administrative Fees: Covering the costs associated with managing policies.

- Surrender Charges: Applied when a policy is terminated early.

- Policy Loan Interest: Charged on any outstanding loans taken against the policy's cash value.

- Late Payment Fees: Incurred when premium payments are not made on time.

Reinsurance Ceded Commissions

Globe Life may benefit from reinsurance ceded commissions, where it receives payments from reinsurers for transferring a portion of its insured risks. This revenue stream, while typically smaller than direct premiums, provides an important offset to the costs associated with securing reinsurance coverage. It’s a mechanism that helps manage the overall expense of risk transfer, contributing to Globe Life's financial stability by making reinsurance more cost-effective. For instance, in 2023, Globe Life's net earnings were $1.23 billion, and while specific figures for ceded commissions aren't always broken out separately, this stream supports the profitability of their core insurance operations.

These commissions are essentially a fee paid to Globe Life for facilitating the reinsurance arrangement and for the expertise involved in managing the ceded business. This income directly supports the company's risk management strategy by making it financially advantageous to share large or complex risks with specialized reinsurers. It’s a recognized component in the economics of reinsurance, ensuring that the practice remains a viable tool for capital management and solvency protection within the insurance industry.

- Revenue Generation: Commissions received from reinsurers for ceding risks.

- Cost Offset: Helps reduce the net cost of reinsurance premiums.

- Risk Management Support: Enhances the financial viability of risk transfer strategies.

- Financial Stability: Contributes to overall profitability and capital efficiency.

Globe Life's diverse revenue streams are anchored by life insurance premiums, supplemented by health insurance premiums, and bolstered by investment income. Policy fees and reinsurance ceded commissions further contribute to its financial robustness.

In 2024, Globe Life saw continued growth in its core life insurance premiums, reflecting strong sales and customer retention. The company's health insurance segment also performed well, with increased policy sales demonstrating consistent market demand. Investment income remained a vital component, with disciplined portfolio management yielding steady returns.

| Revenue Stream | Description | 2024 Data/Trend |

|---|---|---|

| Life Insurance Premiums | Regular payments from life insurance policyholders. | Significant increase reported, indicating market expansion and customer trust. |

| Health Insurance Premiums | Payments for supplemental health coverage. | Notable increase driven by strong policy sales, highlighting demand for specialized coverage. |

| Investment Income | Earnings from the company's invested assets, primarily policy reserves. | Continued to be a significant driver of profitability through disciplined management. |

| Policy Fees & Charges | Revenue from administrative fees, surrender charges, etc. | Contribute to overall earnings, though typically smaller than premiums or investment income. |

| Reinsurance Ceded Commissions | Payments from reinsurers for transferring risk. | Provides an important offset to reinsurance costs and supports risk management strategies. |

Business Model Canvas Data Sources

The Globe Life Business Model Canvas is constructed using a blend of internal financial statements, customer demographic data, and competitive landscape analysis. This multi-faceted approach ensures a comprehensive and actionable representation of the business.