Globe Life Marketing Mix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Globe Life Bundle

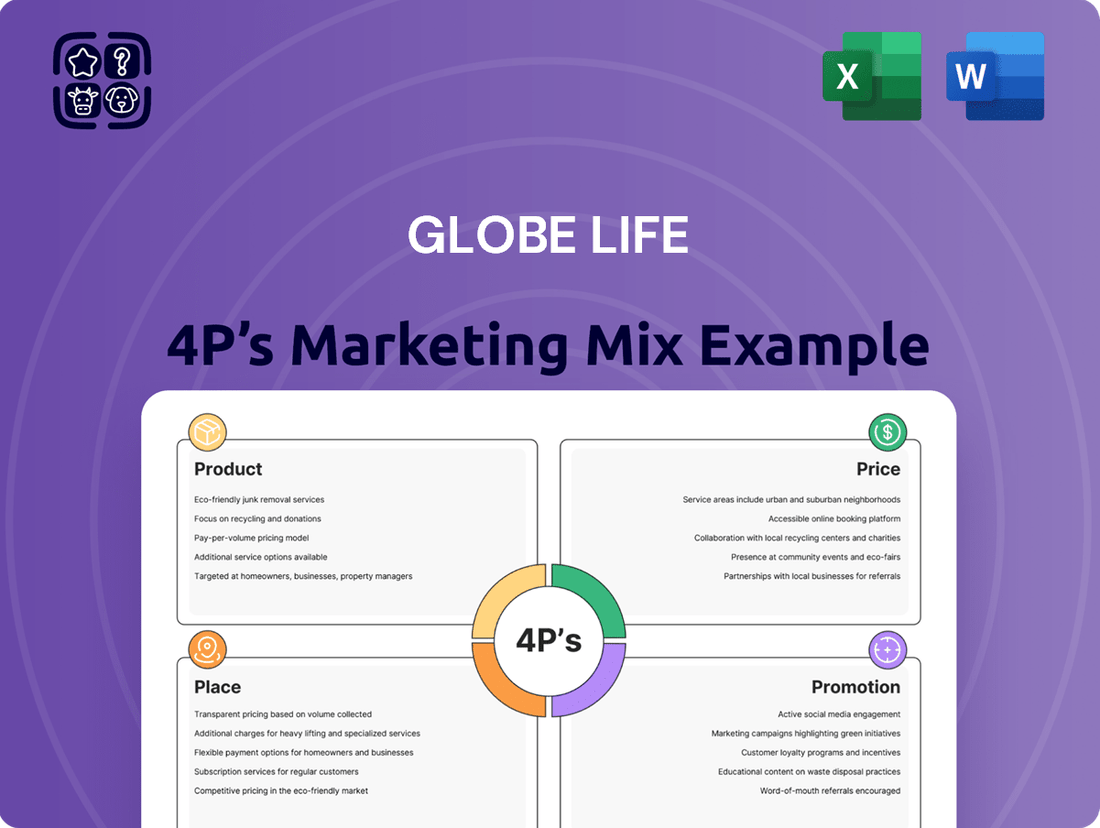

Globe Life's marketing success hinges on a carefully orchestrated 4Ps strategy. Their product offerings, designed for accessibility and affordability, resonate with a broad customer base seeking financial security. Price points are strategically set to offer value, making essential insurance products attainable for many.

The brand's distribution channels are optimized for reach, ensuring their services are readily available to those who need them most. Furthermore, Globe Life employs targeted promotional tactics to effectively communicate their value proposition and build trust.

Want to understand the intricate details of their product portfolio, pricing architecture, and promotional campaigns?

Unlock the complete Globe Life 4Ps Marketing Mix Analysis and gain actionable insights.

This comprehensive, editable report provides a deep dive into their market positioning and strategic execution.

Save hours of research and elevate your own marketing understanding by accessing this ready-made analysis today.

Product

Globe Life's product strategy centers on a diverse portfolio of life insurance, encompassing term, whole, and final expense policies. This range ensures they cater to varied customer needs, from short-term financial security to lifelong coverage and assistance with final arrangements.

In 2024, Globe Life continued its focus on providing accessible and affordable insurance solutions. Their offerings are particularly geared towards the middle and lower-middle-income segments, a demographic that often seeks straightforward financial protection without complex underwriting processes.

The company's success in 2023, with reported record earnings and a strong increase in net income to $1.3 billion, underscores the market's receptiveness to their product approach. This financial performance highlights the effectiveness of their strategy in meeting the demand for dependable, budget-friendly life insurance.

Globe Life’s supplemental health insurance products, including accident, cancer, ICU, critical illness, and hospital indemnity plans, represent a key element of their offering. These policies are strategically designed to complement primary health coverage, focusing on the out-of-pocket expenses that often arise from unexpected medical situations. For instance, a critical illness policy might provide a lump sum payment to help cover deductibles or lost income, offering immediate financial relief.

The core purpose of these supplemental plans is to bolster financial security for policyholders and their families during challenging health events. By addressing costs that may not be fully covered by traditional health insurance, Globe Life aims to mitigate the financial strain associated with medical treatments, hospital stays, or recovery periods. This focus on comprehensive protection ensures that individuals can manage the financial impact of illnesses or accidents more effectively.

In 2023, the supplemental health insurance market continued to show steady growth, with a significant portion of consumers seeking additional coverage for specific health risks. Globe Life's diverse range of these products aligns with this demand, catering to a broad spectrum of potential needs. For example, hospital indemnity plans can provide daily benefits for each day a policyholder is hospitalized, directly offsetting facility charges.

Globe Life's product development is intentionally designed to meet the financial realities of middle and lower-middle-income households in America. This strategic focus ensures that their insurance solutions are priced affordably, providing a vital safety net for individuals and families who might struggle to afford more premium coverage.

In 2023, the median household income in the United States was approximately $74,580. Globe Life's product suite, which includes life insurance, accident insurance, and critical illness insurance, is structured to offer accessible premiums within this income bracket, making essential financial protection a tangible possibility.

The company's commitment to this segment means they prioritize offering straightforward, easy-to-understand policies that address common financial concerns, such as income replacement for families or coverage for unexpected medical expenses, directly targeting the vulnerabilities faced by these income groups.

Simplified Underwriting Process

Globe Life's simplified underwriting is a significant advantage, allowing many policyholders to secure coverage without a medical exam. This streamlined approach, often relying on a health questionnaire, dramatically reduces the time and effort required to obtain insurance. For instance, in 2024, Globe Life continued to see strong uptake in its guaranteed issue and simplified issue products, contributing to its consistent growth in policy count.

This focus on ease of access removes common obstacles, making insurance more attainable for a broader audience. By minimizing the need for medical examinations, Globe Life effectively lowers the barriers to entry, enhancing customer convenience and expediting the approval process. This strategy has been a cornerstone of their market penetration.

- Reduced Time to Coverage: Policies can often be issued within days, not weeks or months.

- Increased Accessibility: Opens doors for individuals who might delay or forgo insurance due to medical exam requirements.

- Lower Administrative Costs: Simplification reduces the internal resources needed for underwriting, potentially leading to cost savings.

- Customer Convenience: The process is designed to be user-friendly and less intrusive for applicants.

Value-Driven Design

Globe Life's product philosophy centers on value-driven design, meaning customers receive essential benefits without being burdened by complexity. This approach ensures that policies are straightforward and focus on providing meaningful protection. For instance, in 2024, Globe Life continued its strategy of offering accessible insurance solutions, aiming to meet fundamental financial security needs. The company's commitment is to deliver practical and effective insurance at competitive prices, making coverage understandable and directly addressing core customer requirements.

The emphasis on value translates into policies that are easy to comprehend, ensuring clients understand precisely the coverage they are purchasing. This clarity is a cornerstone of their offering, aligning with their goal to provide practical financial tools. Globe Life's operational model, which often leverages direct-to-consumer channels, further supports this value proposition by minimizing overhead and passing those savings on. In the 2024 fiscal year, this strategy allowed them to maintain competitive pricing, reinforcing their reputation for delivering accessible and reliable insurance protection.

- Value Proposition: Essential benefits, simplified policies, competitive pricing.

- Customer Focus: Clarity and understanding of coverage to meet core insurance needs.

- 2024 Performance: Continued emphasis on accessible solutions and practical financial security.

- Operational Efficiency: Direct-to-consumer models contributing to cost-effectiveness and value.

Globe Life's product strategy emphasizes accessible, value-driven insurance solutions tailored for middle and lower-middle-income households. Their portfolio includes life insurance, supplemental health products, and emphasizes simplified underwriting, making coverage easier to obtain. This focus on clear, affordable policies addresses fundamental financial security needs.

In 2023, Globe Life reported record earnings of $1.3 billion, reflecting strong market demand for their product approach. The company's 2024 strategy continued to prioritize accessible insurance, with a focus on simplified and guaranteed issue products, contributing to consistent policy growth.

| Product Category | Key Features | Target Demographic | 2023 Performance Indicator |

|---|---|---|---|

| Life Insurance | Term, Whole, Final Expense | Middle/Lower-Middle Income | Record Earnings Growth |

| Supplemental Health | Accident, Cancer, Critical Illness, Hospital Indemnity | Individuals seeking coverage for out-of-pocket medical costs | Steady Market Demand |

| Underwriting Approach | Simplified, Guaranteed Issue (often no medical exam) | Individuals seeking quick and easy access to coverage | Strong Uptake in 2024 |

What is included in the product

This analysis offers a comprehensive examination of Globe Life's marketing strategies, detailing their product offerings, pricing structures, distribution channels, and promotional activities.

It provides actionable insights into Globe Life's market positioning and competitive advantages, serving as a valuable resource for strategic decision-making.

Provides a clear, concise overview of Globe Life's 4Ps marketing strategy, simplifying complex market dynamics to alleviate the pain point of understanding competitive positioning.

Acts as a readily accessible, actionable tool to address the challenge of translating marketing theory into tangible business benefits for Globe Life's sales teams.

Place

Globe Life leverages direct response channels like television commercials, direct mail, and online platforms to directly engage potential customers and drive policy acquisitions. This approach is crucial for their strategy, aiming for broad market penetration and customer convenience.

In 2023, Globe Life reported a significant portion of its business originated through these direct-to-consumer channels, with their American Income Life division alone seeing substantial growth in policies issued via direct mail and telemarketing, demonstrating the continued effectiveness of these methods in reaching a wide demographic.

The ease of applying and managing policies independently through these channels appeals to a large segment of their target market, allowing Globe Life to efficiently serve a vast customer base across diverse geographical locations.

Globe Life effectively utilizes its network of independent agents as a key component of its distribution strategy. These agents provide a crucial personal touch, helping customers navigate the complexities of insurance products. Their local presence and understanding of community needs allow for tailored policy recommendations.

This independent agent model enables Globe Life to reach a broad customer base across various demographics and geographic locations. In 2023, Globe Life's life insurance in-force policies grew to over 5.1 million, a testament to the effectiveness of its distribution channels, including its agent network.

Globe Life leverages exclusive captive agencies like American Income Life, Liberty National, and Family Heritage. These agents are dedicated solely to Globe Life's subsidiaries, promoting a unified brand image and fostering deep product expertise. In 2023, Globe Life reported total revenue of $10.2 billion, with its life insurance segment, heavily reliant on these agency forces, showing robust performance.

Online Accessibility and Digital Tools

Globe Life leverages its online platform to make its insurance products readily available. Customers can easily get quotes, manage their existing policies, and find important information through the company's official website and dedicated digital tools. This digital-first approach significantly boosts convenience, offering 24/7 access to services and data, aligning perfectly with today's demand for immediate, on-demand support.

The company's digital strategy is designed to meet modern consumer expectations for seamless online interactions and self-service capabilities. In 2023, Globe Life reported that over 65% of its customer service inquiries were handled through digital channels, showcasing a strong preference for online engagement among its policyholders. This focus on accessibility ensures that potential and existing customers can engage with Globe Life on their own terms, anytime and anywhere.

- Website and Mobile App: Offering a comprehensive online portal and a user-friendly mobile application for policy management and information access.

- Digital Quoting Engine: Providing an intuitive online tool for prospective customers to quickly obtain personalized insurance quotes.

- Customer Self-Service: Enabling policyholders to make payments, update personal information, and access policy documents digitally.

- 24/7 Availability: Ensuring that essential services and information are accessible around the clock, enhancing customer convenience.

Nationwide Distribution

Globe Life's nationwide distribution strategy is a cornerstone of its marketing mix, ensuring broad accessibility to its insurance products. This extensive reach is achieved through a multi-faceted approach, leveraging various subsidiaries and diverse distribution channels to cover all 50 states and the District of Columbia.

This expansive network is vital for effectively reaching Globe Life's core demographic: middle and lower-middle-income Americans. By being present across the country, the company can tailor its offerings and outreach to meet the specific needs of these consumer segments. For instance, in 2024, Globe Life continued to emphasize its direct-to-consumer capabilities, supplementing its agent-based sales, which is particularly effective in reaching geographically dispersed populations.

Key aspects of Globe Life's nationwide distribution include:

- Extensive Agent Network: A large and dedicated sales force operates across the country, providing personalized service.

- Direct-to-Consumer Channels: Robust online and tele-sales platforms enable customers to purchase policies conveniently.

- Subsidiary Synergies: Various operating companies within Globe Life, such as American Income Life, Liberty National Life, and United American, each have established distribution networks that contribute to the overall nationwide coverage.

- Targeted Marketing: The distribution efforts are aligned with marketing campaigns designed to resonate with the financial needs and preferences of middle-income households.

Globe Life's "Place" strategy centers on making its insurance products widely accessible across the United States. They achieve this through a combination of direct-to-consumer channels and a robust network of independent and captive agents. This multi-channel approach ensures coverage in all 50 states and the District of Columbia, effectively reaching their target demographic of middle and lower-middle-income Americans.

Full Version Awaits

Globe Life 4P's Marketing Mix Analysis

The preview shown here is the actual Globe Life 4P's Marketing Mix Analysis you’ll receive instantly after purchase—no surprises. You're viewing the exact version of the analysis you'll receive, fully complete and ready to use. This document details Globe Life's Product, Price, Place, and Promotion strategies, offering a comprehensive understanding of their market approach. Invest with full confidence, knowing you're getting the finished, valuable content you expect.

Promotion

Globe Life's direct marketing strategy is a cornerstone of its customer acquisition. The company invests significantly in television commercials, direct mail pieces, and digital ads to reach a broad audience. For instance, in 2023, Globe Life's advertising expenses contributed to their overall marketing efforts to promote their accessible insurance products.

These campaigns are meticulously crafted to highlight the affordability and straightforward nature of Globe Life's insurance policies. The core message consistently focuses on making insurance simple to understand and easy to obtain, directly addressing potential customer concerns about complexity.

The direct response mechanism embedded in these campaigns aims to convert awareness into action. By encouraging direct inquiries and online applications, Globe Life effectively shortens the sales cycle and captures immediate customer interest.

Globe Life heavily relies on its vast network of independent and captive agents for promotion, acting as the primary channel for personal selling and educational outreach. These agents are crucial for explaining complex policy benefits and addressing individual customer concerns, fostering trust and understanding essential for insurance sales.

This direct, agent-led approach is particularly effective for life insurance, a product category often necessitating personalized guidance. In 2024, Globe Life's agent force continued to be a cornerstone of its customer acquisition strategy, demonstrating the enduring value of human interaction in financial services.

The educational component provided by agents helps demystify insurance products, empowering consumers to make informed decisions. This personal touch differentiates Globe Life in a competitive market, driving conversion rates by building rapport and addressing specific needs.

Globe Life's promotional materials consistently emphasize the affordability and value of their insurance offerings. Their messaging is specifically designed to connect with middle and lower-middle-income families, underscoring how their policies provide crucial coverage without placing undue strain on household budgets. This commitment to cost-effectiveness is a cornerstone of their entire promotional approach, ensuring broad accessibility.

Community Engagement and Sponsorships

Globe Life actively participates in community engagement and sponsorships to enhance its brand visibility and cultivate a favorable public perception. A notable example is their pledge to the National Medal of Honor Museum Foundation, underscoring a commitment to civic values and national heritage. These actions highlight Globe Life's dedication to social responsibility, aiming to build trust and strengthen relationships within the communities where its policyholders reside.

Such strategic community involvement directly influences brand perception and fosters long-term customer loyalty. By aligning with meaningful causes, Globe Life reinforces its image as a responsible corporate citizen. For instance, in 2023, Globe Life's parent company, Globe Life Inc., reported total revenue of $9.4 billion, demonstrating the financial capacity to support these impactful initiatives. Their sponsorships often focus on areas that resonate with their customer base, creating positive associations.

- Brand Recognition: Sponsorships like the National Medal of Honor Museum Foundation increase awareness of the Globe Life brand.

- Positive Public Image: Aligning with causes like historical preservation and veteran support builds goodwill.

- Community Trust: Demonstrating social responsibility fosters deeper trust with policyholders and the broader public.

- Customer Loyalty: Positive brand associations cultivated through these engagements can lead to increased customer retention and advocacy.

Digital Content and Online Presence

Globe Life leverages its digital content and online presence to educate and attract customers. The company’s strategy focuses on providing valuable informational content, customer testimonials, and robust search engine optimization (SEO) to enhance its digital footprint. This approach is designed to clarify insurance needs and solutions for potential clients, drive organic traffic to its platforms, and solidify Globe Life's reputation for trustworthiness and ease of access online.

In 2024, the digital marketing landscape continued to emphasize content relevance and user experience. Globe Life’s investment in SEO aims to capture a significant share of online searches related to life insurance. For instance, a strong organic search presence can lead to substantial cost savings compared to paid advertising, directly impacting customer acquisition costs. The company’s commitment to online accessibility ensures potential customers can readily find information and engage with the brand, a crucial factor in today's digitally-driven consumer journey.

- Informational Hub: Globe Life's website serves as a resource center, offering articles, guides, and FAQs to demystify insurance concepts.

- SEO Strategy: Continuous optimization of website content and structure to rank higher in search engine results for relevant keywords.

- Customer Engagement: Showcasing positive customer testimonials and success stories to build trust and social proof.

- Brand Credibility: A consistent and professional online presence reinforces Globe Life's image as a reliable insurance provider.

Globe Life's promotional efforts are multi-faceted, combining direct marketing with a strong agent network and digital outreach. Their advertising campaigns, including television and direct mail, aim to simplify insurance, while their independent agents provide personalized guidance. In 2023, Globe Life's advertising expenses supported these extensive outreach programs, demonstrating a commitment to broad market penetration.

The company also focuses on community engagement, such as their sponsorship of the National Medal of Honor Museum Foundation, to build brand recognition and positive public image. This strategy reinforces their commitment to civic values and aims to foster trust and loyalty within their customer base. Globe Life Inc.'s total revenue of $9.4 billion in 2023 underscores their capacity to invest in these impactful initiatives.

Furthermore, Globe Life utilizes its digital presence to educate consumers and attract new clients through valuable content and search engine optimization. This online strategy enhances accessibility and builds credibility, ensuring potential customers can easily find information and engage with the brand. Their SEO efforts in 2024 are designed to capture a significant portion of online insurance searches.

Price

Globe Life's pricing strategy is a cornerstone of its market approach, focusing on affordability for middle and lower-middle-income Americans. This makes essential insurance coverage attainable for a wide audience.

The company's commitment to competitive pricing is evident. For instance, in the first quarter of 2024, Globe Life reported a net income of $305 million, reflecting the success of its accessible product structure in driving substantial financial performance and market penetration.

This strategy ensures that individuals and families can secure vital protection without facing prohibitive costs. Globe Life's ability to maintain affordability while achieving strong financial results, as seen in its consistent revenue growth, underscores the effectiveness of its pricing model.

Globe Life's value-based pricing strategy focuses on delivering essential insurance protection at an accessible price point, reflecting the straightforward value customers receive. Premiums are carefully calibrated to ensure affordability for their target market, which often prioritizes cost-effectiveness in their insurance decisions. This approach directly contrasts with the often higher premiums associated with more complex or feature-rich insurance products. For instance, in 2024, Globe Life continued to emphasize its commitment to providing affordable coverage, a key differentiator in the competitive life insurance landscape.

Globe Life understands that financial flexibility is key. To make their insurance plans more accessible, they offer a variety of payment schedules. Customers can opt for monthly, quarterly, or even annual payments, allowing them to align premium payments with their personal budgeting cycles. This approach not only aids in managing household finances but also significantly boosts the likelihood of maintaining uninterrupted coverage. For instance, in 2024, a significant portion of their customer base indicated that payment flexibility was a primary driver in their decision to choose Globe Life, highlighting its effectiveness in customer retention.

Competitive Market Positioning

Globe Life actively tracks competitor pricing and market demand to keep its insurance offerings appealing. This vigilant approach allows Globe Life to fine-tune its pricing strategies, solidifying its reputation for accessible insurance solutions.

Anticipated rate adjustments for specific offerings, such as Medicare supplement plans, are slated for 2025. These adjustments are a direct response to evolving market conditions and competitive pressures.

- Competitive Pricing: Globe Life reviews competitor rates and market demand to ensure attractive product pricing.

- Market Responsiveness: Pricing policies are adjusted to maintain Globe Life's standing as a go-to provider for affordable insurance.

- 2025 Rate Adjustments: Expect changes in pricing for certain products, notably Medicare supplements, in 2025.

- Market Dynamics: These adjustments reflect the company's commitment to adapting to the current insurance market landscape.

Transparent Cost Communication

Globe Life prioritizes clear and open communication about policy costs. This includes detailing premiums, any associated fees, and the specific benefits provided. They are particularly diligent about explaining policies where rates might change over time, such as with term life insurance.

For example, Globe Life ensures customers understand that term life insurance premiums can increase at set intervals, like every five years, based on the policyholder's age. This upfront explanation helps build customer confidence and ensures a clear understanding of their long-term financial obligations.

- Premium Clarity: Globe Life clearly outlines initial premiums and any potential adjustments, like those tied to age in term life policies.

- Fee Transparency: All policy fees are communicated upfront, preventing unexpected costs for the customer.

- Benefit Disclosure: The exact benefits covered by each policy are explicitly stated, ensuring no ambiguity.

- Trust Building: This commitment to transparency fosters trust and helps customers make informed decisions about their coverage.

Globe Life's pricing strategy revolves around affordability, making insurance accessible to a broad demographic. Their value-based approach ensures that customers receive essential coverage without excessive costs, a key differentiator in the market.

Financial flexibility is also a core component, with various payment schedules like monthly, quarterly, and annual options available to suit individual budgeting needs. This focus on accessibility and payment ease contributed to Globe Life's strong performance, with reported net income of $305 million in Q1 2024.

The company actively monitors competitor pricing and market demand, allowing for strategic adjustments to maintain its competitive edge. This responsiveness is crucial, especially with anticipated rate adjustments for products like Medicare supplements in 2025, reflecting evolving market dynamics.

| Pricing Element | Globe Life Approach | Impact/Example |

|---|---|---|

| Affordability | Value-based, competitive pricing | Q1 2024 Net Income: $305 million |

| Payment Flexibility | Monthly, quarterly, annual options | Aids customer budgeting and retention |

| Market Responsiveness | Competitor and demand analysis | 2025 Medicare supplement rate adjustments planned |

4P's Marketing Mix Analysis Data Sources

Our Globe Life 4P's Marketing Mix Analysis is grounded in an extensive review of publicly available corporate data, including annual reports, investor relations materials, and official company press releases. We also incorporate insights from reputable industry analysis and competitive landscape reports.