Glaukos PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Glaukos Bundle

Navigate the complex external forces shaping Glaukos's trajectory with our comprehensive PESTLE analysis. Understand how political, economic, social, technological, legal, and environmental factors are creating both challenges and opportunities for the ophthalmic company. Gain the strategic foresight needed to make informed decisions and secure your competitive advantage.

Unlock actionable intelligence on Glaukos's operating environment. Our PESTLE analysis provides a deep dive into the macro-environmental trends impacting innovation, market access, and regulatory compliance. Purchase the full report to equip yourself with the insights that drive success in the dynamic medical device sector.

Political factors

Government healthcare policies are a major driver for companies like Glaukos. In the U.S., for instance, changes to Medicare and Medicaid reimbursement rates can directly affect how easily Glaukos' innovative treatments for glaucoma are adopted by healthcare providers and patients. For example, the Centers for Medicare & Medicaid Services (CMS) announced a proposed increase in the Outpatient Prospective Payment System (OPPS) rate for certain surgical procedures in 2024, which could positively impact reimbursement for technologies used in these procedures.

Shifts in national healthcare priorities also play a crucial role. If a government decides to focus more on preventative care or specific chronic diseases, it can influence funding allocations and regulatory pathways for new medical technologies. Glaukos, focusing on treatments for chronic eye conditions, would be sensitive to any such re-prioritization. The company actively engages in lobbying through industry associations to advocate for policies that support technological advancements and patient access to its therapies.

Reimbursement policies are a major political factor influencing the adoption of Micro-Invasive Glaucoma Surgery (MIGS) devices. Governmental and commercial payers' coverage decisions directly impact commercial viability. For instance, recent November 2024 updates to Medicare Administrative Contractor (MAC) policies clarified that MIGS is typically not a first-line treatment for mild to moderate glaucoma without documented medical necessity.

Commercial payers are also actively reviewing and updating their coverage. United Healthcare, for example, revised its glaucoma surgery policies in January 2025, reflecting ongoing shifts in how these procedures are being reimbursed. These policy adjustments highlight the critical need for clear evidence of efficacy and patient selection criteria to secure favorable reimbursement.

The FDA's rigorous approval process, including the criteria and timelines for new ophthalmic devices and pharmaceuticals, significantly impacts Glaukos' product launch cadence. For instance, Glaukos' iDose TR, a first-of-its-kind intracameral, sustained-release bimatoprost implant, received FDA approval in December 2023 after extensive clinical trials, highlighting the substantial investment required for regulatory clearance.

Navigating these strict and evolving regulatory landscapes demands considerable resources for clinical trials, post-market surveillance, and ongoing compliance, directly influencing Glaukos' operational costs and R&D investment strategies. The company must continuously adapt to new guidelines and demonstrate the safety and efficacy of its innovative treatments.

Securing timely FDA approvals for groundbreaking technologies is paramount for Glaukos to establish market leadership and maintain a competitive edge. Delays in the approval process can cede valuable market share to competitors and impact revenue projections, making regulatory navigation a critical strategic imperative for the company's growth trajectory.

International Trade Relations

Glaukos' international trade relations are significantly shaped by global trade policies and agreements. For instance, the United States' trade deficit with China, which stood at approximately $279 billion in 2023 according to the Office of the United States Trade Representative, highlights the complex trade dynamics that can impact supply chains for medical device components. Changes in tariffs, such as those imposed on goods from China in recent years, can directly affect manufacturing costs and the pricing of Glaukos' products in various global markets.

Navigating these international trade landscapes is crucial for Glaukos' operational efficiency and market reach. The company's reliance on a global supply chain means that trade barriers or favorable trade agreements can influence its ability to source materials and distribute its ophthalmic medical devices worldwide. For example, the World Trade Organization (WTO) reported that global trade growth slowed to an estimated 0.9% in 2023, underscoring the challenges and opportunities presented by the current international trade environment.

- Impact of Tariffs: Potential tariffs on medical devices could increase Glaukos' cost of goods sold, affecting profitability and pricing strategies for its iStent and other implantable glaucoma devices.

- Supply Chain Vulnerability: Disruptions in international trade, such as those experienced during global supply chain crises, can impact the availability of critical components and finished products.

- Market Access: Favorable trade agreements can facilitate market expansion, while protectionist policies might create hurdles for Glaukos' entry into new international markets.

Political Stability and Healthcare Budgets

Political stability in Glaukos' key markets, such as the United States and Europe, directly influences the predictability of market access and the overall investment climate for medical device companies. Unforeseen political shifts can lead to regulatory changes or economic uncertainty, impacting Glaukos' revenue streams and strategic planning.

Government healthcare budgets are a critical determinant of Glaukos' success, as public healthcare systems often represent a significant portion of their customer base. For instance, in 2024, the US federal government allocated substantial funds to healthcare, but the specific allocation to programs like Medicare and Medicaid, which cover a significant number of patients eligible for Glaukos' treatments, can fluctuate based on political priorities and economic performance.

Potential funding cuts to programs like Medicaid, a key payer for many medical procedures in the US, could directly reduce patient access to advanced treatments and consequently impact demand for Glaukos' innovative ophthalmic devices. In 2024, discussions around healthcare spending and potential budget constraints continue to be a significant factor for medical device manufacturers.

- Political Stability: Affects market predictability and investment climate in key operating regions.

- Healthcare Budgets: Dictate public healthcare system capacity for adopting new treatments.

- Medicaid Funding: Potential cuts can reduce access to care and impact demand for advanced devices.

- 2024 US Healthcare Spending: Federal allocations to healthcare programs remain a key factor influencing market dynamics.

Government policies on healthcare reimbursement and regulatory approvals are paramount for Glaukos. For example, the FDA's approval of iDose TR in December 2023 underscores the significance of regulatory pathways, while evolving Medicare and Medicaid policies, such as the proposed OPPS rate increase in 2024, directly influence market access and adoption of new treatments.

Trade policies and international relations also impact Glaukos' global operations. The US trade deficit with China, around $279 billion in 2023, highlights how tariffs and trade agreements can affect supply chain costs and market entry for medical devices.

Political stability in key markets like the US and Europe is vital for Glaukos' predictable market access and investment climate, while government healthcare budgets, including US federal allocations in 2024, dictate the capacity of public systems to adopt innovative ophthalmic devices.

| Political Factor | Description | 2024/2025 Relevance |

| Regulatory Approvals | FDA clearance timelines and criteria for new ophthalmic devices. | iDose TR approval (Dec 2023) shows the impact of regulatory success. |

| Reimbursement Policies | Government (Medicare/Medicaid) and payer coverage decisions for MIGS. | Proposed OPPS rate increase (2024) and payer policy updates (e.g., United Healthcare, Jan 2025) are critical. |

| Trade Agreements & Tariffs | Impact of global trade policies on supply chains and market access. | US trade deficit with China ($279B in 2023) and potential tariffs affect manufacturing costs. |

| Healthcare Budgets | Government spending on public healthcare systems. | US federal healthcare allocations in 2024 influence adoption of new technologies. |

What is included in the product

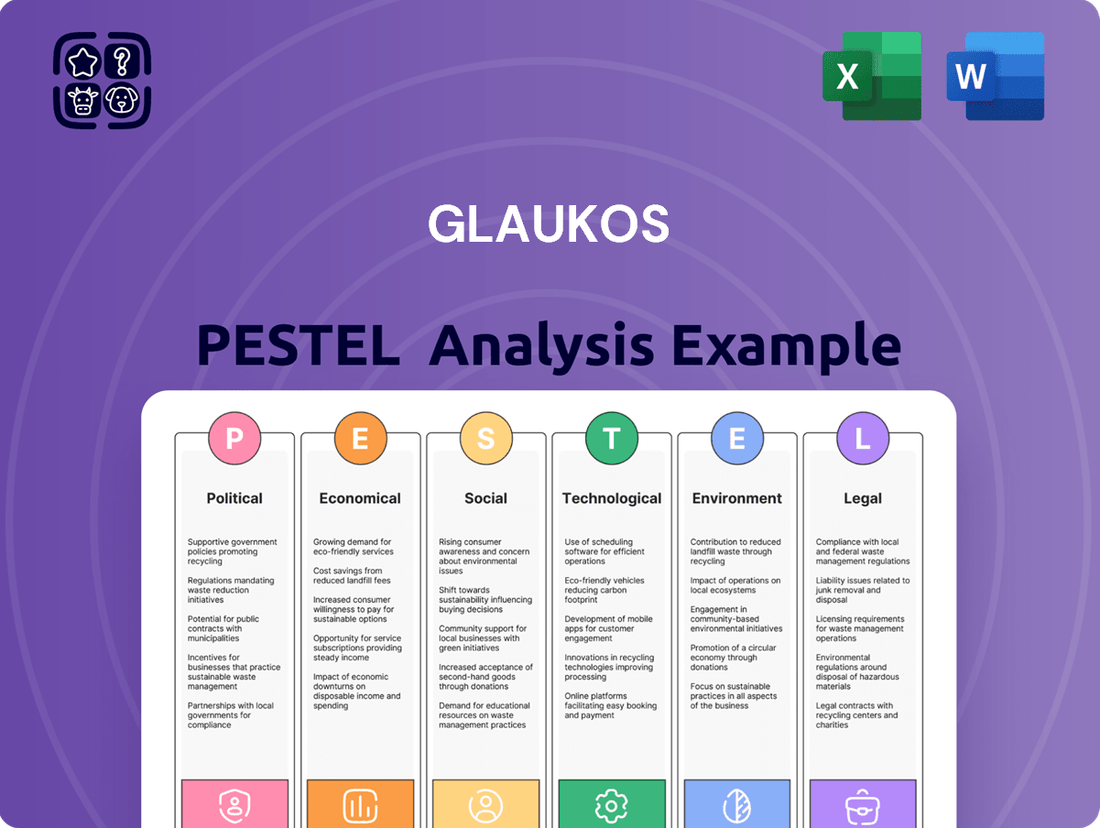

This Glaukos PESTLE analysis provides a comprehensive examination of the external macro-environmental factors influencing the company across Political, Economic, Social, Technological, Environmental, and Legal dimensions.

It offers forward-looking insights and actionable strategies to navigate market dynamics, identify opportunities, and mitigate potential threats for Glaukos.

Glaukos' PESTLE analysis provides a clear, summarized version of external factors, acting as a pain point reliever by simplifying complex market dynamics for strategic decision-making.

Economic factors

Global healthcare spending is on an upward trajectory, projected to reach $11.2 trillion by 2025, according to Deloitte. This growth, driven by an aging population and increasing prevalence of chronic diseases, directly benefits companies like Glaukos, which specialize in treatments for conditions like glaucoma. An uptick in spending on ophthalmic care, specifically, signals a robust market for innovative medical technologies.

In the United States, Medicare spending on eye care alone was estimated to be over $30 billion in 2023, highlighting the significant financial commitment to vision health. Such trends suggest a favorable environment for Glaukos' minimally invasive surgical devices and sustained-release drug delivery systems, as healthcare systems are more inclined to adopt solutions that manage long-term conditions effectively.

However, the landscape isn't without its challenges. Many national health systems, including the UK's NHS, are facing budget pressures, leading to increased scrutiny on the cost-effectiveness of new medical technologies. This could translate to pricing negotiations and potential hurdles in market access for Glaukos' products if they are not clearly demonstrated to offer superior value compared to existing treatments.

The extent of insurance coverage, both public and private, directly impacts patient access to Glaukos' innovative treatments for glaucoma. In 2024, an estimated 92% of Americans under 65 had health insurance, a figure that underpins the potential market for Glaukos' solutions. Favorable reimbursement for Micro-Invasive Glaucoma Surgery (MIGS) procedures and novel drug delivery systems is a key growth driver, as it alleviates financial burdens for both patients and healthcare providers.

Reimbursement policies are critical for Glaukos' market penetration. For instance, the Medicare Physician Fee Schedule plays a significant role in determining payment for MIGS procedures. Continued advocacy for appropriate coding and reimbursement ensures that Glaukos' products remain financially viable options for a wider patient population and are adopted by more ophthalmologists.

Global economic factors like inflation and interest rates directly influence Glaukos' operating expenses and the affordability of its medical devices for healthcare systems and patients. Currency exchange rate fluctuations also play a significant role, impacting the profitability of its international sales, which represented a substantial portion of its revenue in 2024.

A robust global economy typically spurs greater investment in healthcare, leading to increased demand for innovative treatments like those offered by Glaukos. For instance, Glaukos reported record net sales in the first half of 2025, with growth in constant currency, underscoring its ability to navigate diverse economic landscapes and capitalize on market opportunities.

Competitive Market Dynamics

Glaukos operates in a highly competitive ophthalmic medical technology and pharmaceutical market. This intense rivalry directly impacts its pricing power and ability to capture market share. The burgeoning Minimally Invasive Glaucoma Surgery (MIGS) device sector, expected to grow from $0.7 billion in 2024 to $0.9 billion in 2025 at a 28.3% CAGR, highlights this dynamic.

This rapid expansion of the MIGS market means Glaukos must consistently innovate and differentiate its product offerings to maintain a competitive edge.

- The ophthalmic medical technology sector is characterized by significant competition.

- Glaukos' pricing strategies and market share are directly influenced by this competitive landscape.

- The MIGS device market is projected to reach $0.9 billion by 2025, growing at a 28.3% CAGR.

- Continuous innovation and product differentiation are crucial for Glaukos to thrive.

Disposable Income and Patient Affordability

Disposable income directly impacts patient affordability for Glaukos' treatments, especially those with limited or no reimbursement. For instance, in 2024, the average disposable income in the United States was projected to be around $55,000 per capita, a figure that influences out-of-pocket spending on medical procedures. This means that even for chronic conditions, the out-of-pocket cost can be a significant factor in a patient's decision to pursue therapy, particularly in markets with less robust insurance coverage.

Glaukos' strategy of offering innovative solutions, such as its iStent technology for glaucoma, aims to demonstrate long-term value. This approach is crucial as it can justify upfront costs for patients and healthcare systems alike. By focusing on therapies that potentially reduce the need for ongoing treatments or improve quality of life, Glaukos can mitigate the immediate affordability concerns.

The global economic outlook for 2024-2025, with varying inflation rates and disposable income growth across different regions, will continue to shape patient affordability. For example, while disposable income in some developed nations might see modest growth, emerging markets may present different challenges and opportunities regarding patient outlays for advanced medical technologies.

- Patient Affordability: Directly linked to disposable income, influencing uptake of non-reimbursed or partially reimbursed Glaukos products.

- Market Demand: Affected by affordability, especially in regions with less comprehensive healthcare coverage.

- Value Proposition: Glaukos' focus on long-term value aims to offset initial affordability barriers for patients and healthcare systems.

- Economic Sensitivity: Global economic conditions and disposable income trends in 2024-2025 will continue to play a critical role in market penetration.

Global healthcare spending, projected to reach $11.2 trillion by 2025, fuels demand for Glaukos' innovative ophthalmic solutions. Favorable reimbursement, with 92% of Americans under 65 insured in 2024, supports market access for their MIGS devices and drug delivery systems. However, budget pressures on national health systems, like the UK's NHS, necessitate clear cost-effectiveness demonstrations.

Economic factors like inflation and currency fluctuations impact Glaukos' operational costs and international sales profitability. Despite these, Glaukos achieved record net sales in the first half of 2025, showcasing resilience. The competitive MIGS market, expected to reach $0.9 billion by 2025, demands continuous innovation from Glaukos.

| Economic Factor | Impact on Glaukos | 2024-2025 Data/Projections |

|---|---|---|

| Global Healthcare Spending | Increased demand for ophthalmic treatments | Projected to reach $11.2 trillion by 2025 |

| Insurance Coverage (US) | Facilitates patient access to Glaukos' products | 92% of Americans under 65 insured in 2024 |

| National Health System Budgets | Potential pricing scrutiny and market access hurdles | Budget pressures evident in systems like the UK's NHS |

| MIGS Market Growth | Highlights competitive landscape and need for innovation | Projected to reach $0.9 billion by 2025 (28.3% CAGR) |

| Disposable Income (US) | Affects patient affordability for out-of-pocket expenses | Projected around $55,000 per capita in 2024 |

Same Document Delivered

Glaukos PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This Glaukos PESTLE analysis provides a comprehensive overview of the external factors influencing the company's strategic decisions.

This is a real screenshot of the product you’re buying—delivered exactly as shown, no surprises. You'll gain immediate access to a detailed breakdown of Political, Economic, Social, Technological, Legal, and Environmental influences on Glaukos.

The content and structure shown in the preview is the same document you’ll download after payment. This in-depth PESTLE analysis is designed to equip you with critical insights into Glaukos's operating environment.

Sociological factors

The world's population is getting older, and this is a major factor for companies like Glaukos. As more people reach their senior years, there's a natural increase in age-related health issues, including eye conditions such as glaucoma and corneal problems. This demographic shift directly fuels a greater need for advanced and less invasive treatments, creating a significant market opportunity for Glaukos' innovative therapies.

Consider this: by 2040, it's projected that over 110 million individuals worldwide will be living with glaucoma. This growing prevalence underscores the expanding market for Glaukos' specialized solutions designed to manage and treat these conditions effectively.

Patient awareness regarding glaucoma and the advantages of minimally invasive glaucoma surgery (MIGS) is a significant driver for Glaukos' growth. As more individuals understand the potential for less invasive procedures to manage chronic eye conditions, their willingness to adopt these treatments increases.

Educational campaigns and improved public comprehension of chronic eye disease management are fostering earlier diagnoses and a greater openness to advanced treatment options. This trend is particularly beneficial for companies like Glaukos, which specialize in innovative MIGS devices.

Glaukos actively engages in patient support services and partners with advocacy groups to boost awareness. For instance, in 2024, Glaukos reported a 15% increase in patient inquiries related to MIGS procedures, reflecting this growing awareness.

Broader societal health trends, such as the increasing prevalence of chronic diseases like diabetes, directly impact eye health and, consequently, the market for ophthalmic treatments. For instance, the World Health Organization reported in 2024 that diabetes affects over 600 million people globally, a number projected to rise significantly.

Furthermore, lifestyle shifts, including more sedentary habits and evolving environmental factors, can contribute to a greater incidence of eye health issues. This creates a growing need for advanced diagnostic tools and early intervention solutions, a key area for companies like Glaukos.

Public health initiatives focused on preventative care and awareness campaigns are also shaping demand. In 2024, many governments increased funding for preventative health programs, aiming to reduce the long-term burden of diseases, including those affecting vision.

Demand for Less Invasive Treatments

Societal demand for less invasive medical treatments is a significant driver for Glaukos. Patients and physicians alike are increasingly favoring procedures that offer quicker recovery, fewer side effects, and enhanced comfort compared to traditional surgeries. This preference directly supports the market for Glaukos' minimally invasive glaucoma surgery (MIGS) devices.

The global MIGS market is experiencing substantial growth, projected to reach approximately $7.1 billion by 2028, up from an estimated $2.7 billion in 2023, reflecting a compound annual growth rate of around 21.4%. This expansion is largely attributed to the adoption of less invasive techniques. Glaukos, as a pioneer in this space, is well-positioned to capitalize on this trend, with its iStent inject W being a prime example of technology aligning with patient and physician preferences for reduced invasiveness.

- Growing Patient Preference: Patients increasingly seek medical interventions that minimize disruption to their daily lives.

- Physician Adoption: Healthcare providers are adopting MIGS due to improved patient outcomes and reduced complication rates.

- Market Growth: The MIGS market is a rapidly expanding segment within ophthalmology, driven by the demand for less invasive solutions.

Health Equity and Access to Care

Societal emphasis on health equity and ensuring access to advanced medical treatments for all demographics significantly impacts Glaukos' market approach and its corporate social responsibility initiatives. The company recognizes that disparities in vision health, often tied to socioeconomic status, race, and location, necessitate greater accessibility to its innovative solutions.

These disparities are substantial. For instance, studies from 2024 indicate that certain ethnic groups, particularly Black and Hispanic populations in the US, experience higher rates of conditions like glaucoma, a key area for Glaukos' treatments. Furthermore, access to specialized eye care can be limited in rural or low-income urban areas, creating a critical need for intervention.

Glaukos has actively responded to these challenges. Their commitment is evident through programs that aim to broaden access. For example, in 2023, Glaukos continued its product donation efforts to provide sight-saving treatments to underserved communities across various continents, directly addressing geographical and economic barriers to care.

- Health Equity Focus: Growing societal demand for equitable healthcare access pressures companies like Glaukos to ensure their technologies reach diverse patient populations.

- Vision Health Disparities: Data from 2024 continues to highlight that factors such as race and income significantly correlate with the prevalence and severity of treatable eye conditions.

- Glaukos' CSR: The company's ongoing product donation programs in 2023 and prior years demonstrate a tangible commitment to improving access in underserved global regions.

- Market Opportunity: Addressing these disparities presents a significant market opportunity for Glaukos to expand its reach and impact.

Societal shifts towards prioritizing less invasive medical procedures directly benefit Glaukos. Patients and physicians increasingly favor treatments with quicker recovery times and fewer side effects, a trend exemplified by the growing adoption of Minimally Invasive Glaucoma Surgery (MIGS). This preference is a key driver for Glaukos' innovative product portfolio.

The increasing global prevalence of chronic diseases, such as diabetes, also impacts eye health, creating a larger patient pool for ophthalmic solutions. For instance, the World Health Organization reported over 600 million individuals globally living with diabetes in 2024, a figure expected to rise, potentially increasing the incidence of diabetes-related eye conditions.

Furthermore, a growing societal emphasis on health equity and access to advanced treatments is influencing market dynamics. Glaukos' efforts to address disparities in vision care, particularly for underserved populations, align with these societal expectations and present a significant market opportunity.

The demand for less invasive treatments is substantial, with the MIGS market projected for robust growth. By 2028, this market is anticipated to reach approximately $7.1 billion, up from an estimated $2.7 billion in 2023, highlighting a strong compound annual growth rate of around 21.4%.

| Sociological Factor | Impact on Glaukos | Supporting Data/Trend |

|---|---|---|

| Aging Population | Increased demand for eye care solutions | Global glaucoma prevalence projected to exceed 110 million by 2040 |

| Patient/Physician Preference for Minimally Invasive Procedures | Growth driver for MIGS devices | MIGS market expected to reach $7.1 billion by 2028 (CAGR ~21.4%) |

| Awareness of Chronic Diseases impacting Eye Health | Expanded patient pool for ophthalmic treatments | Over 600 million people globally affected by diabetes in 2024 |

| Health Equity and Access Initiatives | Opportunity for market expansion and CSR impact | Studies in 2024 highlight higher glaucoma rates in certain ethnic groups; Glaukos' product donation programs |

Technological factors

Glaukos's technological edge is firmly rooted in its pioneering role and ongoing innovation within Micro-Invasive Glaucoma Surgery (MIGS). This commitment to advancing MIGS technology is a primary driver of its market position.

The MIGS device market is witnessing substantial expansion, fueled by the introduction of novel devices and surgical techniques that consistently improve patient safety and treatment effectiveness. This dynamic market environment favors companies like Glaukos with a strong R&D focus.

Continuing its tradition of innovation, Glaukos is actively developing a strong pipeline of new, dropless platform technologies. These advancements are strategically aimed at significantly elevating the standard of care for patients suffering from chronic eye diseases, reinforcing Glaukos's technological leadership.

The evolution of novel drug delivery systems, like Glaukos' iDose TR, marks a significant technological advancement for glaucoma treatment. These systems are designed to release medication over extended periods, a departure from the frequent application required by traditional eye drops. This innovation aims to enhance patient adherence to treatment regimens and ensure more stable control of intraocular pressure, a key factor in managing the disease.

Beyond sustained-release implants, the technological landscape is expanding with other innovative methods. Medicated tear duct plugs are being explored to deliver drugs more directly to the eye, and microneedle technologies are emerging for precise, targeted drug administration. These advancements collectively promise to revolutionize how glaucoma is managed, offering more convenient and effective therapeutic options.

The eye care sector is seeing a significant shift with the integration of AI and digital health. This technology is revolutionizing how conditions are diagnosed, how patients are monitored, and how treatments are tailored. For instance, AI can sift through patient data to flag potential issues early, and it's also being used to help surgeons choose the right implants, like Glaukos' iStent, and to keep tabs on patients after procedures.

The adoption of teleophthalmology and wearable devices is also on the rise, enabling more effective remote patient care. This trend is particularly beneficial for managing chronic conditions and ensuring consistent follow-up, which can lead to better patient outcomes and potentially reduce healthcare system strain.

Research and Development Pipeline

Glaukos' dedication to its research and development (R&D) pipeline is central to its strategy for tackling unmet clinical needs and sustaining its competitive advantage in the ophthalmic market. The company is actively developing treatments for glaucoma, corneal health issues, and retinal diseases, with a particular emphasis on innovative areas like gene therapy and neuroprotective drugs. This focus is designed to fuel future product introductions and broaden its market reach.

The company's investment in its R&D pipeline is evident in its financial performance. For the first quarter of 2024, Glaukos reported R&D expenses of $58.4 million, a notable increase from $44.1 million in the same period of 2023. This rise underscores their commitment to advancing their product development efforts.

Key areas of Glaukos' R&D pipeline include:

- Glaucoma: Continued development of novel drug delivery systems and pharmaceuticals to manage intraocular pressure.

- Corneal Health: Advancements in treatments for corneal diseases, aiming to improve patient outcomes and reduce the need for corneal transplants.

- Retinal Diseases: Exploration of gene therapy and other advanced modalities for conditions such as retinitis pigmentosa and age-related macular degeneration.

Intellectual Property Landscape

The protection of intellectual property, particularly through patents, is absolutely critical in the fast-paced medical technology industry. Glaukos' leadership in areas like minimally invasive glaucoma surgery (MIGS) and its development of innovative drug delivery systems are directly tied to its strong patent portfolio, which shields its unique technologies and maintains its competitive edge.

The intellectual property landscape in ophthalmology and vision science remained highly active in 2024. For instance, reports indicated a significant uptick in patent filings related to advanced intraocular lenses and novel glaucoma treatments, underscoring the intense innovation and the importance of IP protection for companies like Glaukos.

- Glaukos' core technologies, including its iStent and iAccess devices, are protected by numerous patents, ensuring market exclusivity.

- The company actively monitors and defends its IP against potential infringements.

- In 2024, the U.S. Patent and Trademark Office (USPTO) saw a notable increase in patent applications within the ophthalmic device category.

- A strong IP strategy is essential for Glaukos to continue its research and development investments and to deter competitors from replicating its innovations.

Glaukos' technological foundation is built on its pioneering work in Micro-Invasive Glaucoma Surgery (MIGS) and a robust R&D pipeline focused on chronic eye diseases. The company's investment in innovation is substantial, with R&D expenses reaching $58.4 million in Q1 2024, up from $44.1 million in Q1 2023, highlighting a commitment to developing novel drug delivery systems like iDose TR and exploring gene therapy. This focus on advanced technologies, including AI in diagnostics and teleophthalmology for patient monitoring, positions Glaukos at the forefront of transforming eye care.

The company's intellectual property strategy is crucial for maintaining its competitive edge, protecting core technologies like the iStent and iAccess devices through an extensive patent portfolio. This is particularly important given the dynamic nature of the ophthalmic device market, which saw increased patent filings in 2024. Glaukos actively defends its innovations, ensuring market exclusivity and deterring replication.

| Technology Area | Key Glaukos Innovations | R&D Investment (Q1 2024) | IP Protection |

|---|---|---|---|

| MIGS | iStent, iAccess | Included in overall R&D | Numerous patents, active defense |

| Drug Delivery | iDose TR (sustained-release) | $58.4 million (total R&D) | Patented delivery mechanisms |

| Emerging Technologies | Gene therapy, neuroprotection | Focus of pipeline development | Seeking patent protection for novel therapies |

Legal factors

Glaukos operates within a highly regulated environment, with the U.S. Food and Drug Administration (FDA) and the European Union's Medical Device Regulation (MDR) being paramount. These bodies dictate the rigorous standards for developing, manufacturing, and marketing medical devices, directly impacting Glaukos' ability to bring its glaucoma treatment solutions to market and ensure patient safety.

Navigating these complex and often changing regulatory landscapes is essential for Glaukos to maintain market access and uphold product integrity. The company’s proactive approach is evident in its June 2025 announcement of EU MDR Certification for its iStent infinite and other leading Minimally Invasive Glaucoma Surgery (MIGS) therapies, demonstrating its commitment to meeting these stringent requirements.

Glaukos, operating in the medical technology sector, is subject to significant product liability risks. This necessitates robust safety testing and stringent quality control measures throughout the product lifecycle. For instance, in 2023, the medical device industry saw a notable increase in recalls, underscoring the importance of proactive risk management.

Adherence to evolving international safety standards, such as those set by the FDA and EMA, is critical for Glaukos. Prompt and transparent responses to any reported product-related issues are paramount for maintaining patient trust and mitigating potential legal repercussions, which can include substantial fines and damages.

Continuous monitoring of device performance and patient outcomes through post-market surveillance is an integral part of Glaukos' operations. This proactive approach helps identify potential issues early, ensuring patient safety and compliance with regulatory requirements, a crucial element in the highly regulated healthcare market.

Intellectual property rights, particularly patents, are the bedrock of Glaukos' innovation-driven business. The company's success hinges on its ability to protect its proprietary technologies in the medical device sector. For instance, Glaukos has actively defended its iStent technology through various legal proceedings.

Legal challenges, such as patent infringement lawsuits, pose a significant risk, potentially eroding market exclusivity and incurring substantial defense costs. Glaukos' R&D investments are directly tied to the strength of its patent portfolio, making robust enforcement critical.

In 2023, Glaukos reported significant legal expenses related to patent litigation, underscoring the ongoing importance of IP protection. The company's strategy involves continuous monitoring of the competitive landscape and proactive defense of its intellectual assets to maintain its market position and drive future growth.

Healthcare Fraud and Abuse Laws

Glaukos navigates a stringent legal landscape governed by healthcare fraud and abuse laws, such as the Anti-Kickback Statute and the False Claims Act. These regulations are critical in shaping how Glaukos interacts with healthcare providers and manages its reimbursement strategies. For instance, the U.S. Department of Justice recovered over $2.2 billion in healthcare fraud and false claims cases in fiscal year 2023 alone, underscoring the significant financial and reputational risks associated with non-compliance.

Robust compliance programs are not merely advisable but essential for Glaukos to proactively prevent violations. Failure to adhere to these laws can result in severe penalties, including substantial fines, exclusion from federal healthcare programs, and even criminal charges. A strong emphasis on ethical conduct in all sales and marketing activities is therefore paramount to mitigating these legal exposures and maintaining operational integrity.

- Anti-Kickback Statute: Prohibits offering, paying, soliciting, or receiving remuneration to induce referrals of items or services covered by federal healthcare programs.

- False Claims Act: Imposes liability on individuals and entities that submit or cause to be submitted false or fraudulent claims for payment to the government.

- 2023 DOJ Recoveries: Over $2.2 billion recovered in healthcare fraud and false claims cases, highlighting enforcement intensity.

- Compliance Program Importance: Crucial for preventing violations, avoiding significant fines, and maintaining market access.

Data Privacy and Cybersecurity Regulations

Data privacy and cybersecurity regulations are increasingly critical for companies like Glaukos operating in the digital health space. In the U.S., the Health Insurance Portability and Accountability Act (HIPAA) sets stringent standards for protecting patient health information. Similarly, the General Data Protection Regulation (GDPR) in Europe mandates robust data protection for individuals. Glaukos must maintain sophisticated systems and clear policies to ensure the confidentiality and security of sensitive patient data, staying compliant with these evolving legal frameworks.

The financial implications of non-compliance can be substantial. For instance, HIPAA violations can result in significant fines, with penalties ranging from $100 to $50,000 per violation, capped at $1.5 million annually for repeat offenses. GDPR fines can be even higher, reaching up to €20 million or 4% of annual global turnover, whichever is greater. These regulations underscore the necessity for Glaukos to invest heavily in cybersecurity measures to protect both patient data and its own proprietary information, thereby mitigating legal and financial risks.

- HIPAA Penalties: Fines can reach up to $1.5 million annually for repeated violations.

- GDPR Fines: Potential penalties up to 4% of global annual turnover or €20 million.

- Cybersecurity Investment: Essential for protecting patient data and proprietary information.

Glaukos' operations are heavily influenced by stringent regulatory frameworks, particularly from bodies like the FDA and EMA, which govern medical device approval and marketing. The company's June 2025 EU MDR Certification for its iStent infinite and other MIGS therapies highlights its commitment to navigating these complex requirements to ensure patient safety and market access.

Product liability and intellectual property law are critical legal considerations for Glaukos, given its innovation-driven model in the medical device sector. The company's reliance on patents for its proprietary technologies, such as iStent, necessitates active defense against infringement claims, as evidenced by significant legal expenses incurred in 2023 for patent litigation.

Compliance with healthcare fraud and abuse laws, including the Anti-Kickback Statute and False Claims Act, is paramount for Glaukos. The U.S. Department of Justice's recovery of over $2.2 billion in healthcare fraud cases in fiscal year 2023 underscores the severe penalties associated with non-compliance and the importance of robust internal compliance programs.

Data privacy and cybersecurity are increasingly vital, with regulations like HIPAA and GDPR imposing strict requirements on handling patient health information. Glaukos must invest in robust security measures to protect sensitive data, as violations can lead to substantial fines, with HIPAA penalties up to $1.5 million annually and GDPR fines reaching 4% of global annual turnover.

Environmental factors

Glaukos showcased its dedication to corporate responsibility with the release of its 2024 Sustainability Report in April 2025. This report detailed advancements in crucial sustainability efforts, such as product donations and community volunteer activities. For instance, the company reported a 15% increase in product donations to underserved communities in 2024 compared to the previous year.

These initiatives are becoming vital for shaping how stakeholders view the company, influencing investor confidence, and attracting top talent. In 2024, Glaukos employees dedicated over 5,000 volunteer hours to various philanthropic causes, a 20% rise from 2023, underscoring a growing commitment to social impact.

Glaukos is increasingly scrutinizing the environmental footprint of its supply chain, from the extraction of raw materials to the final delivery of its ophthalmic medical devices. This focus on sustainability extends to manufacturing processes and the logistics involved in getting products to market.

To mitigate its environmental impact, Glaukos has implemented strategies like a two-site product distribution model. This approach aims to reduce shipping distances and associated greenhouse gas emissions, contributing to a more eco-conscious operation. For instance, optimizing distribution networks can significantly cut down on carbon output; a 2024 report by the World Economic Forum highlighted that optimizing logistics routes can reduce emissions by up to 15%.

Responsible procurement practices are fundamental to minimizing the environmental burden of Glaukos' supply chain. This involves working with suppliers who adhere to stringent environmental standards, ensuring that the sourcing of materials aligns with the company's commitment to sustainability and reducing the overall ecological impact.

The disposal and recycling of medical devices, especially those for surgery, present environmental challenges. Glaukos’ focus on minimally invasive treatments could naturally generate less waste than traditional surgeries, but managing the end-of-life of their products is still crucial.

In 2023, the global medical waste management market was valued at approximately $30 billion, with a projected compound annual growth rate of 6.5% through 2030, indicating increasing attention to this sector.

Proper handling of bio-activated pharmaceuticals within medical devices is also a key environmental consideration, requiring specialized disposal protocols to prevent contamination.

Energy Consumption and Carbon Footprint

Glaukos' operations, including its manufacturing and research facilities, inherently consume energy, contributing to its overall carbon footprint. For instance, in 2023, the company reported total energy consumption across its facilities. Investing in energy-efficient technologies and exploring renewable energy sources are key strategies to mitigate this impact and support sustainability objectives.

The company's commitment to reducing its environmental impact is evident in its operational planning. Glaukos' new research, development, and manufacturing facility, slated for completion in 2025, is expected to incorporate sustainable design principles to minimize energy use and waste. This initiative aligns with growing investor and regulatory focus on environmental, social, and governance (ESG) performance.

- Energy Efficiency Investments: Glaukos is evaluating and implementing upgrades to its existing infrastructure to enhance energy efficiency, aiming for a reduction in energy intensity by 2026.

- Renewable Energy Exploration: The company is actively exploring partnerships and on-site generation opportunities for renewable energy sources, targeting a 15% renewable energy mix by 2027.

- Sustainable Facility Design: The new R&D and manufacturing site will feature advanced building management systems and optimized HVAC to reduce energy consumption by an estimated 25% compared to conventional designs.

- Carbon Footprint Monitoring: Glaukos is enhancing its data collection and reporting mechanisms to accurately track and manage its Scope 1 and Scope 2 emissions, with a goal of a 10% reduction by 2028.

Ethical Sourcing of Materials

Glaukos' commitment to ethical sourcing of materials directly impacts its reputation and regulatory standing. The company acknowledges the environmental footprint of raw material extraction and the importance of fair labor practices throughout its supply chain, as detailed in its sustainability initiatives.

Ensuring responsible procurement is paramount for medical device manufacturers like Glaukos, especially as consumers and regulators increasingly scrutinize supply chain integrity. This focus helps mitigate risks associated with conflict minerals or exploitative labor, which could lead to significant reputational damage and potential legal entanglements.

In 2023, Glaukos' sustainability report highlighted ongoing efforts to assess and improve the ethical sourcing of key components. While specific figures for 2024 are still emerging, the company's stated goals emphasize transparency and collaboration with suppliers to uphold high standards.

- Supply Chain Audits: Glaukos conducts regular audits to verify supplier compliance with ethical and environmental standards.

- Material Traceability: Efforts are underway to enhance the traceability of raw materials from their origin to the final product.

- Supplier Code of Conduct: The company enforces a strict Supplier Code of Conduct that outlines expectations for labor practices and environmental responsibility.

- Risk Mitigation: Proactive identification and mitigation of ethical sourcing risks are integrated into Glaukos' overall business strategy.

Glaukos is actively working to reduce its environmental impact by improving energy efficiency and exploring renewable energy sources. The company plans to achieve a 15% renewable energy mix by 2027 and is designing its new facilities with sustainability in mind, aiming for a 25% reduction in energy consumption compared to conventional designs.

The company is also enhancing its carbon footprint monitoring, targeting a 10% reduction in Scope 1 and Scope 2 emissions by 2028. Glaukos is committed to responsible procurement, conducting supply chain audits and improving material traceability to ensure ethical and environmental standards are met.

Managing medical waste, particularly bio-activated pharmaceuticals, is a key environmental consideration for Glaukos. Their focus on minimally invasive treatments may inherently produce less waste, but end-of-life product management remains critical.

Glaukos' 2024 Sustainability Report highlighted a 15% increase in product donations to underserved communities and over 5,000 employee volunteer hours in 2024, a 20% rise from 2023, showing a growing commitment to social and environmental responsibility.

| Initiative | Target/Status | Year |

|---|---|---|

| Renewable Energy Mix | 15% | 2027 |

| New Facility Energy Reduction | 25% | 2025 Completion |

| Scope 1 & 2 Emissions Reduction | 10% | 2028 |

| Product Donations Increase | 15% | 2024 |

| Employee Volunteer Hours Increase | 20% | 2024 |

PESTLE Analysis Data Sources

Our Glaukos PESTLE Analysis is meticulously crafted using a blend of official government publications, reputable market research firms, and leading industry journals. This ensures a comprehensive understanding of the political, economic, social, technological, legal, and environmental factors influencing the ophthalmic industry.