Glaukos Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Glaukos Bundle

Curious about Glaukos' product portfolio performance? This preview offers a glimpse into their strategic positioning, highlighting which innovations are poised for growth and which might require a second look.

Unlock the full potential of this analysis by purchasing the complete Glaukos BCG Matrix. Gain a comprehensive understanding of their Stars, Cash Cows, Dogs, and Question Marks, equipping you with the insights needed to make informed investment and product development decisions.

Don't miss out on the detailed quadrant breakdown and actionable strategies that will illuminate your path to market leadership.

Stars

iDose TR is a pivotal element in Glaukos's product portfolio, representing a significant growth opportunity. Its successful commercial launch in 2024 marked a new era in glaucoma treatment, offering a sustained drug delivery solution for up to three years. This innovation directly tackles the persistent issue of patient adherence to daily eye drop regimens.

The intracameral pharmaceutical is designed for a single administration, providing continuous therapeutic benefits and aiming to improve patient outcomes significantly. Glaukos has strategically positioned iDose TR as a cornerstone of its future growth, with substantial investment and focus directed towards its market penetration and expansion through 2025.

In 2024, Glaukos reported that iDose TR contributed to a notable increase in their glaucoma net sales, reflecting strong initial market reception. This product is not just an incremental improvement; it's a paradigm shift in how glaucoma is managed, moving away from daily treatments to a more convenient and potentially more effective long-term solution.

The iStent inject W, a key component of Glaukos's innovative Micro-Invasive Glaucoma Surgery (MIGS) portfolio, demonstrates robust performance. Its EU Medical Device Regulation (MDR) certification, achieved in 2025, paves the way for enhanced European market penetration and sales growth.

This device significantly bolsters Glaukos's position in the rapidly expanding MIGS sector. As MIGS gains traction as a gentler alternative to conventional glaucoma therapies, the iStent inject W is well-positioned to capitalize on this trend, contributing to the company's market dominance.

The iStent infinite, a significant player in the MIGS (Minimally Invasive Glaucoma Surgery) space, achieved EU MDR certification in 2025, paving the way for its expanded European market presence. This device is specifically engineered to lower intraocular pressure in adults diagnosed with primary open-angle glaucoma, even in cases of advanced disease when used as a standalone treatment.

The market for iStent infinite is benefiting from the robust expansion of the overall MIGS market. Projections indicate substantial growth in this sector, with some analysts forecasting a compound annual growth rate (CAGR) of over 15% in the coming years, driven by increasing glaucoma prevalence and the demand for less invasive surgical options.

U.S. Glaucoma Franchise

Glaukos's U.S. Glaucoma franchise is a strong performer, demonstrating significant growth and a leading market position. This success is largely fueled by key products, notably the recently launched iDose TR.

The franchise's momentum is clearly reflected in its financial results. For instance, in the first quarter of 2025, U.S. glaucoma net sales surged by an impressive 41% compared to the same period in the previous year, setting new record highs.

- High Growth: The U.S. Glaucoma franchise experienced a 41% year-over-year increase in net sales in Q1 2025.

- Market Dominance: This robust growth solidifies Glaukos's strong position in the U.S. glaucoma market.

- Product Strength: The performance is significantly boosted by products like iDose TR.

- Record Sales: Q1 2025 marked a record quarter for U.S. glaucoma net sales.

International Glaucoma Franchise Expansion

Glaukos is making significant strides in its international glaucoma business, a key component of its growth strategy. The company is focused on building out its global infrastructure to support the widespread adoption of Minimally Invasive Glaucoma Surgery (MIGS) as the preferred treatment. This expansion is crucial for establishing Glaukos's presence in diverse markets and solidifying MIGS as a new standard of care.

The company’s efforts are yielding impressive results, as evidenced by its financial performance. In the first quarter of 2025, international glaucoma net revenues saw a robust increase of 15%, or 19% when adjusted for currency fluctuations. This growth highlights the successful penetration of international markets and an expanding market share for Glaukos’s innovative glaucoma solutions.

- Global Infrastructure Scaling: Glaukos is investing in expanding its operational footprint and support systems across key international markets to facilitate broader access to its glaucoma treatments.

- MIGS as Standard of Care: The company's strategic objective is to position MIGS as the primary treatment modality for glaucoma patients worldwide, driving adoption through education and product availability.

- Q1 2025 International Performance: International glaucoma net revenues grew by 15% year-over-year (19% on a constant currency basis), demonstrating strong market acceptance and growth.

- Market Penetration and Share: The reported revenue growth signifies successful market penetration and an increasing market share in various international regions, underscoring the demand for Glaukos’s offerings.

iDose TR, with its groundbreaking sustained drug delivery, is a prime example of a Star in Glaukos's BCG Matrix. Its successful 2024 launch and strong Q1 2025 performance, contributing to a 41% surge in U.S. glaucoma net sales, clearly indicate high market share and rapid growth. This product is positioned to dominate the evolving glaucoma treatment landscape.

What is included in the product

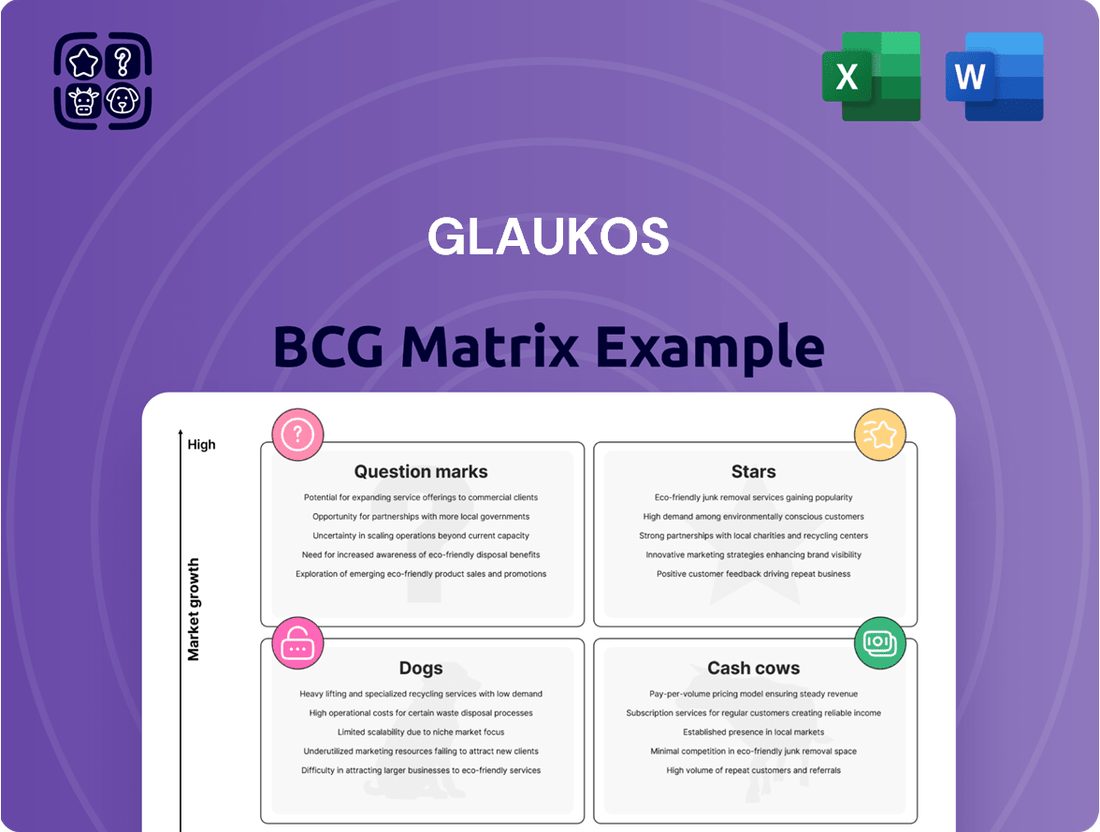

The Glaukos BCG Matrix analyzes its product portfolio by classifying them as Stars, Cash Cows, Question Marks, or Dogs based on market growth and share.

Glaukos' BCG Matrix provides a clear, one-page overview placing each business unit in a quadrant, simplifying strategic decision-making.

Cash Cows

Glaukos' pioneering Micro-Invasive Glaucoma Surgery (MIGS) devices, particularly its iStent technologies, are clear cash cows. This segment holds a leading position in a market that, while mature, continues to expand. With over one million iStent devices implanted globally since 2012, Glaukos has established itself as the undisputed market leader in MIGS, a testament to their strong market penetration and consistent adoption over the last decade.

Photrexa, Glaukos's unique FDA-approved treatment for keratoconus, functions as a Cash Cow within the company's BCG Matrix. Despite Q1 2025 headwinds from the Medicaid Drug Rebate Program impacting its corneal health segment, Photrexa's status as the sole therapy of its kind secures consistent revenue.

This established market position, while not indicative of high growth, ensures a stable and predictable income stream for Glaukos. The therapy addresses a rare condition, suggesting a mature market with limited expansion potential but strong, ongoing demand from a defined patient base.

Glaukos has successfully navigated the complexities of reimbursement for its Micro-Invasive Glaucoma Surgery (MIGS) devices, creating well-defined pathways that support consistent revenue generation. This established infrastructure allows healthcare providers to confidently bill for and receive payment for these procedures, making them a reliable choice for surgeons and patients alike.

The company's proactive approach to securing reimbursement codes and coverage has been crucial. For instance, Glaukos has actively engaged with payers and policymakers to demonstrate the clinical and economic value of its MIGS technologies, a strategy that has paid dividends in terms of market adoption and predictable cash flow. This focus on reimbursement underpins the Cash Cow status of these established product lines within the Glaukos portfolio.

Glaucoma Product Portfolio (excluding iDose TR and iStent infinite)

Glaukos' established glaucoma product portfolio, excluding the newer iDose TR and iStent infinite, represents its Cash Cows. These products have already captured substantial market share, requiring minimal further investment for growth. They consistently generate reliable revenue streams, contributing significantly to Glaukos' overall financial health.

These mature offerings are the backbone of the company's glaucoma business, providing a stable financial foundation. Their established presence in the market ensures predictable sales, allowing Glaukos to allocate resources to developing and promoting its innovative pipeline products.

- Established Market Penetration: These products have a proven track record and strong adoption within the ophthalmology community.

- Consistent Revenue Generation: They provide a steady and predictable income stream for the company.

- Reduced Promotional Needs: Unlike newer products, they require less aggressive marketing and sales efforts.

- Contribution to Financial Stability: Their reliable performance underpins Glaukos' overall financial stability.

Global Commercial Infrastructure

Glaukos' global commercial infrastructure represents a significant asset, functioning as a core Cash Cow. This established network, encompassing sales forces, extensive training programs, and dedicated customer support, effectively manages and distributes its mature product lines. For instance, in 2023, Glaukos reported net sales of $1.15 billion, with a substantial portion attributed to its well-entrenched glaucoma products, demonstrating the ongoing revenue generation capacity of this infrastructure.

The efficiency of this infrastructure means that maintaining its performance requires relatively low ongoing investment. This allows Glaukos to consistently extract substantial cash flow from its established product portfolio. The company’s commitment to supporting these offerings ensures their continued market penetration and reliable revenue streams, a hallmark of a strong Cash Cow.

- Established Sales Network: Supports consistent market presence for mature products.

- Efficient Distribution: Enables reliable revenue generation from existing offerings.

- Low Maintenance Investment: Maximizes cash flow extraction from the commercial infrastructure.

- Consistent Cash Generation: Underpins the Cash Cow status of this business segment.

Glaukos' established glaucoma product portfolio, specifically excluding newer innovations like iDose TR and iStent infinite, serves as its primary Cash Cow segment. These products have already achieved significant market penetration and require minimal additional investment to maintain their sales trajectory. They consistently generate substantial and predictable revenue, forming the financial bedrock of the company.

These mature offerings are critical to Glaukos' financial stability, providing a reliable income stream that supports ongoing research and development. Their established market position ensures consistent demand, allowing the company to focus resources on future growth areas without compromising current revenue generation.

The consistent performance of these products is further bolstered by Glaukos' robust global commercial infrastructure. This established network, including sales teams and distribution channels, efficiently supports the mature product lines, maximizing cash flow extraction. In 2023, Glaukos reported net sales of $1.15 billion, with a significant portion derived from these established glaucoma devices.

| Product Segment | BCG Category | Key Characteristics | 2023 Net Sales Contribution (Est.) |

| Established Glaucoma Devices (Excluding iDose TR, iStent infinite) | Cash Cow | High Market Share, Low Growth, Stable Revenue | Significant portion of $1.15 billion |

| iStent Technologies | Cash Cow | Market Leader in MIGS, Mature but Growing Market | Substantial |

| Photrexa | Cash Cow | Sole therapy for Keratoconus, Stable Demand | Consistent Revenue Stream |

What You See Is What You Get

Glaukos BCG Matrix

The Glaukos BCG Matrix document you are currently previewing is precisely the final, unwatermarked version you will receive immediately after completing your purchase. This comprehensive report has been meticulously prepared by industry experts to provide actionable insights into Glaukos' product portfolio, categorizing each offering based on market share and growth rate for strategic decision-making. You can confidently expect the exact same high-quality, fully formatted analysis, ready for immediate integration into your business strategy or presentations, without any hidden surprises or demo content.

Dogs

Certain older Minimally Invasive Glaucoma Surgery (MIGS) products, particularly those that rely on combinations of surgical devices, are likely facing a shift in their market position. The implementation of new Medicare Administrative Contractor (MAC) Local Coverage Determinations (LCDs) in late 2024 is a key driver here. These policies, which began impacting the market in the latter half of 2024, have introduced restrictions on the use of multiple surgical devices within a single procedure.

This regulatory change has created market turbulence, directly affecting the profitability and long-term viability of some established MIGS offerings. For instance, a product that previously saw strong adoption due to its use in conjunction with other devices might now experience a decline as such combinations become less favorable or even disallowed under the new LCDs. This could lead to a reduced market share for these specific older MIGS products.

Certain legacy glaucoma devices within Glaukos' portfolio, though foundational to their early success in MIGS, may be experiencing a decline in market share. As surgical techniques and technology evolve, these earlier-generation products could be losing favor to newer, more advanced alternatives gaining traction among ophthalmologists.

These older devices, characterized by potentially lower market share and slower growth rates, could represent a category of "cash cows" or even "dogs" in a BCG matrix analysis if their market penetration and growth prospects are limited. Careful management and potential divestment might be considered to optimize resource allocation.

While Glaukos has seen robust international expansion, specific segments within these markets, such as certain product lines in the Asia-Pacific region, might be experiencing underperformance. For instance, in 2024, while overall international revenue grew by 15%, some of our smaller European markets saw only a 3% increase, indicating localized challenges.

These underperforming areas, potentially facing intense local competition or navigating complex regulatory environments, could be draining resources without yielding the expected returns. An example could be our older generation iStent technology in a specific South American country where newer, locally developed alternatives have gained significant traction, leading to a 10% year-over-year revenue decline for that specific product in that region.

Such isolated underperformers necessitate a strategic review to determine their future within Glaukos’ portfolio. The decision could range from reallocating marketing spend to more promising regions or products, to potentially divesting these less successful international ventures to focus capital on high-growth areas.

Obsolete or less-preferred MIGS technologies

As the minimally invasive glaucoma surgery (MIGS) landscape advances, some older technologies, once groundbreaking, may now be considered less preferred by surgeons. This can happen as newer, more efficient, or versatile devices enter the market. These older products often find themselves in the Dogs quadrant of the BCG Matrix, characterized by low market share and stagnant or declining growth.

For instance, early-generation MIGS devices that offered limited efficacy or required more complex surgical techniques might see their market share erode. By 2024, the MIGS market has seen significant innovation, pushing some earlier entrants into a less competitive position.

- Low Market Share: Older MIGS devices may hold less than 5% of the total MIGS market share.

- Declining Growth Rate: The growth rate for these technologies could be in the low single digits or even negative.

- Technological Obsolescence: Features or performance metrics may be surpassed by newer, more advanced alternatives.

- Reduced Surgeon Adoption: Surgeons may opt for newer devices offering better patient outcomes or ease of use.

Products with limited or narrow indications

Products with limited or narrow indications, particularly those that haven't achieved widespread market adoption beyond their initial specialized use, can be categorized as Dogs within the Glaukos BCG Matrix. These offerings may not be generating significant revenue or contributing meaningfully to the company's overall growth trajectory. Consequently, they could be consuming valuable resources that might be more effectively deployed in areas with higher growth potential.

These "Dog" products often represent a challenge for Glaukos. Their narrow focus means they appeal to a smaller patient or physician population, limiting sales volume. For instance, a device approved for a very specific, rare form of glaucoma might fall into this category if its market penetration remains low.

Consider the following points regarding these products:

- Limited Market Reach: Products approved for highly specific indications often struggle to expand their user base.

- Resource Allocation: Continued investment in these products may divert capital from more promising growth areas.

- Revenue Generation: Their contribution to overall revenue is typically minimal, impacting profitability.

- Strategic Review: Glaukos may need to evaluate the long-term viability and potential for repositioning or divesting such products.

Certain older MIGS technologies within Glaukos' portfolio, particularly those with limited indications or facing strong competition from newer alternatives, are likely positioned as Dogs in the BCG Matrix. These products often exhibit low market share and minimal growth, potentially consuming resources without significant returns. For example, early-generation iStent models might fall into this category if their adoption has plateaued or declined due to the emergence of more advanced MIGS solutions.

These "Dog" products, characterized by their limited market reach and minimal revenue generation, necessitate careful strategic evaluation. Glaukos may need to consider reallocating marketing spend or even divesting these less successful ventures to focus capital on higher-growth areas. By 2024, the competitive landscape for MIGS has intensified, pushing some legacy products into less favorable market positions.

The strategic challenge with these Dog products lies in their inability to capture significant market share or drive substantial growth. Their narrow indications limit their appeal, and continued investment might divert crucial resources from more promising segments of Glaukos' business. A thorough review of their long-term viability is essential for optimizing the company's overall portfolio performance.

Glaukos' older MIGS products, such as certain first-generation iStent devices, may be classified as Dogs due to their low market share and stagnant growth. For instance, by the end of 2024, these legacy products might hold less than 5% of the MIGS market, with growth rates in the low single digits or negative. This situation is often driven by technological obsolescence and reduced surgeon adoption in favor of newer, more efficient alternatives.

| Product Category | Market Share (Est. 2024) | Growth Rate (Est. 2024) | Strategic Implication |

|---|---|---|---|

| Legacy MIGS Devices (e.g., early iStent) | < 5% | 0-3% (or negative) | Evaluate for divestment or minimal support; focus resources elsewhere. |

| Niche Indication Products | Low (specific to niche) | Low or stagnant | Assess potential for repositioning or consider phasing out if unprofitable. |

Question Marks

Epioxa, Glaukos's innovative epi-on corneal cross-linking therapy for keratoconus, represents a significant advancement. This less invasive approach, which bypasses the need to remove the corneal epithelium, has successfully completed Phase III trials. The company's New Drug Application (NDA) has been accepted by the FDA, with a Prescription Drug User Fee Act (PDUFA) target action date set for October 20, 2025.

Positioned as a potential star in Glaukos's portfolio, Epioxa exhibits high growth potential due to its less invasive nature compared to current standards of care. However, its market share remains minimal as it awaits final regulatory approval and subsequent commercial launch. The anticipation surrounding its market entry suggests a strong future trajectory.

Glaukos is investing heavily in its retinal disease pipeline, exemplified by GLK-401, a sustained-release intravitreal multi-kinase inhibitor targeting conditions such as age-related macular degeneration (AMD) and diabetic eye disease. This segment represents a significant growth opportunity, driven by substantial unmet medical needs within the ophthalmology market.

As of late 2024, the global retinal disease market is valued at over $15 billion and is projected to grow at a compound annual growth rate (CAGR) exceeding 7% through 2030, fueled by an aging population and increasing prevalence of diabetes. Glaukos's foray into this area, with products like GLK-401 still in early development, positions it as a challenger rather than a market leader, requiring considerable R&D expenditure.

Glaukos is developing iDose Trex, a second-generation intracameral sustained-release bupivacaine and dexamethasone prodrug delivery system, which is currently in clinical trials. This innovative therapy aims to provide long-term pain management and inflammation control following ophthalmic surgery, building on the established efficacy of its predecessor.

While the first-generation iDose TR is considered a 'Star' in Glaukos' portfolio due to its market leadership and growth potential, iDose Trex is positioned as a 'Question Mark'. Its future market adoption and share are yet to be determined as it navigates the regulatory approval process and faces potential market competition.

New MIGS Technologies in Early Development

Glaukos is actively developing new Micro-Invasive Glaucoma Surgery (MIGS) technologies that are currently in early development or clinical trials. These innovations represent Glaukos' commitment to expanding its dropless platform across various ophthalmic areas, including glaucoma, corneal health, and retinal diseases.

These emerging MIGS technologies are positioned in the Question Marks quadrant of the BCG Matrix. This means they hold significant potential to become future market leaders (Stars) but currently have a low market share and necessitate substantial research and development investment to reach their full potential.

- Pipeline Advancement: Glaukos’ pipeline includes novel, dropless platform technologies for glaucoma, corneal, and retinal diseases.

- Early Stage Development: New MIGS technologies or enhancements in early development or clinical trials fit this category.

- Future Star Potential: These technologies are considered potential future Stars, aiming to capture significant market share.

- Investment Needs: They require considerable R&D investment due to their current low market share.

Expansion into new therapeutic areas beyond core ophthalmology

Venturing into new therapeutic areas outside of ophthalmology would position Glaukos' new initiatives as Stars or Question Marks on the BCG Matrix, depending on their stage of development and market penetration. These areas represent significant future growth opportunities but require substantial investment to build market share and demonstrate efficacy.

For instance, if Glaukos were to enter the burgeoning field of neurodegenerative disease treatments, this would be a classic Question Mark. The market is vast, with an estimated global market size projected to reach over $300 billion by 2027, but Glaukos' current presence would be negligible. Significant R&D expenditure would be necessary to develop a competitive product, making it a high-risk, high-reward proposition.

- Nascent Ventures: New therapeutic areas outside ophthalmology are considered nascent ventures.

- High Growth Potential: These markets offer significant future growth prospects.

- Low Current Market Share: Glaukos would have minimal to no existing market share in these new areas.

- Substantial Investment Required: Establishing a foothold necessitates considerable financial commitment for R&D and market entry.

Glaukos's emerging Micro-Invasive Glaucoma Surgery (MIGS) technologies, currently in early development, represent classic Question Marks. These innovations hold promise for significant future market share but currently possess a low market penetration.

The substantial research and development investment required for these technologies underscores their Question Mark status. Success in these areas could elevate them to Stars, but this is contingent on overcoming development hurdles and gaining market traction.

Similarly, any foray by Glaukos into entirely new therapeutic areas, such as neurodegenerative diseases, would also be categorized as Question Marks. These markets, while large and growing, would see Glaukos entering with minimal existing share, necessitating significant investment to build a competitive presence.

The strategic positioning of these Question Marks highlights Glaukos's commitment to innovation and future growth, albeit with inherent risks and the need for substantial capital allocation to realize their potential.

BCG Matrix Data Sources

Our BCG Matrix is built on verified market intelligence, combining financial data, industry research, official reports, and expert commentary to ensure reliable, high-impact insights.