Glaukos Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Glaukos Bundle

Discover the core components driving Glaukos's innovative approach to eye care. This Business Model Canvas dissects their value proposition, customer relationships, and revenue streams, offering a clear roadmap to their success. Understand how Glaukos leverages key partnerships and resources to deliver groundbreaking solutions.

Partnerships

Glaukos strategically partners with premier ophthalmic clinics and hospital systems to drive the adoption of its Micro-Invasive Glaucoma Surgery (MIGS) devices and pharmaceutical treatments. These collaborations are vital for integrating advanced eye care solutions into standard practice.

These partnerships frequently include comprehensive training for surgeons and clinical teams on Glaukos' innovative product portfolio, ensuring safe and effective application. For instance, in 2024, Glaukos continued to expand its surgeon training programs, reaching thousands of eye care professionals across major healthcare institutions.

Such alliances are fundamental to Glaukos' market penetration strategy, fostering credibility and widespread acceptance within the ophthalmology community. The company's commitment to surgeon education underscores its role in advancing glaucoma treatment accessibility.

Glaukos actively cultivates relationships with leading academic and research institutions, recognizing their crucial role in fueling its innovation. These collaborations are instrumental in advancing research into chronic eye diseases, thereby supporting the development of cutting-edge therapies for conditions like glaucoma, corneal health issues, and retinal diseases.

Through these academic partnerships, Glaukos explores novel treatment paradigms and rigorously validates the efficacy of its pioneering technologies. For instance, in 2024, Glaukos continued its engagement with several university research programs focused on understanding the underlying mechanisms of neuroprotection in glaucoma, aiming to translate these findings into clinical applications.

Glaukos's strategic alliances with pharmaceutical firms are crucial for developing and commercializing its intracameral procedural pharmaceuticals, such as iDose TR. These collaborations are vital for ensuring the effective formulation, scalable manufacturing, and successful navigation of regulatory pathways for their innovative drug delivery systems.

These partnerships are instrumental in guaranteeing the sustained release and therapeutic efficacy of Glaukos's dropless therapies, directly tackling the adherence issues often faced with conventional eye drop regimens. For instance, the successful FDA approval of iDose TR in late 2023 highlights the importance of these integrated pharmaceutical and device strategies.

By fostering these relationships, Glaukos effectively broadens its market presence, moving beyond its established medical device portfolio to offer comprehensive, integrated pharmaceutical solutions. This strategic direction allows them to capture a larger share of the glaucoma treatment market by providing more convenient and effective patient care.

Distribution Agreements with International Medical Device Companies

Glaukos strategically partners with international medical device companies to expand its global reach. These distribution agreements are crucial for introducing their innovative MIGS devices and other ophthalmic solutions into new markets. By tapping into established sales networks and local regulatory knowledge, Glaukos can efficiently access a wider patient base and navigate complex healthcare systems.

These partnerships are vital for overcoming geographical barriers and varying reimbursement policies. For instance, in 2024, Glaukos continued to build out its international presence, with a focus on Europe and Asia-Pacific markets where such distribution agreements are key to market penetration.

- Global Expansion: Distribution agreements allow Glaukos to enter new international markets efficiently.

- Leveraging Expertise: Partners provide existing sales channels and crucial regulatory knowledge.

- Market Access: Facilitates bringing MIGS devices and ophthalmic solutions to more patients worldwide.

- Navigating Complexity: Essential for understanding diverse healthcare systems and reimbursement landscapes.

Regulatory and Reimbursement Consultants

Glaukos collaborates with regulatory and reimbursement consultants to navigate complex healthcare market access. These experts are vital for securing FDA approvals and establishing favorable reimbursement policies for Glaukos's ophthalmic technologies.

For instance, in 2023, Glaukos reported net sales of $500.1 million, underscoring the importance of effective market penetration strategies that these consultants help facilitate.

- Regulatory Approvals: Consultants assist in preparing and submitting dossiers to regulatory bodies like the FDA, ensuring compliance and expediting market entry for new devices and therapies.

- Reimbursement Strategies: They develop and execute plans to secure positive coverage decisions and adequate payment rates from payers, crucial for product adoption and commercial viability.

- Market Access Expertise: These partnerships provide critical insights into payer landscapes and policy nuances, enabling Glaukos to optimize its go-to-market approach for innovative treatments.

Glaukos's key partnerships extend to ophthalmic clinics and hospital systems, crucial for integrating its MIGS devices and pharmaceuticals into standard care. These collaborations, including extensive surgeon training, saw Glaukos reach thousands of professionals in 2024, enhancing product adoption and patient access.

Further strengthening its innovation pipeline, Glaukos partners with academic and research institutions to explore new treatment paradigms for chronic eye diseases. In 2024, these engagements focused on neuroprotection mechanisms in glaucoma, aiming to translate research into clinical advancements.

Strategic alliances with pharmaceutical firms are vital for Glaukos's intracameral procedural pharmaceuticals, like iDose TR, ensuring effective formulation and regulatory navigation. The late 2023 FDA approval of iDose TR exemplifies the success of these integrated device and pharmaceutical strategies.

Global expansion is facilitated through partnerships with international medical device companies, leveraging their sales networks and regulatory expertise. In 2024, Glaukos continued to build its international presence, particularly in Europe and Asia-Pacific, through these distribution agreements.

Navigating complex healthcare markets, Glaukos engages regulatory and reimbursement consultants to secure FDA approvals and favorable policies. Glaukos reported net sales of $500.1 million in 2023, highlighting the impact of effective market access strategies supported by these consultants.

What is included in the product

This Glaukos Business Model Canvas provides a strategic blueprint for their ophthalmic medical technology business, detailing customer segments like ophthalmologists and patients, and value propositions centered on innovative glaucoma treatments.

It outlines key resources and activities, revenue streams from device sales and procedures, and cost structures, all designed to support their mission of improving vision for patients worldwide.

Glaukos' Business Model Canvas effectively addresses the pain point of complex, time-consuming business strategy development by offering a structured, visual framework.

It simplifies the process of understanding and communicating Glaukos' core operations, thereby relieving the burden of extensive documentation and analysis.

Activities

Glaukos's central mission revolves around the persistent research and development of groundbreaking treatments for glaucoma, corneal conditions, and retinal disorders. This commitment fuels their efforts to advance a pipeline of innovative, dropless therapeutic platforms and to meticulously conduct clinical trials, ensuring both the safety and effectiveness of their innovations.

The company’s dedication to pioneering new treatments is underscored by its substantial financial commitment. In 2024, Glaukos allocated $136.4 million to research and development, a clear indicator of their strategic focus on expanding their portfolio of novel ophthalmic solutions.

Glaukos' core operations revolve around the meticulous manufacturing and rigorous quality control of its specialized medical devices and pharmaceutical implants. This ensures adherence to strict regulatory requirements, guaranteeing both product efficacy and patient well-being.

The company's commitment to quality is underscored by its investment in advanced manufacturing processes and comprehensive quality assurance systems. For instance, in 2023, Glaukos reported net sales of $530.4 million, a significant increase from $452.1 million in 2022, reflecting strong demand for its high-quality products.

To further enhance its production capabilities and meet growing market needs, Glaukos is actively expanding its infrastructure. A key initiative is the construction of a new, state-of-the-art research, development, and manufacturing facility, designed to bolster its operational capacity and innovation pipeline.

Glaukos dedicates significant resources to conducting thorough clinical trials for its innovative ophthalmic products. This meticulous process is crucial for gathering robust data that demonstrates safety and efficacy.

Securing regulatory approvals from bodies such as the U.S. Food and Drug Administration (FDA) is a critical step that allows Glaukos to bring its therapies to market. This involves navigating complex submission processes and ensuring compliance with stringent guidelines.

The company is actively working towards FDA approval for its Epioxa product, with an anticipated timeline by the end of 2025, highlighting the ongoing commitment to expanding its product pipeline.

Sales, Marketing, and Commercialization of Products

Glaukos focuses on actively promoting and distributing its ophthalmic products worldwide through robust sales, marketing, and commercialization strategies. This involves maintaining direct sales teams in crucial markets and cultivating international distribution partnerships to boost product uptake and revenue.

The company's commitment to commercialization is reflected in its financial performance. For fiscal year 2024, Glaukos reported net sales of $383.5 million. Looking ahead, the company has provided guidance for 2025 net sales in the range of $475 million to $485 million, indicating strong expected growth driven by these commercial efforts.

- Global Reach: Direct sales forces and international distribution networks ensure broad market access for Glaukos' products.

- Revenue Growth: These commercial activities are directly tied to driving sales and achieving financial targets.

- FY 2024 Performance: Net sales reached $383.5 million.

- FY 2025 Outlook: Guidance anticipates net sales between $475 million and $485 million.

Post-Market Surveillance and Patient Support Programs

Post-launch, Glaukos is dedicated to rigorous post-market surveillance, actively monitoring how its products perform in real-world settings and tracking patient outcomes. This diligent approach is crucial for ensuring patient safety and collecting valuable data that informs future product enhancements.

Complementing this surveillance, Glaukos implements robust patient support programs. These initiatives are designed to foster strong relationships with customers and ensure patients receive the necessary assistance. Notably, in 2024, Glaukos expanded its patient services to encompass nearly 5,000 patients diagnosed with keratoconus, demonstrating a significant commitment to supporting specific patient populations.

- Post-Market Surveillance: Ongoing monitoring of product performance and patient safety after launch.

- Real-World Data Collection: Gathering insights from actual patient use to drive product improvements.

- Patient Support Programs: Initiatives to assist patients and build lasting customer relationships.

- 2024 Expansion: Support extended to approximately 5,000 keratoconus patients.

Glaukos's key activities encompass the entire lifecycle of its innovative ophthalmic solutions. This includes substantial investment in research and development, evidenced by $136.4 million allocated in 2024, to create novel treatments for conditions like glaucoma and retinal disorders. The company also focuses on meticulous manufacturing and stringent quality control to ensure product efficacy and patient safety.

Furthermore, Glaukos actively pursues regulatory approvals, such as the anticipated FDA approval for Epioxa by the end of 2025, to bring its therapies to market. Robust sales, marketing, and commercialization strategies drive global product distribution, as seen in their 2024 net sales of $383.5 million, with a projected increase to $475-$485 million for 2025.

Post-market surveillance and patient support programs are also vital, with Glaukos expanding services to nearly 5,000 keratoconus patients in 2024, ensuring ongoing product performance monitoring and patient well-being.

| Key Activity | Description | 2024 Data/Highlights | Outlook/Impact |

|---|---|---|---|

| Research & Development | Developing novel treatments for glaucoma, corneal, and retinal disorders. | $136.4 million invested. | Pipeline expansion, new therapeutic platforms. |

| Manufacturing & Quality Control | Producing specialized medical devices and pharmaceutical implants. | Strong demand reflected in 2023 net sales of $530.4 million. | Ensuring product efficacy and patient safety. |

| Regulatory Approvals | Navigating complex submission processes for market access. | Working towards Epioxa FDA approval by end of 2025. | Enabling product commercialization. |

| Sales & Marketing | Promoting and distributing ophthalmic products globally. | Net sales of $383.5 million in FY24. | Projected 2025 net sales of $475-$485 million. |

| Post-Market Surveillance & Support | Monitoring product performance and providing patient assistance. | Supported ~5,000 keratoconus patients in 2024. | Ensuring patient safety and informing product enhancements. |

Delivered as Displayed

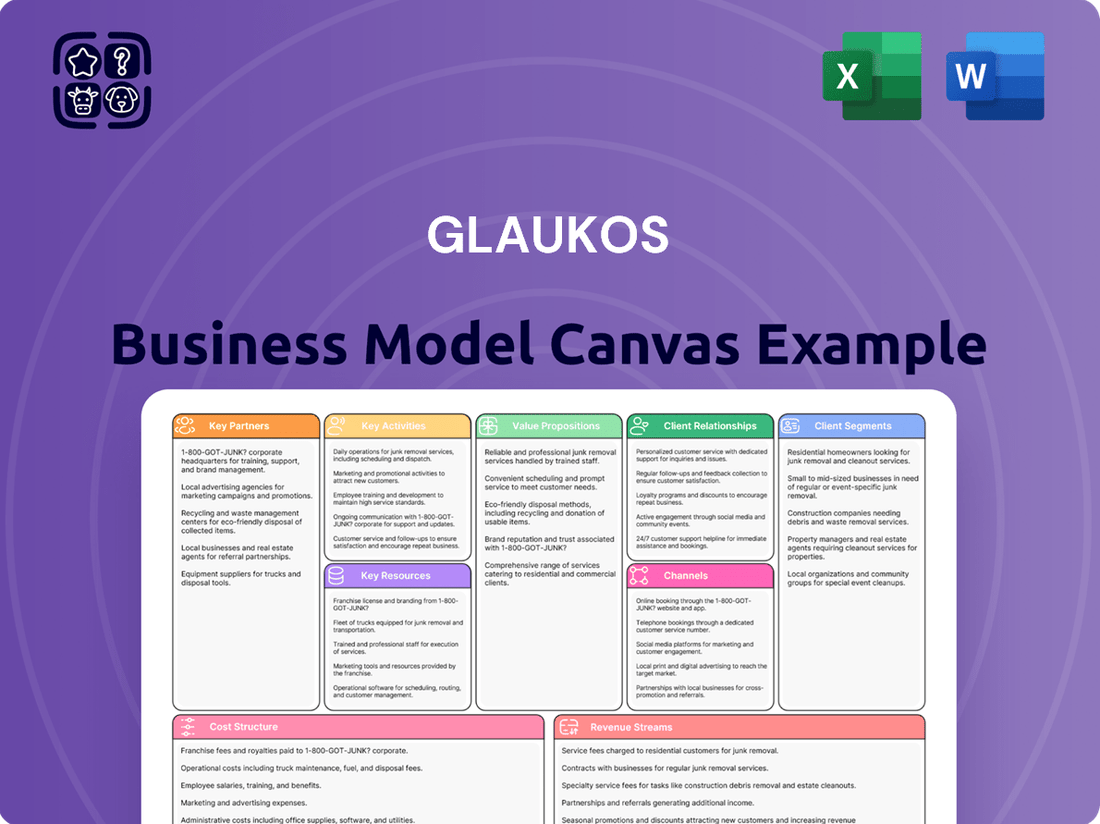

Business Model Canvas

The Glaukos Business Model Canvas preview you are viewing is the exact document you will receive upon purchase. This comprehensive snapshot showcases the core components of Glaukos' strategic approach, including key partners, activities, resources, value propositions, customer relationships, channels, customer segments, cost structure, and revenue streams. You can be assured that the detailed information and structure presented here will be identical in the final deliverable, ready for your immediate use and analysis.

Resources

Glaukos's robust intellectual property portfolio, boasting over 500 issued patents and pending applications as of early 2024, forms a cornerstone of its business model. This extensive IP protection shields its groundbreaking micro-invasive glaucoma surgery (MIGS) devices, specialized pharmaceutical formulations, and proprietary drug delivery systems.

This strong patent protection is crucial for maintaining Glaukos's competitive edge in the dynamic ophthalmic market. It effectively deters competitors from replicating their innovative technologies, allowing Glaukos to command premium pricing and secure market share for its unique solutions.

Glaukos's specialized manufacturing facilities and advanced production technologies are critical. These proprietary assets enable the precise creation of their medical devices and pharmaceutical implants, ensuring high quality and the capacity to scale up production to meet growing patient needs.

The company's investment in these capabilities directly supports its ability to deliver innovative therapies to the market. For instance, Glaukos is actively expanding its operational footprint by constructing a new research and development and manufacturing facility in Huntsville, Alabama, underscoring its commitment to enhancing production capacity and technological advancement.

Highly skilled research and development teams are a cornerstone of Glaukos's business model, representing a critical key resource. These dedicated groups, comprised of expert scientists, engineers, and clinical researchers, are the engine behind the company's innovation and the development of its product pipeline.

The depth of expertise within these teams, spanning ophthalmology, medical device design, and pharmaceutical development, is absolutely vital. This specialized knowledge allows Glaukos to create breakthrough therapies and maintain a significant competitive advantage in the market. In 2024, Glaukos invested $136.4 million in research and development, underscoring the importance of these teams to their strategy.

Clinical Data and Regulatory Approvals

Glaukos's clinical data and regulatory approvals are foundational assets. The extensive clinical trial results for its micro-invasive glaucoma surgery (MIGS) devices, like the iStent and iDose TR, provide strong evidence of safety and efficacy. These approvals, including FDA clearance, are critical for market entry and commercial success, validating the technology for physicians and patients.

These approvals translate directly into market access and revenue generation. For instance, the initial FDA approval for the iStent in 2012 marked a significant milestone, paving the way for Glaukos to establish itself as a leader in MIGS. More recently, the 2023 FDA approval for iDose TR, a first-of-its-kind intracameral, sustained-release bimatoprost implant, further solidifies their product pipeline and commercial potential.

- Clinical Data: Demonstrates product efficacy and safety through rigorous testing, building confidence among medical professionals.

- Regulatory Approvals: FDA clearances (e.g., iStent, iDose TR) are essential for market access and commercialization.

- Market Validation: Approved products validate Glaukos's innovative approach to glaucoma treatment, driving adoption.

- Trust and Credibility: Successful clinical outcomes and regulatory success build significant trust with healthcare providers and patients.

Established Sales and Distribution Network

Glaukos's established sales and distribution network is a critical asset. This includes a direct sales force operating within the United States and expanding into international markets. For the fiscal year 2023, Glaukos reported net sales of $553.2 million, a significant portion of which is attributable to the effectiveness of this network in reaching key customers.

This robust infrastructure is essential for educating ophthalmologists, surgeons, and healthcare providers about Glaukos's innovative technologies. The ability to effectively communicate product benefits and provide necessary training drives the adoption of their glaucoma treatment solutions. International distribution partners further extend this reach, enabling Glaukos to serve a global patient base.

- Direct Sales Force: Glaukos maintains a dedicated sales team in the US and select international regions.

- International Distribution: Partnerships with global distributors broaden market access.

- Customer Education: The network facilitates crucial product training and support for healthcare professionals.

- Market Penetration: This established infrastructure is key to driving product adoption and market share growth.

Glaukos's intellectual property, including over 500 patents as of early 2024, provides crucial protection for its innovative glaucoma devices and drug delivery systems, allowing for premium pricing and market exclusivity.

Specialized manufacturing facilities and advanced production technologies ensure the precise creation and scalability of their medical devices and pharmaceutical implants.

Highly skilled R&D teams, supported by a $136.4 million investment in 2024, are central to developing breakthrough therapies and maintaining a competitive edge.

Clinical data and regulatory approvals, such as the 2023 FDA approval for iDose TR, are vital for market access and commercial success, validating the technology for physicians and patients.

An established sales and distribution network, which contributed to $553.2 million in net sales in 2023, is essential for educating healthcare providers and driving product adoption globally.

| Key Resource | Description | Impact | Data Point (2023/2024) |

| Intellectual Property | Over 500 patents (early 2024) protecting MIGS devices and drug delivery systems. | Maintains competitive edge, enables premium pricing, deters replication. | 500+ issued patents and pending applications (early 2024) |

| Manufacturing Capabilities | Specialized facilities and advanced production technologies. | Ensures high quality, precise creation, and scalability of products. | Expansion of R&D and manufacturing facility in Huntsville, Alabama |

| R&D Expertise | Skilled scientists, engineers, and clinical researchers. | Drives innovation, product pipeline development, and market advantage. | $136.4 million invested in R&D (2024) |

| Clinical Data & Regulatory Approvals | Rigorous clinical trial results and FDA clearances (e.g., iDose TR). | Validates safety and efficacy, essential for market entry and trust. | 2023 FDA approval for iDose TR |

| Sales & Distribution Network | Direct sales force and international distribution partners. | Facilitates customer education, drives product adoption, and market penetration. | $553.2 million in net sales (2023) |

Value Propositions

Glaukos revolutionized glaucoma treatment by pioneering minimally invasive glaucoma surgery (MIGS). This approach offers patients a less burdensome alternative to traditional, more invasive procedures, often resulting in faster recovery and fewer surgical risks. The company's iStent platform stands as a testament to this innovation, addressing the critical need for effective, yet gentler, chronic glaucoma management.

This value proposition directly targets patients seeking improved quality of life and reduced complications associated with glaucoma surgery. For instance, MIGS procedures, like those offered by Glaukos, can significantly lower intraocular pressure with a favorable safety profile compared to conventional surgeries. As of 2024, the global MIGS market is experiencing robust growth, driven by increasing awareness and the demand for less invasive treatments.

Glaukos offers innovative dropless pharmaceutical therapies for chronic eye diseases, exemplified by iDose TR. This technology provides continuous glaucoma drug delivery directly within the eye, a significant advancement over traditional methods.

This approach liberates patients from the daily hassle and adherence challenges of eye drops. The convenience factor is immense, leading to improved patient compliance and potentially better long-term outcomes for managing conditions like glaucoma.

For instance, in 2024, Glaukos continued to focus on expanding the reach of its sustained-release technologies. Their commitment to reducing the treatment burden directly addresses a key unmet need in ophthalmology, enhancing the quality of life for patients managing chronic eye conditions.

Glaukos provides a wide array of treatments for chronic eye conditions, extending beyond just glaucoma to encompass corneal health and retinal diseases. This broad offering simplifies the procurement process for healthcare providers, consolidating their needs for various ophthalmic solutions with a single, reliable partner.

By addressing a spectrum of ophthalmic disorders, Glaukos aims to revolutionize how these conditions are managed. In 2024, the company continued to invest in research and development, with a significant portion of its revenue allocated to expanding its pipeline for these complex diseases, underscoring its commitment to innovation in eye care.

Improved Patient Outcomes and Quality of Life

Glaukos's core value proposition centers on significantly enhancing patient outcomes and elevating the quality of life for individuals battling chronic eye conditions. By developing and offering novel, less invasive treatment options, the company directly addresses the debilitating effects of these diseases.

These advanced treatments are engineered to not only manage the progression of chronic eye diseases but also to preserve precious vision. This focus on preservation is critical for maintaining a patient's independence and overall well-being. For instance, Glaukos's iStent inject technology, a micro-bypass device for glaucoma, has demonstrated its ability to reduce intraocular pressure, a key factor in disease management.

Furthermore, Glaukos's solutions aim to reduce the reliance on more aggressive surgical interventions or the burden of daily medication. This simplification of treatment regimens can lead to greater patient adherence and fewer treatment-related complications, ultimately contributing to a better patient experience and improved long-term health.

- Improved Visual Acuity: Glaukos products are designed to restore or preserve vision, directly impacting a patient's ability to perform daily activities.

- Reduced Treatment Burden: By offering less invasive options and potentially reducing the need for multiple daily medications, Glaukos enhances patient convenience and compliance.

- Enhanced Quality of Life: The preservation of vision and simplification of treatment contribute to greater patient independence and a higher overall quality of life.

- Disease Management Efficacy: Glaukos technologies are clinically proven to effectively manage the progression of chronic eye diseases like glaucoma.

Advancing the Standard of Care in Ophthalmology

Glaukos is dedicated to elevating ophthalmic care by consistently innovating and creating groundbreaking technologies. Their strategy centers on platform-based advancements and a strong pipeline, all designed to significantly improve the current standard of care. This commitment provides the global ophthalmic community with demonstrably better treatment choices.

The company's efforts are geared towards offering superior solutions that address unmet needs in eye disease management. For instance, Glaukos' iStent inject WDS, a micro-invasive glaucoma surgery device, has been a key part of their strategy to redefine treatment paradigms.

- Innovation Focus Glaukos prioritizes developing novel technologies that directly enhance patient outcomes in ophthalmology.

- Pipeline Strength A robust pipeline of new products and advancements underpins their commitment to advancing the standard of care.

- Platform Approach Their strategy leverages a platform-based innovation model to create a range of solutions.

- Global Impact Glaukos aims to provide the global ophthalmic community with improved treatment options.

Glaukos offers groundbreaking treatments for chronic eye diseases, focusing on improving patient outcomes and quality of life through less invasive procedures and innovative drug delivery systems. Their commitment to advancing the standard of care in ophthalmology is evident in their broad product portfolio and ongoing research and development efforts.

The company's value proposition centers on providing superior solutions that reduce treatment burden and enhance patient compliance, ultimately preserving vision and independence. Glaukos's strategic focus on platform-based innovation ensures a continuous stream of advanced therapies for conditions like glaucoma, corneal disease, and retinal disorders.

By addressing key unmet needs in eye care, Glaukos empowers patients and healthcare providers with more effective and convenient treatment options. This dedication to innovation not only improves patient lives but also positions Glaukos as a leader in the rapidly evolving ophthalmic market.

Glaukos's commitment to innovation is reflected in its financial performance and market position. For example, in 2024, the company continued to invest heavily in R&D, with a significant portion of its revenue dedicated to expanding its pipeline and bringing new therapies to market.

| Value Proposition | Key Benefit | Supporting Fact/Data (2024 Focus) |

|---|---|---|

| Pioneering MIGS for Glaucoma | Less invasive, faster recovery, reduced risks | iStent platform continues to be a market leader in MIGS procedures. |

| Dropless Pharmaceutical Therapies | Convenience, improved compliance, continuous drug delivery | iDose TR offers sustained release of medication, reducing the need for daily drops. |

| Broad Ophthalmic Disease Portfolio | One-stop solution for various eye conditions | Continued investment in R&D for corneal and retinal diseases alongside glaucoma. |

| Enhanced Patient Outcomes & Quality of Life | Vision preservation, reduced treatment burden | Focus on technologies that simplify treatment regimens and minimize complications. |

Customer Relationships

Glaukos leverages a dedicated direct sales force to foster deep connections with ophthalmologists and surgeons. This hands-on approach ensures personalized education on their innovative devices and therapies.

This direct engagement is crucial for providing in-depth procedural training and continuous support, building essential trust with the medical professionals who prescribe and utilize Glaukos' solutions. For instance, in 2023, Glaukos reported net sales of $520.7 million, reflecting the success of such direct customer relationships in driving market adoption.

Glaukos offers extensive clinical support and training, a cornerstone for the successful adoption of its innovative glaucoma solutions. These programs are designed to equip eye care professionals with the knowledge and skills necessary for using their micro-invasive glaucoma surgery (MIGS) devices and pharmaceuticals safely and effectively.

By providing hands-on training and ongoing clinical education, Glaukos fosters confidence and proficiency among surgeons, leading to better patient outcomes. For instance, in 2023, Glaukos reported significant growth in its iStent® portfolio, a testament to the successful integration of these technologies into surgical practices, supported by robust training initiatives.

Glaukos provides dedicated patient services and support programs, notably for conditions such as keratoconus, guiding individuals from diagnosis through their treatment. This direct patient interaction underscores their dedication to patient welfare, fostering trust and improving the overall patient experience, extending beyond mere product transactions.

In 2024, Glaukos significantly broadened its reach, extending its keratoconus patient services program to support approximately 5,000 patients. This expansion highlights their commitment to actively engaging with and assisting a growing number of patients navigating specific eye conditions.

Participation in Medical Conferences and Educational Symposia

Glaukos actively engages with the ophthalmic community through participation in key medical conferences and the sponsorship of educational symposia. These events serve as crucial platforms for sharing scientific advancements, highlighting their latest product innovations, and fostering direct interaction with eye care professionals. For instance, Glaukos presented at the 2025 ASCRS Annual Meeting, demonstrating their commitment to disseminating vital information.

These engagements are instrumental in establishing Glaukos as a thought leader and reinforcing their innovative standing within the eye care sector. By sponsoring symposia, they provide valuable educational content, further solidifying relationships and brand presence. In 2024, Glaukos continued its robust presence at major industry gatherings, facilitating knowledge exchange and networking opportunities.

The company's strategic presence at these events directly supports customer relationships by:

- Disseminating scientific data and clinical outcomes related to their micro-invasive glaucoma surgery (MIGS) devices.

- Showcasing new product developments and technological advancements to a targeted audience of ophthalmologists and surgeons.

- Facilitating direct engagement and feedback from key opinion leaders and potential customers.

- Reinforcing Glaukos's commitment to education and innovation within the glaucoma treatment landscape.

Investor Relations and Corporate Communications

Glaukos prioritizes transparent and proactive communication with its investors and stakeholders to foster enduring relationships and trust. This commitment is demonstrated through regular financial result releases, investor calls, and the publication of sustainability reports, all designed to offer deep insights into the company's performance and strategic trajectory.

- Investor Communications: Glaukos actively engages with the investment community through quarterly earnings calls and investor conferences, ensuring timely dissemination of financial and operational updates. For instance, in their Q1 2024 earnings call, the company highlighted strong revenue growth and progress on key pipeline initiatives.

- Transparency in Reporting: The company provides comprehensive financial reports, including detailed breakdowns of revenue by product line and geographic region, enabling investors to understand performance drivers. Their 2023 annual report, filed in early 2024, detailed a 14% increase in net sales compared to 2022, reaching $539.3 million.

- Sustainability Focus: Glaukos publishes sustainability reports, detailing their environmental, social, and governance (ESG) efforts. These reports, which are updated annually, provide stakeholders with information on the company's commitment to ethical practices and long-term value creation.

Glaukos cultivates strong customer relationships through a multi-faceted approach, emphasizing direct engagement with healthcare professionals and patients alike. Their dedicated sales force provides essential product education and procedural training, building trust and ensuring effective use of their innovative technologies.

This commitment extends to robust patient support programs, particularly for conditions like keratoconus, aiming to guide individuals through their treatment journey and enhance overall experience. Glaukos also actively participates in medical conferences and educational symposia, positioning itself as a thought leader and facilitating direct interaction within the ophthalmic community.

The company's transparent communication with investors, through regular financial reporting and sustainability updates, further solidifies stakeholder relationships. This comprehensive strategy underpins Glaukos's market penetration and continued growth in the eye care sector.

| Relationship Aspect | Key Activities | Impact/Evidence (2023-2024) |

|---|---|---|

| Healthcare Professional Engagement | Direct sales force, procedural training, clinical support | Drove adoption of MIGS devices; 2023 net sales of $539.3M (up 14% from 2022) |

| Patient Services | Keratoconus patient program, ongoing support | Supported ~5,000 patients in 2024; enhanced patient experience |

| Community & Thought Leadership | Conference participation, symposia sponsorship | Presented at ASCRS 2025; reinforced brand presence and innovation |

| Investor Relations | Quarterly earnings calls, financial reports, sustainability reports | Q1 2024 earnings highlighted strong revenue growth |

Channels

Glaukos heavily relies on its direct sales force within the United States and other significant global markets. This strategy enables them to directly connect with ophthalmologists, ophthalmic surgeons, and hospitals.

This direct engagement is crucial for showcasing their specialized medical devices and pharmaceutical therapies. It facilitates hands-on product demonstrations and provides in-depth training, which are key to driving adoption.

In 2023, Glaukos reported net sales of $1.1 billion, a significant portion of which is attributable to the effectiveness of their dedicated sales teams in promoting their glaucoma and retinal disease franchises.

Glaukos actively cultivates a robust network of international distributors and strategic partners. This is crucial for expanding its presence, especially in key regions like Europe, Asia Pacific, and Latin America. These collaborations are vital for navigating varied healthcare market dynamics and regulatory environments, facilitating the global rollout of Glaukos' innovative ophthalmic solutions.

In 2023, Glaukos reported that its international net sales represented a significant portion of its total revenue, underscoring the importance of these global partnerships. For instance, their commitment to expanding in Europe has seen steady growth, with many European countries adopting their technologies. This strategic approach allows Glaukos to effectively commercialize its products across diverse international markets.

Participation in major ophthalmic conferences and industry events is a vital channel for Glaukos to boost product visibility, educate stakeholders, and foster key relationships. These gatherings provide a platform to unveil new technologies, share compelling clinical trial results, and connect directly with ophthalmologists, surgeons, and other potential clients.

For instance, Glaukos actively showcased its advancements at the 2025 American Society of Cataract and Refractive Surgery (ASCRS) Annual Meeting, a premier event for anterior segment specialists. Such presence is instrumental in driving market penetration and reinforcing brand leadership in the glaucoma treatment sector.

Company Website and Digital Platforms

Glaukos's official website and digital platforms are crucial for reaching a broad audience. They act as a central hub for product information, showcasing their innovative glaucoma treatments and their iStent® technology. In 2023, Glaukos reported total revenue of $520.3 million, with their implantable glaucoma devices segment being a significant contributor, underscoring the importance of these digital channels in driving awareness and adoption.

These online resources are vital for disseminating key clinical data and research findings, keeping healthcare professionals informed about the efficacy and safety of Glaukos's offerings. The company also leverages these platforms for investor relations, providing financial reports and updates, which is essential given their market capitalization of approximately $4.5 billion as of early 2024. Furthermore, their digital presence highlights their commitment to corporate responsibility initiatives.

- Product Information Dissemination: Glaukos's website details their minimally invasive glaucoma surgery (MIGS) devices, including the iStent inject® W.

- Clinical Data Accessibility: Key trial results and publications are readily available online for medical professionals.

- Investor Relations Hub: Financial reports, SEC filings, and investor presentations are hosted on their digital platforms.

- Corporate Responsibility Showcase: Information on sustainability and ethical practices is shared through their online channels.

Medical Journals and Peer-Reviewed Publications

Glaukos leverages medical journals and peer-reviewed publications to disseminate crucial research findings and clinical study results. This channel is fundamental for building scientific credibility and shaping how healthcare professionals approach treatment.

By publishing in reputable outlets, Glaukos reinforces the evidence-based value of its innovative therapies, directly impacting clinical practice and patient care.

- Dissemination of Evidence: Publications in journals like JAMA Ophthalmology or Investigative Ophthalmology & Visual Science provide rigorous validation of Glaukos's technologies.

- Influencing Practice: Positive results published in 2024 continue to guide ophthalmologists in adopting minimally invasive glaucoma surgery (MIGS) procedures.

- Scientific Authority: These publications serve as a cornerstone for Glaukos's scientific authority, underscoring the efficacy and safety of its product pipeline.

Glaukos utilizes a multi-faceted channel strategy, blending direct sales with strategic partnerships and robust digital engagement. Their direct sales force in the US and key global markets is crucial for educating physicians about their specialized ophthalmic devices and therapies. This direct interaction, coupled with international distributors, ensures broad market access and effective product commercialization.

The company also actively participates in industry conferences and leverages medical journals for scientific validation, reinforcing their market leadership. Digital platforms serve as a vital hub for product information, clinical data, and investor relations, supporting their overall outreach and brand presence.

| Channel | Description | Key Impact | 2023 Data Point |

| Direct Sales Force (US & Global) | On-the-ground engagement with ophthalmologists and hospitals. | Facilitates product demos, training, and direct customer relationships. | Contributed significantly to $1.1 billion in net sales. |

| International Distributors & Partners | Navigating diverse healthcare markets and regulations. | Expands global presence and facilitates product rollout. | International sales formed a significant portion of total revenue. |

| Industry Conferences & Events | Showcasing new technologies and fostering relationships. | Boosts product visibility and drives market penetration. | Active participation in events like ASCRS Annual Meeting. |

| Digital Platforms (Website, etc.) | Central hub for product info, clinical data, and investor relations. | Reaches a broad audience and disseminates key information. | Supports brand awareness for implantable glaucoma devices. |

| Medical Journals & Publications | Disseminating research findings and building scientific credibility. | Influences clinical practice and reinforces product value. | Publications in 2024 continue to guide MIGS adoption. |

Customer Segments

Ophthalmologists and ophthalmic surgeons represent Glaukos's primary customer segment. These specialists are at the forefront of diagnosing and treating a range of eye conditions, with a particular focus on surgical interventions for glaucoma and corneal diseases. Glaukos's innovative micro-invasive glaucoma surgery (MIGS) devices and specialized pharmaceuticals are directly integrated into their daily clinical workflows and surgical procedures.

In 2024, the demand for advanced ophthalmic solutions continues to grow, driven by an aging global population and the increasing prevalence of eye diseases. Glaukos's commitment to developing novel technologies positions them well to serve this segment, as evidenced by their consistent revenue growth in recent years, with reported net sales of $134.4 million in the first quarter of 2024.

Hospitals and Ambulatory Surgery Centers (ASCs) are primary customers, acting as the points of purchase, stocking, and utilization for Glaukos's innovative ophthalmic devices and therapies. These healthcare facilities are where patient treatments occur, making their engagement critical for market penetration. In 2024, the demand for outpatient surgical procedures, a key area for ASCs, continued to grow, with an estimated 20 million procedures performed in the US alone, highlighting the significant volume potential for Glaukos's offerings.

Cultivating strong relationships with hospital procurement departments and administrative leadership is paramount for achieving broad product adoption and ensuring accessibility of Glaukos's solutions to patients. Success hinges on demonstrating the clinical and economic value of their technologies to these key decision-makers within the healthcare system. The increasing focus on value-based care models in 2024 further incentivizes these institutions to adopt technologies that improve patient outcomes and reduce long-term healthcare costs, aligning with Glaukos's mission.

Patients suffering from glaucoma, keratoconus, and retinal diseases represent a crucial, albeit indirect, customer segment for Glaukos. Their well-being and improved quality of life are the primary drivers of demand for Glaukos's groundbreaking treatments. The company's commitment to developing less invasive, dropless therapies directly resonates with patient desires for greater convenience and better treatment outcomes, moving beyond traditional, often burdensome, regimens.

Payers and Reimbursement Bodies (e.g., Medicare, Private Insurers)

Payers and reimbursement bodies, such as Medicare and private insurers, are fundamental to Glaukos's business model. Their coverage decisions directly dictate how accessible and affordable Glaukos's innovative treatments, particularly for glaucoma, become in the market. Without positive reimbursement policies, widespread adoption and financial viability are significantly hindered.

Securing favorable reimbursement is paramount for Glaukos's long-term success. This involves demonstrating the clinical and economic value of their products to these influential entities. The landscape of reimbursement is dynamic, and Glaukos must actively engage with these bodies to ensure their technologies are appropriately covered.

In 2024, Medicare Administrative Contractor (MAC) Local Coverage Determinations (LCDs) played a significant role in shaping the market for micro-invasive glaucoma surgery (MIGS) devices. These decisions directly influenced which MIGS procedures and devices were covered by Medicare, impacting patient access and physician utilization. For Glaukos, understanding and adapting to these LCDs is critical for the commercial success of its MIGS portfolio.

- Coverage Decisions: Payers determine if Glaukos's products are covered, influencing patient access and market penetration.

- Reimbursement Rates: The amount payers reimburse directly impacts Glaukos's revenue and profitability.

- Market Adoption: Favorable reimbursement policies are essential for broad market acceptance and physician adoption of Glaukos's technologies.

- 2024 LCD Impact: Medicare LCDs in 2024 affected the coverage and use of various MIGS devices, highlighting the importance of payer relations for Glaukos.

Academic and Research Institutions

Academic and research institutions are crucial partners for Glaukos, serving as hubs for innovation and validation. Universities and research centers leverage Glaukos's implantable micro-bypass devices and drug delivery systems for groundbreaking studies in glaucoma and retinal disease management. For instance, many academic ophthalmology departments actively engage in clinical trials, providing invaluable data that supports Glaukos's product development and regulatory submissions. This collaboration fosters scientific advancement and enhances the clinical understanding of Glaukos's technologies.

In 2024, Glaukos continued to foster these relationships. The company actively supports research grants and collaborates with key opinion leaders in academic settings. These partnerships are vital for generating real-world evidence and expanding the therapeutic applications of Glaukos's innovations. The insights gained from these institutions directly inform Glaukos's pipeline and strategic direction, ensuring their offerings remain at the forefront of ophthalmic care.

- Academic Engagement: Glaukos actively collaborates with leading universities and research centers globally to advance ophthalmic science.

- Clinical Trial Participation: Academic institutions and their affiliated investigators play a key role in Glaukos's clinical trials, generating critical data.

- Knowledge Advancement: The research conducted by these segments contributes significantly to the understanding and validation of Glaukos's proprietary technologies.

- Innovation Pipeline: Insights from academic research help shape Glaukos's future product development and market strategies.

Glaukos's customer segments are diverse, encompassing the direct users of their technology, the institutions that facilitate its use, and the entities that influence its accessibility and adoption. These groups are interconnected, with the ultimate goal of improving patient outcomes for conditions like glaucoma and keratoconus.

Ophthalmologists and ophthalmic surgeons are the core professional customers, integrating Glaukos's MIGS devices and pharmaceuticals into their surgical practices. Hospitals and Ambulatory Surgery Centers (ASCs) serve as the purchasing and utilization points, with the growing demand for outpatient procedures in 2024 underscoring their importance. Patients, while indirect, are the ultimate beneficiaries, driving demand through their need for improved quality of life and less invasive treatments.

Payers, including Medicare and private insurers, are critical gatekeepers, with their coverage decisions and reimbursement rates directly impacting market penetration and Glaukos's financial performance. Academic and research institutions act as vital partners, fostering innovation and providing validation through clinical trials and studies, which are essential for product development and market acceptance.

| Customer Segment | Role in Glaukos's Business | 2024 Relevance/Data |

| Ophthalmologists & Ophthalmic Surgeons | Direct users and prescribers of Glaukos's devices and therapies. | Integrate MIGS devices into surgical workflows. |

| Hospitals & ASCs | Purchasing and utilization points for Glaukos's products. | Benefit from growing outpatient procedure volume; ~20 million US procedures in 2024. |

| Patients | Ultimate beneficiaries, driving demand for improved treatments. | Seek convenience and better outcomes from less invasive therapies. |

| Payers (Medicare, Insurers) | Influence product accessibility and affordability through coverage and reimbursement. | 2024 Medicare LCDs impacted MIGS device coverage and utilization. |

| Academic & Research Institutions | Partners in innovation, validation, and clinical trial support. | Contribute to scientific advancement and real-world evidence generation. |

Cost Structure

A substantial part of Glaukos's financial outlay is dedicated to research and development, underscoring their focus on pioneering new solutions and growing their product offerings. This investment covers critical areas like conducting clinical trials, employing specialized scientific staff, and maintaining R&D infrastructure.

In 2024, Glaukos reported research and development expenses amounting to $136.4 million. This figure highlights the significant resources the company commits to advancing its innovative pipeline.

Looking at the first half of 2025, Glaukos's R&D expenditures were $36.5 million for the second quarter alone, indicating a continued strong commitment to innovation in the period.

Selling, General, and Administrative (SG&A) expenses are a key component of Glaukos' cost structure, covering everything from their sales team's compensation and extensive marketing efforts to the general operational overhead and the costs associated with distributing their innovative ophthalmic products worldwide. These costs are essential for building brand awareness, reaching new customers, and ensuring their treatments are accessible to patients and eye care professionals globally.

In 2024, Glaukos reported SG&A expenses totaling $261.2 million. This figure reflects the significant investment in expanding their commercial reach and supporting their growing product portfolio. For the second quarter of 2025, these expenses were $83.4 million, indicating continued investment in their go-to-market strategies and operational infrastructure.

Manufacturing and production costs are a significant component of Glaukos's expense base. These include outlays for raw materials, skilled labor involved in device assembly and pharmaceutical production, and the ongoing operational expenses of their manufacturing facilities.

These direct costs are critical as they directly impact Glaukos's gross margin. For instance, in the second quarter of 2025, the company reported a gross margin of approximately 78%, indicating efficient management of these production-related expenditures relative to their revenue.

Clinical Trial and Regulatory Compliance Costs

Glaukos dedicates substantial capital to clinical trials, a critical step in validating the safety and effectiveness of its innovative treatments. These extensive studies are essential for securing regulatory approvals, a process that demands significant financial resources to navigate complex requirements.

The company's commitment to regulatory compliance extends beyond initial approvals, encompassing ongoing monitoring and reporting. For example, in 2023, Glaukos reported research and development expenses of $261.6 million, a significant portion of which is allocated to clinical trials and regulatory activities aimed at bringing its ophthalmic solutions to market.

- Clinical Trials: Investments in Phase I, II, and III trials to gather robust efficacy and safety data.

- Regulatory Submissions: Costs associated with preparing and submitting applications to agencies like the FDA and EMA.

- Post-Market Surveillance: Expenses for ongoing studies and compliance activities after product launch.

- Quality Assurance: Maintaining high standards throughout the product lifecycle to meet regulatory expectations.

Intellectual Property and Licensing Costs

Glaukos invests significantly in protecting its innovations. This includes the substantial costs associated with acquiring, maintaining, and defending its broad patent portfolio and other intellectual property rights. These expenditures are crucial for securing their market position and enabling future product development.

Furthermore, Glaukos incurs licensing fees for technologies and patents acquired from third parties. These agreements are vital for accelerating their research and development initiatives, allowing them to integrate cutting-edge advancements into their product pipeline.

- Patent Portfolio Maintenance: Costs associated with filing, prosecuting, and maintaining patents globally.

- Licensing Fees: Payments made for access to external technologies or intellectual property.

- Legal Defense: Expenses incurred in defending their intellectual property against infringement claims.

- R&D Integration: Costs tied to incorporating licensed technologies into their product development processes.

Glaukos's cost structure is heavily influenced by its commitment to innovation and market expansion. Significant investments are channeled into research and development, aiming to bring novel ophthalmic solutions to market. This is complemented by substantial selling, general, and administrative expenses, which are crucial for global commercialization efforts and brand building.

Manufacturing and intellectual property protection also represent key cost drivers. The company incurs costs related to raw materials, skilled labor, and maintaining its manufacturing facilities, alongside significant expenditure on acquiring and defending its patent portfolio. These elements are fundamental to Glaukos's operational strategy and its ability to maintain a competitive edge.

| Expense Category | 2024 Actual (Millions USD) | Q2 2025 Actual (Millions USD) |

|---|---|---|

| Research & Development | 136.4 | 36.5 (Q2) |

| Selling, General & Administrative | 261.2 | 83.4 (Q2) |

| Gross Margin | ~78% (Q2) |

Revenue Streams

Glaukos' core revenue generation is through the sale of its innovative Micro-Invasive Glaucoma Surgery (MIGS) devices. These specialized surgical implants, like the widely adopted iStent family, are crucial for lowering intraocular pressure in individuals suffering from glaucoma.

The company's financial performance is heavily tied to the adoption and sales of these MIGS technologies. In the second quarter of 2025, Glaukos reported significant traction, with glaucoma net sales reaching $103.5 million, underscoring the market's reliance on their surgical solutions.

Glaukos also generates revenue from its corneal health segment, notably through its FDA-approved corneal cross-linking therapy for keratoconus. This product line effectively broadens their income sources beyond glaucoma treatments.

In the second quarter of 2025, sales from the corneal health franchise reached $20.6 million, demonstrating a growing contribution to the company's overall financial performance.

Glaukos's business model features a crucial revenue stream from the sale of intracameral procedural pharmaceuticals, with iDose TR being a prime example. This innovative dropless drug delivery solution marks a significant expansion for the company.

The commercial introduction of iDose TR has directly translated into substantial sales, demonstrating its market acceptance and revenue-generating potential. For instance, in the second quarter of 2025, iDose TR achieved impressive sales figures, reaching $31 million.

International Product Sales

International product sales are a vital component of Glaukos's revenue generation. In 2024, these sales accounted for a substantial portion, approximately 30% of the company's total net sales, underscoring the global demand for their ophthalmic solutions.

Glaukos actively pursues expansion of its international presence, leveraging both direct sales channels and strategic partnerships with distributors. This global reach is a critical factor in driving the company's ongoing growth and market penetration.

- Global Revenue Contribution: Approximately 30% of Glaukos's net sales in 2024 were generated from international markets.

- Growth Strategy: Expansion of global footprint through direct sales and distribution partners is a key driver for revenue growth.

- Market Reach: Glaukos's international sales demonstrate the broad adoption and acceptance of its innovative ophthalmic products worldwide.

Future Revenue from Pipeline Products and New Indications

Glaukos anticipates significant future revenue growth driven by its promising pipeline of novel therapies targeting glaucoma, corneal, and retinal diseases. This expansion is contingent on securing regulatory approvals for new products and obtaining approvals for new indications for existing treatments.

The company's strategic focus on innovation is expected to unlock substantial revenue streams. For instance, Epioxa, a key product in their pipeline, is projected to receive FDA approval by October 2025, marking a critical milestone for future revenue generation.

- Pipeline Expansion: Glaukos is actively developing novel therapies for glaucoma, corneal, and retinal diseases, aiming to broaden its product portfolio.

- New Indications: Securing new indications for existing products will further extend their market reach and revenue potential.

- Regulatory Milestones: Key regulatory approvals, such as the anticipated FDA approval for Epioxa by October 2025, are crucial catalysts for future revenue.

- Market Penetration: Successful launches of pipeline products and expanded indications are expected to drive increased market penetration and revenue growth.

Glaukos' revenue streams are diversified across its innovative ophthalmic product lines, primarily driven by its Micro-Invasive Glaucoma Surgery (MIGS) devices, corneal health therapies, and intracameral procedural pharmaceuticals. The company's commitment to research and development fuels its pipeline, with new product approvals and expanded indications acting as key revenue drivers.

| Revenue Segment | Q2 2025 Sales (Millions USD) | Key Products |

|---|---|---|

| Glaucoma | $103.5 | iStent family (MIGS devices) |

| Corneal Health | $20.6 | Corneal cross-linking therapy |

| Intracameral Pharmaceuticals | $31.0 | iDose TR |

Business Model Canvas Data Sources

The Glaukos Business Model Canvas is informed by Glaukos's financial reports, market analysis of the ophthalmic industry, and internal strategic planning documents. These sources provide a comprehensive view of the company's operations and market position.