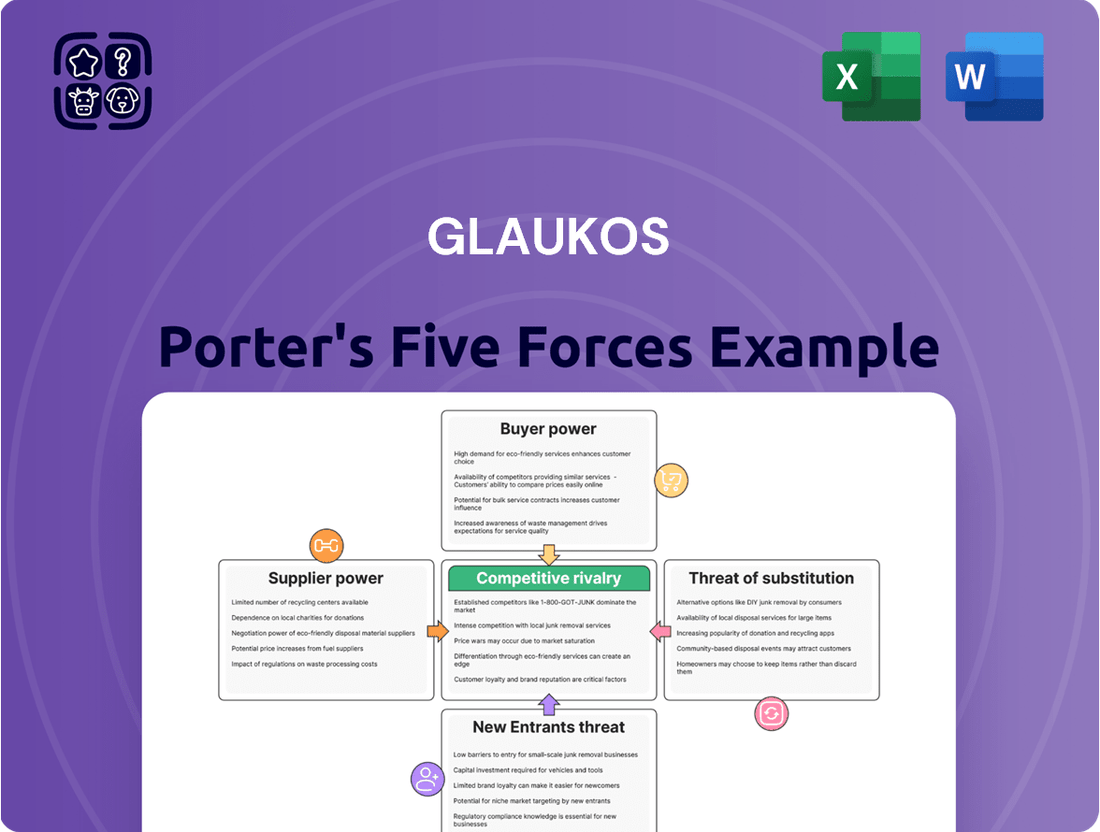

Glaukos Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Glaukos Bundle

Glaukos operates in a dynamic ophthalmic medical device market, facing moderate threats from new entrants and substitutes due to high R&D costs and patent protections. Buyer power is somewhat limited by specialized physician needs and insurance reimbursement, while supplier power is manageable given the availability of component manufacturers.

The competitive rivalry within the glaucoma treatment sector is intense, with established players and emerging technologies vying for market share. Understanding these forces is crucial for Glaukos's strategic planning and competitive positioning.

Ready to move beyond the basics? Get a full strategic breakdown of Glaukos’s market position, competitive intensity, and external threats—all in one powerful analysis.

Suppliers Bargaining Power

In the ophthalmic medical technology sector, particularly for micro-invasive glaucoma surgery (MIGS) devices, Glaukos might face concentrated supplier power. If only a handful of companies provide highly specialized components or raw materials crucial for Glaukos' patented technologies, these suppliers gain significant leverage.

For instance, imagine a critical biocompatible material or a unique micro-fabrication process is controlled by just two or three global suppliers. This limited supply base means Glaukos has fewer options, potentially leading to higher input costs or supply chain disruptions if these key suppliers decide to increase prices or face production issues.

Glaukos faces significant supplier bargaining power due to high switching costs for its iStent inject W and other micro-invasive glaucoma surgery (MIGS) devices. Developing and validating new suppliers for specialized components or manufacturing processes can be a lengthy and expensive undertaking, often requiring extensive re-tooling and rigorous regulatory approvals for medical devices. This integration means that even minor changes can necessitate substantial investment, giving existing suppliers considerable leverage.

Suppliers offering proprietary technology or highly specialized materials essential for Glaukos' minimally invasive glaucoma surgery (MIGS) devices or pharmaceutical products can exert significant leverage. This is because Glaukos’ competitive advantage hinges on these unique inputs, making it difficult to substitute them with readily available alternatives.

For instance, if a key supplier holds patents on a critical component for Glaukos' iStent inject W, a device that saw significant adoption and contributed to Glaukos' revenue growth, that supplier’s bargaining power would be amplified. Glaukos' commitment to innovation in ophthalmology means it often requires inputs that are not mass-produced, further strengthening the position of specialized suppliers.

Threat of Forward Integration

The threat of suppliers integrating forward into producing similar medical devices or pharmaceuticals presents a potential challenge for Glaukos. If suppliers were to manufacture comparable products, they could effectively become competitors, thereby enhancing their bargaining power and potentially impacting Glaukos' market share and pricing strategies.

However, this particular threat is somewhat mitigated by the significant barriers to entry within the specialized field of ophthalmology. The stringent regulatory approval processes for medical devices and pharmaceuticals, coupled with the need for deep scientific knowledge and extensive research and development capabilities, create a high hurdle for potential new entrants, including existing suppliers.

- Regulatory Hurdles: The FDA approval process for ophthalmic devices, for instance, can take years and involve substantial investment, deterring many suppliers from direct forward integration.

- Specialized Expertise: Developing and manufacturing advanced ophthalmic technologies requires highly specialized scientific and engineering talent, which may not be readily available to all suppliers.

- Capital Investment: The significant capital required for R&D, manufacturing facilities, and regulatory compliance for medical devices can be a substantial deterrent for suppliers.

Importance of Glaukos to Supplier

Glaukos' significance to its suppliers plays a crucial role in determining their bargaining power. If Glaukos constitutes a substantial portion of a supplier's overall revenue, that supplier may have less leverage. This is because the supplier's own financial stability would be more closely tied to maintaining the Glaukos relationship, potentially leading to more favorable terms for Glaukos.

Conversely, if Glaukos is a minor customer for a large, diversified supplier, the supplier's bargaining power increases. In such scenarios, the supplier has less dependence on Glaukos and can afford to be less accommodating on pricing or terms, knowing that losing Glaukos' business would not significantly impact their operations. For instance, in 2023, Glaukos' cost of goods sold was $213.7 million, indicating a substantial procurement volume that could influence supplier negotiations.

- Supplier Dependence: Glaukos' revenue contribution to its suppliers directly impacts their willingness to negotiate.

- Supplier Diversification: Suppliers with a broad customer base have more power when dealing with smaller clients like Glaukos.

- Procurement Volume: Glaukos' significant spending, such as its $213.7 million cost of goods sold in 2023, can be a negotiating tool.

- Strategic Importance: The criticality of Glaukos' products to a supplier's portfolio also influences the power dynamic.

Glaukos experiences moderate bargaining power from its suppliers, primarily due to the specialized nature of components required for its MIGS devices and pharmaceutical products. While Glaukos' significant procurement volume, evidenced by its 2023 cost of goods sold of $213.7 million, offers some leverage, the high switching costs and proprietary nature of certain inputs limit its ability to drive down prices or dictate terms.

The threat of supplier forward integration is somewhat contained by the substantial regulatory and capital barriers inherent in the ophthalmic medical technology sector. However, suppliers who provide critical, non-substitutable materials or technologies essential for Glaukos' innovative product pipeline, such as its iStent inject W, retain considerable influence.

| Factor | Glaukos' Position | Supplier Leverage |

| Supplier Concentration | Potentially concentrated for specialized components | High if few suppliers exist |

| Switching Costs | High due to validation and regulatory hurdles | High |

| Proprietary Inputs | Reliance on unique materials/tech | High |

| Supplier Dependence on Glaukos | Glaukos is a significant customer (2023 COGS: $213.7M) | Moderate to Low |

| Threat of Forward Integration | Mitigated by high industry barriers | Low to Moderate |

What is included in the product

This analysis dissects Glaukos' competitive environment by examining the intensity of rivalry, the bargaining power of buyers and suppliers, the threat of new entrants, and the availability of substitutes.

Glaukos' Porter's Five Forces analysis provides a structured framework to identify and mitigate competitive pressures, offering a strategic roadmap for navigating market complexities.

Uncover hidden threats and opportunities across the industry landscape, empowering Glaukos to proactively address potential pain points and strengthen its competitive position.

Customers Bargaining Power

Glaukos' primary customers are ophthalmic surgeons, hospitals, and clinics. While individual surgeons might not wield significant individual power, the consolidation of purchasing power within large hospital systems or integrated delivery networks can amplify their collective leverage, potentially impacting pricing and terms.

The increasing sophistication and growth of healthcare infrastructure also contribute to customer bargaining power. As more healthcare facilities become larger and more integrated, their ability to negotiate favorable terms for medical devices like Glaukos' iStent and other glaucoma treatment solutions becomes more pronounced.

The bargaining power of customers in the glaucoma treatment market is significantly influenced by the availability of alternatives. Patients seeking treatment for glaucoma have a range of options beyond Glaukos's products, including traditional surgical procedures and a variety of medicated eye drops. In 2024, the market for glaucoma medications alone was substantial, with projected revenues indicating continued patient reliance on pharmaceutical solutions.

Furthermore, the competitive landscape includes other medical device companies offering alternative Minimally Invasive Glaucoma Surgery (MIGS) devices. The presence and perceived efficacy of these competing MIGS technologies directly impact Glaukos's pricing flexibility and customer retention. If alternative MIGS procedures demonstrate comparable or superior outcomes with different cost structures, customers gain leverage in negotiating terms or choosing a different provider.

Healthcare providers and patients are increasingly mindful of treatment costs, particularly as reimbursement policies shift and overall healthcare spending rises. This price sensitivity directly impacts Glaukos, as higher-priced advanced devices can slow market adoption. For instance, in 2024, the average annual cost of a glaucoma treatment regimen can range significantly, with some advanced surgical options exceeding several thousand dollars, making cost a crucial factor for patient and provider decisions.

Buyer Information and Transparency

As Glaukos' product efficacy, safety, and pricing information becomes more readily available through clinical studies and industry reports, customers gain a clearer understanding. For instance, detailed clinical trial data on the iStent inject W, a key product, allows potential buyers to compare its performance against alternatives. This heightened transparency empowers buyers, enabling them to negotiate more effectively on price and terms, thereby increasing their bargaining power.

- Increased Information Access: Buyers can access extensive clinical data and comparative studies, reducing information asymmetry.

- Price Sensitivity: Greater transparency on manufacturing costs and R&D investments can lead to increased price sensitivity among customers.

- Negotiation Leverage: Informed customers are better equipped to negotiate pricing and contract terms based on demonstrated product value and market alternatives.

Impact of Product on Customer's Business

Glaukos' minimally invasive glaucoma surgery (MIGS) devices, such as the iStent and iStent inject, offer distinct advantages for ophthalmologists. These benefits include smaller surgical incisions, quicker patient recovery times, and generally less post-operative discomfort. For instance, studies have highlighted faster visual rehabilitation with MIGS compared to traditional procedures.

These product attributes directly impact a customer's practice by potentially improving patient throughput and reducing the resources needed for post-operative care. When Glaukos' solutions demonstrably enhance a healthcare provider's ability to deliver better patient outcomes or streamline their practice's operational efficiency, the customer's leverage in price negotiations or other demands can be somewhat diminished. This is because the perceived value and indispensable nature of the technology increase.

The specific impact on a customer's business can be quantified by looking at metrics like reduced operating room time per procedure or decreased need for adjunctive medications. While precise 2024 figures for Glaukos' specific customer practice impact are proprietary, the broader MIGS market, which Glaukos is a significant player in, has seen consistent growth, indicating adoption driven by these very benefits. The global MIGS market was projected to reach over $5 billion by 2024, underscoring the value proposition.

- Improved Patient Outcomes: Smaller incisions and faster healing lead to better patient satisfaction and quicker return to normal activities.

- Operational Efficiency: Reduced procedure time and post-operative care can increase the number of patients a practice can see.

- Value-Based Proposition: The clinical and economic benefits of Glaukos' MIGS devices can lessen customer price sensitivity.

- Market Growth: The expanding MIGS market reflects the perceived value and advantages offered by products like Glaukos'.

The bargaining power of Glaukos' customers is moderate, influenced by factors like product differentiation and switching costs. While Glaukos' MIGS devices offer unique benefits, the availability of alternative treatments and increasing customer price sensitivity in 2024 temper this power.

Consolidated purchasing by large hospital systems and the growing availability of information on product efficacy and cost empower customers to negotiate more effectively. For instance, the global MIGS market was projected to exceed $5 billion by 2024, indicating strong competition and customer choice.

The ability of Glaukos' products to improve operational efficiency and patient outcomes for healthcare providers can, however, reduce customer price sensitivity and thus their bargaining power. The perceived value of faster recovery and reduced post-operative care strengthens Glaukos' position.

| Factor | Impact on Bargaining Power | Supporting Data/Observation (2024 Focus) |

|---|---|---|

| Customer Concentration | Moderate to High | Consolidation within large hospital systems amplifies collective leverage. |

| Availability of Alternatives | Moderate to High | Range of traditional surgeries and medications, plus competing MIGS devices. |

| Price Sensitivity | Moderate to High | Healthcare cost awareness and the significant cost of advanced treatments influence decisions. |

| Switching Costs | Low to Moderate | While training is involved, adoption of alternative MIGS or treatments is feasible. |

| Product Differentiation | Moderate | Glaukos' MIGS offer benefits like smaller incisions and faster recovery, creating some differentiation. |

Preview the Actual Deliverable

Glaukos Porter's Five Forces Analysis

This preview showcases the complete Glaukos Porter's Five Forces Analysis, offering a thorough examination of the competitive landscape within the ophthalmic medical device industry. The document you see here is the exact, professionally formatted analysis you will receive immediately after purchase, ensuring full transparency and immediate usability for your strategic planning. You are looking at the actual document; once your purchase is complete, you’ll gain instant access to this comprehensive analysis without any alterations or missing sections.

Rivalry Among Competitors

The micro-invasive glaucoma surgery (MIGS) device market, where Glaukos operates, is quite competitive. Several significant companies are actively involved, including giants like Johnson & Johnson Vision, AbbVie (through its Allergan acquisition), and Carl Zeiss Meditec, all vying for market share alongside Glaukos.

This robust presence of multiple large, well-resourced players means that competition is naturally intensified. For instance, Johnson & Johnson Vision has a broad portfolio in eye care, and AbbVie's acquisition of Allergan brought established ophthalmic products and research capabilities into play, directly challenging Glaukos.

The Minimally Invasive Glaucoma Surgery (MIGS) devices market is a hotbed of activity, expected to surge from $0.7 billion in 2024 to $0.9 billion in 2025, marking an impressive 28.3% compound annual growth rate. This rapid expansion offers a double-edged sword for Glaukos; while the growing pie allows for multiple companies to gain traction, it simultaneously beckons new entrants, intensifying competition.

Glaukos has carved out a significant niche by pioneering Minimally Invasive Glaucoma Surgery (MIGS) and consistently advancing its product pipeline. This focus on technological innovation, exemplified by its iStent platform and the novel iDose TR, a long-acting intracameral pharmaceutical, creates strong product differentiation.

This differentiation allows Glaukos to offer unique, less invasive treatment options. For instance, the iStent inject W system, approved in 2020, offers a novel approach to intraocular pressure management. Such advancements reduce the direct pressure of price-based competition by offering superior or distinct patient benefits.

Switching Costs for Patients/Physicians

While Glaukos' iStent and other micro-invasive glaucoma surgery (MIGS) devices offer clear patient benefits such as fewer complications and faster recovery, physicians face certain switching costs. These include the time and resources needed for training on new surgical techniques and the effort to integrate unfamiliar devices into their existing workflows. For instance, adopting new MIGS technologies often requires dedicated training sessions and practice to achieve proficiency.

However, these physician-related switching costs are often mitigated by the significant advantages MIGS procedures provide. The potential for improved patient outcomes and reduced long-term medication reliance can make the transition worthwhile. In 2024, the demand for less invasive glaucoma treatments continued to rise, encouraging more ophthalmologists to explore and adopt MIGS technologies, thereby lowering the perceived barrier of switching costs.

- Physician Training: Learning new surgical techniques and device handling.

- Procedural Familiarity: Building confidence and efficiency with novel MIGS procedures.

- Practice Integration: Adapting existing surgical setups and patient protocols.

- Patient Benefits: Reduced complications and quicker recovery often outweigh training investments.

Industry Concentration and Acquisitions

The ophthalmic device market is experiencing a notable trend of consolidation. A prime example is Alcon's acquisition of Ivantis, a move that signals a shift towards fewer, but more formidable, competitors. This consolidation can intensify competitive rivalry as larger entities leverage expanded product portfolios and market reach to implement aggressive strategies.

This concentration can lead to increased pressure on smaller players to innovate rapidly or seek partnerships to remain competitive. For instance, the increasing market share held by a few dominant companies in specific segments of ophthalmic surgery can create significant barriers to entry and necessitate strategic maneuvering for survival and growth.

- Market Consolidation: Alcon's acquisition of Ivantis highlights the trend of larger players absorbing smaller innovators in the ophthalmic device sector.

- Increased Rivalry: Consolidation often leads to fewer, but stronger, competitors who may engage in more aggressive pricing and marketing strategies.

- Portfolio Expansion: Acquired companies often bring complementary technologies, allowing larger players to offer more comprehensive solutions, thereby intensifying competition.

Competitive rivalry within the MIGS device market is intense, driven by well-established players like Johnson & Johnson Vision and AbbVie, alongside Glaukos. The market's rapid growth, projected to reach $0.9 billion by 2025, attracts new entrants, further intensifying competition.

Glaukos differentiates itself through innovation, such as its iStent and iDose TR, offering unique patient benefits that mitigate direct price competition. While physician switching costs exist, the advantages of MIGS procedures are driving adoption, with demand for less invasive treatments rising in 2024.

Market consolidation, exemplified by Alcon's acquisition of Ivantis, signals a trend towards fewer, stronger competitors, potentially increasing rivalry and requiring strategic adaptation from companies like Glaukos.

| Key Competitors | 2024 Market Position (Estimated) | Key Product Examples |

| Johnson & Johnson Vision | Significant Market Share | Various ophthalmic surgical devices |

| AbbVie (Allergan) | Strong Presence | Established glaucoma treatments and devices |

| Carl Zeiss Meditec | Active Player | Ophthalmic surgical microscopes and diagnostic tools |

| Glaukos | Pioneer in MIGS | iStent, iDose TR |

SSubstitutes Threaten

The primary substitutes for Glaukos' micro-invasive glaucoma surgery (MIGS) devices are the long-standing traditional glaucoma treatments. These include daily medicated eye drops, which are a cornerstone of initial management, and more invasive conventional surgical procedures like trabeculectomy. Laser therapies, such as selective laser trabeculoplasty (SLT), also represent established alternatives.

These traditional methods continue to hold significant market share, with eye drops alone representing a substantial portion of the global glaucoma treatment market. For instance, the glaucoma eye drops market was valued at billions of dollars in recent years, indicating their widespread adoption and continued reliance by patients and physicians.

While traditional glaucoma treatments like eye drops are effective, they face challenges. Patient adherence to daily drop regimens can be low, impacting efficacy, and side effects such as redness or stinging are common. Furthermore, the ongoing cost of prescription eye drops can be a significant burden for patients. In 2024, the global glaucoma treatment market was valued at approximately $6.4 billion, with eye drops representing a substantial portion.

Conventional surgical procedures, such as trabeculectomy, offer a more permanent solution but often involve longer recovery periods and a higher risk of complications like infection or hypotony. These factors can make patients hesitant to opt for surgery. Data from 2023 indicated that complication rates for traditional glaucoma surgeries could range from 5% to 15% depending on the specific procedure and patient factors.

Minimally Invasive Glaucoma Surgery (MIGS) presents a compelling alternative, directly addressing the drawbacks of both eye drops and traditional surgery. MIGS procedures generally offer enhanced safety profiles, quicker recovery times, and improved patient comfort compared to conventional surgeries. This can significantly reduce the appeal of older treatment methods as patients seek less invasive and more tolerable options for managing their intraocular pressure.

The cost-effectiveness of substitutes for Glaukos' products, primarily traditional glaucoma treatments like eye drops and conventional surgeries, presents a significant competitive force. While eye drops may appear cheaper initially, the ongoing expense of lifelong medication, estimated to be hundreds or even thousands of dollars annually per patient, adds up considerably.

Furthermore, the potential for complications from traditional surgeries, requiring additional treatments and incurring further costs, can offset any perceived upfront savings. For instance, a patient might spend $500-$1000 annually on glaucoma eye drops, a cost that accumulates over many years.

Minimally invasive glaucoma surgery (MIGS) devices, like those offered by Glaukos, represent a higher upfront investment. However, their potential to reduce or eliminate the need for daily eye drops and lower the risk of complications from more invasive procedures offers a compelling long-term value proposition that can be more cost-effective over a patient's lifetime.

Patient and Physician Preference

Physician preference for minimally invasive glaucoma surgeries (MIGS) is a significant factor. In 2024, the trend towards MIGS continued, driven by shorter recovery times and reduced complication rates compared to traditional trabeculectomy or tube shunt procedures. This preference directly impacts the demand for devices like those offered by Glaukos.

Patient awareness and demand for less invasive treatments are also on the rise. As patients become more informed about advanced corrective vision options, they increasingly seek out procedures that minimize disruption to their daily lives. This growing patient preference for MIGS over traditional surgical interventions acts as a powerful substitute threat.

The perceived benefits of MIGS, such as quicker visual recovery and lower risk profiles, are key drivers for both physician and patient adoption. For instance, studies in 2024 highlighted that MIGS procedures can lead to a 50% reduction in recovery time compared to traditional surgeries, making them a more attractive substitute option.

- Physician Preference: Healthcare providers increasingly favor MIGS due to enhanced patient outcomes and operational efficiency.

- Patient Awareness: Growing patient knowledge of advanced treatments drives demand for less invasive alternatives.

- Benefit-Driven Adoption: Shorter recovery periods and reduced complication rates make MIGS a compelling substitute.

Emerging Therapies

Beyond current treatments, the threat of substitutes is amplified by ongoing research into novel glaucoma therapies. These include advancements like gene therapy, which aims to correct underlying genetic defects, and next-generation pharmaceuticals offering improved efficacy or delivery methods. Smart contact lenses and implantable sensors are also being developed to continuously monitor intraocular pressure, potentially reducing the need for traditional interventions.

While these emerging therapies are not yet mainstream, their development poses a significant future threat to existing Micro-Invasive Glaucoma Surgery (MIGS) solutions offered by companies like Glaukos. For instance, by mid-2024, several gene therapy candidates were progressing through Phase 1 and 2 clinical trials, indicating potential market entry within the next five to ten years. The successful integration of these advanced treatments could fundamentally alter the treatment landscape, impacting the market share of current MIGS devices.

- Gene Therapy: Several candidates in clinical trials by mid-2024, aiming for long-term IOP control.

- New Drug Generations: Focus on sustained release and improved patient compliance.

- Smart Technologies: Development of continuous IOP monitoring devices, potentially reducing reliance on surgical interventions.

- Future Impact: These innovations could disrupt the market for current MIGS procedures.

The threat of substitutes for Glaukos' MIGS devices is moderate but growing. Traditional treatments like eye drops and conventional surgeries remain dominant, with the global glaucoma treatment market valued at approximately $6.4 billion in 2024, where eye drops constitute a significant portion. However, patient adherence issues with eye drops and the higher risks and longer recovery associated with traditional surgeries create an opening for MIGS.

Physician and patient preference is shifting towards less invasive options, with MIGS procedures in 2024 showing a trend towards reduced recovery times and complication rates compared to older surgical methods. Emerging therapies like gene therapy, with several candidates in clinical trials by mid-2024, also represent a future substitute threat.

| Substitute Type | Key Characteristics | Market Share/Adoption (Approximate) | Threat Level |

| Glaucoma Eye Drops | Lifelong daily use, potential adherence issues, ongoing cost | Substantial portion of $6.4B market (2024) | Moderate |

| Traditional Glaucoma Surgery (e.g., Trabeculectomy) | More invasive, longer recovery, higher complication risk (5-15% in 2023) | Established but declining relative share | Moderate |

| Emerging Therapies (Gene Therapy, Smart Tech) | Potential for long-term control, continuous monitoring, not yet mainstream | Nascent, with gene therapy candidates in trials by mid-2024 | Low to Moderate (Future) |

Entrants Threaten

The ophthalmic medical technology and pharmaceutical sector demands significant upfront capital. Companies like Glaukos, which develop innovative treatments for glaucoma, invest heavily in research and development, lengthy clinical trials, and specialized manufacturing. For instance, the cost of bringing a new drug to market can easily exceed $1 billion, and the specialized equipment for medical devices adds to this substantial barrier.

The medical device and pharmaceutical sectors face formidable regulatory barriers, significantly deterring new entrants. Companies must navigate extensive clinical trials, secure approvals from bodies like the FDA and comply with evolving standards such as the EU Medical Device Regulation (MDR). Glaukos' successful attainment of EU MDR certifications in 2023 exemplifies the demanding nature of these processes, which require substantial investment and time, thereby raising the cost of entry.

Glaukos, a leader in minimally invasive glaucoma surgery (MIGS), leverages its extensive intellectual property, including numerous patents on its innovative devices and proprietary technologies. This strong patent portfolio acts as a significant barrier, deterring potential new entrants who would otherwise struggle to enter the market without infringing on Glaukos' protected innovations. For instance, Glaukos' iStent inject technology, a cornerstone of its MIGS offerings, is protected by a robust suite of patents, making direct replication a costly and legally perilous endeavor for competitors.

Access to Distribution Channels

New companies face significant hurdles in securing access to vital distribution channels within the ophthalmic medical device sector. Glaukos, for instance, has cultivated robust relationships with key stakeholders, including ophthalmic surgeons, hospitals, and clinics. These established networks are a substantial barrier, making it difficult for newcomers to penetrate the market and gain traction for their products.

The existing infrastructure and strong ties held by companies like Glaukos mean that new entrants must invest heavily to build their own distribution capabilities or find ways to partner with established players. For example, in 2023, Glaukos reported net sales of $1.1 billion, reflecting the strength and reach of its existing market access.

- Established Networks: Glaukos has built strong, long-standing relationships with ophthalmic surgeons and healthcare facilities, providing preferential access for its products.

- High Adoption Costs: New entrants must overcome significant costs associated with establishing their own distribution networks or convincing existing channels to carry their devices.

- Market Penetration Challenges: Gaining shelf space and surgeon adoption against established, trusted brands like Glaukos requires substantial marketing and sales efforts.

Brand Recognition and Physician Loyalty

Glaukos has cultivated strong brand recognition and deep physician loyalty within the micro-invasive glaucoma surgery (MIGS) market. This established presence, backed by extensive clinical experience and a substantial global installed base of devices, creates a significant hurdle for potential new entrants. Building comparable trust and awareness requires immense investment in time and resources, making it difficult for newcomers to gain traction.

The company's leadership in MIGS is evident in its market penetration and physician adoption rates. For instance, Glaukos' iStent technology, a pioneer in the MIGS category, has been implanted in hundreds of thousands of eyes worldwide, fostering a strong familiarity and comfort level among surgeons. This deep-seated physician loyalty, cultivated over years of product performance and support, acts as a formidable barrier.

- Brand Equity: Glaukos has invested heavily in building its brand as a trusted innovator in glaucoma treatment.

- Physician Education & Training: The company's commitment to physician training programs has fostered a loyal user base.

- Clinical Data: A robust portfolio of clinical studies and real-world evidence supports Glaukos' product efficacy and safety, further solidifying physician confidence.

The threat of new entrants for Glaukos is considerably low due to substantial capital requirements for R&D, clinical trials, and specialized manufacturing, often exceeding $1 billion for new pharmaceutical products. Regulatory hurdles, including FDA approvals and compliance with evolving standards like the EU MDR, demand significant investment and time, as seen with Glaukos' EU MDR certifications in 2023. Furthermore, Glaukos' extensive patent portfolio, protecting innovations like its iStent inject technology, creates a costly and legally risky environment for potential competitors attempting to replicate its offerings.

| Barrier Type | Description | Impact on New Entrants |

|---|---|---|

| Capital Requirements | High costs for R&D, clinical trials, manufacturing. | Significant financial barrier. |

| Regulatory Hurdles | Extensive trials, FDA/EU MDR approvals. | Time-consuming and costly compliance. |

| Intellectual Property | Robust patent portfolio on innovative devices. | Legal risks and high replication costs. |

Porter's Five Forces Analysis Data Sources

Our Glaukos Porter's Five Forces analysis is built upon a foundation of robust data, including Glaukos's own SEC filings and investor presentations, alongside comprehensive market research reports from firms specializing in the ophthalmic medical device sector.