G-III PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

G-III Bundle

Unlock the external forces shaping G-III's future with our comprehensive PESTLE analysis. Understand how political shifts, economic volatility, and evolving social trends are impacting the company's operations and market position. This expertly crafted report provides the actionable intelligence you need to make informed strategic decisions. Download the full version now and gain a critical competitive edge.

Political factors

Changes in international trade agreements, tariffs, and import/export regulations directly influence G-III's sourcing and distribution networks. For instance, the imposition of new tariffs on key components sourced from Asia could increase production costs for G-III by an estimated 5-10% in 2024, impacting its overall pricing strategy and competitiveness.

Fluctuations in trade relations between countries where G-III manufactures or sells are critical. A trade dispute between the United States and China, for example, could disrupt G-III's supply chain for electronics, potentially leading to delays and increased shipping expenses, estimated at an additional 3% on logistics costs.

Navigating these evolving trade policies is paramount for G-III to maintain cost-efficiency and secure market access. The company's ability to adapt its sourcing strategies and distribution channels in response to new trade pacts, such as potential revisions to the USMCA in late 2024, will be a key determinant of its financial performance.

Geopolitical stability is a critical consideration for G-III Apparel, particularly concerning its global sourcing and manufacturing operations. Regions experiencing political unrest, such as ongoing conflicts or the imposition of sanctions, can significantly disrupt G-III's supply chains. For instance, if a key manufacturing partner is located in a country facing new trade restrictions, it could lead to delays and increased costs for G-III's finished goods.

The company's reliance on diverse sourcing locations means that instability in any one region can have ripple effects. In 2024, several apparel-producing nations faced heightened political tensions, impacting logistics and material availability. This instability directly translates to increased operational risks and potential impacts on G-III's ability to meet delivery commitments to its retail partners, as seen with disruptions in East Asian shipping routes earlier in the year.

Labor laws and regulations directly impact G-III's operational costs and human resource strategies. For instance, in the United States, the Fair Labor Standards Act (FLSA) mandates minimum wage and overtime pay. As of January 1, 2024, the federal minimum wage remained at $7.25 per hour, but many states and cities have higher rates. For example, California's minimum wage increased to $16.00 per hour in 2024, significantly affecting labor expenses for any manufacturing or retail operations within the state.

Stricter enforcement of workplace safety standards, such as those overseen by the Occupational Safety and Health Administration (OSHA), can also necessitate increased investment in compliance and training. Changes in unionization rules or collective bargaining agreements can lead to higher wage demands and altered working conditions, potentially impacting G-III's supply chain partners and their pricing structures.

Consumer Protection Legislation

Consumer protection legislation is a critical political factor for G-III, encompassing laws safeguarding consumer rights related to product safety, clear labeling, and honest advertising. Navigating these regulations across various operating regions is paramount to prevent legal repercussions and uphold the company's image.

For instance, in 2024, the European Union continued to strengthen its consumer protection framework with potential updates to the General Product Safety Regulation, emphasizing stricter enforcement and digital product safety. G-III must remain agile in adapting its product development and marketing strategies to align with these evolving standards.

Key areas of focus for G-III in 2024 and 2025 include:

- Product Safety: Ensuring all products meet or exceed international safety standards, particularly in markets with stringent regulations like the EU and the US.

- Labeling Requirements: Adhering to precise ingredient, origin, and usage instructions as mandated by different national bodies, such as the FDA in the United States.

- Advertising Standards: Maintaining transparency and accuracy in all marketing claims to avoid deceptive practices, a growing area of scrutiny by consumer watchdogs globally.

- Data Privacy: Complying with data protection laws like GDPR and CCPA, which increasingly govern how consumer data is collected and used in marketing and sales.

Taxation Policies

G-III Apparel Group's profitability is significantly influenced by governmental tax rates and policies, encompassing corporate income tax, sales tax, and import duties. For instance, a notable shift in corporate tax policy in a major market like the United States, where G-III operates extensively, could directly alter its net earnings. As of the latest available data, the U.S. federal corporate income tax rate stands at 21%.

Changes in these fiscal regulations can necessitate adjustments to G-III's pricing strategies, impacting its competitive positioning. Furthermore, import duties on apparel and related materials, a common practice in international trade, can increase the cost of goods sold, thereby affecting gross margins. For example, tariffs imposed on goods sourced from countries with preferential trade agreements could raise production costs.

- Corporate Income Tax: The U.S. federal corporate tax rate remains at 21%, a key factor in G-III's overall tax burden.

- Sales Tax Variations: State and local sales tax rates differ across the U.S., impacting consumer pricing and G-III's revenue collection.

- Import Duties: Tariffs on imported goods can directly increase the cost of inventory for G-III, influencing product pricing and profitability.

Governmental policies on trade, such as tariffs and trade agreements, directly impact G-III's global operations. For example, changes in import duties on apparel from countries like China, where G-III sources a significant portion of its products, could increase costs. In 2024, the potential for new tariffs on imported textiles could add an estimated 4-8% to G-III's cost of goods sold.

Geopolitical stability is also a key factor, as unrest in manufacturing regions can disrupt supply chains. For instance, if a major production hub in Southeast Asia experiences political instability, it could lead to delays and increased shipping costs for G-III, potentially impacting inventory levels and sales by 2-5% in affected periods.

Labor laws, including minimum wage and workplace safety regulations, influence operational expenses. With minimum wages rising in many U.S. states in 2024, such as California's $16.00 per hour, G-III's labor costs for its domestic retail and distribution centers will see an upward adjustment.

Consumer protection laws, focusing on product safety and labeling, require G-III to maintain high standards across its diverse product lines. The EU's ongoing review of its General Product Safety Regulation in 2024 emphasizes stricter compliance, potentially necessitating additional investment in product testing and quality control for G-III's European market presence.

What is included in the product

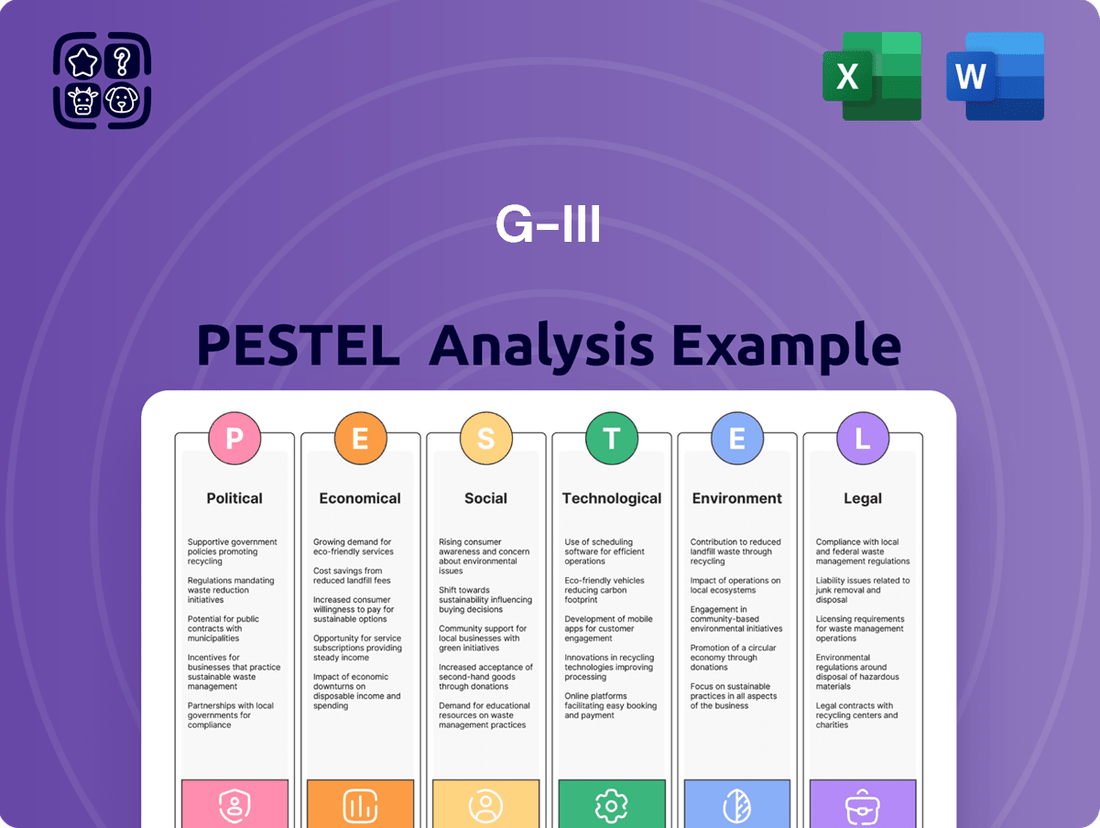

The G-III PESTLE Analysis systematically examines the Political, Economic, Social, Technological, Environmental, and Legal forces impacting the G-III's operating landscape.

This comprehensive evaluation provides actionable insights for strategic decision-making and risk mitigation.

Provides a concise version that can be dropped into PowerPoints or used in group planning sessions, streamlining strategic discussions and ensuring everyone is on the same page regarding external factors.

Economic factors

Consumer discretionary spending is a crucial gauge for companies like G-III Apparel Group, as it directly reflects consumers' capacity and inclination to buy non-essential goods. When the broader economy is robust, consumers feel more secure, leading to increased spending on items such as apparel and accessories. For instance, in early 2024, consumer confidence saw fluctuations, impacting discretionary budgets.

Conversely, economic headwinds, such as rising inflation or a potential recession, can significantly dampen consumer sentiment. This often results in consumers prioritizing essential purchases, leading to reduced demand for discretionary items and a direct impact on G-III's sales volumes. Data from late 2023 and early 2024 indicated persistent inflation affecting household budgets, potentially constraining discretionary outlays.

Rising inflation in 2024 and 2025 directly impacts G-III Apparel Group's operational expenses. For instance, the Producer Price Index (PPI) for apparel and textiles saw significant increases, directly affecting the cost of raw materials like cotton and synthetic fabrics. Higher transportation costs, driven by elevated fuel prices, further squeeze profit margins on goods moving through the supply chain.

Furthermore, increased interest rates implemented by central banks to combat inflation can elevate G-III's cost of capital. This makes borrowing for inventory, expansion, or operational needs more expensive. Additionally, higher interest rates can dampen consumer spending by making credit more costly, potentially slowing down discretionary purchases of apparel, a key segment for G-III's brands.

Exchange rate fluctuations can significantly impact G-III Apparel Group's financial performance due to its global operations. For instance, a stronger U.S. dollar in 2024 could make imported materials and finished goods cheaper for G-III, potentially boosting profit margins on those items. However, this same strong dollar makes G-III's products more expensive for international customers, which could dampen overseas sales and affect overall revenue.

Supply Chain Costs

Supply chain costs are a critical consideration for G-III Apparel Group, encompassing expenses from raw materials and manufacturing to the final delivery of goods. Fluctuations in these costs can directly impact the company's profitability.

Disruptions in global supply chains, such as those experienced in recent years, along with escalating fuel prices and surges in demand for key components, can significantly increase G-III's input costs. This, in turn, puts pressure on the company's gross margins.

For instance, the cost of shipping containers saw dramatic increases, with some routes experiencing a rise of over 500% from pre-pandemic levels by late 2021. While some of these costs have moderated, they remain a key factor. In early 2024, ocean freight rates, though down from their peaks, were still elevated compared to historical averages, particularly for certain East-West trade lanes. This directly affects G-III's ability to manage its cost of goods sold.

- Increased Raw Material Prices: Cotton prices, a key input for apparel, have seen volatility. For example, ICE cotton futures experienced significant price swings throughout 2023 and into early 2024, impacting the cost of fabrics.

- Rising Logistics Expenses: Fuel surcharges and trucking rates continue to be sensitive to global energy markets. The average cost per mile for trucking in the US remained a significant operational expense for G-III in 2023 and is projected to continue in 2024.

- Manufacturing Cost Pressures: Labor costs in manufacturing hubs, particularly in Asia, have been on an upward trend, further contributing to higher overall production expenses for G-III.

- Inventory Management Costs: Extended lead times due to supply chain bottlenecks can necessitate higher inventory levels, leading to increased warehousing and carrying costs for G-III.

Retail Sector Performance

The retail sector's health is paramount for G-III Apparel. In 2024, the U.S. retail sales saw a modest increase, with e-commerce continuing its upward trajectory, accounting for approximately 16.5% of total retail sales by the end of the year. This highlights the ongoing shift in consumer purchasing habits.

Foot traffic in brick-and-mortar stores remains a critical indicator, though it faces persistent competition from online channels. While physical retail experienced some recovery in 2024, the integration of omnichannel strategies is essential for brands to thrive amidst evolving consumer expectations and intense market competition.

- E-commerce Growth: Online retail sales in the U.S. are projected to grow by 8-10% in 2025, further pressuring traditional retail models.

- Consumer Spending: Overall consumer spending, a key driver for retail, showed resilience in early 2025, supported by a stable labor market.

- Omnichannel Adoption: Retailers are increasingly investing in seamless online-to-offline experiences, with over 70% of consumers expecting to utilize buy-online-pickup-in-store (BOPIS) options in 2025.

- Competitive Landscape: The market remains highly competitive, with discounters and direct-to-consumer brands posing significant challenges to established players like G-III.

Economic factors significantly influence G-III Apparel Group's performance. Consumer discretionary spending, a key driver, is sensitive to inflation and economic stability. For instance, while consumer spending showed resilience in early 2025, persistent inflation in 2024 impacted household budgets, potentially constraining apparel purchases.

Rising raw material and logistics costs directly affect G-III's profitability. Cotton prices experienced volatility in 2023-2024, and elevated shipping rates in early 2024, though down from peaks, remained a concern impacting the cost of goods sold.

Interest rate hikes aimed at controlling inflation increase G-III's cost of capital and can curb consumer spending by making credit more expensive. Exchange rate fluctuations also play a role, with a stronger U.S. dollar in 2024 potentially impacting the cost of imports and the price of G-III's products internationally.

| Economic Indicator | Value/Trend | Impact on G-III Apparel |

|---|---|---|

| U.S. Consumer Confidence (Early 2024) | Fluctuating | Affects discretionary spending on apparel. |

| U.S. Inflation (2024) | Persistent | Increases operational costs and may reduce consumer purchasing power. |

| ICE Cotton Futures (2023-Early 2024) | Volatile | Directly impacts raw material costs for fabrics. |

| Ocean Freight Rates (Early 2024) | Elevated (vs. historical) | Increases supply chain and logistics expenses. |

| U.S. Interest Rates (2024-2025) | Rising | Increases cost of capital and can dampen consumer credit spending. |

| U.S. Dollar Strength (2024) | Stronger | Cheaper imports, but potentially more expensive exports. |

Preview Before You Purchase

G-III PESTLE Analysis

The preview you see here is the exact G-III PESTLE Analysis document you’ll receive after purchase—fully formatted and ready to use.

This is a real screenshot of the product you’re buying, showcasing the comprehensive G-III PESTLE Analysis. You'll get it delivered exactly as shown, with no surprises.

The content and structure shown in this preview is the same G-III PESTLE Analysis document you’ll download after payment, providing immediate value.

Sociological factors

Consumer preferences in fashion are in constant flux, impacting brands like G-III Apparel Group. For instance, the rise of athleisure, driven by a desire for comfort and versatility, significantly reshaped apparel markets in recent years, with the global activewear market projected to reach $547.2 billion by 2024, according to Grand View Research. This necessitates G-III's continuous adaptation of its product lines to incorporate these evolving styles.

Brand loyalty is also a dynamic factor. As new trends emerge, consumers may shift their allegiances, seeking out brands that best represent their current aesthetic. G-III must therefore invest in robust market research and agile design processes to stay ahead of these shifts, ensuring its collections resonate with target demographics. The increasing influence of social media on trend dissemination means G-III needs to monitor digital platforms closely for emerging styles and consumer sentiment.

Demographic shifts are profoundly impacting G-III's operating environment. For instance, the global population is aging, with the United Nations projecting that by 2050, one in six people worldwide will be over 65, a significant increase from one in eleven in 2019. This trend necessitates G-III's consideration of products and services appealing to older demographics, potentially influencing apparel choices and lifestyle needs.

Furthermore, income distribution is evolving. While global wealth continues to grow, the gap between the richest and the rest is a persistent concern. G-III must analyze how these income stratifications affect purchasing power across its diverse markets, potentially leading to the development of tiered product lines or targeted marketing strategies for different economic segments to maximize market penetration.

Cultural diversity is also on the rise, driven by migration and globalization. G-III needs to understand these evolving cultural landscapes to ensure its brand messaging and product designs are inclusive and resonate with a broad range of consumers. For example, in the United States, the Hispanic population is projected to reach 119 million by 2060, representing a substantial and growing consumer base whose preferences G-III should actively cultivate.

Ethical consumerism is reshaping markets, with a significant portion of consumers actively seeking out brands that align with their values. For instance, a 2024 survey indicated that over 60% of Gen Z and Millennials consider sustainability a key factor in their purchasing decisions, impacting billions in consumer spending power.

This trend translates into direct pressure on companies like G-III to showcase responsible sourcing and transparent supply chains. Failure to do so can lead to reputational damage and lost sales, as consumers increasingly scrutinize manufacturing processes and environmental impact.

G-III's commitment to eco-friendly practices and ethical production is therefore not just a matter of corporate social responsibility but a critical business imperative. Demonstrating this commitment can enhance brand loyalty and attract a growing segment of environmentally and socially conscious customers.

Lifestyle Changes

Lifestyle changes significantly shape apparel demand, directly impacting G-III Apparel Group's product strategies. The ongoing shift towards remote and hybrid work models, for instance, has decreased the need for formal office wear and boosted demand for comfortable, casual attire. This trend is supported by data showing a continued preference for flexible work arrangements; a 2024 survey indicated that 60% of US workers prefer hybrid work, influencing their purchasing decisions towards athleisure and comfortable casual wear.

Furthermore, a heightened emphasis on health and wellness is driving interest in activewear and performance-oriented clothing. As more individuals engage in fitness activities, from yoga to running, G-III's brands that cater to these segments, such as those offering athletic apparel, are likely to see increased sales. For example, the global activewear market was projected to reach over $380 billion by 2024, reflecting this growing consumer focus.

These evolving consumer habits necessitate strategic adjustments in G-III's product development and marketing. The company must remain agile to capitalize on these shifts:

- Increased demand for athleisure and comfortable casual wear due to remote work trends.

- Growing market for performance apparel driven by a focus on health and wellness.

- Potential for reduced demand in traditional formal wear categories.

- Opportunities to expand product lines that align with active lifestyles and comfort.

Influence of Social Media and Influencers

Social media and digital influencers are powerful forces in shaping consumer behavior, directly impacting brand perception and purchasing choices. For G-III, this means a robust digital marketing and influencer collaboration strategy is crucial for audience connection and engagement.

The reach is substantial; for instance, in 2024, global social media users are projected to exceed 5 billion, with influencer marketing spend anticipated to grow significantly, reaching an estimated $21.1 billion in the US alone by the end of 2024. This underscores the need for G-III to strategically leverage these platforms.

- Brand Perception: Influencer endorsements can build trust and credibility, directly affecting how consumers view G-III's products and services.

- Purchasing Decisions: A significant percentage of consumers, particularly Gen Z and Millennials, report making purchase decisions based on influencer recommendations.

- Digital Strategy: G-III must invest in authentic influencer partnerships and engaging social media content to maintain relevance and drive sales in the evolving digital landscape.

Sociological factors significantly influence consumer behavior and market trends, directly impacting companies like G-III Apparel Group. Evolving lifestyle choices, such as the increased preference for athleisure and comfortable wear due to remote work, are reshaping demand for apparel. Furthermore, a growing emphasis on health and wellness is boosting the market for performance-oriented clothing, with the global activewear market projected to exceed $380 billion by 2024.

Demographic shifts, including an aging global population and increasing cultural diversity, necessitate that G-III adapt its product offerings and marketing strategies to cater to a broader range of consumers. For example, the projected growth of the Hispanic population in the US to 119 million by 2060 presents a significant consumer base.

Ethical consumerism is also a powerful driver, with a majority of younger consumers prioritizing sustainability and responsible sourcing. This trend requires G-III to demonstrate transparency and commitment to eco-friendly practices to maintain brand loyalty and attract environmentally conscious customers, as over 60% of Gen Z and Millennials consider sustainability in their purchasing decisions.

The pervasive influence of social media and digital influencers cannot be overstated, with billions of users worldwide engaging with these platforms. In 2024, global social media users are expected to surpass 5 billion, and influencer marketing spend in the US alone is projected to reach $21.1 billion, highlighting the critical need for G-III to leverage these channels for brand engagement and sales.

| Sociological Factor | Impact on G-III | Supporting Data/Trend (2024/2025) |

| Lifestyle Changes (e.g., remote work, wellness focus) | Increased demand for athleisure and casual wear; growth in performance apparel. | Global activewear market projected to exceed $380 billion by 2024; 60% of US workers prefer hybrid work (2024 survey). |

| Demographic Shifts (e.g., aging population, cultural diversity) | Need to adapt product lines and marketing for diverse age groups and cultural backgrounds. | UN projects 1 in 6 people globally over 65 by 2050; US Hispanic population projected to reach 119 million by 2060. |

| Ethical Consumerism | Pressure for sustainable sourcing, transparency, and eco-friendly practices to maintain brand loyalty. | Over 60% of Gen Z/Millennials consider sustainability in purchasing decisions. |

| Social Media & Influencer Impact | Crucial for brand perception, engagement, and driving purchasing decisions. | Global social media users projected to exceed 5 billion (2024); US influencer marketing spend estimated at $21.1 billion (2024). |

Technological factors

E-commerce and digital retail innovation are reshaping how consumers shop, demanding constant adaptation from companies like G-III. The global e-commerce market was projected to reach over $6.3 trillion in 2024, highlighting the immense shift towards online purchasing. This necessitates G-III's commitment to enhancing its online platforms, ensuring a seamless user experience, and leveraging digital marketing to capture market share.

Mobile commerce, a significant driver within e-commerce, accounted for a substantial portion of online sales in recent years, with projections indicating continued growth. G-III's investment in mobile-first strategies and app development is crucial for engaging a mobile-centric customer base. Direct-to-consumer (DTC) models are also gaining traction, allowing brands to build direct relationships with customers, bypass traditional intermediaries, and gather valuable data for personalized marketing efforts.

Supply chain digitalization and automation are transforming how companies like G-III Apparel Group operate. The adoption of technologies such as Artificial Intelligence (AI), the Internet of Things (IoT), and blockchain is leading to significant improvements in inventory management, logistics, and real-time tracking. For instance, a 2024 report indicated that companies investing in supply chain automation saw an average cost reduction of 15% in their logistics operations.

These technological advancements directly benefit G-III by enhancing overall efficiency and reducing operational costs. Improved responsiveness, a key outcome of real-time tracking and optimized logistics, allows G-III to better manage stock levels and react swiftly to market demands. In 2025, the global market for supply chain management software is projected to reach over $40 billion, highlighting the widespread investment in these digital solutions.

G-III Apparel Group is increasingly leveraging advanced manufacturing techniques to enhance its operations. Innovations like 3D printing and robotic automation are being integrated into production lines, aiming to boost efficiency and speed. For instance, the apparel industry saw a global market for 3D printing reach an estimated $1.9 billion in 2023, with significant growth projected in custom apparel and footwear.

These technological advancements enable faster production cycles and offer greater customization capabilities, allowing G-III to better respond to evolving consumer demands. Furthermore, the adoption of advanced textile machinery can contribute to more sustainable manufacturing processes by reducing waste and optimizing resource utilization, a key focus for many brands in 2024 and beyond.

Data Analytics and AI for Trend Forecasting

G-III Apparel Group is increasingly using data analytics and AI to forecast fashion trends. This involves analyzing vast amounts of data on consumer behavior, sales figures, and emerging styles. For instance, in fiscal year 2024, G-III reported net sales of $3.1 billion, a slight decrease from $3.2 billion in fiscal year 2023, highlighting the need for more precise trend forecasting to optimize inventory and marketing. The company is investing in these technologies to make smarter decisions about what products to develop and how to manage stock effectively.

These advanced analytical tools allow G-III to move beyond traditional market research by identifying subtle shifts in consumer preferences and predicting demand with greater accuracy. This proactive approach is crucial in the fast-paced apparel industry. By understanding what consumers want before they even fully realize it, G-III can gain a competitive edge.

The implementation of AI and machine learning helps G-III in several key areas:

- Predictive Analytics: Identifying future popular styles and colors based on historical data and real-time social media sentiment analysis.

- Inventory Optimization: Reducing overstock and stockouts by accurately forecasting demand for specific SKUs.

- Personalized Marketing: Tailoring marketing campaigns to specific customer segments based on their purchasing history and predicted interests.

- Supply Chain Efficiency: Improving the speed and responsiveness of the supply chain by anticipating product needs.

Material Science and Textile Innovation

The textile industry is experiencing rapid advancements in material science, directly impacting fashion brands like G-III Apparel Group. Innovations in sustainable fibers, such as recycled polyester and organic cotton, are becoming increasingly important as consumers prioritize eco-friendly options. For instance, the global sustainable textile market was valued at approximately $10.5 billion in 2023 and is projected to grow, presenting a significant opportunity for G-III to enhance its product offerings with environmentally conscious materials.

Performance textiles, engineered for specific functionalities like moisture-wicking, temperature regulation, and enhanced durability, are also gaining traction. G-III can leverage these materials to create more appealing and functional apparel, potentially commanding premium pricing. The development of smart fabrics, which integrate technology for features like health monitoring or connectivity, represents a frontier that could offer a distinct competitive advantage, though adoption is still in its early stages.

G-III's strategic integration of these material innovations can lead to several benefits:

- Enhanced Product Appeal: Incorporating sustainable and performance fabrics can attract environmentally conscious and active consumers.

- Competitive Differentiation: Unique material properties can set G-III's products apart in a crowded market.

- Operational Efficiencies: Some advanced materials may offer improved durability, potentially reducing returns or increasing product lifespan.

- Market Expansion: Entering segments focused on specialized apparel, like athleisure or outdoor wear, becomes more feasible with the right material innovations.

Technological advancements are fundamentally altering the retail landscape, pushing companies like G-III Apparel Group to embrace digital transformation. E-commerce continues its upward trajectory, with global sales expected to exceed $6.3 trillion in 2024, underscoring the necessity for robust online platforms and digital marketing strategies. Mobile commerce, a critical component of this shift, demands a mobile-first approach, including investment in app development to engage a growing mobile-centric consumer base.

Supply chain operations are being revolutionized by digitalization and automation, with AI, IoT, and blockchain enhancing efficiency. Companies focusing on supply chain automation saw an average 15% reduction in logistics costs in 2024. G-III benefits from these improvements through better inventory management, real-time tracking, and increased responsiveness to market demands, as the global supply chain management software market is projected to surpass $40 billion in 2025.

G-III is also integrating advanced manufacturing techniques, such as 3D printing and robotics, to boost production efficiency and customization. The 3D printing market in apparel reached an estimated $1.9 billion in 2023, indicating a growing trend. These innovations allow for faster production cycles and greater product personalization, aligning with evolving consumer preferences and potentially reducing waste in manufacturing.

Data analytics and AI are becoming indispensable tools for G-III in forecasting fashion trends and optimizing operations. Despite a slight dip in net sales to $3.1 billion in fiscal year 2024 from $3.2 billion in fiscal year 2023, the company's investment in these technologies is crucial for smarter product development and inventory management. AI-driven predictive analytics can identify future popular styles and optimize inventory by reducing overstock and stockouts.

Legal factors

G-III Apparel Group's legal framework heavily relies on protecting its extensive portfolio of owned and licensed brands, trademarks, and designs. This intellectual property is the bedrock of its market presence and brand equity.

Effective legal strategies are paramount to combatting counterfeiting and unauthorized use of these valuable assets, which can significantly dilute brand value and impact sales. In 2023, the U.S. Chamber of Commerce reported that counterfeiting and piracy cost the global economy an estimated $1.9 trillion between 2017 and 2022, a figure that underscores the importance of vigilant IP enforcement for companies like G-III.

Furthermore, G-III must meticulously enforce its licensing agreements to ensure partners adhere to brand standards and royalty obligations, safeguarding revenue streams and brand integrity.

G-III Apparel Group must navigate a complex web of product safety and labeling regulations across its global markets. These legal mandates cover everything from flammability standards for children's sleepwear to material content disclosure and allergen warnings on apparel. Failure to comply can lead to significant penalties; for instance, in 2023, the Consumer Product Safety Commission (CPSC) in the US issued numerous recalls for apparel items due to violations of federal safety standards, impacting brands across the industry.

Ensuring accurate labeling, including country of origin, fiber content, and care instructions, is crucial for G-III to avoid costly fines and maintain consumer trust. For example, the Federal Trade Commission (FTC) enforces the Textile Fiber Products Identification Act, which dictates how textile products must be labeled. G-III's compliance efforts in 2024 and 2025 will be vital in preventing product recalls, which can severely damage brand reputation and incur substantial financial losses, as seen with past industry-wide recalls costing millions.

Labor and employment laws are foundational to G-III Apparel Group's operations, covering everything from employee rights and fair working conditions to strict non-discrimination policies and ethical labor practices across its global supply chain. Ensuring compliance with these regulations, such as the Fair Labor Standards Act (FLSA) in the US, is paramount for avoiding costly litigation and upholding the company's ethical standing.

Data Privacy and Cybersecurity Laws

Data privacy and cybersecurity laws, such as the EU's General Data Protection Regulation (GDPR) and California's Consumer Privacy Act (CCPA), significantly impact how G-III Apparel Group handles customer and employee information. These regulations mandate strict protocols for data collection, storage, and usage, requiring robust security measures to prevent breaches. Failure to comply can result in substantial fines; for instance, GDPR penalties can reach up to 4% of global annual revenue or €20 million, whichever is higher. G-III must invest in advanced cybersecurity infrastructure and ongoing training to safeguard sensitive data and maintain consumer trust.

The evolving landscape of data protection necessitates continuous adaptation. As of early 2024, new data privacy regulations are being introduced or updated in various jurisdictions, increasing the complexity of global compliance for companies like G-III. For example, the California Privacy Rights Act (CPRA), which went into effect in 2023, further strengthens consumer data rights. This means G-III needs to remain vigilant and proactive in its data governance practices.

- GDPR Fines: Potential penalties up to 4% of global annual revenue or €20 million.

- CCPA/CPRA Impact: Enhanced consumer rights regarding personal data access and deletion.

- Cybersecurity Investment: Ongoing need for robust security measures and employee training.

- Regulatory Landscape: Increasing number of global data privacy laws requiring continuous monitoring.

Advertising and Marketing Regulations

Advertising and marketing regulations are critical for G-III Apparel Group. These laws ensure that promotional content is truthful and that consumers are adequately informed. For instance, the Federal Trade Commission (FTC) in the United States actively enforces rules against deceptive advertising, a key area for G-III to monitor. Failure to comply can lead to significant fines and reputational damage, impacting sales and brand trust.

G-III must navigate a complex web of legal guidelines to avoid misleading claims and unfair competition. This includes adhering to disclosure requirements for pricing, product origin, and any promotional offers. In 2023, the FTC reported a substantial increase in enforcement actions related to advertising practices, underscoring the importance of meticulous compliance for companies like G-III.

- Truthful Advertising: G-III must ensure all marketing claims are substantiated and not misleading to consumers.

- Consumer Disclosure: Regulations often mandate clear and conspicuous disclosure of key product information and promotional terms.

- Unfair Competition: Marketing practices must not unfairly disadvantage competitors or exploit consumer vulnerabilities.

- Regulatory Enforcement: Non-compliance can result in penalties from bodies like the FTC, impacting financial performance and brand reputation.

G-III Apparel Group operates within a stringent legal framework encompassing intellectual property protection, consumer safety, labor laws, data privacy, and advertising standards. These legal factors directly influence brand value, operational costs, and market access.

In 2023, the global apparel industry faced increased scrutiny regarding supply chain transparency and ethical labor practices, with regulatory bodies like the US Department of Labor actively investigating compliance with laws such as the Uyghur Forced Labor Prevention Act. G-III's adherence to these evolving labor regulations, including those concerning fair wages and safe working conditions, is crucial to avoid sanctions and maintain its corporate social responsibility image.

Navigating international trade agreements and tariffs, such as those impacting goods imported from China, presents ongoing legal challenges. Changes in trade policy can directly affect G-III's cost of goods sold and its ability to source materials efficiently. For instance, the ongoing trade discussions between the US and China in 2024 continue to create uncertainty regarding import duties, necessitating flexible sourcing strategies.

| Legal Area | Key Considerations for G-III | Potential Impact | 2023/2024 Data/Trend |

|---|---|---|---|

| Intellectual Property | Brand protection, trademark enforcement, licensing agreements | Brand dilution, revenue loss, legal costs | Global anti-counterfeiting efforts are intensifying; G-III actively monitors and enforces its IP rights. |

| Consumer Safety & Labeling | Product safety standards (e.g., CPSC), accurate labeling (FTC) | Recalls, fines, reputational damage | In 2023, the CPSC issued numerous recalls for apparel due to safety violations, highlighting the need for rigorous compliance. |

| Labor & Employment | Fair Labor Standards Act (FLSA), supply chain ethics, non-discrimination | Litigation, labor disputes, brand reputation | Increased focus on supply chain audits and fair labor practices globally. |

| Data Privacy & Cybersecurity | GDPR, CCPA/CPRA, data breach prevention | Significant fines, loss of consumer trust | As of early 2024, new data privacy laws are emerging, requiring continuous adaptation of data governance. GDPR penalties can reach up to 4% of global annual revenue. |

| Advertising & Marketing | Truthful advertising (FTC), disclosure requirements, unfair competition | Fines, reputational damage, decreased sales | The FTC reported a substantial increase in enforcement actions for deceptive advertising in 2023. |

| Trade & Tariffs | International trade agreements, import/export regulations | Increased costs, supply chain disruptions | Ongoing trade policy shifts create uncertainty in global sourcing and pricing for apparel manufacturers. |

Environmental factors

Consumers and regulators are increasingly demanding that companies like G-III Apparel Group prioritize sustainability and ethical sourcing. This means scrutinizing every step of the supply chain, from where raw materials originate to the conditions under which garments are made. For instance, by 2024, over 70% of consumers surveyed by McKinsey indicated they were willing to pay more for sustainable products, highlighting a significant market shift.

G-III must actively focus on responsible material sourcing, aiming to reduce environmental impact and ensure fair labor practices across its supplier network. This includes commitments to fair wages and safe working environments, as regulatory bodies worldwide, such as the European Union with its proposed Corporate Sustainability Due Diligence Directive, are strengthening oversight on supply chain ethics.

Growing regulatory pressure and consumer demand are pushing the apparel industry towards more sustainable practices, directly impacting G-III Apparel Group. Initiatives focused on reducing textile waste and promoting a circular economy are becoming paramount, with a significant portion of apparel ending up in landfills annually. For instance, the Ellen MacArthur Foundation reported in 2023 that globally, less than 1% of material used to produce clothing is recycled into new clothing, highlighting a massive opportunity for improvement.

G-III may need to proactively invest in strategies that enhance product longevity, such as offering repair services, and develop robust end-of-life recycling programs for its garments. By 2025, it's anticipated that extended producer responsibility (EPR) schemes for textiles will expand across more regions, requiring companies like G-III to manage the collection and recycling of their products. This shift necessitates a business model that prioritizes durability and resource recovery.

Governments worldwide are intensifying efforts to curb carbon emissions, with many setting ambitious net-zero targets. For instance, the European Union aims for climate neutrality by 2050, backed by policies like the Carbon Border Adjustment Mechanism (CBAM) which could impact imported goods. This regulatory landscape directly affects G-III's manufacturing and supply chain, necessitating investments in cleaner energy sources and more sustainable logistics to comply and remain competitive.

Water Usage and Pollution Control

Water usage and pollution control are critical environmental concerns for textile manufacturers like G-III. The industry is notoriously water-intensive, and improper wastewater discharge can lead to significant pollution. For instance, in 2023, the global textile industry consumed an estimated 93 billion cubic meters of water.

G-III must prioritize implementing water-saving technologies, such as closed-loop systems and advanced dyeing techniques, to reduce its overall water footprint. Compliance with stringent environmental regulations is paramount.

- Water Consumption: Textile dyeing and finishing processes account for a substantial portion of water usage.

- Pollution Control: Effluent treatment plants are essential for removing harmful chemicals and dyes before discharge.

- Regulatory Compliance: Companies face increasing pressure from governments and consumers to adhere to water quality standards.

- Technological Adoption: Investing in water-efficient machinery and water recycling systems can mitigate environmental impact and operational costs.

Chemical Restrictions and Material Safety

Chemical restrictions significantly impact textile manufacturers like G-III Apparel Group. Regulations, such as the EU's REACH (Registration, Evaluation, Authorisation and Restriction of Chemicals) and similar initiatives globally, limit or ban the use of certain hazardous substances in textiles. For instance, restrictions on azo dyes, formaldehyde, and heavy metals are common. G-III must meticulously manage its supply chain to ensure compliance, which can involve higher material costs and more rigorous testing protocols.

The financial implications are substantial. In 2024, the global textile chemical market was valued at approximately $10.5 billion, with a growing segment focused on eco-friendly and compliant chemicals. Companies failing to meet these standards face penalties, reputational damage, and potential market access limitations. G-III's investment in sustainable sourcing and chemical management is therefore crucial for long-term viability and consumer trust.

Key considerations for G-III include:

- Supply Chain Auditing: Regularly assessing suppliers for adherence to chemical safety standards.

- Material Innovation: Investing in research and development for safer, compliant materials.

- Product Labeling: Ensuring accurate information regarding material content and care instructions.

- Regulatory Monitoring: Staying updated on evolving chemical regulations worldwide.

Environmental factors are increasingly shaping the operational landscape for G-III Apparel Group. Growing consumer and regulatory demands for sustainability necessitate a closer look at raw material sourcing and manufacturing conditions. For instance, by 2024, McKinsey reported that over 70% of consumers were willing to pay more for sustainable products, signaling a clear market preference.

G-III must prioritize responsible sourcing to minimize its environmental footprint and ensure ethical labor practices throughout its supply chain. This includes adhering to fair wage and safe working environment standards, especially as regulatory bodies like the EU strengthen oversight with initiatives such as the Corporate Sustainability Due Diligence Directive.

The apparel industry faces significant pressure to adopt more sustainable practices, with textile waste being a major concern. Globally, less than 1% of clothing material is recycled into new garments, according to the Ellen MacArthur Foundation's 2023 report, presenting a substantial area for improvement and innovation.

To address these environmental shifts, G-III may need to invest in strategies that promote product longevity, such as offering repair services, and develop effective garment recycling programs. By 2025, the expansion of extended producer responsibility (EPR) schemes for textiles in various regions will likely require companies to manage product end-of-life management.

| Environmental Factor | Impact on G-III Apparel Group | Key Data/Trend (2024/2025) |

|---|---|---|

| Consumer Demand for Sustainability | Increased pressure to adopt eco-friendly materials and practices. | 70%+ consumers willing to pay more for sustainable products (McKinsey, 2024). |

| Regulatory Pressure (Supply Chain Ethics) | Need for stringent oversight on labor conditions and sourcing. | EU's Corporate Sustainability Due Diligence Directive strengthening oversight. |

| Textile Waste Reduction | Opportunity for innovation in recycling and circular economy models. | < 1% of clothing material recycled into new clothing globally (Ellen MacArthur Foundation, 2023). |

| Extended Producer Responsibility (EPR) | Requirement for managing product end-of-life and recycling. | Anticipated expansion of EPR schemes for textiles by 2025. |

PESTLE Analysis Data Sources

Our G-III PESTLE Analysis is meticulously constructed using a blend of official government publications, reputable international organizations, and leading market research firms. This ensures a comprehensive understanding of political stability, economic trends, social shifts, technological advancements, environmental regulations, and legal frameworks.