G-III Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

G-III Bundle

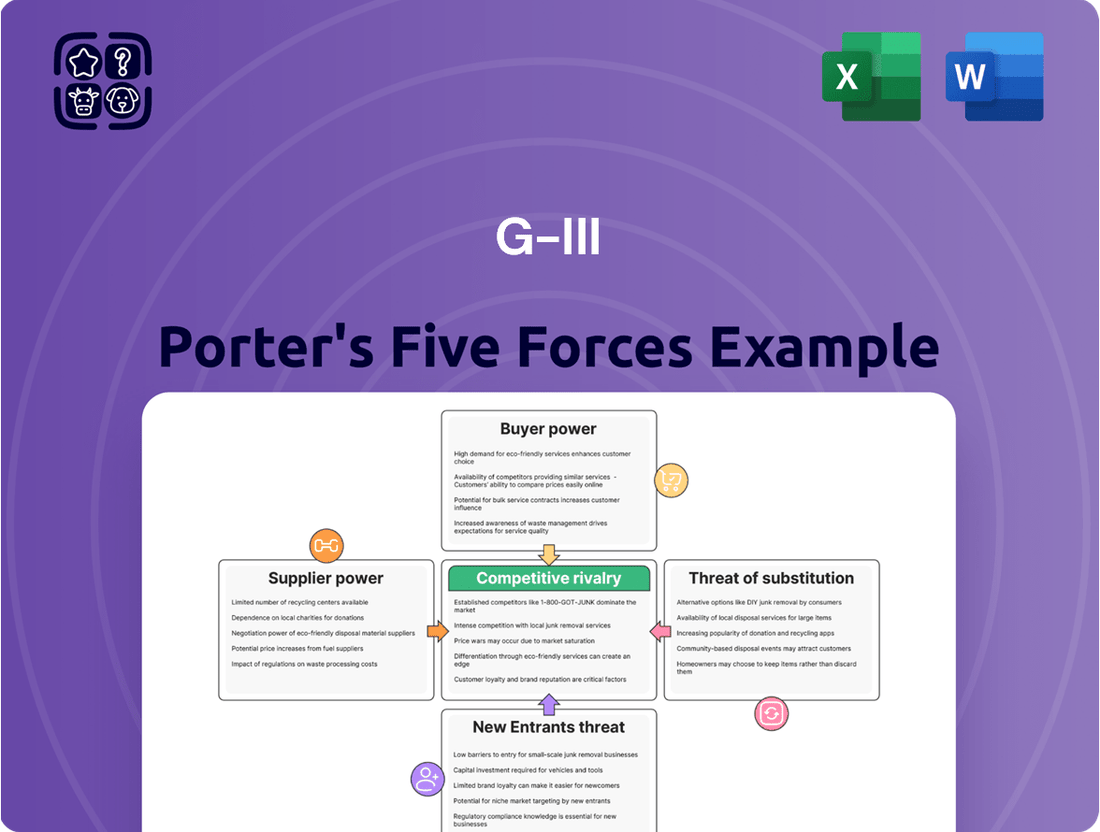

G-III Apparel Group operates within a dynamic fashion landscape, where understanding the intensity of competitive rivalry and the power of buyers is crucial for strategic success. This brief overview hints at the underlying forces at play, but the full Porter's Five Forces Analysis unlocks a comprehensive strategic roadmap.

Ready to move beyond the basics? Get a full strategic breakdown of G-III’s market position, competitive intensity, and external threats—all in one powerful analysis.

Suppliers Bargaining Power

The apparel industry, including G-III Apparel Group, depends on a worldwide web of manufacturers and raw material providers. When a handful of major suppliers control key fabrics or components, their leverage grows, which could result in increased expenses or less advantageous agreements for G-III.

For example, the market for sustainable fabrics is still developing and somewhat limited, granting these specialized suppliers greater influence. In 2023, the global textile market was valued at approximately $1 trillion, with a growing segment dedicated to sustainable materials, indicating a concentrated area where supplier power could be significant.

If G-III Apparel Group faces significant expenses or disruptions when changing suppliers, like the need to retool manufacturing lines or extensively re-qualify new sources for quality and ethical compliance, its suppliers hold greater bargaining power. For instance, in 2023, G-III's reliance on established relationships for specialized fabrics or production techniques could mean that switching incurs substantial upfront costs, making them hesitant to seek alternatives even with price hikes.

Suppliers who provide unique or highly specialized materials, finishes, or manufacturing techniques that are crucial for G-III's product differentiation can wield significant bargaining power. If a supplier possesses proprietary technology for a specific performance fabric, for instance, G-III might find itself with very few viable alternatives, increasing the supplier's leverage.

However, G-III's extensive and varied brand portfolio can mitigate this risk by reducing its dependency on any single unique input. For example, in fiscal year 2024, G-III Apparel Group reported net sales of $3.07 billion, showcasing the breadth of its operations across multiple brands and product categories, which likely diversifies its sourcing needs.

Threat of Forward Integration by Suppliers

The threat of suppliers integrating forward into G-III Apparel Group's core business, such as manufacturing or design, represents a significant bargaining power lever. If suppliers can effectively move into these areas, they could directly compete with G-III, diminishing the latter's control over its product offerings and potentially eroding profit margins. While large-scale forward integration by material suppliers is less common in the apparel industry, specialized component or fabric providers might explore niche product manufacturing, creating a competitive pressure.

For instance, a sophisticated textile manufacturer with unique finishing capabilities could potentially leverage its expertise to produce finished garments, thereby bypassing G-III as a customer and becoming a direct rival. This scenario would shift the power dynamic, as G-III would then need to contend with its former suppliers as competitors in the marketplace.

- Supplier Forward Integration: Suppliers moving into G-III's manufacturing or design operations increases their leverage.

- Competitive Landscape Shift: Forward integration turns suppliers into potential direct competitors for G-III.

- Niche Market Threat: Specialized material suppliers are more likely to pursue this strategy in specific product segments.

- Impact on G-III: This threat could reduce G-III's operational independence and profitability.

Impact of Raw Material Price Fluctuations

The bargaining power of suppliers significantly impacts G-III Apparel Corporation, especially concerning raw material price fluctuations. Adverse climate conditions, animal diseases, and natural disasters can disrupt the supply chain, affecting both the availability and price of essential materials like cotton, leather, and synthetics. For instance, in 2024, global cotton prices experienced volatility due to drought conditions in key producing regions, directly impacting apparel manufacturers. G-III, like many in the industry, may find it challenging to pass on the full extent of these increased costs to consumers, potentially squeezing profit margins.

- Raw Material Volatility: Climate events and disease outbreaks in 2024 directly impacted the cost and availability of key inputs for G-III.

- Margin Squeeze: G-III's ability to absorb or pass on higher raw material costs is a critical factor for its profitability.

- Supplier Dependence: The concentration of certain raw material sources can amplify supplier bargaining power.

The bargaining power of suppliers is a key factor for G-III Apparel Group, influencing costs and operational flexibility. When suppliers have significant leverage, they can command higher prices or dictate terms that are less favorable to G-III. This power is amplified when there are few suppliers for critical inputs or when switching costs are high.

In 2024, the apparel industry, including G-III, faced continued supply chain pressures. For example, the cost of certain synthetic fabrics, heavily reliant on petrochemicals, saw fluctuations tied to global energy markets. G-III's reliance on specific, high-quality materials, like those used in its premium licensed brands, can concentrate power among a limited number of specialized fabric mills, potentially leading to price increases.

Furthermore, suppliers who can offer unique design elements or specialized manufacturing processes that differentiate G-III's products hold considerable sway. If a supplier possesses proprietary technology for a sought-after finish or fabric construction, G-III may have few alternatives, increasing that supplier's bargaining position. This is particularly relevant as consumer demand for unique and innovative apparel continues to grow.

The threat of suppliers integrating forward into manufacturing or design also strengthens their hand. If a supplier can produce finished garments, they transition from a partner to a competitor, potentially impacting G-III's market share and profitability. While less common for broad-line material suppliers, specialized component providers could explore this avenue in niche markets.

| Factor | Impact on G-III | Example (2024 Context) |

|---|---|---|

| Supplier Concentration | Increased pricing power for suppliers | Limited availability of specialized sustainable fabrics |

| Switching Costs | Reduced G-III flexibility | High costs associated with re-qualifying new fabric sources |

| Supplier Differentiation | Leverage for unique inputs | Proprietary finishes or performance fabrics |

| Forward Integration Threat | Potential competition | Specialized component suppliers entering garment manufacturing |

What is included in the product

This analysis dissects the competitive landscape for G-III Apparel Group by examining the intensity of rivalry, the bargaining power of buyers and suppliers, the threat of new entrants, and the availability of substitutes.

Quickly identify and quantify competitive threats, allowing for proactive strategy adjustments and reduced market vulnerability.

Customers Bargaining Power

G-III Apparel Group leverages diverse distribution channels, including department stores, specialty retailers, and its own branded stores, alongside wholesale operations. This broad reach means G-III isn't dependent on any single customer type, which in turn can lessen the bargaining power of any one segment. For instance, in fiscal year 2024, G-III's wholesale segment represented a significant portion of its net sales, but direct-to-consumer channels also showed robust growth, indicating a balanced reliance across different buyer groups.

Customer price sensitivity is a significant factor in the apparel industry, especially as economic conditions tighten. In 2024, consumers are more inclined to scrutinize prices, making them a powerful force.

The proliferation of fast fashion and budget-friendly brands means consumers have an abundance of choices and can readily switch if they find better deals. This ease of comparison directly amplifies their bargaining power.

For instance, reports from early 2024 indicated a noticeable shift in consumer spending habits, with a greater emphasis on discounts and promotions across major apparel retailers, demonstrating this heightened price sensitivity.

The fashion retail sector is incredibly crowded, with countless brands selling very similar items. This means customers have a huge selection to choose from, making it easy for them to shop around and find exactly what they're looking for, whether it's a specific price point, style, or ethical sourcing.

In 2024, the sheer volume of online and brick-and-mortar fashion retailers means consumers can readily compare prices and quality. For instance, a study by Statista in late 2023 indicated that over 60% of online shoppers in the US regularly compare prices across different websites before making a purchase, directly impacting the bargaining power of customers in the fashion industry.

Buyer Concentration (Wholesale)

G-III Apparel Group's wholesale business, a significant revenue driver, faces potential pressure from concentrated buyers. Major department stores and specialty retailers often represent a substantial portion of these sales.

If a few key retail partners account for a large percentage of G-III's wholesale income, these powerful buyers can leverage their volume to negotiate more favorable pricing and payment terms, thereby impacting G-III's profit margins.

- Wholesale Dependence: G-III's reliance on wholesale channels means that the bargaining power of its large retail clients is a critical factor in its financial performance.

- Concentration Risk: A limited number of large wholesale customers can significantly amplify their influence over G-III's pricing and product assortment strategies.

- Impact on Margins: Intense price negotiations with major buyers can directly reduce G-III's gross profit margins, especially in a competitive retail landscape.

Impact of Private Label and Licensed Brands

G-III Apparel Group's bargaining power with customers, particularly retailers, is significantly influenced by its brand portfolio. The strength of its licensed brands, such as Calvin Klein and Tommy Hilfiger, provides a degree of leverage because these well-known names attract shoppers, making G-III a desirable supplier for retailers. This brand recognition can translate into more favorable terms for G-III.

However, this reliance on licensed brands also introduces a vulnerability. The staggered expiration of these licenses means G-III must continually renegotiate terms or risk losing access to popular brands, which could diminish its bargaining power. For instance, in fiscal year 2024, G-III reported net sales of $3.05 billion, with a significant portion attributed to its licensed brands, highlighting their importance to its market position and customer relationships.

The company's strategy also includes owned and private label brands. While owned brands can offer greater control and potentially higher margins, their bargaining power is typically built over time through consumer recognition and loyalty, which is a longer-term play compared to the immediate draw of established licensed brands. Private labels, while potentially offering strong retailer partnerships, can also see retailers demanding lower prices due to the inherent brand equity residing with the retailer.

- Brand Mix Influence: G-III's leverage with retailers is a function of its brand portfolio, with strong licensed brands like Calvin Klein and Tommy Hilfiger driving demand and enhancing G-III's negotiating position.

- License Expiration Risk: The staggered expiration of licensing agreements poses a risk, as G-III must manage renewals to maintain access to key brands and, by extension, its bargaining power.

- Fiscal Year 2024 Performance: G-III's net sales of $3.05 billion in fiscal year 2024 underscore the financial significance of its brand strategy and its impact on relationships with retail customers.

- Owned vs. Licensed Brands: While owned brands offer long-term control, the immediate impact of established licensed brands provides a more direct, albeit potentially less stable, source of bargaining power with retailers.

Customers in the apparel market possess significant bargaining power, primarily driven by price sensitivity and a vast array of choices. In 2024, economic pressures have made consumers more discerning about pricing, readily comparing options and seeking discounts. This heightened awareness, coupled with the ease of switching between brands, allows customers to exert considerable influence over pricing and product offerings.

The competitive landscape, flooded with similar products, further empowers consumers. They can easily find alternatives that meet their needs, whether for style, price, or ethical considerations. For instance, a late 2023 Statista study revealed that over 60% of US online shoppers routinely compare prices across different retailers, a trend that continued into 2024, directly impacting the leverage customers hold.

G-III Apparel Group's wholesale segment, a substantial revenue contributor, faces direct pressure from concentrated retail buyers. Major department stores and specialty retailers, often accounting for a significant portion of these sales, can leverage their purchasing volume to negotiate more favorable terms. This concentration risk can directly impact G-III's profit margins, especially when a few key clients hold substantial sway over pricing and product assortment decisions.

| Customer Segment | Bargaining Power Drivers | Impact on G-III |

|---|---|---|

| End Consumers | Price sensitivity, abundant choices, ease of switching | Pressure on retail pricing, demand for promotions |

| Wholesale Retailers (Large Chains) | Volume purchasing, concentration of sales | Negotiating power on price, payment terms, product assortment |

| Wholesale Retailers (Smaller Chains) | Lower volume, but collective impact can be felt | Less individual power, but can influence demand for certain styles |

Preview the Actual Deliverable

G-III Porter's Five Forces Analysis

This preview showcases the entirety of the G-III Porter's Five Forces Analysis you will receive; what you see is precisely what you will download immediately after purchase, ensuring full transparency and immediate utility.

You are viewing the complete, professionally crafted G-III Porter's Five Forces Analysis, which will be instantly accessible to you upon completing your purchase, offering no surprises and full readiness for your strategic planning.

The document displayed here is the exact, fully formatted G-III Porter's Five Forces Analysis that you will receive, allowing for immediate application without any need for further editing or setup.

Rivalry Among Competitors

The apparel industry is incredibly crowded, with a vast array of companies vying for market share. This fragmentation means G-III Apparel Group faces intense competition from both massive global brands and smaller, specialized players.

Key rivals for G-III include established names like PVH, known for brands such as Calvin Klein and Tommy Hilfiger, and Gildan Activewear, a major player in basic apparel. Other significant competitors are Oxford Industries, which owns brands like Tommy Bahama, and Steven Madden, a prominent fashion footwear and accessories company.

G-III Apparel Group's competitive edge is significantly bolstered by its extensive portfolio, boasting over 30 owned and licensed brands. This diverse collection includes highly recognizable names such as DKNY, Donna Karan, Karl Lagerfeld, Calvin Klein, and Tommy Hilfiger. This broad brand base effectively mitigates risks tied to any single brand's performance and enables a varied product offering.

The fashion industry's growth trajectory is notably subdued for 2024 and projected into 2025. Analysts anticipate revenue growth to hover in the low single digits, indicating a period of stabilization rather than robust expansion. This sluggishness directly fuels competitive rivalry.

Economic uncertainty and heightened consumer price sensitivity are key drivers intensifying this rivalry. As discretionary spending tightens, companies are forced to compete more aggressively for a shrinking pool of consumer demand. This environment makes it harder for any single player to gain significant market share without impacting profitability.

Product Differentiation and Innovation

G-III Apparel Group actively pursues product differentiation across its extensive portfolio, which spans outerwear, dresses, sportswear, and footwear. This strategy is built upon unique design aesthetics, strategic global sourcing, and impactful marketing campaigns. For instance, in fiscal year 2024, G-III reported net sales of $3.1 billion, demonstrating its ability to capture market share through distinct product offerings.

The company’s success hinges on its commitment to continuous innovation. This involves staying ahead of fashion trends, exploring new materials, and refining marketing approaches to resonate with consumers. In the competitive apparel landscape, where brand loyalty can be fleeting, this focus on innovation is vital for maintaining a competitive edge and driving sales growth. The ability to consistently introduce fresh designs and compelling marketing ensures G-III remains relevant.

- Diverse Product Segments: G-III’s strength lies in its broad product categories, from performance sportswear to fashion-forward dresses, allowing it to cater to varied consumer preferences.

- Design and Sourcing Expertise: The company leverages specialized design teams and a global sourcing network to create unique products at competitive price points.

- Marketing Prowess: G-III effectively utilizes brand partnerships and targeted marketing to build awareness and drive demand for its differentiated offerings.

- Innovation Focus: Ongoing investment in new designs, materials, and marketing techniques is critical for G-III to stand out against numerous competitors.

Marketing and Brand Building Investment

G-III Apparel Group makes significant investments in marketing to bolster its portfolio of owned brands, such as Donna Karan and DKNY. These initiatives are crucial for cultivating demand and ensuring brand longevity in a competitive fashion landscape. For instance, in the fiscal year ending January 31, 2024, G-III reported marketing and advertising expenses of $241.7 million, a notable increase from the prior year, highlighting their commitment to brand building.

The effectiveness of these marketing and brand-building campaigns directly impacts G-III's ability to capture consumer attention and secure market share. Strong brand equity allows the company to command premium pricing and foster customer loyalty, which are vital differentiators against numerous apparel competitors. The company's strategic focus on owned brands, supported by robust marketing, aims to create a more resilient and profitable business model.

- Marketing Spend: G-III Apparel Group's marketing and advertising expenses reached $241.7 million for the fiscal year ending January 31, 2024.

- Brand Focus: Investment is concentrated on owned brands like Donna Karan and DKNY to drive demand and maintain relevance.

- Competitive Necessity: Effective brand building is essential for capturing consumer attention and market share against rivals in the apparel industry.

The apparel industry's intense rivalry is amplified by a subdued growth outlook for 2024, with revenue growth projected in the low single digits. This economic environment, coupled with consumer price sensitivity, forces companies to compete more aggressively for a smaller pool of demand.

G-III Apparel Group faces formidable competition from giants like PVH and Gildan Activewear, as well as specialized players such as Oxford Industries and Steven Madden. The company's strategy to counter this involves differentiating its extensive brand portfolio, which includes DKNY and Calvin Klein, through unique design, sourcing, and marketing.

In fiscal year 2024, G-III reported net sales of $3.1 billion, underscoring its ability to gain traction through distinct product offerings. The company's marketing and advertising expenses reached $241.7 million for the fiscal year ending January 31, 2024, a significant investment aimed at strengthening its owned brands and maintaining a competitive edge.

| Key Competitors | Key Brands | G-III's Competitive Strengths |

| PVH | Calvin Klein, Tommy Hilfiger | Diverse Brand Portfolio (30+ brands) |

| Gildan Activewear | Basic Apparel | Design & Sourcing Expertise |

| Oxford Industries | Tommy Bahama | Marketing Prowess |

| Steven Madden | Footwear, Accessories | Innovation Focus |

SSubstitutes Threaten

Fast fashion brands present a considerable threat to established apparel companies by offering highly trend-driven clothing at remarkably low price points. This accessibility draws in a large segment of consumers, particularly younger demographics, who are more inclined to prioritize affordability and frequent wardrobe updates over brand loyalty or longevity.

The global fast fashion market is a significant force, with projections indicating continued expansion. For instance, the market was valued at approximately $39.7 billion in 2023 and is expected to reach $75.7 billion by 2030, demonstrating a strong consumer preference for these value-oriented alternatives.

The burgeoning second-hand and resale market poses a significant threat of substitution. Thrift shopping and online resale platforms are experiencing robust growth, with the global second-hand apparel market projected to reach $350 billion by 2027, up from $177 billion in 2022. This trend is fueled by consumers, particularly Gen Z and Millennials, seeking affordability, unique styles, and more sustainable purchasing options, directly competing with new product sales.

The rising popularity of athleisure and activewear as everyday wear presents a significant threat of substitutes for traditional apparel. Consumers are increasingly opting for comfortable and versatile sportswear, blurring the lines between workout gear and casual fashion. This shift means items like leggings and stylish sneakers can replace dresses, skirts, or even casual jackets for many occasions.

In 2024, the global activewear market continued its robust growth, with projections indicating it could reach over $200 billion by 2025. This expansion directly reflects consumers’ willingness to substitute traditional clothing with activewear for daily use, impacting sales in categories like formal wear and everyday casual wear.

'Dupes' and Affordable Replicas

The rise of 'dupes' or affordable replicas, significantly amplified by social media platforms, presents a potent threat of substitutes. These products mimic the aesthetic and function of higher-priced branded items, offering consumers a much lower-cost alternative.

This trend directly challenges the perceived exclusivity and brand loyalty of original manufacturers. For instance, in the beauty industry, sales of "dupe" makeup products have surged, with some reports indicating that the global market for dupes is growing at a rapid pace, potentially impacting the revenue streams of established luxury brands.

- Social Media's Role: Platforms like TikTok and Instagram have become major drivers for the dupe market, showcasing affordable alternatives and influencing consumer purchasing decisions.

- Consumer Behavior Shift: Consumers are increasingly prioritizing value and accessibility, making them more open to purchasing dupes over original, premium-priced goods.

- Market Impact: The proliferation of dupes can lead to reduced demand for original products, forcing brands to reconsider their pricing strategies and marketing approaches.

Rental and Sharing Economy Models

The fashion industry, including companies like G-III Apparel Group, faces a growing threat from rental and sharing economy models. These platforms allow consumers to access a rotating wardrobe without the commitment of purchasing new items, potentially dampening demand for traditional retail sales of apparel. For instance, the global online clothing rental market was valued at approximately $1.5 billion in 2023 and is projected to grow significantly, indicating a shift in consumer behavior towards access over ownership.

These alternative consumption methods present a challenge by offering variety and affordability, which can appeal to a broad consumer base. As these services gain traction, they could divert a portion of consumer spending away from new garment purchases. By 2024, the subscription box and rental market for fashion is expected to continue its upward trajectory, providing consumers with flexible and often more sustainable ways to engage with fashion trends.

- Growing Rental Market: The global online clothing rental market reached about $1.5 billion in 2023, highlighting a substantial shift in consumer preferences.

- Consumer Behavior Shift: Consumers are increasingly valuing access to a variety of fashion items over outright ownership, driven by cost-effectiveness and trend-following.

- Impact on Demand: This trend poses a threat by potentially reducing the overall demand for new apparel purchases, affecting sales volumes for traditional retailers.

- Sustainability Appeal: Rental models often align with growing consumer interest in sustainability, offering a more eco-conscious way to experience fashion.

The threat of substitutes for G-III Apparel Group comes from various alternative ways consumers can acquire clothing and accessories. These substitutes offer similar benefits, often at lower costs or with added conveniences, directly impacting demand for traditional retail purchases.

Fast fashion, second-hand markets, athleisure, dupes, and rental services all represent significant substitutes. These alternatives are gaining traction due to their affordability, trendiness, sustainability appeal, and flexibility, forcing established brands to adapt.

The combined growth of these substitute markets indicates a fundamental shift in consumer behavior. Consumers are increasingly prioritizing value, variety, and conscious consumption, making them less reliant on purchasing new apparel from traditional retailers.

| Substitute Category | Market Size (Approx.) | Projected Growth Driver | Impact on Apparel Retailers |

|---|---|---|---|

| Fast Fashion | $39.7 billion (2023) | Low price points, trend-driven | Reduced demand for higher-priced items |

| Second-hand Apparel | $177 billion (2022) to $350 billion (2027) | Affordability, uniqueness, sustainability | Direct competition with new sales |

| Activewear (as everyday wear) | Over $200 billion (projected by 2025) | Comfort, versatility | Substitution for casual and even some formal wear |

| Clothing Rental | $1.5 billion (2023) | Variety, cost-effectiveness, sustainability | Decreased need for ownership |

Entrants Threaten

G-III Apparel Group's extensive portfolio, boasting over 30 owned and licensed brands like Calvin Klein, Tommy Hilfiger, and DKNY, presents a formidable barrier to new entrants. Building comparable brand recognition and fostering consumer trust in the highly competitive apparel market requires immense capital investment and significant time, making it difficult for newcomers to gain traction.

Entering the apparel sector, particularly to rival a company like G-III Apparel Group, demands substantial financial investment. This capital is needed for everything from initial design and sourcing materials to manufacturing, extensive marketing campaigns, and establishing a robust distribution network. For instance, in 2023, G-III Apparel Group reported net sales of $3.06 billion, illustrating the scale of operations that a new entrant would need to match.

Established companies such as G-III leverage significant economies of scale. This means they can produce goods at a lower per-unit cost due to high production volumes and efficient supply chain management. Consequently, new competitors face a considerable challenge in matching these cost efficiencies, making it difficult to offer competitive pricing and capture market share from the outset.

G-III Apparel Group, a significant player in the apparel industry, benefits from its deeply entrenched relationships with major department stores like Macy's and Kohl's, as well as a robust network of specialty retailers. These established partnerships provide G-III with preferential access to prime shelf space and favorable distribution terms, crucial for reaching a broad consumer base.

Newcomers to the market find it exceptionally difficult to replicate this level of distribution access. Securing comparable shelf space and distribution agreements with these key retailers often requires significant investment, established brand recognition, and a proven track record, hurdles that emerging brands typically struggle to overcome in the competitive retail landscape.

Licensing Agreements and Intellectual Property

The threat of new entrants into G-III Apparel Corporation's market is significantly mitigated by the intricate web of licensing agreements and intellectual property. A substantial part of G-III's success hinges on its ability to secure and maintain licenses for well-known brands, a process that demands considerable legal acumen and financial investment. For instance, as of their latest reporting, G-III holds licenses for numerous prominent brands across various apparel categories, which are crucial to their revenue streams.

Developing a robust portfolio of proprietary designs and trademarks also presents a formidable barrier. New companies would need to invest heavily in brand building, design innovation, and legal protection to compete effectively. This requirement for substantial upfront capital and specialized expertise effectively deters many potential new players from entering the market.

- Licensing Dependence: G-III's business model relies heavily on securing licenses for popular brands, a costly and legally complex undertaking.

- Intellectual Property Hurdles: Establishing and protecting proprietary designs and trademarks requires significant investment in legal services and brand development.

- Capital Requirements: New entrants face substantial financial barriers to entry due to the need for licensing fees, legal costs, and marketing expenditures.

Supply Chain Complexity and Relationships

The global apparel supply chain is notoriously complex, weaving together sourcing, manufacturing, and logistics across multiple countries. G-III Apparel Group has cultivated deep, long-standing relationships with foreign manufacturers and established international offices to effectively manage these intricate operations. This established network and operational infrastructure represent a significant barrier to entry for new competitors, who would find it challenging and time-consuming to build comparable connections and capabilities.

New entrants face substantial hurdles in replicating G-III's established supply chain advantages.

- Established Global Sourcing Network: G-III leverages decades of experience in building relationships with diverse overseas suppliers, ensuring access to a wide range of materials and manufacturing capabilities.

- Logistical Expertise and International Presence: The company's international offices and logistical expertise are crucial for navigating the complexities of global shipping, customs, and inventory management, areas where newcomers would lack G-III's established track record.

- Economies of Scale in Production: G-III's volume of production allows for greater negotiation power with manufacturers, leading to potentially lower per-unit costs that are difficult for smaller, newer entrants to match.

The threat of new entrants for G-III Apparel Group is considerably low due to high capital requirements, strong brand loyalty, and established distribution channels. Companies like G-III have invested heavily in brand building and securing prime retail space, making it difficult for newcomers to compete effectively. For instance, G-III's net sales reached $3.37 billion in the fiscal year ending January 28, 2024, indicating the scale of operations required to enter this market.

The complexity of licensing agreements and the need to develop proprietary intellectual property also act as significant deterrents. New entrants would need substantial financial resources and legal expertise to navigate these aspects, further limiting the threat. The company's robust supply chain, built over years, also presents a considerable barrier, as replicating G-III's established relationships and logistical efficiencies is a daunting task for any new player.

| Barrier to Entry | Description | Impact on New Entrants |

|---|---|---|

| Capital Requirements | Significant investment needed for brand building, marketing, inventory, and distribution. | High barrier; newcomers struggle to match G-III's scale and marketing spend. |

| Brand Equity & Licensing | G-III's portfolio includes well-known brands like Calvin Klein, Tommy Hilfiger, and DKNY, requiring substantial licensing fees. | High barrier; replicating brand recognition and securing licenses is costly and time-consuming. |

| Distribution Channels | Established relationships with major retailers like Macy's and Kohl's. | High barrier; securing comparable shelf space and favorable terms is difficult for new brands. |

| Economies of Scale | G-III benefits from lower per-unit costs due to high production volumes. | High barrier; new entrants cannot match G-III's cost efficiencies or pricing power. |

| Supply Chain Complexity | Decades of experience in managing global sourcing and logistics. | High barrier; building a comparable, efficient supply chain takes significant time and investment. |

Porter's Five Forces Analysis Data Sources

Our G-III Porter's Five Forces analysis leverages data from industry-specific market research, financial statements of key players, and publicly available company reports to provide a comprehensive view of the competitive landscape.