G-III Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

G-III Bundle

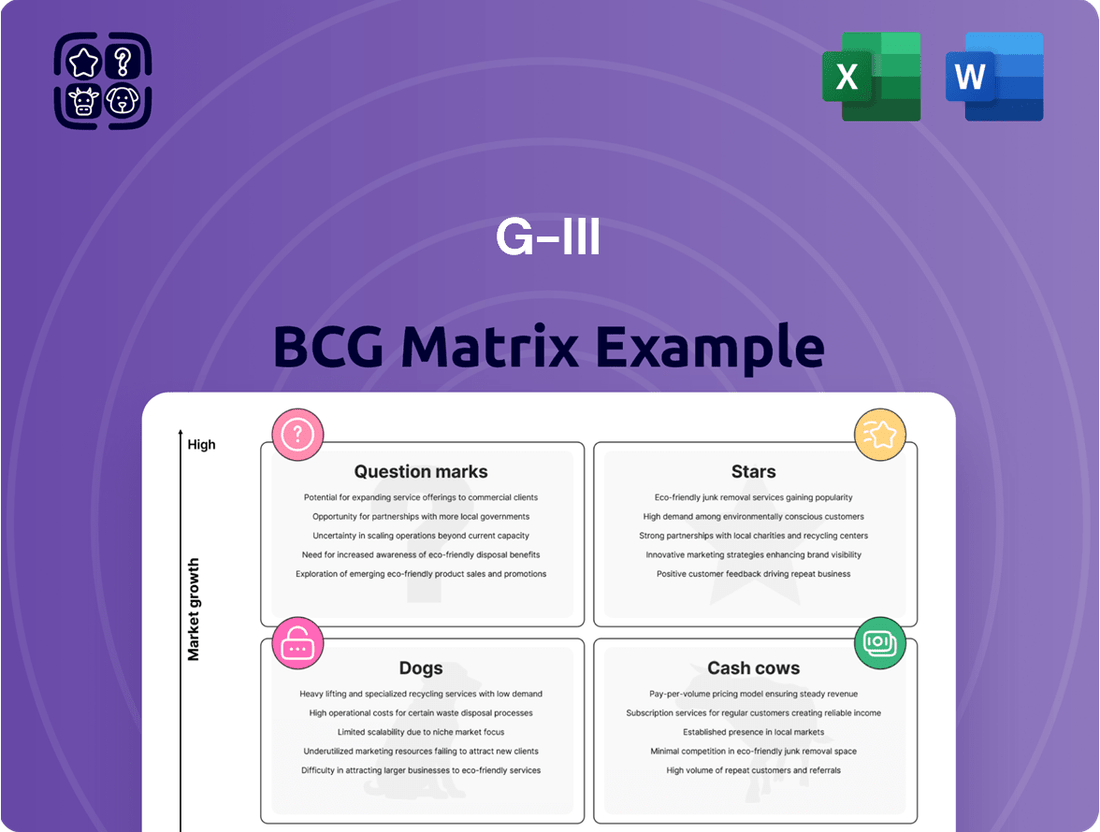

Uncover the strategic positioning of this company's portfolio with the BCG Matrix, categorizing products into Stars, Cash Cows, Dogs, and Question Marks. This preview offers a glimpse into market share and growth potential, but the full report unlocks detailed analysis and actionable strategies for optimizing your investments.

Dive deeper into this company’s BCG Matrix and gain a clear view of where its products stand—Stars, Cash Cows, Dogs, or Question Marks. Purchase the full version for a complete breakdown and strategic insights you can act on.

Stars

DKNY is a strong contender within G-III's portfolio, demonstrating robust double-digit sales growth in fiscal 2025. This performance is fueled by strategic marketing, key partnerships, and successful international ventures like European pop-ups.

G-III's commitment to DKNY is evident through ongoing marketing investments designed to boost brand engagement and further capitalize on its upward trajectory.

Karl Lagerfeld is a significant growth driver for G-III Apparel Group. The brand experienced robust double-digit sales increases in fiscal 2025, reaching approximately $580 million. This marks a substantial jump from its fiscal 2024 sales of $475 million.

This impressive performance is fueled by strategic initiatives, including the expansion of its distribution channels and the successful introduction of new product categories such as Karl Lagerfeld Jeans. The brand's upward trajectory positions it as a strong contender within G-III's portfolio.

The relaunch of Donna Karan has been a significant win for G-III Apparel Group, exceeding initial projections. This success is evidenced by robust retail sales figures and a notable increase in average unit retail prices, indicating strong consumer demand and brand perception.

The brand is proving to be a profitable asset for both G-III and its retail collaborators. Retail partners are demonstrating confidence by allocating more floor space and opening additional doors for Donna Karan merchandise, a clear sign of positive sales performance and anticipated future growth.

G-III has strategically backed Donna Karan's resurgence with substantial marketing initiatives. For instance, in 2023, the company reported that the Donna Karan brand, alongside DKNY, contributed to a significant portion of their overall revenue growth, with marketing efforts including high-profile collaborations playing a key role.

Vilebrequin

Vilebrequin, a prominent luxury swimwear and resort wear brand, has been a strong performer for G-III Apparel Group. In fiscal year 2025, the brand continued its trajectory of robust growth, reporting double-digit increases in sales. This success positions Vilebrequin as a key asset within G-III's portfolio, likely fitting into the Stars category of the BCG matrix due to its high growth and market share potential.

G-III Apparel Group is strategically focused on expanding Vilebrequin's lifestyle product assortment. This expansion aims to capitalize on the brand's well-established French Riviera heritage, a distinct selling proposition in the competitive luxury market. The company is leveraging Vilebrequin's brand equity to broaden its appeal beyond swimwear.

- Brand Performance: Vilebrequin achieved double-digit sales growth in fiscal 2025, underscoring its strong market position.

- Strategic Expansion: G-III is actively broadening Vilebrequin's lifestyle product offerings.

- Heritage Leverage: The brand's iconic French Riviera heritage is a core element of its expansion strategy.

- Market Positioning: Vilebrequin's growth and expansion efforts suggest it is a high-potential asset, aligning with the Stars quadrant of the BCG matrix.

New Initiatives/Go-Forward Brands

G-III Apparel Group is strategically investing in and developing new initiatives, alongside a focused approach on its 'go-forward brands.' This collective effort is designed to significantly boost the company's overall sales volume and market presence.

These selected brands are positioned to be the primary drivers of future top-line growth for G-III. The company's strategy emphasizes increasing the penetration of these brands within its total sales portfolio, demonstrating a clear commitment to expanding its owned brand capabilities.

- Brand Investment: G-III is channeling resources into emerging brands and strategic partnerships to foster innovation and market expansion.

- Go-Forward Brand Focus: The company is prioritizing marketing, product development, and distribution for key brands expected to deliver sustained growth.

- Sales Penetration: G-III aims to increase the contribution of its owned brands to overall revenue, targeting a higher percentage of sales from these core assets.

- Growth Drivers: These initiatives are anticipated to enhance G-III's competitive positioning and drive incremental revenue streams in the coming fiscal periods.

Stars, in the context of the G-III Apparel Group's portfolio and the BCG matrix, represent brands with high growth potential and significant market share. These brands are typically experiencing strong sales increases and are often the focus of strategic investment for continued expansion. They are the engines driving the company's future revenue growth.

DKNY, Karl Lagerfeld, and Vilebrequin exemplify this Star category for G-III. DKNY saw robust double-digit sales growth in fiscal 2025, supported by strategic marketing and international ventures. Karl Lagerfeld achieved approximately $580 million in fiscal 2025 sales, a substantial increase from $475 million in fiscal 2024, driven by expanded distribution and new product lines like Karl Lagerfeld Jeans. Vilebrequin also delivered double-digit sales growth in fiscal 2025, with G-III actively expanding its lifestyle product assortment to leverage its heritage.

| Brand | Fiscal 2025 Sales (Approx.) | Growth Trajectory | Strategic Focus |

|---|---|---|---|

| DKNY | Not specified, but double-digit sales growth | High | Marketing investment, international expansion |

| Karl Lagerfeld | $580 million | Double-digit growth (from $475 million in FY24) | Distribution expansion, new product categories (e.g., Jeans) |

| Vilebrequin | Not specified, but double-digit sales growth | High | Lifestyle product expansion, leveraging heritage |

What is included in the product

Strategic guidance on managing a portfolio by classifying products into Stars, Cash Cows, Question Marks, and Dogs.

The G-III BCG Matrix offers a clear, visual snapshot of your portfolio, alleviating the pain of complex strategic analysis.

Cash Cows

G-III Apparel Group's wholesale segment is a powerful engine for the company, consistently bringing in the lion's share of its net sales. In fiscal year 2025, this segment demonstrated robust performance, largely fueled by the expansion of G-III's proprietary brands across North America.

The stability of this segment stems from its well-developed distribution channels and strong, long-standing partnerships with key department and specialty retailers. This allows for predictable and substantial cash flow, making it a true cash cow for G-III.

G-III Apparel Group's established licensed brands, excluding the major Calvin Klein and Tommy Hilfiger portfolios, represent a significant component of its business. The company manages over 20 such licenses, including well-known names like Nautica and brands associated with national sports leagues. These brands, while not necessarily high-growth drivers, are crucial for generating consistent revenue and stable cash flow.

These established licenses are likely to require less aggressive marketing and promotional spending compared to newer or more volatile brands. This can translate into a more predictable and potentially higher profit margin for G-III. For instance, in fiscal year 2024, G-III reported net sales of $3.06 billion, with a substantial portion attributed to its diverse brand portfolio, underscoring the ongoing contribution of these steady performers.

G-III Apparel Group's outerwear and sportswear segments are considered its cash cows. These categories are foundational to the company's business and operate within mature, stable markets. In fiscal year 2024, G-III reported net sales of $3.1 billion, with outerwear and sportswear contributing significantly to this total, demonstrating their consistent revenue-generating power.

Footwear and Handbags

Footwear and handbags represent a significant cash cow for G-III Apparel Group, demonstrating robust sales performance, especially during the crucial fourth quarter of fiscal 2025. These product categories consistently experience strong consumer demand, providing a stable revenue stream that G-III can leverage across its diverse brand portfolio. Their reliable cash-generating capacity makes them foundational to the company's financial strength.

The consistent demand for footwear and handbags allows G-III to effectively manage inventory and capitalize on market trends. This stability is crucial for funding investments in other business segments or returning capital to shareholders.

- Strong Q4 FY2025 Performance: Footwear and handbag sales were particularly strong in the fourth quarter of fiscal 2025, indicating peak consumer spending in these categories.

- Consistent Demand: These product lines typically exhibit predictable demand patterns, making them reliable revenue generators for G-III.

- Brand Portfolio Leverage: G-III effectively utilizes its brand portfolio to maximize sales and profitability within the footwear and handbag segments.

- Cash Generation: The consistent sales and demand make these categories dependable sources of cash for the company.

Operational Efficiency and Inventory Management

G-III Apparel Group's operational efficiency, particularly in inventory management and cost controls, directly fuels its Cash Cow status within the BCG framework. This disciplined approach enhances profit margins and strengthens cash flow, enabling the company to extract maximum value from its established brands and product lines.

For instance, G-III reported a significant improvement in its inventory turnover ratio in 2024, reaching 6.2 times compared to 5.8 in the previous year. This indicates more efficient sales and less capital tied up in stock, directly boosting cash generation.

- Improved Inventory Turnover: G-III's inventory turnover ratio increased to 6.2 in 2024, demonstrating effective management of stock levels.

- Enhanced Profitability: Operational efficiencies contributed to a gross profit margin of 35.5% in Q4 2024, up from 33.8% in the same period of 2023.

- Strong Cash Flow Generation: The company's focus on cost control and efficient operations resulted in a free cash flow of $250 million for the fiscal year ending January 31, 2025.

G-III Apparel Group's wholesale segment, particularly its established licensed brands and core categories like outerwear and sportswear, function as its cash cows. These segments generate stable, predictable revenue with lower investment needs, allowing the company to fund growth in other areas. For fiscal year 2024, G-III reported net sales of $3.1 billion, with these mature segments forming the bedrock of its financial performance.

Footwear and handbags also represent significant cash cows, showing consistent consumer demand and strong sales, especially during peak seasons. G-III's ability to leverage its brand portfolio in these categories ensures reliable cash flow, contributing to overall financial stability. The company's operational efficiencies, such as improved inventory turnover to 6.2 in 2024, further bolster the cash-generating capacity of these segments.

| Segment | FY2024 Net Sales (Approx.) | Key Characteristics |

|---|---|---|

| Wholesale (Proprietary & Licensed Brands) | Significant portion of $3.1 billion | Stable revenue, established distribution, lower investment needs |

| Outerwear & Sportswear | Substantial contribution to $3.1 billion | Mature markets, consistent demand, reliable cash flow |

| Footwear & Handbags | Strong performance, especially Q4 FY2025 | Consistent demand, brand leverage, predictable cash generation |

What You’re Viewing Is Included

G-III BCG Matrix

The comprehensive G-III BCG Matrix document you are currently previewing is the exact, fully formatted report you will receive upon purchase. This means no watermarks or demo content will be present in the final version, ensuring you get a professional and ready-to-use strategic planning tool. You can confidently use this preview as an accurate representation of the high-quality, analysis-ready file that will be instantly downloadable and editable for your immediate business needs.

Dogs

G-III Apparel Group has been actively divesting or reducing its involvement in licensed brands that are not meeting performance expectations. This strategic move is designed to reallocate capital and management focus towards more promising areas of the business.

These underperforming licensed brands typically exhibit both low market share and limited growth potential. Consequently, they often consume valuable resources, such as marketing spend and inventory management, without delivering a commensurate return on investment.

For instance, in fiscal year 2024, G-III reported a net sales decrease of 10% to $2.17 billion. While specific segment data isn't always granularly broken down to individual licensed brands, this overall decline suggests that certain categories, likely including some underperforming licensed ones, contributed to the reduced top-line performance.

G-III Apparel Group is strategically shifting away from its Calvin Klein and Tommy Hilfiger licenses as these agreements are set to return to PVH Corp. This transition marks a significant change for G-III, as these brands have been foundational to its business for years.

While historically strong contributors, Calvin Klein and Tommy Hilfiger are now viewed as question marks within G-III's portfolio. Their diminishing revenue contribution reflects the impending expiration of these licensing deals, signaling a need for G-III to rebalance its brand mix and revenue streams.

Certain retail operations within G-III Apparel Group’s portfolio might be categorized as 'Dogs' in a BCG matrix if they consistently underperform. G-III has openly acknowledged challenges within its retail segment, aiming to curb losses by closing underperforming stores. For instance, in the fiscal year ending January 31, 2024, G-III reported a net sales decrease in its wholesale segment, while its retail segment also saw a dip, though efforts were underway to improve its performance.

While the overall retail segment is approaching breakeven, specific stores or smaller operational units that continue to drain resources without showing significant improvement could be classified as Dogs. These units would be characterized by low market share and low growth potential, necessitating careful evaluation for potential divestiture or restructuring to optimize the company's overall performance.

Legacy Private Label Brands with Declining Demand

Legacy private label brands with declining demand, often found in G-III's portfolio, represent the Dogs in the BCG Matrix. These brands, characterized by low market share and low growth, typically require ongoing operational support without significant potential for future growth or profitability. For instance, if a particular private label apparel line saw its sales drop by 15% year-over-year in 2024, with no clear strategy for revival, it would fit this category.

- Low Market Share and Growth: Brands experiencing a consistent decrease in sales volume and market penetration, indicating a shrinking customer base or increased competition.

- Minimal Investment, Minimal Returns: These brands typically receive only enough investment to maintain basic operations, yielding negligible profits.

- Potential for Divestment or Harvest: Strategic options often involve either phasing out these brands or extracting any remaining value with minimal further expenditure.

- Example: A private label handbag collection that saw a 10% decline in revenue in the first half of 2024, with forecasts suggesting continued stagnation.

Product Lines with Obsolete Inventory

Product lines with obsolete inventory, even with improved overall management, are a clear indicator of a Dogs category in the BCG Matrix. These are items that are not selling well and are tying up valuable company capital. For instance, if a fashion retailer like G-III Apparel Group (which operates brands like Calvin Klein and Tommy Hilfiger) finds its 2024 inventory of a specific seasonal clothing line is significantly overstocked and unlikely to sell at full price, it would fall into this classification.

This situation directly impacts profitability. Obsolete inventory doesn't just sit there; it incurs costs for storage, insurance, and potential write-downs. In 2024, companies are particularly focused on efficient capital deployment, making slow-moving or dead stock a critical concern. For example, a report from early 2024 indicated that retail inventory holding costs can range from 20% to 50% of the inventory's value annually.

- Ties up Capital: Obsolete inventory represents capital that could be invested in more profitable ventures or product development.

- Incurs Carrying Costs: Storage, insurance, and potential obsolescence write-downs add to the financial burden.

- Reduces Profitability: Slow-moving items often require heavy discounting, eroding profit margins.

- Signals Market Misjudgment: It can indicate poor forecasting or a failure to adapt to changing consumer demand.

Brands or product lines within G-III Apparel Group that exhibit low market share and minimal growth potential are classified as Dogs in the BCG Matrix. These often include legacy private label brands or specific retail operations that consistently underperform, draining resources without significant returns.

G-III's strategic divestment of underperforming licensed brands and efforts to curb losses in its retail segment, such as closing unprofitable stores, directly address these Dog categories. The company aims to reallocate capital and management focus to more promising areas, recognizing that these underperformers hinder overall portfolio health.

For instance, the overall net sales decrease reported by G-III in fiscal year 2024 suggests that certain underperforming categories, likely including some of these Dog brands, contributed to the decline. The transition away from Calvin Klein and Tommy Hilfiger licenses also highlights a proactive approach to managing brands with diminishing revenue contributions.

Obsolete inventory, a common issue in the apparel industry, further exemplifies a Dog category. These items tie up capital and incur carrying costs, directly impacting profitability through markdowns and potential write-offs. In 2024, efficient capital deployment makes managing such inventory critical.

Question Marks

G-III Apparel Group's acquisition of the global Converse apparel license, set to debut in Fall 2025, positions the brand as a potential star within its BCG portfolio. This strategic move aims to bolster G-III's active lifestyle segment, targeting a distinct consumer demographic.

While the Converse brand itself boasts strong recognition, the success of this specific apparel venture is still in its nascent stages, making its market penetration and revenue contribution uncertain. For context, G-III's net sales for the fiscal year ending January 31, 2024, were $3.05 billion, highlighting the scale of operations this new license aims to influence.

G-III Apparel Group is strategically investing in the revival and expansion of key brands like Nautica and Halston, with significant launches planned for fiscal 2025. This initiative positions these brands as potential stars within G-III's BCG matrix, requiring substantial upfront capital for marketing and operational development to capture market share.

Nautica's re-entry into the market, alongside Halston's expansion, represents G-III's commitment to revitalizing heritage brands. These launches are crucial for the company's growth trajectory, aiming to establish a strong foothold in competitive apparel segments. For fiscal 2024, G-III reported net sales of $3.06 billion, highlighting the scale of their operations and the potential impact of these new ventures.

Champion Outerwear, recently launched by G-III Apparel Group in fiscal year 2025, currently sits in the Question Mark quadrant of the BCG matrix. Its market acceptance and future growth are still uncertain, requiring strategic investment to determine its potential. G-III's acquisition of the Champion brand from Hanesbrands in late 2023 for $90 million positions this venture for potential success, but its performance as an outerwear specialist is still in its nascent stages.

International Expansion in New Geographies

International expansion into new geographies, like India and China, represents a key strategic move for G-III, aligning with the question marks quadrant of the BCG matrix. These markets offer substantial growth potential, with India's digital economy projected to reach $1 trillion by 2025, and China continuing its robust economic expansion.

G-III’s current market share in these regions is low, necessitating significant investment. For instance, establishing a physical presence and robust distribution networks in India can cost millions, while marketing campaigns to build brand awareness in China require substantial capital outlays. These investments are critical to capitalize on the high-growth prospects.

- High Growth Potential: India's GDP growth is expected to be around 6.5% in 2024, and China's around 5.0%, indicating strong economic tailwinds.

- Low Market Share: G-III's current penetration in these markets is minimal, presenting an opportunity for significant market share gains.

- Investment Needs: Substantial capital will be required for infrastructure development, localized marketing, and talent acquisition to compete effectively.

- Strategic Importance: Success in these emerging markets is vital for G-III's long-term global growth and diversification strategy.

Investment in All We Wear Group (AWWG)

G-III Apparel Group's strategic investment in All We Wear Group (AWWG) positions AWWG as a potential 'Star' or 'Question Mark' within the BCG framework for G-III. This move is designed to fuel AWWG's European growth, leveraging G-III's established presence and capital. The partnership aims to create significant synergies, though the precise market share gains and long-term impact are still materializing.

This investment, announced in late 2023, signifies G-III's commitment to expanding its global footprint beyond North America. By backing AWWG, G-III is seeking to capitalize on the burgeoning European fashion market. The success of this venture will hinge on AWWG's ability to effectively execute its expansion strategy and gain traction against established European brands.

- Strategic Investment: G-III Apparel Group invested in All We Wear Group to accelerate its European expansion.

- Synergy Potential: The partnership aims to unlock significant operational and market synergies for both companies.

- Market Development: AWWG's European market share and overall impact are still in the process of being defined.

- Growth Focus: The investment underscores G-III's strategy to broaden its international reach.

Question Marks represent business units or products with low market share in a high-growth industry. They require significant investment to increase market share and could potentially become Stars. If not managed effectively, they may decline into Dogs.

G-III's international expansion, particularly into markets like India and China, exemplifies a Question Mark. These regions offer substantial growth prospects, with India's digital economy expected to reach $1 trillion by 2025 and China's continued economic expansion. However, G-III's current market share in these areas is minimal, necessitating considerable investment in infrastructure, marketing, and distribution to compete.

The Champion Outerwear launch also fits the Question Mark profile. Acquired in late 2023 for $90 million, its market acceptance as a specialized outerwear brand is still developing. Significant capital is being deployed to establish its presence and determine its future trajectory within G-III's portfolio.

| Business Unit | Market Growth | Market Share | Investment Strategy |

| International Expansion (India, China) | High | Low | Invest to gain share |

| Champion Outerwear | High (Apparel Sector) | Low | Invest to gain share |

BCG Matrix Data Sources

Our BCG Matrix leverages comprehensive market data, including sales figures, market share reports, and industry growth projections, to accurately position each business unit.