G-III Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

G-III Bundle

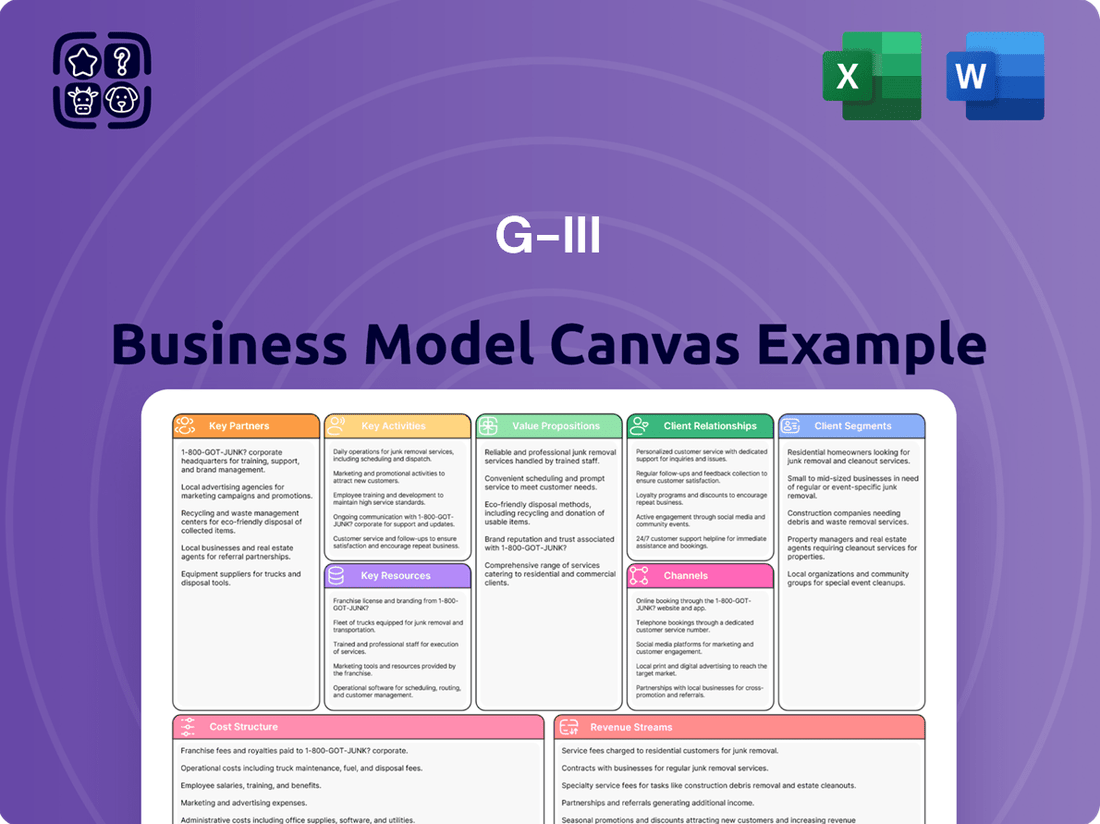

Curious about the strategic engine driving G-III's success? Our comprehensive Business Model Canvas breaks down their key partnerships, revenue streams, and customer relationships into an easily digestible format. Unlock the full blueprint to understand how they dominate their market.

Partnerships

G-III Apparel Group’s success is deeply intertwined with its licensed brand owners, forming a cornerstone of its business strategy. These crucial partnerships enable G-III to leverage the established equity and consumer recognition of iconic brands, allowing them to design, manufacture, and distribute a wide array of apparel and accessories.

This licensing model significantly broadens G-III's market presence and product diversity. For instance, a notable recent development is the global apparel license secured for Nike-owned Converse, with product introductions planned for Fall 2025. This follows established and successful collaborations with brands like Champion and Halston, demonstrating a consistent and effective approach to brand acquisition through licensing.

Strategic alliances with wholesale retailers, including department stores and specialty retailers, form the bedrock of G-III Apparel Group's distribution strategy. These partnerships are vital sales channels, ensuring G-III's extensive brand portfolio reaches a wide consumer base.

These collaborations are not merely transactional; G-III actively cultivates these relationships. For instance, the company has strategically expanded floor space and the number of retail doors for key brands like Donna Karan, demonstrating a commitment to deepening these crucial wholesale partnerships and enhancing brand visibility.

G-III Apparel Group's Key Partnerships in manufacturing and sourcing are foundational to its global operations. The company leverages a vast network of factories and suppliers across the globe to produce its diverse range of apparel and accessories. These relationships are critical for maintaining product quality and ensuring that all items meet the stringent standards set by G-III's licensed brands.

A prime example of these critical partnerships is G-III's need to work with Nike-approved factories when manufacturing apparel for the Converse brand. This requirement highlights the importance of adhering to specific brand protocols and quality control measures. In 2023, G-III reported that its net sales increased by 10% to $3.12 billion, underscoring the scale and success of its manufacturing and sourcing operations.

Strategic Investment Partners (e.g., AWWG)

G-III Apparel Group actively pursues strategic investments and partnerships to fuel its global growth and bolster its operational strengths. A prime illustration of this strategy is its investment in and collaboration with All We Wear Group (AWWG), a prominent fashion platform headquartered in Madrid.

This alliance is specifically designed to amplify G-III's presence in the European market. Through this partnership, AWWG is set to become the exclusive agent for G-III's owned brands within Spain and Portugal, a move expected to significantly boost sales and market penetration in these key regions.

- Strategic Alignment: G-III's partnership with AWWG leverages AWWG's established European footprint and fashion platform expertise.

- Market Expansion: The collaboration targets accelerated growth for G-III's owned brands in the crucial Spanish and Portuguese markets.

- Operational Efficiency: Appointing AWWG as an agent streamlines distribution and sales operations in the designated territories.

- Brand Penetration: This move is anticipated to enhance brand visibility and accessibility for G-III's portfolio across Southern Europe.

Footwear and Accessories Licensees (e.g., ALDO Group)

G-III leverages licensing agreements with specialized partners to broaden its owned brands' presence in key product categories. A prime example is the seven-year exclusive licensing deal with ALDO Product Services. This agreement empowers ALDO to handle the design, manufacturing, distribution, marketing, and sales of G.H. Bass footwear, bags, and small leather goods throughout North America.

This strategic alliance capitalizes on ALDO's established expertise within these specific product segments. For the fiscal year ended January 31, 2024, G-III reported that licensed wholesale net sales represented approximately 16.1% of its total net sales, underscoring the financial significance of these partnerships.

- Brand Extension: Allows G-III to reach consumers in product categories where it may not have direct manufacturing or design capabilities.

- Expertise Leverage: Partners like ALDO bring specialized knowledge, operational efficiency, and market access for specific product lines.

- Revenue Generation: Licensing agreements provide a consistent revenue stream through royalties and wholesale sales, contributing to overall financial performance.

G-III Apparel Group's key partnerships are multifaceted, encompassing brand licensors, wholesale retailers, manufacturers, and strategic investors. These relationships are foundational, enabling G-III to access established brands, reach consumers, ensure product quality, and expand its global footprint. For fiscal year 2024, G-III's net sales reached $3.09 billion, with licensed wholesale net sales contributing approximately 16.1% of this total, highlighting the financial impact of these collaborations.

| Partnership Type | Key Examples | Strategic Importance |

| Brand Licensors | Nike (Converse), Champion, Halston | Leverage brand equity, expand product offerings |

| Wholesale Retailers | Department stores, Specialty retailers | Primary distribution channels, market access |

| Manufacturers & Suppliers | Global network, Nike-approved factories | Ensure product quality, operational efficiency |

| Strategic Investments | All We Wear Group (AWWG) | European market expansion, brand penetration |

| Category Specialists | ALDO Product Services (G.H. Bass) | Leverage expertise in specific product categories |

What is included in the product

A structured framework detailing G-III's customer segments, value propositions, and channels to achieve its strategic objectives.

The G-III Business Model Canvas provides a structured framework to systematically identify and address customer pain points by clearly defining value propositions and customer segments.

It offers a visual and organized approach to pinpointing and resolving key challenges within a business's operations and customer interactions.

Activities

G-III Apparel Group's core activity revolves around designing and developing a wide array of apparel and accessories. This crucial process involves staying ahead of fashion trends, conceptualizing unique designs, and ensuring every product meets the high aesthetic and quality expectations for both their proprietary brands and those they license. For instance, in fiscal year 2024, G-III continued to invest in its product development capabilities to maintain its competitive edge across its extensive brand portfolio.

G-III Apparel Group excels in global sourcing and manufacturing, orchestrating a complex supply chain to bring its diverse product lines to life. This core activity involves meticulous supplier selection, with a keen eye on ethical practices and robust quality assurance protocols. Navigating international trade regulations and stringent factory approval processes, akin to those required by major partners like Nike, is paramount to their operational success.

G-III Apparel Group's brand marketing and portfolio management are central to its success. The company manages over 30 brands, both owned and licensed, requiring sophisticated strategies to maintain brand equity and drive sales globally. Effective management ensures each brand resonates with its target audience.

High-impact marketing campaigns are key. G-III strategically allocates resources to marketing, aiming to build excitement and compelling narratives around its collections. This focus is particularly evident with its core owned brands, such as DKNY and Donna Karan, where significant investment fuels momentum and consumer engagement.

For the fiscal year 2024, G-III reported net sales of $3.15 billion, underscoring the impact of their brand strategies. This performance highlights how robust brand marketing directly translates into substantial revenue, reinforcing the importance of these activities within their business model.

Wholesale and Retail Distribution Operations

G-III Apparel Group's key activities in wholesale and retail distribution are critical to its business model, ensuring its diverse portfolio of brands reaches consumers effectively. The company manages a complex network to deliver products to department stores, specialty retailers, and its own direct-to-consumer channels, including a growing e-commerce presence.

This dual approach requires sophisticated logistics and inventory management. For instance, G-III's wholesale segment relies on strong relationships with major retailers like Macy's and Kohl's, which represent significant sales volume. In fiscal year 2024, G-III reported net sales of $3.1 billion, with a substantial portion derived from its wholesale operations.

The retail segment, encompassing owned brick-and-mortar stores and online platforms, allows G-III to control the brand experience and capture higher margins. The company is strategically expanding its physical retail footprint, aiming to enhance brand visibility and customer engagement. As of January 31, 2024, G-III operated 274 company-operated stores.

- Wholesale Distribution: Managing relationships with over 30,000 wholesale customers globally, including major department stores and specialty retailers.

- Retail Operations: Overseeing a network of company-operated stores and e-commerce platforms for brands like G.H. Bass, DKNY, and Karl Lagerfeld Paris.

- E-commerce Growth: Investing in digital infrastructure to expand online sales channels and reach a wider customer base.

- Brand Expansion: Actively developing and distributing new brands and product lines through both wholesale and retail channels to diversify revenue streams.

Licensing Agreement Negotiation and Management

G-III Apparel Group's core operations heavily rely on the meticulous negotiation and ongoing management of numerous licensing agreements. This encompasses securing rights for popular brands like Converse and Nautica, as well as extending its own brands, such as G.H. Bass, to other manufacturers.

Effective management ensures adherence to brand standards, timely royalty remittances, and strategic alignment across product lines and geographical markets. For instance, in fiscal year 2024, G-III reported approximately $3.2 billion in net sales, a substantial portion of which is driven by these licensed brand relationships.

- Brand Acquisition & Integration: Negotiating terms for new brand licenses and integrating them into G-III's product portfolio.

- Royalty & Compliance Monitoring: Tracking sales and ensuring timely royalty payments to licensors, alongside adherence to brand guidelines.

- Performance Analysis: Evaluating the success of licensed brands and making strategic adjustments to maximize revenue and market penetration.

- Contract Renewal & Renegotiation: Proactively managing existing agreements to secure favorable terms for future periods.

G-III Apparel Group's key activities are centered on designing, sourcing, marketing, and distributing a vast portfolio of apparel and accessories. This involves managing both owned and licensed brands, ensuring product quality, and executing effective marketing strategies to drive sales across wholesale and retail channels.

The company's operational backbone includes global sourcing, intricate supply chain management, and robust brand marketing to maintain consumer engagement and brand equity. For fiscal year 2024, G-III reported net sales of $3.15 billion, highlighting the success of these integrated activities.

Central to G-III's model is the strategic management of over 30 brands, including significant investments in marketing owned brands like DKNY. Furthermore, the company actively manages licensing agreements, which are crucial for revenue generation and brand portfolio expansion.

G-III's distribution network spans thousands of wholesale customers and a growing number of company-operated retail stores and e-commerce platforms. As of January 31, 2024, the company operated 274 stores, supporting its multi-channel sales approach.

Delivered as Displayed

Business Model Canvas

The G-III Business Model Canvas preview you are viewing is the actual document you will receive upon purchase. This means the structure, content, and formatting are identical to the final deliverable, ensuring no discrepancies between what you see and what you get. You can confidently assess the quality and completeness of the Business Model Canvas, knowing that your purchase will unlock the entire, ready-to-use file exactly as presented.

Resources

G-III Apparel Group's extensive brand portfolio, featuring over 30 owned and licensed brands, is its most significant asset. This includes powerful names like DKNY, Karl Lagerfeld, Calvin Klein, and Tommy Hilfiger, which are crucial for driving sales and ensuring sustained profitability.

In fiscal year 2024, G-III Apparel Group reported net sales of $3.06 billion, with a substantial portion directly attributable to the strength and market penetration of its diverse brand offerings. The strategic management of this brand portfolio is fundamental to the company's business model.

G-III Apparel Group's success in offering a wide range of fashion-forward apparel and accessories hinges on its skilled design and creative teams. These professionals are the driving force behind conceptualizing new collections, ensuring products resonate with consumers, and preserving the unique brand identities across G-III's diverse portfolio.

These teams are crucial for G-III's operational strength, allowing the company to adapt to evolving fashion trends and consumer preferences. For instance, in fiscal year 2024, G-III reported net sales of $3.35 billion, demonstrating the market's strong reception to the company's product offerings, which are directly influenced by the creativity and expertise of its design staff.

G-III Apparel Group's global sourcing and supply chain network is a cornerstone of its business model, enabling efficient access to diverse manufacturing capabilities worldwide. This established network is crucial for optimizing costs and ensuring quality across its extensive portfolio of brands and licensed products.

In 2024, G-III continued to leverage this robust infrastructure, which includes rigorous factory approval processes, to manage the complexities of international production. The company's ability to navigate these intricate supply chain requirements is fundamental to its operational success and competitive positioning in the apparel market.

Strong Financial Capital and Liquidity

G-III Apparel Group’s strong financial capital and liquidity are foundational to its business model, enabling strategic agility and resilience. The company consistently demonstrates a healthy balance sheet, allowing for proactive investment and operational flexibility.

This robust financial position is a key resource, providing the means to pursue growth opportunities and weather economic downturns. For instance, G-III reported significant financial strength in fiscal 2025, with over $775 million in cash and available credit. This liquidity is crucial for funding initiatives like brand acquisitions and international market penetration.

- Significant Cash Reserves: Over $775 million in cash and availability reported in fiscal 2025, providing immediate operational and investment capacity.

- Debt Reduction: Substantial debt reduction in fiscal 2025 demonstrates a commitment to financial health and improved leverage ratios.

- Strategic Investment Capacity: Financial strength allows for targeted investments in brand development, marketing, and international expansion to drive long-term growth.

- Economic Resilience: Ample liquidity enables the company to navigate challenging economic conditions and maintain operational stability.

Proprietary Retail Infrastructure and E-commerce Platforms

G-III Apparel Group leverages its proprietary retail infrastructure, including a significant number of owned brick-and-mortar stores and robust e-commerce platforms, as a crucial direct-to-consumer channel. This allows for complete control over brand presentation and customer interaction, fostering a consistent brand image. These owned channels are vital for capturing direct consumer insights, informing product development and marketing strategies.

The company’s e-commerce operations are a key growth driver, as demonstrated by the strong performance of its digital properties like donnakaran.com. In fiscal year 2024, G-III reported that its digital business, a significant portion of which is driven by these proprietary platforms, continued to show resilience and contribute meaningfully to overall revenue. This direct engagement bypasses traditional wholesale markups, potentially leading to higher margins and a more direct understanding of consumer purchasing habits.

- Direct Sales Channels: G-III's owned retail stores and e-commerce sites provide direct access to consumers, enhancing brand control.

- Consumer Insights: These platforms enable the collection of valuable data on customer preferences and purchasing behavior.

- E-commerce Growth: Digital channels, such as donnakaran.com, are key contributors to the company's revenue and brand presence.

- Brand Experience Control: Direct operations allow G-III to curate the complete brand experience from product to point of sale.

G-III Apparel Group's intellectual property, encompassing its extensive portfolio of owned and licensed brands, represents a critical intangible asset. This includes globally recognized names such as DKNY, Calvin Klein, and Tommy Hilfiger, which are the bedrock of the company's market appeal and revenue generation.

The company's skilled design and creative teams are paramount, driving product innovation and ensuring brand relevance in a dynamic fashion landscape. Their ability to translate trends into commercially successful collections directly impacts G-III's sales performance and market positioning.

A robust global sourcing and supply chain network is another key resource, enabling efficient production and cost management across a wide array of product categories and brands. This infrastructure is vital for meeting consumer demand and maintaining competitive pricing.

G-III's financial capital, including significant cash reserves and access to credit, provides the necessary liquidity for strategic investments, operational flexibility, and resilience against market fluctuations. In fiscal year 2025, the company reported over $775 million in cash and available credit, underscoring its financial strength.

The company's proprietary retail infrastructure, comprising owned brick-and-mortar stores and e-commerce platforms, serves as a crucial direct-to-consumer channel. This allows for enhanced brand control and direct consumer engagement, with digital channels showing continued growth and contributing significantly to overall revenue in fiscal year 2024.

| Key Resource | Description | Fiscal Year 2024/2025 Data Point |

|---|---|---|

| Brand Portfolio | Owned and licensed brands driving sales and market presence. | Over 30 owned and licensed brands, including DKNY, Karl Lagerfeld, Calvin Klein, Tommy Hilfiger. |

| Design & Creative Teams | Expertise in product development and trend translation. | Directly influence product offerings contributing to reported net sales of $3.35 billion in FY2024. |

| Supply Chain Network | Global infrastructure for efficient sourcing and production. | Established network enabling cost optimization and quality assurance for diverse brands. |

| Financial Capital | Liquidity for investment and operational stability. | Over $775 million in cash and available credit in FY2025. |

| Retail Infrastructure | Direct-to-consumer channels for brand control and customer engagement. | Owned stores and e-commerce platforms, with digital business showing continued revenue contribution in FY2024. |

Value Propositions

G-III Apparel Group's diverse portfolio is a cornerstone of its business model, featuring a broad spectrum of apparel and accessories. This includes everything from outerwear and dresses to sportswear and footwear, designed to satisfy a wide array of consumer tastes and needs for various occasions.

This extensive product assortment allows G-III to effectively address varied market demands and resonate with different consumer lifestyles. The company's strength lies in its ability to differentiate itself through distinct brand identities and specialized product categories.

For instance, in fiscal year 2024, G-III reported net sales of $3.03 billion, underscoring the breadth of its market reach. The company operates with a strategy that leverages multiple brands, including DKNY, Donna Karan, Calvin Klein, and Tommy Hilfiger, each contributing to its overall market penetration and appeal.

G-III Apparel Group offers consumers access to a curated selection of iconic and desirable fashion brands. This includes their wholly-owned labels like DKNY and Karl Lagerfeld, alongside a robust licensed portfolio featuring popular names such as Calvin Klein and Tommy Hilfiger.

The company's core strategy revolves around securing and presenting the most sought-after brands to its customer base. This focus on desirability is a key driver of their value proposition in the competitive fashion market.

For the fiscal year ending January 31, 2024, G-III Apparel Group reported net sales of $3.15 billion, underscoring the broad appeal and market penetration of the brands they offer and manage.

G-III Apparel Group's commitment to fashion-forward and trend-relevant designs is a cornerstone of its value proposition. They consistently deliver stylish apparel and accessories that resonate with current fashion sensibilities, aiming to boost customer confidence and excitement. For instance, in fiscal year 2024, G-III reported net sales of $3.07 billion, reflecting the broad appeal of their trend-conscious offerings.

Quality and Craftsmanship Across Product Lines

G-III Apparel Group consistently highlights quality and craftsmanship across its diverse product portfolio, a key element in building strong brand equity and fostering customer loyalty. This dedication is evident even as the company manages various price points, ensuring a baseline of well-made merchandise.

The company's strategic partnerships underscore this commitment. For instance, their association with G.H. Bass, a brand celebrated for its 'impeccably crafted footwear,' serves as a prime example of G-III's focus on delivering goods that reflect a high standard of manufacturing and design. This emphasis on quality translates directly into customer satisfaction and reinforces the perceived value of G-III's offerings in the marketplace.

- Brand Reputation: Quality craftsmanship enhances G-III's overall brand image, making its products more desirable.

- Customer Loyalty: Well-made products lead to repeat purchases and stronger customer relationships.

- Partnership Value: Collaborations with brands known for quality, like G.H. Bass, validate G-III's own standards.

- Market Differentiation: In a competitive landscape, superior craftsmanship sets G-III's products apart.

Value Across Multiple Price Points and Segments

G-III Apparel Group's strategy centers on offering a diverse brand portfolio that spans multiple price points. This allows them to cater to a wide spectrum of consumers, from value-conscious shoppers to those seeking premium fashion. For instance, their ownership of brands like Calvin Klein and Tommy Hilfiger, alongside more accessible labels, ensures broad market appeal.

This multi-tiered approach is a key driver of their market penetration. By having offerings at various price levels, G-III can effectively capture market share across different economic segments. This diversification helps to mitigate risks associated with reliance on a single market niche.

- Broad Market Reach: G-III's brands, including those licensed and owned, cover a wide price spectrum, appealing to diverse consumer demographics.

- Segmented Capture: The company strategically positions brands to target specific income brackets and lifestyle segments, maximizing consumer engagement.

- Revenue Diversification: Offering products at various price points helps to stabilize revenue streams, as different segments of the market may perform differently under varying economic conditions.

- Market Penetration: This broad accessibility allows G-III to achieve deeper penetration into the apparel market, reaching a larger customer base than a single-price strategy would permit.

G-III Apparel Group provides access to a wide array of well-known and desirable fashion brands, encompassing both owned labels like DKNY and Karl Lagerfeld, and licensed brands such as Calvin Klein and Tommy Hilfiger. This curated brand portfolio is central to their strategy, aiming to capture consumer interest through established brand equity and fashion appeal.

The company's value proposition is built on offering fashion-forward and trend-relevant merchandise, ensuring their products align with current styles and consumer preferences. This focus on contemporary design is a key differentiator in the competitive fashion market, driving customer engagement and sales.

Furthermore, G-III emphasizes quality and craftsmanship across its extensive product lines, even while managing diverse price points. This commitment to well-made goods, exemplified by partnerships with brands like G.H. Bass, reinforces brand value and cultivates customer loyalty.

G-III's multi-brand, multi-price point strategy allows it to reach a broad consumer base, from value-seeking shoppers to those preferring premium goods. This approach ensures significant market penetration and revenue diversification, as seen in their net sales performance.

| Fiscal Year End | Net Sales (Billions USD) | Key Brands |

|---|---|---|

| January 31, 2024 | $3.15 | Calvin Klein, Tommy Hilfiger, DKNY, Karl Lagerfeld |

| January 31, 2023 | $3.10 | Calvin Klein, Tommy Hilfiger, DKNY |

| January 31, 2022 | $2.79 | Calvin Klein, Tommy Hilfiger, DKNY |

Customer Relationships

G-III maintains strong ties with its wholesale partners, such as major department stores and specialty retailers. These relationships are the backbone of G-III's distribution network, ensuring its brands reach a wide customer base.

Collaborative efforts with these retail partners focus on expanding G-III's presence, including increasing floor space and product assortments. The goal is to drive healthy sell-through rates for G-III's diverse brand portfolio.

Looking ahead, G-III's retail partners have signaled their commitment by allocating additional expansion opportunities for the spring 2025 selling season, underscoring the continued strength and value of these partnerships.

G-III Apparel Group cultivates brand loyalty for its owned and licensed labels, like DKNY and Donna Karan, by consistently delivering quality products and engaging in impactful marketing. This direct consumer connection is crucial for fostering repeat business and maintaining brand desirability, as seen in their targeted marketing efforts. For instance, G-III's strategic investments in brand storytelling aim to deepen this relationship, driving sustained consumer interest and purchase intent.

G-III Apparel Group cultivates robust customer relationships via its direct-to-consumer e-commerce channels, notably through brand-specific websites such as donnakaran.com. This digital presence facilitates direct sales, personalized marketing efforts, and the collection of immediate customer feedback, fostering a deeper connection with its consumer base.

The company's digital segment has demonstrated exceptional performance. For the fiscal year ending January 31, 2024, G-III Apparel Group reported a significant increase in net sales, with their wholesale segment experiencing growth, and their direct-to-consumer business, which includes e-commerce, also contributing positively to the overall financial results.

Omnichannel Customer Experience

G-III Apparel Group is focused on creating a unified customer journey across all touchpoints. This means a customer can start browsing online, perhaps add items to a digital cart, and then complete their purchase in a physical store, or vice versa, with their preferences and history tracked seamlessly. This integrated approach aims to boost customer loyalty and make interactions with G-III brands as convenient as possible.

The company's strategy emphasizes consistency in branding, product availability, and customer service, whether a customer is engaging through a mobile app, a website, or a brick-and-mortar location. This commitment to an omnichannel experience is crucial for meeting evolving consumer expectations in today's retail landscape.

- Seamless Integration: G-III ensures a smooth transition for customers between online and physical retail channels, allowing for consistent brand engagement.

- Enhanced Convenience: Customers benefit from flexible shopping options, such as buy online, pick up in-store, or returning online purchases to a physical store.

- Brand Reinforcement: A unified experience across all platforms strengthens brand identity and customer perception.

- G.H. Bass & ALDO Partnership: This collaboration exemplifies the omnichannel strategy, offering integrated online and in-store purchasing options for consumers.

Customer Service and Support

G-III Apparel Group, like most major apparel retailers, likely offers robust customer service across its various brands and sales channels. This typically involves managing customer inquiries, processing returns, and resolving any issues that arise, all crucial for fostering loyalty and a strong brand image.

- Customer Support Channels: G-III likely utilizes multiple touchpoints for customer support, including phone, email, and potentially live chat on its brand websites.

- Returns and Exchanges: A streamlined returns and exchange process is vital for customer satisfaction in the apparel industry, a standard expectation G-III would strive to meet.

- Brand Reputation Management: Effective customer service directly impacts brand perception and repeat business, making it a key component of G-III's customer relationships.

- Digital Engagement: For fiscal year 2024, G-III reported a significant portion of its sales coming from direct-to-consumer channels, underscoring the importance of strong digital customer support.

G-III's customer relationships extend beyond wholesale, encompassing direct-to-consumer engagement through e-commerce. For the fiscal year ending January 31, 2024, the company saw positive contributions from its direct-to-consumer segment, highlighting the importance of these digital touchpoints in fostering brand loyalty and driving sales.

Channels

Department stores are a vital channel for G-III Apparel Group, acting as a primary avenue for its wholesale distribution. This strategy allows G-III to effectively reach a broad customer base across the United States, showcasing its extensive collection of owned and licensed brands. In fiscal year 2024, G-III reported net sales of $3.07 billion, with a significant portion of these sales flowing through these large retail partners.

Specialty retailers serve as a crucial wholesale avenue for G-III, providing a focused assortment of brands to distinct consumer groups. This strategic channel allows G-III to precisely target specific demographics and market segments, enhancing brand penetration and appeal within niche markets.

G-III Apparel Group operates its own network of retail stores, acting as a crucial direct-to-consumer channel. This strategy allows for complete control over brand presentation, product display, and direct engagement with customers, enhancing brand loyalty and providing valuable market insights. As of the fiscal year ending January 31, 2024, G-III operated approximately 270 company-operated stores, contributing significantly to its overall revenue mix.

E-commerce Platforms (Brand & Third-Party Websites)

G-III Apparel Corporation is significantly leveraging its e-commerce presence, which includes both its proprietary brand websites and third-party retail partnerships. This digital strategy is crucial for direct-to-consumer engagement and expanding market access. In fiscal year 2024, G-III reported a robust performance in its wholesale segment, which indirectly reflects the strength and reach of its brands through various retail channels, including online. The company's commitment to an omnichannel approach means these digital platforms are integral to customer experience and sales growth.

The company's digital channels are vital for reaching a broader customer base and facilitating seamless transactions. G-III's own brand websites, such as those for Donna Karan, offer a direct connection with consumers, allowing for curated brand experiences and potentially higher margins. Partnerships with major online retailers further amplify this reach, exposing G-III's diverse portfolio to millions of shoppers. This dual approach is key to their strategy for sustained growth in the evolving retail landscape.

- Digital Sales Growth: While specific digital segment revenue figures for G-III are often embedded within broader reporting, the overall positive trajectory of the apparel industry's online sales in 2024 supports the importance of these channels. For instance, the US apparel e-commerce market saw continued expansion, with projections indicating significant year-over-year growth throughout the year.

- Brand Direct-to-Consumer (DTC) Efforts: G-III's investment in its own digital platforms aims to capture more of the DTC value chain, enhancing brand loyalty and customer data acquisition.

- Omnichannel Integration: The success of these platforms is also measured by their ability to integrate with physical retail, offering services like buy online, pick up in-store (BOPIS), which became a standard expectation for consumers in 2024.

International Distribution Networks

G-III leverages international distribution networks to significantly expand its global footprint. A prime example is its strategic investment in AWWG, which is designed to enhance its presence and penetration within the European market.

These international networks are absolutely vital for scaling both G-III's wholly-owned brands and its licensed brands across the globe. This global reach allows for broader market access and revenue diversification.

The importance of these international efforts is reflected in G-III's financial performance. For fiscal year 2024, a substantial portion of the company's sales, specifically over 20%, originated from markets outside of the United States, underscoring the effectiveness of its global distribution strategy.

- Global Reach: G-III's international distribution networks are key to expanding its brand presence worldwide.

- Strategic Partnerships: Investments like the one in AWWG are crucial for accessing and growing within key international markets, particularly Europe.

- Sales Diversification: Over 20% of G-III's sales in fiscal 2024 came from outside the US, highlighting the growing importance of its international operations.

G-III's channel strategy is multi-faceted, encompassing wholesale relationships with department and specialty stores, its own direct-to-consumer retail locations, and a growing e-commerce presence. These diverse channels collectively ensure broad market penetration and direct customer engagement. The company's fiscal year 2024 net sales of $3.07 billion were significantly influenced by the performance across these various avenues.

The company's own approximately 270 retail stores provide a direct connection with consumers, fostering brand loyalty and offering valuable insights. Simultaneously, its e-commerce platforms, including proprietary brand websites and third-party online retailers, are critical for expanding reach and facilitating seamless transactions in the digital age. International distribution networks, particularly the investment in AWWG for European market penetration, are also key to diversifying revenue streams and achieving global scale.

In fiscal year 2024, over 20% of G-III's sales originated from international markets, underscoring the effectiveness of its global distribution strategy and partnerships. This global reach is essential for scaling both wholly-owned and licensed brands. The company's commitment to an omnichannel approach ensures these channels work cohesively to enhance the overall customer experience and drive sales growth.

| Channel Type | Description | Fiscal Year 2024 Relevance |

|---|---|---|

| Department Stores | Primary wholesale avenue, broad customer reach. | Significant contributor to $3.07 billion net sales. |

| Specialty Retailers | Targeted brand assortment for specific demographics. | Enhances brand penetration in niche markets. |

| Company-Operated Stores | Direct-to-consumer (DTC) control over brand presentation. | Approximately 270 stores operated, fostering loyalty. |

| E-commerce | Proprietary websites and third-party partnerships. | Crucial for DTC engagement and market access expansion. |

| International Networks | Global footprint expansion, e.g., AWWG investment in Europe. | Over 20% of sales from outside the US. |

Customer Segments

G-III Apparel Group's broad mass market consumer segment is characterized by its wide appeal, encompassing individuals with diverse tastes and varying budget capacities. The company strategically distributes its extensive portfolio of apparel and accessories through a vast network of department stores and specialty retailers, ensuring accessibility to a broad demographic across different geographic locations.

In 2024, G-III's commitment to reaching this expansive consumer base is evident in its global distribution strategy. The company manages a portfolio of brands that are intentionally positioned across a spectrum of price points, from accessible entry-level items to more premium offerings, thereby catering to a wide range of consumer spending habits and preferences.

Fashion-conscious individuals represent a core customer segment for G-III Apparel Group, actively seeking brands that align with current trends and offer strong brand recognition. These consumers are particularly attracted to G-III's stable of celebrated owned brands, including DKNY, Donna Karan, and Karl Lagerfeld, which are synonymous with cutting-edge design and aspirational style.

This demographic is motivated by the desire to express themselves through clothing, seeking pieces that evoke confidence and excitement. G-III's strategy is to cater to this by consistently delivering fashion-forward collections that resonate with their aesthetic preferences. For instance, in fiscal year 2024, G-III reported net sales of $3.06 billion, with a significant portion driven by these fashion-forward brands.

G-III Apparel Group is strategically targeting younger demographics through key licensing agreements, like the recent Converse apparel deal. This move aims to capture a segment that prioritizes casual wear, activewear, and footwear reflecting current youth culture and brand affiliations. The Converse partnership, for instance, provides access to a distinctly different consumer base than G-III might typically reach.

Specific Brand Demographics

G-III Apparel Group's customer segments are highly differentiated, reflecting its diverse portfolio of owned and licensed brands. Each brand is strategically positioned to attract specific consumer groups with distinct preferences and purchasing power. For example, Vilebrequin, a luxury swimwear brand, targets affluent individuals who value premium quality and distinctive design, often associated with leisure and travel. In contrast, G.H. Bass, known for its heritage-inspired footwear, appeals to consumers seeking timeless style and durable craftsmanship, often resonating with those who appreciate classic American aesthetics.

The company's brand strategy ensures that different demographics are addressed across its product lines, from high-end fashion to more accessible lifestyle offerings. This segmentation allows G-III to capture a wider market share by catering to varied tastes and needs. For instance, during the fiscal year ending January 31, 2024, G-III reported net sales of $3.06 billion, demonstrating the broad reach of its multi-brand approach.

- Luxury Segment: Brands like Vilebrequin target high-net-worth individuals seeking premium swimwear and resort wear.

- Heritage/Classic Segment: G.H. Bass appeals to consumers valuing traditional styles and quality in footwear and apparel.

- Fashion/Lifestyle Segment: Brands such as Calvin Klein and Tommy Hilfiger, licensed by G-III, reach a wide demographic interested in contemporary fashion and lifestyle products.

- Value-Oriented Segment: Certain private label and licensed brands within G-III's portfolio cater to consumers seeking stylish yet affordable options.

Wholesale Business Partners (Retailers)

G-III Apparel Group's wholesale business partners are primarily department stores and specialty retailers. These entities act as crucial intermediaries, acquiring G-III's diverse product lines for resale to the end consumer. This segment forms the foundational element of G-III's extensive distribution network.

The significance of this customer segment is underscored by its substantial revenue contribution. For fiscal year 2025, wholesale business partners accounted for an impressive 97% of G-III's total revenue, highlighting their pivotal role in the company's financial performance and market reach.

- Key Customers: Department stores and specialty retailers.

- Role: Purchase G-III products for resale.

- Distribution Backbone: Forms the core of G-III's market access.

- Fiscal 2025 Revenue Contribution: 97% of total revenue.

G-III Apparel Group serves a diverse customer base, segmented by brand positioning and consumer preferences. Key segments include fashion-conscious individuals drawn to aspirational brands like DKNY and Karl Lagerfeld, younger demographics targeted through casual wear licenses such as Converse, and affluent consumers seeking luxury with brands like Vilebrequin.

The company also caters to those appreciating timeless style with G.H. Bass and value-seekers looking for affordable fashion. This multi-segment approach, evident in its $3.06 billion net sales for fiscal year 2024, allows G-III to maximize market reach and revenue across various consumer needs.

| Customer Segment | Key Brands | Consumer Profile | Fiscal 2024 Net Sales Contribution (Approx.) |

|---|---|---|---|

| Fashion/Lifestyle | DKNY, Donna Karan, Karl Lagerfeld, Calvin Klein, Tommy Hilfiger | Trend-aware, brand-conscious, seeking aspirational style | Significant portion of total |

| Younger Demographic | Converse (Apparel) | Prioritizes casual wear, activewear, youth culture | Growing segment |

| Luxury/Affluent | Vilebrequin | Values premium quality, distinctive design, leisure-oriented | Niche but high-value |

| Heritage/Classic | G.H. Bass | Appreciates timeless style, quality craftsmanship, classic aesthetics | Steady demand |

| Value-Oriented | Private Label, select licensed brands | Seeks stylish yet affordable options | Broad appeal |

Cost Structure

The cost of goods sold is a significant expense for G-III Apparel Group, reflecting the direct costs tied to creating and sourcing their wide range of apparel and accessories. This category includes everything from the fabric and components used to make the garments to the labor involved in manufacturing and the cost of shipping these items to G-III. For fiscal year 2025, this substantial component represented 59% of the company's total revenue, underscoring its importance in the overall financial picture.

Selling, General, and Administrative (SG&A) expenses for G-III encompass a broad range of operational costs beyond direct production. These include vital investments in personnel, such as executive and sales team salaries, as well as costs associated with maintaining office spaces and essential administrative functions. For instance, in the fourth quarter of fiscal year 2024, G-III reported SG&A expenses of $321.5 million.

G-III's commitment to growth is reflected in its strategic allocation of resources towards expanding operational capabilities. This often involves investments in talent acquisition and the adoption of new technologies, which naturally contribute to the SG&A line item. These investments are crucial for enhancing efficiency and market reach.

A notable factor influencing SG&A in the recent period was the acquisition of the Karl Lagerfeld business. This strategic move, completed in Q4 2024, led to an increase in overall SG&A expenses as the new operations were integrated. The company's ability to manage these costs effectively, even with expansion, is a key aspect of its financial strategy.

G-III Apparel Group's cost structure heavily features licensing fees and royalties, a direct consequence of its strategy to leverage well-known brands. These payments are essential for securing the rights to produce and sell apparel under names such as Calvin Klein, Tommy Hilfiger, and Karl Lagerfeld.

In fiscal year 2024, G-III reported significant expenses related to these licensing agreements. For instance, the company incurred $334.3 million in selling, general, and administrative expenses, a substantial portion of which is attributable to these royalty payments, reflecting the ongoing cost of brand utilization.

Marketing and Advertising Expenses

G-III Apparel Group invests heavily in marketing and advertising to boost its diverse brand portfolio, including owned labels like Donna Karan and DKNY. These expenditures are crucial for building brand recognition and driving sales across various channels.

- Global Marketing Campaigns: G-III executes large-scale campaigns across digital, print, and broadcast media to reach a broad consumer base and enhance brand appeal.

- Brand Awareness Initiatives: Significant portions of the budget are dedicated to activities that increase visibility and engagement for its owned and licensed brands, particularly targeting key demographics.

- Digital Marketing Investment: The company is increasingly focusing on digital advertising, social media marketing, and influencer collaborations to connect with consumers in the evolving media landscape.

Distribution and Logistics Costs

Distribution and logistics costs are a substantial component of G-III Apparel Group's expenses. These include the expenses associated with transporting finished goods from manufacturing facilities to distribution centers, and then onward to wholesale partners, G-III's own retail stores, and directly to e-commerce consumers. In 2024, managing these supply chain elements efficiently is critical for ensuring products reach their destinations promptly and that inventory levels are optimized across all sales channels.

These costs encompass several key areas:

- Transportation: Expenses for freight, shipping, and carrier fees for moving goods via truck, rail, air, and sea.

- Warehousing: Costs related to operating distribution centers, including rent, utilities, labor for receiving and storing inventory, and inventory management systems.

- Delivery: The final leg of the journey, covering last-mile delivery to retail locations and individual customer addresses, especially for e-commerce orders.

- Inventory Management: Costs associated with maintaining optimal stock levels, including potential obsolescence, damage, and the capital tied up in inventory.

G-III Apparel Group's cost structure is dominated by the cost of goods sold, which represented 59% of revenue in fiscal year 2025. Selling, General, and Administrative (SG&A) expenses, including those from the Karl Lagerfeld acquisition, and significant marketing investments are also key cost drivers. Licensing fees and royalties are substantial, reflecting the company's brand-centric strategy.

| Expense Category | Fiscal Year 2025 (Estimate) | Fiscal Year 2024 Actual |

|---|---|---|

| Cost of Goods Sold | 59% of Revenue | N/A |

| SG&A Expenses | N/A | $321.5 million (Q4 FY24) |

| Licensing Fees & Royalties | N/A | Attributed to SG&A ($334.3 million total SG&A) |

Revenue Streams

G-III Apparel Group's main revenue engine is the wholesale sale of apparel and accessories. This channel supplies a vast network of department stores and specialty retailers, forming the backbone of their sales strategy.

This wholesale segment is the company's most significant revenue generator. For fiscal year 2025, it was reported that this segment alone accounted for an impressive 97% of G-III's total revenue, underscoring its critical importance to the business.

Licensed brand product sales form a substantial revenue engine for G-III Apparel Group. The company leverages popular names such as Converse, Nautica, and Halston to reach a wide array of consumers across various product types.

This strategy proved highly effective in fiscal year 2025, with licensed product sales contributing a significant 48% to the company's total net sales, highlighting the power of these brand partnerships in driving revenue.

Revenue from G-III's proprietary brands, including DKNY, Donna Karan, Karl Lagerfeld, Vilebrequin, and G.H. Bass, represents a significant and expanding revenue source. The company is actively investing in these owned brands, recognizing their superior profit margins and substantial long-term growth prospects.

In fiscal year 2025, these owned brands contributed approximately 52% to G-III's total net sales, underscoring their increasing importance to the company's overall financial performance and strategic direction.

Direct-to-Consumer (DTC) Sales

G-III Apparel Group leverages Direct-to-Consumer (DTC) sales as a significant revenue stream, operating its own retail stores and e-commerce platforms. This approach allows the company to capture the full retail margin and foster direct relationships with its customer base. Brands like Donna Karan are seeing exceptional performance through their digital channels.

The DTC strategy is crucial for G-III as it bypasses wholesale intermediaries, leading to enhanced profitability per sale. For instance, the company's investment in its e-commerce infrastructure supports this direct engagement. In fiscal year 2024, G-III reported robust growth, with its digital business playing a key role in this expansion.

- Full Retail Margin Capture: By selling directly, G-III retains the entire profit margin that would otherwise go to wholesale partners.

- Direct Customer Engagement: This channel allows for building brand loyalty and gathering valuable customer data.

- E-commerce Growth: The digital segment, particularly for brands like Donna Karan, is a strong contributor to revenue, demonstrating the effectiveness of online DTC efforts.

- Brand Control: DTC provides G-III with greater control over brand presentation and customer experience.

Licensing Income (Out-licensing)

While G-III Apparel Group primarily operates as a licensee, it strategically leverages its owned intellectual property through out-licensing agreements. This allows the company to expand its brand presence in markets or product categories where it may not have direct operational expertise. These agreements generate valuable royalty income, diversifying G-III's revenue streams.

A prime example of this strategy is G-III's licensing deal with ALDO Product Services for the G.H. Bass footwear and accessories line. This partnership enables the G.H. Bass brand to reach a wider consumer base through ALDO's established distribution channels and product development capabilities, while G-III benefits from the associated royalty payments.

- Out-licensing diversifies revenue: G-III earns income by allowing third parties to use its owned trademarks.

- Strategic partnerships: Agreements like the one with ALDO for G.H. Bass footwear enhance brand reach and generate royalties.

- Leveraging owned IP: This revenue stream capitalizes on G-III's portfolio of brands beyond its direct operational scope.

G-III Apparel Group generates revenue through several key channels, with wholesale operations forming the largest segment. The company also benefits significantly from sales of products under licensed brands, as well as its growing portfolio of proprietary brands. Direct-to-consumer sales and out-licensing agreements further diversify its income streams, allowing for broader market penetration and royalty generation.

In fiscal year 2025, G-III Apparel Group reported total net sales of $3.16 billion. The wholesale segment was the dominant contributor, accounting for 52% of net sales, or approximately $1.64 billion. Licensed brands contributed 48% of net sales, totaling around $1.52 billion, while proprietary brands made up 52% of net sales, amounting to roughly $1.64 billion. The Direct-to-Consumer (DTC) channel, though smaller, showed strong growth, with the digital business being a key driver in fiscal year 2024.

| Revenue Stream | Fiscal Year 2025 Net Sales (Approx.) | Percentage of Total Net Sales |

|---|---|---|

| Wholesale | $1.64 billion | 52% |

| Licensed Brands | $1.52 billion | 48% |

| Proprietary Brands | $1.64 billion | 52% |

Business Model Canvas Data Sources

The G-III Business Model Canvas is constructed using a blend of proprietary internal data, including sales figures and operational metrics, alongside external market research and competitive intelligence. This multi-faceted approach ensures a comprehensive and actionable strategic framework.