GFT Technologies SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

GFT Technologies Bundle

GFT Technologies demonstrates significant technological expertise and a strong presence in key markets, positioning them for continued growth. However, understanding the competitive landscape and potential regulatory shifts is crucial for navigating future challenges.

Want the full story behind GFT Technologies' strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

GFT Technologies' specialized expertise in financial services is a significant strength. They have a proven history of delivering IT services and software engineering solutions tailored specifically for the financial industry. This deep understanding allows them to create solutions that meet the stringent regulatory, security, and operational demands of banks and insurers, setting them apart from broader IT firms.

GFT is doubling down on an AI-first approach, aiming to be a frontrunner in AI-powered digital overhauls. Their in-house GenAI tool, Wynxx, has already proven its worth by significantly speeding up AI and cloud project deployments for banks, enhancing software development efficiency by as much as 90%.

GFT Technologies boasts a significant global presence, employing over 12,000 individuals across more than 20 countries. This extensive network facilitates a robust global delivery model, ensuring diversified revenue streams from various geographical regions. This international reach is a key strength, allowing GFT to tap into diverse markets and client needs.

While some European markets present headwinds, GFT has demonstrated impressive growth in the Americas, including Brazil, the USA, Canada, and Colombia. Furthermore, the APAC region also shows strong performance, contributing to a stable overall business trajectory. This geographic diversification is crucial for mitigating regional economic downturns and capitalizing on emerging market opportunities.

The company's global footprint grants it access to a broad spectrum of new technology trends and a wide-ranging client base. This exposure to different technological landscapes and customer demands fosters innovation and adaptability, keeping GFT at the forefront of the digital transformation sector.

Robust Client Relationships and Strategic Acquisitions

GFT Technologies boasts a strong foundation built on enduring client relationships, including significant partnerships with Tier 1 clients and major global accounts. This is evidenced by their consistent success in securing new, long-term contracts, demonstrating a high level of trust and value delivered to their customer base.

Strategic acquisitions have been a key driver in expanding GFT's capabilities and market reach. The integration of companies like Sophos Solutions and Megawork has notably broadened their service portfolio, particularly in critical areas such as core banking modernization and complex SAP migration programs. These moves not only enhance their technical expertise but also solidify their appeal to a wider range of clients, reinforcing their competitive position.

- Client Retention: GFT's ability to retain major Tier 1 and global accounts highlights the deep trust and satisfaction derived from their services.

- Acquisition Impact: The successful integration of Sophos Solutions and Megawork has demonstrably expanded GFT's service offerings, particularly in high-demand areas like banking modernization.

- Market Expansion: These strategic acquisitions have broadened GFT's market presence, enabling them to target and serve a more diverse client base with specialized solutions.

Commitment to Innovation and Future Growth

GFT Technologies is demonstrating a strong commitment to innovation, which is a key strength for future growth. Their five-year strategy emphasizes developing high-value-added services and a modern Global Delivery Platform, ensuring they stay ahead in a rapidly evolving tech landscape. This forward-thinking approach is further highlighted by their significant investment in upskilling their workforce, preparing them for the technologies of tomorrow.

A prime example of this commitment is GFT's strategic entry into the robotics and physical AI sector through a partnership with Neura Robotics. This move positions GFT at the forefront of emerging technological trends, allowing them to capitalize on new market opportunities. For instance, in 2023, GFT reported a revenue increase of 11% to €802.3 million, with a significant portion of this growth driven by their focus on digital transformation and innovative solutions.

- Investment in High-Value Offerings: GFT's strategic focus on premium services and solutions is designed to capture higher margins and differentiate them in the market.

- Global Delivery Platform: A modern, efficient platform supports scalability and the delivery of complex projects worldwide.

- Workforce Upskilling: Continuous training ensures employees possess the latest skills, crucial for innovation and client satisfaction.

- Robotics and Physical AI: The Neura Robotics partnership signifies GFT's proactive exploration of cutting-edge technologies with significant growth potential.

GFT Technologies possesses deep, specialized expertise in the financial services sector, enabling them to deliver tailored IT and software engineering solutions that meet stringent industry demands. Their proactive AI-first strategy, exemplified by the Wynxx tool, significantly boosts project deployment efficiency, with reported improvements of up to 90% in AI and cloud projects.

A robust global presence, with over 12,000 employees in more than 20 countries, underpins a diversified revenue model and allows GFT to effectively serve a wide client base across various regions, including strong growth in the Americas and APAC.

The company's strength lies in its enduring client relationships, evidenced by consistent success in securing long-term contracts with Tier 1 clients, indicating high trust and value delivery. Strategic acquisitions, such as Sophos Solutions and Megawork, have effectively expanded GFT's capabilities in core banking modernization and SAP migration, enhancing their competitive market position.

GFT's commitment to innovation is a significant asset, with a five-year strategy focused on high-value services and a modern Global Delivery Platform, supported by substantial investment in workforce upskilling. Their entry into robotics and physical AI via a Neura Robotics partnership positions them at the forefront of emerging technologies, contributing to their reported 11% revenue increase to €802.3 million in 2023.

What is included in the product

Delivers a strategic overview of GFT Technologies’s internal and external business factors, highlighting its technological expertise and market position.

Gives a clear, actionable SWOT analysis that helps GFT Technologies identify and address potential challenges, thereby relieving the pain of strategic uncertainty.

Weaknesses

GFT Technologies has signaled potential financial performance volatility by recently revising its full-year 2025 revenue and adjusted EBIT forecasts downwards. This adjustment stems from adverse currency effects, specifically the appreciation of the euro, which impacts international earnings.

Furthermore, weaker business performance in key markets, notably the UK, contributed to the revised outlook. For instance, GFT's updated guidance for 2025 now anticipates revenue between €1.9 billion and €2.0 billion, a reduction from its previous forecast, and adjusted EBIT between €180 million and €220 million.

GFT Technologies has encountered notable headwinds in several key European markets. Business performance in the UK, Spain, and Italy has seen a downturn, impacting overall revenue streams. The UK, specifically, has been a significant challenge, with revenue reductions and declining earnings before tax (EBT) margins, stemming from structural market issues and evolving client needs.

GFT's earnings before taxes (EBT) faced a headwind from the absence of a substantial one-off positive effect that boosted results in the first half of 2024. This makes year-on-year comparisons appear weaker.

Looking ahead to 2025, GFT anticipates continued pressure on its earnings. This is due to strategic, increased investments aimed at securing future growth, alongside higher social security contributions and efficiency initiatives, notably in its UK and German markets.

Cash Flow from Operating Activities Impacted

GFT Technologies experienced a setback in its operating cash flow during the first quarter of 2025, reporting a negative figure. This was largely driven by a significant increase in working capital, particularly in customer receivables, suggesting potential delays in payment collection.

This situation contrasts with the prior quarter, which benefited from substantial payments received from key clients. The current trend highlights a need for GFT to focus on improving its cash conversion cycle and managing its liquidity more effectively.

- Negative Operating Cash Flow: Q1 2025 saw a negative cash flow from operating activities.

- Working Capital Strain: An increase in funds tied up in working capital, specifically customer receivables, was the primary cause.

- Collection Challenges: This may indicate difficulties in collecting payments from customers.

- Liquidity Management: The trend poses a challenge to the company's operational liquidity management.

Dependence on Financial Services Sector

GFT Technologies' heavy reliance on the financial services sector, which typically accounts for around 90% of its revenue, presents a significant vulnerability. This concentrated business model means that any adverse developments within the banking or insurance industries, such as regulatory changes or economic slowdowns, can disproportionately impact GFT's performance.

This specialization, while a core strength, also limits GFT's ability to offset potential sector-specific downturns through diversification into other growing industries. For instance, while the digital transformation trend is broad, GFT's deep integration within finance means its growth is intrinsically tied to that sector's investment appetite for such initiatives.

This dependence was evident in past performance trends where financial sector volatility directly correlated with GFT's revenue streams. For example, during periods of heightened economic uncertainty affecting global banking, GFT has historically seen a slowdown in new project acquisitions within its core market.

- Sector Concentration: Approximately 90% of GFT's business is derived from the financial services industry.

- Susceptibility to Downturns: Economic recessions or significant market shifts in finance directly impact GFT's revenue.

- Limited Diversification: The company's focus restricts its ability to leverage growth in non-financial sectors.

GFT Technologies faces challenges with its operating cash flow, which turned negative in Q1 2025 due to increased working capital, particularly in customer receivables. This suggests potential payment collection issues, contrasting with the prior quarter's positive cash flow driven by client payments. The company's heavy reliance on the financial services sector, representing about 90% of its revenue, makes it vulnerable to sector-specific downturns and limits diversification opportunities.

The company's 2025 outlook has been tempered by currency headwinds, specifically a stronger euro, and weaker performance in key markets like the UK. GFT's updated 2025 revenue guidance is now between €1.9 billion and €2.0 billion, with adjusted EBIT projected between €180 million and €220 million.

Furthermore, GFT anticipates continued earnings pressure in 2025 due to planned strategic investments for future growth, higher social security contributions, and efficiency initiatives, particularly in the UK and German markets.

Structural market issues and evolving client needs in the UK have led to revenue reductions and declining earnings before tax (EBT) margins in that region.

| Weakness | Description | Impact | Data Point |

| Negative Operating Cash Flow | Q1 2025 operating cash flow was negative, driven by increased working capital. | Potential liquidity strain and payment collection challenges. | Q1 2025 Operating Cash Flow: Negative |

| Sector Concentration | ~90% of revenue comes from the financial services industry. | High vulnerability to financial sector downturns and limited growth avenues. | Financial Services Revenue Share: ~90% |

| Market Performance | Weaker business performance in the UK, Spain, and Italy. | Reduced overall revenue streams and profitability. | UK Revenue: Reduced; UK EBT Margins: Declining |

| Currency Headwinds | Appreciation of the euro impacting international earnings. | Reduced profitability on foreign currency-denominated revenue. | 2025 Revenue Guidance Revised Downwards |

Same Document Delivered

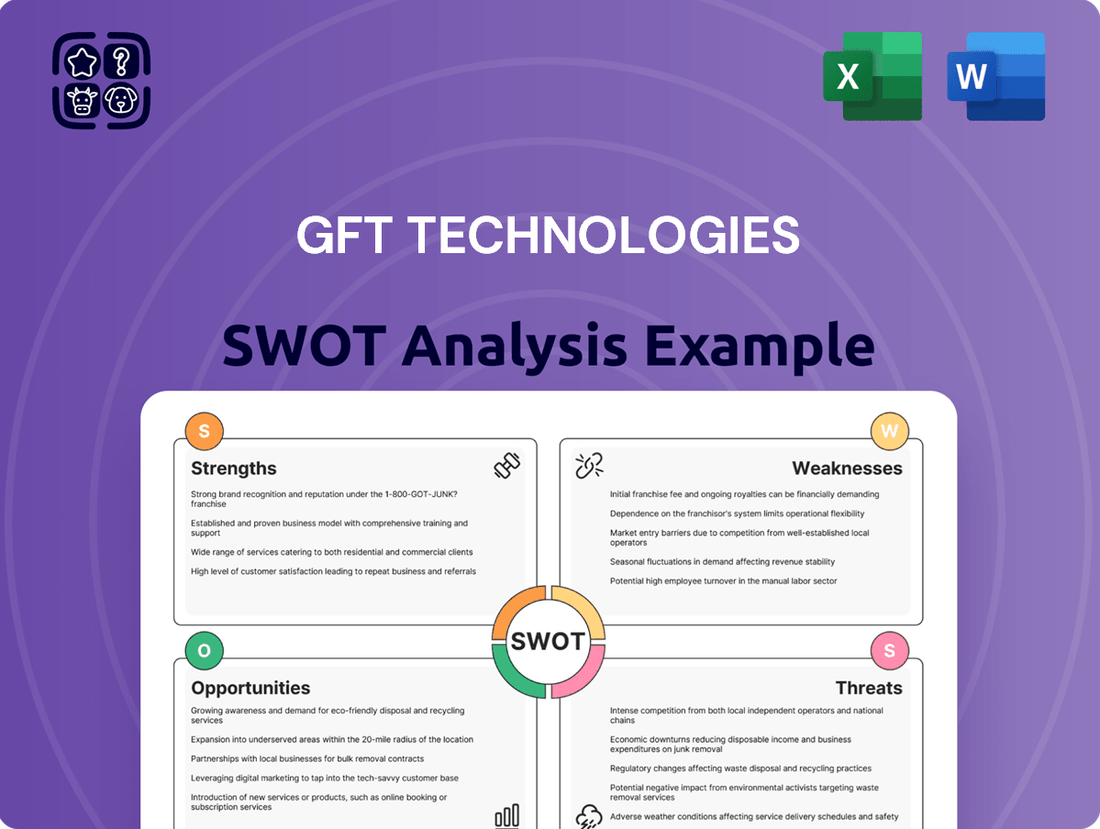

GFT Technologies SWOT Analysis

This is the actual SWOT analysis document you’ll receive upon purchase—no surprises, just professional quality. It provides a comprehensive overview of GFT Technologies' Strengths, Weaknesses, Opportunities, and Threats, offering actionable insights for strategic planning.

Opportunities

The financial services sector is undergoing a massive digital overhaul, with banks and other institutions urgently needing to update their aging IT infrastructure. This digital transformation is a huge tailwind for companies like GFT, as it fuels a strong demand for advanced solutions.

Cloud adoption and the integration of artificial intelligence are no longer optional; they are critical for financial firms to remain competitive and meet evolving customer expectations. GFT's expertise in these areas, particularly with its Wynxx AI platform, positions it to capitalize on this trend, helping clients streamline operations and innovate.

In 2023, the global AI in financial services market was valued at approximately $10.5 billion and is projected to grow substantially. This growth is driven by use cases like fraud detection, customer service automation, and personalized financial advice, all areas where GFT offers solutions.

GFT Technologies is strategically expanding into the robotics and physical AI sector, notably through its partnership with Neura Robotics. This move diversifies their revenue streams away from a sole reliance on financial services, tapping into a rapidly growing market. For instance, the global robotics market is projected to reach over $200 billion by 2030, presenting a significant growth avenue for GFT.

The company's focus on increasing high-value-added services, such as those for independent software vendors (ISVs) and technology consulting, is another key opportunity. These offerings typically command higher profit margins compared to more commoditized services, enhancing GFT's overall profitability. In 2024, GFT reported a significant increase in its consulting and digital transformation services, contributing to a robust revenue architecture.

GFT Technologies is capitalizing on its success in the Americas and Asia-Pacific (APAC) regions, which are showing robust growth despite some headwinds in certain European markets. This geographic expansion presents a significant opportunity for increased revenue and market share.

The company's strategic focus on penetrating these dynamic markets, especially the United States, is yielding tangible results. GFT has recently secured several new long-term contracts with major clients in the US, underscoring the strong demand for its services in this key market.

Leveraging AI for Internal Efficiency and External Offerings

GFT's continued investment in its Generative AI product, Wynxx, presents a dual opportunity. Not only does Wynxx offer a compelling new service for clients, but its internal application can also streamline GFT's own operations, particularly in software development. This internal efficiency gain can lead to faster project delivery and improved profitability.

By leveraging Wynxx to boost software development productivity, GFT can achieve a competitive edge. This enhancement allows for quicker turnaround times on client projects, directly impacting their satisfaction and GFT's bottom line. For instance, in 2024, the demand for AI-driven development tools is projected to grow significantly, with reports suggesting a substantial increase in the adoption of AI in software engineering workflows.

The strategic deployment of Wynxx internally can unlock significant operational efficiencies. This includes:

- Accelerated Code Generation: Reducing development cycles and associated costs.

- Enhanced Testing Automation: Improving software quality and reducing manual effort.

- Streamlined Project Management: Optimizing resource allocation and timelines.

- Faster Time-to-Market: Allowing GFT to bring new solutions to clients more rapidly.

Strategic Acquisitions and Partnerships

GFT Technologies actively pursues strategic acquisitions and key global partnerships to bolster its growth. This strategy aims to integrate specialized expertise, broaden its client reach, and enrich its service offerings. For instance, the acquisition of Megawork in 2024 significantly strengthened GFT's capabilities in specific technology domains.

Furthermore, GFT's collaboration with NVIDIA, announced in early 2025, focuses on leveraging advanced AI solutions to drive innovation for clients. These moves are designed to enhance GFT's competitive edge and expand its market presence in critical technology areas.

- Acquisition of Megawork: This 2024 acquisition brought specialized expertise, enhancing GFT's service portfolio.

- NVIDIA Partnership: The 2025 collaboration with NVIDIA targets the development of advanced AI solutions.

- Global Expansion: The strategy aims to expand client bases and service offerings on a global scale.

GFT is well-positioned to benefit from the ongoing digital transformation in financial services, a trend that is driving significant demand for its specialized IT solutions and consulting services.

The company's expansion into physical AI and robotics, coupled with its focus on high-margin consulting and ISV services, presents clear avenues for revenue diversification and enhanced profitability.

Strategic geographic expansion, particularly in the Americas and APAC, along with key partnerships and acquisitions like Megawork in 2024 and the NVIDIA collaboration in 2025, further solidifies GFT's growth trajectory and market competitiveness.

Threats

The IT services market is becoming increasingly crowded, fueled by the rapid adoption of AI and the ongoing digital transformation wave. This surge in demand for tech solutions means more players are entering the arena, intensifying the competitive landscape for companies like GFT Technologies.

GFT must contend with formidable global giants such as Accenture, Deloitte Consulting, IBM Consulting, and SHI. These established firms possess vast resources and broad service portfolios, which can present a significant challenge, particularly in areas where GFT's specialization might be less pronounced. This intense competition can indeed lead to downward pressure on pricing and potentially impact market share.

Global macroeconomic headwinds, including persistent inflation and recessionary concerns throughout 2024, present a significant threat to GFT Technologies. These broader economic challenges can dampen client investment in IT projects, directly impacting GFT's revenue streams.

Adverse currency fluctuations, particularly the appreciation of the Euro against key trading currencies, can also negatively affect GFT's reported earnings. For instance, if GFT generates a substantial portion of its revenue in US Dollars, a stronger Euro would translate to lower Euro-denominated revenues, potentially impacting profitability in 2024 and 2025.

GFT Technologies faces significant execution risks with its ongoing structural and turnaround initiatives, particularly in challenging markets such as the UK. These efforts are critical for navigating current economic headwinds and repositioning the company for future growth.

The German subsidiary, GFT Software Solutions GmbH, is also undergoing restructuring, and the effective implementation of these changes is paramount. Any setbacks or delays in these crucial turnaround plans could directly impact GFT's financial performance, potentially leading to further margin compression in the near to medium term.

Rapid Technological Change and Talent Retention

GFT Technologies faces the persistent threat of rapid technological change, especially with advancements in artificial intelligence. Keeping pace demands significant and ongoing investment in research and development, a factor that directly impacts their ability to innovate and maintain a competitive edge in the evolving digital landscape.

Attracting and retaining highly skilled talent is a major hurdle in this environment. The demand for professionals proficient in emerging technologies, particularly AI and cloud computing, is intense. GFT must contend with a competitive market where securing and keeping top performers is both challenging and expensive, potentially affecting project delivery and innovation cycles.

- Talent Gap: In 2024, the global shortage of AI specialists was estimated to affect over 80% of companies, according to industry reports.

- R&D Investment: For companies like GFT, R&D spending as a percentage of revenue can range from 5% to 15% to stay competitive in tech sectors.

- Wage Inflation: Tech salaries, particularly for AI engineers, saw an average increase of 10-15% year-over-year in major tech hubs during 2024.

Client Decision-Making Delays and Market Volatility

Ongoing market volatility, a persistent challenge in the financial sector, can significantly affect GFT Technologies' project pipeline. This uncertainty makes forecasting more difficult, potentially leading to fluctuations in project starts and revenue recognition, as observed in earlier periods.

Client decision-making delays, exacerbated by economic uncertainty, pose a direct threat to GFT's revenue growth. These extended cycles can stall new project initiations and impact the timely delivery of services, creating a less predictable business environment.

- Market Volatility Impact: Increased market swings can lead clients to pause or re-evaluate technology investments, directly affecting GFT's order intake.

- Decision Delays: Longer client approval processes, driven by economic caution, can push back project commencement dates, impacting GFT's revenue recognition schedule.

- Forecasting Challenges: The combination of these factors makes it harder for GFT to accurately predict future revenue streams and resource allocation.

GFT Technologies faces intense competition from established IT service giants like Accenture and Deloitte, which possess greater resources and broader service offerings. Global economic headwinds, including inflation and recessionary fears throughout 2024, threaten client IT project investments, directly impacting GFT's revenue. Additionally, rapid technological advancements, particularly in AI, necessitate substantial and continuous R&D investment to maintain a competitive edge.

| Threat Category | Specific Threat | Impact on GFT | 2024/2025 Data/Trend |

|---|---|---|---|

| Competition | Intensified Market Competition | Downward pressure on pricing, potential market share erosion | IT services market growth projected at 7-9% in 2024, attracting new entrants and intensifying rivalry. |

| Economic Factors | Global Macroeconomic Headwinds | Reduced client IT spending, dampening revenue streams | Inflation remained a concern in major economies through early 2024, with recessionary risks persisting in some regions. |

| Technological Change | Rapid Technological Advancements (AI) | Need for significant R&D investment, risk of obsolescence | AI adoption is a top priority for 70% of enterprises in 2024, driving demand but also rapid evolution of required skills. |

| Talent Acquisition | Shortage of Skilled Tech Talent | Increased recruitment costs, potential project delays | The global AI talent gap impacted over 80% of companies in 2024, driving up salaries for specialized roles by 10-15%. |

SWOT Analysis Data Sources

This SWOT analysis is built upon a robust foundation of data, including GFT Technologies' official financial reports, comprehensive market research, and expert industry analyses to provide a well-rounded and accurate assessment.