GFT Technologies PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

GFT Technologies Bundle

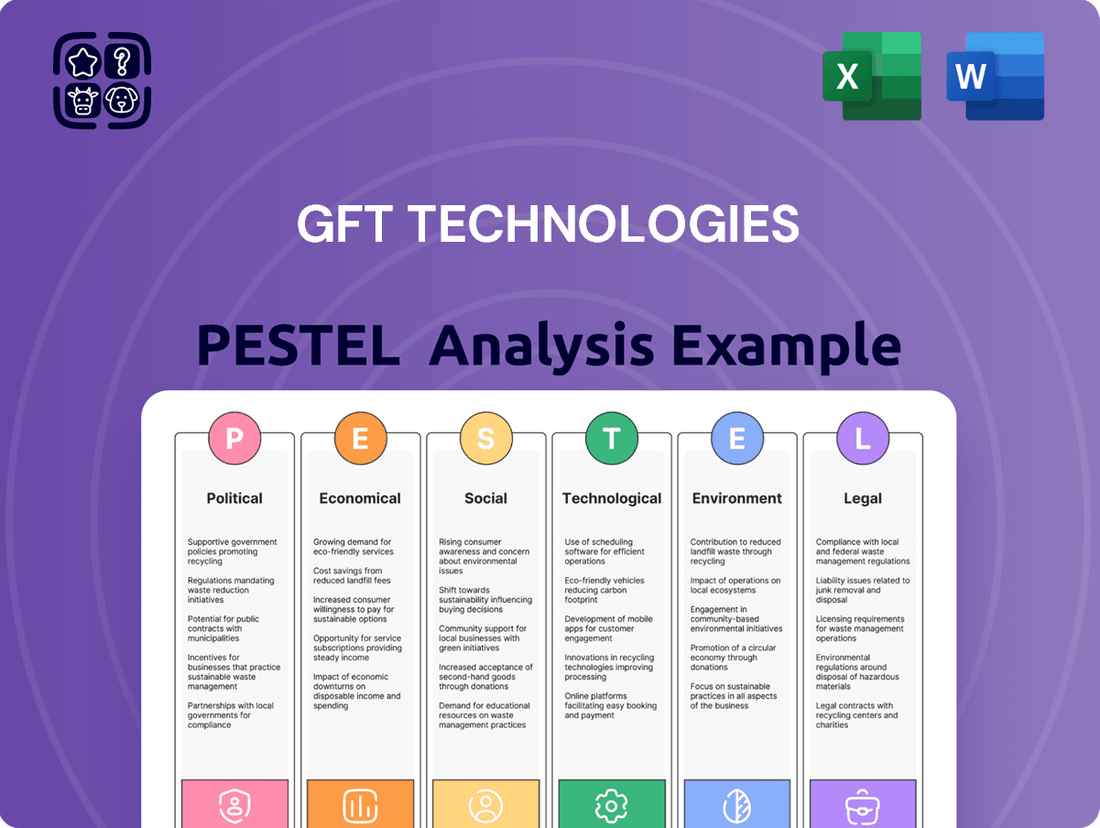

Uncover the critical political, economic, social, technological, legal, and environmental factors shaping GFT Technologies's trajectory. Our meticulously researched PESTLE analysis provides the strategic intelligence you need to anticipate market shifts and capitalize on emerging opportunities. Don't just react to change; proactively leverage it. Download the full report for actionable insights and a competitive edge.

Political factors

Government regulations and policies are a major force shaping GFT Technologies' business. Rules around data privacy, like GDPR, and cybersecurity mandates directly affect how GFT must design and implement its IT solutions. For instance, the upcoming Digital Operational Resilience Act (DORA) in the EU, expected to be fully applicable by January 2025, will require financial entities to strengthen their IT security and resilience, creating demand for GFT's expertise.

Stricter compliance requirements in regions like North America also push GFT to continuously update its offerings. The Corporate Sustainability Reporting Directive (CSRD) in Europe, with its phased implementation starting for many companies in 2024, adds another layer of complexity, demanding transparent reporting on environmental, social, and governance (ESG) factors, which GFT’s solutions can help manage.

GFT's success hinges on its capacity to provide RegTech solutions that assist clients in navigating this intricate web of regulations. The global RegTech market was valued at approximately $11.1 billion in 2023 and is projected to grow significantly, underscoring the substantial opportunity for GFT to leverage its technological capabilities in compliance support.

Geopolitical stability is a critical factor for GFT Technologies, given its global footprint. Disruptions from trade disputes or political unrest in regions where its over 12,000 employees work across more than 20 countries could impact operations. For example, ongoing trade tensions between major economic blocs could affect client confidence and investment in technology services.

Governments worldwide are actively promoting digital transformation, particularly within financial services and manufacturing. For instance, the German government's 'Digital Strategy 2025' aims to accelerate digitalization across industries, potentially boosting demand for GFT's IT modernization services. This focus translates into increased opportunities for GFT as public and private entities seek to upgrade their financial infrastructure and operational efficiency through cloud adoption and AI integration.

Political Stability and Investment Climate

GFT Technologies operates in regions with varying degrees of political stability, directly influencing the investment climate. For instance, in Germany, a key market, the political landscape has remained largely stable, fostering confidence in long-term IT investments. However, in other operating regions, political shifts could potentially temper financial institutions' willingness to commit to large-scale digital transformation projects, impacting GFT's core business.

Political stability is crucial for GFT's business model, as it underpins the confidence of financial institutions to invest in digital transformation. A secure political environment encourages sustained spending on IT infrastructure and modernization. For example, the World Bank's Governance Indicators for 2023 showed stable scores for many of GFT's primary European markets, suggesting a supportive environment for IT outsourcing and consulting.

- Political Stability: GFT operates in countries with generally stable political systems, such as Germany and the UK, which supports consistent IT spending by financial services firms.

- Investment Climate: Political stability directly correlates with business confidence, encouraging financial institutions to undertake significant digital transformation initiatives, a core service for GFT.

- Impact of Uncertainty: Conversely, political instability in any of GFT's operating markets could lead to a slowdown in IT project funding as financial firms adopt a more cautious approach to spending.

Cybersecurity as a National Security Priority

Governments globally are increasingly recognizing cybersecurity as a critical national security issue, directly boosting demand for GFT's specialized solutions. This heightened focus translates into more stringent regulatory requirements for financial institutions, pushing them to adopt advanced protective technologies and services that GFT offers.

For instance, in 2024, the US government continued to emphasize critical infrastructure protection, with agencies like CISA issuing frequent alerts and guidance on emerging cyber threats targeting the financial sector. Similarly, the European Union's NIS2 directive, fully in effect from 2024, mandates enhanced cybersecurity measures across a broader range of entities, including financial services, creating a significant market opportunity for GFT.

- Increased Government Spending: Global government spending on cybersecurity is projected to reach over $150 billion in 2024, a significant portion of which is allocated to protecting financial systems.

- Regulatory Mandates: New regulations like NIS2 in the EU and evolving frameworks in the US compel financial firms to invest in robust cybersecurity, directly benefiting GFT.

- Cyber Threat Landscape: The rising sophistication and frequency of cyberattacks, including ransomware and state-sponsored threats, make proactive security solutions from companies like GFT indispensable for financial institutions.

Government policies significantly influence GFT's operational landscape, particularly concerning data privacy and cybersecurity regulations like GDPR and the upcoming DORA directive, which will be fully applicable by January 2025. These evolving compliance demands create a strong market for GFT's RegTech and cybersecurity solutions, as financial institutions strive to meet stricter requirements.

Geopolitical stability is a key consideration for GFT, given its global operations spanning over 20 countries. Trade disputes or political unrest can impact client confidence and investment in technology services, highlighting the need for GFT to monitor global political climates closely.

Governments worldwide are actively promoting digital transformation, especially in financial services. Initiatives like Germany's 'Digital Strategy 2025' aim to accelerate digitalization, directly benefiting GFT by increasing demand for its IT modernization services, cloud adoption, and AI integration expertise.

What is included in the product

This PESTLE analysis of GFT Technologies offers a comprehensive examination of how political, economic, social, technological, environmental, and legal forces shape its operating landscape.

It provides actionable insights for strategic decision-making by identifying potential threats and opportunities arising from these external macro-environmental factors.

Provides a concise version of GFT Technologies' PESTLE analysis that can be dropped into PowerPoints or used in group planning sessions, simplifying complex external factors into actionable insights.

Helps support discussions on external risks and market positioning for GFT Technologies during planning sessions by offering a clear, summarized view of the PESTLE landscape.

Economic factors

Global economic growth significantly influences IT spending across sectors GFT Technologies serves. A strong economic environment, for instance, saw projected global IT spending reach $5.06 trillion in 2024, a 6.8% increase from 2023, according to Gartner. This often translates to greater investment in digital transformation, cloud services, and AI, directly benefiting companies like GFT.

Conversely, economic downturns can lead to tighter IT budgets and postponed projects. For example, if global GDP growth forecasts are revised downwards, as seen in some projections for late 2024 or early 2025 due to persistent inflation or geopolitical instability, financial institutions might scale back their technology investments, impacting GFT's revenue streams.

The interest rate environment is a critical factor for GFT's financial services clients. With expectations of lower interest rates persisting into 2025, banks face diminished net interest margins, a key driver of profitability. This economic pressure often spurs greater demand for technological solutions that boost operational efficiency and reduce costs.

For instance, a persistently low rate environment, such as the projected 2025 landscape, encourages financial institutions to seek alternative revenue streams and cost-saving measures. GFT's expertise in digital transformation and process automation directly addresses these needs, helping clients navigate profitability challenges by optimizing their core operations.

Rising inflation, particularly in key markets like Germany and the UK where GFT has a significant presence, directly impacts operational expenses. For instance, the German inflation rate averaged 5.9% in 2023, and projections for 2024 suggest a continued, albeit moderated, trend. This means GFT's costs for skilled technology talent and general overheads are likely to increase.

To navigate these inflationary pressures, GFT must implement robust cost management strategies and adjust its pricing models. Maintaining profitability hinges on these measures, especially given the competitive landscape for IT services. The company's ability to pass on increased costs or absorb them through efficiency gains will be critical.

GFT's strategic investment in AI and automation is a key lever for mitigating inflation's impact. By enhancing productivity and streamlining processes, these technologies can help offset rising labor costs. For example, AI-driven code generation and automated testing can reduce the manual effort required for software development, thereby improving cost efficiency for clients and protecting GFT's margins.

Currency Exchange Rate Fluctuations

Currency exchange rate fluctuations present a significant challenge for GFT Technologies, a company with operations spanning more than 20 countries. These shifts can materially affect reported revenues and profitability as earnings from foreign operations are translated back into GFT's reporting currency. For instance, a stronger Euro against other currencies could reduce the value of earnings generated in those foreign markets when consolidated.

GFT's financial outlook for 2025 explicitly acknowledges these currency headwinds. The company has already incorporated substantial adverse currency effects into its adjusted guidance, indicating a proactive approach to managing this volatility. This suggests that the projected financial performance for 2025 is being presented with a clear understanding of the potential negative impact from currency movements.

- Global Operations Exposure: GFT operates in over 20 countries, creating inherent exposure to a multitude of currency exchange rates.

- Impact on Financials: Fluctuations directly influence reported revenues and profitability due to currency translation of foreign earnings.

- 2025 Guidance Adjustment: GFT's adjusted guidance for 2025 has already factored in significant adverse currency effects, highlighting the anticipated impact.

- Strategic Currency Management: The company's acknowledgment of these effects implies ongoing strategies to mitigate currency-related risks, though specific details are proprietary.

Competition and Market Dynamics in IT Services

The IT services and software engineering market, especially for financial services, is intensely competitive. This environment directly impacts GFT Technologies' ability to set prices and grow its market share. Companies like Accenture, Infosys, and Capgemini are major players, alongside specialized fintech consultancies.

The rapid rise of agile fintech startups and digital-first neobanks presents a significant challenge. These entities often offer specialized, cost-effective solutions, forcing established players like GFT to adapt quickly. For instance, the global fintech market size was estimated to be around $11.2 trillion in 2023 and is projected to reach $33.4 trillion by 2030, highlighting the scale of disruption.

Furthermore, the accelerating pace of technological advancements, particularly in artificial intelligence (AI) and cloud computing, necessitates continuous innovation. GFT must consistently enhance its service portfolio and develop unique value propositions to stand out. The global AI market alone was valued at approximately $200 billion in 2023 and is expected to grow substantially, indicating the critical need for AI-centric service offerings.

- Intense Competition: Major global IT consultancies and emerging fintech specialists vie for market dominance in financial IT services.

- Fintech Disruption: New fintechs and neobanks are rapidly gaining traction, challenging traditional service providers with agile and specialized offerings.

- Technological Advancements: Rapid evolution in AI and cloud services demands constant innovation and differentiation from companies like GFT to maintain a competitive edge.

- Market Growth: The expanding fintech sector, projected to reach $33.4 trillion by 2030, underscores the opportunities and competitive pressures within this space.

Global economic growth directly impacts IT spending, with Gartner projecting IT spending to reach $5.06 trillion in 2024, an increase from the previous year. This trend favors companies like GFT Technologies, which benefit from increased investment in digital transformation and cloud services during robust economic periods. Conversely, economic downturns can lead to reduced IT budgets, potentially affecting GFT's revenue streams, especially if global GDP growth forecasts are revised downwards for late 2024 or early 2025.

Interest rate environments significantly influence GFT's financial services clients. With interest rates expected to remain lower into 2025, banks face pressure on their net interest margins, driving demand for efficiency-boosting technological solutions. GFT's expertise in digital transformation and automation helps these institutions optimize operations and navigate profitability challenges in this economic climate.

Inflation, particularly in key markets like Germany and the UK, directly affects GFT's operational expenses, increasing costs for talent and overheads. For instance, German inflation averaged 5.9% in 2023, with projections for 2024 indicating a continued trend. GFT must manage these costs through efficient strategies and pricing adjustments to maintain profitability amidst a competitive IT services landscape.

Currency exchange rate fluctuations pose a significant challenge for GFT's global operations across over 20 countries. These shifts can impact reported revenues and profitability due to the translation of foreign earnings. GFT's adjusted guidance for 2025 already incorporates substantial adverse currency effects, demonstrating a proactive approach to managing this volatility.

| Economic Factor | Impact on GFT Technologies | 2024/2025 Data/Projections |

|---|---|---|

| Global IT Spending | Increased spending drives demand for digital transformation and cloud services. | Projected to reach $5.06 trillion in 2024 (Gartner), a 6.8% increase from 2023. |

| Interest Rates | Lower rates pressure financial clients' margins, increasing demand for efficiency solutions. | Expectations of persistently lower rates into 2025. |

| Inflation | Increases operational expenses for talent and overheads. | German inflation averaged 5.9% in 2023; continued moderated trend projected for 2024. |

| Currency Exchange Rates | Affects reported revenues and profitability from foreign operations. | 2025 guidance includes significant adverse currency effects. |

What You See Is What You Get

GFT Technologies PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive PESTLE analysis of GFT Technologies delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company's operations and strategic outlook.

Sociological factors

Customers now expect financial services to be as seamless and personalized as their experiences with tech giants. This means intuitive mobile apps, instant access to information, and financial products that feel custom-made. For instance, a 2024 report indicated that over 70% of consumers prefer digital channels for banking, highlighting the urgency for financial institutions to adapt.

This shift directly fuels demand for GFT's expertise in digital transformation. As banks and financial firms grapple with these evolving expectations, they are investing heavily in modernizing their core systems and leveraging technologies like AI. The goal is to create those engaging, real-time customer journeys that today's consumers have come to expect, making GFT's services indispensable.

The technology sector, including companies like GFT, faces a significant challenge with a global shortage of skilled IT professionals. This scarcity is particularly acute for specialized expertise in areas like artificial intelligence (AI) and cloud computing, where demand is rapidly outpacing supply. For instance, a 2024 report indicated that the global IT skills gap could leave millions of unfilled positions, impacting innovation and project delivery.

Attracting and retaining top-tier talent is therefore paramount for GFT to maintain its competitive edge and deliver advanced solutions. Companies are increasingly investing in robust talent acquisition and retention strategies to secure individuals with in-demand skills. This focus on human capital is a key differentiator in the fast-paced tech landscape.

GFT is actively addressing these talent dynamics through strategic initiatives. Their 'Grow tech talent worldwide' program aims to cultivate a global pool of skilled professionals, while specific training for engineers in Generative AI (GenAI) demonstrates a proactive approach to skill development. This commitment to upskilling ensures GFT's workforce remains at the forefront of technological advancements, ready to meet evolving client needs.

The shift towards remote and hybrid work models significantly influences GFT Technologies' operational strategy, affecting how it manages its diverse global workforce and delivers client services. This ongoing workforce transformation necessitates adaptable IT systems and robust collaboration platforms.

In 2024, it's projected that around 30% of the global workforce will continue to work remotely or in a hybrid arrangement, a trend GFT must actively support. This requires investment in secure, cloud-based infrastructure and advanced cybersecurity protocols to protect sensitive data across distributed teams, ensuring seamless service delivery regardless of employee location.

Ethical Considerations of AI and Data Usage

Societal concerns regarding AI, particularly data privacy, bias, and transparency, are increasingly shaping how companies like GFT develop and deploy AI solutions. These ethical debates directly impact customer trust and regulatory landscapes, forcing a more cautious and responsible approach to AI-centric offerings.

GFT actively addresses these concerns by prioritizing responsible AI development. Their commitment is underscored by internal policies such as the GFT Group Data Protection Policy for Responsible AI, which guides their practices in data handling and algorithmic fairness.

- Growing public awareness: Surveys in 2024 indicate a significant rise in consumer apprehension about how their data is used by AI systems, with over 60% expressing concerns about privacy.

- Regulatory scrutiny: The EU AI Act, fully implemented in 2025, imposes strict requirements on AI systems, particularly those deemed high-risk, impacting development and deployment strategies.

- Industry best practices: GFT's adherence to responsible AI principles aligns with growing industry demand for ethical AI, enhancing their reputation and competitive edge.

- Data governance focus: The company's data protection policies are crucial for maintaining compliance and building trust in an era of heightened data sensitivity.

Demand for Sustainable and Ethical Business Practices (ESG)

Societal expectations are increasingly pushing businesses towards sustainable and ethical operations, a trend GFT Technologies actively addresses. This growing demand for Environmental, Social, and Governance (ESG) principles directly shapes GFT's strategic direction and how it partners with clients. By embedding ESG into its core business, GFT not only bolsters its own image but also provides clients with the tools they need to achieve their sustainability objectives, making it a more appealing partner for ethically-minded investors and corporations alike.

GFT's commitment to ESG is reflected in its offerings, which help clients navigate complex sustainability regulations and consumer preferences. For instance, in 2024, a significant portion of investment capital was allocated to ESG-focused funds, highlighting the market's appetite for responsible business. GFT's solutions empower financial institutions to report on their carbon footprint, promote social equity within their operations, and maintain strong governance structures, directly responding to this societal shift.

- Growing ESG Investment: Global sustainable investment assets reached an estimated $37.8 trillion in early 2024, demonstrating a strong market preference for ESG-compliant companies.

- Client Demand for Sustainability Solutions: GFT reports a marked increase in client requests for digital solutions that support ESG reporting and compliance, particularly in the banking and insurance sectors.

- Reputational Enhancement: Companies with strong ESG performance, like GFT, often experience higher brand loyalty and attract top talent, reinforcing the link between ethical practices and business success.

- Regulatory Tailwinds: Evolving regulations around climate disclosure and social impact are compelling businesses to adopt more sustainable practices, creating opportunities for GFT's expertise.

Societal expectations are increasingly pushing businesses towards sustainable and ethical operations, a trend GFT Technologies actively addresses. This growing demand for Environmental, Social, and Governance (ESG) principles directly shapes GFT's strategic direction and how it partners with clients. By embedding ESG into its core business, GFT not only bolsters its own image but also provides clients with the tools they need to achieve their sustainability objectives, making it a more appealing partner for ethically-minded investors and corporations alike.

Technological factors

The financial services sector is undergoing a significant transformation driven by rapid advancements in Artificial Intelligence, particularly generative AI. This evolution is a cornerstone of GFT's strategic direction, as the company actively positions itself as an 'AI-centric' organization.

GFT is harnessing AI to achieve substantial improvements in key areas for its clients. This includes a notable boost in software development productivity, the enhancement of fraud detection capabilities, the delivery of more personalized client services, and the automation of complex compliance processes. Products like Wynxx and AI Impact are central to GFT's efforts to integrate these AI-driven solutions.

By mid-2024, the global AI market in financial services was projected to reach over $25 billion, with significant growth anticipated in the coming years. GFT's focus on AI is therefore strategically aligned with a major industry trend, aiming to provide tangible value and competitive advantages to its clientele through intelligent automation and data-driven insights.

The financial services sector's ongoing shift to cloud computing is a major technological tailwind for GFT. While many institutions are still navigating this transition, it presents a substantial market for GFT's expertise in modernizing older systems and facilitating moves to robust cloud platforms.

This cloud adoption is critical, as it lays the groundwork for more sophisticated technologies like AI. For instance, by mid-2024, a significant portion of financial firms were still in the process of migrating core banking systems to the cloud, highlighting the demand for GFT's modernization services.

The cybersecurity threat landscape is constantly evolving, with sophisticated attacks becoming more prevalent. In 2024, the global cost of cybercrime was projected to reach $10.5 trillion annually, highlighting the critical need for robust security solutions. GFT's commitment to developing advanced AI-driven defense mechanisms directly addresses this escalating risk, safeguarding client data and systems.

GFT's investment in cutting-edge cybersecurity technologies, such as advanced threat detection and response systems, is crucial for maintaining client trust and operational integrity. This focus on innovation ensures GFT can effectively counter emerging threats, protecting sensitive financial information in an increasingly digital world.

Data Analytics and Big Data Processing

The sheer volume of data generated globally is exploding, creating a significant demand for sophisticated data analytics. GFT Technologies is well-positioned to capitalize on this trend, offering expertise in processing vast datasets to extract valuable insights. This is crucial for businesses looking to understand market dynamics and customer behavior more deeply.

Financial institutions, in particular, are increasingly reliant on data to sharpen their competitive edge, streamline operations, and elevate customer interactions. They require resilient data infrastructure and strong governance, areas where GFT's solutions are vital. For instance, the global big data market was valued at an estimated $229.5 billion in 2023 and is projected to grow significantly in the coming years, highlighting the scale of this opportunity.

- Explosive Data Growth: Global data creation is projected to reach over 180 zettabytes by 2025, a substantial increase from previous years.

- Financial Sector Data Demand: Banks and financial services firms are investing heavily in data analytics to improve fraud detection and personalize customer offerings.

- GFT's Role: GFT provides the technological backbone and analytical expertise necessary for financial institutions to manage and leverage this data effectively.

- Market Opportunity: The increasing need for data-driven decision-making across industries fuels the demand for companies like GFT specializing in data processing and analytics.

Emergence of Blockchain and Distributed Ledger Technologies (DLT)

Blockchain and Distributed Ledger Technologies (DLT) are rapidly evolving, promising to reshape financial transactions by enhancing security and transparency. GFT is actively observing these advancements, with potential integration into future offerings to ensure tamper-proof and clear record-keeping, especially for supply chain provenance and environmental impact monitoring.

The adoption of blockchain in finance is growing, with projections suggesting the global blockchain in BFSI market could reach $24.9 billion by 2027, up from $3.4 billion in 2022. This indicates a significant shift towards leveraging DLT for more efficient and secure financial operations.

- Increased Transaction Security: DLT’s decentralized nature makes it highly resistant to fraud and unauthorized alterations.

- Enhanced Transparency: Shared ledgers provide a clear, auditable trail for transactions, improving trust.

- Potential for Cost Reduction: By streamlining processes and reducing intermediaries, DLT can lower operational costs in financial services.

- New Business Models: Blockchain enables innovative solutions for areas like digital identity management and tokenized assets.

GFT's strategic focus on AI is directly addressing a booming market. By mid-2024, the global AI market in financial services was already exceeding $25 billion, with continuous growth expected. This positions GFT to capitalize on the increasing demand for intelligent automation and data-driven insights within the sector.

The ongoing migration of financial institutions to cloud computing presents a substantial opportunity for GFT. Many firms were still in the process of moving core systems to the cloud by mid-2024, underscoring the need for GFT's expertise in system modernization and cloud enablement.

Cybersecurity remains a critical concern, with global cybercrime costs projected to hit $10.5 trillion annually in 2024. GFT's investment in advanced AI-driven security solutions directly addresses this escalating threat, ensuring the protection of sensitive client data.

The explosion of data, with global data creation set to surpass 180 zettabytes by 2025, fuels the demand for sophisticated analytics. GFT is well-equipped to help financial firms leverage this data for improved decision-making and customer engagement, tapping into a market valued at nearly $230 billion in 2023 for big data.

Legal factors

Global data privacy regulations like GDPR and CCPA are significantly impacting how companies handle customer information. For GFT Technologies, this means ensuring their digital transformation solutions enable clients to comply with strict rules around data security, consent management, and privacy by design. Failure to comply can lead to substantial fines, with GDPR penalties reaching up to 4% of global annual turnover or €20 million, whichever is higher.

The financial services sector operates under a stringent and constantly shifting regulatory framework. Directives such as DORA (Digital Operational Resilience Act), MiFID II (Markets in Financial Instruments Directive II), EMIR (European Market Infrastructure Regulation), and the Dodd-Frank Act in the US impose significant compliance burdens on companies like GFT Technologies.

GFT is well-positioned to capitalize on these regulatory demands by offering specialized services and AI-powered tools. These solutions assist financial institutions in navigating complex compliance requirements, including transaction monitoring and fraud detection, thereby enhancing operational efficiency and risk management.

For instance, the implementation of DORA, which came into effect in January 2023, mandates robust digital operational resilience for financial entities across the EU. GFT's expertise in this area, coupled with its AI capabilities, allows it to provide critical support to clients in meeting these new, stringent operational security standards.

Stringent Anti-Money Laundering (AML) and Know Your Customer (KYC) laws are critical for financial institutions. These regulations mandate robust systems for identifying suspicious activities and verifying customer identities to prevent financial crime. For instance, in 2024, global AML fines reached approximately $4.2 billion, underscoring the high stakes of non-compliance.

GFT Technologies' AI-powered compliance suite directly addresses these demands. It helps credit unions and other financial entities efficiently identify, escalate, and halt threats such as identity theft and unauthorized payments. This technology ensures these institutions meet evolving governmental regulatory requirements, thereby mitigating significant financial and reputational risks.

Intellectual Property Laws and Software Licensing

Intellectual property laws are foundational for GFT Technologies, safeguarding its innovative software and solutions such as Wynxx and AI Impact. These legal frameworks protect GFT's core assets, allowing it to maintain a competitive edge in the digital solutions market. The company's ability to innovate and monetize its intellectual property is directly tied to the strength and enforcement of these laws.

Software licensing agreements are equally critical, governing the use of both GFT's proprietary technologies and any third-party software it incorporates. Ensuring compliance with these licenses is paramount to GFT's operational integrity and its business model. For instance, in 2024, the global software market was valued at over $700 billion, highlighting the significant economic stakes involved in licensing and IP protection.

GFT's commitment to navigating these legal complexities is demonstrated through its robust IP management strategies. This includes proactive measures to secure patents, trademarks, and copyrights for its unique offerings. Furthermore, strict adherence to software licensing terms prevents potential legal disputes and ensures that GFT can continue to develop and deploy its advanced digital solutions without interruption.

Key considerations for GFT regarding intellectual property and software licensing include:

- Protection of proprietary software: Ensuring GFT's core technologies are legally shielded from unauthorized use or replication.

- Compliance with licensing terms: Adhering to all agreements for both inbound and outbound software licenses to avoid legal repercussions.

- Global IP enforcement: Maintaining vigilance and taking action against any infringement of its intellectual property rights across various jurisdictions.

- Mitigation of licensing risks: Regularly reviewing and updating software licenses to align with evolving technology and business needs, a crucial aspect in a rapidly changing tech landscape.

Consumer Protection Laws in Digital Finance

Consumer protection in digital finance is a growing concern, especially with personalized services and AI-driven decisions. Regulators are increasingly scrutinizing AI algorithms to prevent bias in areas like lending, ensuring fair treatment for all consumers. This means companies like GFT Technologies will need to ensure their AI models are transparent and explainable, a significant legal hurdle.

The European Union's AI Act, expected to be fully implemented in 2025, categorizes AI systems based on risk, with financial services AI facing stringent requirements. For instance, Article 13 of the proposed Act mandates that high-risk AI systems, including those used in credit scoring, must be designed to ensure human oversight and provide clear information about their operation. GFT Technologies must therefore invest in developing AI that can clearly articulate its decision-making process to comply with these evolving legal frameworks and maintain consumer trust.

- AI Regulation: The EU AI Act, set for full implementation in 2025, will impose strict rules on AI in finance.

- Explainable AI (XAI): GFT Technologies will need to develop AI models that can clearly explain their outputs, particularly in lending decisions.

- Bias Mitigation: Legal frameworks will require robust measures to prevent algorithmic bias in financial services, ensuring fairness and non-discrimination.

- Consumer Trust: Compliance with these regulations is crucial for building and maintaining consumer confidence in digital financial products.

The evolving landscape of data privacy, exemplified by GDPR and CCPA, necessitates that GFT Technologies' solutions prioritize client compliance with stringent data handling rules. Penalties for non-compliance are substantial, with GDPR fines potentially reaching 4% of global annual turnover or €20 million.

Financial services are heavily regulated, with acts like DORA and MiFID II creating complex compliance demands. GFT's AI-powered tools help financial institutions navigate these rules, improving efficiency and risk management. DORA, effective January 2023, mandates strong digital operational resilience for EU financial entities.

Stringent AML and KYC laws are critical, with global AML fines in 2024 reaching approximately $4.2 billion. GFT's AI compliance suite aids financial institutions in identifying threats and meeting regulatory requirements, mitigating financial and reputational risks.

Intellectual property laws safeguard GFT's innovations like Wynxx, crucial for its competitive edge. Software licensing agreements also govern GFT's operations, with the global software market valued over $700 billion in 2024, underscoring the importance of IP protection.

Environmental factors

Growing global awareness of climate change is significantly influencing business operations, and GFT Technologies is no exception. Regulatory bodies worldwide are implementing stricter Environmental, Social, and Governance (ESG) reporting requirements, pushing companies like GFT to be more transparent about their sustainability practices. This trend directly impacts GFT and its clients by necessitating robust data collection and reporting mechanisms for environmental impact.

GFT is actively addressing climate change by setting ambitious science-based targets for carbon footprint reduction. For instance, in 2024, GFT aimed to reduce its Scope 1 and 2 emissions by 42% by 2030 compared to a 2019 baseline. Furthermore, the company is embedding sustainability into its core business strategy, developing and offering solutions that empower clients to analyze and manage their own ESG factors, thereby fostering a more sustainable financial ecosystem.

The increasing demand for cloud computing and artificial intelligence is driving substantial energy consumption within IT infrastructure, posing a significant environmental concern. Globally, data centers are estimated to account for around 1% of total electricity consumption, a figure projected to rise as digital services expand.

GFT is actively addressing this by championing GreenCoding, a methodology focused on developing and running software in ways that minimize energy usage. This initiative is designed to lessen the environmental footprint of GFT's internal operations and extend to the IT systems of its clients.

The growing volume of electronic waste (e-waste) presents a significant environmental challenge. As companies upgrade their IT infrastructure, the disposal and recycling of old equipment become critical. For GFT Technologies, while primarily a software and services provider, the lifecycle of the hardware utilized by its clients carries indirect environmental weight, necessitating a focus on responsible IT asset management and sustainable practices within its service delivery.

Globally, the amount of e-waste generated is substantial, with estimates suggesting over 50 million metric tons were produced in 2023 alone. This trend is expected to continue rising. GFT's commitment to sustainability can involve advising clients on extended hardware lifecycles, promoting energy-efficient solutions, and supporting circular economy principles in IT procurement and disposal, thereby mitigating its indirect environmental footprint.

Resource Scarcity and Sustainable Operations

Concerns over the availability of essential raw materials for IT hardware, such as rare earth elements and semiconductors, directly impact operational costs and the reliability of GFT Technologies' supply chains. This scarcity can lead to price volatility and potential disruptions, necessitating robust risk management strategies.

GFT Technologies' strategic focus on sustainable corporate management aims to ensure long-term profitable growth by aligning business objectives with environmental stewardship. This commitment involves actively monitoring and minimizing resource consumption throughout their operations and encouraging sustainable practices among their partners and clients.

- Resource Scarcity Impact: Rising costs for critical IT components, driven by global supply chain pressures, could affect GFT's hardware-dependent projects.

- Sustainable Operations: GFT's 2023 sustainability report highlighted a 5% reduction in energy consumption per employee, demonstrating progress in resource efficiency.

- Ecosystem Engagement: The company is actively involved in initiatives promoting circular economy principles for electronic waste, aiming to reintegrate materials back into the supply chain.

- Future Outlook: Proactive sourcing and investment in more sustainable technology alternatives are key to mitigating future resource-related risks.

Regulatory Pressure for Environmental Sustainability

Regulatory pressure for environmental sustainability is intensifying globally. The European Union's Corporate Sustainability Reporting Directive (CSRD), for instance, now mandates extensive disclosure of environmental impacts for a broad range of companies, starting with large public interest entities in 2024. This directive aims to enhance transparency and comparability of sustainability information.

GFT Technologies is actively adapting its own reporting to align with these evolving regulatory landscapes. By understanding and integrating these requirements, GFT is positioning itself to offer solutions that assist clients in achieving greater environmental transparency and meeting their compliance obligations. This includes leveraging digital solutions to streamline data collection and reporting processes.

- CSRD implementation: Affects over 50,000 companies across the EU, requiring detailed environmental impact reporting.

- Growing ESG focus: Investors increasingly demand robust environmental, social, and governance (ESG) data, influencing corporate strategy.

- GFT's role: Providing technology solutions that enable clients to manage and report on their environmental performance effectively.

- Market opportunity: Demand for sustainability reporting software and consulting services is projected to grow significantly in the coming years.

Environmental regulations are becoming increasingly stringent, pushing companies like GFT Technologies to prioritize sustainability. The European Union's Corporate Sustainability Reporting Directive (CSRD), for example, mandates detailed environmental impact disclosures for many companies starting in 2024, directly influencing reporting practices.

GFT is actively responding by embedding sustainability into its strategy, developing solutions that help clients manage their environmental impact and meet compliance needs. This includes initiatives like GreenCoding to reduce software's energy footprint and advising clients on responsible IT asset management.

The company's commitment is evident in its 2023 sustainability report, which noted a 5% reduction in energy consumption per employee. GFT is also engaging in circular economy initiatives for electronic waste, demonstrating a proactive approach to environmental stewardship.

The increasing demand for digital services, such as cloud computing and AI, drives significant energy consumption in data centers, estimated to be around 1% of global electricity use. GFT's GreenCoding methodology aims to mitigate this by optimizing software for lower energy usage, benefiting both its own operations and client systems.

| Metric | 2023 Data | Target/Trend |

|---|---|---|

| Energy Consumption per Employee | Reduced by 5% | Continued reduction |

| Scope 1 & 2 Emissions Reduction | On track for 42% by 2030 (vs. 2019 baseline) | Science-based targets |

| E-waste Generation | Indirect impact via clients | Promoting circular economy principles |

| Data Center Energy Use | Global ~1% of electricity | Mitigation through GreenCoding |

PESTLE Analysis Data Sources

Our PESTLE Analysis for GFT Technologies is meticulously constructed using data from reputable financial institutions like the IMF and World Bank, alongside official government publications and leading technology industry research firms. This ensures a comprehensive understanding of the political, economic, social, technological, legal, and environmental factors impacting GFT.