GFT Technologies Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

GFT Technologies Bundle

Curious about GFT Technologies' product portfolio performance? This glimpse into their BCG Matrix reveals how their offerings are positioned as Stars, Cash Cows, Dogs, or Question Marks. For a comprehensive understanding and actionable strategies to optimize their market presence, purchase the full BCG Matrix report.

Unlock the full strategic potential of GFT Technologies' product line. The complete BCG Matrix provides detailed quadrant analysis, expert commentary, and clear recommendations for resource allocation and future growth. Don't miss out on the insights that will drive your investment decisions; get the full report today.

Stars

GFT's AI-powered software development solutions, including GFT AI Impact and Wynxx, are positioned as stars in the BCG matrix, indicating high growth and high market share. These innovative tools are engineered to dramatically enhance developer productivity, with reported increases ranging from 50% to a remarkable 90%.

The impact of these AI solutions is substantial, significantly accelerating the delivery of cloud and AI projects. GFT reports that their tools can reduce the time to market for such initiatives by as much as 95%, a critical advantage in today's fast-paced digital landscape.

Client enthusiasm and the rapid international rollout of Wynxx further validate its star status. This widespread adoption and expansion highlight GFT's strong competitive footing and the immense market potential for these cutting-edge AI development products.

GFT's Americas and APAC regions are showing impressive revenue growth, solidifying their status as Stars in the BCG matrix. Latin America, for instance, experienced a significant 21% revenue increase in the first half of 2025, while North America saw a healthy 14% rise. This strong performance indicates successful market penetration and expansion, setting a solid base for future growth and market leadership in these dynamic geographies.

The insurance sector is a prime example of digital transformation's impact, with GFT Technologies seeing remarkable growth. In Q1 2025, GFT's insurance business expanded by 24%, followed by a 20% growth in the first half of 2025. This robust performance underscores a rapidly expanding market where GFT is clearly capturing significant share.

Insurers are actively investing in digital and AI-driven solutions to modernize their operations and customer experiences. GFT's deep expertise in these advanced IT services positions it perfectly to meet this escalating demand, driving its impressive market penetration.

Entry into Robotics and Physical AI

GFT Technologies' strategic alliance with Neura Robotics heralds its significant entry into the burgeoning robotics and physical artificial intelligence market. This collaboration leverages GFT's established prowess in AI and data analytics, extending its reach into promising new sectors beyond its traditional financial services stronghold. The global robotics market is projected to reach $200 billion by 2030, indicating substantial growth potential.

This strategic pivot underscores GFT's ambition to capitalize on the transformative capabilities of physical AI. By integrating advanced robotics solutions, GFT aims to address complex operational challenges across various industries. The company's investment in this area is substantial, positioning it for leadership in a field experiencing rapid technological advancement and increasing demand.

- Market Entry: GFT Technologies has entered the robotics and physical AI sector through a partnership with Neura Robotics.

- Strategic Focus: This move diversifies GFT's AI and data expertise into high-growth industries.

- Market Potential: The global robotics market is expected to reach $200 billion by 2030, highlighting significant opportunity.

- Investment Outlook: GFT is making significant investments to establish dominance in this rapidly evolving market.

Digital Currencies and Stablecoin Guidance

GFT Technologies is actively shaping the future of digital payments by guiding U.S. banks through the complexities of launching their own stablecoins. This strategic engagement underscores GFT's commitment to innovation in a sector poised for significant expansion.

Their collaboration with the Universal Digital Payment Network (UDPN) sandbox further solidifies GFT's position at the forefront of digital currency development. This initiative is crucial for testing and refining new payment infrastructures.

While the digital currency market is still in its early stages, GFT's proactive involvement provides a distinct early mover advantage. This positions them to capture substantial market share as the sector matures.

- Market Potential: The global digital asset market is projected to reach trillions of dollars in the coming years, with stablecoins playing a pivotal role in facilitating widespread adoption.

- Regulatory Landscape: GFT's expertise is vital in navigating the evolving regulatory environment for digital currencies in the U.S., ensuring compliance for its banking partners.

- Technological Advancement: By participating in sandboxes like UDPN, GFT contributes to the development of robust and scalable digital payment solutions.

- Strategic Positioning: GFT's early engagement in stablecoin guidance and network development positions it as a key player in the future of financial technology.

GFT's AI-powered software development solutions, including GFT AI Impact and Wynxx, are positioned as stars in the BCG matrix, indicating high growth and high market share. These innovative tools are engineered to dramatically enhance developer productivity, with reported increases ranging from 50% to a remarkable 90%. The impact of these AI solutions is substantial, significantly accelerating the delivery of cloud and AI projects. GFT reports that their tools can reduce the time to market for such initiatives by as much as 95%, a critical advantage in today's fast-paced digital landscape.

GFT's Americas and APAC regions are showing impressive revenue growth, solidifying their status as Stars in the BCG matrix. Latin America, for instance, experienced a significant 21% revenue increase in the first half of 2025, while North America saw a healthy 14% rise. This strong performance indicates successful market penetration and expansion, setting a solid base for future growth and market leadership in these dynamic geographies.

The insurance sector is a prime example of digital transformation's impact, with GFT Technologies seeing remarkable growth. In Q1 2025, GFT's insurance business expanded by 24%, followed by a 20% growth in the first half of 2025. This robust performance underscores a rapidly expanding market where GFT is clearly capturing significant share.

GFT Technologies is actively shaping the future of digital payments by guiding U.S. banks through the complexities of launching their own stablecoins. Their collaboration with the Universal Digital Payment Network (UDPN) sandbox further solidifies GFT's position at the forefront of digital currency development. GFT's proactive involvement provides a distinct early mover advantage in this sector poised for significant expansion.

| Business Unit/Region | BCG Category | Growth Rate (H1 2025) | Market Share Indication |

|---|---|---|---|

| AI Software Solutions (Wynxx, AI Impact) | Star | High (95% faster delivery) | High (Client enthusiasm, international rollout) |

| Americas Region | Star | 14% (North America) | Strong |

| APAC Region | Star | 21% (Latin America) | Strong |

| Insurance Sector Solutions | Star | 20% (H1 2025) | High (Capturing significant share) |

| Digital Payments (Stablecoins) | Star | High Potential | Early Mover Advantage |

What is included in the product

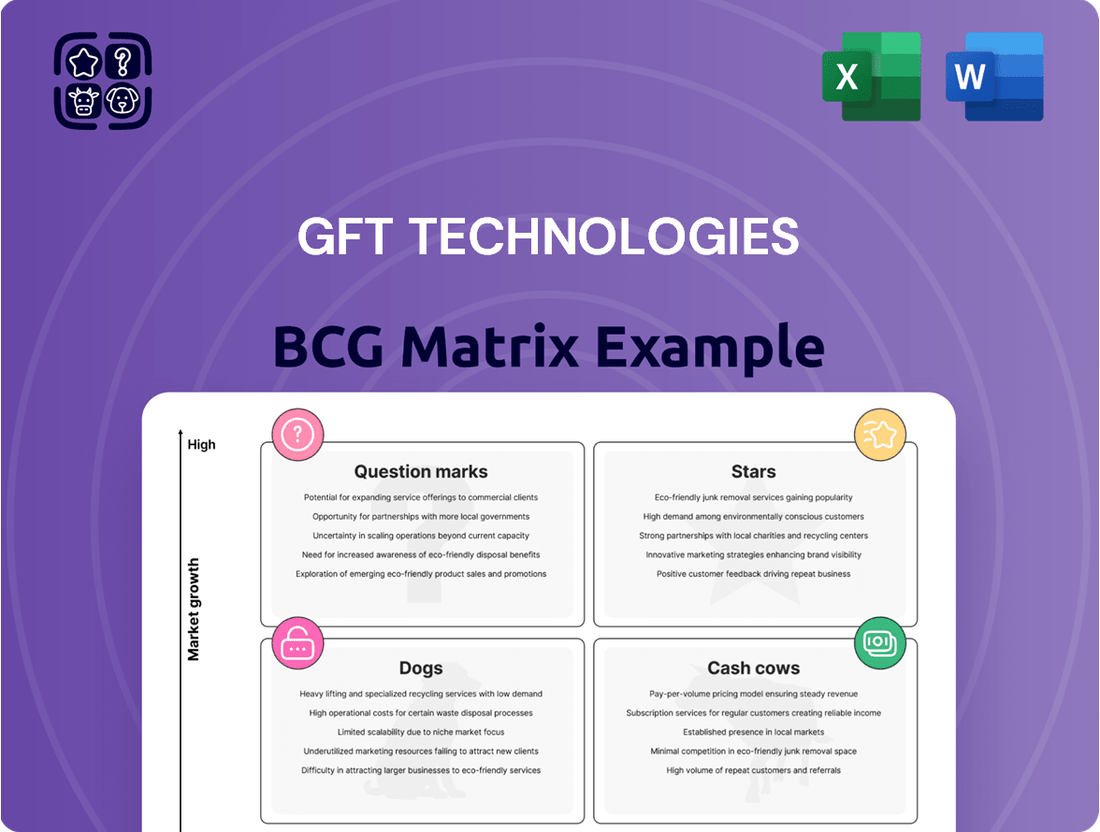

This BCG Matrix overview for GFT Technologies analyzes its business units, identifying Stars for growth, Cash Cows for funding, Question Marks for potential, and Dogs for divestment.

GFT Technologies BCG Matrix provides a clear, one-page overview, instantly clarifying the strategic position of each business unit to alleviate confusion.

Cash Cows

GFT Technologies' established core banking modernization is a clear cash cow, leveraging decades of experience and deep ties with major financial players. This segment consistently generates robust revenue, driven by the perpetual demand for banks to upgrade their aging infrastructure.

The company's success in this mature but critical area is further amplified by the integration of Sophos Solutions, enhancing GFT's competitive edge and profitability. For instance, in 2023, GFT reported a significant portion of its revenue stemming from its Banking sector, demonstrating the sustained strength of its core modernization services.

GFT Technologies holds a significant position in mature financial services IT consulting, leveraging its long-standing presence since 1987. This segment, characterized by a high market share among banks and insurers, acts as a stable cash cow for the company.

While the growth rate for traditional IT consulting might be modest compared to emerging technologies, GFT's established client relationships and consistent project demand ensure a reliable stream of revenue. For instance, GFT reported a revenue of €753.6 million in the first half of 2024, indicating the ongoing strength of its core services.

The company's deep understanding of the financial sector's complexities and its robust, trusted partnerships are key drivers of sustained profitability in this mature market. This allows GFT to continue generating substantial cash flow to fund investments in other areas.

GFT Technologies' Platform Modernization Services, encompassing cloud migration and mainframe modernization, are firmly positioned as a cash cow. This segment holds a substantial market share, reflecting its status as a fundamental requirement for businesses navigating digital transformation. The consistent demand for these services ensures a stable revenue stream for GFT.

The inherent nature of platform modernization means that promotional and placement investments are minimal, allowing GFT to realize strong profit margins. This efficiency translates directly into robust cash flow generation, a hallmark of a cash cow business unit. For instance, in 2024, the global cloud migration market was projected to reach over $200 billion, underscoring the vast and ongoing demand GFT is capitalizing on.

Long-Term Client Contracts

GFT Technologies' long-term client contracts, particularly with major financial institutions, function as significant cash cows. These agreements, often spanning multiple years, generate a consistent and substantial revenue stream, providing a stable financial foundation for the company. The predictable nature of these contracts allows for efficient resource allocation and planning, reinforcing GFT's profitability.

The company's success in securing new strategic deals, such as those with Tier 1 banks in the USA, further solidifies its cash cow position. These relationships typically involve ongoing projects and managed services, which are hallmarks of mature, low-risk business segments. This ongoing engagement ensures a high-volume, predictable income, characteristic of cash cow operations within the BCG matrix.

- Revenue Stability: Long-term contracts with major clients, including new US Tier 1 bank deals, create a predictable and high-volume revenue stream.

- Managed Services: Established relationships often include ongoing projects and managed services, typical of cash cow operations.

- Financial Underpinning: These stable contracts provide the financial security and profitability that characterize a cash cow.

Recurring Revenue from Software Products and Solutions

GFT Technologies' software products and solutions are a significant driver of recurring revenue, highlighting their strong market position within specialized segments of the financial and industrial industries. This consistent income stream, often generated from subscriptions or maintenance agreements, lessens the need for continuous, high-cost sales efforts once a customer is onboarded.

This predictable revenue model is crucial for GFT, providing a stable financial base that supports ongoing operations and strategic investments. For instance, in 2024, recurring revenue streams are anticipated to form a substantial portion of GFT's overall income, offering a buffer against market volatility.

- Strong Market Share: GFT's software solutions maintain a dominant presence in niche markets, ensuring consistent demand.

- Reduced Sales Costs: Recurring revenue models typically require lower incremental sales and marketing expenditure per dollar earned compared to one-off projects.

- Stable Cash Flow: The predictable nature of these revenues provides a reliable financial foundation for the company.

- Foundation for Growth: This stable income allows GFT to reinvest in innovation and expand its service offerings.

GFT Technologies' established core banking modernization services represent a significant cash cow, built on decades of experience and strong relationships within the financial sector. This segment benefits from consistent demand as financial institutions continually need to update their legacy systems. For example, GFT reported a revenue of €753.6 million in the first half of 2024, with a substantial portion attributed to its banking sector operations, underscoring the enduring strength of these core services.

The company's platform modernization, including cloud and mainframe updates, also functions as a cash cow due to its essential nature in digital transformation and minimal associated investment needs. The global cloud migration market's projected growth to over $200 billion in 2024 highlights the vast, ongoing demand GFT is effectively serving, leading to strong profit margins and robust cash flow generation.

Furthermore, GFT's software products and solutions are a key driver of recurring revenue, solidifying their cash cow status. These offerings, often based on subscriptions or maintenance, require less incremental sales effort once a customer is acquired, ensuring a predictable and stable income stream. This recurring revenue is anticipated to form a substantial part of GFT's income in 2024, providing a vital financial buffer.

| GFT Technologies' Cash Cow Segments (Illustrative) | Key Characteristics | Supporting Data/Trends |

|---|---|---|

| Core Banking Modernization | High Market Share, Mature Market, Stable Demand | Generated significant portion of €753.6M H1 2024 revenue. |

| Platform Modernization (Cloud/Mainframe) | Low Investment Needs, High Profit Margins, Essential Service | Capitalizing on >$200B global cloud migration market (2024 projection). |

| Software Products & Solutions | Recurring Revenue, Reduced Sales Costs, Predictable Income | Anticipated substantial contribution to 2024 overall income. |

Preview = Final Product

GFT Technologies BCG Matrix

The GFT Technologies BCG Matrix preview you are currently viewing is the identical, fully formatted report you will receive upon purchase. This means no watermarks, no placeholder text, and no altered content – just the complete, ready-to-deploy strategic analysis. You can confidently assess the quality and comprehensiveness of this document, knowing that the purchased version will be precisely the same. This ensures you receive a professional, actionable tool for evaluating GFT Technologies' business portfolio without any surprises.

Dogs

GFT Technologies' UK operations are currently classified as a 'Dog' in the BCG matrix. This is due to a significant 19% year-on-year revenue decline in the first half of 2025, coupled with a collapse in Earnings Before Tax (EBT) margins. This performance suggests a weak competitive position within a market that is either experiencing slow growth or intense competition.

The company has acknowledged these challenges and is actively executing a turnaround strategy. However, a return to growth is not anticipated until 2027, reinforcing the 'Dog' classification. This extended period of expected underperformance necessitates careful management and strategic evaluation of these UK assets.

GFT Software Solutions GmbH in Germany is currently positioned as a 'Dog' within the BCG framework, characterized by declining profitability and ongoing structural adjustments. This indicates a low market share in a slow-growing segment, requiring substantial resource allocation without commensurate returns.

The company's strategic focus on improving this German operation suggests an effort to either revitalize this unit or consider its divestiture if significant enhancements aren't achieved. As of the latest available data, GFT Technologies' overall revenue growth, while positive, has seen varying contributions from different segments, with the German software solutions area presenting a challenge.

While GFT Technologies boasts robust performance in many European markets, certain Continental Europe segments are experiencing a downturn. Overall European client revenue saw a 6% decrease in the first half of 2025, signaling challenges within the region.

Digging deeper, GFT's revenue from Spanish clients declined by 7%, and from Italian clients by 4%. These figures highlight specific sub-regions or client segments within Continental Europe that are struggling, potentially due to low growth or GFT's market share, acting as a drag on the company's overall financial health.

Legacy Systems and Non-AI-Enhanced Services

Services tied to older automation tools or traditional IT that haven't integrated AI significantly would likely be categorized here. GFT Technologies is focusing on AI, so supporting these legacy systems without AI's efficiency boosts can be expensive and less profitable.

These segments might become cash traps, demanding considerable investment with limited potential for growth or high returns. For instance, maintaining outdated infrastructure for clients who haven't yet migrated to AI-driven solutions could tie up resources without generating substantial new business.

- Legacy Systems: Services relying on outdated technology with low AI integration.

- Lower Returns: Reduced profitability due to lack of AI-driven efficiency gains.

- Costly Maintenance: Significant expenditure required to keep non-AI systems operational.

- Cash Trap Potential: Risk of becoming a drain on resources with dim growth prospects.

Areas with High Capital Investment and Low Immediate Return

Certain segments within GFT Technologies, particularly those involving the modernization of legacy software systems or the development of entirely new technological infrastructures, demand substantial capital outlay. For instance, the ongoing investment in upgrading GFT’s core banking platforms or expanding its cloud-native capabilities requires significant upfront expenditure.

These initiatives, while crucial for long-term market positioning and future revenue streams, do not typically yield immediate financial returns. This means that while GFT might be spending heavily to stay competitive, these particular business units might currently represent a drag on overall profitability, tying up valuable company funds without a proportional contribution to current earnings.

The strategic necessity of these investments is clear; failure to modernize could lead to obsolescence and a loss of market share. However, from a short-term financial perspective, these areas can be viewed as cash consumers rather than cash generators.

- High Capital Outlay: Investments in areas like AI-driven analytics platforms or quantum computing research require substantial upfront capital.

- Delayed Profitability: Returns on these investments are often realized over several years, not immediately.

- Competitive Necessity: Modernization is essential to maintain GFT's competitive edge in the rapidly evolving tech landscape.

- Potential Cash Drain: Currently, these segments may consume more cash than they generate, impacting short-term financial metrics.

Segments of GFT Technologies that are classified as 'Dogs' in the BCG matrix are characterized by low market share in slow-growing or declining industries. These units often require significant investment to maintain their position but offer limited potential for future growth or profitability. Examples include services tied to legacy systems without substantial AI integration, or specific regional operations experiencing revenue declines.

The UK operations and GFT Software Solutions GmbH in Germany are prime examples of these 'Dog' segments. The UK saw a 19% year-on-year revenue decline in H1 2025, and German operations face ongoing structural adjustments and declining profitability. These units are consuming resources without generating commensurate returns, highlighting the need for strategic review.

These 'Dog' segments can become cash traps, demanding ongoing expenditure for maintenance or minimal upgrades without the prospect of significant market share gains or revenue growth. The focus for GFT is to either revitalize these areas through strategic initiatives or consider divestiture to reallocate capital to more promising growth opportunities.

The strategic challenge lies in managing these underperforming units. While they may not contribute significantly to current growth, their complete divestiture could impact overall market presence or client relationships. Therefore, a balanced approach is crucial to navigate these 'Dog' classifications effectively.

| Segment | BCG Classification | Key Financial Indicator (H1 2025) | Strategic Outlook |

|---|---|---|---|

| GFT Technologies UK | Dog | -19% Revenue Decline | Turnaround strategy in place, return to growth not expected until 2027. |

| GFT Software Solutions GmbH (Germany) | Dog | Declining Profitability | Ongoing structural adjustments, strategic focus on improvement or divestiture. |

| Legacy Systems Support (without AI) | Dog | Low Profitability/High Maintenance Costs | Potential cash trap, requires careful resource allocation and potential phasing out. |

Question Marks

GFT's partnership with Google Cloud to develop new AI applications for Google Gemini positions them at the forefront of a rapidly expanding market. While the potential is immense, GFT's current market share in Gemini-specific solutions is likely minimal, reflecting the early stage of this technology. This segment requires substantial investment in research, development, and market penetration to transition from a question mark to a star performer.

GFT Technologies' collaboration with Neura Robotics to develop advanced software for physical AI represents a strategic move into a burgeoning, high-potential market. This partnership aims to create cutting-edge solutions for robots that interact physically with their environment, a field experiencing rapid technological advancement and increasing demand across various industries.

Despite the significant market opportunity, GFT's current penetration within this niche segment of physical AI software development is relatively modest. This positions the venture in the question mark category of the BCG matrix, signifying high growth potential but also requiring substantial investment and strategic focus to gain traction and market share.

The success of this initiative hinges on GFT's ability to effectively execute its development roadmap and capture a significant portion of the expanding physical AI market. Failure to do so could result in the venture remaining a low-share, high-growth entity, potentially transitioning into a Dog if market growth slows or competitive pressures intensify without commensurate market share gains.

GFT Technologies' acquisition of Megawork, a Brazilian SAP specialist, positions them to capture a share of the lucrative SAP migration market. This move signals a strategic push into a high-margin segment of enterprise IT services, aiming to bolster GFT's capabilities in complex system transformations.

The SAP migration market is experiencing robust growth, driven by companies seeking to upgrade their legacy systems to cloud-based solutions like SAP S/4HANA. GFT's investment in Megawork, which closed in late 2023, reflects this trend, though the full impact on market share is yet to be realized, classifying this initiative as a Question Mark in the BCG matrix.

Geographical Expansion for Wynxx Product

Wynxx, GFT's generative AI product, is strategically entering new international markets, aiming to capture high-growth opportunities. These expansions are currently in their early stages, with GFT focusing on establishing a solid market presence in these new territories.

The success of these ventures hinges on significant investment in localized strategies. This includes tailored marketing campaigns, dedicated sales teams, and efficient implementation support to build substantial market share.

- Geographical Expansion: Wynxx is moving into new countries, targeting regions with high growth potential for AI solutions.

- Market Share Development: GFT is actively working to build its market share in these newly entered geographical areas.

- Investment Focus: Significant capital is being allocated to localized marketing, sales, and implementation efforts to solidify Wynxx's position.

- Strategic Goal: The aim is to transform these new market entries into dominant positions rather than maintaining a low-share presence.

Initial Tier-1 Client Wins in New Verticals/Regions

Securing initial Tier-1 client wins in new areas, like the first US Tier-1 retail bank contract, signals strong growth prospects. These early successes, however, represent foundational steps in markets where GFT's presence is still developing.

These new vertical or regional wins are characteristic of the 'Question Mark' category in a BCG Matrix. They possess high market growth potential but currently hold a low relative market share for GFT. For instance, GFT's expansion into the US retail banking sector, while promising, means they are just beginning to establish their footprint within the IT spend of these large institutions.

- High Growth Potential: New markets and verticals offer significant expansion opportunities.

- Low Market Share: Initial wins in these areas mean GFT's penetration is still minimal.

- Investment Required: Capturing greater market share necessitates substantial investment for relationship expansion.

- Strategic Focus: These clients are crucial for future growth but require careful nurturing and resource allocation.

GFT's ventures into emerging AI technologies and new geographical markets for products like Wynxx exemplify the Question Mark category. These initiatives possess high growth potential but currently represent a low market share for the company.

Significant investment is required to nurture these areas, aiming to convert them into Stars. Without successful market penetration and increased share, these ventures risk becoming Dogs if market growth falters or competition intensifies.

The strategic acquisition of Megawork for SAP migrations also falls into this category, showcasing a high-growth market where GFT is still building its presence following the late 2023 acquisition.

| Initiative | Market Growth | GFT Market Share | BCG Category | Investment Need |

| Google Gemini AI Apps | High | Low | Question Mark | High |

| Physical AI Software (Neura Robotics) | High | Low | Question Mark | High |

| SAP Migrations (Megawork) | High | Low | Question Mark | High |

| Wynxx International Expansion | High | Low | Question Mark | High |

| US Retail Banking IT | High | Low | Question Mark | High |

BCG Matrix Data Sources

Our BCG Matrix is built on verified market intelligence, combining financial data, industry research, official reports, and expert commentary to ensure reliable, high-impact insights.