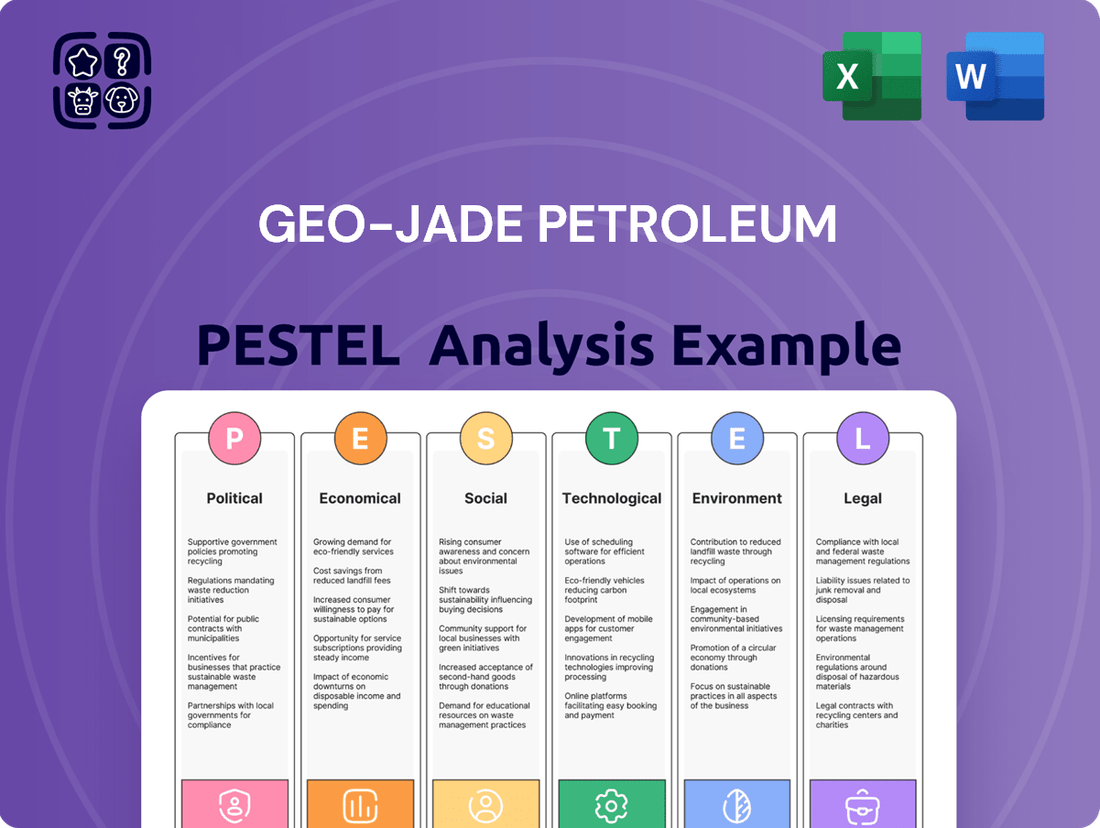

Geo-Jade Petroleum PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Geo-Jade Petroleum Bundle

Uncover the critical political, economic, social, technological, legal, and environmental factors shaping Geo-Jade Petroleum's trajectory. Our comprehensive PESTLE analysis provides actionable intelligence to anticipate market shifts and competitive threats. Download the full version now to gain a strategic advantage and make informed decisions.

Political factors

Geo-Jade Petroleum's core operations are concentrated in Central Asia, a region where the political landscape directly influences the success of oil and gas ventures. The stability of these nations is paramount for exploration, extraction, and transportation.

Recent geopolitical developments, including tensions affecting major economies like Kazakhstan, introduce significant unpredictability. For instance, Kazakhstan's economy, a key player in the region's energy sector, has faced challenges impacting foreign investment and the reliability of energy supplies, creating a more volatile operating environment for companies like Geo-Jade Petroleum.

China's commitment to energy transition significantly shapes Geo-Jade Petroleum's operating environment. The nation's 2024-2025 action plan targets energy saving and carbon reduction, signaling a move away from fossil fuels. This policy direction directly impacts the long-term demand outlook for oil and gas products, which are central to Geo-Jade's business.

The implementation of the new Energy Law in January 2025 further underscores this shift. The law prioritizes the development and utilization of renewable energy sources, potentially creating regulatory hurdles and market competition for traditional energy companies like Geo-Jade Petroleum. This regulatory landscape necessitates strategic adaptation to align with national energy objectives.

Geo-Jade Petroleum's success hinges on navigating complex government relations and securing crucial exploration and production licenses in key operational areas like Kazakhstan and Iraq. Favorable government interactions are paramount for sustained operations and future growth opportunities.

Kazakhstan's commitment to fostering investment in its oil and gas sector is evident through its ongoing development of a transparent legal framework. This includes new legislation aimed at streamlining processes and attracting foreign capital, which is a positive indicator for companies like Geo-Jade.

International Sanctions and Trade Policies

International sanctions and evolving trade policies present a significant political factor for Geo-Jade Petroleum. The imposition of sanctions on major energy producers can lead to volatile oil prices and restrict market access, directly impacting Geo-Jade's export potential and overall financial performance. For instance, while direct sanctions on Kazakhstan's oil exports might be limited, broader trade disputes, such as recent U.S. tariffs on certain Kazakh goods, can create an atmosphere of uncertainty and deter investment in the broader industrial sector, indirectly affecting companies like Geo-Jade.

These geopolitical shifts can also influence supply chain stability and operational costs. Changes in trade agreements or the introduction of new tariffs can affect the import of necessary equipment and services, potentially increasing expenses for Geo-Jade. The global energy landscape is highly sensitive to such political maneuvers, making it crucial for Geo-Jade to monitor and adapt to these dynamic international relations to safeguard its profitability and market position.

- Trade Tensions: Ongoing trade disputes between major economies can introduce volatility into global commodity markets, including oil.

- Sanctions Impact: The threat or implementation of sanctions on energy-producing nations can disrupt supply routes and affect pricing for companies like Geo-Jade.

- Regulatory Shifts: Changes in international trade regulations or the imposition of tariffs can increase operational costs and limit market access for energy exports.

National Security and Energy Independence Goals

Governments in regions where Geo-Jade Petroleum operates often place a high value on national security and energy independence. This translates into policies that can either support or challenge domestic energy producers, like Geo-Jade. For example, China's Energy Law, with its focus on enhancing energy security through 2025, aims to strike a balance between traditional fossil fuels and the growing importance of non-fossil energy sources.

This policy direction can influence Geo-Jade's operational landscape. The drive for energy independence might encourage investments in domestic exploration and production, potentially benefiting companies like Geo-Jade. However, it also signals a long-term shift towards diversification, which could impact demand for conventional oil and gas in the future.

- Energy Security Focus: Governments prioritize stable and reliable energy supplies, often through domestic production.

- Policy Favoritism: Policies may be enacted to support national energy companies or encourage local resource development.

- Diversification Drive: A growing emphasis on non-fossil fuel sources creates a long-term strategic shift in the energy sector.

Political stability in Central Asia, where Geo-Jade Petroleum operates, is crucial for its operations, with Kazakhstan's economic performance and foreign investment climate being key indicators. China's energy transition policies, including its 2024-2025 action plan and the January 2025 Energy Law, signal a move towards renewables, potentially impacting long-term oil demand for Geo-Jade.

Navigating government relations and securing licenses in countries like Kazakhstan and Iraq remains vital for Geo-Jade's growth. Kazakhstan's efforts to create a transparent legal framework aim to attract foreign investment, a positive sign for companies like Geo-Jade.

International trade tensions and sanctions pose risks to Geo-Jade by creating market volatility and potentially restricting access. For instance, broader trade disputes, like U.S. tariffs on certain Kazakh goods, can indirectly deter investment and create operational uncertainties.

Governments' focus on energy security can lead to policies favoring domestic production, but also signal a long-term shift towards energy diversification, which could affect demand for traditional fossil fuels.

What is included in the product

This Geo-Jade Petroleum PESTLE analysis examines the impact of political, economic, social, technological, environmental, and legal factors on the company's operations and strategy.

It provides a comprehensive overview of the external landscape, highlighting key trends and potential challenges relevant to Geo-Jade Petroleum's business environment.

Geo-Jade Petroleum's PESTLE analysis offers a clear, summarized version of the full analysis for easy referencing during meetings or presentations, alleviating the pain of sifting through extensive data.

Economic factors

Fluctuations in global crude oil prices have a direct and significant impact on Geo-Jade Petroleum's revenue streams and overall profitability. When oil prices surge, the company's earnings tend to rise, but sharp declines can put considerable pressure on its financial performance.

Looking ahead to 2025, forecasts suggest that global oil prices are likely to remain volatile. This instability is driven by a complex interplay of factors, including ongoing geopolitical tensions in key oil-producing regions, the strategic production decisions made by OPEC+ members, and the ever-shifting balance between global oil supply and demand.

Central Asia's economic landscape presents a compelling investment climate, with countries like Kazakhstan demonstrating strong growth, fueled by oil production and significant foreign investment. In 2023, Kazakhstan's GDP growth was projected to reach 3.5%, underscoring its economic vitality. China's Belt and Road Initiative continues to be a major driver, fostering infrastructure development and increasing trade flows, which directly benefits companies like Geo-Jade Petroleum by improving access to markets and resources.

China's own economic trajectory is paramount, with its vast market and ongoing industrial development creating substantial opportunities. Despite global economic headwinds, China's GDP growth was estimated at 5.2% for 2023. This robust growth translates into increased demand for energy resources, a key factor for Geo-Jade's revenue streams and future expansion plans in the region.

Managing operational costs is paramount for Geo-Jade Petroleum's financial health. The company must maintain tight control over expenses, from exploration and production to refining and distribution, to ensure profitability. This focus on efficiency is especially critical given the inherent volatility of global oil prices.

In 2024, the energy sector continued to grapple with fluctuating commodity prices, directly impacting the cost-effectiveness of operations. Companies like Geo-Jade Petroleum are under pressure to optimize every stage of their value chain. Achieving efficiency gains can translate into significant competitive advantages, allowing the company to weather market downturns more effectively.

Access to Capital and Funding

Geo-Jade Petroleum's capacity to fund crucial initiatives like new acquisitions, project developments, and operational upgrades is directly tied to its access to capital markets. The company's financial standing, as reflected in its balance sheet and return on capital employed (ROCE), significantly impacts investor trust and the availability of funding avenues.

For instance, as of the end of 2023, Geo-Jade Petroleum reported a net debt to equity ratio of 0.85, indicating a moderate reliance on debt financing. This metric, alongside its ROCE of 12.3% for the same period, provides a snapshot for potential lenders and investors assessing the company's financial health and its ability to generate returns from its capital investments.

- Financing Capacity: Geo-Jade's ability to secure loans and issue bonds is contingent on its financial performance and market conditions.

- Investor Confidence: A strong balance sheet and consistent ROCE are vital for attracting equity investment.

- Project Viability: Access to capital directly impacts the scale and pace of new exploration and production projects.

- Operational Improvements: Funding is necessary for implementing advanced technologies and enhancing existing infrastructure.

Demand for Hydrocarbons

Despite the global shift towards renewables, the demand for hydrocarbons remains robust, especially in rapidly developing economies. Emerging markets like China and India continue to drive significant consumption, underpinning the need for oil and gas.

The International Energy Agency (IEA) forecasts that global oil demand will continue to grow, potentially extending into 2030. This sustained demand is a positive indicator for companies like Geo-Jade Petroleum, whose operations are centered on hydrocarbon extraction and production.

- Projected Oil Demand: The IEA's latest outlook suggests oil demand could see continued growth through 2030, offering a stable market for producers.

- Emerging Market Growth: Nations such as China and India are key drivers of hydrocarbon demand, representing substantial markets for Geo-Jade's products.

- Energy Transition Impact: While the transition to renewables is underway, the immediate future still relies heavily on traditional energy sources.

Global economic growth significantly influences energy demand, with China's robust expansion being a key driver for Geo-Jade Petroleum. In 2023, China's GDP growth was an estimated 5.2%, fueling increased consumption of oil and gas resources.

Central Asian economies, particularly Kazakhstan, also present opportunities, with projected GDP growth of 3.5% in 2023, largely supported by its oil sector and foreign investment. This regional economic vitality benefits Geo-Jade by enhancing market access and resource development.

The International Energy Agency (IEA) anticipates continued growth in global oil demand, potentially through 2030, underscoring the sustained relevance of hydrocarbon markets for companies like Geo-Jade.

| Indicator | Value (2023/2024 Est.) | Source |

|---|---|---|

| China GDP Growth | 5.2% (2023) | Various economic reports |

| Kazakhstan GDP Growth | 3.5% (2023 Est.) | IMF, World Bank |

| Global Oil Demand Outlook | Continued growth through 2030 (Projected) | IEA |

Preview the Actual Deliverable

Geo-Jade Petroleum PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This PESTLE analysis of Geo-Jade Petroleum offers a comprehensive overview of the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company. You'll gain valuable insights into the external forces shaping its operations and strategic decisions.

Sociological factors

Geo-Jade Petroleum's operations necessitate robust community engagement to secure and maintain its social license to operate. Negative impacts on local populations can lead to operational disruptions and reputational damage, underscoring the importance of proactive stakeholder management.

The company's Environmental, Social, and Governance (ESG) framework prioritizes understanding and responding to community needs. This involves establishing diverse communication channels and feedback loops to foster trust and collaboration, ensuring that development benefits are shared equitably.

For instance, in 2024, Geo-Jade Petroleum reported investing $5 million in local infrastructure projects in its primary operating regions, a move directly linked to enhancing community relations and operational stability. This investment reflects a commitment to shared value creation beyond mere resource extraction.

Ensuring a safe working environment and fair labor practices is a critical sociological factor for Geo-Jade Petroleum. The oil and gas sector globally saw a 15% reduction in recordable incidents in 2023 compared to 2022, reflecting a strong industry push for improved safety. This focus is driven by societal expectations and regulatory pressures to protect workers, especially in high-risk offshore and remote operations.

Technological advancements are playing a key role in enhancing workforce safety. Companies are increasingly deploying drones and robotics for tasks like pipeline inspections and maintenance in hazardous areas, minimizing direct human exposure. For instance, by 2024, over 60% of major oil and gas firms are expected to have integrated AI-powered safety monitoring systems into their operations.

Public sentiment towards the oil and gas sector is increasingly shaped by climate change awareness and the ongoing global energy transition. This evolving perception directly impacts governmental policies, investment flows, and consumer choices, compelling companies like Geo-Jade Petroleum to embrace more sustainable operations and explore diversification into renewable energy sources.

Local Content Requirements and Employment

Geo-Jade Petroleum must navigate local content requirements, particularly in areas like Kazakhstan, where there's a strong push to boost local participation in procurement and workforce development. This translates into a strategic imperative to prioritize local employment and invest in training programs to meet these evolving demands.

For instance, in 2023, Kazakhstan's oil and gas sector saw continued efforts to increase the share of goods and services procured from local suppliers. While specific figures for Geo-Jade's local content adherence are not publicly detailed, the national trend indicates a growing expectation for companies to contribute to the local economy through employment and sourcing. This focus aims to build domestic capacity and ensure a larger portion of the sector's economic benefits remain within the country.

- Kazakhstan's Local Content Push: Emphasis on increasing the percentage of locally sourced goods and services in the oil and gas industry.

- Workforce Development: A strategic need for Geo-Jade to invest in training and upskilling local personnel to meet employment mandates.

- Economic Contribution: Local content requirements are designed to foster domestic industry growth and retain economic benefits within the host nation.

- Compliance and Strategy: Geo-Jade's operational strategy must integrate compliance with these local content and employment regulations to ensure smooth operations and positive stakeholder relations.

Impact on Indigenous Populations and Land Rights

Geo-Jade Petroleum's operations, particularly in exploration and production, can significantly impact Indigenous populations and their land rights. Responsible engagement is paramount to prevent social unrest and ensure smooth operations. For instance, in 2024, several resource development projects in Canada faced delays due to Indigenous consultations, highlighting the critical need for early and meaningful engagement.

Failure to adequately address these concerns can lead to protracted legal battles and operational disruptions, impacting project timelines and financial viability. Companies are increasingly expected to go beyond minimum legal requirements, fostering partnerships and benefit-sharing agreements. As of early 2025, discussions around Indigenous sovereignty and resource revenue sharing continue to shape the regulatory landscape for energy projects globally.

- Land Rights Conflicts: Disputes over land ownership and resource extraction rights can arise, potentially leading to protests and legal challenges that halt operations.

- Social License to Operate: Maintaining positive relationships with Indigenous communities is vital for securing and retaining a social license to operate, crucial for long-term business sustainability.

- Benefit Sharing: Implementing fair benefit-sharing mechanisms, including employment opportunities and economic participation, can mitigate conflict and foster community support.

- Environmental Stewardship: Indigenous communities often have deep connections to the land and are key stakeholders in ensuring environmentally responsible resource development.

Public perception of the oil and gas industry is increasingly influenced by environmental concerns and the energy transition. This shift impacts regulatory frameworks and investment decisions, pushing companies like Geo-Jade Petroleum towards more sustainable practices and diversification into renewables. By 2024, global investment in renewable energy sources reached an estimated $2 trillion, signaling a significant market shift.

Labor relations and workforce safety are paramount. The industry is seeing a trend towards enhanced safety protocols, with a global reduction in recordable incidents by 15% in 2023 compared to 2022. Geo-Jade Petroleum's commitment to fair labor practices and safe working environments is crucial for maintaining operational continuity and employee morale.

Local content requirements, particularly in nations like Kazakhstan, necessitate increased local employment and procurement. In 2023, Kazakhstan's oil and gas sector continued efforts to boost local supplier participation, reflecting a broader trend of nations seeking to retain greater economic benefits from resource extraction.

Geo-Jade Petroleum must also navigate land rights and Indigenous community relations, especially in exploration activities. In 2024, several resource projects faced delays due to inadequate Indigenous consultation, underscoring the critical need for proactive engagement and benefit-sharing agreements to ensure social license and operational stability.

Technological factors

The oil and gas sector is rapidly embracing digital transformation, with artificial intelligence (AI), the Internet of Things (IoT), and robotics becoming central to operations. Geo-Jade Petroleum can harness these technologies for predictive maintenance, advanced reservoir modeling, and automated drilling processes, aiming to boost operational efficiency and reduce expenditures.

By integrating AI for predictive analytics, Geo-Jade can anticipate equipment failures, minimizing downtime and associated costs. For instance, in 2024, many energy companies reported significant cost savings, with some seeing reductions of up to 15% in maintenance expenses through AI-driven predictive strategies. This digital shift also extends to supply chain management, where IoT sensors can provide real-time tracking of assets and inventory, leading to more streamlined logistics and reduced waste.

The adoption of advanced Enhanced Oil Recovery (EOR) techniques is crucial for increasing oil recovery rates and extending the life of existing fields, particularly in mature regions like Central Asia where Geo-Jade Petroleum operates. These technologies help maximize the output from Geo-Jade's assets, ensuring continued production and profitability.

In 2024, the global EOR market was valued at approximately $35 billion, with significant growth anticipated in the coming years. Techniques such as thermal EOR, gas injection, and chemical EOR are becoming increasingly sophisticated, offering higher recovery factors and improved economic viability for mature oil fields, directly benefiting companies like Geo-Jade.

Advanced seismic technologies, particularly those leveraging machine learning and artificial intelligence, are revolutionizing hydrocarbon exploration. These sophisticated algorithms can process vast amounts of geological data with unprecedented speed and accuracy, identifying subtle seismic signatures that might indicate the presence of oil and gas reserves previously considered undetectable.

For Geo-Jade Petroleum, this translates into a significant competitive advantage. By integrating these cutting-edge seismic tools, the company can improve the precision of its exploration efforts, leading to higher success rates in discovering commercially viable hydrocarbon traps. This enhancement in exploration capability is crucial for maintaining and expanding reserves in a dynamic energy market.

Carbon Capture and Storage (CCS)

As environmental scrutiny intensifies, technologies like Carbon Capture and Storage (CCS) are becoming crucial for the oil and gas sector. Geo-Jade Petroleum can leverage investments in CCS to mitigate risks tied to conventional operations and demonstrate a commitment to sustainability. For instance, global investment in CCS projects reached an estimated $10 billion in 2023, signaling a growing industry trend towards decarbonization.

Implementing CCS can enhance Geo-Jade's long-term viability by aligning its business model with evolving regulatory landscapes and investor expectations for lower emissions. Companies are increasingly pressured to adopt such technologies, with many governments offering incentives. For example, the US Inflation Reduction Act provides significant tax credits for carbon capture projects, making them more economically attractive.

- Growing Industry Adoption: Over 30 large-scale CCS facilities were operational globally by the end of 2023, with more than 150 in various stages of development.

- Economic Incentives: Government policies, such as carbon pricing mechanisms and tax credits, are driving investment in CCS technologies.

- Risk Mitigation: CCS adoption helps oil and gas companies like Geo-Jade address regulatory risks and potential future carbon taxes.

- Technological Advancements: Ongoing research and development are improving the efficiency and reducing the cost of CCS technologies.

Data Analytics and Cloud Computing

Data analytics and cloud computing are revolutionizing how companies like Geo-Jade Petroleum operate. By leveraging these technologies, the oil and gas sector can make more informed decisions, leading to increased efficiency and reduced costs. For instance, in 2024, the global cloud computing market in the oil and gas industry was projected to reach over $30 billion, highlighting its growing importance.

Cloud-based platforms allow for real-time monitoring of operations, from exploration to production. This capability enables better resource allocation, ensuring that assets are utilized effectively. Geo-Jade Petroleum can use these insights to optimize drilling strategies, potentially increasing output and minimizing downtime. The ability to run accurate simulations on cloud infrastructure also plays a crucial role in risk assessment and operational planning.

The integration of data analytics and cloud computing offers several key advantages:

- Enhanced Decision-Making: Real-time data analysis supports quicker and more accurate strategic and operational choices.

- Operational Efficiency: Streamlining processes like procurement and resource allocation through cloud platforms.

- Optimized Resource Management: Improving the utilization of equipment and personnel.

- Advanced Simulation Capabilities: Enabling better planning and risk mitigation for drilling and production activities.

Technological advancements are reshaping the oil and gas industry. Geo-Jade Petroleum can leverage AI for predictive maintenance, aiming for cost reductions similar to the 15% seen by some energy firms in 2024 through AI-driven strategies. Enhanced Oil Recovery (EOR) technologies, with the global market valued at approximately $35 billion in 2024, are critical for maximizing output from mature fields.

Sophisticated seismic technologies, powered by machine learning, improve exploration success rates. Furthermore, Carbon Capture and Storage (CCS) is gaining traction, with over 30 large-scale facilities operational globally by the end of 2023, offering a path to mitigate environmental risks and align with sustainability goals.

| Technology Area | 2024/2025 Relevance | Potential Impact for Geo-Jade |

| AI & Machine Learning | Predictive maintenance, reservoir modeling, seismic analysis | Reduced downtime, improved exploration success, cost savings |

| Enhanced Oil Recovery (EOR) | Global market ~ $35 billion (2024), crucial for mature fields | Maximized production from existing assets, increased profitability |

| Carbon Capture & Storage (CCS) | Over 30 operational facilities (end of 2023), growing investment | Environmental risk mitigation, regulatory compliance, enhanced sustainability profile |

| Data Analytics & Cloud Computing | Over $30 billion market (2024 projection), real-time operations monitoring | Informed decision-making, optimized resource allocation, improved efficiency |

Legal factors

Geo-Jade Petroleum's operations are fundamentally shaped by subsoil use and licensing laws in its host countries. For instance, in Kazakhstan, the Code on Subsoil and Subsoil Use sets the framework for exploration, development, and production rights, directly influencing Geo-Jade's ability to extract and monetize resources. These regulations often include specific fiscal terms, environmental standards, and local content requirements that impact profitability and operational flexibility.

Environmental regulations are tightening globally, directly affecting oil and gas companies like Geo-Jade Petroleum. These rules often focus on reducing emissions and managing waste more effectively, adding complexity and cost to operations.

China's recent action plan for energy saving and carbon reduction, aiming for significant emission cuts by 2030, means Geo-Jade must adapt its practices in China to meet these new standards. Similarly, Kazakhstan's commitment to integrating Environmental, Social, and Governance (ESG) principles into its energy sector necessitates strict adherence to sustainability mandates.

Geo-Jade's profitability is directly tied to the fiscal regimes of its operating countries. For instance, changes in corporate tax rates or royalty payments can materially impact its bottom line. In 2024, many resource-rich nations are reviewing their tax structures to capture a larger share of energy profits amidst volatile global prices.

Governments often use tax policies to steer energy development. New tax holidays or credits for exploration and production activities could encourage Geo-Jade to invest further, while increased environmental taxes might dampen enthusiasm for certain projects. For example, several countries are considering carbon taxes in 2025, which could add operational costs for any fossil fuel producer.

International Trade Laws and Agreements

International trade laws and agreements significantly influence Geo-Jade Petroleum's global operations, affecting the import and export of oil, gas, and essential equipment. For instance, the World Trade Organization (WTO) agreements set broad guidelines, but specific bilateral or regional pacts, like those between China and its trading partners, can introduce preferential tariffs or, conversely, impose restrictions. Geo-Jade must navigate these varying legal landscapes, which can impact cost structures and market access.

The company's international footprint necessitates strict compliance with a patchwork of regulations. These can range from sanctions imposed by major economic blocs on certain countries to specific import/export licensing requirements for specialized petroleum equipment. Failure to adhere to these complex legal frameworks can result in substantial fines, operational disruptions, and reputational damage, underscoring the critical nature of legal due diligence in every international transaction.

- Trade Agreements: Geo-Jade must monitor evolving trade pacts that could alter duties on imported drilling technology or exported refined products.

- Tariffs and Restrictions: Potential imposition of tariffs, as seen in trade disputes impacting global commodity flows, can directly affect Geo-Jade's profitability and supply chain costs.

- Regulatory Compliance: Adherence to international standards for safety, environmental impact, and product quality is mandatory for all export and import activities.

Corporate Governance and Reporting Requirements

Geo-Jade Petroleum, as a listed entity on the Shanghai Stock Exchange, faces stringent corporate governance and reporting mandates. Compliance with these regulations, including timely and accurate financial disclosures, is paramount for maintaining investor confidence and market access. Failure to meet these standards can lead to penalties and reputational damage.

The company must navigate a complex web of rules governing its operations and financial reporting. In 2023, for example, the China Securities Regulatory Commission (CSRC) continued to emphasize enhanced disclosure requirements for listed companies, particularly concerning environmental, social, and governance (ESG) factors. This means Geo-Jade Petroleum needs robust internal controls to ensure adherence.

- Adherence to Shanghai Stock Exchange Listing Rules: Geo-Jade Petroleum is subject to continuous disclosure obligations and corporate governance guidelines set by the exchange.

- Financial Reporting Standards: The company must comply with Chinese Accounting Standards (CAS) and ensure transparency in its financial statements, audited annually.

- Regulatory Oversight by CSRC: The China Securities Regulatory Commission oversees the capital markets, enforcing regulations that impact Geo-Jade Petroleum's reporting and governance practices.

- ESG Reporting Expectations: Growing pressure from regulators and investors means Geo-Jade Petroleum is increasingly expected to report on its environmental, social, and governance performance.

Geo-Jade Petroleum operates within a framework of evolving international trade laws and bilateral agreements, impacting its import/export activities. For instance, the company must navigate varying tariffs on drilling equipment and refined products, with potential trade disputes in 2024-2025 potentially altering supply chain costs and market access. Adherence to global safety and environmental standards is also critical for all international transactions.

Corporate governance and financial reporting are heavily regulated, especially for Geo-Jade as a Shanghai Stock Exchange-listed entity. The China Securities Regulatory Commission (CSRC) continues to emphasize enhanced disclosure, particularly for ESG factors, requiring robust internal controls for compliance by 2025. Adherence to Chinese Accounting Standards and continuous disclosure obligations are paramount for investor confidence.

| Legal Factor | Impact on Geo-Jade Petroleum | 2024-2025 Relevance |

|---|---|---|

| Subsoil Use Laws | Defines exploration, development, and production rights; includes fiscal terms, environmental standards, and local content requirements. | Crucial for operational planning and profitability in host countries like Kazakhstan. |

| Environmental Regulations | Mandates emissions reduction and waste management, increasing operational costs and complexity. | China's 2030 emission targets and Kazakhstan's ESG integration necessitate adaptation. |

| Fiscal Regimes & Taxation | Directly impacts profitability through corporate tax rates and royalty payments. | Many resource nations are reviewing tax structures in 2024; carbon taxes are being considered for 2025. |

| International Trade Laws | Governs import/export of oil, gas, and equipment, influencing cost structures and market access. | Evolving trade pacts and potential tariffs in 2024-2025 require constant monitoring. |

| Corporate Governance & Reporting | Requires adherence to listing rules, financial standards, and ESG reporting. | CSRC emphasizes enhanced disclosure; compliance with Shanghai Stock Exchange rules is ongoing. |

Environmental factors

Global climate change policies and increasing decarbonization pressures are significant environmental factors impacting the oil and gas sector. Countries worldwide are setting ambitious targets to reduce carbon emissions, which directly affects fossil fuel producers like Geo-Jade Petroleum.

China, a key market for many energy companies, has committed to achieving carbon neutrality by 2060, a goal that is already driving policy shifts and investment in cleaner energy alternatives. This ambition translates into stricter regulations and a growing demand for lower-carbon fuels and technologies.

Kazakhstan, where Geo-Jade operates, is also embracing renewable energy. The country aims to increase the share of renewables in its energy mix, influencing production methods and potentially creating new operational challenges or opportunities for companies in the region.

Methane leaks are a major environmental concern for oil and gas companies, including Geo-Jade Petroleum, as they significantly contribute to greenhouse gas emissions and impact air quality. The industry is under increasing scrutiny to adopt advanced technologies and operational practices aimed at detecting and mitigating these leaks. For instance, the International Energy Agency (IEA) reported in 2024 that the oil and gas sector is responsible for a substantial portion of global methane emissions, highlighting the urgent need for action.

Geo-Jade Petroleum's operations, especially in regions like Egypt, are significantly impacted by water management. Oil and gas extraction often requires substantial water for processes like hydraulic fracturing and enhanced oil recovery, raising concerns about water scarcity in already arid environments. In 2024, Egypt, a key operational area for Geo-Jade, faced ongoing challenges with water stress, with per capita renewable water resources remaining critically low, placing pressure on industries reliant on this resource.

The increasing focus on environmental stewardship means companies like Geo-Jade must adopt sustainable water management practices. This includes minimizing water usage, recycling produced water, and ensuring responsible disposal to prevent pollution of local water sources. Failure to do so can lead to regulatory penalties and reputational damage, impacting the company's social license to operate and its long-term financial viability.

Biodiversity and Ecosystem Impact

Geo-Jade Petroleum's exploration and production operations, particularly in ecologically sensitive regions, pose a direct risk to biodiversity and ecosystem health. The company must actively address potential environmental damage, including habitat fragmentation and the threat of oil spills, to uphold its environmental stewardship. For instance, in 2024, the global oil and gas industry faced increased scrutiny following incidents that highlighted the vulnerability of marine ecosystems, with reports indicating that oil spills can have long-term detrimental effects on marine life populations, sometimes taking decades to recover.

Mitigation strategies are crucial for Geo-Jade to minimize its ecological footprint. This involves investing in advanced containment technologies and rigorous environmental impact assessments before commencing any new projects. The company's commitment to environmental responsibility is also tied to regulatory compliance, with many international bodies, including the UN Environment Programme, emphasizing the need for companies to adhere to strict guidelines to protect biodiversity hotspots. By 2025, stricter regulations regarding offshore drilling and waste management are anticipated to be implemented globally, requiring companies like Geo-Jade to adapt their operational practices.

- Habitat Disruption: Exploration activities can lead to the destruction or fragmentation of critical habitats for numerous species, impacting biodiversity.

- Pollution Risks: Potential oil spills or leaks from infrastructure can contaminate soil and water, severely damaging local ecosystems and wildlife.

- Ecosystem Services: Degradation of ecosystems can impair essential services like water purification and carbon sequestration, affecting both the environment and local communities.

- Regulatory Compliance: Adherence to evolving environmental regulations and international standards is paramount to avoid penalties and maintain operational licenses.

Waste Management and Pollution Control

Effective waste management and pollution control are paramount for Geo-Jade Petroleum, directly impacting its environmental footprint and operational sustainability. The company must diligently manage drilling waste, produced water, and other industrial byproducts to prevent soil and water contamination, a critical concern in the oil and gas sector.

For instance, the International Energy Agency reported in 2024 that the oil and gas industry globally generated approximately 200 million tonnes of drilling waste annually, with improper disposal leading to significant environmental damage. Geo-Jade Petroleum's commitment to advanced treatment and disposal methods, such as reinjection or specialized landfilling, is therefore essential to mitigate these risks and comply with increasingly stringent environmental regulations.

- Regulatory Compliance: Adhering to national and international environmental standards for waste disposal and emission control is non-negotiable for Geo-Jade Petroleum.

- Technological Investment: Implementing state-of-the-art technologies for treating produced water and managing hazardous waste is crucial to minimize pollution.

- Carbon Footprint Reduction: Efforts to reduce greenhouse gas emissions from operational activities, including flaring and fugitive emissions, are vital for environmental stewardship.

- Circular Economy Principles: Exploring opportunities for waste reuse and recycling, such as using treated wastewater for industrial purposes, can enhance efficiency and reduce environmental impact.

Geo-Jade Petroleum must navigate evolving climate policies and decarbonization mandates, especially with China's 2060 carbon neutrality goal influencing its key markets. Kazakhstan's push for renewables also impacts operational strategies. Methane emissions remain a critical concern, with the oil and gas sector facing scrutiny for its contribution to greenhouse gases, as highlighted by the IEA in 2024.

Water scarcity is a significant environmental challenge for Geo-Jade, particularly in operational areas like Egypt, where water stress is a persistent issue. The company needs to implement sustainable water management practices, including minimizing usage and recycling, to avoid regulatory penalties and maintain its social license to operate.

The company's operations risk impacting biodiversity and ecosystems, necessitating robust mitigation strategies such as advanced containment technologies and thorough environmental impact assessments. By 2025, stricter global regulations on offshore drilling and waste management are expected, requiring Geo-Jade to adapt its practices.

Effective waste management is crucial, with the industry generating millions of tonnes of drilling waste annually, as reported by the IEA in 2024. Geo-Jade must adopt advanced treatment and disposal methods to prevent contamination and comply with environmental regulations.

| Environmental Factor | Impact on Geo-Jade Petroleum | Key Data/Trends (2024-2025) |

| Climate Change Policies | Pressure to reduce carbon emissions, potential for carbon taxes or stricter regulations. | China's 2060 carbon neutrality target; Kazakhstan's renewable energy targets. |

| Water Scarcity | Increased operational costs and regulatory scrutiny for water usage in arid regions. | Egypt's critical low per capita renewable water resources. |

| Biodiversity and Ecosystems | Risk of habitat disruption and pollution from operations, requiring mitigation investments. | Increased global scrutiny on oil spill impacts; anticipation of stricter regulations by 2025. |

| Waste Management | Need for advanced treatment and disposal methods to prevent soil and water contamination. | Global oil and gas industry generating ~200 million tonnes of drilling waste annually (IEA, 2024). |

PESTLE Analysis Data Sources

Our Geo-Jade Petroleum PESTLE analysis is built on a robust foundation of data from reputable sources including the International Energy Agency (IEA), national energy ministries, and leading financial news outlets. We meticulously gather information on political stability, economic forecasts, environmental regulations, technological advancements, and social trends impacting the oil and gas sector.