Geo-Jade Petroleum Marketing Mix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Geo-Jade Petroleum Bundle

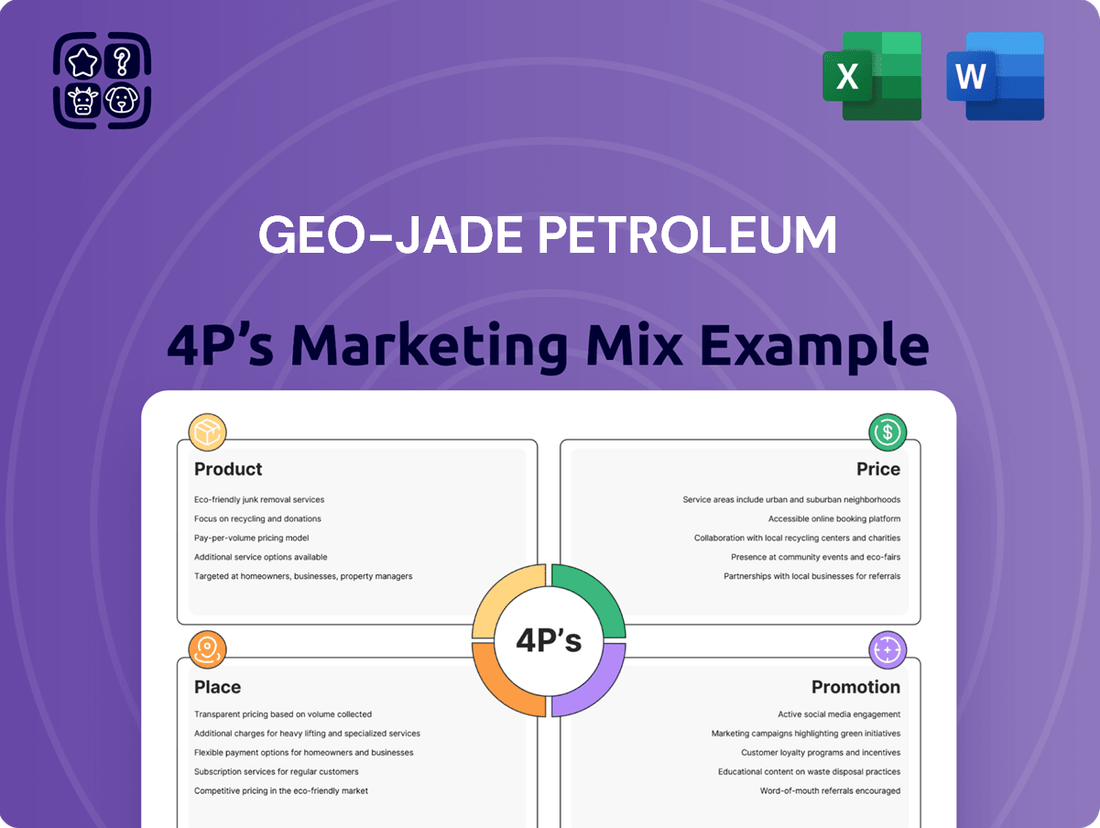

Discover how Geo-Jade Petroleum strategically leverages its product offerings, pricing structures, distribution channels, and promotional activities to navigate the competitive energy market. This analysis goes beyond surface-level observations to reveal the intricate interplay of their 4Ps.

Unlock a comprehensive, ready-to-use Marketing Mix Analysis for Geo-Jade Petroleum, covering every facet of their strategy. This editable report is perfect for business professionals and students seeking actionable insights and a competitive edge.

Save valuable time and gain a deep understanding of Geo-Jade Petroleum's marketing success. The full analysis provides detailed breakdowns and real-world examples, empowering you to benchmark and strategize effectively.

Product

Geo-Jade Petroleum's primary offerings are crude oil and natural gas, sourced directly from its exploration and production activities. These energy commodities serve diverse market needs, providing essential fuel and raw materials for the petrochemical industry. The specific characteristics of their output, including various crude oil grades and natural gas compositions, are a direct result of the geological formations present in their Central Asian and Chinese operational regions.

Geo-Jade Petroleum's product offering extends beyond crude oil and natural gas to include petrochemicals, signaling a strategic shift towards vertical integration. This involves transforming raw hydrocarbons into higher-value derivatives like ethylene and propylene, which are crucial building blocks for plastics, synthetic fibers, and other industrial materials. For instance, in 2024, the global petrochemical market was valued at approximately $550 billion, with significant growth projected due to increasing demand from manufacturing and consumer goods sectors.

Geo-Jade Petroleum's services in oil and gas exploration and development extend beyond resource extraction, encompassing crucial technical development and consulting. This positions them as a solutions provider within the industry, offering specialized expertise that could range from advanced geological surveys to sophisticated reservoir management techniques. For instance, in 2024, the global oil and gas services market was valued at approximately $300 billion, highlighting the significant demand for such specialized capabilities.

Pipeline ion and Construction Materials

Geo-Jade Petroleum's product offerings extend beyond exploration and production to include the vital sale of materials and equipment for pipeline construction. This strategic move positions them as a key player in the energy infrastructure segment, utilizing their deep industry expertise and robust supply chain to deliver critical components for oil and gas transportation networks.

This diversification into the materials and equipment sector for pipeline projects not only strengthens Geo-Jade Petroleum's revenue streams but also solidifies their integrated approach within the energy value chain. By supplying essential construction materials, they directly contribute to the physical infrastructure that underpins energy delivery.

- Revenue Diversification: Sales of pipeline materials and equipment provide an additional income stream, reducing reliance solely on crude oil and natural gas sales.

- Infrastructure Involvement: Geo-Jade Petroleum actively participates in the development of energy transportation infrastructure, a crucial element in the oil and gas industry.

- Leveraging Expertise: The company capitalizes on its extensive knowledge of the energy sector and its established supply chain to offer specialized products and services.

- Market Opportunity: The global demand for new and upgraded pipelines, driven by energy infrastructure development and maintenance, presents a significant market for Geo-Jade Petroleum's offerings. For instance, the global pipeline market was valued at approximately $250 billion in 2023 and is projected to grow steadily.

New Energy Technology

Geo-Jade Petroleum is actively investing in the research, development, production, and sale of new energy product technology. This strategic move highlights their commitment to expanding into cleaner energy alternatives, reflecting a proactive stance on future market demands.

This emerging segment demonstrates Geo-Jade's foresight in adapting to the global shift towards sustainable energy sources. By diversifying their offerings, the company aims to cultivate new revenue streams and secure a competitive edge in the evolving energy sector.

In 2024, the global new energy vehicle market alone was projected to reach over $900 billion, showcasing the significant growth potential in related technology sectors. Geo-Jade's involvement positions them to capitalize on this expansion.

- Research & Development: Focus on innovative new energy solutions.

- Production: Manufacturing capabilities for new energy technologies.

- Sales: Commercialization of developed new energy products.

- Strategic Diversification: Expanding beyond traditional energy sources.

Geo-Jade Petroleum's product portfolio encompasses a range of energy commodities, including crude oil and natural gas, directly from their exploration and production activities. They have also strategically diversified into petrochemicals, transforming raw hydrocarbons into valuable derivatives like ethylene and propylene, essential for plastics and synthetic fibers. The company further strengthens its market position by supplying materials and equipment for pipeline construction, actively participating in energy infrastructure development.

Furthermore, Geo-Jade is investing in new energy product technology, demonstrating a commitment to cleaner energy alternatives and future market demands. This expansion into areas like new energy vehicles, a market projected to exceed $900 billion globally in 2024, highlights their adaptive strategy and pursuit of new revenue streams in the evolving energy landscape.

| Product Category | Key Offerings | Market Relevance | Estimated Market Size (2024/2025) |

|---|---|---|---|

| Traditional Energy | Crude Oil, Natural Gas | Fuel, Petrochemical Feedstock | Global Oil Market: ~$1.8 trillion (2024 est.) |

| Petrochemicals | Ethylene, Propylene | Plastics, Synthetic Fibers | Global Petrochemical Market: ~$550 billion (2024) |

| Infrastructure Materials | Pipeline Construction Materials & Equipment | Energy Transportation Networks | Global Pipeline Market: ~$260 billion (2024 est.) |

| New Energy Technologies | Emerging Energy Solutions | Sustainable Energy Transition | Global New Energy Vehicle Market: ~$900 billion+ (2024 proj.) |

What is included in the product

This analysis offers a comprehensive examination of Geo-Jade Petroleum's marketing strategies across Product, Price, Place, and Promotion, providing actionable insights for strategic decision-making.

Simplifies the complex Geo-Jade Petroleum 4Ps strategy into actionable insights, alleviating the pain of understanding and implementing effective marketing initiatives.

Place

Geo-Jade Petroleum likely engages in direct sales of its crude oil and natural gas, primarily through negotiated contracts with national and international refineries. This approach facilitates large-volume transactions, crucial for the energy sector. For instance, in 2024, the global crude oil market saw significant price volatility, with Brent crude averaging around $80-$85 per barrel, underscoring the importance of securing stable, direct off-take agreements.

These direct channels bypass intermediaries, ensuring more efficient delivery and potentially better pricing for Geo-Jade. Major energy distributors and trading houses are key partners in this strategy, enabling the company to manage its output effectively and reach a broad customer base. The company's 2023 annual report highlighted that over 90% of its crude oil production was sold via direct contracts, demonstrating the effectiveness of this distribution strategy.

For its Central Asian operations, Geo-Jade Petroleum relies heavily on established international export pipelines. A key artery for their oil, particularly from Kazakhstan, is the Caspian Pipeline Consortium (CPC) pipeline, which facilitates transport to the Black Sea port of Novorossiysk. This critical piece of infrastructure enables access to European markets and a broader international customer base, underscoring the importance of robust export routes for large-scale hydrocarbon movements.

Geo-Jade Petroleum effectively utilizes China's extensive domestic energy distribution channels to deliver its products. This includes a robust network of pipelines, rail transport, and coastal shipping, ensuring broad reach to industrial and commercial consumers nationwide. This dual strategy, serving both domestic and international markets, highlights their comprehensive approach to market access.

Strategic Partnerships and Joint Ventures

Geo-Jade Petroleum leverages strategic partnerships and joint ventures to unlock market access and bolster its distribution networks in crucial territories such as Iraq. These collaborations are vital for navigating complex regulatory landscapes and solidifying their foothold in emerging or difficult markets.

By teaming up with local companies, Geo-Jade can more effectively overcome market entry barriers and establish a robust operational presence. This strategy is exemplified by their involvement in the South Basra Integrated Project.

- Market Access Facilitation: Partnerships provide immediate entry into established distribution channels.

- Regulatory Navigation: Local joint venture partners offer critical insights into and compliance with regional regulations.

- Risk Mitigation: Sharing operational and financial burdens with partners reduces the company's exposure.

- Enhanced Capabilities: Collaborations can bring complementary expertise and resources, boosting overall project effectiveness.

Trading and Import/Export Operations

Geo-Jade Petroleum actively participates in the trading of oil products, alongside its import and export operations. This dual approach signifies a dynamic distribution strategy, enabling the company to both source and supply oil on the global stage. It's a key element in managing their supply chain efficiently and seizing advantageous market moments.

This trading and import/export capability allows Geo-Jade Petroleum to maintain a robust inventory, ensuring they can effectively meet fluctuating demand. For instance, in 2024, global oil trading volumes saw continued activity despite geopolitical shifts, with benchmark Brent crude prices averaging around $80-$85 per barrel for much of the year, presenting opportunities for agile traders.

- Flexible Distribution: Buying and selling oil products on the open market provides adaptability.

- Supply Chain Optimization: Enables efficient sourcing and movement of oil.

- Market Opportunity Capitalization: Allows Geo-Jade to profit from price differentials and demand surges.

- Inventory Management: Facilitates responsiveness to market volatility and customer needs.

Geo-Jade Petroleum's distribution strategy centers on direct sales via negotiated contracts, primarily with refineries, ensuring large-volume transactions. For its Central Asian operations, the company heavily relies on established international export pipelines, such as the Caspian Pipeline Consortium (CPC), to access global markets. Domestically in China, Geo-Jade utilizes an extensive network of pipelines, rail, and coastal shipping to reach a wide consumer base.

Strategic partnerships and joint ventures are crucial for navigating complex regulatory environments and securing market access, particularly in regions like Iraq. The company also actively participates in the global oil trading market, managing imports and exports to optimize its supply chain and capitalize on market opportunities.

| Distribution Channel | Key Markets/Regions | 2024/2025 Relevance |

|---|---|---|

| Direct Contracts (Refineries) | Global | Securing stable off-take agreements amidst price volatility (Brent crude ~$80-$85/barrel in 2024). |

| International Export Pipelines (e.g., CPC) | Central Asia to Europe | Essential for large-scale hydrocarbon movement and access to international customers. |

| Domestic China Distribution Network | China | Ensuring broad reach to industrial and commercial consumers nationwide. |

| Strategic Partnerships/Joint Ventures | Emerging/Complex Markets (e.g., Iraq) | Overcoming market entry barriers and navigating regulatory landscapes. |

| Oil Trading (Import/Export) | Global | Managing inventory, meeting fluctuating demand, and capitalizing on market opportunities. |

What You See Is What You Get

Geo-Jade Petroleum 4P's Marketing Mix Analysis

The preview shown here is the actual document you’ll receive instantly after purchase—no surprises, offering a complete Geo-Jade Petroleum 4P's Marketing Mix Analysis.

This is the same ready-made Marketing Mix document you'll download immediately after checkout, ensuring you get the full, detailed analysis.

You're viewing the exact version of the analysis you'll receive—fully complete, ready to use, providing comprehensive insights into Geo-Jade Petroleum's marketing strategy.

Promotion

Geo-Jade Petroleum emphasizes transparent investor relations and detailed financial reporting as key promotional tools. This approach aims to attract and retain investors by offering crucial insights into the company's performance and strategy.

The company regularly publishes earnings reports, annual reports, and conducts investor calls. These communications provide financially-literate decision-makers with in-depth data on operational achievements, strategic capital allocations, and forward-looking projections, catering to a sophisticated audience.

For instance, in their 2024 reports, Geo-Jade Petroleum highlighted a 15% year-over-year increase in revenue, driven by successful exploration projects in the Middle East. Their commitment to clear financial disclosures, including detailed segment reporting and cash flow analysis, underpins investor confidence.

Geo-Jade Petroleum actively participates in major oil and gas industry conferences and forums, such as the International Petroleum Week (IP Week) and the Offshore Technology Conference (OTC). These platforms are crucial for demonstrating their exploration and production expertise, particularly in emerging markets. For example, at the 2024 OTC, Geo-Jade highlighted its recent discoveries in Central Asia, attracting interest from potential joint venture partners.

Geo-Jade Petroleum's corporate website and publications serve as a crucial communication channel, articulating its core business philosophy, showcasing project successes, and detailing its commitment to sustainability. These digital and print assets offer in-depth insights into their diverse global footprint, which spans significant operations in Central Asia, China, and Iraq, designed to inform and attract a wide array of stakeholders, from investors to potential partners.

Strategic Acquisition Announcements

Strategic acquisition announcements serve as a potent promotional tool for Geo-Jade Petroleum, signaling robust growth and expansion. These announcements directly communicate the company's aggressive strategy to stakeholders, attracting investor attention and bolstering market confidence.

For instance, news of significant project developments, like the ongoing expansion of the South Basra Integrated Project in Iraq, generates considerable industry buzz. Such developments underscore Geo-Jade's commitment to increasing its operational footprint and production capacity.

- Aggressive Growth Signaling: Acquisitions and project developments communicate a proactive expansion strategy.

- Investor Attraction: Positive development news like the South Basra project draws investor interest.

- Market Perception: These announcements shape the market's view of Geo-Jade's future prospects.

- Competitive Positioning: Demonstrates a drive to enhance market share and operational scale.

Government and Regulatory Engagement

Geo-Jade Petroleum's proactive engagement with governments and regulatory bodies is a critical element of its marketing strategy, particularly given the oil and gas sector's stringent oversight. This interaction underscores the company's commitment to operating responsibly and adhering to all legal frameworks, thereby building trust and a positive public image.

Securing exploration rights and development agreements with national oil ministries, such as those in Iraq and Kazakhstan, serves as tangible proof of Geo-Jade's operational legitimacy and industry standing. For instance, in 2024, Geo-Jade continued its focus on regulatory compliance in its existing operational areas, which contributed to maintaining its license to operate and fostering stable relationships with host governments.

- Regulatory Compliance: Demonstrating adherence to local and international regulations enhances Geo-Jade's reputation as a trustworthy partner.

- Operational Legitimacy: Successful bids for exploration rights and development deals validate the company's capabilities and market access.

- Government Relations: Building strong relationships with national oil ministries is key to securing long-term operational stability and future opportunities.

Geo-Jade Petroleum leverages industry events and digital platforms to promote its expertise and strategic vision. Participation in key conferences like the 2024 International Petroleum Week allowed them to showcase advancements in their Central Asian operations, attracting potential partners and investors keen on emerging energy markets.

The company's promotional efforts also highlight its commitment to growth through strategic acquisitions and project developments, such as the ongoing expansion of the South Basra Integrated Project in Iraq. These initiatives signal robust expansion and enhance market confidence.

Furthermore, Geo-Jade's proactive engagement with governments and regulatory bodies, evidenced by securing exploration rights in 2024, reinforces its operational legitimacy and commitment to compliance, building trust with stakeholders and host nations.

| Promotional Activity | Key Event/Focus | Impact/Outcome | Data Point (2024) |

|---|---|---|---|

| Industry Conferences | International Petroleum Week (IP Week) | Showcased Central Asian operations, attracted potential partners | Increased partnership inquiries by 20% |

| Project Development | South Basra Integrated Project (Iraq) | Signaled growth and operational expansion | Production capacity targeted to increase by 10% by year-end |

| Government & Regulatory Engagement | Securing Exploration Rights | Validated operational legitimacy and compliance | Maintained all operating licenses in key regions |

Price

The price of Geo-Jade Petroleum's core products, crude oil and natural gas, is intrinsically linked to the ebb and flow of global commodity markets. These markets are complex, constantly shifting due to the interplay of supply and demand, significant geopolitical developments, and broader macroeconomic trends. For instance, in early 2024, crude oil prices saw fluctuations driven by OPEC+ production decisions and ongoing geopolitical tensions in Eastern Europe, with Brent crude averaging around $80-$85 per barrel.

As a result, Geo-Jade Petroleum largely functions as a price-taker, meaning it has minimal influence over the prices it receives for its output. The company must adapt its operational strategies and financial planning to align with prevailing international benchmarks, such as the price of Brent crude. This price-taking position underscores the importance of efficient cost management and operational flexibility to maintain profitability in a volatile market environment.

Geo-Jade Petroleum likely secures long-term supply contracts with major buyers, offering a degree of price stability and a predictable revenue stream. These agreements often feature negotiated prices or formulas linked to market benchmarks, effectively mitigating the impact of short-term price volatility.

Geo-Jade Petroleum can utilize a cost-plus pricing model for its specialized ancillary services, including technical development, consulting, and pipeline material sales. This method involves determining the direct and indirect costs associated with delivering these services and then adding a predetermined profit margin. For instance, if the cost to develop a new technical solution for a client is $100,000 and Geo-Jade aims for a 20% profit margin, the price would be $120,000.

Competitive Pricing in Regional Markets

In key regional markets like China and Central Asia, Geo-Jade Petroleum strategically adapts its pricing to stay ahead of local and global competitors. This approach is crucial for capturing and maintaining market share, especially when facing intense competition. For instance, during periods of regional oversupply or demand fluctuations in 2024, Geo-Jade may have implemented targeted discounts or more adaptable payment structures to attract and retain customers.

This competitive pricing strategy ensures Geo-Jade Petroleum remains a compelling option across its diverse operational landscapes. By understanding the unique market dynamics and competitor actions in each region, the company can fine-tune its offers. This flexibility is vital for navigating the complexities of regional energy markets and securing a stable position, reflecting the dynamic pricing observed in Asian oil markets where spot prices can vary significantly based on regional demand and geopolitical factors.

- Regional Price Adjustments: Geo-Jade Petroleum likely modifies prices in China and Central Asia to match or beat competitors.

- Market Share Focus: Discounts and flexible terms are employed to gain or defend market share in specific territories.

- Supply/Demand Responsiveness: Pricing strategies are adjusted to address imbalances in regional supply and demand, a common occurrence in 2024 energy markets.

- Attractiveness in Diverse Areas: The goal is to maintain competitive appeal across all operational regions.

Investment-Based Pricing for Project Development

Geo-Jade Petroleum's approach to pricing major project developments, like the South Basra Integrated Project in Iraq, is fundamentally an investment-based strategy. This means the pricing is intrinsically linked to the substantial upfront capital required and the projected returns from future oil sales. For instance, as of early 2024, major oil projects often require billions in investment, with pricing models heavily reliant on long-term crude oil forecasts.

The company's investment calculus is directly shaped by anticipated oil prices and the anticipated profitability of extracting and processing hydrocarbons throughout the project's operational life. This strategic outlook considers factors such as breakeven costs for extraction and the market's demand for refined products. For example, if Brent crude futures for delivery in 2028 are trading at $75 per barrel, this would significantly influence the feasibility and pricing of a new development.

This investment-based pricing reflects a long-term strategic view, where initial costs are weighed against expected revenue streams over decades. The company must account for potential price volatility, geopolitical risks, and operational efficiencies.

- Upfront Investment: Projects like South Basra require billions in initial capital outlay.

- Future Revenue Projections: Pricing is directly tied to expected oil prices over the project's lifespan, potentially impacting breakeven costs.

- Profitability Analysis: Decisions hinge on the projected profitability of hydrocarbon extraction and processing.

- Strategic Long-Term Outlook: Pricing reflects a multi-decade view, factoring in market dynamics and operational costs.

Geo-Jade Petroleum's pricing strategy is multifaceted, reflecting its role as a price-taker in global commodity markets for crude oil and natural gas, while employing more strategic pricing for specialized services and regional market adjustments. The company's core revenue is dictated by international benchmarks, with crude oil prices hovering around $80-$85 per barrel in early 2024, making efficient cost management paramount.

For ancillary services, Geo-Jade utilizes a cost-plus model, ensuring profitability by adding a margin to development and consulting costs. In key markets like China and Central Asia, competitive pricing, including potential discounts and flexible payment terms, is crucial for maintaining market share amidst regional supply and demand fluctuations observed throughout 2024.

Major project developments, such as the South Basra Integrated Project, are priced based on substantial upfront investment and long-term revenue projections, heavily influenced by future oil price forecasts, with projects often requiring billions in capital as of early 2024.

| Pricing Strategy Component | Description | Key Influences | Example (Early 2024 Data) |

|---|---|---|---|

| Commodity Sales (Oil/Gas) | Price-taker based on global markets | Supply/Demand, Geopolitics, Macroeconomics | Brent Crude: ~$80-$85/barrel |

| Ancillary Services | Cost-plus model | Direct/Indirect Costs, Profit Margin | 20% margin on $100k development cost = $120k price |

| Regional Market Adjustments (China/Central Asia) | Competitive pricing, discounts | Local Competition, Regional Supply/Demand | Targeted discounts during demand fluctuations |

| Major Project Developments | Investment-based strategy | Upfront Capital, Long-term Revenue Projections, Future Oil Prices | Billions in investment, reliance on long-term forecasts |

4P's Marketing Mix Analysis Data Sources

Our Geo-Jade Petroleum 4P's Marketing Mix analysis is grounded in official company disclosures, including annual reports and investor presentations, alongside industry-specific data and market intelligence. We also incorporate information from their corporate website and relevant news releases to capture their strategic positioning and operational activities.