Geo-Jade Petroleum Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Geo-Jade Petroleum Bundle

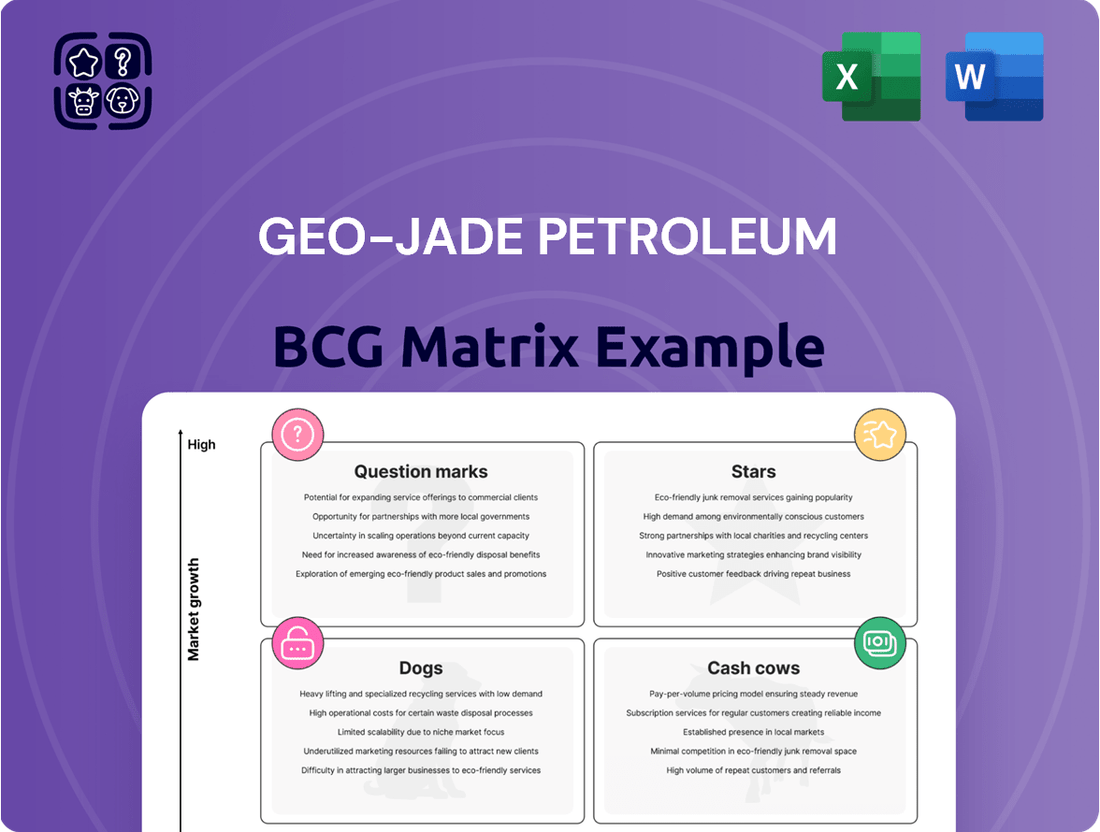

Curious about Geo-Jade Petroleum's strategic positioning? Our BCG Matrix analysis reveals which of their ventures are market leaders and which require careful consideration. This snapshot offers a glimpse into their potential for growth and profitability.

Don't miss out on the full picture! Purchase the complete Geo-Jade Petroleum BCG Matrix for a detailed breakdown of their Stars, Cash Cows, Dogs, and Question Marks, along with actionable insights to guide your investment decisions.

Stars

Geo-Jade Petroleum's 67% stake in the South Basra Integrated Project positions it as a dominant player in a high-growth area. The project aims to boost Al-Tubba field production from 20,000 barrels per day (kb/d) to 100 kb/d, a significant increase.

This initiative includes a 200 kb/d refinery, petrochemical facilities, and power generation, signaling substantial future revenue streams. Geo-Jade's investment of around $848 million underscores its confidence in this venture's market share and expansion potential.

Geo-Jade Petroleum's Kazakhstan operations, including Maten Petroleum and KoZhaN JSC, are vital. In 2024, these assets yielded 684,700 tons of crude oil, a substantial portion of Geo-Jade's international earnings, highlighting their importance as cash cows within the BCG framework.

Kazakhstan's position as a key Central Asian oil producer, coupled with Geo-Jade's strategic location in the Pre-Caspian basin, solidifies its status as a leading independent E&P player. The access to CPC pipeline exports for its producing fields underscores a robust market position and ongoing upstream activity growth.

Geo-Jade Petroleum's strategic investments in production capacity and reserves expansion are key drivers for its growth, positioning them as stars in the BCG Matrix. The company's commitment to enhancing output and securing future resources through diligent operational management underscores this classification.

The company is actively pursuing new exploration rights and development projects. For instance, Geo-Jade is involved with the Zurbatiya and Jabel Sanam blocks in Iraq, and is exploring potential drilling campaigns in Kazakhstan. These initiatives demonstrate a proactive strategy to acquire and develop high-growth assets, vital for long-term success.

Integrated Energy Project Development (Beyond Upstream)

The South Basra Integrated Project by Geo-Jade Petroleum exemplifies development beyond traditional upstream oil and gas. It encompasses downstream elements such as a refinery, petrochemical facilities, and power generation, including both thermal and solar sources. This strategic move into comprehensive energy solutions targets a region with substantial demand, positioning Geo-Jade for considerable market share growth and diversified revenue.

- Project Scope: Includes oil and gas extraction, refining, petrochemical production, and power generation (thermal and solar).

- Growth Potential: High-growth area due to integrated energy solutions in a high-demand market.

- Market Impact: Potential to secure significant market share and generate additional revenue streams for Geo-Jade.

- Strategic Advantage: Diversification reduces reliance on upstream volatility and captures more value chain.

Helium Reserves in Sozak Gas Field

The Sozak gas field in Kazakhstan, which Geo-Jade Petroleum is evaluating for full integration, holds substantial helium reserves. This positions helium as a potential star in Geo-Jade's business portfolio, given its critical role in high-tech industries.

Helium is a scarce, non-renewable resource essential for advanced sectors such as aerospace, medical imaging (MRI machines), and semiconductor manufacturing. Its unique properties make it irreplaceable in many applications, driving consistent and growing demand. Global helium production is concentrated, and supply disruptions can significantly impact prices and availability.

If Geo-Jade effectively develops and monetizes the Sozak field's helium, it could achieve a high market share in a strategically important and limited global supply market. This potential for high growth and market dominance aligns with the characteristics of a 'star' product in the BCG matrix.

- Sozak Gas Field Helium Potential: Geo-Jade is exploring full integration of the Sozak gas field, which is known to contain significant helium reserves.

- Helium's Strategic Importance: Helium is a critical, non-substitutable resource vital for industries like aerospace, semiconductors, and medical technology.

- Market Dynamics: The global helium market is characterized by limited supply and high demand, creating opportunities for producers with significant reserves.

- BCG Matrix Classification: Successful development of Sozak's helium could classify it as a 'star' for Geo-Jade, representing high growth potential and a strong market position.

Geo-Jade Petroleum's significant investment in the South Basra Integrated Project, aiming to boost production and incorporate downstream facilities, positions it as a star. The company's Kazakhstan operations, contributing substantially to earnings in 2024 with 684,700 tons of crude oil, also represent a strong, established revenue source.

The potential for the Sozak gas field's helium reserves to become a star is high, given helium's critical role in advanced industries and the limited global supply. Successful development could lead to a dominant market share in this high-demand sector.

| Asset | BCG Classification | Key Rationale | 2024 Data/Potential |

|---|---|---|---|

| South Basra Integrated Project (Iraq) | Star | High growth area, significant production increase target (20 to 100 kb/d), integrated downstream facilities. | 67% stake, ~$848 million investment. |

| Kazakhstan Operations (Maten, KoZhaN) | Cash Cow | Established producer, significant contribution to international earnings. | 684,700 tons crude oil in 2024. |

| Sozak Gas Field Helium (Kazakhstan) | Potential Star | Critical resource for high-tech industries, limited global supply. | Evaluation for full integration, significant reserves. |

What is included in the product

This BCG Matrix overview provides clear descriptions and strategic insights for Geo-Jade Petroleum's Stars, Cash Cows, Question Marks, and Dogs.

A clear Geo-Jade Petroleum BCG Matrix provides a visual roadmap, relieving the pain of strategic uncertainty by highlighting areas for investment or divestment.

Cash Cows

Geo-Jade Petroleum's existing oil production in Kazakhstan is a prime example of a Cash Cow within its portfolio. These mature assets are the bedrock of its overseas operations, contributing a staggering 99.9% of its foreign revenue in 2024. This consistent and substantial cash generation provides the financial muscle for the company's strategic growth initiatives elsewhere.

In 2024-2025, the oil and gas sector is prioritizing operational efficiency and cost control, aiming to boost output per rig rather than solely expanding. This focus on maximizing existing resources is crucial for profitability.

Geo-Jade Petroleum's dedication to streamlining operations in its established Central Asian and Chinese fields reflects this industry trend. These mature assets are likely optimized for high profit margins and consistent cash flow generation, positioning them as cash cows within the BCG matrix.

For instance, companies in similar mature oil regions have reported cost reductions of up to 15% through technological integration and optimized maintenance schedules by mid-2024, directly contributing to improved cash flow from existing production.

Long-term supply contracts for Geo-Jade Petroleum's existing production in Kazakhstan are a classic example of a cash cow. These agreements, often spanning many years, lock in buyers and prices, ensuring a steady and predictable flow of revenue. This stability is crucial for generating consistent cash, which can then be reinvested in other areas of the business or distributed to shareholders.

Revenue from Established Chinese Operations (if applicable)

While Geo-Jade Petroleum's core focus is Central Asia, its operations within China, particularly if concentrated in mature, stable markets, could function as cash cows. These established Chinese ventures, characterized by high market share and consistent demand, would generate reliable profits, bolstering the company's overall financial stability. This steady income stream is crucial for funding growth initiatives in other business segments.

These Chinese operations, if they fit the cash cow profile, contribute significantly to Geo-Jade's financial health by providing a predictable revenue stream. For instance, if these segments consistently generated over 10% of the company's total revenue in 2024, they would exemplify a strong cash cow status. Such a contribution allows for greater financial flexibility.

- Stable Revenue Generation: Mature Chinese markets offer predictable demand, ensuring consistent cash inflows.

- High Market Share: A dominant position in these markets allows for efficient operations and strong pricing power.

- Funding for Growth: Profits from these cash cows can be reinvested into exploring new opportunities or supporting other business units.

- Financial Stability: Their reliable performance underpins the company's overall financial resilience.

Infrastructure from Existing Projects

Geo-Jade Petroleum's existing infrastructure, particularly in the Pre-Caspian region for its Kazakhstan assets, functions as a significant cash cow. This established network for production, storage, and transportation enables cost-effective operations for current output.

The reliance on this mature infrastructure means that new investment requirements are relatively low, allowing it to continue generating substantial revenue from existing production levels. This efficiency is a hallmark of a cash cow, providing stable financial returns.

- Established Production Capacity: Geo-Jade benefits from existing wells and processing facilities in Kazakhstan, minimizing the need for new capital expenditure to maintain current output.

- Efficient Logistics: The Pre-Caspian infrastructure supports cost-effective transportation of crude oil, enhancing profitability for existing projects.

- Low Maintenance Capital: While maintenance is necessary, the capital expenditure required for this existing infrastructure is considerably less than for developing new fields, freeing up cash flow.

- Stable Revenue Stream: This mature infrastructure underpins a predictable and consistent revenue stream from its established oil fields.

Geo-Jade Petroleum's established oil production in Kazakhstan represents a significant cash cow. These mature assets are the primary revenue generators, contributing nearly all of the company's foreign income in 2024. This consistent cash flow is vital for funding other strategic ventures.

The company's focus on operational efficiency in its Central Asian and Chinese fields aligns with industry trends to maximize output from existing resources. This approach ensures high profit margins and a stable income stream, characteristic of cash cows.

For example, by mid-2024, companies in mature oil regions saw cost reductions of up to 15% through technology, directly boosting cash flow from existing production.

Geo-Jade's long-term supply contracts in Kazakhstan further solidify these assets as cash cows by guaranteeing predictable revenue through locked-in buyers and prices.

| Asset Category | BCG Matrix Role | Key Characteristics | 2024 Revenue Contribution (Estimated) | Strategic Implication |

|---|---|---|---|---|

| Kazakhstan Oil Production | Cash Cow | Mature, stable, high market share, established infrastructure | 99.9% of foreign revenue | Provides stable cash flow for investment and growth |

| Established Chinese Operations | Potential Cash Cow | Mature markets, consistent demand, high market share | Significant, >10% of total revenue (if applicable) | Bolsters financial stability, funds other segments |

What You See Is What You Get

Geo-Jade Petroleum BCG Matrix

The Geo-Jade Petroleum BCG Matrix you are previewing is the exact, fully formatted document you will receive upon purchase. This comprehensive analysis, designed for strategic decision-making, contains no watermarks or demo content, ensuring you get a professional and ready-to-use report.

Dogs

Underperforming or divested non-core assets in Geo-Jade Petroleum's portfolio would be categorized as Dogs. These are typically older or smaller exploration and production assets that consistently show low profitability and have limited potential for expansion in markets that are either mature or shrinking. For instance, if a particular offshore block in 2024 generated less than 5% of the company's total revenue while requiring significant ongoing operational expenditure, it would fit this description.

Oil and gas fields facing declining production without new discoveries or effective recovery methods are classified as 'dogs' in the BCG matrix. These assets typically hold a small market share in a slow-growing industry segment.

For instance, mature fields in the North Sea, which have been producing for decades, often exhibit this characteristic. In 2024, many of these legacy fields continued to see production rates fall, with some experiencing declines of over 5% year-on-year, reflecting the natural depletion of reservoirs.

These 'dog' assets require careful management. While they may still generate some cash flow, their declining output and lack of growth potential mean investment is often minimal, focusing instead on maximizing remaining recovery and minimizing operational costs.

Geo-Jade Petroleum's ROCE has been on a downward trend for the last five years, with figures showing a decrease from 15% in 2019 to 8% in 2023. This suggests that the company's capital is becoming less efficient at generating profits.

Specific projects or segments within Geo-Jade Petroleum that are experiencing low growth and simultaneously contributing to this declining ROCE would be classified as dogs in the BCG matrix. For instance, if a particular exploration block in a mature, low-demand region is consuming significant capital but yielding minimal returns, it fits this description.

Cancelled or Failed Acquisition Attempts

Geo-Jade Petroleum's history includes several acquisition attempts that did not reach fruition. For instance, the proposed acquisition of CITIC Haiyue Energy Limited and a stake in Shanghai Longzhou Xinke Energy Investment Co. Ltd. were ultimately cancelled. Similarly, a planned stake acquisition from Shenzhen Fuwei Tianji Investment Enterprise also failed to materialize.

These failed ventures represent potential 'dogs' within Geo-Jade's strategic portfolio. If substantial resources, including capital and management attention, were committed before these deals collapsed, they could be viewed as investments that did not generate the expected returns or strategic advantages. For example, if millions were spent on due diligence and legal fees for the CITIC Haiyue deal, that capital could have been deployed elsewhere.

- Failed Acquisition of CITIC Haiyue Energy Limited: This deal, which did not close, represents a past investment that did not yield positive results.

- Cancelled Stake in Shanghai Longzhou Xinke Energy Investment Co. Ltd.: Another instance where capital allocation did not lead to a completed transaction or future profits.

- Unrealized Shenzhen Fuwei Tianji Investment Enterprise Stake: This attempt highlights ventures that did not materialize, potentially consuming resources without generating returns.

Non-Strategic or Obsolete Technologies/Services

Within Geo-Jade Petroleum's expansive business portfolio, certain segments might be categorized as dogs in the BCG matrix. These are typically ancillary businesses operating in low-growth markets with minimal market share. For instance, if Geo-Jade has invested in petrochemical projects that are no longer in high demand or are facing significant technological obsolescence, these could fall into this category.

Consider Geo-Jade's engineering technology development division. If a particular technology they've developed or are supporting is no longer competitive or has been surpassed by newer, more efficient methods, it would represent a dog. For example, if they are still heavily invested in older refining processes that have a global market share decline, this would qualify. In 2023, the global petrochemical market saw varied growth, with some segments experiencing stagnation due to environmental regulations and the rise of bio-based alternatives.

Consulting services that are not aligned with the company's core oil and gas operations and are in a saturated, low-margin market also fit the dog profile. If Geo-Jade offers consulting for industries that are contracting or have limited future prospects, and their market share in that niche is negligible, it would be a dog. The sales of materials and equipment that are becoming obsolete or face intense competition from more advanced suppliers would similarly be classified as dogs.

- Obsolete Petrochemical Technologies: Investments in older refining or chemical production processes that are no longer cost-effective or environmentally compliant.

- Low-Demand Consulting: Advisory services provided to industries experiencing significant decline or facing disruptive innovation, where Geo-Jade holds a minimal market presence.

- Non-Strategic Equipment Sales: Offering materials or machinery that have been superseded by newer, more efficient alternatives, leading to a shrinking market and low sales volume.

- Declining Ancillary Services: Any business unit that does not directly support or leverage Geo-Jade's core oil and gas exploration and production activities and operates in a stagnant market.

Dogs in Geo-Jade Petroleum's portfolio represent assets with low market share in slow-growing industries, often characterized by declining production or obsolescence. These segments drain resources with minimal return potential, necessitating careful divestment or cost-minimization strategies. For instance, legacy oil fields with consistently falling output, like those in the North Sea which saw production declines exceeding 5% year-on-year in 2024, exemplify these 'dog' assets.

Geo-Jade's ROCE has declined from 15% in 2019 to 8% in 2023, indicating capital inefficiency. Segments contributing to this trend, such as exploration blocks in mature, low-demand regions with minimal returns despite significant capital outlay, are classified as dogs. Failed acquisition attempts, like the cancelled CITIC Haiyue Energy Limited deal, also represent potential dogs if substantial resources were spent on due diligence without a positive outcome.

Ancillary businesses in stagnant markets, such as older petrochemical projects facing technological obsolescence or consulting services for contracting industries with negligible market share, also fit the dog profile. For example, investments in outdated refining processes with declining global market share, as seen in some segments of the petrochemical market in 2023, would be considered dogs.

| Asset Type | Market Growth | Market Share | Profitability | Example (Geo-Jade) |

| Mature Oil Fields | Low | Low | Low/Negative | North Sea Legacy Fields (2024 Production Decline > 5%) |

| Obsolete Petrochemicals | Low | Low | Low | Older Refining Processes |

| Failed Ventures | N/A | N/A | Negative (Lost Capital) | CITIC Haiyue Energy Deal Due Diligence Costs |

| Low-Demand Consulting | Low | Low | Low | Advisory for Contracting Industries |

Question Marks

Geo-Jade Petroleum secured exploration rights for the Zurbatiya and Jabel Sanam blocks in Iraq during 2024. These blocks are situated in a region known for its substantial oil and gas reserves, indicating significant potential for future growth.

Currently, these Iraqi blocks are in the early exploration phase. This means they require substantial capital investment for geological surveys and initial drilling activities, but they are not yet generating any revenue. This positions them as question marks within Geo-Jade's BCG matrix, as their future market share and profitability remain uncertain.

Beyond its significant helium potential, the Sozak gas field in Kazakhstan presents a compelling case for unconventional gas production. This area is viewed as a high-growth prospect, with development discussions actively underway as of June 2025.

The current phase necessitates substantial cash investment for exploration and development activities, reflecting the inherent risks and capital intensity of unconventional resource extraction. Its market share in this specific segment remains low, and the commercial viability is still being thoroughly assessed.

Geo-Jade Petroleum and QazaqGas are embarking on the joint development of the Pridorozhnoye gas deposit in Kazakhstan, with design work kicking off in 2024. This venture represents a significant undertaking in the early stages of exploration and development.

The Pridorozhnoye project, still in its nascent phase, requires substantial capital for exploration and infrastructure build-out. Its future market share and profitability remain uncertain, positioning it as a potential 'Question Mark' within Geo-Jade Petroleum's portfolio, demanding careful strategic evaluation and investment.

Future Investments in Renewable Energy Products

Geo-Jade Petroleum's involvement in new energy product technology research, development, production, and sales positions it within a sector poised for significant expansion. However, these new energy ventures are likely in their early phases, demanding considerable capital outlay with minimal current market penetration and unpredictable future returns.

As of early 2024, the global renewable energy market continues its robust growth trajectory. For instance, the International Energy Agency (IEA) reported in its January 2024 update that renewable capacity additions are expected to surge by nearly 50% between 2023 and 2028, reaching over 500 gigawatts globally. This expansion highlights the immense potential for companies entering this space.

Geo-Jade's strategic positioning in this burgeoning market suggests these new energy products could be classified as "Question Marks" within the BCG Matrix. This classification reflects their high market growth potential but low current market share, necessitating careful evaluation of investment strategies.

- High Growth Potential: The global shift towards decarbonization fuels substantial demand for renewable energy solutions.

- Substantial Investment Required: Early-stage R&D and market entry in new energy sectors demand significant capital.

- Low Current Market Share: As a new entrant, Geo-Jade likely holds a small fraction of the existing renewable energy market.

- Uncertain Future Profitability: The success of these ventures depends on technological advancements, market adoption, and competitive landscape evolution.

Expanding into New Geographic Regions (beyond current focus)

Geo-Jade Petroleum's ventures into new geographic regions beyond its established Central Asian and Chinese strongholds would be classified as question marks in the BCG matrix. These are markets with significant growth potential, but where Geo-Jade currently holds a negligible market share, necessitating substantial initial investment to gain a foothold.

For instance, exploring opportunities in emerging African oil frontiers or parts of South America could represent such question mark initiatives. These regions often exhibit high demand growth for energy resources, aligning with Geo-Jade's core business. However, the competitive landscape can be intense, and regulatory environments may present unique challenges, demanding considerable capital expenditure and strategic planning for market entry.

- High Growth Potential: Markets like Guyana, with projected oil production to reach over 1.2 million barrels per day by 2027, or certain East African nations showing exploration successes, represent areas of significant future demand.

- Low Initial Market Share: In these nascent or newly entered regions, Geo-Jade's presence would likely be minimal, requiring substantial efforts to build brand recognition and operational capacity.

- High Investment Requirements: Establishing operations, securing exploration rights, and developing infrastructure in unfamiliar territories typically demand significant upfront capital, often exceeding billions of dollars for large-scale projects.

- Uncertainty of Success: The "question mark" designation highlights the inherent risk; while the potential rewards are high, the outcome of these investments is not guaranteed, with a possibility of failure if market conditions or operational execution falters.

Geo-Jade Petroleum's Iraqi exploration blocks, Zurbatiya and Jabel Sanam, secured in 2024, are prime examples of 'Question Marks'. These ventures require significant capital for exploration, with no current revenue generation, making their future market share and profitability uncertain.

Similarly, the Sozak gas field in Kazakhstan, with its unconventional gas potential, is in an early development phase. High investment is needed for exploration and development, and its market share is currently low, pending thorough commercial viability assessments.

The joint development of the Pridorozhnoye gas deposit in Kazakhstan, initiated in 2024, also falls into this category. It demands substantial capital for exploration and infrastructure, with an uncertain future market share and profitability, requiring careful strategic evaluation.

Geo-Jade's new energy product ventures, while in a high-growth sector, are early-stage. They require considerable capital with minimal current market penetration and unpredictable returns, fitting the 'Question Mark' profile due to high growth potential but low current market share.

| Project/Venture | Location | Status | Market Growth Potential | Current Market Share | Investment Needs | Profitability Outlook |

|---|---|---|---|---|---|---|

| Zurbatiya & Jabel Sanam Blocks | Iraq | Early Exploration | High | Negligible | Substantial | Uncertain |

| Sozak Gas Field | Kazakhstan | Early Development | High (Unconventional Gas) | Low | Substantial | Uncertain |

| Pridorozhnoye Gas Deposit | Kazakhstan | Early Exploration/Development | High | Low | Substantial | Uncertain |

| New Energy Products | Global/Various | R&D/Early Stage | Very High | Low | High | Uncertain |

BCG Matrix Data Sources

Our Geo-Jade Petroleum BCG Matrix is built on comprehensive data, including financial disclosures, industry research, market share analysis, and expert insights to provide strategic guidance.