Genworth Financial PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Genworth Financial Bundle

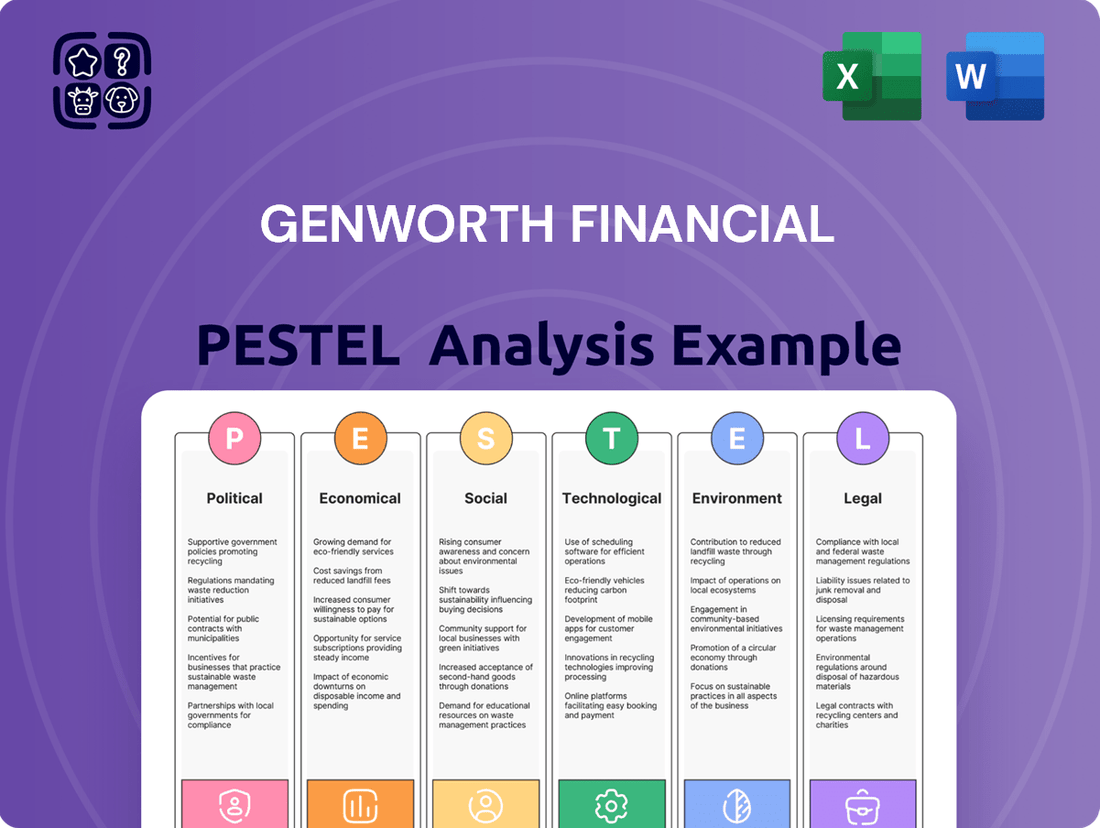

Navigating the complex landscape of the financial services industry requires a keen understanding of external forces. Our PESTLE analysis for Genworth Financial delves deep into the political, economic, social, technological, legal, and environmental factors that are actively shaping its present and future. Discover how shifts in these areas present both challenges and opportunities for the company.

Gain a competitive advantage by understanding the intricate web of influences affecting Genworth Financial. Our expertly crafted analysis provides actionable intelligence, empowering you to make informed strategic decisions. Don't get left behind; unlock the full PESTLE analysis now and equip yourself with the insights needed to thrive.

Political factors

Government housing policies significantly impact Genworth's mortgage insurance business. For instance, initiatives like the US Federal Housing Administration (FHA) loan programs, which offer lower down payment options, directly influence the volume of mortgages requiring private mortgage insurance when FHA limits are reached or for borrowers exceeding FHA eligibility. In 2024, the FHA's loan limits were adjusted, with the baseline limit increasing to $498,279 in most areas and $1,133,200 in high-cost areas, potentially affecting the demand for private mortgage insurance on FHA-backed loans.

Changes in policies promoting homeownership, such as first-time homebuyer tax credits or adjustments to loan-to-value ratios, can either boost or dampen demand for mortgage insurance. For example, if a government introduces a new incentive that makes it easier for individuals to purchase homes with very low down payments, this could lead to a higher volume of insured mortgages. Conversely, tighter lending standards or reduced government support could decrease this volume.

The availability and scope of government-backed mortgage programs, like Canada Mortgage and Housing Corporation (CMHC) insurance, create direct competition for private insurers like Genworth. Shifts in CMHC's pricing, coverage, or eligibility criteria can alter market dynamics, influencing Genworth's market share and pricing strategies within Canada. Fiscal policies aimed at housing affordability and development also play a role, as they can influence overall housing market activity and, by extension, the demand for mortgage insurance.

Legislative shifts in healthcare funding, including changes to Medicare and Medicaid, directly affect Genworth's long-term care insurance business. For instance, ongoing debates about the sustainability of these programs and potential expansions of benefits could alter the demand for private long-term care solutions. In 2024, continued discussions around healthcare affordability and access will likely shape how consumers view and purchase private insurance.

The financial services and insurance industries face significant regulatory oversight, directly impacting Genworth's operational flexibility and compliance expenses. Political shifts can introduce stricter consumer protection mandates, alter capital reserve requirements for insurers, or modify regulations governing financial product sales and marketing. For instance, in 2024, ongoing discussions around data privacy regulations, such as potential updates to state-level privacy laws mirroring aspects of GDPR, could necessitate further investment in compliance infrastructure for Genworth.

International Relations and Trade Agreements

Political stability and robust trade relations are crucial for Genworth Financial's Canada Mortgage Insurance segment. The close economic ties with the United States, Canada's largest trading partner, mean that any shifts in this relationship can have ripple effects. For instance, the USMCA (United States-Mexico-Canada Agreement), which replaced NAFTA, continues to shape trade dynamics. In 2023, Canada's trade surplus with the US reached approximately CAD 137 billion, highlighting the significance of this partnership for economic stability.

Geopolitical tensions or alterations to existing trade agreements can indirectly influence economic growth, housing market performance, and overall investor confidence within Canada. A predictable business environment, fostered by stable international relations, is essential for the mortgage insurance sector. For example, disruptions in cross-border trade or investment flows could impact the affordability of housing and the demand for mortgage insurance.

- USMCA Impact: The continued implementation of the USMCA provides a framework for trade, influencing economic conditions relevant to the Canadian housing market.

- Trade Balance: Canada's significant trade surplus with the US underscores the importance of stable bilateral relations for economic predictability.

- Investor Confidence: Geopolitical stability directly correlates with investor confidence, affecting capital flows into the Canadian housing market and, by extension, mortgage insurance demand.

Fiscal and Monetary Policy Direction

The political landscape significantly shapes Genworth's operating environment through fiscal and monetary policy. A government's approach to spending and taxation directly impacts economic growth and inflation, influencing interest rate levels. For instance, as of early 2024, many developed economies are grappling with inflationary pressures, leading central banks to maintain higher interest rates, which in turn affects mortgage affordability and the returns Genworth can achieve on its investment reserves.

Monetary policy decisions, particularly by the U.S. Federal Reserve and other major central banks, are critical. Their actions on interest rates and quantitative easing or tightening directly influence the cost of capital and the valuation of financial assets. In 2024, the focus remains on balancing inflation control with economic growth, a delicate act that can lead to volatility in financial markets, impacting Genworth's investment portfolio and its ability to price its insurance products competitively.

Government debt levels and budgetary priorities also present political factors. High national debt can lead to concerns about future tax increases or spending cuts, potentially dampening consumer confidence and demand for financial services. Genworth, like other financial institutions, monitors these fiscal trends closely as they can affect long-term economic stability and consumer purchasing power for products like mortgages and long-term care insurance.

- Fiscal Stance: Government spending and taxation policies impact consumer disposable income and business investment, directly affecting demand for Genworth's products.

- Monetary Policy: Central bank interest rate decisions influence Genworth's investment income and the cost of borrowing for its customers. As of mid-2024, inflation concerns continue to guide monetary policy in major economies.

- Government Debt: High levels of national debt can signal future fiscal adjustments, potentially impacting economic stability and consumer confidence.

- Regulatory Environment: Political decisions on financial regulation can alter Genworth's compliance costs and operational flexibility.

Government housing policies directly influence Genworth's mortgage insurance business, with initiatives like FHA loan programs impacting demand. For example, the FHA's 2024 loan limit adjustments in high-cost areas to $1,133,200 could affect the volume of mortgages requiring private mortgage insurance.

Changes in government support for homeownership, such as first-time homebuyer credits, can either boost or curb demand for mortgage insurance. Similarly, the presence and policies of government-backed mortgage insurers, like Canada's CMHC, create competitive dynamics for Genworth.

Legislative changes in healthcare funding, including Medicare and Medicaid, directly impact Genworth's long-term care insurance. Ongoing discussions about healthcare affordability in 2024 will likely shape consumer decisions regarding private long-term care solutions.

The political environment dictates regulatory oversight for financial services, affecting Genworth's compliance costs and operational flexibility. Potential updates to data privacy regulations in 2024 could necessitate further investment in compliance infrastructure.

What is included in the product

This Genworth Financial PESTLE Analysis provides a comprehensive examination of the Political, Economic, Social, Technological, Environmental, and Legal factors impacting the company.

It offers actionable insights for strategic decision-making by identifying potential threats and opportunities within Genworth Financial's operating landscape.

A concise, PESTLE-driven overview of Genworth Financial's external landscape, streamlining strategic discussions and identifying key opportunities and threats.

Economic factors

Interest rate fluctuations are a major concern for Genworth. For instance, if the Federal Reserve continues its tightening cycle, higher borrowing costs could dampen housing market activity, directly impacting Genworth's mortgage insurance segment.

The current interest rate environment, with the Federal Funds Rate hovering around 5.25%-5.50% as of mid-2024, also affects Genworth's long-term care insurance. Higher rates can boost investment income on reserves, potentially improving profitability, but also increase the cost of capital for new business.

The housing market's vitality, marked by home price trends, new and existing home sales, and foreclosure activity, directly influences Genworth's mortgage insurance business. A strong housing sector typically boosts mortgage originations and reduces claim payouts, whereas a weakening market elevates risk and dampens demand.

For instance, in early 2024, the U.S. median home price saw continued appreciation, though the pace moderated compared to prior years. New home sales in February 2024, according to the U.S. Census Bureau, were at a seasonally adjusted annual rate of 661,000 units, indicating a resilient market. Conversely, existing home sales faced headwinds from higher interest rates, impacting affordability and transaction volumes.

Regional differences are crucial; a booming market in one area might offset a slowdown in another, impacting Genworth's exposure and risk assessment across its portfolio.

Rising inflation, especially within the healthcare sector, poses a significant challenge for Genworth. For instance, the U.S. Bureau of Labor Statistics reported that medical care inflation averaged 5.5% in 2023, a notable increase from previous years. This directly escalates the cost of long-term care claims, potentially impacting the profitability of Genworth's existing long-term care insurance policies.

In the realm of mortgage insurance, inflation influences property values and the broader economic landscape. As of early 2024, while housing price growth has moderated, persistent inflation in building materials and labor costs can still affect home affordability and the risk profile of insured mortgages. Effectively managing these inflationary pressures is paramount for Genworth to ensure accurate product pricing and maintain adequate reserves across its business lines.

Economic Growth and Employment Rates

Robust economic growth and low unemployment are generally positive for Genworth Financial. For instance, in the U.S., the unemployment rate hovered around 3.7% in late 2024, a historically low figure. This environment typically boosts consumer confidence, leading to greater demand for financial products like mortgages and long-term care insurance, which are key to Genworth's business. Higher employment means more people have stable incomes to afford premiums and are more likely to invest in financial security.

Conversely, economic slowdowns present challenges. During a recession, rising unemployment can lead to increased mortgage defaults, directly impacting Genworth's loan servicing business. Furthermore, job losses reduce disposable income, making consumers more hesitant to purchase or maintain insurance policies. For example, if the U.S. unemployment rate were to climb to 6% or higher, as seen in some past downturns, Genworth could face higher claim payouts and reduced new business acquisition.

- Economic Growth Impact: Strong GDP growth, such as the projected 2.5% for the U.S. in 2025, typically fuels demand for Genworth's insurance and mortgage services.

- Employment Stability: Low unemployment rates, like the 3.7% seen in late 2024, enhance consumer purchasing power and confidence in long-term financial commitments.

- Recessionary Risks: An economic downturn leading to higher unemployment (e.g., exceeding 5%) can increase mortgage defaults and reduce insurance premium affordability for Genworth's customers.

- Consumer Confidence: Stable employment and economic growth correlate with higher consumer confidence, a critical driver for the uptake of insurance and mortgage products.

Consumer Debt Levels and Disposable Income

The aggregate level of consumer debt and the availability of disposable income are critical indicators for Genworth Financial. High consumer debt, such as credit card balances and auto loans, can directly impact an individual's capacity to take on new financial obligations like mortgages or insurance policies. For instance, in the first quarter of 2024, total household debt in the United States reached a record $17.7 trillion, according to the Federal Reserve Bank of New York. This figure highlights a significant financial burden on consumers.

Conversely, disposable income, the money left after taxes and essential expenses, dictates consumers' purchasing power and their ability to afford discretionary spending, including insurance premiums and investment products. As of the first quarter of 2024, U.S. disposable income saw a notable increase, providing some relief, but the persistent high levels of debt remain a constraint. This dynamic directly influences the demand for Genworth's offerings.

- Consumer Debt Impact: High debt levels can limit mortgage qualification and insurance affordability, potentially reducing Genworth's customer base.

- Disposable Income Influence: Increased disposable income can boost demand for financial products, expanding Genworth's addressable market.

- 2024 Data Snapshot: U.S. household debt hit $17.7 trillion in Q1 2024, while disposable income showed growth, creating a mixed financial landscape for consumers.

- Market Responsiveness: Genworth's success is tied to its ability to navigate economic conditions where consumers are financially healthy enough to purchase its services.

Economic factors significantly shape Genworth Financial's operating environment. Interest rate shifts directly impact mortgage insurance profitability and long-term care insurance investment income. For instance, the Federal Funds Rate around 5.25%-5.50% in mid-2024 influences borrowing costs and investment returns.

The housing market's health, evidenced by home price appreciation and sales volumes, is crucial for Genworth's mortgage insurance segment. U.S. median home prices continued to rise in early 2024, though at a moderated pace, while new home sales reached 661,000 units in February 2024.

Inflation, particularly in healthcare, increases the cost of long-term care claims, with medical care inflation averaging 5.5% in 2023. Persistent inflation also affects building material costs, impacting housing affordability and mortgage risk.

Robust economic growth and low unemployment, such as the 3.7% U.S. unemployment rate in late 2024, generally boost demand for Genworth's products. Conversely, economic slowdowns and rising unemployment increase mortgage default risk and reduce insurance affordability.

| Economic Factor | Key Metric | 2024/2025 Data Point | Impact on Genworth |

|---|---|---|---|

| Interest Rates | Federal Funds Rate | 5.25%-5.50% (Mid-2024) | Affects borrowing costs, mortgage demand, and investment income. |

| Housing Market | New Home Sales | 661,000 units (Feb 2024) | Influences mortgage origination volumes and risk. |

| Inflation | Medical Care Inflation | 5.5% average (2023) | Increases long-term care claim costs. |

| Employment | Unemployment Rate | 3.7% (Late 2024) | Low rates support consumer confidence and demand for financial products. |

Full Version Awaits

Genworth Financial PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive PESTLE analysis of Genworth Financial delves into Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company.

What you’re previewing here is the actual file—fully formatted and professionally structured. It provides a detailed examination of the external forces shaping Genworth Financial's strategic landscape, offering valuable insights for decision-making.

The content and structure shown in the preview is the same document you’ll download after payment. This PESTLE analysis is designed to equip you with a thorough understanding of the macro-environmental influences on Genworth Financial.

Sociological factors

The global population is aging significantly, especially in countries like the US and Canada. This demographic shift is a major reason why demand for long-term care insurance is growing. As people are living longer, they are more likely to need assistance with everyday tasks for extended periods, making long-term care solutions a financial necessity.

In the US, the number of people aged 65 and over is projected to reach 80 million by 2040, nearly doubling from 2012. This increasing life expectancy directly translates to a greater need for long-term care services, a core market for Genworth's offerings.

Societal attitudes are shifting, with a growing recognition of the challenges associated with an aging population. This evolving perspective directly impacts how individuals view and plan for long-term care needs. As traditional family support networks change, there's an increasing reliance on formal solutions, like insurance, rather than solely on familial or governmental assistance.

In 2024, approximately 53 million adults in the U.S. provided unpaid care to an adult or child, a significant number highlighting the prevalence of family caregiving. However, the financial burden of this care is substantial, with the estimated economic value of unpaid caregiving reaching $490 billion in 2023. This growing awareness of care costs, coupled with changing family dynamics, is likely to drive greater consumer interest in long-term care insurance products.

Cultural norms also play a crucial role. Societies that emphasize individual independence and proactive financial planning tend to see higher adoption rates of insurance products designed to cover future care needs. As more people recognize the potential costs and complexities of aging, these cultural underpinnings will further shape the demand for financial security solutions.

Growing public emphasis on health, wellness, and proactive healthcare is significantly influencing the demand for long-term care services. As people prioritize healthier living, the onset of conditions requiring extensive care may be delayed, but extended life expectancies mean a higher cumulative need for such services over an individual's lifespan.

For instance, in 2024, the global health and wellness market was valued at over $5.0 trillion, reflecting a strong consumer commitment to well-being. This trend directly impacts how individuals approach financial planning for potential future care needs, increasing interest in insurance products that cover these eventualities.

Financial Literacy and Planning Behaviors

The level of financial literacy significantly impacts the uptake of long-term care insurance. In 2024, a substantial portion of the adult population still struggles with basic financial concepts, particularly those related to retirement and the escalating costs of aging. This lack of awareness can hinder the adoption of products designed to mitigate these future expenses.

Consumers who demonstrate higher financial awareness and actively plan for future uncertainties are more receptive to Genworth's offerings. A 2025 survey indicated that individuals with a clear retirement savings plan were 40% more likely to explore long-term care solutions compared to those without one.

Educational programs play a crucial role in bridging this knowledge gap. Initiatives aimed at improving financial understanding, especially concerning the long-term care needs of an aging population, can boost market penetration for insurance providers like Genworth.

- 2024 Data: Approximately 60% of US adults reported feeling stressed about their financial future, with a significant portion citing retirement as a primary concern.

- 2025 Projection: Experts anticipate a growing demand for financial education, with online platforms expected to reach over 50 million users seeking retirement planning advice.

- Impact on Genworth: Financially literate individuals are more likely to understand the value proposition of long-term care insurance, leading to increased product adoption.

- Market Opportunity: Targeted educational campaigns can unlock a larger market segment for long-term care solutions by demystifying costs and planning strategies.

Homeownership Aspirations and Lifestyles

The deep-seated desire for homeownership remains a significant driver for mortgage insurance in North America. Despite economic shifts, this aspiration continues to shape housing demand and, by extension, the need for products like those offered by Genworth.

However, evolving societal trends are reshaping this aspiration. For instance, data from 2024 indicates a continued trend of delayed homeownership among millennials and Gen Z, often due to student loan debt and rising housing costs, which can temper immediate demand for traditional mortgages and related insurance.

Furthermore, shifts in lifestyle, such as increasing preferences for urban living or smaller, more sustainable housing options, directly influence the types of properties being financed and the associated mortgage insurance needs. This diversification in housing preferences requires mortgage insurers to adapt their product offerings.

- Enduring Homeownership Dream: The cultural significance of owning a home in North America remains a core pillar supporting the mortgage insurance sector.

- Generational Shifts: Younger generations, facing affordability challenges and different life priorities, are delaying home purchases, impacting the volume of new mortgage insurance policies. For example, in 2023, the average age of first-time homebuyers in the US reached a new high, reflecting this trend.

- Urbanization and Housing Types: Migration to urban centers and a growing interest in diverse housing styles, from condos to townhouses, alter the landscape of mortgage financing and insurance requirements.

The aging global population is a primary driver for Genworth's long-term care insurance, as increased life expectancy necessitates greater planning for future care needs. Societal attitudes are increasingly recognizing the financial burden of caregiving, pushing individuals towards formal insurance solutions as family support structures evolve.

Financial literacy significantly influences the adoption of long-term care insurance, with a 2025 projection indicating a surge in demand for retirement planning education. Culturally, societies valuing independence and proactive planning show higher uptake of these products, directly benefiting Genworth.

| Sociological Factor | 2024/2025 Data/Projection | Impact on Genworth |

|---|---|---|

| Aging Population | US population aged 65+ projected to reach 80 million by 2040. | Increased demand for long-term care insurance. |

| Caregiving Burden | Estimated economic value of unpaid caregiving was $490 billion in 2023. | Growing awareness of costs drives interest in insurance. |

| Financial Literacy | 60% of US adults stressed about financial future (2024); 50M+ users seeking retirement advice (2025 projection). | Higher adoption by financially aware consumers; opportunity for educational campaigns. |

| Homeownership Trends | Average age of first-time homebuyers reached a new high in 2023. | Shifts in demand for mortgage insurance due to delayed purchases. |

Technological factors

Genworth's competitive edge hinges on its digital transformation, which streamlines operations and improves customer interactions. The company is actively integrating online portals for policy management and claims, aiming for greater efficiency. This digital shift is crucial for cost reduction and reaching a wider audience through digital marketing.

Genworth can leverage advanced data analytics and AI to significantly enhance its risk assessment and underwriting processes for both mortgage and long-term care insurance. This technology allows for more precise fraud detection, ultimately reducing potential losses.

AI's ability to personalize product offerings and anticipate customer needs presents a key opportunity for Genworth to boost customer engagement and retention. Furthermore, optimizing pricing strategies through AI can lead to more efficient capital allocation and better management of claims expenses.

As a financial services firm, Genworth Financial is acutely aware of the escalating cybersecurity threats targeting sensitive personal and financial data. Maintaining robust defenses is paramount not only to safeguarding customer information but also to upholding trust and adhering to increasingly strict data privacy regulations. For instance, in 2023, the financial services sector experienced a significant rise in ransomware attacks, with average recovery costs exceeding $1 million, underscoring the financial implications of security failures.

Automated Underwriting and Claims Processing

Technological advancements are significantly automating underwriting for mortgage insurance, speeding up approvals and cutting operational costs. For instance, by mid-2024, many insurers were leveraging AI-driven platforms that could process applications in minutes rather than days, a stark contrast to earlier manual processes. This automation streamlines the entire mortgage insurance lifecycle, from initial application to policy issuance.

Similarly, automation in claims processing across all insurance segments is boosting efficiency and reducing administrative workloads. By the end of 2024, reports indicated that automated claims handling systems were reducing processing times by up to 40% for routine claims. This not only lowers expenses but also enhances the customer experience by providing quicker resolutions.

These technological shifts empower faster decision-making and create a more seamless interaction for both customers and business partners. The integration of technologies like robotic process automation (RPA) and machine learning in 2024 allowed companies to handle a higher volume of transactions with greater accuracy and speed, ultimately improving service delivery.

Key technological impacts include:

- Accelerated Underwriting: AI and machine learning algorithms can analyze vast datasets to assess risk more rapidly, with some systems achieving near-instantaneous approvals for low-risk applications in 2024.

- Efficient Claims Handling: Automation reduces manual data entry and verification in claims processing, leading to faster payout cycles and improved operational efficiency.

- Enhanced Customer Experience: Quicker approvals and claims settlements translate to greater customer satisfaction and loyalty.

- Cost Reduction: Automating routine tasks lowers labor costs and minimizes errors, contributing to improved profitability.

Telehealth and Remote Monitoring Technologies

Telehealth and remote monitoring technologies are rapidly evolving, presenting new avenues for managing long-term care. These advancements could reshape how care is delivered and managed, potentially influencing the cost and nature of future claims for companies like Genworth. For instance, the global telehealth market was valued at approximately $113.5 billion in 2023 and is projected to grow significantly, indicating a strong trend towards remote health solutions.

While not directly Genworth's primary insurance product, these technological shifts could create opportunities for new product development or necessitate adjustments in existing long-term care benefit structures. The ability to monitor health proactively through remote devices might lead to earlier interventions, potentially mitigating the severity and cost of long-term care needs down the line.

- Market Growth: The telehealth market is experiencing robust expansion, with projections indicating continued strong growth through 2030.

- Impact on Claims: Innovations in remote monitoring could alter the frequency and cost of long-term care claims, requiring insurers to adapt their models.

- Proactive Health: These technologies enable proactive health management, potentially reducing the need for extensive long-term care services.

- Product Innovation: The evolving landscape may spur the development of new insurance products or riders tailored to technologically-enabled care solutions.

Technological advancements are reshaping Genworth's operations, particularly in underwriting and claims processing. By mid-2024, AI-driven platforms were significantly accelerating mortgage insurance application approvals, reducing processing times from days to minutes. This automation extends to claims handling, with systems by the end of 2024 cutting routine claim processing times by up to 40%, enhancing both efficiency and customer satisfaction.

| Technology Area | Impact on Genworth | Key Data/Trend (2023-2024) |

|---|---|---|

| AI & Machine Learning | Accelerated underwriting, improved risk assessment, fraud detection | AI platforms processing mortgage applications in minutes (mid-2024) |

| Automation (RPA) | Streamlined operations, reduced administrative costs, faster decision-making | 40% reduction in routine claims processing time (end of 2024) |

| Cybersecurity | Essential for data protection, maintaining customer trust, regulatory compliance | Financial sector ransomware attack recovery costs exceeded $1 million (2023) |

| Telehealth & Remote Monitoring | Potential for new product development in long-term care, altered claims landscape | Global telehealth market valued at $113.5 billion (2023) |

Legal factors

Genworth Financial navigates a labyrinth of state, provincial, and federal insurance regulations across the US and Canada. These rules dictate critical aspects of its operations, including solvency, capital adequacy, and reserving, as well as product development, pricing strategies, and how claims are processed. For instance, in 2024, the National Association of Insurance Commissioners (NAIC) continued to refine capital requirements under the Risk-Based Capital (RBC) framework, impacting insurers like Genworth.

Adherence to these stringent compliance mandates is non-negotiable for Genworth. Failure to comply can result in significant financial penalties, jeopardizing its licenses to operate and potentially disrupting its business continuity. Maintaining a strong compliance record is paramount to preserving stakeholder trust and ensuring the company's long-term stability in a heavily regulated industry.

Consumer protection laws, focusing on fair lending, data privacy, and clear disclosures, directly shape Genworth's operational framework. These regulations mandate transparency and prohibit predatory tactics, compelling Genworth to refine its business practices and customer interactions to align with safeguarding consumer rights.

Failure to adhere to these legal stipulations can expose Genworth to substantial legal repercussions and financial penalties. For instance, the U.S. Consumer Financial Protection Bureau (CFPB) reported over $1.2 billion in enforcement actions in 2023 alone, highlighting the significant financial risks associated with non-compliance in the financial services sector.

Legislation like the Dodd-Frank Act significantly shapes Genworth's mortgage insurance business by setting new standards for lending and consumer protection. These regulations directly impact how Genworth assesses risk and operates within the mortgage market.

Evolving underwriting standards and loan qualification criteria, often driven by legal frameworks, can alter demand for private mortgage insurance. For instance, shifts in loan-to-value ratios or credit score requirements directly influence the pool of eligible borrowers and the associated risk for insurers.

Genworth actively monitors legal reforms in housing finance. In 2024, discussions around housing affordability and potential regulatory adjustments to mortgage insurance requirements continue, indicating an ongoing need for adaptation to the legal landscape.

Long-Term Care Insurance Specific Legislation

The long-term care insurance sector operates under a complex web of specific legislation. These laws often dictate crucial policy elements such as how long-term care is defined, what conditions trigger benefit payouts, and the availability of inflation protection features. Consumer suitability is also a key focus, ensuring policies align with individuals' needs and financial situations.

Legal changes impacting long-term care services, the licensing of providers, and the rights of consumers in this space have a direct bearing on Genworth's product development and how it manages its associated risks. For instance, changes in state-specific regulations, which are often quite detailed, can necessitate adjustments to policy terms or operational procedures.

State-level regulations are particularly granular and can vary significantly across jurisdictions. For example, as of 2024, some states have implemented or are considering stricter reserve requirements for long-term care policies, which can impact insurer solvency and product pricing. Consumer protection laws, such as those mandating specific disclosure requirements or outlining grievance procedures, also shape how Genworth markets and administers its long-term care products.

- Policy Definitions and Benefit Triggers: State laws often define what constitutes qualifying long-term care services and the specific health conditions that must be met for benefits to be paid.

- Inflation Protection: Regulations may mandate or restrict the inclusion and structure of inflation protection riders, which adjust benefit amounts over time to account for rising costs.

- Consumer Suitability Standards: Many states have laws requiring insurers to assess a potential policyholder's financial capacity and need for long-term care insurance before issuing a policy.

- Provider Licensing and Regulation: Laws governing the licensing and operation of long-term care facilities and home health agencies indirectly influence the availability and cost of services that Genworth's policies may cover.

Data Privacy and Security Regulations

Genworth Financial, like many in the financial services sector, operates under a complex web of data privacy and security regulations. In the US, laws such as the Health Insurance Portability and Accountability Act (HIPAA) for health-related data and various state-level privacy acts, like the California Consumer Privacy Act (CCPA), mandate strict protocols for handling customer information. These regulations govern how Genworth collects, stores, processes, and shares sensitive data, requiring robust security measures and transparent practices.

Failure to comply with these stringent legal frameworks can result in substantial financial penalties and severe reputational damage. For instance, under GDPR, which could impact Genworth if it processes data of EU residents, fines can reach up to 4% of global annual turnover or €20 million, whichever is higher. In the US, CCPA violations can incur statutory damages. Genworth's commitment to data security is therefore not just a matter of good practice but a critical legal imperative to maintain customer trust and operational continuity.

- HIPAA: Governs the privacy and security of protected health information in the US.

- CCPA/CPRA: Grants California consumers rights regarding their personal information, impacting data handling practices.

- GDPR: A comprehensive data protection law for EU residents, potentially affecting global operations.

- State-specific laws: Numerous other state laws add layers of complexity to data privacy compliance across the US.

Genworth Financial's operations are significantly shaped by evolving legal and regulatory landscapes across its product lines. In 2024, the company continues to navigate stringent state and federal insurance regulations governing solvency, capital adequacy, and product specifics, particularly for long-term care insurance where definitions of services and benefit triggers are legally defined.

Consumer protection laws, including data privacy mandates like CCPA and HIPAA, are critical. Non-compliance risks substantial penalties; for example, CFPB enforcement actions in 2023 exceeded $1.2 billion, underscoring the financial implications. These laws dictate transparency and fair practices in all customer interactions.

Legislation like Dodd-Frank continues to influence Genworth's mortgage insurance business, impacting underwriting standards and risk assessment. Ongoing discussions in 2024 regarding housing affordability may introduce further regulatory adjustments to mortgage insurance requirements.

The company must also adhere to a patchwork of state-specific laws, such as stricter reserve requirements for long-term care policies being considered in some states as of 2024, which can affect pricing and solvency.

Environmental factors

Climate change is increasingly impacting the housing market. More frequent and intense extreme weather events, like hurricanes and floods, are causing significant property damage, especially in coastal and disaster-prone areas. This trend directly affects mortgage insurers like Genworth by increasing the potential for higher claims and mortgage defaults in these vulnerable regions.

For instance, the National Oceanic and Atmospheric Administration (NOAA) reported a record 30 billion-dollar weather and climate disasters in the U.S. in 2023, totaling over $190 billion in damages. Such events can depress property values and lead to greater financial risk for mortgage lenders and insurers, necessitating robust risk assessment and management strategies for companies like Genworth.

The intensifying focus on Environmental, Social, and Governance (ESG) factors significantly shapes investor perceptions and the valuation of financial institutions like Genworth. As of early 2024, global sustainable investment assets reached an estimated $37 trillion, underscoring the growing demand for companies demonstrating strong ESG credentials.

Adhering to robust environmental stewardship, demonstrating genuine corporate social responsibility, and maintaining high governance standards are now critical for attracting investment capital and safeguarding a positive corporate image. Genworth's own ESG disclosures and performance metrics are under increasing scrutiny by stakeholders seeking alignment with these evolving priorities.

Genworth Financial's exposure to mortgage insurance risk is indirectly tied to the physical environment, particularly through natural disasters. While homeowners' insurance typically covers direct property damage, events like hurricanes or widespread floods can trigger significant economic disruption. This disruption can lead to increased job losses and, consequently, a rise in mortgage delinquencies and foreclosures, directly impacting Genworth's claims experience.

For instance, the economic fallout from major natural disasters can depress local housing markets for extended periods, affecting recovery rates on foreclosed properties. Risk modeling for Genworth must therefore incorporate sophisticated analyses of potential economic impacts stemming from various natural disaster scenarios, not just direct physical damage. This ensures a more robust understanding of potential financial liabilities.

Resource Scarcity and Operational Sustainability

Genworth's commitment to operational sustainability, encompassing energy use, waste reduction, and office space management, directly impacts its environmental footprint. As of 2024, there's a growing investor and consumer demand for companies to showcase responsible resource management, influencing brand reputation and investment decisions.

Companies like Genworth are increasingly scrutinized for their carbon emissions and waste generation. For instance, many large corporations aim for significant reductions in their operational carbon emissions; some have set targets to achieve net-zero emissions by 2040 or earlier, a trend that will likely influence Genworth's long-term operational strategies.

This focus on sustainability affects how Genworth is perceived by stakeholders. A strong environmental, social, and governance (ESG) profile can attract capital and talent, while a weaker one may lead to divestment or reputational damage. Financial institutions are increasingly integrating ESG factors into their investment analysis, with assets under management in ESG-focused funds projected to reach trillions globally by 2025.

- Energy Consumption: Reducing electricity usage in offices through efficiency upgrades and renewable energy sourcing.

- Waste Management: Implementing robust recycling programs and minimizing paper consumption in daily operations.

- Office Footprint: Optimizing real estate usage and promoting remote work policies to lessen the environmental impact of physical spaces.

- Supply Chain: Encouraging sustainable practices among suppliers to extend environmental responsibility beyond direct operations.

Environmental Regulations and Disclosure Requirements

Evolving environmental regulations, especially those impacting real estate development and land use, could indirectly shape the housing market and, by extension, the demand for mortgage insurance. For instance, stricter rules on building materials or energy efficiency standards might influence housing affordability and construction rates, areas Genworth closely monitors.

The growing demand for climate-related financial disclosures is a significant factor. Genworth, like many financial institutions, will likely face increased pressure to report on its exposure to climate risks and any associated opportunities within its financial statements and public communications. This transparency is becoming a key expectation from investors and regulators alike.

- Regulatory Shifts: Anticipate changes in environmental laws affecting property development, potentially impacting mortgage demand.

- Disclosure Mandates: Genworth must prepare for enhanced reporting requirements on climate-related financial risks and opportunities.

- Market Impact: Environmental policies can indirectly influence housing market dynamics, a core area for mortgage insurers.

Genworth's operations are increasingly influenced by environmental factors, particularly concerning climate change and sustainability. Extreme weather events, a growing concern, lead to increased property damage and can disrupt economic stability, potentially impacting mortgage defaults and claims for insurers. The global push towards Environmental, Social, and Governance (ESG) principles is reshaping investor expectations, with a significant portion of global investment now aligning with sustainable practices, making strong ESG performance crucial for companies like Genworth.

Genworth's commitment to operational sustainability, including energy efficiency and waste reduction, is under scrutiny. Many corporations are setting ambitious emission reduction targets, aiming for net-zero by 2040, a trend that will likely influence Genworth's long-term strategies and stakeholder perception. Furthermore, evolving environmental regulations, such as those impacting property development, could indirectly affect housing market dynamics and the demand for mortgage insurance.

| Environmental Factor | Impact on Genworth | Supporting Data/Trend (2024/2025 Focus) |

|---|---|---|

| Climate Change & Extreme Weather | Increased claims from property damage, potential for higher mortgage defaults due to economic disruption. | Record 30 billion-dollar weather/climate disasters in U.S. in 2023 (NOAA), exceeding $190 billion in damages. |

| ESG Focus | Attracting investment capital, stakeholder perception, reputational risk. | Global sustainable investment assets estimated at $37 trillion (early 2024), with continued growth projected. |

| Operational Sustainability | Reputational impact, operational efficiency, potential cost savings. | Growing demand for companies to demonstrate responsible resource management; many aim for net-zero emissions by 2040. |

| Environmental Regulations | Potential shifts in housing market dynamics, influencing demand for mortgage insurance. | Increased pressure for climate-related financial disclosures from regulators and investors. |

PESTLE Analysis Data Sources

Our PESTLE Analysis for Genworth Financial is built upon a robust foundation of data from leading financial institutions, government regulatory bodies, and reputable market research firms. We integrate global economic indicators, demographic trends, and technological advancements to ensure a comprehensive view of the macro-environment.