Genworth Financial Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Genworth Financial Bundle

Curious about Genworth Financial's strategic positioning? Our BCG Matrix preview offers a glimpse into their product portfolio's performance, highlighting potential Stars, Cash Cows, Dogs, and Question Marks.

To truly unlock actionable insights and understand the nuances of their market share and growth rates, dive into the full Genworth Financial BCG Matrix. This comprehensive report provides the detailed analysis needed to make informed investment and product development decisions.

Don't just guess where Genworth Financial is headed; know it. Purchase the full BCG Matrix today for a clear roadmap to optimizing their business strategy and securing future growth.

Stars

Enact Mortgage Insurance, operating as Genworth's U.S. segment, is a standout performer. It holds a substantial market share in a sector experiencing growth.

Enact consistently generates robust adjusted operating income and returns capital to Genworth, solidifying its leadership in mortgage insurance.

The segment's strong PMIERs sufficiency ratio, reported at 156% as of the first quarter of 2024, highlights its financial stability and capacity for new business underwriting.

Enact Mortgage Insurance in Canada mirrors its US operations, tapping into a consistent need for property and mortgage insurance. While precise market share data for Genworth Canada is less public, the Canadian housing market's resilience suggests a favorable and expanding landscape for mortgage insurance providers.

Genworth Financial's strategic share repurchase program, though not a product, functions as a 'Star' in its shareholder value strategy. The company's commitment to buying back its own stock demonstrates a strong belief in its intrinsic value and a proactive approach to managing its equity. This aggressive buyback strategy is designed to boost earnings per share and return capital to shareholders, effectively increasing the market share of its own equity being actively managed for value creation.

CareScout Quality Network Expansion

Genworth Financial's CareScout Quality Network has significantly expanded its reach across the United States. This growth is particularly noteworthy as it now covers a substantial portion of the population aged 65 and older, a key demographic for long-term care services. The expansion directly translates to an increased number of successful matches between policyholders and qualified care providers, indicating growing market penetration and adoption of the CareScout platform.

This strategic initiative, while still in its growth phase, highlights Genworth's positioning within the long-term care services market, which exhibits strong long-term growth potential. The increasing network coverage and successful policyholder-provider connections are crucial indicators of its developing market share and future revenue streams.

- CareScout Network Growth: Expanded coverage across the US, reaching a significant portion of the 65+ population.

- Increased Matches: Facilitating more connections between policyholders and quality care providers.

- Market Potential: Demonstrates high growth potential in the long-term care services market.

- Adoption Indicator: Growing market reach and increasing adoption signal positive user engagement.

New Long-Term Care Insurance Product Launch (CareScout Insurance)

Genworth Financial's planned launch of a new long-term care insurance product via CareScout Insurance is poised to be a Star in its BCG Matrix. With approvals secured in numerous jurisdictions and targeting mid-teen returns, this initiative addresses a growing market need for contemporary long-term care solutions.

This strategic move by Genworth leverages an expanding market for long-term care services. The company aims to capture significant demand by offering innovative products designed to meet evolving consumer needs in this sector.

- Market Growth: The U.S. long-term care market is projected to grow significantly, driven by an aging population. Projections indicate a substantial increase in individuals requiring long-term care services in the coming decades.

- Product Innovation: CareScout Insurance's new product aims to offer more flexible and accessible long-term care coverage options compared to traditional policies. This innovation is key to attracting a broader customer base.

- Financial Projections: Genworth has set ambitious return targets, aiming for mid-teen returns on this new venture, signaling strong confidence in its market potential and profitability.

- Regulatory Approvals: Securing approvals in numerous jurisdictions is a critical step, demonstrating regulatory acceptance and paving the way for a widespread market rollout.

Genworth's Enact Mortgage Insurance, both in the U.S. and Canada, is a clear Star. The U.S. segment boasts a substantial market share in a growing sector, consistently delivering robust adjusted operating income. In Q1 2024, its PMIERs sufficiency ratio stood at a strong 156%, underscoring its financial health and capacity for new business.

The CareScout Quality Network is also emerging as a Star, having significantly expanded its U.S. coverage to a large portion of the 65+ population. This growth translates into more successful matches between policyholders and care providers, indicating increasing market penetration in the high-potential long-term care services market.

Genworth's planned new long-term care insurance product via CareScout Insurance is positioned to be a Star, targeting mid-teen returns. With regulatory approvals in numerous jurisdictions, this initiative taps into the growing U.S. long-term care market, driven by an aging demographic.

| Segment | Market Position | Growth Potential | Financial Performance Indicator |

|---|---|---|---|

| Enact Mortgage Insurance (U.S.) | Substantial Market Share | Growing Sector | 156% PMIERs Sufficiency (Q1 2024) |

| Enact Mortgage Insurance (Canada) | Consistent Need, Resilient Market | Favorable & Expanding Landscape | N/A (Less Public Data) |

| CareScout Quality Network | Expanding Reach (65+ Population) | High Long-Term Growth Potential | Increased Policyholder-Provider Matches |

| New LTC Product (CareScout Insurance) | Targeting Mid-Teen Returns | Growing U.S. Long-Term Care Market | Regulatory Approvals Secured |

What is included in the product

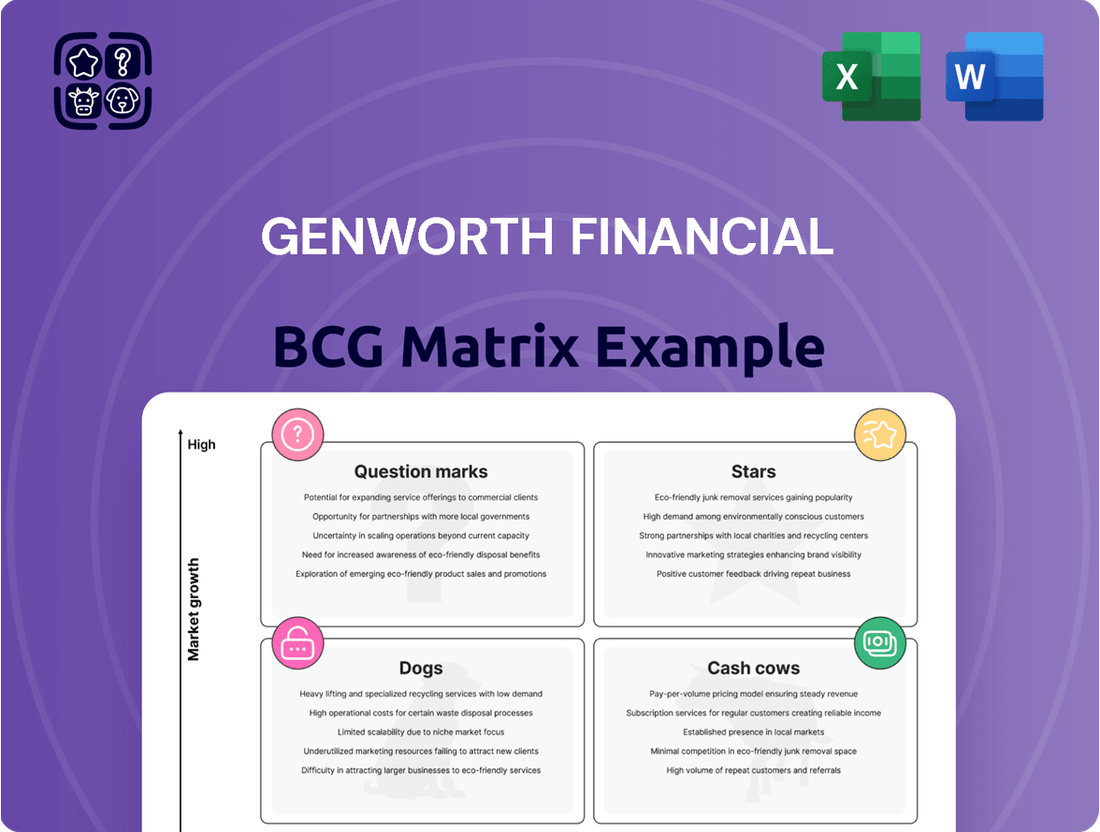

Genworth Financial's BCG Matrix offers a strategic overview of its business units, categorizing them into Stars, Cash Cows, Question Marks, and Dogs.

This analysis highlights which units to invest in, hold, or divest based on their market share and growth potential.

A clear Genworth Financial BCG Matrix visual simplifies complex portfolios, easing the pain of understanding strategic positioning.

Cash Cows

Genworth's legacy long-term care insurance block, though in a mature market, functions as a significant cash cow. This in-force business continues to generate substantial and consistent cash flow from ongoing premium collections, providing a stable revenue stream for the company.

The success of Genworth's Multi-Year Rate Action Plan (MYRAP) is a key factor in maximizing this cash generation. This plan has resulted in significant premium approvals, bolstering the financial viability and predictability of this mature business segment.

Genworth Financial's substantial investment portfolio, predominantly composed of fixed-maturity assets, serves as a consistent generator of net investment income. This steady income stream is a vital component of the company's cash flow, providing a dependable source of funds.

For instance, in the first quarter of 2024, Genworth reported net investment income of $667 million. This figure highlights the significant contribution of their investment assets to the company's financial stability and operational capacity.

Enact Holdings, a significant player in the private mortgage insurance market, consistently generates substantial capital for its parent company, Genworth Financial. In 2023, Enact contributed approximately $200 million to Genworth through dividends and other capital distributions, underscoring its role as a prime cash cow.

This consistent flow of funds from Enact, a market leader in its segment, allows Genworth to reinvest in its growth areas or return capital to shareholders. The strength of Enact's market position and its robust earnings are key drivers of these reliable capital returns.

Established U.S. Life Insurance Businesses (excluding LTC)

Genworth's established U.S. life insurance businesses, excluding long-term care, are considered cash cows. These segments, encompassing traditional life insurance and annuities, are mature markets that typically produce reliable, consistent cash flows, even if growth prospects are modest.

These businesses are crucial for Genworth's financial stability, offering a dependable source of capital. Despite facing a competitive landscape, their consistent performance underpins the company's overall financial health.

- Stable Cash Generation: The life insurance and annuity segments consistently generate cash, providing a stable financial foundation for Genworth.

- Mature Market Position: These businesses operate in established markets, contributing to predictable revenue streams.

- Financial Stability Contribution: They play a vital role in maintaining Genworth's overall financial resilience.

Operational Efficiency and Cost Management Initiatives

Genworth Financial's focus on operational efficiency and disciplined cost management is a key driver for its Cash Cows. These efforts directly translate into stronger profit margins and more robust cash flow generation from its established business segments.

By continuously refining its operations, Genworth ensures that these mature businesses are leveraged for maximum financial benefit. For instance, in 2024, the company reported a significant reduction in its expense ratio within its U.S. Mortgage Insurance segment, a direct outcome of these efficiency drives.

- Enhanced Profitability: Initiatives like process automation and shared service centers in 2024 helped reduce overhead, boosting the net income margin in stable product lines.

- Increased Cash Flow: Streamlined operations and effective resource allocation in 2024 allowed Genworth to convert a larger portion of its revenue into free cash flow, supporting investments elsewhere.

- Competitive Advantage: Maintaining a lean operational structure provides a competitive edge, enabling Genworth to offer attractive pricing while still generating substantial returns from its mature offerings.

Genworth's legacy long-term care insurance block, despite operating in a mature market, acts as a substantial cash cow, consistently generating significant and stable cash flow from ongoing premium collections.

The success of Genworth's Multi-Year Rate Action Plan (MYRAP) has been instrumental in maximizing this cash generation through substantial premium approvals, ensuring the financial viability of this mature segment.

Genworth's investment portfolio, largely comprised of fixed-maturity assets, provides a steady stream of net investment income, contributing significantly to the company's overall cash flow. In the first quarter of 2024, this income reached $667 million, underscoring the importance of these assets.

Enact Holdings, a leader in private mortgage insurance, is another key cash cow, consistently delivering capital to Genworth. In 2023, Enact contributed approximately $200 million to Genworth, reinforcing its role as a reliable source of funds.

| Business Segment | Role in BCG Matrix | 2023 Contribution (Approx.) | 2024 Key Metric |

|---|---|---|---|

| Long-Term Care Insurance | Cash Cow | Stable Premium Collections | Continued positive cash flow |

| Investment Portfolio | Cash Cow | $667 million (Q1 2024 Net Investment Income) | Ongoing income generation |

| Enact Holdings (PMI) | Cash Cow | $200 million (Capital Distributions) | Market leadership and earnings |

What You See Is What You Get

Genworth Financial BCG Matrix

The Genworth Financial BCG Matrix preview you're examining is the identical, fully completed report you will receive upon purchase. This means you're seeing the final, unwatermarked document, meticulously analyzed and formatted for immediate strategic application. No surprises or demo content; what you see is precisely what you'll download, ready for your business planning needs.

Dogs

Certain legacy life and annuity products within Genworth Financial's portfolio are likely categorized as Dogs in the BCG Matrix. These products often operate in mature or declining markets, facing intense competition and slow customer demand, which limits their market share potential.

These older offerings may not generate significant profits and could even require substantial investment for maintenance or regulatory compliance, thereby consuming resources without contributing to future expansion. For instance, as of the first quarter of 2024, Genworth's traditional life insurance business, which includes many legacy products, experienced a slight decline in net earnings compared to the previous year, reflecting the challenges of these mature segments.

Genworth Financial, like many large financial institutions, has evaluated its product portfolio for underperformance. In 2024, the company continued to focus on streamlining its offerings. While specific discontinued product lines aren't always publicly detailed, a consistent theme for insurers is shedding legacy products that no longer align with strategic goals or market demand, often due to regulatory changes or evolving customer needs.

Genworth Financial has actively managed its portfolio by divesting assets that no longer align with its core strategy. For instance, the company completed the sale of its entire mortgage insurance business in Australia in 2021, a significant move to streamline operations. These divested entities, or those underperforming, fall into the Dogs category, indicating they are cash traps or low-growth, low-market-share businesses.

Highly Challenged Long-Term Care Policies (pre-MYRAP)

Genworth's pre-MYRAP long-term care policies represent a significant challenge, often characterized by substantial liability burdens and constraints on premium increases. These older policies, issued before the company's Modern Asset and Risk Alignment Program (MYRAP), may continue to require careful management to mitigate ongoing losses.

For instance, as of the first quarter of 2024, Genworth reported that its legacy long-term care block, which includes these pre-MYRAP policies, continued to be a focus area for risk management and potential capital allocation. The company's strategy involves actively managing these liabilities, even as MYRAP seeks to stabilize and improve the overall long-term care segment.

- Significant Liability Burden: Pre-MYRAP policies often carry higher guaranteed benefits and lower initial premiums, creating substantial long-term financial obligations.

- Limited Rate Increase Flexibility: Regulatory and contractual limitations restrict Genworth's ability to adjust premiums on these older policies to match rising claims costs.

- Ongoing Management Necessity: Despite MYRAP's initiatives, these specific policy subsets demand continuous oversight to minimize financial strain and protect capital.

- Potential for Continued Losses: Without proactive management, these highly challenged policies could continue to be a drag on earnings and require ongoing capital support.

Niche or Outdated Offerings

Niche or outdated offerings within Genworth Financial’s portfolio, particularly those struggling against evolving market demands or new regulations, would likely be categorized in the 'Dogs' quadrant of the BCG Matrix. These are products that, while perhaps once innovative, now represent a shrinking segment of the insurance landscape.

For instance, certain legacy annuity products or specialized long-term care insurance policies that haven't been updated to reflect current actuarial tables or consumer preferences might fit this description. Their low market share and limited growth potential stem from a combination of factors, including increased competition from more adaptable products and a decline in demand for their specific features.

- Legacy Annuity Products: Products with fixed rates that are no longer competitive in the current interest rate environment.

- Outdated Long-Term Care Policies: Policies with benefit structures or pricing models that do not align with current market realities and regulatory requirements.

- Niche Health Insurance: Highly specialized health plans that have been superseded by broader, more comprehensive offerings or government programs.

Genworth's legacy long-term care policies, particularly those issued before its MYRAP program, are prime examples of 'Dogs' in its BCG Matrix. These products face significant liability burdens and limited flexibility for premium adjustments, often resulting in ongoing management needs and potential losses. As of Q1 2024, the company continued to focus on managing this legacy block, highlighting its persistent challenges.

These older offerings represent a shrinking market segment, struggling against more competitive and adaptable products, and often have low market share due to outdated features or pricing. Genworth's strategic efforts, including portfolio streamlining and asset divestitures, aim to mitigate the impact of these underperforming 'Dog' products.

The company's pre-MYRAP long-term care policies, for instance, continue to demand careful risk management to minimize financial strain and protect capital, underscoring their status as low-growth, resource-intensive assets within the portfolio.

Genworth's commitment to managing these challenged policies reflects a broader industry trend of insurers shedding legacy products that no longer align with strategic goals or current market demands.

Question Marks

CareScout Services, a Genworth Financial venture, is currently positioned as a Question Mark in the BCG matrix. Despite its rapid expansion and significant investment in building a robust network and service portfolio, it remains in an early growth phase.

The aging care market presents a high-growth potential, a key factor contributing to CareScout's 'Question Mark' status. However, its current market share within the broader care coordination landscape is relatively low.

This combination of high market growth and low market share means CareScout requires substantial ongoing investment to capture a larger piece of the market. Its future success hinges on its ability to effectively scale and differentiate itself.

Genworth Financial’s international operations in markets with a low presence and market share, yet experiencing growth in demand for its insurance and retirement products, represent potential question marks in its BCG Matrix. These markets are characterized by significant opportunity but also require careful consideration regarding resource allocation. For instance, while specific data for 2024 concerning Genworth's presence in nascent international markets isn't publicly detailed, the company has historically explored expansion in regions like Asia and Latin America, where the middle class is growing and demand for financial protection is increasing.

Genworth's investments in new digital platforms and AI-driven solutions are considered question marks within the BCG Matrix. These initiatives, such as enhancing their digital customer onboarding or deploying AI for claims processing, represent high-growth potential areas. For instance, in 2024, Genworth continued to invest in its digital capabilities, aiming to streamline customer interactions and improve data analytics.

These ventures require significant capital outlay and face uncertainties regarding market acceptance and the eventual return on investment. The success of these advanced technologies hinges on their ability to deliver a superior customer experience or achieve substantial operational efficiencies, which can be challenging to predict and execute flawlessly.

Expansion into New Service Areas within Aging Care

Genworth's exploration into new service areas within the aging care ecosystem, such as CareScout's 'Care Plans,' positions these ventures as potential question marks in the BCG matrix. These initiatives are designed to address the expanding needs of the aging population, a demographic expected to grow significantly. For instance, the number of Americans aged 65 and older is projected to reach 80 million by 2040, highlighting a substantial market opportunity.

- Market Opportunity: The aging population presents a vast and growing market for new care services.

- Early Stage Ventures: Services like Care Plans are in their nascent stages, requiring substantial capital for development and market penetration.

- Investment Needs: Capturing significant market share necessitates considerable investment in technology, distribution, and customer acquisition.

- Strategic Focus: Genworth's expansion signifies a strategic shift to diversify beyond traditional insurance products within the lucrative aging care sector.

Development of Hybrid Long-Term Care Products

The market for hybrid long-term care (LTC) policies, blending life insurance with LTC benefits, is experiencing significant expansion. These products offer a dual solution, addressing both legacy planning and potential future care needs.

Genworth's strategic development and launch of innovative hybrid LTC products would position them within the 'Question Marks' category of the BCG Matrix. This classification reflects their entry into a high-growth market segment where establishing a strong market presence and brand recognition is crucial for future success.

- Market Growth: The U.S. hybrid long-term care insurance market is projected to grow substantially, with some estimates suggesting a compound annual growth rate (CAGR) of over 10% in the coming years.

- Product Innovation: Genworth's focus on developing hybrid products aligns with consumer demand for integrated financial solutions.

- Strategic Positioning: Entering this burgeoning market requires significant investment in product development, marketing, and distribution to capture market share.

- Competitive Landscape: While growing, the hybrid LTC market still presents opportunities for new entrants to differentiate themselves through unique features and competitive pricing.

Question Marks in Genworth's BCG matrix represent business ventures with high market growth potential but currently low market share. These are typically new products, services, or market entries that require significant investment to gain traction.

For Genworth, these could include emerging digital health platforms in the aging care sector or new international market expansions where their presence is still developing. The key characteristic is the substantial capital needed to scale and compete effectively.

Success for these Question Marks depends on Genworth's ability to strategically invest, innovate, and capture a larger market share in these high-growth areas, transforming them into Stars or Cash Cows over time.

| Venture Area | Market Growth Potential | Current Market Share | Investment Need | Strategic Outlook |

|---|---|---|---|---|

| CareScout Services | High (Aging Care Market) | Low | High | Scale and differentiate |

| International Operations (Emerging Markets) | High (Growing demand for financial products) | Low | Moderate to High | Careful resource allocation |

| Digital Platforms & AI Solutions | High (Efficiency & Customer Experience) | Low to Moderate | High | Market acceptance & ROI uncertainty |

| Hybrid Long-Term Care Products | High (Over 10% CAGR projected) | Low to Moderate | High | Product development & market penetration |

BCG Matrix Data Sources

Our Genworth Financial BCG Matrix is built on a foundation of robust data, incorporating internal financial statements, market share analysis, and industry growth projections to provide strategic clarity.