Genworth Financial Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Genworth Financial Bundle

Genworth Financial operates in a dynamic insurance landscape where buyer power can significantly influence pricing, and the threat of new entrants, though moderated by capital requirements, remains a persistent consideration. Understanding these forces is crucial for navigating the competitive waters.

The complete report reveals the real forces shaping Genworth Financial’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

For Genworth Financial's mortgage insurance operations, the suppliers are typically specialized. These can include data providers that offer crucial information for risk assessment, technology vendors supplying the underwriting platforms, and reinsurance companies. The market for these services, while specialized, is generally fragmented, meaning no single supplier holds a dominant position.

This fragmentation is a key factor in moderating supplier power. Because Genworth can often find alternative providers for data, technology, or reinsurance, the bargaining leverage of any individual supplier is diminished. While switching providers might incur some transition costs, the availability of multiple options prevents any single entity from dictating terms excessively.

Suppliers of critical services to the insurance sector, particularly in data analytics and technology, face a landscape shaped by stringent regulations. For instance, data privacy laws like GDPR and CCPA impose significant compliance burdens, requiring substantial investment and expertise. This regulatory complexity can deter new entrants, thereby bolstering the bargaining power of existing, compliant suppliers who have already absorbed these costs and established robust operational frameworks.

Genworth's reliance on data and analytics for accurate risk assessment and pricing in its mortgage and long-term care insurance segments significantly influences supplier power. Access to high-quality data and advanced analytical tools is not just beneficial; it's fundamental to Genworth's operational success and competitive edge.

Suppliers offering superior data sets or cutting-edge analytical platforms can command greater leverage. For instance, in 2024, the market for insurtech solutions, which heavily involve data analytics, continued its robust growth, with significant investments flowing into companies providing predictive modeling and data enrichment services. This environment elevates the bargaining power of those suppliers who can demonstrably enhance Genworth's ability to underwrite and price policies more effectively.

Reinsurance Market Dynamics

Reinsurance providers are critical partners for Genworth, enabling the company to effectively manage its substantial risk exposures. The leverage these suppliers hold is directly tied to the broader health and dynamics of the global reinsurance market, encompassing factors like available capacity, prevailing pricing trends, and the existence of alternative risk transfer solutions.

A tightening reinsurance market, characterized by reduced capacity and rising premiums, demonstrably amplifies the bargaining power of these suppliers. For instance, in 2024, the property catastrophe reinsurance market saw significant price increases, with renewal rates for certain perils escalating by over 50% in some instances, reflecting a constrained supply environment.

- Market Capacity: In 2024, the overall capacity in the global reinsurance market remained somewhat constrained, particularly for peak perils, giving reinsurers more pricing power.

- Pricing Trends: Reinsurance pricing continued its upward trajectory in 2024, with increases of 10-30% reported across various lines of business, impacting Genworth's cost of risk transfer.

- Alternative Risk Transfer: The availability and cost-effectiveness of alternative risk transfer mechanisms, such as catastrophe bonds, influence the bargaining power of traditional reinsurers. While these alternatives offer diversification, their issuance volumes and pricing also fluctuate based on market conditions.

Specialized Technology Providers

As the financial services sector leans heavily on technology, specialized software and platform providers hold significant sway. If a vendor provides a unique, integrated solution that's hard to replicate or switch away from, their bargaining power over Genworth Financial increases. This is due to high switching costs and the potential operational disruption a change would cause.

For instance, in 2024, the global FinTech market was valued at over $1.1 trillion, showcasing the critical role of technology providers. Companies offering proprietary AI-driven underwriting platforms or specialized cloud-based data management systems for insurance could command higher prices or more favorable terms.

- High Switching Costs: Implementing new core insurance platforms can take years and cost tens of millions of dollars, making it difficult for Genworth to change vendors.

- Proprietary Technology: Suppliers with unique, patented technologies that provide a competitive edge for Genworth have stronger leverage.

- Limited Alternatives: If only a few providers offer the specific, advanced capabilities Genworth requires, their bargaining power is amplified.

The bargaining power of suppliers for Genworth Financial is generally moderate, influenced by the specialized nature of services like data provision, technology platforms, and reinsurance. While fragmentation exists, regulatory compliance and the demand for advanced insurtech solutions in 2024 bolstered the leverage of key data and analytics providers.

Reinsurers, crucial for risk management, saw their power increase in 2024 due to constrained market capacity and rising pricing trends, with some property catastrophe reinsurance rates jumping over 50%. This upward pricing pressure impacts Genworth's cost of risk transfer.

Technology suppliers, especially those offering proprietary platforms, possess significant leverage due to high switching costs and potential operational disruptions. The massive global FinTech market, valued over $1.1 trillion in 2024, highlights the essential role and increased influence of these specialized vendors.

| Supplier Type | Key Factors Influencing Power | 2024 Data/Trends |

|---|---|---|

| Data Providers | Data quality, analytical capabilities, regulatory compliance | Robust growth in insurtech solutions; demand for predictive modeling. |

| Technology Vendors | Proprietary technology, switching costs, integration complexity | Global FinTech market > $1.1 trillion; AI-driven platforms in demand. |

| Reinsurance Providers | Market capacity, pricing trends, alternative risk transfer availability | Constrained capacity, 10-30% price increases across various lines. |

What is included in the product

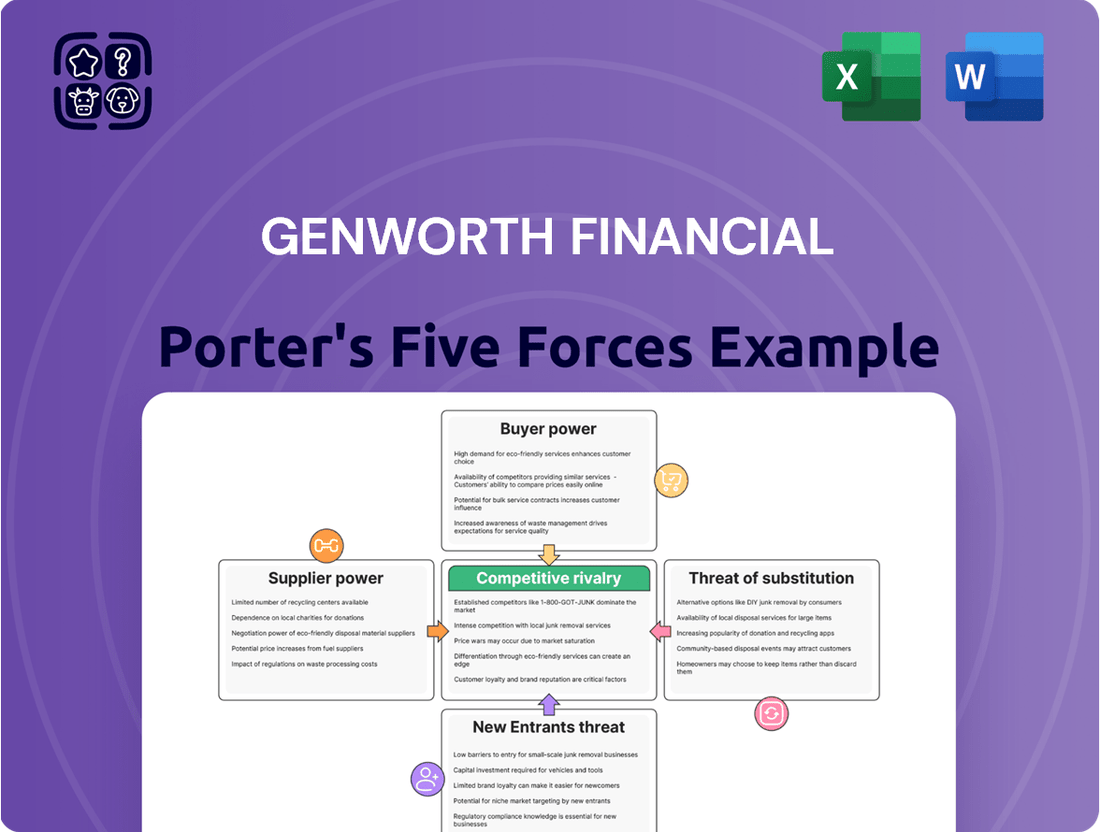

This analysis of Genworth Financial's competitive landscape examines the intensity of rivalry, buyer and supplier power, threat of new entrants, and the impact of substitutes, providing strategic insights into market dynamics.

Effortlessly identify and mitigate competitive threats by visualizing the intensity of each of Porter's Five Forces on a dynamic, interactive dashboard.

Customers Bargaining Power

Genworth's primary customers for mortgage insurance are lenders, predominantly large financial institutions. These entities wield considerable bargaining power because of the substantial volume of business they represent and their capacity to select from various mortgage insurance providers. This includes Genworth's subsidiary, Enact. For instance, in 2024, the U.S. private mortgage insurance market continued to be shaped by the concentration of large originators, many of whom have the scale to negotiate favorable terms.

The competitive landscape of the private mortgage insurance market further amplifies customer bargaining power. Key players such as Arch Capital Group, Essent Guaranty, MGIC Investment Corporation, National Mortgage Insurance Corporation (NMI), and Radian Group are all vying for lender business. This intense competition allows lenders to play providers against each other, seeking better pricing and service agreements. In 2023, for example, the market saw continued efforts by insurers to gain market share, often through competitive pricing strategies, which directly benefits the lenders.

Individual policyholders in long-term care insurance generally wield limited direct bargaining power. This is largely due to the heavily regulated nature of these products and the intricate process of underwriting and risk assessment, which prevents individual negotiation.

However, the collective actions of policyholders can exert considerable influence. For instance, significant premium increases, which have been a persistent concern, can lead to widespread policy cancellations or a shift towards alternative solutions, thereby impacting market dynamics for insurers like Genworth Financial.

In 2024, the average annual premium for long-term care insurance continued to be a point of contention, with many policyholders facing increases that outpaced inflation. This trend underscores the sensitivity of this customer segment to pricing, even without direct individual bargaining leverage.

Customers possess significant bargaining power when numerous alternatives are readily available. For Genworth Financial's mortgage insurance segment, government-backed programs such as FHA and VA loans present direct substitutes, diminishing the leverage of private insurers.

Similarly, in the long-term care market, a diverse array of alternatives exists. These include hybrid life insurance policies with long-term care riders, specialized short-term care insurance, annuities offering long-term care benefits, and the option of self-funding through personal savings, all of which dilute the bargaining power of traditional long-term care insurance providers.

Price Sensitivity and Market Transparency

Customers, particularly individual policyholders, exhibit significant price sensitivity regarding long-term care insurance premiums. This sensitivity is amplified as premiums for these essential services continue to climb, forcing consumers to scrutinize costs more closely.

The growing transparency within the insurance market significantly bolsters customer bargaining power. With readily available comparative data on policies from numerous providers, individuals can more effectively identify and pursue more competitive pricing and favorable terms, directly influencing insurer strategies.

- Price Sensitivity: A significant portion of consumers actively seeks lower-cost alternatives when faced with increasing insurance premiums, particularly for long-term care.

- Market Transparency: Online comparison tools and independent reviews empower consumers to easily assess and contrast offerings from various insurers, fostering a more competitive environment.

- Bargaining Power Enhancement: This increased access to information allows customers to negotiate better rates or switch providers, thereby increasing their leverage over insurance companies.

Role of Financial Advisors and Brokers

Financial advisors and brokers significantly shape customer decisions in the long-term care insurance market. Their guidance can steer clients toward particular insurers, thereby concentrating customer demand and granting these intermediaries a degree of bargaining power. This influence stems from their ability to direct business to providers offering competitive terms or products that align with client needs and advisor recommendations.

For instance, in 2024, a substantial portion of long-term care insurance policies were sold through agents and brokers, highlighting their gatekeeper role. This intermediation allows them to negotiate, implicitly or explicitly, with insurers on behalf of their client base.

- Intermediary Influence: Advisors act as crucial conduits, channeling customer demand towards specific long-term care insurance providers.

- Consolidated Demand: By guiding multiple clients to the same insurers, advisors can create concentrated blocks of demand.

- Negotiating Leverage: This consolidated demand gives advisors indirect bargaining power, influencing insurer pricing and product offerings.

- Market Share Impact: In 2024, an estimated 70% of long-term care insurance policies were sold through agents and brokers, underscoring their market power.

Genworth's customers, particularly lenders in the mortgage insurance sector, possess considerable bargaining power due to the high volume of business they represent and the availability of numerous competitors. This allows them to negotiate favorable pricing and terms, a dynamic evident in 2024 as large originators continued to shape market conditions through their scale.

The long-term care insurance market sees individual policyholders with limited direct bargaining power, but collective actions, like policy cancellations due to premium increases, can influence insurers. In 2024, rising premiums heightened consumer price sensitivity, even without direct negotiation capabilities.

The presence of substitutes, such as government-backed loans for mortgage insurance and hybrid policies or self-funding for long-term care, significantly dilutes the bargaining power of traditional providers. This availability of alternatives empowers customers to seek more cost-effective solutions.

Market transparency, fueled by comparison tools and reviews, further enhances customer leverage. This allows individuals to readily assess options and pursue better rates, as seen with the continued growth of online insurance marketplaces in 2024.

| Customer Segment | Bargaining Power Drivers | 2024 Market Observation |

|---|---|---|

| Mortgage Insurance Lenders | High volume, numerous competitors, scale | Large originators negotiated favorable terms. |

| Long-Term Care Individual Policyholders | Limited direct power, collective action, price sensitivity | Premium increases led to scrutiny and potential cancellations. |

| Overall Customer Base | Availability of substitutes, market transparency | Growth in alternative insurance products and comparison platforms. |

Full Version Awaits

Genworth Financial Porter's Five Forces Analysis

This preview shows the exact document you'll receive immediately after purchase—no surprises, no placeholders. It details Genworth Financial's competitive landscape, analyzing the intensity of rivalry, the bargaining power of buyers and suppliers, the threat of new entrants, and the threat of substitute products within the financial services industry.

Rivalry Among Competitors

Genworth Financial operates in markets with a substantial number of competitors. In the U.S. mortgage insurance sector, its subsidiary Enact faces formidable rivals. These include established companies such as Arch Capital Group, Essent Guaranty, MGIC Investment Corporation, National Mortgage Insurance Corporation (NMI), and Radian Group.

The long-term care insurance landscape also presents a competitive environment for Genworth. While specific market share data for 2024 is still emerging, historical trends indicate the presence of several significant insurers actively participating in this segment. This competitive density necessitates continuous innovation and efficient operations for Genworth to maintain its market position.

The long-term care insurance market is expected to expand, fueled by a growing elderly demographic. This trend could potentially ease competitive pressures by creating more room for all participants. For instance, the U.S. long-term care insurance market saw a 3.2% increase in premiums in 2023, reaching $11.5 billion.

Conversely, the U.S. private mortgage insurance sector presents a stable but challenging environment. Higher interest rates in 2024 have put a damper on mortgage originations, which directly impacts the demand for mortgage insurance. This segment experienced a slight contraction of 1.5% in new policies written in the first half of 2024 compared to the same period in 2023.

The private mortgage insurance market is characterized by homogeneity, meaning products are very similar. This lack of differentiation often leads to intense competition primarily focused on price, impacting Genworth's ability to command premium pricing.

However, Genworth's long-term care insurance segment is experiencing a counter-trend. The introduction of hybrid policies and more adaptable solutions suggests a growing degree of product differentiation and innovation within this market, potentially offering Genworth a competitive edge.

Switching Costs for Customers

For Genworth Financial, switching costs vary significantly across its business lines. In mortgage insurance, lenders face moderate switching costs. They can opt for alternative providers for new mortgage originations, allowing for a degree of flexibility in their choice of insurance partners. This means Genworth needs to remain competitive on pricing and service to retain these clients.

However, for existing long-term care insurance policyholders, the situation is quite different. Switching to a new long-term care policy can involve substantial costs. These often include potentially higher premiums on new policies due to age and health, and the forfeiture of accumulated benefits or guaranteed features from their current Genworth policy. This creates a strong retention dynamic for Genworth with its established long-term care customer base.

- Mortgage Insurance: Lenders can switch providers for new business, indicating moderate switching costs.

- Long-Term Care: Existing policyholders face high switching costs due to premium increases and loss of benefits.

- New Buyers: Individuals seeking new long-term care policies have more flexibility and lower switching costs compared to existing policyholders.

Regulatory Environment and Market Conduct

The insurance industry, including Genworth Financial's operating segments, is inherently regulated. This regulatory oversight significantly shapes competitive rivalry by establishing stringent solvency requirements and consumer protection standards. For instance, in 2024, the National Association of Insurance Commissioners (NAIC) continued to emphasize risk-based capital (RBC) standards, ensuring insurers maintain adequate financial resources to meet their obligations. These regulations, while creating barriers for new entrants, also foster a more stable competitive landscape by mandating fair market conduct.

Regulatory requirements directly influence pricing strategies and product development, impacting how companies like Genworth compete. For example, state-specific regulations on long-term care insurance premiums and policy features can lead to varied competitive dynamics across different geographic markets. By ensuring a baseline level of financial health and consumer fairness, regulators can inadvertently level the playing field, pushing competition towards service quality, innovation, and operational efficiency rather than solely on price or less regulated practices.

- Impact of Regulations: Insurance markets are heavily regulated, influencing competitive rivalry by setting solvency and consumer protection standards.

- Barriers to Entry: Regulatory requirements act as barriers to entry, shaping the competitive landscape.

- Level Playing Field: Regulations ensure a level playing field regarding solvency and consumer protection, affecting pricing and competition.

- Market Conduct: Oversight of market conduct dictates how companies interact with consumers and each other, influencing competitive strategies.

Competitive rivalry is intense for Genworth Financial, particularly in the U.S. mortgage insurance sector where Enact faces major players like Arch Capital Group and MGIC. The long-term care market, though growing, also sees significant competition, with Genworth needing to innovate to stay ahead. This rivalry is further shaped by regulations, which, while creating barriers to entry, also promote a more stable playing field focused on service and efficiency.

| Competitor | Primary Market | 2024 Outlook |

| Arch Capital Group | Mortgage Insurance | Strong market presence, expanding offerings. |

| Essent Guaranty | Mortgage Insurance | Focus on technology and customer service. |

| MGIC Investment Corporation | Mortgage Insurance | Established player, adapting to market shifts. |

| National Mortgage Insurance Corporation (NMI) | Mortgage Insurance | Niche player, focusing on specific segments. |

| Radian Group | Mortgage Insurance | Diversified services, including title insurance. |

SSubstitutes Threaten

Government-backed mortgage programs like those from the FHA and VA represent a significant threat of substitutes for private mortgage insurers. These programs allow borrowers with less than 20% down payment to obtain home loans, effectively circumventing the need for private mortgage insurance. In 2023, FHA-insured loans accounted for approximately 11% of all single-family originations, demonstrating their substantial market presence.

The threat of substitutes for traditional long-term care insurance is significant, with options like hybrid life insurance policies offering long-term care riders, providing a death benefit and care benefits. As of early 2024, these hybrid products have seen increasing popularity as they can be more attractive than standalone policies for some consumers.

Short-term care insurance policies, covering care for a limited duration, also present a substitute, especially for individuals needing assistance for a few months rather than years. Additionally, annuities with built-in long-term care benefits offer a way to fund care needs while potentially preserving capital, making them a viable alternative for those focused on wealth preservation.

Self-funding through personal savings and investments remains a primary substitute, with many individuals aiming to build sufficient assets to cover potential long-term care costs. The rise of health savings accounts (HSAs) and other investment vehicles further supports this self-funding strategy, making it a competitive alternative to traditional insurance products.

Informal care provided by family members is a significant substitute for formal long-term care insurance. The willingness and availability of family to provide care can reduce the perceived need for, or reliance on, long-term care insurance policies. However, evolving family dynamics and increasing workforce participation mean that the capacity for informal care is diminishing, driving demand for formal solutions.

Medicaid and Other Public Assistance Programs

Medicaid and other public assistance programs represent a significant threat of substitutes for private long-term care insurance. These programs act as a financial safety net, particularly for individuals with lower incomes, by covering a portion of long-term care expenses. This availability, even with stringent eligibility criteria like asset spend-down requirements, offers a fallback option that can deter individuals from purchasing private insurance.

The existence of Medicaid as an ultimate alternative, especially for those who may exhaust private resources, directly impacts the demand for private long-term care solutions. For instance, in 2024, Medicaid continued to be the largest payer of long-term care services in the United States, underscoring its role as a substitute. This public funding can influence pricing strategies and market penetration for private insurers.

- Medicaid's Role: Acts as a primary payer for long-term care for low-income individuals, substituting for private insurance.

- Eligibility Constraints: Strict asset and income requirements limit direct substitution for those with higher financial means.

- 2024 Impact: Medicaid remains a dominant force in long-term care financing, influencing the market for private alternatives.

- Deterrent Effect: The availability of public assistance can reduce the perceived necessity and willingness to pay for private long-term care insurance.

Technological Advancements in Care Delivery

Technological advancements are increasingly offering alternatives to traditional long-term care facilities. Innovations like remote patient monitoring and telehealth allow individuals to receive care in their homes, potentially lowering costs and reducing the demand for insurance covering facility-based services. For instance, the global telehealth market was valued at approximately $120 billion in 2023 and is projected to grow significantly, indicating a strong shift towards these substitute care models.

These emerging technologies can be viewed as substitutes for traditional long-term care insurance products. By enabling individuals to age in place more affordably and conveniently, these solutions may diminish the perceived necessity of comprehensive long-term care insurance policies. This trend could impact Genworth's market share and product demand.

- Remote Patient Monitoring (RPM): Devices that track vital signs and health metrics remotely.

- Telehealth: Virtual consultations with healthcare providers.

- In-Home Care Solutions: Services and technologies supporting care within a person's residence.

- Market Impact: Potential reduction in demand for traditional long-term care insurance.

The threat of substitutes for Genworth's core insurance offerings, particularly long-term care and mortgage insurance, is multifaceted. For long-term care, alternatives range from hybrid life insurance policies with long-term care riders, which gained traction in early 2024, to self-funding via savings and HSAs. Medicaid, a significant payer of long-term care services in 2024, also acts as a crucial substitute, especially for lower-income individuals. Technological advancements like telehealth and remote patient monitoring, with the telehealth market valued around $120 billion in 2023, further enable aging in place, potentially reducing reliance on traditional insurance.

| Substitute Category | Specific Examples | 2023/2024 Relevance | Impact on Genworth |

|---|---|---|---|

| Government Programs | FHA, VA loans | FHA loans were ~11% of single-family originations in 2023. | Reduces need for private mortgage insurance. |

| Hybrid Insurance | Life insurance with LTC riders | Increasing popularity as of early 2024. | Offers an alternative to standalone LTC policies. |

| Public Assistance | Medicaid | Largest payer of long-term care services in the US (2024). | Acts as a financial safety net, potentially reducing demand for private LTC insurance. |

| Technology | Telehealth, Remote Patient Monitoring | Global telehealth market valued at ~$120 billion in 2023. | Enables in-home care, potentially lowering demand for facility-based LTC insurance. |

Entrants Threaten

The insurance sector, particularly in areas like long-term care and mortgage insurance, demands substantial capital. For instance, in 2024, regulatory bodies continue to enforce robust solvency requirements, often necessitating billions in capital reserves for insurers to operate.

These significant capital needs, coupled with complex and time-consuming regulatory approval processes for new licenses and products, create formidable barriers. Navigating these hurdles requires extensive legal, actuarial, and financial expertise, making it exceptionally difficult for newcomers to establish a foothold against established players like Genworth.

Established players like Genworth Financial benefit from strong brand recognition and trust built over years, particularly in sensitive areas like long-term care. This is a significant barrier for newcomers. For instance, in 2024, consumer trust surveys consistently showed established financial institutions holding a substantial lead over newer fintech entrants in securing long-term financial commitments.

New entrants would need substantial investment in marketing and time to build similar levels of credibility and trust with consumers and lenders. Without this established reputation, attracting customers and securing favorable terms from capital providers becomes considerably more challenging and costly.

Distribution channels are a significant barrier for new entrants in the financial services sector. For instance, establishing the necessary relationships with mortgage lenders to offer mortgage insurance, or building a robust network of financial advisors for long-term care products, requires substantial time and investment. Genworth, like many established players, benefits from these deep-rooted networks, making it difficult for newcomers to gain comparable market access.

Expertise in Risk Underwriting and Actuarial Science

The threat of new entrants for Genworth Financial, particularly in its mortgage and long-term care insurance segments, is significantly mitigated by the substantial expertise required in risk underwriting and actuarial science. Building this deep knowledge base is a considerable hurdle for any new competitor aiming to enter the market effectively.

New players must invest heavily in developing or acquiring specialized skills in actuarial modeling, risk assessment, and complex claims management. This isn't easily replicated; it requires years of experience and data analysis to price policies accurately and manage potential liabilities. For instance, the accuracy of actuarial assumptions directly impacts profitability, making this a critical barrier.

- Specialized Knowledge: Mortgage and long-term care insurance demand intricate actuarial science and underwriting expertise, a significant barrier for new entrants.

- Capital Investment: Developing the necessary technological infrastructure and talent pool for risk assessment requires substantial upfront capital.

- Regulatory Hurdles: Navigating complex insurance regulations in various jurisdictions adds another layer of difficulty for potential new competitors.

- Brand Reputation: Established players like Genworth benefit from years of building trust and a reputation for reliability, which new entrants must work hard to achieve.

Incumbent Advantages and Economies of Scale

Existing insurers like Genworth Financial hold significant advantages due to their established operations and economies of scale. These scale benefits are evident in areas such as claims processing, where higher volumes lead to lower per-claim costs, and in data analytics, where larger datasets allow for more sophisticated risk modeling and pricing. For instance, in 2024, the average cost of processing a life insurance claim for a large insurer was significantly lower than what a startup would likely incur.

New entrants would face considerable hurdles in matching the cost efficiencies of incumbents. Without the benefit of scale, new companies would likely experience higher per-unit costs across their operations. This makes competing on price extremely challenging unless they possess substantial initial capital to absorb these higher costs or can achieve rapid market penetration to build scale quickly.

- Economies of Scale: Incumbents like Genworth leverage scale in operations, claims, and data analytics, leading to lower per-unit costs.

- Cost Disadvantage for New Entrants: Startups face higher initial per-unit costs, hindering price competitiveness.

- Capital Requirements: Significant financial backing is necessary for new entrants to overcome cost disadvantages and compete effectively.

The threat of new entrants for Genworth Financial is generally low due to high capital requirements, stringent regulatory approvals, and the need for specialized underwriting and actuarial expertise. For example, in 2024, the solvency capital requirement for insurers in many developed markets remained in the billions, a significant barrier for startups.

Established brand loyalty and extensive distribution networks further solidify Genworth's position, making it difficult for new players to gain market share. The cost of building comparable trust and access to distribution channels, like financial advisor networks for long-term care, requires years and substantial investment, often in the tens of millions for effective reach.

New entrants also face a cost disadvantage due to the lack of economies of scale that incumbents like Genworth enjoy in claims processing and data analytics. For instance, a 2024 industry report indicated that large insurers could process claims at nearly 20% lower per-unit costs than smaller or new operations.

| Barrier to Entry | Impact on New Entrants | Genworth's Advantage |

|---|---|---|

| Capital Requirements | Very High (Billions for solvency) | Established capital base |

| Regulatory Hurdles | Complex and time-consuming approvals | Experienced compliance teams |

| Specialized Expertise | Requires deep actuarial/underwriting knowledge | Years of developed talent and data |

| Brand Reputation & Trust | Difficult to replicate (years to build) | Strong consumer and partner recognition |

| Distribution Networks | Costly and time-consuming to establish | Existing relationships with lenders/advisors |

| Economies of Scale | Higher per-unit operating costs | Lower costs in claims, data, operations |

Porter's Five Forces Analysis Data Sources

Our Genworth Financial Porter's Five Forces analysis is built upon a robust foundation of data, including Genworth's annual reports and SEC filings, alongside industry-specific market research from firms like IBISWorld and S&P Global Market Intelligence.