Genus SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Genus Bundle

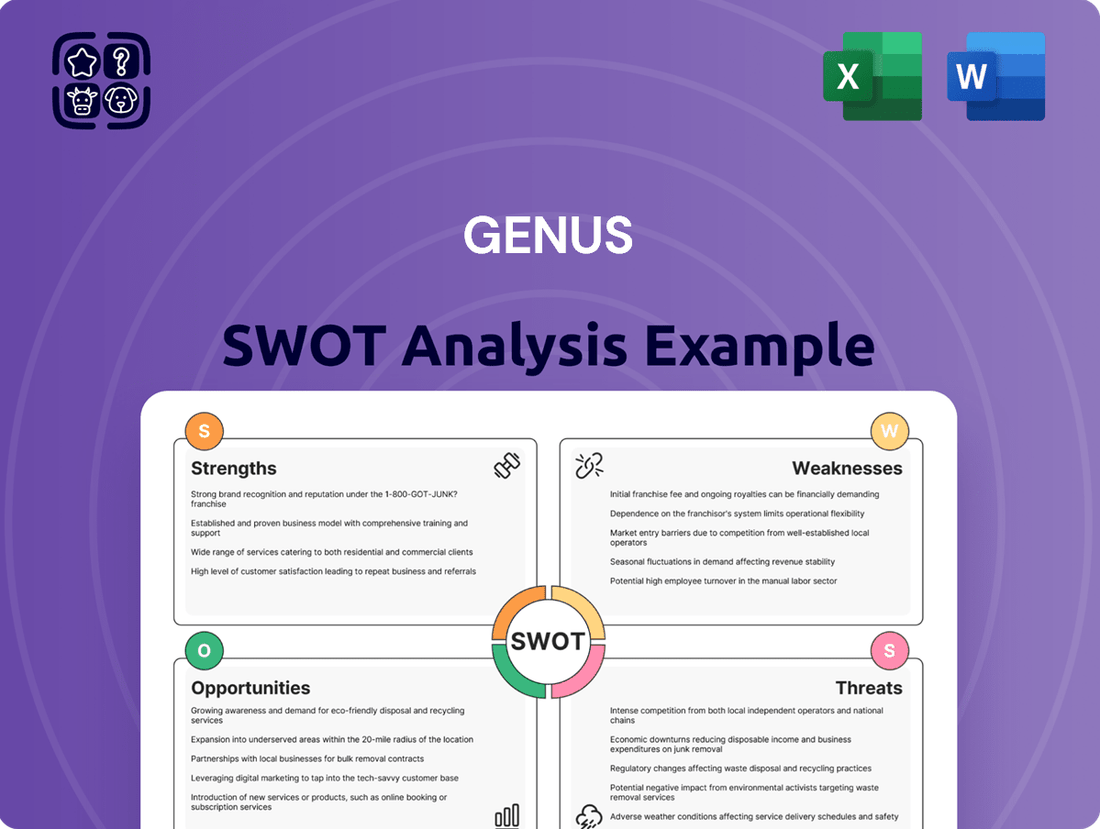

The Genus SWOT analysis provides a crucial overview of its market standing, highlighting key strengths and potential challenges. Understanding these elements is vital for anyone looking to invest or strategize within this sector.

Ready to dive deeper and unlock actionable intelligence? Purchase the full SWOT analysis for a comprehensive, professionally crafted report that includes detailed breakdowns and strategic recommendations, empowering your decision-making.

Strengths

Genus plc stands as a global leader in animal genetics, leveraging advanced biotechnology to drive improvements in livestock. Its operations, primarily through PIC for pigs and ABS for cattle, span over 85 countries, significantly boosting the efficiency and sustainability of farming practices.

Genus demonstrates a robust commitment to innovation through substantial R&D spending, consistently allocating over £20 million each year. This financial backing fuels their pursuit of cutting-edge genetic technologies.

This dedication to research has resulted in significant advancements, notably the PRRS Resistant Pig. This breakthrough has already achieved positive regulatory assessments in multiple nations, with anticipated US FDA approval slated for 2025.

Genus possesses a significant competitive advantage due to its ownership of proprietary genetics, meticulously developed through cutting-edge biotechnology. This unique asset allows them to offer superior breeding lines to customers worldwide.

Their strength is further amplified by an extensive global network, encompassing a robust supply chain, dedicated technical services, and efficient sales and distribution channels. This infrastructure ensures their advanced genetics, available as semen and breeding animals, reach markets effectively.

For the fiscal year ending September 30, 2023, Genus reported revenue of £575.5 million, with their Animal Genetics segment being the primary driver of this performance. This demonstrates the commercial success and market penetration of their genetic offerings.

Commitment to Sustainability

Genus demonstrates a strong commitment to sustainability by embedding it within their core mission. They focus on enabling farmers to produce high-quality, affordable meat and milk more efficiently, which inherently means using fewer resources like water, energy, and land.

Their innovative genomic approaches to animal breeding are specifically designed to reduce environmental impact. This includes lowering greenhouse gas emissions and improving animal health and welfare, which can also lead to a decreased reliance on antibiotics.

- Resource Efficiency: Genus's genetic solutions aim to maximize output while minimizing inputs such as water, energy, and land.

- Environmental Impact Reduction: Their breeding programs are geared towards lowering greenhouse gas emissions from livestock.

- Animal Welfare and Health: Improved animal health and welfare can reduce the need for veterinary interventions, including antibiotics.

Resilient Performance and Strategic Focus

Genus has shown impressive resilience, especially in its PIC ex-China operations, where it has successfully expanded its market share despite broader economic headwinds. This sustained growth in key international markets underscores the company's ability to navigate complex environments effectively.

Management's proactive approach is evident in initiatives like the Value Acceleration Program (VAP) for its ABS division. This program is designed to fundamentally improve the Group's financial health and set a strong foundation for sustained profit expansion in the coming years.

- PIC ex-China Market Share Growth: Genus's PIC business outside of China has continued its upward trajectory, indicating strong competitive positioning.

- Value Acceleration Program (VAP): This strategic initiative in ABS aims to enhance profitability and operational efficiency across the segment.

- Structural Strengthening: Management actions are focused on building a more robust and profitable business model for the long term.

Genus's proprietary genetic technology is a significant strength, providing a unique competitive edge in the animal genetics market. Their substantial and consistent R&D investment, exceeding £20 million annually, fuels continuous innovation, such as the PRRS Resistant Pig, which is nearing US FDA approval in 2025. This technological leadership, coupled with an extensive global network for distribution and support, ensures effective market reach and reinforces their market position.

| Metric | Value | Year | Source |

|---|---|---|---|

| R&D Investment | > £20 million | FY23 | Genus plc Financial Reports |

| Global Reach | 85+ countries | FY23 | Genus plc Company Overview |

| Revenue (Animal Genetics) | £575.5 million | FY23 | Genus plc Financial Reports |

What is included in the product

Analyzes Genus’s competitive position through key internal and external factors, detailing its strengths, weaknesses, opportunities, and threats.

Offers a structured framework to identify and address critical business weaknesses before they escalate into major problems.

Weaknesses

Genus's exposure to the Chinese market presents a notable weakness. The company has experienced a significant impact on both its PIC (Pig Improvement Company) and ABS (Artificial Insemination) segments due to adverse market conditions in China. This includes low pork prices, reduced bovine volumes, and a substantial decline in the dairy herd, a situation that has persisted into 2024.

These fluctuations in China directly affected Genus's financial performance, contributing to a decrease in its overall adjusted operating profit. For instance, the company has cited the challenging Chinese market as a key factor impacting its results, with a cautious outlook remaining for this region as of early 2025.

The strengthening of the Sterling pound against major global currencies presents a notable weakness for Genus. This currency appreciation acts as a headwind, negatively affecting the company's reported financial results.

For the fiscal year 2025, Genus anticipates an approximate £8-9 million currency headwind. This significant impact can obscure the underlying positive financial performance when measured in constant currency terms, making it harder to assess true operational growth.

Genus Power's profitability has seen a dip in certain key areas, even as other regions demonstrate stability. For instance, the PIC Asia segment experienced a notable decline in its operating profit during the first half of fiscal year 2025. This downturn was largely attributed to the challenging market conditions prevalent in the region, coupled with substantial investments made in supply chain enhancements.

More specifically, PIC China's adjusted operating profit saw a significant decrease, falling by 18.5% year-over-year for the same period. This contraction directly impacted the group's overall profitability, underscoring the sensitivity of Genus Power's financial performance to regional market dynamics and strategic capital expenditures.

Increased Net Financing Costs

Genus has faced a significant challenge with its increased net financing costs, largely driven by a higher interest rate environment and a greater reliance on borrowings. This financial headwind has directly impacted its profitability, contributing to a reduction in adjusted profit before tax, even as the company strived for operational efficiencies.

The financial pressure stemming from these higher financing expenses is a notable weakness. For instance, in their fiscal year ending March 31, 2023, Genus reported finance costs of £24.0 million, a notable increase from £17.1 million in the prior year. This surge in costs, up by over 40%, underscores the impact of rising interest rates on their debt obligations.

- Rising Interest Rates: Global monetary policy shifts have led to higher borrowing costs for Genus.

- Increased Borrowings: The company's debt levels have contributed to the overall rise in finance expenses.

- Profitability Impact: Higher net financing costs directly reduce profit before tax, creating financial strain.

- FY23 Finance Costs: A jump to £24.0 million from £17.1 million in FY22 highlights the growing burden.

Reliance on Regulatory Approvals for New Products

Genus's ability to bring groundbreaking products, such as its PRRS Resistant Pig, to market hinges significantly on securing approvals from regulatory bodies like the US Food and Drug Administration (FDA). Delays in these crucial approval stages can directly impede the planned launch dates and, consequently, the expected revenue streams from these advanced biotechnologies. For instance, the timeline for commercializing gene-edited products can extend for years, impacting the return on significant R&D investments.

The inherent unpredictability of regulatory review processes introduces a notable weakness. Any setbacks or extended timelines in obtaining necessary certifications can disrupt Genus's product pipeline and financial projections. This reliance means that even a scientifically sound and commercially viable product can face substantial hurdles before reaching its target market, potentially affecting investor confidence and the company's growth trajectory.

- Regulatory Dependence: Genus's commercialization strategy for novel products, including those in animal health, is directly tied to obtaining approvals from agencies such as the US FDA.

- Timeline Uncertainty: Delays or complications in the regulatory approval process can significantly impact the market entry timelines and revenue generation from new technologies.

- Impact on R&D Investment: Extended approval cycles can affect the return on substantial research and development investments, creating financial risks.

Genus's significant reliance on the Chinese market, particularly its PIC and ABS segments, poses a substantial weakness. Adverse conditions such as low pork prices and a reduced dairy herd in China have directly impacted the company's financial results, leading to a decrease in adjusted operating profit. This vulnerability to regional market downturns, a situation persisting into early 2025, creates considerable financial risk.

The strengthening of the Sterling pound against other currencies is another key weakness, acting as a headwind that negatively affects Genus's reported financial performance. For fiscal year 2025, the company projected an approximate £8-9 million currency headwind, which can obscure underlying operational growth when results are viewed in constant currency terms.

Genus's profitability is also hampered by increased net financing costs, driven by higher interest rates and greater reliance on borrowings. This financial strain directly reduces profit before tax. For instance, finance costs rose to £24.0 million in fiscal year ending March 31, 2023, a significant increase from £17.1 million in the prior year, highlighting the growing burden of debt in a rising rate environment.

The company's commercialization of innovative products, such as its PRRS Resistant Pig, is heavily dependent on regulatory approvals, for example from the US FDA. Delays in these crucial stages can impede launch dates and expected revenue streams, with gene-edited product timelines potentially extending for years and impacting R&D investment returns.

Preview Before You Purchase

Genus SWOT Analysis

This preview reflects the real document you'll receive—professional, structured, and ready to use. You're seeing the actual Genus SWOT analysis, ensuring transparency and quality. Once purchased, the complete, detailed report will be yours to download immediately.

Opportunities

The world's population is projected to reach nearly 10 billion by 2050, driving a substantial increase in demand for animal protein. This surge, particularly in emerging economies, creates a robust market for companies like Genus that provide advanced breeding solutions to boost livestock productivity.

As urbanization accelerates, so does the consumption of protein-rich foods. This shift means livestock producers are increasingly seeking genetic technologies to improve feed conversion, disease resistance, and overall output of meat, milk, and eggs, directly benefiting Genus's core business.

Continuous innovations in genetic technologies, such as genomic selection and CRISPR-based gene editing, present significant opportunities for Genus. These advancements allow for the creation of livestock with enhanced traits like disease resistance and improved feed efficiency.

The integration of artificial intelligence into genetic research further accelerates the development of superior animal genetics. This technological edge is crucial for Genus to maintain its market leadership by offering livestock solutions that boost productivity and food quality for its global clientele.

Genus is well-positioned to capitalize on the growing demand for advanced livestock genetics in emerging markets across Asia and Latin America. These regions are experiencing a significant push towards agricultural intensification and increased investment in modern breeding technologies, creating a fertile ground for Genus's solutions.

Strategic moves, like the complete acquisition of De Novo Genetics LLC in early 2024, bolster Genus's capabilities and market reach. This expansion into new species and the integration of novel technologies are key to unlocking further growth opportunities and diversifying its revenue streams.

Commercialization of PRRS Resistant Pig

The anticipated FDA approval for the PRRS resistant pig in 2025, coupled with positive regulatory outlooks in key markets like Brazil and Colombia, unlocks a substantial commercialization pathway for Genus. This innovation directly tackles the significant economic burden of PRRS in the global swine industry, promising substantial value for pork producers and a novel revenue source for the company.

The commercialization of this gene-edited pig represents a pivotal moment, addressing a critical unmet need in swine health. The potential market impact is considerable, given that PRRSV costs the US pork industry an estimated $664 million annually, according to a 2023 USDA report. Genus is well-positioned to capitalize on this opportunity.

- FDA Approval Anticipated: Expected in 2025, paving the way for US market entry.

- International Regulatory Progress: Favorable determinations in Brazil and Colombia expand global reach.

- Disease Threat Mitigation: Addresses a major economic challenge for pork producers worldwide.

- New Revenue Stream: Creates a significant opportunity for Genus to generate new income.

Value Acceleration Programs for Operational Efficiency

Genus's commitment to operational efficiency is highlighted by its Value Acceleration Program (VAP) within the ABS bovine business. This initiative, coupled with strategic research and development reviews, is specifically designed to unlock greater value and achieve significant cost savings. These focused efforts are projected to deliver substantial improvements in adjusted operating profit, bolstering the company's financial performance in the upcoming fiscal years.

The VAP and R&D reviews are not just internal processes; they represent a strategic pivot towards enhanced profitability. The anticipated benefits are concrete, aiming for tangible year-over-year gains. For instance, the company has previously indicated that such programs could lead to millions in annual adjusted operating profit improvements, directly translating to a stronger bottom line and increased shareholder value.

- Value Acceleration Program (VAP) in ABS bovine business

- Strategic R&D reviews for cost efficiencies

- Expected substantial annual adjusted operating profit improvements

- Contribution to stronger business performance in coming fiscal years

The global demand for protein continues to rise, particularly in emerging markets, creating a significant opportunity for Genus to expand its advanced breeding solutions. Innovations in gene editing, such as CRISPR, offer pathways to develop livestock with improved disease resistance and feed efficiency, directly addressing key industry needs. The anticipated FDA approval for a PRRS-resistant pig in 2025, with an estimated annual cost of $664 million to the US pork industry, presents a substantial commercialization opportunity. Furthermore, strategic acquisitions and a focus on operational efficiency through programs like VAP are poised to unlock further growth and profitability.

| Opportunity Area | Key Driver | Potential Impact | 2025 Outlook |

|---|---|---|---|

| Growing Protein Demand | Global population growth to nearly 10 billion by 2050 | Increased market for livestock genetics | Continued demand growth in emerging markets |

| Genetic Technology Advancements | Genomic selection, CRISPR gene editing | Enhanced livestock traits (disease resistance, feed efficiency) | Development of new, improved animal lines |

| PRRS Resistant Pig Commercialization | Anticipated FDA approval in 2025 | Addresses $664M annual PRRS cost in US | Significant new revenue stream |

| Operational Efficiency (VAP) | Focus on cost savings and value acceleration | Projected substantial improvements in adjusted operating profit | Strengthened financial performance |

Threats

Geopolitical and macroeconomic instability presents a significant threat to Genus. Ongoing conflicts, such as the protracted Russia-Ukraine war, continue to disrupt global energy markets and supply chains, impacting operational costs and material availability.

Furthermore, slower-than-anticipated economic recovery in major markets, including China, which saw its GDP growth moderate to 5.2% in 2023, creates uncertainty in demand for Genus's products and services. The potential for increased trade restrictions or protectionist policies in various regions could also hinder international sales and market access.

The persistent threat of livestock diseases, including devastating outbreaks like Porcine Reproductive and Respiratory Syndrome (PRRS) and African Swine Fever (ASF), continues to challenge the industry. These outbreaks can decimate herds, leading to significant financial losses for producers and impacting the demand for high-quality genetics.

The economic fallout from such diseases is substantial. For instance, the USDA estimated that PRRS alone cost the US pork industry $664 million annually in the late 2010s, a figure that likely remains a significant concern in 2024 and 2025. Such events create market volatility and uncertainty, affecting breeding stock values and overall industry stability.

Volatile commodity and feed prices present a significant threat to Genus. Fluctuations in the cost of feed, a major input for protein production, directly impact farmer profitability. For instance, a sharp increase in corn or soybean prices during 2024 could squeeze margins for livestock producers.

This reduced profitability can dampen demand for Genus's genetic products and services. When farmers face tighter financial conditions, their willingness to invest in advanced breeding technologies and premium genetics may decrease, potentially leading to lower sales volumes for Genus.

Intense Competition in the Animal Genetics Market

The animal genetics market is a crowded space, with established global giants like Urus, Neogen Corporation, and Groupe Grimaud actively competing. This fierce rivalry means companies must constantly invest in research and development to stay ahead. Failure to innovate can quickly lead to a loss of market share.

The competitive landscape demands strategic agility. For instance, Neogen Corporation's acquisition of Detectify in late 2023 for $16 million aimed to bolster its food safety testing capabilities, showcasing a move to consolidate and expand offerings in a bid to outmaneuver rivals. This intense pressure requires Genus to continuously refine its genetic solutions and expand its service offerings to maintain its standing.

- Global Animal Genetics Market Size: Projected to reach approximately $5.5 billion by 2025, indicating substantial growth and intense competition for a share of this expanding market.

- Key Competitors: Urus, Neogen Corporation, and Groupe Grimaud are significant players with diverse genetic portfolios and global reach.

- Innovation Imperative: Continuous investment in R&D is crucial to develop superior genetic traits and advanced breeding technologies, a necessity driven by competitive pressures.

Evolving Regulatory Landscape for Genetic Engineering

The regulatory environment for genetic engineering is a significant challenge, as rules are constantly changing and differ greatly from one nation to another. For instance, the European Union's stance on genetically modified organisms (GMOs) remains more restrictive than that of the United States, impacting market entry for new breeding technologies. This variability means Genus must navigate complex compliance requirements, which can delay product launches and increase operational expenses.

Stricter regulations, particularly concerning gene editing technologies like CRISPR, could significantly hinder the commercialization of Genus's innovative products. For example, if new legislation imposes lengthy and costly approval processes for gene-edited traits, it could reduce the speed at which Genus can bring its advanced genetics to market. This also affects market access, potentially limiting where Genus’s solutions can be sold and utilized.

- Regulatory Uncertainty: Evolving global regulations for genetic engineering create unpredictability for product development and market access.

- Increased Compliance Costs: Adapting to diverse and changing regulatory frameworks in different countries raises operational expenses for Genus.

- Market Access Limitations: Unfavorable regulatory changes in key markets could restrict the commercialization and adoption of Genus's advanced breeding technologies.

- Impact on Innovation Pipeline: Stringent or slow approval processes for gene-edited products could delay or even halt the introduction of new, valuable traits.

The increasing prevalence of antibiotic-resistant bacteria poses a significant threat to animal health and, consequently, to Genus's business. This growing resistance can reduce the effectiveness of treatments for common livestock infections, leading to higher mortality rates and reduced productivity. The economic impact of widespread antibiotic resistance could translate into increased veterinary costs and a diminished demand for premium genetics if herd health deteriorates across the industry.

SWOT Analysis Data Sources

This Genus SWOT analysis draws from a robust blend of internal financial statements, comprehensive market research reports, and expert industry forecasts to provide a well-rounded and actionable strategic overview.