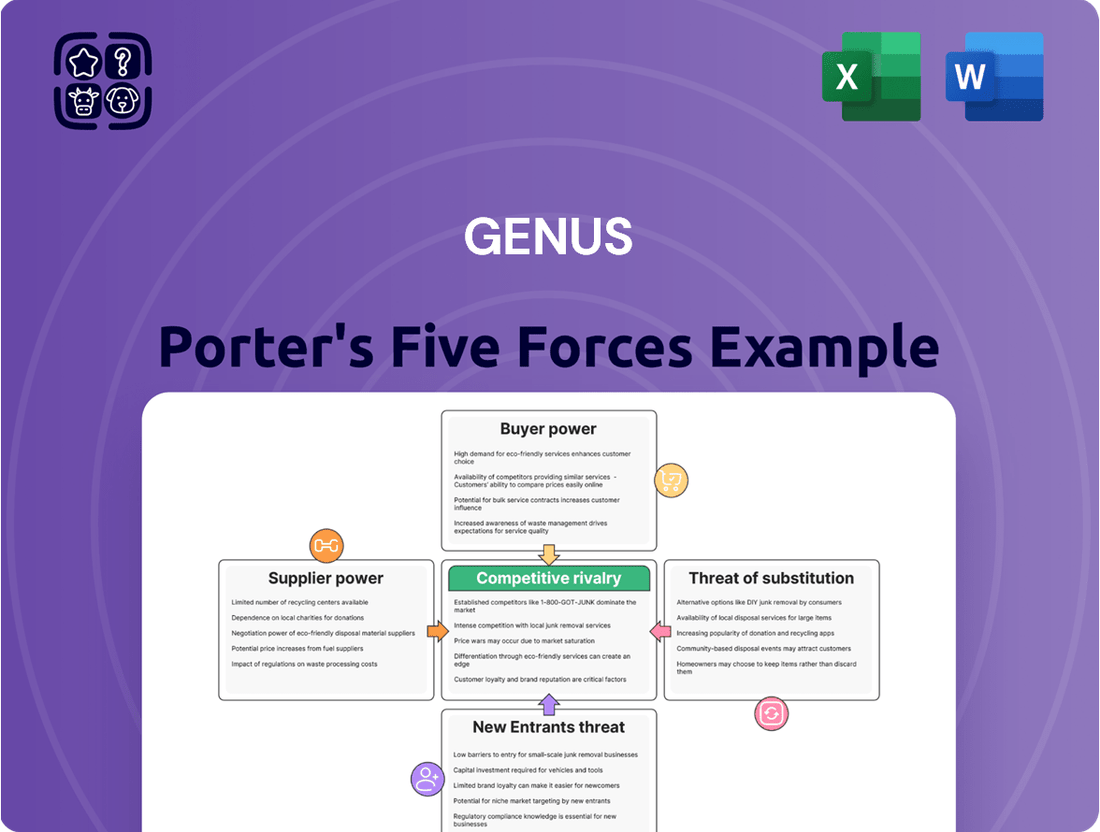

Genus Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Genus Bundle

Understanding the competitive landscape is crucial for any business, and Porter's Five Forces provides a powerful framework to dissect Genus's industry. This analysis reveals the underlying forces that shape profitability and strategic positioning.

This brief snapshot only scratches the surface. Unlock the full Porter's Five Forces Analysis to explore Genus’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

Genus plc's reliance on specialized genetic material suppliers is a key factor in its bargaining power analysis. These suppliers provide unique genetic lines and advanced research tools crucial for Genus's operations. The scarcity and proprietary nature of these inputs can give these suppliers considerable leverage.

The bargaining power of these specialized suppliers is amplified if there are limited alternative sources for the required genetic materials or if the intellectual property surrounding these inputs is heavily protected. This concentration of specialized knowledge and resources means suppliers can dictate terms, impacting Genus's cost structure and operational flexibility.

Advanced biotechnology equipment providers wield significant bargaining power, especially for companies like Genus, whose operations rely on highly specialized machinery for genetic analysis, reproduction, and storage. The substantial investment required for this cutting-edge equipment, coupled with ongoing maintenance contracts and the need for specialized operational expertise, creates a strong dependency on these suppliers. For instance, the global market for laboratory equipment, which includes advanced biotechnology tools, was valued at approximately $50 billion in 2023 and is projected to grow, indicating a robust demand that further solidifies supplier leverage.

Genus's reliance on a concentrated pool of high-skilled scientific talent, including geneticists, veterinarians, and biotechnology researchers, significantly amplifies supplier bargaining power. In 2024, the demand for specialized life sciences professionals continued to outstrip supply, with reports indicating an average of 10 qualified candidates per opening in niche areas, a stark contrast to broader fields.

Universities and specialized recruitment firms, acting as primary suppliers of this critical expertise, can leverage this scarcity to negotiate higher placement fees and compensation packages. This dynamic directly impacts Genus's operational costs and its ability to attract and retain top-tier scientific minds, a key differentiator in its competitive landscape.

Regulatory Compliance and Biosecurity Inputs

Suppliers of critical biosecurity and regulatory compliance inputs, such as vaccines and diagnostic kits, possess significant bargaining power over Genus. Failure to adhere to strict biosecurity protocols, often mandated by governmental bodies, can lead to operational shutdowns and reputational damage. For instance, outbreaks of diseases like Avian Influenza or African Swine Fever, which require stringent biosecurity measures, can halt production and incur substantial financial losses, highlighting the dependency on reliable suppliers of preventative and diagnostic solutions.

- Biosecurity Input Dependency: Genus relies on specialized suppliers for vaccines, disease testing kits, and sterile housing solutions crucial for maintaining herd health and preventing costly disease outbreaks.

- Regulatory Adherence: Compliance with evolving animal health regulations and international trade standards necessitates sourcing inputs from suppliers who meet these rigorous requirements, granting them leverage.

- Impact of Non-Compliance: A single breach in biosecurity or a failure in a critical diagnostic input could lead to widespread animal loss, market access restrictions, and severe financial penalties, underscoring the power of these specialized suppliers.

Proprietary Data and Analytics Tools

In today's data-centric landscape, suppliers offering sophisticated bioinformatics software, genetic sequencing, and extensive data analytics platforms hold significant sway. The unique capabilities of these tools and the crucial information they unlock can create a dependency for companies like Genus on these specialized providers.

The proprietary nature of these advanced technologies means that switching costs can be substantial. For instance, if a key analytics platform used by Genus for genomic data interpretation is provided by a single vendor, that vendor gains considerable bargaining power. This is particularly true if the platform is deeply integrated into Genus's research and development workflows.

- High Switching Costs: Companies often invest heavily in integrating specialized software and services, making it costly and time-consuming to switch to alternatives.

- Data Integration Complexity: Proprietary systems can lock in data, requiring significant effort and expertise to migrate or access elsewhere.

- Dependence on Innovation: Suppliers who are leaders in developing new analytical techniques or data processing capabilities can command greater leverage.

- Limited Availability of Alternatives: In niche areas of bioinformatics or genetic analysis, there may be few, if any, comparable suppliers.

Suppliers of specialized genetic materials and advanced biotechnology equipment possess significant bargaining power due to the scarcity and proprietary nature of their offerings. This leverage is amplified when there are limited alternatives, as seen in the high demand for specialized life sciences professionals in 2024, where niche areas reported an average of 10 qualified candidates per opening. Furthermore, critical biosecurity input providers and sophisticated bioinformatics software vendors can dictate terms, especially when switching costs are high and data integration is complex, impacting Genus's cost structure and operational flexibility.

| Supplier Type | Key Leverage Factors | Impact on Genus | 2024/2023 Data Point |

|---|---|---|---|

| Specialized Genetic Material Suppliers | Scarcity, proprietary nature, limited alternatives | Higher input costs, reduced operational flexibility | N/A (inherently proprietary) |

| Advanced Biotechnology Equipment Providers | High capital investment, ongoing maintenance, specialized expertise | Increased capital expenditure, dependence on service contracts | Global lab equipment market valued ~$50 billion in 2023 |

| Specialized Scientific Talent Providers (Recruiters/Universities) | Shortage of niche skills, high demand | Elevated recruitment costs, challenges in talent retention | ~10 qualified candidates per opening in niche life sciences roles (2024) |

| Biosecurity & Regulatory Compliance Suppliers | Strict regulatory requirements, risk of operational shutdown | Dependency on reliable suppliers for disease prevention and compliance | N/A (contextual to disease outbreaks) |

| Bioinformatics & Data Analytics Software Suppliers | Proprietary technology, high switching costs, data integration complexity | Lock-in effect, significant costs for system migration | N/A (contextual to integration) |

What is included in the product

This analysis dissects the competitive forces impacting Genus, including the threat of new entrants, the bargaining power of buyers and suppliers, the threat of substitutes, and the intensity of rivalry within the industry.

Quickly identify and mitigate competitive threats by visualizing the intensity of each of Porter's Five Forces.

Customers Bargaining Power

Genus's main customers are typically large, consolidated commercial livestock operations and integrators. These entities buy genetics in substantial quantities, giving them considerable sway.

Their significant purchasing volume allows these major buyers to negotiate favorable prices and terms, thereby increasing their bargaining power.

In 2024, the global livestock market continued to see consolidation, with large integrators representing a significant portion of genetic material purchases, reinforcing their leverage over suppliers like Genus.

While Genus's advanced genetics provide a competitive edge, for certain standard product offerings, customers may find it easy to switch to alternative suppliers if they perceive comparable basic genetic lines. This ease of switching, particularly in less specialized market segments, can significantly amplify the bargaining power of these customers.

Very large livestock producers or agricultural conglomerates could potentially develop their own genetic improvement programs. This capability for backward integration, leveraging their financial strength and technical expertise, grants them significant negotiation power with Genus.

Price Sensitivity in Commodity Markets

The ultimate output of Genus's genetics, like meat and dairy, often finds itself in commodity markets. This means producers are acutely aware of their input costs, and any fluctuation can significantly impact their bottom line. Consequently, these customers are highly price-sensitive.

This inherent price sensitivity in commodity markets directly translates to Genus. Customers, aiming to protect their own profit margins, will actively push for competitive pricing on Genus's genetic products. They need to ensure their own costs are managed to remain viable in these low-margin environments.

- 2024 Global Meat Production: Expected to reach approximately 370 million metric tons, highlighting the scale of the market and the importance of cost control for producers.

- Dairy Commodity Price Volatility: Global dairy prices can fluctuate significantly, with indices like the Global Dairy Trade (GDT) Price Index showing month-over-month changes that directly impact buyer margins. For instance, in early 2024, certain dairy commodities experienced price adjustments that put pressure on processors.

- Impact on Input Costs: Producers in these sectors often operate on thin margins, making the cost of high-quality genetics a critical factor in their overall profitability.

- Customer Bargaining Power: The ability of customers to switch suppliers if prices are not competitive is a significant lever in their favor, directly influencing Genus's pricing power.

Access to Information and Benchmarking

Customers today have unprecedented access to information. They can easily compare Genus's performance data, genetic traits, and industry benchmarks against those of its competitors. This transparency significantly bolsters their ability to negotiate better terms and pricing, as they can readily identify more advantageous options.

For instance, in the agricultural sector, where Genus operates, online platforms and industry publications frequently publish detailed performance metrics for various livestock breeds and genetic lines. This allows farmers to make highly informed decisions, directly impacting their purchasing power when selecting breeding stock or genetics from companies like Genus. In 2024, the availability of such data is more widespread than ever, making it a critical factor in customer decision-making.

- Enhanced Transparency: Customers can now easily access and analyze performance data, genetic comparisons, and industry benchmarks.

- Informed Purchasing Decisions: This readily available information empowers customers to make more strategic and cost-effective choices.

- Increased Competitive Awareness: Customers can directly compare Genus's offerings against rivals, driving down prices and demanding better value.

- Negotiating Leverage: Greater knowledge translates into stronger bargaining power for customers seeking optimal outcomes.

Genus's customers, primarily large commercial livestock operations, wield significant bargaining power due to their substantial purchasing volumes and the price-sensitive nature of commodity markets. The ongoing consolidation in the global livestock sector in 2024 further amplifies this leverage, as larger entities represent a greater share of genetic material acquisitions. Customers can also switch to alternative suppliers for less specialized genetic lines, and their ability to access transparent performance data empowers them to negotiate better terms.

| Customer Characteristic | Impact on Bargaining Power | 2024 Data/Context |

| High Purchasing Volume | Enables negotiation of favorable prices and terms | Global meat production expected around 370 million metric tons |

| Price Sensitivity (Commodity Markets) | Drives demand for competitive pricing on inputs | Dairy commodity prices show volatility, impacting producer margins |

| Ease of Switching (Standard Products) | Increases leverage for customers seeking cost-effective alternatives | Availability of comparable basic genetic lines from competitors |

| Access to Information & Benchmarks | Empowers informed decision-making and negotiation | Widespread availability of performance metrics and industry comparisons |

What You See Is What You Get

Genus Porter's Five Forces Analysis

This preview shows the exact document you'll receive immediately after purchase—no surprises, no placeholders.

You're looking at the actual document. Once you complete your purchase, you’ll get instant access to this exact file, providing a comprehensive overview of Porter's Five Forces Analysis.

The document displayed here is the part of the full version you’ll get—ready for download and use the moment you buy, offering insights into competitive intensity and industry attractiveness.

Rivalry Among Competitors

Genus operates in a highly competitive global landscape, facing off against established giants in animal genetics. Companies like Hendrix Genetics and divisions of major agricultural conglomerates, such as Zoetis, possess substantial market presence and deep financial resources. These competitors often command significant market share, bolstered by extensive distribution networks that reach across continents and robust research and development budgets that fuel innovation. For instance, the global animal genetics market was valued at approximately $3.5 billion in 2023 and is projected to grow steadily, indicating the scale of investment and competition within the sector.

The animal genetics sector is characterized by significant barriers to entry, largely due to the immense capital required for research and development. Companies must invest heavily in cutting-edge genetic sequencing technology, sophisticated breeding programs, and extensive field trials. For instance, major players in the global animal genetics market, such as Hendrix Genetics and Genus Plc, consistently report R&D expenditures in the tens of millions of dollars annually, reflecting the ongoing need for innovation and product improvement.

These substantial upfront investments translate into high fixed costs for animal genetics firms. Once these facilities and technologies are in place, there's a strong incentive to achieve high sales volumes to spread these costs over a larger production base. This can fuel aggressive competition, with companies potentially engaging in price wars to capture market share and ensure their expensive infrastructure is fully utilized, impacting overall industry profitability.

Competitive rivalry is intense, fueled by the constant pursuit of superior genetic traits and robust intellectual property protection. Companies are locked in an innovation race, differentiating their products through enhanced genetic performance, improved disease resistance, and greater operational efficiency to secure market share.

For instance, in the agricultural sector, companies like Bayer and Corteva Agriscience invest billions annually in research and development to develop proprietary seed traits and crop protection solutions. In 2023, Bayer reported R&D expenses of over €5.7 billion, with a significant portion dedicated to its Crop Science division, highlighting the substantial financial commitment to intellectual property and product differentiation.

Strategic Alliances and Acquisitions

The biotechnology sector, for instance, witnessed significant consolidation in 2024. Major players like Pfizer and Moderna continued to explore strategic alliances to bolster their mRNA pipeline, driven by the success of their COVID-19 vaccines. This trend intensifies rivalry as companies aim to secure market share and technological leadership through mergers and acquisitions, reshaping the competitive landscape.

These strategic moves are not limited to large corporations; smaller, innovative firms are also targets or partners, seeking to leverage their unique technologies. For example, the acquisition of a promising gene-editing startup by a larger pharmaceutical company in early 2024 demonstrates the ongoing pursuit of enhanced genetic portfolios and advanced capabilities. Such actions fuel a dynamic environment where market structures are constantly evolving, thereby heightening competitive pressures.

- Increased Consolidation: Strategic alliances and acquisitions are a hallmark of industries like biotech and pharmaceuticals, leading to fewer, larger competitors.

- Technological Advancement: Companies merge or partner to gain access to new technologies, expanding their genetic portfolios and research capabilities.

- Market Share Expansion: Geographic reach and market penetration are key drivers for these strategic moves, intensifying competition as companies vie for dominance.

Market Share Concentration and Niche Specialization

While the animal feed industry might appear to have numerous participants, certain segments, like dairy and swine feed, exhibit higher market share concentration. This means a few dominant companies directly vie for market share within these specific areas. For instance, in 2024, the global animal feed market, valued at over $470 billion, saw significant concentration in the poultry and swine segments, where leading players often control substantial portions of regional markets.

Companies also differentiate themselves by focusing on specialized niches, such as organic feed, pet food additives, or feed for aquaculture. This specialization further fragments the competitive landscape, as businesses aim to capture market share within these distinct areas rather than competing across the entire industry. This strategy allows smaller or more agile companies to thrive by catering to specific customer needs or emerging trends.

- Concentrated Segments: Dairy and swine feed markets often show higher concentration, with a few key players dominating.

- Niche Specialization: Companies compete by focusing on specialized areas like organic feed or aquaculture solutions.

- Market Fragmentation: Specialization leads to a more segmented competitive environment, allowing niche players to gain traction.

Competitive rivalry within the animal genetics sector is fierce, driven by innovation and market share battles among major players like Hendrix Genetics and Zoetis. The pursuit of superior genetic traits and robust intellectual property is paramount, leading to significant R&D investments. For example, in 2023, the global animal genetics market was valued at approximately $3.5 billion, highlighting the substantial financial stakes involved.

The industry is marked by high barriers to entry, primarily due to the immense capital needed for advanced research and development, including genetic sequencing and extensive field trials. Companies like Genus Plc and Hendrix Genetics routinely invest tens of millions annually in R&D to maintain a competitive edge.

Aggressive competition can also stem from the need to achieve high sales volumes to offset substantial fixed costs associated with advanced facilities and technologies. This dynamic can lead to price pressures as firms strive to maximize the utilization of their infrastructure.

Consolidation, strategic alliances, and acquisitions are also reshaping the competitive landscape, particularly in related sectors like biotechnology, as seen with pharmaceutical companies exploring partnerships to enhance their pipelines in 2024.

| Competitor | Approximate 2023 R&D Investment (USD Millions) | Key Focus Areas |

|---|---|---|

| Genus Plc | Tens of Millions (Industry Estimate) | Porcine, Bovine, Avian Genetics |

| Hendrix Genetics | Tens of Millions (Industry Estimate) | Poultry, Swine, Aquaculture Genetics |

| Zoetis (Animal Genetics Division) | Significant (Part of larger Agri-conglomerate) | Genetics for various livestock and companion animals |

SSubstitutes Threaten

For livestock producers, especially those who are smaller or less technologically inclined, traditional on-farm breeding methods or acquiring animals through standard livestock markets represent a viable substitute for investing in advanced genetics. This approach, while generally less efficient in terms of genetic gain, offers a readily accessible alternative.

In 2024, the global livestock genetics market is projected to reach approximately $3.5 billion, indicating a significant investment in advanced breeding. However, the continued reliance on traditional methods by a segment of producers means that the threat of substitutes remains a relevant consideration, particularly for companies focused on premium genetic products.

The expanding availability of alternative protein sources, such as plant-based meats, cultivated meat, and insect protein, presents a growing threat. While these aren't direct replacements for Genus's core animal genetics business, their increasing market penetration could dampen demand for conventional livestock products. For instance, the global plant-based meat market was valued at approximately $5.0 billion in 2023 and is projected to grow significantly, potentially impacting the overall protein market that Genus serves.

Farmers can achieve significant efficiency and productivity gains by focusing on improved nutrition and husbandry, acting as a substitute for relying solely on advanced genetics. Optimized feed formulations, for instance, can boost animal growth rates and health, potentially offsetting some of the benefits derived from superior genetic stock. In 2024, the global animal feed market was valued at approximately $450 billion, indicating substantial investment in these nutritional strategies.

Better animal health management, including robust vaccination programs and biosecurity measures, also serves as a substitute. By minimizing disease outbreaks, producers can reduce losses and improve overall output, diminishing the perceived need for genetic resistance. The global veterinary pharmaceuticals market, a key component of animal health, was projected to reach over $60 billion in 2024.

Furthermore, investments in improved farm infrastructure, such as climate-controlled housing and automated feeding systems, can enhance animal welfare and performance. These operational upgrades can contribute to higher yields and better quality products, presenting a viable alternative to purely genetic advancements. The agricultural technology sector, encompassing such infrastructure, saw significant growth in 2024, with substantial capital flowing into innovative farm solutions.

Synthetic Biology for Animal Products

Emerging biotechnologies like precision fermentation and cellular agriculture present a significant long-term threat of substitution for traditional animal product industries. These innovations aim to create identical proteins and meats without the need for conventional animal husbandry. For instance, companies are already producing animal-free dairy proteins, potentially disrupting the dairy sector. The market for these alternative proteins is projected to grow substantially, with some estimates suggesting it could reach billions of dollars in the coming years.

The development of these synthetic biology approaches bypasses the core business of animal genetics companies like Genus. Instead of improving livestock breeds, the focus shifts to laboratory-based production methods. This technological shift could fundamentally alter the value chain, reducing reliance on genetic improvement services. By 2024, investment in food tech, including cellular agriculture and precision fermentation, has continued to climb, indicating a strong market signal for these substitute technologies.

- Growing Investment: Venture capital funding for food tech, including cellular agriculture, reached over $5 billion globally in 2023, signaling strong investor confidence in these alternative production methods.

- Technological Advancements: Companies are achieving cost reductions and scaling up production for lab-grown meat and animal-free dairy, making them increasingly viable alternatives.

- Consumer Acceptance: While still developing, consumer interest in sustainable and ethical food production is a key driver for the adoption of these substitute products.

- Market Potential: Projections indicate the global market for cultivated meat could reach $25 billion by 2030, illustrating the significant long-term threat to traditional animal agriculture.

Lower-Cost, Less Differentiated Genetic Options

Farmers in certain agricultural sectors might turn to less sophisticated, cheaper genetic breeds or seeds as a substitute for Genus's advanced, specialized offerings. This is particularly true in markets where the immediate need is for basic yield improvement rather than highly tailored genetic traits.

These lower-cost alternatives, while less differentiated, can still fulfill the fundamental requirements of many producers, thereby limiting the pricing power of premium genetic providers like Genus. For instance, in the global livestock market, while Genus focuses on optimizing traits like feed conversion efficiency and disease resistance, a farmer might opt for a locally sourced, less genetically refined breed if the cost savings are significant and the performance gap is manageable for their specific operational scale.

- Cost Sensitivity: In 2024, global agricultural input costs saw an average increase of 5-10% depending on the region and commodity, making cost-conscious decisions paramount for many farmers.

- Basic Needs Fulfillment: For producers with less demanding production cycles or those operating in less competitive markets, the incremental benefits of premium genetics might not justify the higher price point.

- Availability of Alternatives: The presence of readily available, albeit less advanced, genetic material from local breeders or less established international suppliers provides a tangible substitute option.

- Market Segmentation: Genus's premium products cater to a specific segment of the market that prioritizes cutting-edge genetics; a broader market segment may be satisfied with more conventional, lower-cost alternatives.

The threat of substitutes for Genus's advanced livestock genetics business is multifaceted, encompassing alternative protein sources and improvements in farm management practices. The rise of plant-based and cultivated meats, while not directly replacing animal genetics, could reduce overall demand for traditional livestock. In 2024, the plant-based meat market was valued at approximately $7 billion, a significant figure indicating a growing consumer shift.

Improved animal nutrition and health management also act as substitutes, allowing producers to achieve better results without solely relying on superior genetics. The global animal feed market, valued at around $450 billion in 2024, highlights the substantial investment in these areas. Likewise, advancements in farm infrastructure can boost productivity, lessening the perceived need for genetic enhancements.

Emerging biotechnologies like precision fermentation and cellular agriculture represent a more direct, long-term substitution threat, aiming to produce animal proteins without traditional husbandry. Investment in food tech, including these areas, exceeded $5 billion globally in 2023. These innovations bypass the need for genetic improvement services, potentially reshaping the entire value chain.

Farmers may also opt for less sophisticated, lower-cost genetic breeds as a substitute, especially when basic yield improvement is the primary goal. Global agricultural input costs rose by an average of 5-10% in 2024, making cost-effectiveness a key consideration for many producers, even if it means forgoing the incremental benefits of premium genetics.

| Substitute Category | Example | 2024 Market Relevance/Data | Impact on Genus |

|---|---|---|---|

| Alternative Proteins | Plant-based meats, Cultivated meat | Plant-based meat market: ~$7 billion | Potential reduction in overall livestock demand |

| Farm Management | Improved nutrition, Better health protocols | Animal feed market: ~$450 billion | Reduced reliance on genetics for performance gains |

| Biotechnologies | Precision fermentation, Cellular agriculture | Food tech investment (2023): >$5 billion | Bypasses traditional animal husbandry and genetics |

| Lower-Cost Genetics | Less sophisticated breeds | Increased input costs (5-10% avg. in 2024) | Limits pricing power for premium genetics |

Entrants Threaten

The animal genetics sector demands significant upfront investment in research and development, advanced laboratory infrastructure, and comprehensive breeding programs. For instance, companies like Genus plc, a leader in the field, consistently invest heavily in R&D; in fiscal year 2023, Genus reported R&D expenditure of £102.8 million, highlighting the substantial financial commitment required to innovate and maintain a competitive edge. This high capital outlay acts as a powerful barrier, deterring many potential new players from entering the market.

The threat of new entrants in industries reliant on intellectual property, like advanced biotechnology or specialized software, is significantly diminished by robust patent protection. Companies invest heavily in research and development, securing patents for unique genetic lines or proprietary algorithms, creating substantial barriers. For example, in the biopharmaceutical sector, the average cost to develop a new drug can exceed $2 billion, with patent protection being crucial for recouping these investments.

Strict regulatory frameworks, health certifications, and complex biosecurity protocols govern the production and distribution of animal genetics globally. For instance, the European Union's stringent regulations on animal health and traceability, including requirements for disease-free status and detailed genetic lineage documentation, can be costly and time-consuming for new entrants to meet. Navigating these diverse and rigorous requirements presents a substantial barrier to entry for new players.

Established Distribution Networks and Brand Loyalty

The threat of new entrants in the seed and crop protection industry is significantly mitigated by the immense investment required to establish comparable distribution networks and cultivate brand loyalty. Established players like Bayer, Corteva, and Syngenta have spent decades building expansive global supply chains and deep relationships with farmers. For instance, in 2023, these companies continued to leverage their vast networks, with Bayer reporting €53.3 billion in total sales and Corteva Agriscience achieving $15.1 billion in net sales, underscoring the scale of their operations and market penetration.

New companies face a steep uphill battle in replicating the trust and reach that incumbent firms have earned. Farmers often rely on established brands and proven genetic lines, making it difficult for newcomers to gain market share. This loyalty is built on years of consistent performance and reliable support, factors that are hard to substitute quickly.

- High Capital Investment: Replicating the global distribution infrastructure of major seed and crop protection companies requires billions of dollars in investment.

- Brand Equity: Established brands benefit from years of farmer trust and proven product performance, creating a significant barrier to entry.

- Regulatory Hurdles: Navigating complex and varied global regulatory landscapes for new product approvals adds further cost and time to market entry.

- Farmer Relationships: Existing deep-rooted relationships between incumbent firms and farmers are difficult for new entrants to establish quickly.

Scarcity of Specialized Expertise and Genetic Stock

The scarcity of specialized expertise and high-quality genetic stock presents a substantial threat of new entrants in sectors relying on advanced biological breeding. Access to a limited pool of highly specialized geneticists, experienced veterinarians, and the foundational genetic material necessary for robust breeding programs acts as a significant barrier. For instance, companies in the advanced livestock or specialized crop industries require years of dedicated research and development to establish competitive genetic lines, a process that is both time-consuming and requires deep scientific knowledge.

Developing competitive genetic lines from scratch is an expertise-intensive and lengthy undertaking. New players must invest heavily in research, attract top talent, and meticulously build their genetic databases. This can take upwards of a decade and millions in investment before a company can even begin to compete with established entities that have decades of accumulated genetic data and breeding experience. For example, in the high-performance equine breeding industry, the lineage and genetic history of a horse can significantly impact its market value, making it difficult for newcomers to establish credibility without proven genetic pedigrees.

- Limited Access to Talent: The global pool of leading geneticists and specialized veterinarians is relatively small, with many already engaged by established firms.

- High R&D Costs: Building a competitive genetic library requires substantial upfront investment in research, data acquisition, and laboratory infrastructure.

- Time to Market: Developing and validating new genetic lines can take 5-10 years or more, delaying profitability for new entrants.

- Intellectual Property: Existing players often hold patents or proprietary knowledge on key genetic traits, further restricting new entrants.

The threat of new entrants in the animal genetics sector is largely constrained by the substantial capital required for research, infrastructure, and breeding programs. For instance, Genus plc's 2023 R&D investment of £102.8 million exemplifies the significant financial commitment needed to compete. Furthermore, robust intellectual property protection, like patents on unique genetic lines, creates formidable barriers, as seen in the biopharmaceutical industry where drug development costs can exceed $2 billion. Stringent global regulations and biosecurity protocols, such as those in the EU for animal health and traceability, also add considerable cost and time for newcomers.

The established market presence and deep farmer relationships of incumbent firms, particularly in the seed and crop protection industry, present another significant hurdle. Companies like Bayer, with €53.3 billion in 2023 sales, and Corteva Agriscience, with $15.1 billion in net sales, have spent decades building extensive distribution networks and brand loyalty. This makes it challenging for new players to gain traction without comparable investments in supply chains and cultivating trust. The scarcity of specialized expertise and high-quality genetic stock further limits new entrants, as acquiring top talent and foundational genetic material requires extensive time and financial resources, often taking a decade or more to build competitive genetic lines.

| Barrier Type | Description | Example Data/Company |

| Capital Investment | High upfront costs for R&D, infrastructure, and breeding programs. | Genus plc R&D: £102.8 million (FY2023) |

| Intellectual Property | Patents and proprietary knowledge on genetic traits. | Biopharmaceutical drug development cost: >$2 billion |

| Regulatory Compliance | Navigating complex health, traceability, and biosecurity regulations. | EU animal health and traceability requirements |

| Brand Equity & Distribution | Established trust and extensive supply chains. | Bayer Sales: €53.3 billion (2023); Corteva Agriscience Sales: $15.1 billion (2023) |

| Expertise & Genetic Stock | Scarcity of specialized talent and foundational genetic material. | Time to develop competitive genetic lines: 5-10+ years |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis is built upon a robust foundation of data, incorporating financial statements, industry-specific market research reports, and publicly available company filings to accurately assess competitive intensity.