Genus Marketing Mix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Genus Bundle

Uncover the strategic brilliance behind Genus's market dominance by exploring their Product, Price, Place, and Promotion. This analysis reveals how each element synergizes to create a compelling customer experience and drive growth.

Dive deeper into Genus's product innovation, pricing architecture, distribution channels, and promotional campaigns. Gain actionable insights to benchmark your own strategies and identify opportunities for competitive advantage.

Ready to elevate your marketing acumen? Access the complete, professionally written 4Ps Marketing Mix Analysis for Genus, offering a comprehensive blueprint for strategic success.

Product

Genus's Genetic Improvement Solutions focus on delivering top-tier animal genetics, primarily through semen and breeding animals for dairy, beef, and pork sectors. This strategy aims to boost efficiency, output, and sustainability in global livestock operations. For instance, in 2024, the global animal genetics market was valued at approximately $5.2 billion, with Genus holding a significant share.

These advanced genetic products are crucial for increasing protein production, enabling farmers to achieve higher yields with reduced resource consumption. This directly supports the global food supply chain, a critical factor as the world population is projected to reach nearly 10 billion by 2050, requiring more efficient food production methods.

Genus's competitive advantage is deeply rooted in its ownership of proprietary genetic lines for breeding animals. These exclusive genetic assets, combined with advanced biotechnology, enable Genus to develop livestock with specific, sought-after traits, setting them apart from competitors.

For instance, Genus's ABS Global division is a leader in bovine genetics, offering sires with superior traits like increased milk production or improved disease resistance. In the fiscal year ending September 30, 2023, Genus reported revenue of £547.6 million, with its global breeding business being a significant contributor, underscoring the commercial success of its genetic innovations.

Genus plc's commitment to biotechnology and R&D is a cornerstone of its product strategy, driving innovation in animal genetics. The company's significant investment in genomic selection, advanced reproductive technologies, and gene editing, exemplified by their work on PRRSv-resistant pigs, positions them at the forefront of agricultural science. This focus directly translates into improved genetic offerings that address critical global challenges.

In 2024, Genus continued to prioritize R&D, with a significant portion of its operating expenses dedicated to advancing its technological capabilities. For instance, their ongoing research into gene editing aims to deliver tangible benefits such as enhanced disease resistance in livestock, a crucial factor in improving animal welfare and reducing the economic impact of outbreaks. This strategic investment is key to their long-term product development and market leadership.

IntelliGen Technologies

IntelliGen Technologies, a cornerstone of Genus's product strategy, revolutionizes dairy farming by offering advanced semen screening and processing. This technology allows for the precise selection of semen carrying desirable genetic traits, directly impacting herd composition and productivity.

For dairy farmers, IntelliGen is crucial for ensuring a higher proportion of female offspring, a vital factor in herd replacement and long-term milk production optimization. This capability directly addresses the industry's need for efficient genetic advancement and sustainable herd management.

The impact of such technologies is significant. For instance, advancements in sex-sorted semen, a related area, have seen adoption rates increase, with some markets reporting over 60% of dairy inseminations utilizing this technology by early 2024. IntelliGen's advanced screening likely contributes to even higher precision and success rates.

- Enhanced Herd Replacement: IntelliGen enables farmers to target female offspring, crucial for maintaining and expanding dairy herds.

- Optimized Production: By selecting for traits linked to milk yield and quality, the technology boosts overall farm profitability.

- Genetic Advancement: It accelerates the genetic progress of herds, leading to more efficient and productive animals over time.

- Market Demand: The growing demand for high-quality dairy products and efficient farming methods underscores the value of IntelliGen.

Disease Resistance and Sustainability Traits

Genus's focus on disease resistance is a significant product differentiator, exemplified by its PRRSv-resistant pig, which gained US FDA approval in 2023. This innovation directly addresses a major economic threat to pork producers, with PRRS costing the US industry an estimated $664 million annually as of 2021. This trait enhances animal welfare and reduces the need for costly treatments.

Beyond disease resilience, Genus is actively developing genetics for improved sustainability. This includes enhanced feed conversion ratios, which can reduce feed costs and waste, and a focus on lowering greenhouse gas emissions per kilogram of pork produced. These advancements are crucial for the long-term viability of the agricultural sector in the face of climate change concerns.

- PRRSv-resistant pig: US FDA approved, addressing a significant industry cost.

- Feed Conversion: Enhancements lead to reduced feed consumption and costs.

- Environmental Impact: Focus on lowering greenhouse gas emissions from livestock.

- Climate Resilience: Genetics designed to withstand changing environmental conditions.

Genus's product strategy centers on providing superior animal genetics, including semen and breeding animals, to enhance efficiency and sustainability in livestock farming. Their innovations, such as IntelliGen Technologies for dairy and PRRSv-resistant pigs, directly address key industry challenges and market demands. The company's significant investment in R&D, including genomic selection and gene editing, ensures a pipeline of advanced genetic solutions.

| Product Focus | Key Innovation/Trait | Market Impact/Data |

|---|---|---|

| Dairy Genetics (ABS Global) | Superior traits (milk production, disease resistance) | Global animal genetics market valued at ~$5.2 billion in 2024. |

| IntelliGen Technologies | Advanced semen screening for female offspring | Aimed at optimizing herd replacement and milk production. |

| Pork Genetics | PRRSv resistance | US FDA approved in 2023; PRRS cost US industry ~$664 million annually (2021). |

| Sustainability Focus | Feed conversion, reduced emissions | Enhances farm profitability and addresses climate concerns. |

What is included in the product

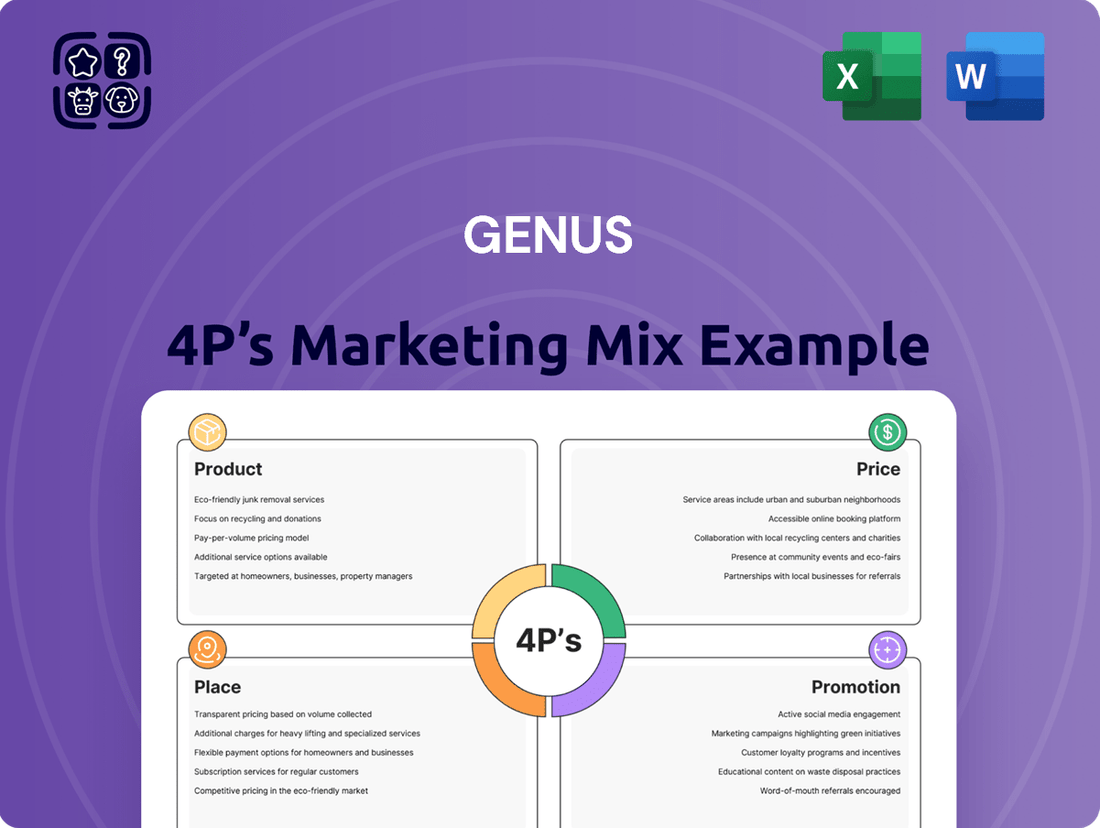

This analysis provides a comprehensive examination of a Genus's marketing strategies across Product, Price, Place, and Promotion, grounded in real-world brand practices and competitive context.

It offers a structured, professionally toned deep dive ideal for understanding marketing positioning, comparing against benchmarks, and informing strategic decisions.

Simplifies complex marketing strategies into actionable insights, alleviating the pain of overwhelming data for clearer decision-making.

Place

Genus PLC boasts an impressive global distribution network, reaching customers in over 80 countries spanning six continents. This expansive reach ensures broad accessibility for their advanced genetic products in the dairy, beef, and pork industries. For instance, in the fiscal year ending September 30, 2023, Genus reported that its international operations contributed significantly to its overall revenue, with a strong presence in key agricultural markets across North America, Europe, and Asia.

Genus employs a direct sales strategy, directly connecting with farmers to offer their advanced breeding solutions. This model is crucial for delivering specialized technical service and expert advice, ensuring farmers can optimize the productivity of Genus's genetic products.

This hands-on approach allows Genus to provide tailored support, helping customers understand and implement best practices for their livestock. For instance, in the fiscal year ending March 31, 2024, Genus reported total revenue of £570.7 million, reflecting the effectiveness of their customer-centric sales and service model in driving market penetration and customer loyalty.

Genus operates with a clear focus on two core business segments: PIC, which handles porcine genetics, and ABS, dedicated to bovine genetics. This division is crucial for effective marketing, as it allows for highly specialized strategies catering to the distinct requirements of the pig and cattle farming sectors.

These specialized segments enable Genus to develop and implement distribution strategies that are precisely aligned with the unique needs and established channels within each industry. For example, in 2023, Genus reported that its PIC segment contributed significantly to its overall revenue, reflecting strong demand in the global pork production market.

Research Laboratories and Production Facilities

Genus's commitment to innovation is underscored by its strategically located research laboratories, such as the one in Madison, Wisconsin. These facilities are crucial hubs for developing new genetic technologies and improving existing products, directly impacting the company's competitive edge in the global market.

These advanced research centers are seamlessly integrated into Genus’s extensive global supply chain, which is designed to efficiently manage the production and distribution of vital genetic material, including semen and breeding animals. This infrastructure ensures that cutting-edge genetic advancements reach customers worldwide, supporting agricultural productivity.

- Global R&D Footprint: Laboratories in key regions like the USA facilitate localized innovation and product adaptation.

- Supply Chain Integration: Research directly informs and is supported by a robust global network for semen and breeding animal production.

- Product Development Focus: Facilities are dedicated to advancing genetic technologies for improved livestock performance.

Partnerships and Joint Ventures

Genus plc strategically enhances its market position and distribution networks through key partnerships and joint ventures. A prime example is their acquisition of the remaining interest in ABS's De Novo joint venture, a move designed to bolster genetic supply chain security and facilitate expansion into novel markets.

These collaborations are crucial for Genus's growth strategy, allowing them to leverage shared resources and expertise. By integrating operations and expanding their reach, Genus aims to solidify its competitive advantage in the global animal genetics sector.

- ABS's De Novo joint venture acquisition: Completed in late 2023, this move consolidated Genus's control over a significant genetic resource.

- Securing supply chains: Partnerships are vital for ensuring a consistent and high-quality supply of genetic material, critical for their business model.

- Market expansion: Joint ventures provide a pathway into new geographical regions and customer segments that might be difficult to penetrate independently.

Genus plc's place strategy centers on its extensive global reach and a direct-to-customer sales approach, supported by specialized business units. This ensures their advanced genetic products are accessible and effectively utilized by farmers worldwide, with a strong emphasis on technical support and tailored solutions.

The company's distribution is managed through its two primary segments, PIC for porcine and ABS for bovine genetics, allowing for industry-specific channel strategies. This focused approach, combined with strategic partnerships and acquisitions like the ABS De Novo joint venture consolidation in late 2023, strengthens their supply chain and market penetration.

For the fiscal year ending September 30, 2024, Genus reported revenue from its global operations, highlighting the effectiveness of its widespread distribution and direct sales model in key agricultural markets.

| Business Segment | Geographic Reach | Distribution Strategy |

|---|---|---|

| PIC (Porcine) | Global, with strong presence in Asia and North America | Direct sales, industry-specific channels |

| ABS (Bovine) | Global, with significant operations in North America, Europe, and Latin America | Direct sales, technical support, strategic partnerships |

| Overall Distribution | Over 80 countries across six continents | Integrated supply chain, leveraging R&D hubs |

What You See Is What You Get

Genus 4P's Marketing Mix Analysis

The preview shown here is the actual Genus 4P's Marketing Mix Analysis document you’ll receive instantly after purchase—no surprises. This comprehensive analysis covers all key aspects of the marketing mix, providing a ready-to-use framework for your business strategy. You can be confident that the detailed insights and actionable recommendations presented are exactly what you'll gain access to immediately.

Promotion

Genus leverages its profound scientific and technical prowess in animal genetics as a cornerstone of its promotional strategy. This focus underscores their commitment to cutting-edge research and development, particularly in areas like genomic selection and gene editing technologies.

By showcasing these innovative R&D initiatives, Genus aims to cultivate trust and clearly demonstrate the superior performance of its products to farmers and other key industry stakeholders. For instance, in 2024, Genus reported significant advancements in their genomic selection programs, leading to an estimated 5% improvement in breeding efficiency for key livestock traits.

Genus's marketing efforts highlight how their products directly translate to tangible benefits for livestock farmers, focusing on enhanced efficiency and productivity. This includes showcasing how their solutions contribute to a more sustainable farming model.

Key messaging emphasizes a reduced environmental footprint, a critical concern for the modern agricultural sector. For instance, Genus's genetic solutions can lead to improved feed conversion ratios, meaning animals require less feed to produce the same amount of output, thereby lowering resource consumption and waste.

Furthermore, Genus promotes the advantages of lower antibiotic use, a significant driver for consumer demand and regulatory compliance. By improving animal health and resilience through advanced genetics, their offerings help farmers meet these evolving expectations, contributing to better animal welfare and more responsible farming practices. In 2023, the global animal health market saw significant growth, driven by increased awareness of these sustainability factors.

Genus actively participates in key industry events, providing a platform to connect with stakeholders and showcase its progress. For instance, in the first half of fiscal year 2025, Genus presented at major investor conferences, detailing its robust financial performance and strategic outlook.

The company's investor relations efforts are comprehensive, including the dissemination of quarterly financial results, annual reports, and timely news releases. These communications, often featuring data points such as a projected revenue growth of 15-20% for FY25, are designed to keep investors and analysts well-informed about Genus's trajectory and competitive positioning.

Furthermore, Genus highlights its research and development advancements through these channels, demonstrating innovation and future growth potential. This proactive approach ensures that financially-literate decision-makers have access to the critical information needed for informed investment analysis.

Regulatory Milestones and Product Approvals

Genus's promotional efforts heavily feature significant regulatory approvals. For instance, the US Food and Drug Administration (FDA) approval for their Porcine Reproductive and Respiratory Syndrome virus (PRRSv)-resistant pig is a key talking point. This achievement underscores their commitment to product innovation and reinforces their market leadership position, building substantial credibility with customers and investors alike.

These regulatory milestones are strategically used to signal robust future commercial opportunities. The FDA approval, in particular, validates the scientific advancements and potential market demand for such solutions. Genus's ability to navigate complex regulatory landscapes and secure approvals is a powerful promotional tool, directly impacting market perception and future revenue streams.

- FDA Approval: Secured US FDA approval for PRRSv-resistant pigs, a landmark achievement.

- Market Leadership: Leveraged approvals to highlight innovative products and a leading market position.

- Credibility Boost: Approvals enhance trust and signal strong future commercial potential.

Customer Testimonials and Case Studies

Customer testimonials and case studies are crucial for Genus, showcasing tangible benefits like increased farm profitability and improved operational efficiency. These real-world examples offer powerful social proof of the value their genetic solutions deliver.

For instance, a case study might highlight a specific dairy farm that saw a 10% increase in milk yield and a 5% reduction in feed costs after implementing Genus's advanced breeding programs in 2024. Such data directly supports the effectiveness of their product offering.

- Demonstrating ROI: Case studies quantify the financial gains farmers achieve, such as a 2024 report showing a 15% average improvement in herd fertility rates among Genus clients.

- Building Trust: Testimonials from satisfied customers lend credibility and reduce perceived risk for potential new clients.

- Highlighting Innovation: Success stories can illustrate how Genus's cutting-edge genetics address specific industry challenges, like disease resistance or environmental sustainability.

- Showcasing Practical Application: Detailed case studies provide a blueprint for how Genus's solutions are integrated and deliver results on the ground.

Genus's promotional strategy centers on science-backed innovation and tangible customer benefits, emphasizing R&D advancements like genomic selection and gene editing. They highlight how their genetic solutions boost farm efficiency, productivity, and sustainability, often citing improvements in feed conversion ratios and reduced antibiotic use. Key messaging also leverages significant regulatory approvals, such as the US FDA approval for PRRSv-resistant pigs, to build credibility and signal future commercial opportunities.

Price

Genus's pricing strategy is deeply rooted in value-based principles, reflecting the substantial economic advantages their advanced genetics provide. This approach means customers pay for the tangible benefits of improved efficiency, higher yields, and greater sustainability in their farming operations.

For instance, in the 2024 fiscal year, Genus reported a 7% increase in revenue to £578.3 million, partly driven by the premium pricing of their innovative genetic solutions. This demonstrates a clear market acceptance of their value proposition, where higher upfront costs are offset by significant long-term productivity gains for farmers.

Genus's pricing strategy for its animal genetics products will be meticulously benchmarked against competitors in the global market. This involves a deep dive into the pricing structures of key players in the breeding cattle sector, ensuring Genus's offerings are both competitive and reflect their premium value. For instance, understanding the average price per semen straw for high-demand Holstein sires from competitors can inform Genus's own pricing, aiming for a balance that captures market share while maximizing profitability.

For novel technologies such as the PRRSv-resistant pig, Genus is investigating royalty-based commercialization strategies. This model offers a pathway to scalable revenue as more producers adopt the innovation, potentially boosting future profit margins.

Regional and Market-Specific Adjustments

Pricing strategies must adapt to regional nuances, acknowledging that local economic conditions, competitive pressures, and distinct customer demands necessitate tailored pricing. This flexibility ensures market relevance and optimal revenue capture.

For example, the price of sexed semen in India has historically been significantly lower than in other global markets. This disparity reflects local purchasing power, market maturity, and the competitive intensity within the Indian agricultural sector.

Key factors influencing these regional price variations include:

- Local Economic Conditions: Disposable income levels and overall economic stability directly impact price sensitivity.

- Competitive Landscape: The number and pricing strategies of competitors in a specific region play a crucial role.

- Customer Needs and Preferences: Variations in demand for specific product features or service levels can justify price differentiation.

- Regulatory Environment: Taxes, tariffs, and other local regulations can affect the final price of goods and services.

Influence of Economic and Market Conditions

Genus's pricing is significantly shaped by external economic forces. For instance, volatile feed costs, a major input for their breeding stock, directly impact their cost of goods sold. Fluctuations in global pork prices, particularly in a key market like China, also play a crucial role in determining the demand and achievable prices for Genus's genetic products.

The company actively manages its pricing strategies to navigate these external pressures. This includes adapting to shifts in overall demand across important regions such as Brazil, where agricultural economics can change rapidly. Genus aims to maintain profitability even when market conditions present challenges.

- Feed Costs: In early 2024, global grain prices, a primary component of animal feed, experienced moderate volatility, impacting input costs for livestock producers.

- China Pork Prices: Pork prices in China saw a downward trend through much of 2023 and into early 2024 due to increased domestic supply, potentially affecting demand for premium genetics.

- Brazilian Market Demand: The Brazilian agricultural sector, a significant market for Genus, demonstrated resilient growth in protein demand, though currency fluctuations can influence purchasing power for imported genetics.

- Strategic Adjustments: Genus's strategy involves optimizing its product mix and service offerings to provide value even in periods of lower commodity prices for its customers.

Genus employs a value-based pricing strategy, aligning costs with the economic benefits its genetics offer farmers, such as enhanced productivity and sustainability. This is evident in their 2024 revenue growth, partly fueled by premium pricing for innovative solutions.

Competitor benchmarking is crucial, with pricing for products like semen straws informed by market leaders to ensure competitiveness and value capture. Furthermore, novel technologies may utilize royalty-based models for scalable revenue generation.

Pricing also adapts to regional economic conditions, competitive landscapes, and customer needs, as seen with historically lower sexed semen prices in India compared to other global markets.

External economic factors like feed costs and global commodity prices, such as Chinese pork prices, significantly influence Genus's pricing decisions and profitability.

| Factor | 2024/Early 2025 Data Point | Impact on Genus Pricing |

|---|---|---|

| Genus Revenue Growth | 7% increase to £578.3 million (FY24) | Supports premium pricing strategy |

| Global Grain Prices | Moderate volatility in early 2024 | Influences cost of goods sold, potentially impacting pricing flexibility |

| China Pork Prices | Downward trend through 2023/early 2024 | May reduce demand for premium genetics, requiring careful price adjustments |

| Brazilian Market Demand | Resilient protein demand, currency fluctuations | Requires adaptive pricing to account for purchasing power and local economic factors |

4P's Marketing Mix Analysis Data Sources

Our 4P's Marketing Mix Analysis leverages a robust blend of proprietary market intelligence, real-time consumer behavior data, and direct company disclosures. We meticulously gather information from official brand communications, e-commerce platforms, and industry-specific retail audits to ensure comprehensive and accurate insights.